- SUPERVISION NEWSLETTER

Banks’ business models: an uncertain environment needs agile steering

15 February 2023

ECB Banking Supervision aims to keep banks sound and healthy. This requires ongoing supervision of their activities today, as well as making sure they are fit for tomorrow. Especially in uncertain times, effectively adapting business models to changes in the macroeconomic environment is crucial for managing risk. This is why banks’ business models and profitability have ranked high on supervisory agendas for several years in a row and supervisors regularly assess how banks fare in day-to-day supervision. This attention is clearly needed: one in four banks was not able to benefit from rising interest rates due to their business mix and internal steering. On a more positive note, the ECB found that banks with stronger strategic steering capabilities typically generate higher returns. This might incentivise all banks to proactively improve their processes and procedures, where relevant.

In this article, we explain how banks’ profitability responded to the challenging economic situation and why we would caution against overly optimistic forecasts. Finally, we share the key lessons from our 2022 on-site inspection campaign on banks’ business models and profitability.

Banks’ profitability in the current macroeconomic environment

The post-pandemic recovery shaped the macroeconomic environment in 2021, with rebounding GDP growth and elevated inflation as supply chain issues were exposed when demand picked up. At the beginning of 2022, most projections pointed towards more of the same and some moderate shifts of the yield curve indicated expectations of an exit from negative interest rates. However, with the Russian invasion of Ukraine, economic sanctions and the partial stoppage of Russian gas supplies to EU countries, the economic environment underwent rather drastic changes. Since the beginning of 2022, Eurosystem staff have significantly revised down their year-end projections for real euro area GDP growth: from 4.2% to 3.4% for 2022, and from 2.9% to 0.5% for 2023. Some euro area countries were even close to entering a recession in the second half of 2022. At the same time, inflation spiked to 9.2% in December 2022, mostly related to surging energy prices. Consequently, the ECB had to drastically speed up the exit from the low interest rate environment, raising the main refinancing rate (MRO) by large steps in consecutive meetings to the current MRO rate of 3%, which led to strong upward shifts of the yield curve.

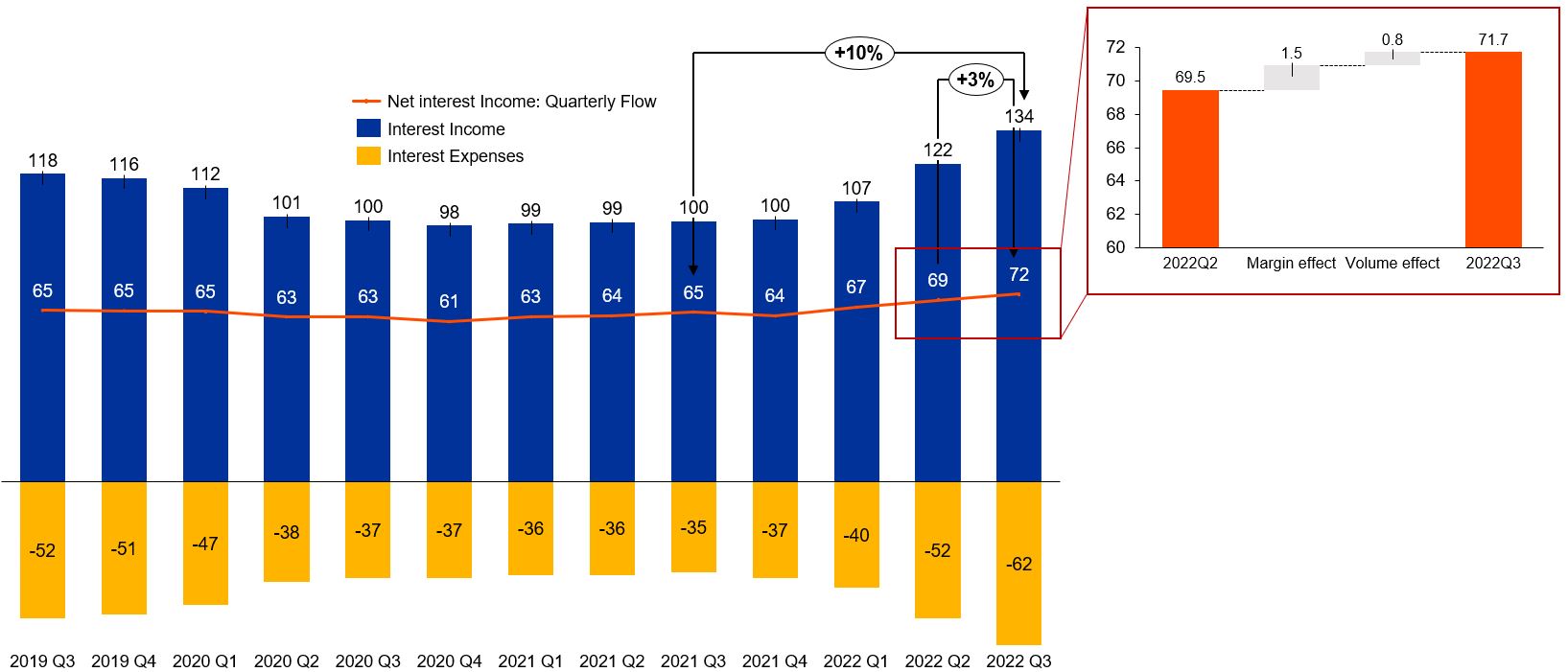

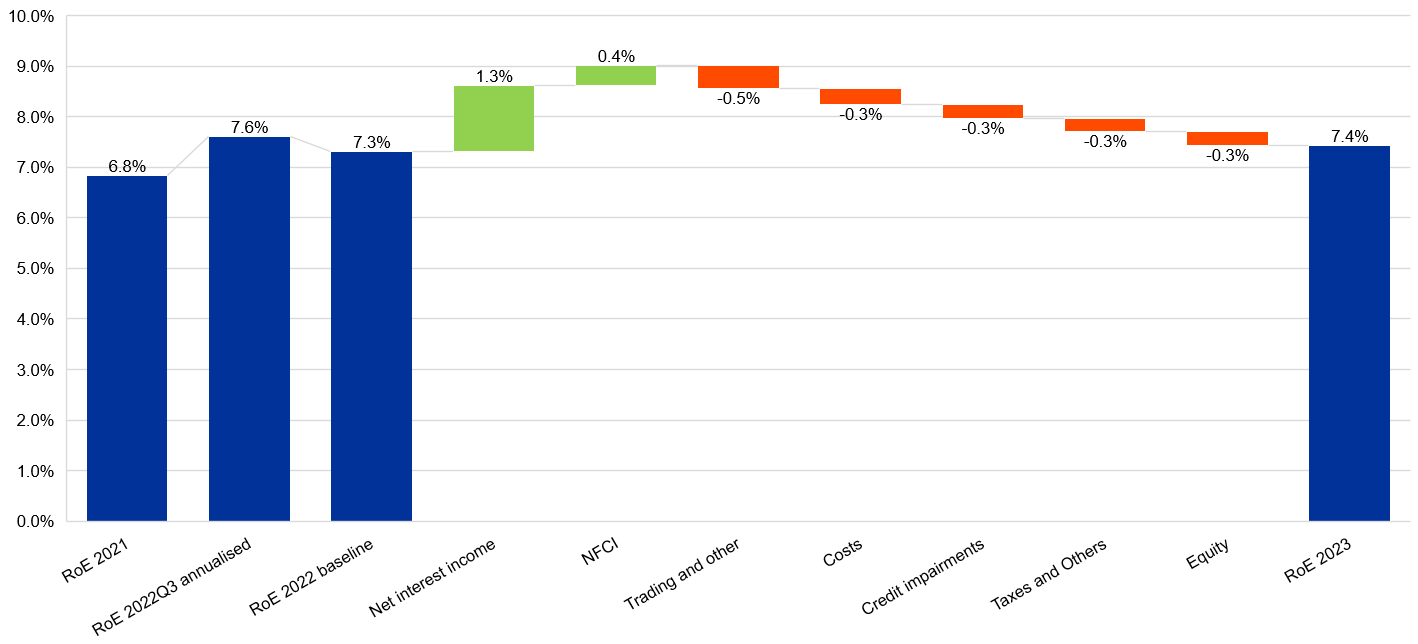

As a result, banks experienced a boost in profitability not seen for more than a decade: The upward shift of the yield curve has mainly had very positive effects on banks’ profitability because it has helped strengthen their lending margins. The pass-through of interest rates to deposit rates has been contained so far, while lending rates on new origination have spiked for all counterparties. This development contrasts with previous years when banks suffered from declining margins that they had to compensate for by raising lending volumes to keep net interest income (NII) roughly stable. Thanks to this new environment, banks were able to boost their NII by 10% on aggregate.

Chart 1

Net interest income has increased each quarter in 2022, supported by margin effect and volume effects

Net Interest Income, quarterly flows, EUR billions, for a constant sample of 105 Significant Institutions

Sources: Supervisory Reporting, ECB Banking Supervision calculations

This more than offset the slight declines in net fee and commission income since the beginning of 2022, mostly caused by the drop in the stock and bond markets and the related declines in fees from asset management, and the slowdown in securities markets fees. As the euro weakened against the US Dollar and other currencies, banks with large subsidiaries outside the euro area also benefitted from some currency effects on the income side.

Chart 2

The increase in profitability is mainly driven by improvements in net interest income

Annualised Return on Equity (9/month net profits*(4/3)/average equity) for a constant sample of 105 Significant Institutions

Sources: Supervisory Reporting, ECB Banking Supervision calculations

Overall, the macroeconomic environment has benefited banks’ profitability first and foremost by strengthening operating income through the boost in net interest income (NII), which is expected to persist. The sector’s generally positive performance in 2022 was also supported by the absence of excessive costs and cost of risk for banks, which could be expected to be the main drag on their net profits in a low growth and high inflation environment.

However, the macroeconomic changes also affected banks and their lending behaviour: loan growth to households started decelerating in the third quarter of 2022 amid softening consumer confidence and deteriorating prospects in real estate markets. In addition, according to the January 2023 ECB Bank Lending Survey, banks have substantially tightened their lending standards in view of higher risk perception and increased funding costs.

Chart 3

Banks net interest income is supported by growth in loan volumes

Decomposition of Interest-Earning Assets, EUR billions, carrying amounts for a constant sample of 105 Significant Institutions

Sources: Supervisory Reporting, ECB Banking Supervision Calculations.

These initial signs of change in the lending market call for some caution, as a scenario in which inflation rises and growth weakens more rapidly and to a greater extent than expected could reduce the debt servicing capacity of businesses and households. This may in turn complicate refinancing and raise interest expenses on variable rate debt, increasing the burden on borrowers.

