Decision-making

We have the authority to take supervisory decisions that banks under our supervision are legally required to follow.

How do we take decisions?

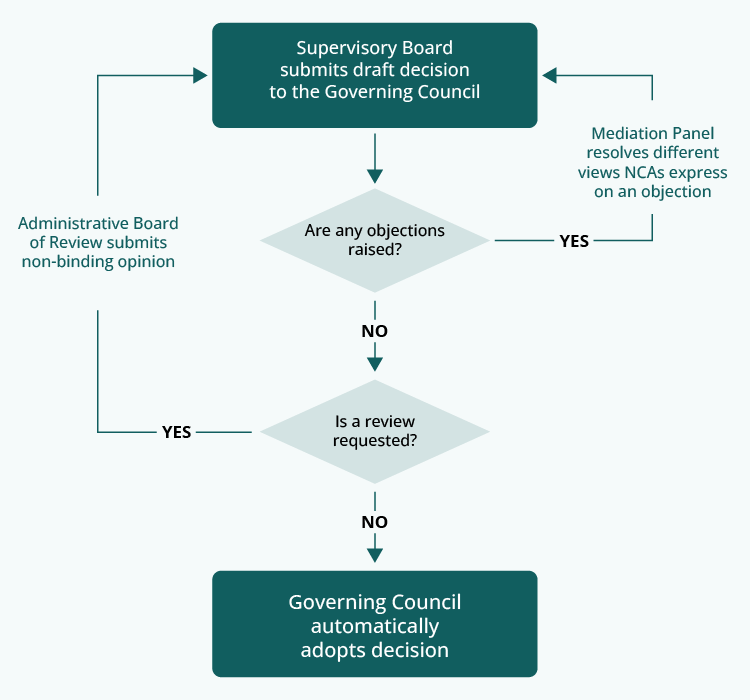

The Supervisory Board prepares draft decisions, which are then adopted by the Governing Council under a non-objection procedure. If the Governing Council does not object within a defined period of time, the decision is deemed adopted.

Our duty to explain our decisions

Our supervisory decisions are accompanied by clear reasoning which sets out the material facts, legal reasons and supervisory considerations underlying the decision.

Banks’ right to be heard

Banks affected by our draft decisions must have the opportunity to comment on these decisions before they are adopted. This ensures that they can respond to our factual and legal analysis, and also means that our decision-making is based on a complete set of information.

Banks’ right to access supervisory files

Banks have the right to access the supervisory file before a decision that can negatively affect them is adopted. They can access the file from the start of the supervisory procedure until the decision is final.

Separation principle

To prevent potential conflicts of interest between the ECB’s monetary policy and supervisory responsibilities, we keep our objectives, decision-making processes and tasks separate.