- SUPERVISION NEWSLETTER

Internal models supervision: where do we stand?

16 August 2023

The supervision of internal models has come a long way: European banking supervision has made a considerable investment in assessing internal models in order to ensure regulatory compliance, while banks have made efforts to review their model landscapes. This feature article looks at the model investigations performed and the supervisory approach taken towards these assessments in recent years. As challenges still persist and banks are required to ensure full compliance with regulatory requirements, the article also discusses the weaknesses identified and their severities as well as the measures imposed to address potential underestimation of capital requirements.

Going forward, banks should continue to ensure that their model applications are submitted in due time and in high quality and make further efforts to streamline their sometimes highly complex model landscapes. The ECB strongly encourages banks to make use of the available supervisory framework to obtain permission to use less sophisticated approaches when the models apply to small portfolios or rely on limited representative data or require high operational efforts and are expensive to maintain.

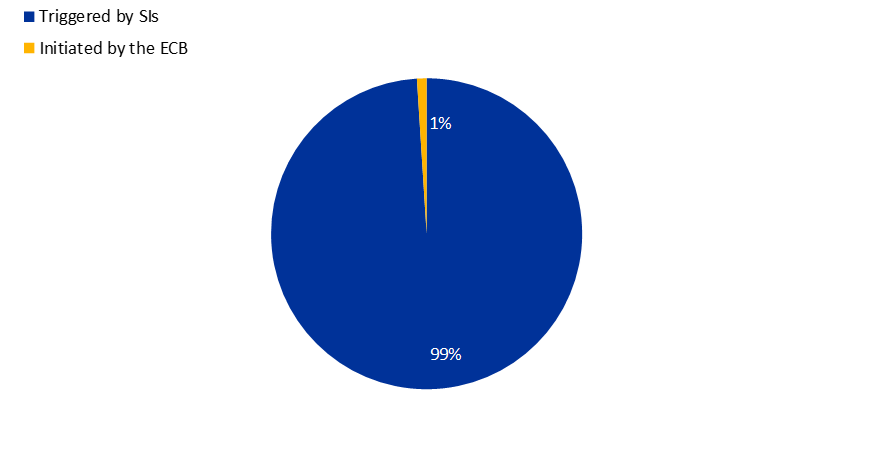

Over the past two years 99% of investigations have been triggered by requests from the banks themselves

The Targeted Review of Internal Models (TRIM)[1], which was concluded in April 2021, was ECB Banking Supervision’s biggest push towards harmonising the supervisory treatment of internal models and making them compliant with existing rules. Since then, ECB Banking Supervision has focused mainly on assessing model changes requested by significant institutions (SIs) to comply with new regulatory requirements or to remediate weaknesses identified during TRIM. Thus, over the past two years, the vast majority of internal model investigations (IMIs) have been triggered by requests from banks to assess model changes, model extensions or initial model approvals rather than being initiated by the ECB.

Chart 1

Share of IMIs by requester

(percentages)

Source: Supervisory Examination Programmes 2021-2023.

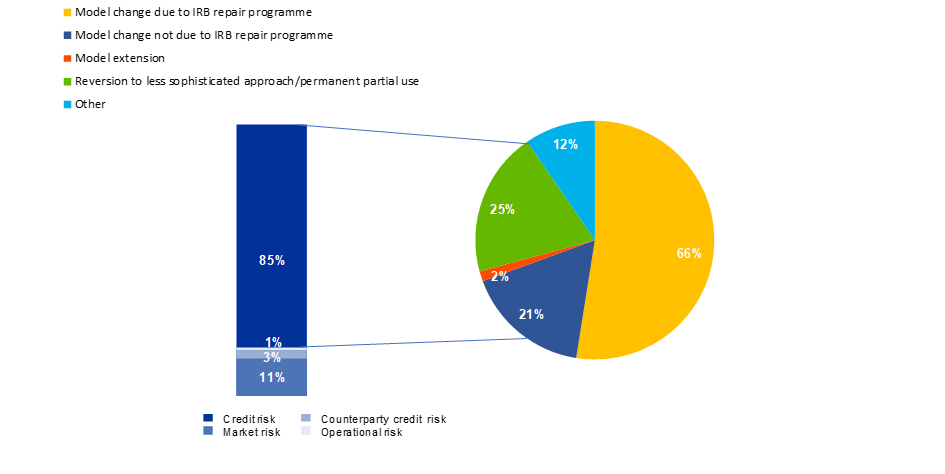

More than 80% of all internal model-related requests assessed by the ECB since the beginning of 2021 focused on credit risk internal models, of which almost two thirds were triggered by the need to meet new European Banking Authority (EBA) requirements arising from the regulatory review of the internal ratings-based (IRB) approach (the EBA “IRB repair programme”). The deadline for complying with most of these requirements was the end of 2021, so a large number of corresponding requests were assessed in 2021 and 2022 and the remaining ones will be assessed in the course of 2023.