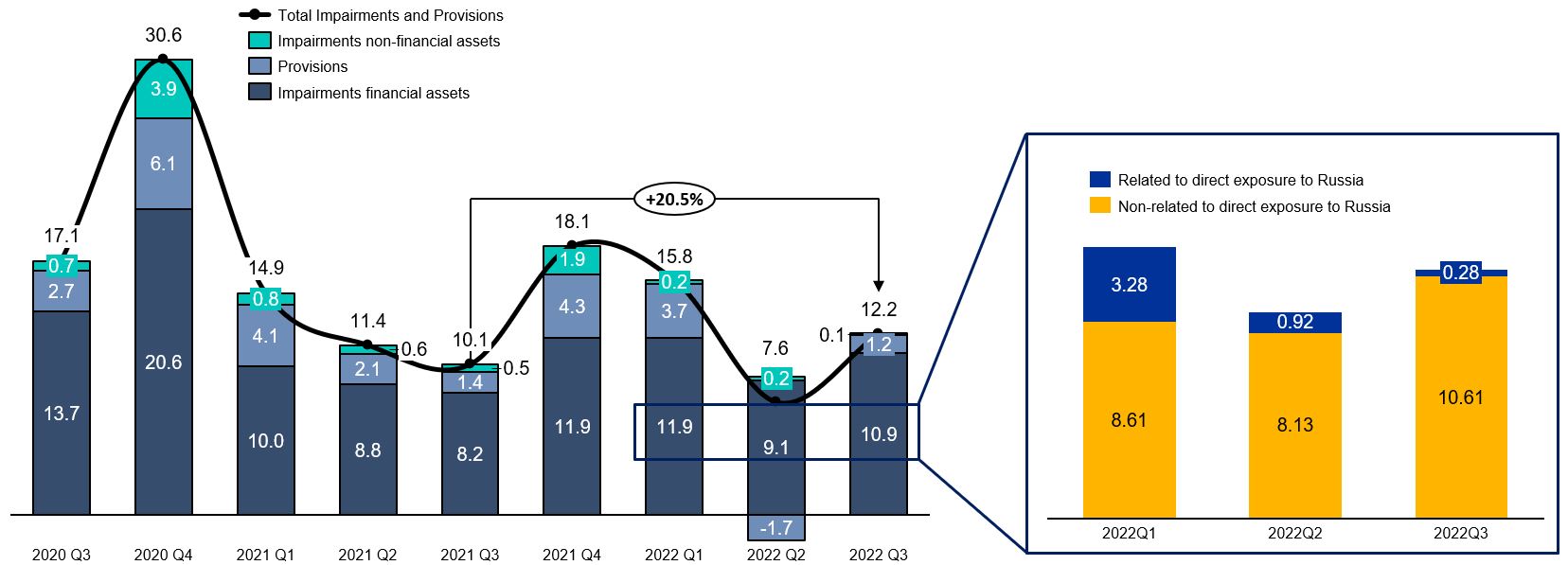

Fortunately, increases in loan loss provisions have not affected banks much yet, for two reasons: first, banks benefited from provisions booked during the pandemic and second, asset quality kept improving. Also, the non-performing loan (NPL) ratio has improved each quarter in 2022 to reach 2.29% in the third quarter (-32 basis points since the beginning of the year) due to disposals of non-performing assets, continuing the strong positive trend from previous years. This creates an overall positive picture and reflects the European banking sector’s strength despite the volatile macroeconomic environment. Only few euro area banks with large direct exposures to Russia suffered from increased impairments on those exposures, but these impairments and the related provisions seem to have been mostly all recorded in the first quarter of 2022. This was complemented with sales of Russian activities: by the end of the third quarter euro area banks had strongly reduced their exposures to Russia, with only two banks retaining significant operations in the Russian market.

Chart 4

Impairment flows picked up in the third quarter of 2020 but remain at a low level

Impairments and provisions, quarterly flows, EUR billions, for a constant sample of 105 Significant Institutions

Sources: Supervisory Reporting, results publications of the banks, ECB Banking Supervision calculations.

However, the positive messages on asset quality warrant some caution because costs from deteriorating asset quality may outweigh the income benefits as interest rates keep increasing and macroeconomic growth continues to decline. Additionally, there are some early warning signs of pressure on asset quality like increased stage 2 loans, a rise in provisioning needs for consumer credit loans and non-financial corporations, and the fact that impairments unrelated to direct exposures to Russia also picked up by more than 20% quarter-on-quarter.

Moreover, banks’ expenses are also on the rise, even if to date they have managed to contain the increase far below the general inflation rate. In particular, staff expenses have increased only by a moderate 5% year-on-year as of the third quarter of 2022, while other administrative expenses have grown more dynamically. It may well be that the effect of inflation on expenses is delayed, but banks are also taking active cost control measures which may help them to keep expenses at bay.

Even in the light of the crisis banks’ performance has been positive, but there is some heterogeneity among them: one in four have not been able to benefit from rising interest rates, partly owing to their business mix, and partly to their internal steering. This calls for supervisors to focus their efforts on identifying and remediating banks’ weaknesses and emphasises the importance of solid and agile strategic planning in a volatile market environment.

Therefore, Joint supervisory teams (JSTs) use on-site inspections, as well as other ongoing supervisory investigations to gain a supervisory understanding of potential deficiencies in this area. This helps them to better comprehend banks’ forecasts, future developments and ultimately judge banks’ readiness to adapt.

Expectations of banks’ future profitability requires caution

The ECB collects data on financial projections from banks under its supervision on a regular basis. The aim is to understand banks’ vulnerabilities to a changing environment, and to identify any such vulnerabilities which could ultimately lead to supervisory actions being taken in response. The outcome of the latest collection from October 2022 reflects banks’ positive outlook based on their own bottom-up projections.

On aggregate, banks forecast roughly stable profits until the end of 2023 under their baseline scenario. This results from an expected strong operating income fed by a positive net interest income trend to offset limited increases in loan loss provisions, expenses and taxes and duties. However, the current outlook is characterised by high uncertainty, and downside risks have increased with the change in the macroeconomic environment. Under an adverse scenario, banks project a strong decline in profitability as heavy increases in loan loss provisions and slower growth in operating income are factored in.

However, these results need to be taken with a pinch of salt as the quality of banks’ underlying scenario assumptions and their translations into financial projections are quite heterogenous. Moreover, there are differences between banks in terms of profitability drivers, accumulated impairments, and capital headroom. In particular, 17 banks forecast losses and six banks forecast a breach of their capital requirements or buffers in 2023 in their adverse scenarios.

These varied forecasts, hidden risks in adverse scenarios and the shortcomings identified during some on-site inspections continue to draw supervisors’ attention. In response, ECB Banking Supervision regularly scrutinises banks’ outlook assumptions and identifies those banks exhibiting the potentially largest negative impacts. This should help ensure that banks have sufficient capital headroom to absorb potential future losses, keeping them sound and healthy. At the same time, supervisors also monitor banks’ business models and their readiness to adapt in case of a changing environment or adverse scenarios.

Chart 5

Banks project profitability to be resilient in 2023 under their baseline scenario, with NII increases largely offsetting negative factors

Sources: DCFP22 data collection of banks’ updated projections (October 22), ECB Banking Supervision calculations

Chart 6

In the banks’ adverse scenarios, a surge in credit impairments and reductions in trading income drive down profitability significantly

Sources: DCFP22 data collection of banks’ updated projections (October 22), ECB Banking Supervision calculations

Can banks quickly adapt to changes in the business environment?

As explained above, banks’ business models have received a lot of supervisory attention since the inception of the Single Supervisory Mechanism (SSM). The supervisory review and evaluation process (SREP) is the backbone of supervisory engagement with banks. Over the years, JSTs issued nearly 3,000 measures and recommendations to banks in the context of the SREP. The most common measures have been related to governance and implementation of strategic planning, a required change or update of the business plan, and business line planning.

In 2016, the ECB started additional activities like the SSM thematic review on profitability and business models, which focused on the review of banks’ profitability drivers due to observed low profitability and pressure on revenues, linked to the low level of interest rates, elevated levels of non-performing loans (NPLs) and high competition, including new competition from fintech and big tech companies. The findings from the thematic review on profitability and business models resulted in targeted recommendations to banks, and supervisors monitored the implementation in the following years.

More recently, in 2021, the ECB launched a dedicated campaign of on-site inspections examining the same topic directly in the banks, thereby providing a framework for inspection teams to coordinate, continuously collaborate, align objectives and exploit synergies. The campaign included eleven significant institutions from eight countries, with the aim of gaining a better understanding of banks’ processes and procedures related to profitability steering and to identify potential deficiencies. The campaign focused on the four dimensions presented in figure 1 below: financial projections, strategy process, product pricing and profitability analysis. Overall, the results revealed deficiencies in all four dimensions: Some banks demonstrated weak strategy processes; they presented inadequate profitability analysis; they had ineffective pricing frameworks – which threatens actual profitability and the realisation of chosen strategies – and they often used overly optimistic and poorly structured multi-year financial projections.

Figure 1

The 4 dimensions of the OSI campaign and related findings

Sources: Results of the OSI campaign 2021/2022

The results of the recent OSI campaign point in the same direction as the former thematic review: banks show weaknesses in strategic steering of profitability. While the situation differs from bank to bank, overall evidence shows that banks with better strategic steering capabilities have generated higher returns in recent years. The results of the on-site campaign are important for two reasons: first, they lay the foundations for requesting the inspected banks to eliminate the deficiencies identified. Second, they can help the remaining banks not included in the campaign to proactively improve their own processes and procedures where relevant.

This article therefore offers a deeper look at each of the dimensions and their related findings in the subsequent sections.

Observations from the on-site inspection campaign

Strategy process

Under the strategy process review performed in the campaign, two major objectives were assessed: first the adequacy of the strategy process and second the consistency of the business strategy with the risk appetite.

Adequacy of strategy process sought to identify whether the decision-making bodies exhibit ownership of a defined strategic plan, based on formalised strategy documentation that clarifies the strategy’s essential elements as well as the ability to anticipate, monitor, and update the strategic plan, when one or more elements change. Observations from several on-site inspections pointed to the following:

- Decision-making bodies do not always receive a sufficient level of information.

- Documentation focusing on the strategic orientation should be organised systematically, with actionable, quantified, and traceable strategic objectives, especially at business unit, business line and segment level.

- Concerning meetings of decision-making bodies, it would be a good practice if minutes not only contained sufficient detail but also provided evidence that decision-makers adequately challenged strategy proposals.

- Reporting should be more systematic, providing a concise overview of milestones, strategic KPIs and overall progress on the various strategic fields.

- Banks would benefit from an escalation process with mitigating actions when strategic goals have not been achieved.

When assessing the alignment of risk appetite with business strategy, the emphasis was given to the adequate involvement of the risk function in the strategy process and to check whether the banks look at preserving the right balance between the first and second lines of defence, including in the setting up of their business strategy. Many of the onsite inspections revealed the following:

- The strategic goals and the risk limits defined in the risk appetite statement are often inconsistent.

- When critical risk factors change, certain decision-making bodies react inappropriately: instead of initiating a revision of the business strategy, they tend to relax the risk appetite statement’s limits to meet strategic goals.

- Some relevant risk drivers (such as IT risk or concentration risk) have not been included in the risk appetite framework.

Profitability analysis

The inspections looked in a granular manner at key profitability drivers such as income, costs and capital allocation, as well as at the institution’s traceable and strategy-related Key Performance Indicators (KPIs) that may also have risk-adjusted elements. This assessment revealed several areas for improvement, namely related to the KPIs:

- Often the selection of KPIs is inadequate and incomplete.

- A comprehensive set of triggers and limits for escalation and subsequent actions are often not available.

- Banks would benefit from more stable KPIs, which affects year-on-year comparisons and can therefore help to fully understand the business development.

- Not all governance frameworks are adequately integrated, since some decision-making bodies do not provide their desired values of KPIs/targets prior to the budgeting process.

- KPIs could be improved by capturing the entire period of financial planning (3-5 years) instead of only a one-year horizon;

- The reasons underpinning deviations of KPIs from defined targets could be better assessed and should allow tracking of whether the institution has properly performed the follow-up actions.

When assessing the (decision-relevant) reporting to management, supervisors found that granularity and insight on profitability drivers is often insufficient. The reports merely focus on numerical comparisons with no further explanations. Many institutions have difficulties in providing profitability analysis on product, client, segment or profit centre level, and therefore are unable to evaluate the real root causes when profitability has deteriorated.

Many banks have shortcomings related to cost allocation. Material costs were found to have not been fully allocated to the profit centres, but remained at cost centres or at corporate level, irrespective of their nature (for example structural or one-off). It became clear to the inspection teams that if banks would be able to allocate overhead costs to a sufficiently granular level like regions, products and business units, they would be less likely to overstate profitability of the business lines or profit centres, and would thus not hamper profitability steering and appropriate decision-taking. A number of them are though not yet there.

Product pricing

The onsite review assesses the robustness of the overall pricing framework and its support by sound methodologies, monitoring and follow-up. This is key to ensure that product pricing adequately includes all relevant inputs like cost of funding, operating costs, cost of credit risk and cost of capital, and is aligned with the goal of generating sustainable profitability within the boundaries set by the risk appetite. Major shortcomings identified are related to the fact that pricing policies lack a strong governance framework and a thoroughly documented methodology, covering all pricing components. In many instances, it was observed that the pricing framework is updated less than once a year, with no assurance that the risk function has a sufficiently active and independent role in the update process. Furthermore, even where internal control systems are integrated in the product pricing process, they do not identify several deficiencies, such as missing documentation for the substantiation of any pricing concessions, missing documentation on overrides of automated controls or deficiencies in cross-selling treatment, where different pricing exceptions are applied at the same time. Finally, relating to the validity and accuracy of the cost component calibration methodologies, banks should improve in the following areas:

- Some banks lack back-testing procedures, which hampers the accuracy of pricing and jeopardises the alignment of pricing with business and risk strategies.

- Pricing decisions should consider potential credit losses beyond a one-year horizon.

- Administrative and accounting arrangements for the allocation of direct or indirect costs to products should be in place. Otherwise, lending profitability could be overestimated, which could lead banks to grant loans at margins that do not cover all associated costs.

Financial projections

The focus was here on the assessment of the credibility and completeness of the key performance drivers and assumptions regarding future developments especially beyond one year, since one-year expectations tend to be more reliable than those over longer time spans. There are many cases of too vague justification of financial projections’ assumptions: those are largely based on expert and too-optimistic judgement, and do not capture macroeconomic assumptions. The impact of the business environment has often been inadequately assessed, especially aspects related to market competition. Moreover, documentation explaining how strategic initiatives and objectives are translated into financial projections is often missing. Material assumptions made by the institutions, that underlie the financial projections, are often neither visible nor fully disclosed to those approving the financial plan, which prevents reasonable assessment and challenge.

In what regards scenario plausibility, the on-site inspections aimed primarily to obtain assurance that scenarios run by the institutions are plausible and secondly that their impact is measured against the sustainability of institutions’ business model. By reviewing the scenario setting process, supervisors concluded the following:

- Banks would benefit from an increased number of scenarios to properly measure the probability of achieving the business strategy.

- Adverse scenarios should be used at business unit level and embed the key impact drivers.

- Relevant baseline scenario assumptions should be subject to sensitivity analyses in the adverse scenario.

In addition to scenario setting, back-testing also plays an important role in the financial projections process. However, some banks did not perform back-testing in the strict statistical sense, or through the analyses of profitability and performance drivers in a backward-looking fashion.

These findings outline several areas where banks could improve KPIs and their monitoring. Financial projections become more credible if banks track relevant KPIs to measure their performance and if they take appropriate actions should their actual performance deviate from the business plan.

Conclusion

Even though banks have displayed significant resilience in the last three years, high uncertainty and downside risk continue to mark the business environment. It is extremely important that supervisors thoroughly assess whether banks’ processes and procedures enable them to quickly adapt to any changes in the economic environment. Conservative capital policies and strong strategic planning capabilities are equally important. In order to navigate the current uncertainty, banks need to upscale their overall strategic process, in the areas of scenario analysis and related risk-adjusted performance measures, they need to apply a granular perspective per business line and product as well as boost their execution capabilities.

Readiness to adapt quickly to changes in the business environment differs from bank to bank. This largely relates to the management body and whether they are aware of the importance of having in place appropriate processes and procedures that would: (i) promptly identify changes in the business environment; (ii) prepare and assess different options for adapting the business and risk strategy, financial and capital plan and dividend policy; and (iii) bring these different options for consideration into management body discussions around strategic, financial and capital planning. However, past experience proved that even where sound governance arrangements were established, appropriate reactions did not necessarily follow in a timely manner, especially when entailing drastic changes, such as restructuring or dismissal of employees.

As the sound and agile steering of business models is critical for managing risks from the macroeconomic environment, ECB Banking Supervision will continue the thorough supervision of banks’ processes and procedures in two ways: First, it will extend the on-site inspection campaign to additional significant institutions throughout 2023. And second, it will foster awareness of the importance of appropriate profitability steering processes in dialogues with the banks. This can help banks to strengthen their steering capabilities and make them fit for the challenges the uncertain future might hold.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts