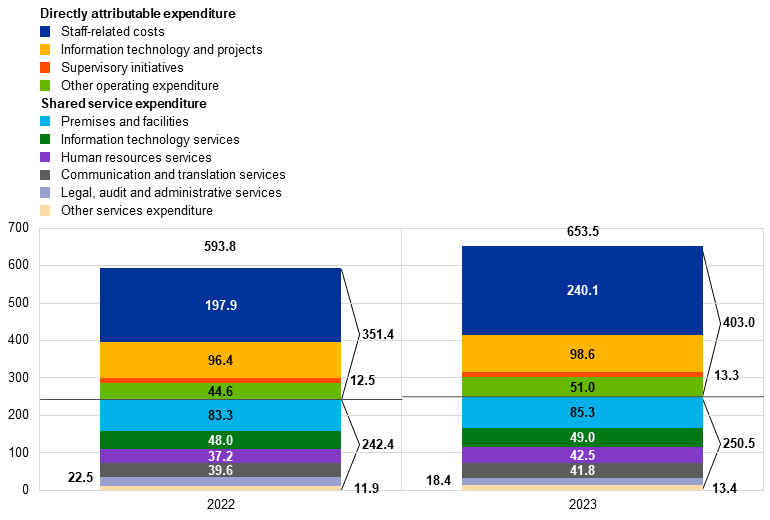

Foreword by Christine Lagarde, President of the ECB

European banks continued to navigate a challenging environment in 2023. They faced a weak euro area economy and rising geopolitical risks, especially from Russia’s unjustified war against Ukraine and the tragic conflict in the Middle East. Financial tensions in other jurisdictions affected funding markets in the spring. And, with inflation set to remain too high for too long, the ECB continued to tighten its monetary policy.

But the hard work done in previous years to make euro area banks more resilient has paid off. Banks maintained solid capital and liquidity positions, with the aggregate Common Equity Tier 1 capital ratio of supervised banks standing at 15.6%, close to its record-high level. This helped to shield the sector from external shocks and allowed banks to smoothly transmit the ECB’s policy tightening to the economy.

But several challenges remain. While higher interest rates affected euro area banks’ net interest margins, leading to an average return on equity of 10% in the third quarter of 2023, deposit rates are rising and non-performing loans are increasing. Supervisors will continue to closely monitor risks. In particular, they will keep a close eye on banks’ exposures to vulnerable sectors, such as commercial real estate, and address concerns about banks’ governance and internal risk control frameworks.

Resilience and adaptability will be crucial to confront the structural challenges posed by climate change and digitalisation. In 2024 banks are expected to meet the ECB’s supervisory expectations on climate-related and environmental risks and embed these risks in their strategies and risk management processes. And as the use of artificial intelligence becomes more widespread, supervisors will continue to scrutinise banks’ digitalisation strategies and their resilience to cyberattacks. These efforts will help to ensure that banks remain strong and continue to play their part in supporting the euro area economy on its path towards a greener and more digital future.

Introductory interview with Claudia Buch, Chair of the Supervisory Board

You took over as Chair of the ECB’s Supervisory Board in January 2024. What will be your guiding principle in carrying out this important task?

We must always remember that, as supervisors, we act on behalf of the public. Banks play a huge role in everyday life: they safeguard deposits, they facilitate payments and they lend money to households and firms. Our job is to ensure that banks are safe and do not take too many risks.

This has very practical implications: we need to be forward-looking and have a critical mindset, as set out in the Basel Committee’s Core Principles for Effective Banking Supervision. The forward-looking element is particularly important now that many economies and societies have reached a turning point. And we need to be critical, to think outside of the box. Well-functioning banks are clearly good for society. But banks are private entities and, ultimately, they act in the interest of their shareholders. It is our role as supervisors to ensure that they also act in the interest of society.

In 2024 European banking supervision celebrates its tenth anniversary. How mature is it, and what can still be improved?

With the Single Supervisory Mechanism (SSM), Europe has made significant progress as regards institution-building and delegating powers to the European level. A decade ago, the supervisory landscape in Europe was fragmented, in terms of both institutions and practices. Cross-border risks were often ignored, and it was impossible to benchmark banks against their peers. Supervisory standards differed across countries.

We now have strong supervisory powers at European level, while cooperating closely with national authorities. I think that the way in which European banking supervision is organised today can serve as a model for other policy areas where more integration may be needed.

But, of course, we can always improve. One of my goals is to make European supervision even more integrated. We have named 2024, our tenth anniversary year, our “year of integration”. It will include a number of initiatives to further promote knowledge sharing, invest in common supervisory technologies and leverage the expertise of national supervisors. This will foster our “one team” culture.

How do you think supervised banks fared in 2023?

European banks have proven resilient to the shocks that have hit our economies in recent years. The COVID-19 pandemic, rising energy prices and inflation, the Russian invasion of Ukraine and, more recently, the conflict in the Middle East have all put our economies under stress. The effects of these shocks are reflected in higher inflation and interest rates and weaker economic growth. We saw the sharpest increase in interest rates in the history of the ECB.

These higher interest rates are certainly an important driver of the strong increase in banks’ profitability, also because banks have been slow to pass on the increases to deposit rates. Banks’ capital positions have remained robust and well above regulatory requirements. European banks’ unrealised losses from the devaluation of securities have also been relatively contained. And their liquidity positions have remained strong, even after the gradual withdrawal of the ECB’s extraordinary liquidity support. This can be attributed to the regulatory and supervisory changes implemented after the global financial crisis. But we must also acknowledge that banks have benefited from the strong monetary and fiscal responses to past shocks.

So, there is no room for complacency. Macro-financial and geopolitical risks are heightened and, in many countries, the real economy needs to adjust to structural changes. This can affect banks through increased credit and liquidity risk. In fact, some emerging risks have already started to materialise. We are seeing increases in underperforming loans, in corporate bankruptcies and in default rates. We will continue our efforts to strengthen the resilience of the banks we supervise. And we will address identified shortcomings in their governance and risk management.

What lessons do you think European banking supervision can learn from the market turmoil of March 2023?

For me, the main lesson is that crises often happen when banks’ poor risk management is exposed by negative external shocks. This has two concrete implications for us.

First, as supervisors we have to be proactive and address findings early on. The events of March 2023 showed that even stress in smaller locally active banks can have global repercussions if not tackled proactively. Therefore, at international level, we are reviewing shortcomings in the regulatory framework, for example in the areas of liquidity risk and interest rate risk, and we are discussing the implications for supervisory effectiveness.

Second, we need a good understanding of how changes in the macro environment affect banks. The US and Swiss authorities have acknowledged that there had been risk management and governance deficiencies before the turmoil. In a benign macroeconomic environment, these fault lines do not do much harm. But when the tide turns, they become exposed and can damage the whole financial system.

Of course, having a sufficient level of capital in the system is the first line of defence against unforeseen events and external shocks. It also mitigates the negative impact of poor governance and deficiencies in risk management.

Supervisory effectiveness is a topical issue and was also the focus of a recommendation in the external assessment of the Supervisory Review and Evaluation Process (SREP). How do you intend to make European banking supervision more effective?

For a supervisor, being effective means ensuring that relevant findings translate into concrete improvements in banks’ risk profiles and resilience. This is a major lesson from the events of last spring. But being effective also means focusing on relevant risks.

In fact, we have been paying attention to the effectiveness of European banking supervision for a while now. I am very grateful to Andrea Enria for having appointed an expert advisory group to review the SREP. The group’s report contains clear recommendations for us: we should become more adaptable, intrusive and risk-focused; enhance our efficiency and effectiveness; and make full use of all supervisory tools.

We have discussed these recommendations extensively within the Supervisory Board. Some were implemented in the 2023 SREP cycle. We have a new risk tolerance framework and a multi-year SREP assessment, which gives supervisors more flexibility to focus on individual banks’ vulnerabilities. Other recommendations will be considered for the 2025 SREP cycle. We are also strengthening our supervision by using more intrusive measures, as Frank Elderson explained in a recent speech.

What do you think will be the biggest challenges for European banks in the near future?

I would say that the biggest challenges facing banks are the changes in the macro-financial and geopolitical environment and the evolving competitive landscape.

We are coming out of a period of ultra-low interest rates. That environment may have prompted banks to take on more risk to support profits. Despite recent shocks to GDP, insolvencies and defaults have remained at very low levels, as have banks’ loan loss provisions. This disconnect is in large part due to the unprecedented fiscal and monetary support that shielded banks’ balance sheets from those shocks.

This has implications for future risk assessments, as past data on loan defaults do not truly reflect the risks to asset quality that lay ahead. And many of the risks to which banks are exposed, such as cyber risk, climate-related and environmental risks and geopolitical risks, have only emerged more recently.

It is therefore crucial that banks adjust their risk management practices to the new environment.

The second challenge facing banks is the changing competitive environment. Non-bank financial institutions have increased their market share, and while innovations such as distributed ledger technology and artificial intelligence provide opportunities for banks to boost their productivity, they also enable new market entrants to challenge existing business models. Innovation and increased competition may improve economic welfare, but they also create new risks. If banks see their margins being squeezed, they may turn to potentially riskier activities. They might, for example, relax their underwriting standards. We are therefore keeping a close eye on banks’ exposures to non-banks and the digital ecosystem and we are monitoring how their business models are affected by increased competition.

How do you see the future of the banking union?

We have made very good progress on the first two pillars of the banking union – supervision and resolution – but the third pillar, deposit protection, is moving much more slowly. I think that further delays in completing the banking union could prove harmful. We need to prepare for a potentially more adverse environment, and this requires closing the remaining gaps in the European crisis management and deposit insurance frameworks.

The three pillars of the banking union are in fact closely connected. Supervision ensures that bank failures are unlikely and, if they do occur, are not severe. But even the highest quality supervision cannot, and should not, prevent all failures. When failures occur, disruptions to banking services should be minimised and taxpayers’ money should be protected. That’s where the second pillar comes in – a credible and efficient resolution regime under the auspices of the Single Resolution Board.

More work is clearly needed on the third pillar – a common deposit insurance scheme. Deposit insurance is essential to protect depositors. But, as with any insurance, it can foster moral hazard and risk-taking. That’s why European banking supervision ensures high supervisory standards are applied consistently across all participating countries.

At present, deposit insurance is largely organised at the national level, which is not compatible with European-level supervision and resolution. We need a European deposit insurance scheme to ensure a uniform level of depositor protection across the euro area. This could also promote better integration of banking markets and cross-border risk sharing.

I would also like to stress that legacy assets are no longer a reason to delay the next steps. When the banking union project started, it made sense to first focus on removing legacy assets from banks’ balance sheets. This has now been achieved – the non-performing loans ratio of significant banks has fallen from 7.5% in 2015 to 1.9% in the third quarter of 2023, close to its record low.

1 Banking Supervision in 2023

1.1 Resilience of banks under European banking supervision

1.1.1 Introduction

Prudential regulation and supervisory policy helped put euro area banks in a good position in spite of the uncertain economic environment

The 2023 Supervisory Review and Evaluation Process (SREP) confirmed that euro area banks continued to exhibit resilience, with robust capital and liquidity positions, in spite of the uncertain economic environment. Banks are overall well capitalised. The aggregate Common Equity Tier 1 (CET1) capital ratio of significant institutions (SIs) returned to the historical highs seen in 2021, standing at 15.6% in the third quarter of 2023, while it reached 17.7% for less significant institutions (LSIs). The aggregate leverage ratios also improved, reaching 5.6% (+0.5 percentage points) for SIs and 9.3% (+0.7 percentage points) for LSIs.

On aggregate, SIs also have ample liquidity buffers in terms of the regulatory requirements, in spite of the decline in these liquidity buffers since the start of the current monetary policy tightening cycle. In the third quarter of 2023, the aggregate liquidity coverage ratio of SIs was 159%, up from around 140% before the pandemic. For LSIs, this ratio stood higher, at 205%.

However, subdued economic growth in the first nine months of 2023, the weak economic outlook in the face of tighter financing conditions, and elevated geopolitical tensions all contributed to a high level of uncertainty surrounding the macro-financial environment.

Banks’ profitability improved further in 2023, but supervisors remain cautious about the sustainability of this surge in profitability

In the third quarter of 2023, SIs’ aggregate annualised year-to-date return on equity stood at 10%, unchanged compared with the previous quarter and up from 7.6% one year earlier. LSIs generated a lower annualised year-to-date return on equity, standing at 8.0% in the third quarter of 2023, down from 8.3% in the previous quarter but up significantly from 1.3% one year earlier.

Net interest margins were the main profitability driver in 2022 and the first nine months of 2023. This more than offsets the stagnant or slightly declining lending volumes. Revenues from trading and investment banking decreased by 5% compared with 2022, with subdued fees from equity, fixed income and commodities in the second quarter partially compensated by a buoyant third quarter and, for some banks, by credit trading.

In 2023 supervisors continued to keep a close eye on issues such as the sustainability of surging profitability and credit risk stemming from exposures to vulnerable sectors, such as residential and commercial real estate. Internal governance and risk management also remained an area of focus for supervisors. Higher funding costs were the main downside risk to euro area banks’ profits. The cost of deposits, which has adjusted slowly thus far, is expected to increase further as competitive pressure increases and depositors shift their funds from overnight deposits to time deposits that yield higher remuneration.

Data from the first nine months of 2023 show a gradual, albeit modest, increase in the volume of non-performing loans (NPLs). Inflationary and market pressure on vulnerable credit risk portfolios such as consumer credit, residential and commercial real estate, as well as on small and medium-sized enterprises, continued. Consequently, increased provisions owing to higher credit risk may weigh on future profits.

1.1.2 Stress testing and ad hoc data collection of unrealised losses

1.1.2.1 Stress testing of euro area banks

In 2023 the ECB performed two stress-testing exercises for euro area SIs. 57 large euro area banks took part in the EU-wide stress test coordinated by the European Banking Authority (EBA). Another 41 medium-sized SIs took part in the parallel stress test coordinated by the ECB. These two exercises constituted the annual supervisory stress test that the ECB is required to carry out under EU law.[1]

The EBA published detailed results of its 2023 EU-wide stress test for the 57 largest euro area banks. The ECB published individual results for the additional 41 medium-sized banks, as well as a report on the aggregate final results of its stress test of euro area banks for the full sample of 98 supervised entities.

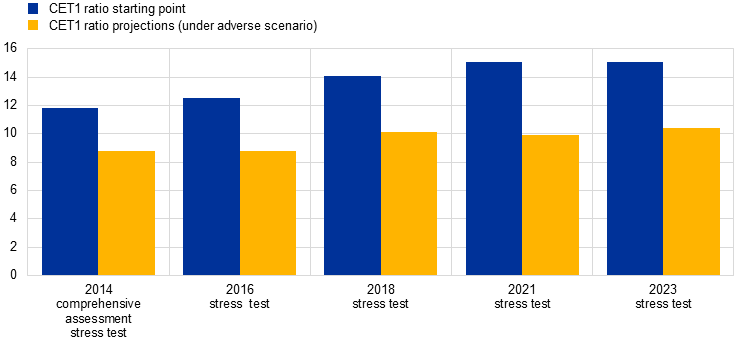

The euro area banking sector could withstand a severe economic downturn, but continued monitoring is still called for

The ECB’s 2023 stress test results showed that the euro area banking sector could withstand a severe economic downturn. Under the adverse scenario, the CET1 ratio would, on average, fall by 4.8 percentage points, to 10.4%, at the end of 2025.[2] The marked improvement in banks’ asset quality and profitability compared with the previous exercises, along with the significant capital accumulation over the last decade (Chart 1), helped banks weather the high severity of the adverse scenario. That said, the stress test also identified potential vulnerabilities, calling for the continued monitoring of risks.

The ECB uses the stress test results as input for the annual SREP. The quantitative results play a key role in defining the Pillar 2 guidance, which for the first time also includes a leverage ratio Pillar 2 guidance, where appropriate. The qualitative results of the stress test are included in the risk governance part of the SREP, thereby potentially influencing the Pillar 2 requirements.

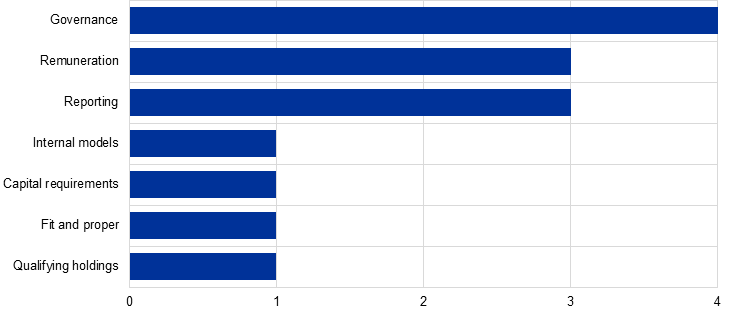

Chart 1

Developments in CET1 ratio starting point and projections

(percentage points)

Source: ECB calculations.

Notes: All figures are in fully loaded terms, with the exception of the 2014 comprehensive assessment stress test. CET1 ratio projections refer to the end of the stress test horizon. The sample of banks may differ across exercises.

1.1.2.2 Data collection to assess unrealised losses in euro area banks’ bond portfolios measured at amortised cost

The overall amount of unrealised losses in euro area banks’ bond portfolios is contained

The EBA and ECB also carried out an ad hoc data collection to comprehensively assess the risks related to unrealised losses in banks’ bond portfolios measured at amortised cost and the related hedges. The amount of net unrealised losses in euro area banks’ bond portfolios is overall contained, standing at €73 billion as at February 2023, after taking into account the effect of fair value hedges. The additional losses, net of fair value hedges, projected under the adverse scenario of the EU-wide stress test would amount to €155 billion. However, the materialisation of these unrealised losses should be regarded as an unlikely, hypothetical outcome, since banks’ amortised cost portfolios are designed to be held to maturity and banks would typically turn to repo transactions and other mitigating measures before liquidating their bond positions. The ECB published the individual results of banks’ carrying and fair value amounts for these bond portfolios as at February 2023.

1.2 Supervisory priorities for 2023-25

1.2.1 Introduction

In 2022 Russia’s invasion of Ukraine and its macro-financial consequences increased uncertainty about developments in the economy and the financial markets, while heightening the risks to the banking sector. Against this background, supervised entities were asked to strengthen their resilience to the immediate macro-financial and geopolitical shocks (Priority 1). In particular, the ECB demanded that banks focus on their credit risk management frameworks and target those sectors prone to deteriorating credit risk. The ECB also further scrutinised the adequacy of banks’ funding plans and the diversity of their funding sources. In addition, banks were asked to address digitalisation challenges, strengthen their management bodies’ steering capabilities (Priority 2) and step up their efforts to address climate change (Priority 3).

The ECB continuously assesses and monitors the changing nature of the risks and vulnerabilities faced by supervised entities. This agile approach allows the ECB to flexibly adjust its focus to changes in the risk landscape. In 2023, the continuous monetary policy tightening employed by several central banks highlighted the importance for banks to prudently manage their exposures to interest rate risk and credit spread risk in the banking book (IRRBB/CSRBB). Furthermore, following the market turmoil in spring 2023, which was marked by the failure of some medium-sized banks in the United States, the ECB adjusted its supervisory priorities and extended its targeted review of IRRBB/CSRBB to a wider scope of institutions. At the same time, the ECB carried out ad hoc analyses to identify banks’ potential vulnerabilities stemming from unrealised losses on their balance sheets. Moreover, the heightened risk posed by the commercial real estate business made supervisors reprioritise certain on-site inspections to assess banks’ management and mitigation measures for some of the riskier counterparties operating in this sector.

1.2.2 Priority 1: Strengthening resilience to immediate macro-financial and geopolitical shocks

1.2.2.1 Shortcomings in credit risk management, including exposures to vulnerable portfolios and asset classes

Effective credit risk management frameworks are essential for banks to proactively address emerging credit risk

Throughout 2023 supervisors continued to implement a credit risk work programme focused on addressing structural deficiencies in banks’ credit risk management frameworks, including the area of real estate and vulnerable portfolios. Amid rising interest rates and macroeconomic uncertainty, it is especially important for supervisors to ensure that banks proactively address emerging credit risk in vulnerable portfolios and asset classes. Loan origination is also a key component of the credit risk management cycle of a bank and is increasingly becoming the focus of supervisors, because originating good quality loans can help prevent future NPLs. In 2023, the ECB continued its focus on NPL management[3] and related activities, ensuring that if NPLs begin to rise, banks are equipped to react proactively with recourse to the appropriate processes and procedures.

Despite a relatively stable NPL ratio at the aggregate level in the 2023 cycle, the ECB observed a deterioration in specific portfolios more vulnerable to inflationary pressure, including loans to households[4]. It also observed a downturn in commercial real estate markets,[5] together with increased pressure on borrowers’ ability to refinance maturing commercial real estate loans. Moreover, corporate bankruptcies and default rates increased from the low levels seen during the pandemic.[6] Euro area firms, particularly small and medium-sized enterprises, also continued to face challenges from higher funding costs but also higher costs in general owing to inflation[7]. Highly indebted firms, or those firms operating in vulnerable sectors, were more affected by higher costs and lower demand, which in turn put pressure on profit margins.

Supervisory activities and outcomes

The off-site and on-site activities performed in 2023 revealed that banks have made progress in mitigating the risks related to vulnerable portfolios and asset classes. However, several shortcomings remained unaddressed.

Recent in-depth assessments in areas such as forbearance[8] revealed significant gaps in some banks’ preparedness for dealing with an increase in distressed debtors and refinancing risks, including identifying and monitoring clients in financial difficulty. The assessments also showed that banks need to pursue more proactive remedial actions. On-site inspections and targeted reviews of IFRS 9 provisioning practices (including overlays) revealed that while many banks have adequate practices in place, a considerable number need to better capture emerging risks and better reflect these in their staging approach. For all these supervisory activities, a set of supervisory measures have been communicated to banks to ensure that remediation occurs in a timely manner. The ECB closely monitors the planned remedial actions and their implementation.

Specifically focusing on the portfolios of loans to households, a targeted review of residential real estate lending found that banks have limited capabilities to anticipate risks and differentiate them both at origination and in pricing. This targeted review involved a sample of 34 SIs with material portfolios including residential real estate exposures. Several cases of non-compliance with the EBA Guidelines on loan origination and monitoring came to light, also in the area of collateral valuation processes.

In-depth assessments of banks’ commercial real estate unveiled exposures with bullet or balloon and floating rate loans, as well as potential collateral overvaluation (see Box 1).

Detailed findings from the off-site and on-site supervisory activities were communicated to banks. Where appropriate, these fed into the 2023 SREP outcomes and the related supervisory measures discussed with the supervised entities as part of the regular supervisory dialogue.

Box 1

Commercial real estate: emerging risk

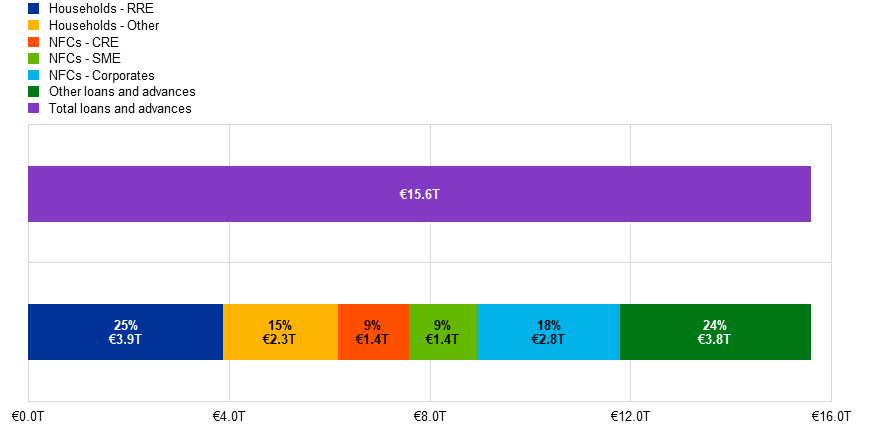

Commercial real estate (CRE) is a material asset class which accounted for €1.4 trillion of SIs’ loan books in the second quarter of 2023. €52 billion (3.67%) of CRE loans were classified as non-performing loans (NPLs) in that quarter. This corresponds to 15% of total overall NPLs, of which the majority stems from legacy NPLs from the 2008 financial crisis. Banks’ material exposures to CRE loans are particularly concentrated in German, French and Dutch banks (around 52% of total commercial real estate).

Chart A

Materiality of commercial real estate loans in significant institutions

(EUR trillions)

Source: Financial Reporting, June 2023.

Notes: Commercial real estate (CRE) is reported based on the European Systemic Risk Board’s definition of CRE loans, which are: loans extended to a legal entity aimed at acquiring income-producing real estate (or a set of properties defined as income-producing real estate), either existing or under development, or real estate used by the owners of the property for conducting their business, purpose or activity (or a set of such properties), either existing or under construction, or secured by a commercial real estate property (or a set of commercial real estate properties). CRE exposures were subtracted from small and medium-sized enterprises (SME) and non-financial corporation (NFC) exposures. Residential real estate (RRE) loans to households only include loans to households collateralised by RRE. The category “Other” includes central banks, general governments, credit institutions and other financial corporations.

Following years of rising property prices, CRE markets are currently in a downturn,[9] as signs of deterioration are becoming apparent across several euro area countries.[10] Commercial real estate is facing tighter financing conditions and an uncertain economic outlook, as well as weaker demand following the pandemic.[11]

The main factor negatively weighing on CRE markets was the increase in interest rates and the higher cost of debt financing. Together with higher construction costs and changing demand dynamics (i.e. remote working and more energy efficient retail space and offices), this was associated with a repricing in CRE property valuations (particularly office and retail), which is still ongoing. Furthermore, there was also a sharp fall in investment and transaction volumes and a halt on new constructions, as well as compressed returns on CRE properties, leading to negative margins.

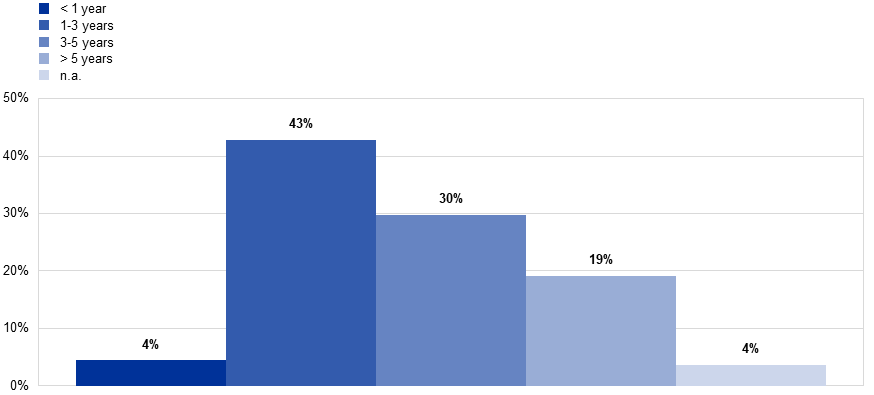

Loans with a large balance falling due at maturity[12] are often called “bullet” or “balloon” loans and are currently a particular focal point for the ECB owing to the current market conditions. A material share of these CRE loans are structured as bullet or balloon loans and as non-recourse loans. These types of financing structures pose higher refinancing risk, meaning that at maturity, borrowers may need to refinance their loans at much higher financing costs than originally foreseen. Other repayment options have also become challenging, as the deteriorating market conditions and higher financing costs also negatively affect the ability of the borrower to sell the asset and/or refinance the CRE loan at another bank.

Of the exposures captured in AnaCredit as at the second quarter of 2023, bullet/balloon type structures maturing in the next two years accounted for 8% of CRE loans. It is crucial for banks to actively engage with their CRE borrowers and assess the refinancing risk of CRE loans in a meaningful manner. They need to focus on the key considerations of this assessment, such as updated and realistic collateral valuations, the cashflow generation capability to cover financing costs, and where relevant, also sponsorship cash injection options.

Chart B

Breakdown of commercial real estate loans on varying repayment type structures by maturity end date

(share of total CRE loans)

Source: AnaCredit.

Notes: CRE loans include those loans that are collateralised or that have a CRE-related loan purpose based on AnaCredit attributes. The data are extracted from the second quarter of 2023.

The ECB continues to conduct a range of on-site and off-site supervisory activities[13] to ensure active supervisory focus on commercial real estate risk. This active focus will continue into 2024,[14] with supervisors keeping a close eye on banking and market developments in this material portfolio.

Counterparty credit risk and non-bank financial institutions

In 2023, the ECB followed up on the outcome of the work carried out on governance and management of counterparty credit risk by way of off-site and on-site activities. To this end, it published a report entitled Sound practices in counterparty credit risk governance and management summarising the outcome of the review performed in 2022 and outlining sound practices observed in the industry.

The ECB also organised a conference on counterparty credit risk for senior risk managers of SIs and other banking supervisors to discuss developments in the counterparty credit risk landscape and industry practices, as well as the current challenges and opportunities from both a practitioner’s and a supervisory perspective.

1.2.2.2 Lack of diversification in funding sources and deficiencies in funding plans

Over the past ten years, targeted longer-term refinancing operations (TLTROs) have supported banks in ensuring the supply of credit to the economy during crisis periods. That said, recourse to TLTRO III during the pandemic increased the concentration of liabilities considerably.[15] Owing to the maturity of the loans under TLTRO III, SIs now need to develop and implement sound and credible multi-year funding plans that address the challenges stemming from changing funding conditions and ensure the appropriate diversification of funding sources.

In line with the supervisory priorities for 2023-25, and as part of a broader analysis of the feasibility of liquidity and funding plans, the ECB assessed the planned repayments of the loans under TLTRO III for those SIs more exposed to increases in funding costs. Most of the scrutinised supervised entities proved to have credible TLTRO III exit strategies in place and to continue to meet both the minimum liquidity coverage ratio and the net stable funding ratio. However, some proved to have a relatively high proportion of low-quality liquid assets in the Eurosystem’s collateral pool which, once released, could not be used as collateral for private secured funding transactions. Other SIs had made rather optimistic assumptions about their deposit increases, making their strategies less viable.

The failure of Silicon Valley Bank, as well as other regional banks in the United States, in March 2023 illustrated that depositors’ behaviour can change abruptly and without warning. Social media and digitalisation, combined with the attractiveness of alternative investment opportunities, can affect the speed with which depositors react to price signals and market rumours. Therefore, in 2023 the ECB initiated additional analyses of contingency plans and collateral mobilisation capabilities in order to understand the extent to which banks can withstand short-term liquidity shocks and unexpected crisis events, including high deposit outflows. This also involved evaluating asset and liability management strategies, as well as the modelling of behavioural assumptions in the current interest rate environment.

Continued supervisory scrutiny of exposure to interest rate risk and credit spread risk

In 2023 the ECB followed up on the outcome of its targeted review of exposure to interest rate risk and credit spread risk, conducted on 29 SIs in 2022[16]. In the second quarter of 2023, the review was extended to include a new set of ten SIs. This initiative was complemented by on-site inspections. Furthermore, in the second half of 2023, the ECB initiated a horizontal review of the governance of assets and liabilities management involving 24 SIs and covering aspects related to both interest rate risk and liquidity risk management, such as the modelling of non-maturity deposits.

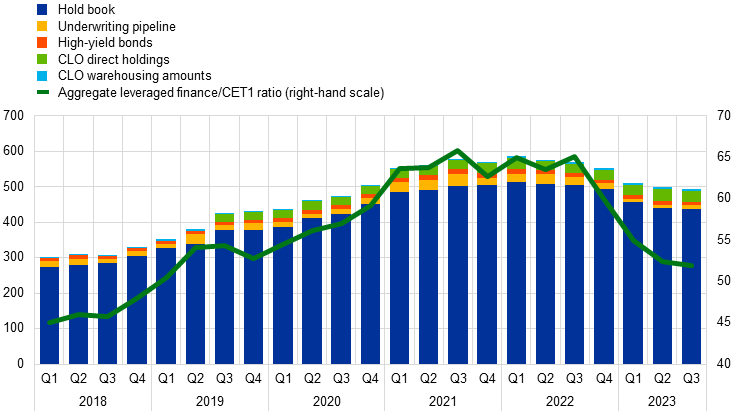

1.2.2.3 Leveraged finance

Since introducing reporting templates for leveraged finance in 2018, the ECB has observed a continued increase in holdings of leveraged loans by SIs. This increase was driven by sustained low interest rates and abundant liquidity, which encouraged higher leverage levels for borrowers and lenders, combined with a loosening of lending standards. Over the course of 2022 and in the first half of 2023, this trend was reversed. New leveraged loan issuances fell considerably on account of the energy crisis, inflation and interest rate volatility. This decrease is gradually being reflected in declining exposure levels across SIs (Chart 2). The combination of declining exposure levels and increasing CET1 ratio levels has led to a significant reduction in the leveraged finance/CET1 ratio over the past few quarters.

Chart 2

SI exposures to leveraged finance

(left-hand scale: EUR billions; right-hand scale: percentage of CET1 capital)

Sources: ECB Banking Supervision and ECB Leveraged Finance Dashboard.

Notes: Data refer to a sub-sample of banks. CLO stands for collateralised loan obligations.

The ECB has, on numerous occasions, called for more restraint by SIs in this particular market segment because of the continued growth in highly leveraged transactions. As expected, increasing borrower weakness is being reflected through higher default rates for leveraged loans both in Europe and the United States. However, overall, these default levels remain low compared with previous periods of stress, which may be explained by the weakening of covenants observed in the market. Given the high debt refinancing risk facing leveraged finance borrowers in a higher interest rate environment, there is a risk of potentially much higher non-performing exposures and defaults materialising over the next few years.

In 2022 the ECB issued a “Dear CEO” letter with detailed expectations of the internal risk appetite frameworks to be implemented and it reported on high levels of risk-taking in leveraged transactions. A gap assessment revealed numerous deficiencies for which specific follow-up measures were imposed on SIs. Throughout 2023, the ECB continued to scrutinise banks’ progress in implementing these measures. While some progress could be observed in certain banks, significant risk control deficiencies persist. Therefore, the number of banks that were subject to specific capital charges for the risks associated with leveraged finance activities increased significantly compared with 2022.

Furthermore, to support the ongoing supervisory monitoring of banks’ leveraged finance exposures, the ECB included an in-depth quality assurance analysis of leveraged finance in its 2023 EU-wide stress test. The findings of this analysis were published in a dedicated section of the ECB report on the 2023 stress test of euro area banks.

1.2.3 Priority 2: Addressing digitalisation challenges and strengthening management bodies’ steering capabilities

1.2.3.1 Digital transformation strategies and operational resilience frameworks

In 2023 the ECB continued engaging with banks on their digital transformation journey and the related risks by means of further discussions, targeted reviews and on-site inspections

Banks are becoming increasingly digital. This means that further supervisory attention needs to be paid to digital transformation strategies and the necessary risk management capabilities. This involves examining risks relating to the use of innovative technologies, as well as risks relating to operational resilience frameworks, such as dependencies on third parties and cyber risks.

With regard to digitalisation more generally, in February 2023 the ECB published an overview of the main takeaways from a survey on digital transformation and the use of fintech conducted in 2022. The overview confirmed that most SIs’ have a digital transformation strategy in place, which is focused on enhancing the customer experience. This overview also demonstrated the importance of having the right tone from executive management, as well as an effective internal control framework.

Further to this, targeted reviews on digitalisation were conducted for 21 SIs in 2023, building on the above survey results to better understand how banks define their digitalisation strategy objectives, monitor their implementation and ensure that their risk appetite frameworks and governance are fit for purpose. The results of these reviews are due to be published in the first half of 2024 and will be instrumental in providing supervised entities with the supervisors’ views and their benchmarks.

Regarding operational resilience, the number of significant cyber incidents reported to the ECB increased significantly in 2023 on a year-on-year basis. This increase was mainly driven by threat actors running distributed denial-of-service campaigns against several banks. This was accompanied by a notable surge of incidents at third-party service providers related to ransomware, a type of attack with a high potential for disruption. Furthermore, cyberattacks by state-sponsored actors also increased in the financial sector. The ECB therefore carried out a number of off-site and on-site supervisory activities relating to IT and cyber risk in 2023 and published the key results and observations in its November 2023 Supervision Newsletter.

In addition to the cyber resilience stress test planned for 2024, the ECB conducted an internal cyber resilience dry run to test the ECB’s and several NCAs’ internal communication, coordination and escalation processes in the event of a cyberattack on multiple supervised entities. This exercise was internal with no industry involvement.

With regard to outsourcing, the registers of all SIs’ outsourcing arrangements were again collected in 2023. Compared with the first submission in 2022, considerable progress was made in terms of data quality and consistency of the information collected. The results of this exercise confirmed that outsourcing is a highly relevant topic for SIs, particularly in the area of information and communication technologies. A well-established notification process informing supervisors about the intentions of supervised entities to conclude new outsourcing agreements lent additional support in assessing outsourcing risk. Additionally, the ECB initiated a targeted review of outsourcing risk, involving several SIs, which will continue until 2025. Each year, the outsourcing management framework of these SIs, together with a selected number of their outsourcing arrangements, will be reviewed. The exercise will provide a horizontal view of the risk management processes for outsourcing arrangements within SIs.

Furthermore, in line with international standards[17], operational resilience and digitalisation were the focus of the supervisory activities conducted in working groups with other European supervisory authorities in 2023. These activities included the implementation of the Markets in Crypto-Assets Regulation and the Distributed ledger technology pilot regime, discussions surrounding the Artificial Intelligence Act and the implementation of the Digital Operational Resilience Act. The ECB also incorporated the Basel Committee on Banking Supervision’s Principles for Operational Resilience in its SREP framework.

1.2.3.2 Management bodies’ functioning and steering capabilities

To foster adequate decision-making and mitigate excessive risk-taking, it is crucial for banks to have effective management bodies, sound governance arrangements,[18] robust internal controls and reliable data. The importance of having sound arrangements in place in these different areas was also illustrated by the bank failures which took place in the United States and Switzerland in the spring of 2023. These failures had governance and risk management deficiencies at their root. Despite some progress in recent years, the ECB continues to see a high number of structural deficiencies in internal control functions, management bodies’ functioning, as well as risk data aggregation and reporting capabilities.[19]

Therefore, supervisors have continued to engage with supervised entities to achieve further progress in this regard. Since 2022 the ECB has performed targeted reviews of banks with deficiencies in the composition and functioning of their management bodies, on-site inspections and targeted risk-based fit and proper (re)assessments. The ECB has further developed an approach to reflect diversity in its fit and proper assessments and has refined its data collections to enhance peer analysis[20], with targeted reviews and supervisory action continuing throughout 2024.

Follow-up action to address deficiencies also took place as part of the 2023 SREP (see Section 1.3.1.5).

Sound governance arrangements are essential for all banks regardless of their size. For this reason, the ECB continued to follow up on the results of its 2021-22 thematic review of the governance arrangements for LSIs.[21] In this vein, the ECB and national supervisors have been continuing to promote greater alignment of European supervisory expectations and standards for internal governance.

Moreover, in an effort both to encourage dialogue about what constitutes effective governance and to communicate its supervisory approach and expectations in this regard, in April 2023, the ECB reached out to industry representatives in a seminar jointly organised with the EUI Florence School of Banking[22].

1.2.3.3 Risk data aggregation and risk reporting

Robust risk data aggregation and risk reporting capabilities are a prerequisite for sound and prudent risk management. ECB Banking Supervision stepped up supervisory activities in this area in 2023

The ECB identified several deficiencies in risk data aggregation and risk reporting and included it as a key vulnerability in its planning of the supervisory priorities for the 2023-25 cycle. A comprehensive, targeted supervisory strategy covering both on-site and off-site activities was therefore developed with the aim of ensuring that banks have effective steering and risk management procedures in place based on reliable data.

With regard to the on-site activities, a dedicated on-site inspection campaign on risk data aggregation and risk reporting continued, covering 23 SIs over the course of 2022 and 2023. This campaign revealed shortcomings in terms of the involvement of management bodies, the unclear and incomplete definition of the scope of the data governance framework, as well as the lack of independent validation. Furthermore, weaknesses in data architecture and IT infrastructure, the extensive usage of manual workarounds and long reporting timelines, as well as a lack of data quality controls, were a major source of concern.

As for the off-site activities, a key pillar was the draft Guide on effective risk data aggregation and risk reporting, which includes a set of minimum requirements for effective risk data aggregation and risk reporting and is meant to assist banks in strengthening their capabilities in this regard.[23] This draft Guide does not impose new requirements but rather consolidates and clarifies important supervisory priority topics. It is therefore important that banks do not see the latest publication of the Guide as an opportunity to reset the clock for their implementation deadlines but rather as further guidance for identifying gaps and achieving observable progress in closing them. Further supervisory activities included the pilot of the Management report on data governance and data quality[24], the contribution to the progress report on global systemically important banks’ compliance with the Basel Committee on Banking Supervision’s Principles for effective risk data aggregation and risk reporting, the further strengthening of the measurement of data quality in supervisory reporting and the more effective use of supervisory tools to escalate severe, persistent deficiencies in risk data aggregation and risk reporting, including the related quantitative and qualitative measures.

1.2.4 Priority 3: Stepping up efforts in addressing climate change

Since the publication of the ECB Guide on climate-related and environmental risks in 2020, the ECB has consistently highlighted the need for banks to properly manage these risks. One of the ECB’s main supervisory priorities for 2023-25 is for banks to adequately integrate these risks into their business strategy and governance and risk management frameworks in order to mitigate and disclose such risks.

1.2.4.1 Follow-up on deficiencies identified in the thematic review

Following the 2022 thematic review on climate-related and environmental risks, the ECB set deadlines in order to smooth banks’ transition towards full alignment with the expectations outlined in the aforementioned ECB Guide by the end of 2024. The ECB communicated at that point that these deadlines would be closely monitored and, if necessary, enforcement action would be taken.

The first deadline fell due in March 2023, when banks were expected to have in place a sound and comprehensive materiality assessment and business environment scan. Since a number of banks did not deliver within this deadline, in 2023 the ECB issued binding supervisory decisions for 23 supervised entities, which envisage the accrual of periodic penalty payments for the 18 most relevant cases should the supervised entities fail to comply with the requirements within the deadlines set out in these decisions. Proceedings concerning additional draft decisions, including some with periodic penalty payments, were still ongoing at the end of 2023 (see Section 2.3.1).

The ECB will continue to closely monitor banks’ progress in 2024 and 2025 and, if needed, take enforcement action.

1.2.4.2 One-off fit-for-55 climate risk scenario analysis

In March 2023, as part of the “sustainable finance package”, the European Commission issued a mandate to the three European Supervisory Authorities[25] to conduct, together with the European Systemic Risk Board and the ECB, a one-off fit-for-55 climate risk scenario analysis to assess how agreed transition policies would affect the financial sector. The ECB is involved in the banking sector module, which includes a data collection exercise launched on 1 December 2023. The related data collection templates cover credit risk, market risk, real estate risk and income data as well as climate-relevant data on transition risk and physical risk at the counterparty and sectoral levels. The ECB intends to share its individual feedback, including the main findings, with those banks that participated in the data collection. The results of the overall climate scenario analysis for the banking sector module are due to be published in early 2025. This data collection will allow supervisors to monitor progress in line with the ECB’s 2022 climate risk stress test and to assess banks’ climate risk data capabilities and alignment with good practices in accordance with the ECB report on good practices for climate stress testing.

1.3 Direct supervision of significant institutions

1.3.1 Off-site supervision

The ECB strives to supervise SIs in a proportionate and risk-based manner. To this end, it plans and conducts various off-site supervisory activities, including horizontal and institution-specific activities each year. These supervisory activities draw on the existing regulatory requirements, the Supervisory Manual and the supervisory priorities, and form part of the annual Supervisory Examination Programme (SEP) conducted for each SI. These activities are meant to address institution-specific risks, while ensuring compliance with the supervisory priorities set by the ECB.

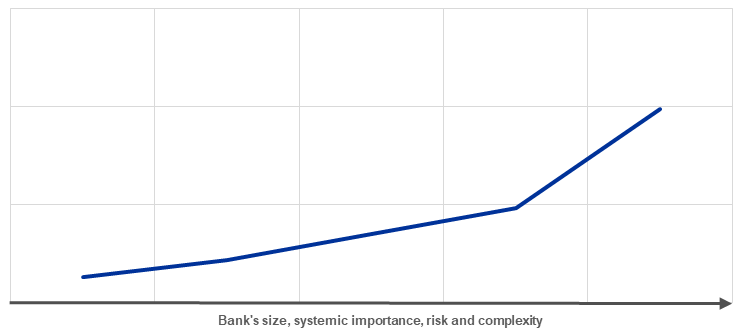

1.3.1.1 Principle of proportionality

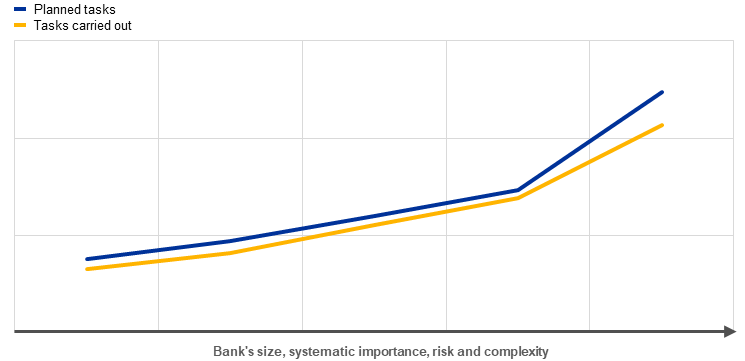

The SEP follows the principle of proportionality, i.e. the intensity of the supervision depends on the size, systemic importance, risk and complexity of each SI. Therefore, Joint Supervisory Teams (JSTs) supervising bigger and riskier SIs, on average, plan a higher number of SEP activities (Chart 3).

Chart 3

Average number of planned tasks per significant institution in 2023

Source: ECB.

Note: Data extracted as at 18 January 2024.

The number of activities carried out in 2023 was marginally lower than what was originally planned at the beginning of the year (Chart 4). This is mostly due to a small number of administrative tasks being cancelled throughout the year, which is in line with previous years.

Chart 4

Average number of tasks per significant institution in 2023

Source: ECB.

Note: Data extracted as at 18 January 2024.

1.3.1.2 Risk-based approach

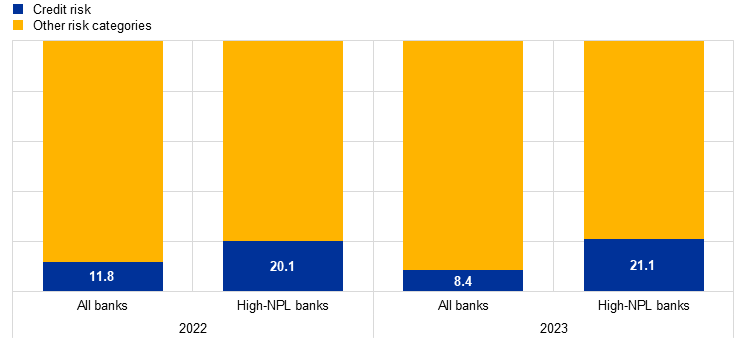

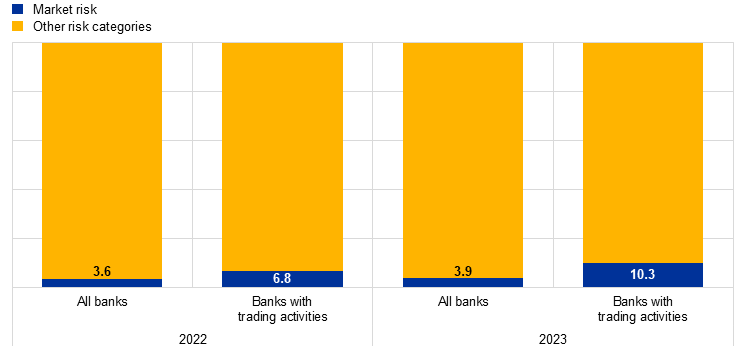

The SEP follows a risk-based approach, focusing on the most relevant systemic and institution-specific risks for each SI. For example, for high-NPL banks, the JSTs conducted (relatively) more activities related to credit risk than for the average SI (Chart 5).

Chart 5

SEP activities in 2022 and 2023: credit and market risk activities as a share of all activities

Credit risk

(percentages)

Market risk

Source: ECB.

Note: Data extracted as at 18 January 2024.

In 2023 the ECB introduced a new risk tolerance framework to better focus its work on strategic priorities and key vulnerabilities. This new framework is crucial for a more risk-focused supervisory culture that allows supervisors to tailor their activities to the individual situation of the institution they supervise, rather than taking a one-size-fits-all approach.

The risk tolerance framework is designed to facilitate the translation of the supervisory priorities into strategic planning and day-to-day supervision. For this purpose, it combines top-down guidance from the Supervisory Board on prioritised risks and vulnerabilities with bottom-up relevance assessments for each individual supervised entity. The bottom-up assessments effectively complement the top-down guidance, as some supervised entities deal with institution-specific issues that affect the risk tolerance levels set across various risks and, consequently, also affect the supervisory focus. Within the risk tolerance framework, supervisors have the authority to make full use of the flexibility embedded in the supervisory toolkit to focus on the most relevant tasks. This means that, depending on an institution’s specific circumstances, supervisors may intensify their efforts in those areas which warrant greater engagement and assign a lower priority to those areas considered less pressing.

Drawing on the positive experience gained over the course of the year, the ECB intends to complete the implementation of the risk tolerance framework by embedding it in all its supervisory processes.[26] This should further enhance the JSTs’ ability to focus on what matters the most for their individual supervised entity, including the necessary flexibility to address new and emerging risks in a changing macro-financial environment.

1.3.1.3 Supervisory planning process

The supervisory planning process, which was revamped in 2022, follows a consistent and integrated approach by which the supervisory priorities steer the planning of horizontal activities, on-site inspections and internal model investigations, among tasks.

To ensure effective supervision, the various business areas of the ECB collaborate closely when planning their activities and with due regard for the supervisory priorities, SIs’ institution-specific risks and the risk tolerance framework. This planning involves selecting samples of supervised entities that are to participate in these horizontal activities and on-site inspections. As in past years, a campaign approach was taken to on-site inspections (see Section 1.3.3 on on-site supervision). The outcome of that process is reflected in the SEP conducted by each JST for its supervised entity. Given that the SEP is an important part of the JSTs’ communication with the SI, a simplified SEP is also shared with the SIs which forms the work programme for the forthcoming year.

Based on the principle of proportionality, the off-site SEP activities include (i) risk-related activities (e.g. the SREP); (ii) other activities related to organisational, administrative or legal requirements (e.g. the annual assessment of significance); and (iii) additional activities planned by JSTs to further tailor the SEP to the specific characteristics of the supervised group or entity (e.g. analyses of the bank’s business model or governance structure).

1.3.1.4 Overview of supervisory activities

The ECB ensures that its resources are adequate for addressing its strategic and supervisory needs. Senior management is provided with regular reports on how its supervisory priorities have been incorporated into the planning and whether all activities and projects have been accomplished as planned.

In 2023 the ECB conducted an organisational readiness assessment, which evaluated its preparedness in ensuring that its proposed supervisory priorities could be successfully put into action based on the available set of skills and resources (see Section 5.3.3).

Monitoring and regular reporting of supervisory activities is crucial for the strategic steering of supervisory initiatives. This way, senior management can assess developments in supervisory priorities, as well as other initiatives, and stay informed about the progress being achieved in terms of the related supervisory activities. This assessment forms the basis for the update of the supervisory priorities and fosters efficient decision-making by senior management.

1.3.1.5 Supervisory measures

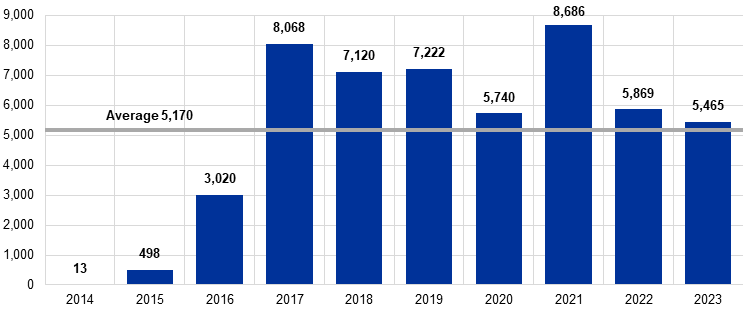

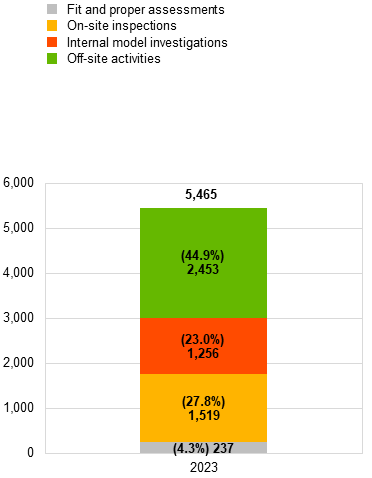

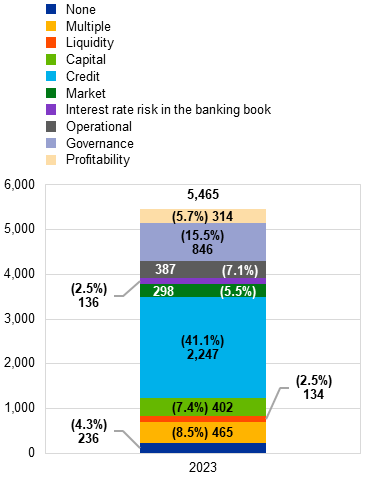

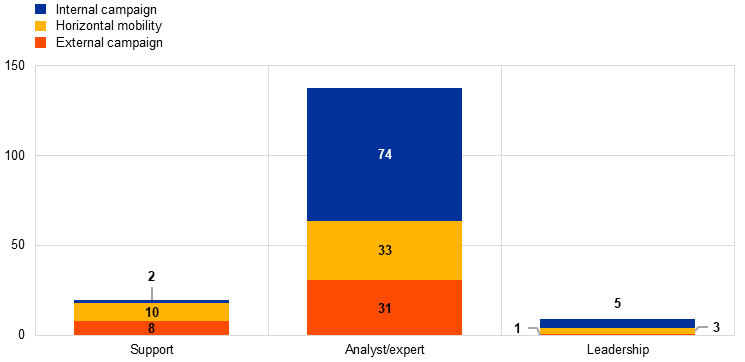

Supervisory measures are one of the key outcomes of regular on-site and off-site activities. They set out detailed actions to be taken by supervised entities to remediate shortcomings. The JSTs are responsible for monitoring the timely and effective implementation of these measures. In 2023, the total number of recorded measures was similar to that in 2022. The most important driver of supervisory measures in 2023 was off-site supervisory activities (39%). As in 2022, the highest number of new supervisory measures (45%) related to credit risk (Chart 6).

Chart 6

a) Number of measures recorded each year

(number of measures)

b) Measures by activity | c) Measures by risk category |

|---|---|

(number of measures) | (number of measures) |

|  |

Source: ECB.

Notes: The sample includes measures across all entities under the ECB (varying sample). Data extracted as at 25 September 2023.

1.3.1.6 SREP horizontal analysis

The ECB published the outcome of the 2023 Supervisory Review and Evaluation process on 19 December 2023. This included further developments in SREP scores and Pillar 2 capital requirements and guidance as well as a deeper analysis of selected risk areas. With the consent of the relevant SIs, the ECB made available bank-specific Pillar 2 requirements, including those that are used for addressing the risk of excessive leverage applicable in 2024.

The 2023 SREP demonstrated banks’ overall resilience, as they maintained solid capital and liquidity positions amid various macroeconomic challenges (see Section 1.1.1).

Downside risks remained resulting from reduced economic growth, continued restrictive monetary policy, credit supply tightening and the withdrawal of fiscal support. The banking turmoil seen in the United States and Switzerland last spring did not significantly affect supervised entities but called attention to the potential for rapid interest rate adjustments to cause market instability.

In 2023 the ECB observed improvements in the banking sector. Benefiting from boosted interest income, the aggregate return on equity of supervised entities was 10.0% in the first nine months of 2023. Asset quality improved, with the NPL ratio decreasing from 2.6% in 2021 to 2.3% in the third quarter of 2023.

The overall SREP score remained stable at 2.6, with 30% of supervised entities seeing a change in their score. The overall capital requirements and guidance increased slightly to 15.5% of risk-weighted assets (15.1% in 2022), while the median of Pillar 2 requirements stood at 2.25% (2.15% in 2022). Banks should continue to address the structural challenges outlined in the supervisory priorities for 2024-26 (see Section 1.6).

1.3.1.7 SREP review by external experts

On 17 April 2023 the ECB published the results and recommendations of an expert group’s assessment of European banking supervision, and in particular of the SREP.

While acknowledging good progress in ensuring that SIs maintain sufficient capital levels, the Assessment of the European Central Bank’s Supervisory Review and Evaluation Process invites the ECB to revise its risk scores, as well as the process for determining Pillar 2 capital requirements. Given that capital alone cannot address all types of risk, the report recommends that the ECB make full use of all instruments in its toolbox, including effective qualitative measures, to encourage banks to tackle weak business models and governance practices.

The report complements the conclusions drawn by the European Court of Auditors’ report to further enhance the efficiency and effectiveness of ECB Banking Supervision (see Section 5.1.1).

The ECB began implementing some of the expert group’s recommendations during the 2023 SREP cycle. For example, as part of completing the implementation of its risk tolerance framework for all supervisory processes, the ECB introduced a new multi-year assessment for the SREP. This enables supervisors to better calibrate the intensity and frequency of their analyses, in line with the individual banks’ vulnerabilities and broader supervisory priorities. The ECB also continues to strive to improve its risk-based supervision and foster the influence of supervisory judgement. Therefore, initiatives such as the multi-year assessment and the risk tolerance framework will be further refined to help nourish a well-defined supervisory culture.

Furthermore, in 2023 the ECB improved its communication surrounding the disclosure of SREP methodologies for Pillar 2 requirements. This included enhanced disclosure on methodologies for assessing the leverage ratio, internal governance and risk management, and business model, credit and market risks.

Box 2

Follow-up on Brexit: desk-mapping review and on-site activities

The desk-mapping review is a review of booking and risk management practices across market-making trading desks of banks that relocated some of their business to subsidiaries in the euro area after Brexit. It was initiated in the second quarter of 2020, with a view to ensuring that third-country subsidiaries did not operate as empty shells.

The first phase of this exercise found that of the 264 relevant trading desks, equating to around €91 billion of risk-weighted assets, around 70% used a back-to-back booking model and circa 20% were organised as split desks, whereby an affiliate of the primary desk that trades the same products is set up. This high rate of back-to-back booking models, particularly for material trading desks, was considered to be out of line with the supervisory expectations on booking models. In response, the ECB took a proportionate approach based on materiality and identified 56 material trading desks, resulting in individual binding decisions, including several requirements with which third-country subsidiaries would need to comply.

Once they do comply, most of the market risk-related risk-weighted assets managed by third-country subsidiaries will be subject to enhanced local risk management. In particular, first and second lines of defence are to be strengthened, with reporting lines straight to the relevant European entity. Third-country subsidiaries are also expected to establish local treasury units and x-value adjustment desks. In addition, third-country subsidiaries will need to ensure independent access to critical infrastructures and establish additional controls for remote bookings and hedging between different entities.

Supervised entities plan to comply with the requirements of the desk-mapping review through the use of a combination of booking models. For the interest rate business, such as European government bonds and euro-denominated swaps, the relevant entities intend to establish a significant trading presence in Europe, moving from back-to-back to a local risk management booking model. In the equity business, by contrast, cash, credit and derivatives are predominantly covered by split desks.

The ECB will continue monitoring the alignment of banks’ booking models with supervisory expectations and will plan supervisory measures accordingly.

1.3.2 Supervision of entities with subsidiaries in Russia

Supervised entities are scaling down their activities in Russia which is being closely monitored by the ECB

Since the start of Russia’s invasion of Ukraine in February 2022, the ECB has been closely monitoring the situation and has engaged in dialogue with the few supervised entities that have subsidiaries in Russia. While most of these entities have held on to their Russian subsidiaries, they have made some progress in scaling down their activities in this market. Overall, SIs reduced their exposures to Russia by 21.4% between the end of 2022 and the third quarter of 2023[27], thus progressively shrinking their exposure levels since the onset of the war. Most banks also decided not to accept any new business in Russia, where legally permissible, and are now exploring exit strategies, such as the sale of business or the winding down of their operations in the Russian market. As explained in a letter dated 27 June 2023 to MEPs de Lange and Juknevičienė on banks’ activities in Russia, the ECB asked these banks to push ahead with their downscaling and exit strategies by creating clear roadmaps and regularly reporting to their management bodies and to the ECB on the progress being made, as well as explaining any delays and/or execution impediments. Where relevant, specific measures were taken by the ECB to address the particular situation of individual SIs.

1.3.3 On-site supervision

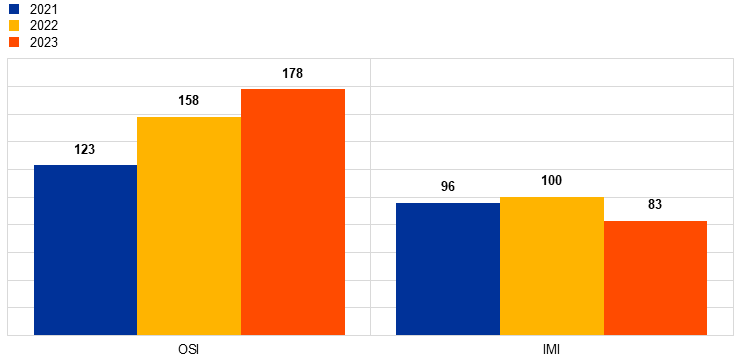

178 on-site inspections (OSIs) and 83 internal model investigations (IMIs) were launched for SIs in 2023. Similar to the previous year’s trend, in 2023 most OSIs and IMIs were performed based on hybrid working arrangements. The ECB also continued to work on the implementation of the risk tolerance framework[28].

Implementing the risk tolerance framework meant increasing efficiency by optimising resource allocation in line with the scope, size and complexity of the inspected institution. It also involved strengthening the risk-based approach as well as combining missions and, where possible, examining blind spots and top-down priorities, while also better integrating off-site, horizontal and on-site activities. This streamlining has allowed the number of OSIs to be increased over the last three years. The number of IMIs to be conducted has, by contrast, decreased over the last two years (Chart 7) owing to a lack of resources, together with an increased number of extensive IMIs to address banks’ requests for material model changes following the latest regulatory requirements.

The OSI campaign approach used in previous years continued to be applied to a number of risk areas, thereby transforming the supervisory priorities into strategic initiatives and complementing other more institution-specific OSIs. These campaigns focused on (i) credit risk, (ii) interest rate risk and credit spread risk in the banking book (IRRBB/CSRBB), (iii) risk data aggregation and reporting, (iv) internal capital adequacy assessment process (ICAAP), and (v) business model and profitability. Dedicated OSIs were also conducted in connection with the supervisory priorities on topics such as digital transformation, IT and cybersecurity, management body functioning and effectiveness. Climate-related and environmental risks were assessed either by way of institution-specific or risk-specific OSIs.

The IMIs conducted in 2023 covered areas such as the implementation of the latest EBA standards and guidelines, the fundamental review of the trading book, and follow-ups to the targeted review of internal models.

Chart 7

On-site inspections and internal model investigations launched in 2021, 2022 and 2023

(number of investigations)

Source: ECB Banking Supervision.

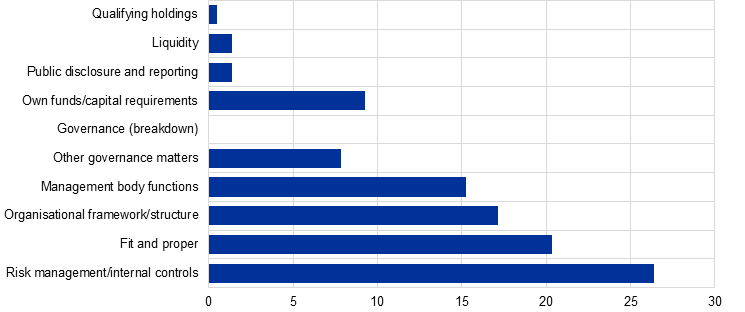

1.3.3.1 Key findings from on-site inspections

In terms of credit risk, severe weaknesses were found in identifying credit deterioration, including evaluating and identifying significant increases in credit risk, classifying both Stage 2 and unlikely-to-pay exposures, and classifying forborne exposures and the related forbearance processes. There were also some major issues in the risk monitoring processes, with deficiencies in the areas of the early warning system and the role of the risk management body in managing to properly monitor and control credit risk. Furthermore, there were shortcomings in the areas of expected credit losses, including the calculation and calibration of parameters such as the loss given default, the probability of default and the cure rates, as well as in the provisioning process for Stage 2 and Stage 3 exposures, both at the individual and collective levels.

In terms of market risk, the main weaknesses concerned governance, fair value measurements and additional value adjustments. These were particularly apparent as regards the insufficient reliability of market data sources or the coverage of independent price verifications, inadequate methodologies for the fair value hierarchy and additional value adjustments, or in the shortcomings in the day-one profit deferral calculations. Severe shortcomings were also evident in counterparty credit risk, where stress-testing frameworks, risk identification, limit setting and collateral management were seen to be areas for concern.

In terms of liquidity risk, the severe findings related to weaknesses in the measurement and monitoring of risk, including shortcomings in quantification methodologies, the accuracy and completeness of data and in scenario design for stress testing. Further severe findings were identified with regard to regulatory reporting and the calculation of the liquidity coverage ratio and the net stable funding ratio.

In terms of IRRBB, the vast majority of critical findings concerned weaknesses in the measurement and monitoring of IRRBB. In particular, they related to the inadequacy of quantification methods, the lack of robustness of key modelling assumptions, outdated data and weak model risk frameworks. Other severe findings revealed an insufficient formalisation of the IRRBB management profile and strategy, as well as the low involvement of the risk management body in defining and monitoring IRRBB risk management processes.

In terms of business model and profitability, the most severe findings related to strategic planning, the monitoring of strategy implementation, income and cost allocation frameworks and financial projections, with inadequately justified and outdated assumptions being a source of concern.[29]

The initial OSIs on the review of banks’ digital transformation[30] showed challenges related to monitoring and steering projects and change management. Additionally, the misalignment of IT strategies and business strategies raised concerns with respect to governance.

In terms of climate risk, which is a risk driver of other existing risk categories, such as the business model, credit risk, internal governance and operational risk, the initial dedicated OSIs on climate risk revealed further weaknesses in terms of integrating climate risk in credit risk management and climate and environmental data governance, in quality controls and in data strategies. This was also corroborated by a supervisory horizontal review, which ultimately led to enforceable transition plans for all SIs.

In terms of internal governance, the most critical findings were related to (i) independence, scope of activity and resources for all internal control functions; (ii) insufficiently comprehensive frameworks, inadequate data architecture and IT infrastructures, and weaknesses in data quality management in the area of risk data aggregation and reporting; and (iii) the management body’s steering capabilities, including insufficient interaction between members of the management body, weak institution-wide risk culture, insufficient oversight over the implementation of banks’ business and risk strategies. These findings also confirm that governance remains a high supervisory priority.

In terms of the ICAAP, the most severe findings concerned (i) weak internal quantification methodologies for credit risk, market risk or interest rate risk; (ii) inadequate methodologies to identify material risks as part of the risk identification process, with an incoherent overall ICAAP architecture; and (iii) discrepancies between the internal capital and economic capital adequacy concepts.

In terms of the regulatory capital (Pillar 1), the main findings revealed (i) insufficient control frameworks for the capital requirements and own funds calculation process, and (ii) incorrect allocation of exposures to exposure class or inadequate assignment of risk weights to exposures.

In terms of IT and cybersecurity management, these risks constituted around half of the most severe findings identified in the overall area of IT risk. Previously, the findings had related to preventing a cyberattack, identifying cybersecurity risks and safeguarding IT assets. However, in 2023 the ECB identified an increasing trend in findings surrounding cyber incident response and recovery capabilities.[31]

A substantial number (around 16%) of the remaining IT severe findings concerned the IT outsourcing arrangements that banks have with third parties. Therefore, in addition to assessing this risk during the usual IT risk OSIs conducted at the SIs, in 2023 the ECB performed a dedicated OSI at a large cloud service provider.

1.3.3.2 Key findings from internal model investigations

In 2023 most IMIs were triggered by requests from banks to assess model changes[32], model extensions or model approvals, rather than having been initiated by the ECB. The ECB also received and assessed numerous applications to revert to less sophisticated approaches, usually as part of the broader initiatives taken to simplify internal model landscapes.

Banks’ internal models generally improved following the 200 model investigations conducted as part of the targeted review of internal models between 2017 and 2021. Their modelling approaches now better meet (or are being changed to meet) the specifications defined in the EBA’s new regulatory framework. However, the investigations still exposed several weaknesses, some of which were severe, indicating institutions’ lack of preparedness in terms of model change requests. The internal control functions of banks should play a more active and independent role in this respect.

Approximately one-third of the findings resulting from IMIs were of high severity. Regardless of the risk type being investigated, the categories “model description”, “processes” and “validation” contained the highest number of findings. Looking purely at the procedural aspects related to IRB models, approximately one-third of the findings were of high severity, of which roughly half concerned shortcomings in the IT infrastructure and the definition of default. For probability of default modelling and for loss given default modelling, approximately one-third of the findings were of high severity and mostly concerned risk quantification and the structure of the rating system.[33] In areas where severe findings were numerous, the ECB provided additional clarification in its revised Guide to internal models.

Only very few market risk investigations took place during the reporting period owing to the forthcoming fundamental review of the trading book. As a result of those market risk IMIs, findings mostly concerned validation, x-value adjustment and incremental risk charge modelling. As a result of the very limited number of counterparty credit risk IMIs, there was no clustering of findings.

1.4 ECB oversight and indirect supervision of less significant institutions

1.4.1 Structure of the less significant institution sector

The number of LSIs continued to decline, mainly due to mergers, although some new licences were granted to new fintech entities

The LSI sector remains rather fragmented. 83% of all European LSIs are located in Germany, Austria and Italy. These countries have therefore been the drivers of consolidation in the LSI sector. The number of LSIs declined to 1,956 entities in the third quarter of 2023 compared with 2,014 at the end of 2022. Most of these structural changes were related to the mergers of 53 entities, with four banking licences being withdrawn. At the same time, six new licences were granted, most of which were for technology-enabled companies (fintech entities).

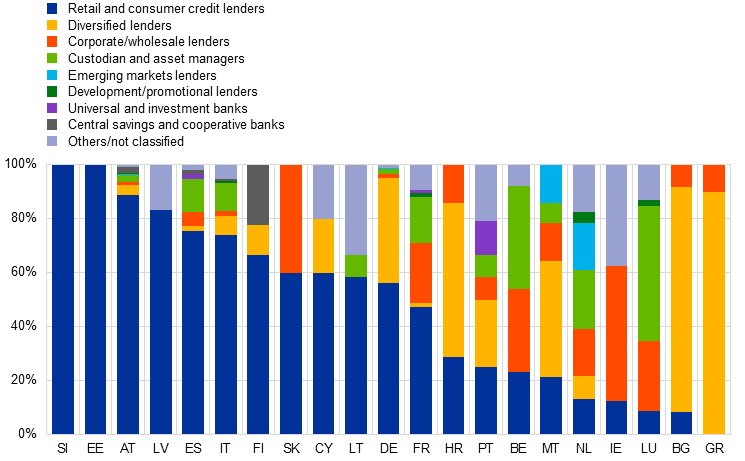

While the LSI sector is composed of quite diverse and sometimes very specialised business models, retail lenders remain the predominant component. They are often regional savings and/or cooperative banks, many of which are members of institutional protection schemes and mostly located in Germany and Austria. Generally, LSI activities are still more concentrated in certain regions than those of SIs.

Despite ongoing consolidation, the number of LSIs still exceeds that of SIs, particularly in Germany, Austria, and Italy, where the vast majority of European LSIs are located.

Despite the overall declining number of LSIs, this sector continues to constitute a relevant share of the European banking sector, accounting for roughly 15.4% of total banking assets excluding financial market infrastructures. The share of LSI assets in the respective country’s total banking assets deviates considerably, however, pointing to structural differences across Member States. While in Luxembourg, Germany, Malta and Austria, LSIs accounted for more than one-third of the total assets held in the domestic banking sector, the LSI sector in most other countries is relatively small. For instance, in France, Greece and Belgium, this sector represents only 2.4%, 4.1% and 5.5%, respectively, of total banking assets.

Chart 8

Business model classification of less significant institutions

(percentages)

Source: ECB calculations based on FINREP F 01.01, F 01.01DP.

Note: The chart shows the number of banks by business model according to the classification as reported by the national competent authorities following a standardised classification menu.

1.4.1.1 Selected oversight activities

Interest rate shifts drew attention to liquidity, as well as increasing credit risk in terms of outstanding loans

Owing to geopolitical events, financial markets were subject to significant volatility in 2023. Moreover, the rapid increases in interest rates, affected existing interest-bearing assets and liabilities. The increased risk aversion of investors led banking supervisors to place liquidity and funding risks at the top of their agenda. ECB Banking Supervision and the national competent authorities focused increasingly on interest rate risk, as well as the suitability and sustainability of LSI funding.

Despite the continued decrease in the NPL ratio in 2023, credit risk remained a key area of supervisory focus for LSIs. Besides multiple quantitative benchmarking exercises, the ECB also conducted a review of credit risk assessment practices within European banking supervision, as well as updating the harmonised SREP methodology for credit risk in LSIs.

At the same time, supervisors strengthened their crisis management cooperation frameworks (see Section 3.3).

1.4.2 Horizontal work on stress testing of less significant institutions

Building on the 2022 review of national practices for the supervisory stress testing of LSIs, the ECB and the national competent authorities have been working on collecting and exchanging information on the stress-testing practices used for LSIs, including the methodologies and tools. This ongoing work aims to promote both good practices and synergies, and where appropriate, also draw on the supervisory stress test approaches used for SIs.

1.5 The ECB’s macroprudential tasks