Chart 2

Share of IMIs by type of request – with particular focus on credit risk IMIs

(percentages)

Source: Supervisory Examination Programmes 2021-2023.

A large number of investigations also included reviews of measures taken to remediate weaknesses identified during TRIM investigations. The 200 on-site TRIM investigations had revealed that banks needed to improve the way they implemented and used internal models (see TRIM project report). In addition, some institutions relocated business (e.g. as a result of Brexit) and required the ECB’s approval to continue using internal models that had initially been approved outside the scope of European banking supervision. The main focus of the latter investigations in 2021 and 2022 was on the internal model approach for market risk and counterparty credit risk.

Finally, the ECB received and assessed applications to revert to less sophisticated approaches (the standardised approach or the foundation IRB approach). Some of these requests anticipated the decommissioning of models as a result of the new Basel standards (in particular, advanced measurement approaches for operational risk, and models for loss given default (LGD) and conversion factor for large corporates and financial institutions). In other cases, the requests were part of broader initiatives launched by banks in coordination with their Joint Supervisory Teams to simplify their model landscapes in line with the ECB’s supervisory expectations (see section “Banks are expected to simplify their internal model landscapes” below). Particular attention was paid by the ECB to preventing any cherry-picking in the selection of portfolios for these reversions. The ECB has also included specific guidance on this in its revised ECB Guide to internal models which is currently under consultation.

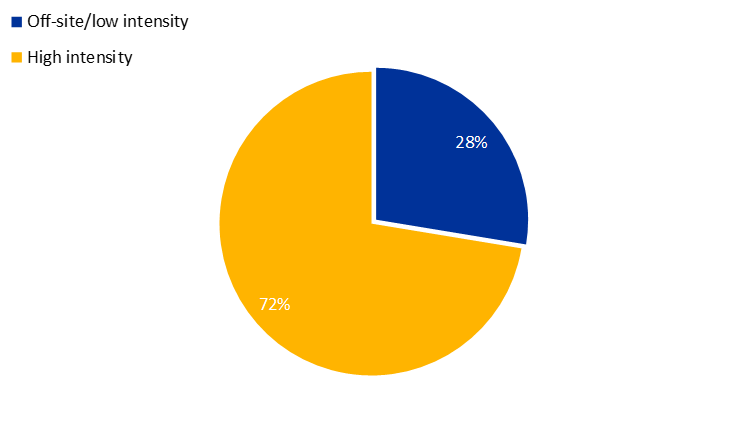

Investigations of different intensity

In 2021 the ECB introduced a new intensity framework for IMIs in order to ensure that available resources are used in a proportionate, efficient and consistent manner. For the assessment of less material and/or less complex model requests, the intensity framework foresees a fully off-site assessment (“central model desk review”) or a low intensity on-site mission. In 2021-22 about one quarter of the finalised investigations were already performed with lower intensity and required substantially less resources than the more complex and intense on-site investigations. It is worth mentioning, however, that lower intensity does not mean lower expectations regarding banks’ fulfilment of the regulatory requirements or regarding their interaction with the assessment team during the investigation.

Chart 3

Share of IMIs by intensity

(percentages)

Source: Supervisory Examination Programmes 2021-2023.

However, as the introduction of this new intensity framework coincided with a period in which banks requested more fundamental changes to their rating systems, a significant proportion of the investigations continued to be of higher intensity. The full potential of the intensity framework is therefore expected to materialise only after the conclusion of the IRB repair programme when banks return to more normal levels of model maintenance. Going forward, the ECB expects the newly introduced intensity framework to contribute to further increasing the ECB’s capacity to carry out model investigations applying a risk-based approach. At present, however, the efficiency of the assessment process is sometimes significantly hampered by the poor quality of the applications submitted and documentation provided by institutions. Still too many planned applications continue to be postponed or cancelled because banks are not ready in time, or because the quality of the application package is insufficient, leading also to the withdrawal of applications during an already ongoing investigation.

Main results of the investigations

Banks’ internal models have generally improved following TRIM, and the modelling approaches now meet (or are being changed to meet) the specifications defined in the EBA’s new regulatory products. Nonetheless, the assessments still revealed weaknesses, some of which were severe. On average, 17 findings were identified per investigation, and a third of these findings were of higher severity.

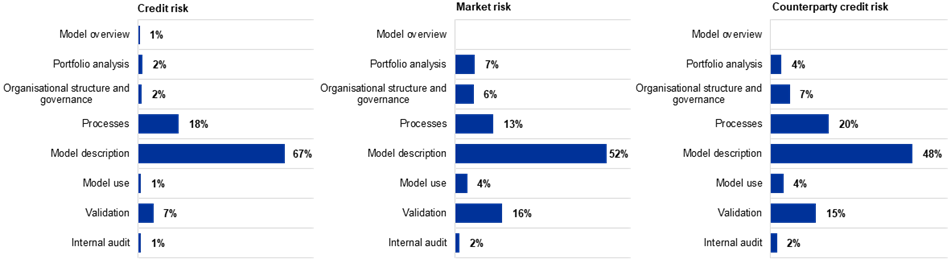

Regardless of the risk type investigated, the categories "model description", "processes" and "validation" contained the highest share of findings.

Chart 4

Share of total number of findings (F1 to F4) by category and risk type

(percentages)

Source: Supervisory Examination Programmes 2021-2023.

Note: Findings are ranked by severity from F1 (low) to F4 (very high) based on their expected impact.

High severity findings (F3/F4) on processes related to credit risk models

Looking only at procedural aspects related to IRB models, 30% of the findings are high severity findings, of which one third concern shortcomings in data quality and documentation. Following TRIM, most banks implemented a data quality framework, but the quality of the data entering the models is still a concern and improvements are needed. While the new definition of default is now used by all banks, deficiencies were still observed in its technical implementation. Similarly, shortcomings in banks’ readiness to implement model changes (not assessed in TRIM) were identified.

High severity findings (F3/F4) on credit risk modelling approaches

For probability of default (PD) modelling, 31% of findings are high severity findings and these mostly concern risk quantification and margin of conservatism (MoC)[2]. Banks have now implemented a framework to identify deficiencies and apply an MoC, but their MoC calculation practices are still diverse and not always appropriate. Banks have also set up a dedicated process to define the period used for the likely range of variability of default rates. However, in many cases supervisors deemed the definition of this period still improperly justified or inadequate. For LGD modelling, 33% of findings are high severity findings, of which the majority pertain to risk quantification and the calculation of realised LGD, which was already a major point of concern in TRIM. Although some topics are now subject to fewer deficiencies (in particular, discount rates and the treatment of multiple defaults), a lot of severe shortcomings are still identified, including for the estimation of downturn LGD.

In areas where severe findings were frequent, the ECB has made additional clarifications in its revised Guide to internal models. Areas with particularly frequent deficiencies include models/portfolios that cover a low number of exposures and/or lack sufficient historical default data.

IMIs do not systematically raise risk-weighted assets

The weaknesses identified during the internal model investigation, their severities and the quantification of their impact are shared with the bank via the assessment report and discussed in a dedicated exit meeting after the end of the on-site phase. The final outcome of the investigation is set out in a supervisory decision.

The actual impact of such a supervisory decision depends on the implementation of the model changes and on the limitations imposed by the decision that aim to cover for any material underestimation of capital requirements or for high uncertainty with regard to the reliability of the risk parameters.[3]

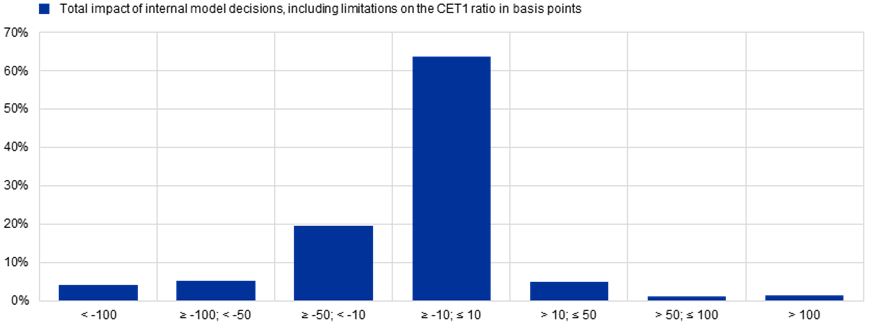

Chart 5

Total impact of internal model decisions on banks’ CET1 capital ratio

(percentages)

Source: ECB decisions issued between January 2021 and March 2023, excluding decisions taken in the context of TRIM.

More than half of the model investigation decisions taken between January 2021 and March 2023[4] had no material impact on banks’ Common Equity Tier 1 (CET1) capital ratios. Any observed negative impact is mostly associated with model changes requested in order to comply with new regulatory requirements (EBA IRB repair programme) and requests to revert to less sophisticated approaches in order to simplify the model landscape. About 20% of all internal model decisions impose a limitation to address severe shortcomings that leads to a decrease of more than 10 basis points in the CET1 capital ratio, in addition to the impact of the model change. Overall, there is no evidence of a systematic increase in risk-weighted assets (RWA) as result of internal model investigations.

Banks are expected to simplify their internal model landscapes

When the Basel 2 framework was introduced in 2007, national supervisory authorities underscored the importance of implementing internal models across all exposure classes, sometimes even imposing minimum coverage requirements for IRB models. This led some banks to develop IRB models across all exposure classes, even for small portfolios or portfolios with limited representative data.

More recently, however, regulators have recognised the limitations of applying IRB modelling techniques, especially for such portfolios. In addition, more detailed and stricter standards resulting from EBA and EU regulation make it more challenging for banks to comply with all the rules, in particular for portfolios of small size and/or with limited representative data. This is also confirmed by the findings of the model investigations, which identified frequent severe deficiencies in modelling approaches.

In this context, the ECB expects banks to undertake a thorough evaluation of their IRB model landscapes with the aim of streamlining them. The evaluation should take into account the implementation of the final Basel 3 standards, the bank’s operational capacity for – and costs associated with – rolling out or maintaining IRB models, and the suitability of these models for different portfolios (e.g. availability of minimum representative data). On the basis of the evaluation, banks should establish a comprehensive internal models strategy, including clear and well-defined criteria for choosing the appropriate approach for calculating own funds requirements (i.e. foundation IRB, advanced IRB or standardised approach for credit risk), thereby ensuring an efficient, consistent and holistic approach.

The ECB’s expectations going forward

To conclude, the ECB has made great efforts to ensure that the quality standards defined under TRIM continue to be applied and to ensure a level playing field for all institutions directly supervised by the ECB. Most of the model investigations carried out over the past two years were aimed at assessing either model changes triggered by TRIM findings or changes introduced to comply with EBA requirements. While there was no systematic increase in risk-weighted assets as a result of these investigations, some decisions had an impact on banks’ capital requirements, either through new EBA requirements or through supervisory add-ons imposed to address deficiencies in banks’ modelling approach that led to an underestimation of risk.

The ECB encourages banks to continue to simplify their model landscape. It expects banks to place the primary focus of their internal model-related activities on the most material portfolios where sufficient data for proper modelling are available. In this respect, banks need to ensure that the models are built on a sufficient number of exposures in order to fulfil the regulatory requirements and in particular to prove the accuracy and robustness of the estimates. Banks should also ensure that all the units in charge of developing and implementing internal models (including units in charge of independent reviews) are adequately staffed so that shortcomings identified internally or externally can be corrected in a timely manner.

Finally, the ECB is continuing to improve its own processes to ensure efficient and risk-based model assessments on an ongoing basis. However, these improvements can only fully materialise if banks’ model applications are of good quality and are submitted in time. The ECB expects banks, and particularly their management bodies and senior management, to be committed to ensuring a high quality of applications and to adhere to the agreed timelines. In particular, banks should only submit requests for model changes or extensions when all the underlying deficiencies have been fully remediated. The internal control functions of banks should play a significant role in this respect, and their role, independence and commitment should be further strengthened.

TRIM was ECB Banking Supervision’s largest project to date. It looked at how 65 banks model credit, market and counterparty credit risk with the aim of making internal models more reliable and comparable and supervisory practices more consistent.

MoC is an add-on incorporated in risk estimates that accounts for the expected range of estimation errors stemming from any identified deficiencies that generate additional uncertainty as well as from general estimation errors.

The impact is estimated considering the data provided in the application of the institution. Therefore, it does not necessarily reflect the impact observed at the time the model is actually implemented, given that the composition of the portfolio can change and other value-influencing factors can occur at any time.

Excluding decisions taken in the context of TRIM.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts