ECB Banking Supervision: SSM supervisory priorities for 2023-2025

1 Introduction

The geopolitical shock caused by Russia’s invasion of Ukraine and its immediate macro-financial consequences have increased uncertainties about the evolution of the economy and financial markets and elevated risks to the banking sector. The current situation calls for extreme prudence on the part of banks and banking supervisors. During the first half of 2022, supervised institutions performed well overall, supported by the economic rebound following the progressive easing of restrictions related to the coronavirus (COVID-19) pandemic and the stepwise normalisation of interest rates. Banks reported sound capital ratios and ample liquidity buffers throughout the period, reflecting the strong resilience of the sector, while aggregate volumes of non-performing loans (NPLs) continued to decrease.

While the direct impact of the war in Ukraine has remained contained so far for most supervised institutions, the macroeconomic shock, which has exacerbated pre-existing inflationary pressures and lingering supply chain bottlenecks, has spread, particularly in Europe. As a consequence, financial and non-financial risks have increased for the European financial sector. A potential intensification of geopolitical tensions in the future may further increase repricing risks in financial markets and cyber threats. Overall, the evolution of the economy and financial markets remains highly uncertain, leaving more room for surprises on the downside than on the upside.

Besides the more imminent risks triggered by the Russian invasion of Ukraine, previously existing and more structural risks and vulnerabilities also require appropriate attention from banks and supervisors, such as addressing challenges stemming from the development and execution of banks’ digital transformation strategies or physical and transition risks from global climate change.

ECB Banking Supervision, in close collaboration with national competent authorities, has reviewed its strategic priorities for the next three years against this challenging background. The review builds on a thorough assessment of the main risks and vulnerabilities for supervised banks, considers the progress made on the priorities endorsed last year and draws on the outcome of the 2022 Supervisory Review and Evaluation Process (SREP). Although circumstances have materially changed compared to last year, increasing the likelihood and severity of the risks faced by the banking sector, overall the supervisory priorities and the corresponding activities set out in 2022 still remain suitable to address both pressing challenges and the more structural vulnerabilities in the banking sector.

Nonetheless, some adjustments are warranted to tackle emerging risks stemming from the war and high inflation. The updated planning also reflects the progress achieved by supervisors in addressing the vulnerabilities and risks that were prioritised in previous years. Interest rate and credit spread risks, counterparty credit risk and leveraged finance are examples of persistent and highly relevant risks, especially in the current situation, that have been addressed by substantial supervisory effort in 2022. The supervisors are following up with the affected banks in a targeted manner through regular supervisory activities to ensure that these risks are adequately managed and the identified shortcomings are fully addressed.

The current environment also warrants prudence. It is therefore essential for supervisors to keep monitoring and reviewing the adequacy and soundness of banks’ provisioning practices and capital positions as well as projections and distribution plans as part of their regular supervisory activities. This includes the assessment of banks’ paths towards compliance with minimum requirement for own funds and eligible liabilities (MREL), particularly in the light of the current macro-financial situation.

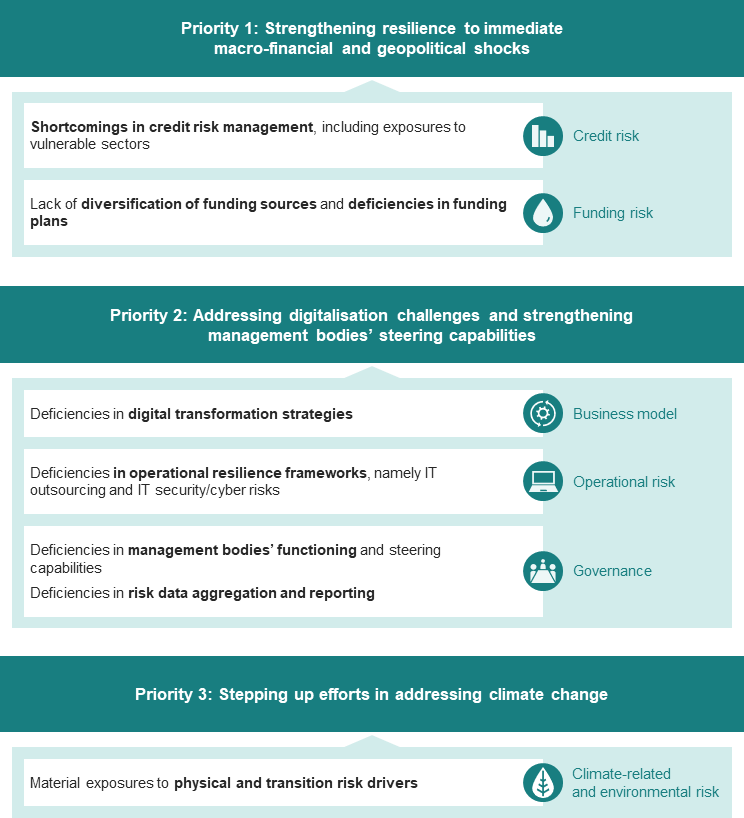

The SSM supervisory priorities for 2023-2025 aim to strengthen supervisory efforts in delivering the medium-term strategic objectives while adjusting the focus to shifting challenges. Supervised institutions will be requested to strengthen their resilience to immediate macro-financial and geopolitical shocks (Priority 1), address digitalisation challenges and strengthen management bodies’ steering capabilities (Priority 2), and step up their efforts in addressing climate change (Priority 3) (see Figure 1).

Figure 1

Supervisory priorities for 2023-2025, addressing identified vulnerabilities in banks

Source: ECB.

Notes: The figure shows the three supervisory priorities and the corresponding vulnerabilities banks are expected to address over the coming years. ECB Banking Supervision will carry out targeted activities to assess, monitor and follow up on the identified vulnerabilities. Each vulnerability is associated with its overarching risk category. Vulnerable sectors are the sectors more sensitive to the current macroeconomic environment.

Developing a sound strategy for ECB Banking Supervision for the next three years is the main purpose of its strategic planning. Following a holistic and collaborative approach, this exercise comprises a comprehensive assessment of the main risks and vulnerabilities of the European banking sector. The supervisory priorities promote effectiveness and consistency in the supervisory planning of the Joint Supervisory Teams (JSTs) and support a more efficient allocation of resources. Supervisory priorities also support the setting of risk tolerance levels and provide guidance for prioritising risks in the SREP, bearing in mind that vulnerabilities and challenges may differ from bank to bank. Finally, the supervisory priorities help national supervisors to set their own priorities for the supervision of less significant institutions in a proportionate way. Transparent communication of the priorities also clarifies supervisory expectations to banks, enhances the impact that supervision has on the resilience of the banking sector, and helps to ensure a level playing field.

ECB Banking Supervision constantly monitors and assesses both the way the risks and vulnerabilities of supervised institutions evolve and how much progress is made in implementing the selected priorities. Regular reviews of the strategic priorities enable ECB Banking Supervision to flexibly adjust its focus and activities to changes in the risk landscape. This flexibility is particularly important in the current uncertain economic and geopolitical climate.

The following sections provide more detail on the outcome of the risk identification and assessment process and set out the supervisory priorities and underlying work programmes for 2023-2025. Other regular activities are also carried out by supervisors as part of their ongoing engagement with banks and complement the work on the priorities.

2 Supervisory priorities and risk assessment for 2023-2025

2.1 Operating environment for supervised institutions

The growth outlook for the euro area has significantly deteriorated over the course of the year as a result of high inflation and the consequences of Russia’s war in Ukraine. Uncertainties remain high for the months ahead. The rebound in economic activity observed in the first half of 2022, resulting from, among other things, the progressive lifting of pandemic-related restrictions, has slowed down. Russia’s invasion of Ukraine triggered a series of Western sanctions, followed by retaliatory measures from Russia, leading to surging energy, food and commodity prices as well as disruptions of energy supplies. Inflationary pressures increased as a result, with euro area inflation reaching record highs. These effects, together with a resulting confidence shock, exacerbated pre-existing supply chain bottlenecks and led to a deterioration in the economic outlook. In an environment of highly elevated uncertainties, the main downside risks to the growth outlook include a longer than expected war in Ukraine, an escalation of geopolitical tensions, rising energy costs and inflation which, combined with further energy supply disruptions and rationing, could lead to recession in Europe.

High inflation levels around the globe have led major central banks, including the ECB, to accelerate the pace of their monetary policy normalisation. After public and private debt-to-GDP ratios expanded during the pandemic, the combination of tighter financing conditions in the wake of increasing policy rates and a deteriorated growth outlook is expected to further challenge the debt servicing capacity of banks’ counterparties. Corporates, particularly in the high-yield segment or energy-intensive sectors, are also expected to be challenged by higher financing, input and operating costs, as well as by the weaker growth outlook, potentially leading to a rise in default rates. Finally, households with higher levels of indebtedness, lower incomes or variable rate mortgages may also see a deterioration in their creditworthiness in the future, although fiscal measures, savings accumulated during the pandemic and an overall resilient labour market may help cushion at least partially the impact of inflation and higher interest rates.

Heightened geopolitical tensions, rising interest rates and fears of economic recession in Europe are weighing on financial markets dynamics. Interest rates around the globe have followed the pace of central bank decisions and exhibited episodes of volatility in 2022 as a result of uncertainties concerning the timing and magnitude of policy rate adjustments. After experiencing a sharp drop in valuations in the first half of the year, equity markets have recovered somewhat but remain susceptible to further price corrections. Going forward, high uncertainty may translate into increased market turbulence and episodes of high volatility, which may in turn lead to a further repricing in financial markets and subsequent mark-to-market losses on banks’ balance sheets or lower earnings from market-related business.

2.2 Risks and priorities, 2023-2025

The SSM supervisory priorities include the strategic objectives that ECB Banking Supervision is committed to pursuing over the next three years to tackle prioritised vulnerabilities and the supervisory activities planned to achieve those objectives. The following sections outline these priorities for 2023-2025.

2.2.1 Priority 1: Strengthening resilience to immediate macro-financial and geopolitical shocks

High uncertainties and downside risks associated with the current macro-financial and geopolitical environment are materially affecting the outlook for the European banking sector. Supervised institutions need to be prudent in developing and planning their business strategies, to keep monitoring closely the risks associated with the fast-changing financial environment and to focus their efforts on risk management. This includes developing sound and credible capital, liquidity and funding plans that take into account the current uncertain outlook and being ready to adjust them to the evolving risk landscape in a flexible and timely manner.

Against this background, ECB Banking Supervision’s primary objective for the coming months is to ensure that banks under its direct supervision strengthen their resilience to immediate macro-financial and geopolitical shocks. The 2023 EU-wide stress test exercise, coordinated by the European Banking Authority (EBA), will support this effort and feed into the outcome of the next SREP cycle, contributing to the supervisory priorities for 2023. Other supervisory activities that are more focused on specific risks are described in the next section. Also included are follow-up activities in relation to certain priorities from last year that are being performed as part of the regular supervisory work.

Prioritised vulnerability: Shortcomings in credit risk management, including exposures to vulnerable sectors

Strategic objective: Banks should effectively remedy structural deficiencies in their credit risk management cycle, from loan origination to risk mitigation and monitoring, and address in a timely manner any deviations from regulatory requirements and supervisory expectations.

Banks should be in a position to swiftly identify and mitigate any build-up of risks in their exposures to sectors that are more sensitive to the current macroeconomic environment, including sectors affected by the war in Ukraine and real estate portfolios.

While volumes of NPLs continued to decrease in the first half of 2022, tighter financing conditions and an increasing risk of recession have started to affect credit conditions in Europe. This will have an impact on households and corporates, albeit to different degrees, depending on factors such as their level of indebtedness or adverse sensitivities to the current macro-financial environment. More precisely, the energy price shock and supply chain disruptions caused by the war in Ukraine are typically hitting economic sectors linked to the production and processing of raw materials, energy suppliers and energy-intensive sectors, such as agriculture and air, land and water transportation. High input prices are also weighing on construction, while, for a number of euro area countries, gas supply disruptions might additionally weigh on major gas consumers, such as producers of metals, chemicals, food and beverages.

Following a sharp price correction at the onset of the pandemic, conditions in commercial real estate markets appear to be stabilising. However, the office sector in Europe is still very much challenged by rising interest rates and the surge in construction costs, which are adding to the pandemic shift towards remote working. Despite persistent signs of overvaluation in the euro area, house prices increased in the first half of 2022, further widening the gap to rental prices. This, combined with the increase in the cost of living, declining real wages and rising interest rates, is raising concerns, especially for banks operating in countries where a high share of mortgages have variable interest rates.

Against this background, the supervisory activities initiated since the outbreak of the pandemic aimed at tackling structural deficiencies in banks’ credit risk management frameworks also remain broadly relevant in addressing challenges stemming from the current environment. While banks have achieved some progress over recent years, the 2022 SREP exercise confirmed that shortcomings persist in supervised institutions’ risk controls, especially in relation to loan origination and monitoring, classification of distressed borrowers and provisioning frameworks. While most of the banks have developed remedial action plans to address the gaps identified in the 2020 “Dear CEO” initiative[1], some gaps remain, including deficiencies in forbearance, unlikeliness-to-pay (UTP) and provisioning practices. Supervisors will accordingly strengthen and intensify their efforts to achieve ECB Banking Supervision’s strategic objective in this area, and, while most of the activities planned are a continuation of last year’s priority work programme, the focus will be adjusted to also cover the sectors most affected by the consequences of the war in Ukraine (e.g. energy-intensive sectors) and by the macroeconomic environment.

Main activities part of the supervisory priorities work programme

- Targeted reviews[2] of loan origination and monitoring, assessing compliance with the related EBA guidelines with a focus on residential real estate portfolios.

- Targeted reviews of IFRS 9 aimed at assessing compliance of selected banks with supervisory expectations laid down in the 2020 “Dear CEO” letter (focus on residual issues) and investigating specific modelling aspects (including overlays).

- Deep dives on forbearance and UTP policies, following up on residual issues identified as part of the “Dear CEO” initiative, taking into account the current macro-financial environment.

- On-site inspection (OSI) campaigns on IFRS 9 – focusing on large corporates, small and medium-sized enterprises and retail portfolios – and on commercial real estate/collateral (extension from 2022).

- Targeted OSIs on energy and/or commodity traders.

- Targeted joint on-site/internal model investigations for some material portfolios in selected vulnerable sectors to assess the adequacy of the corresponding internal ratings-based (IRB) models, accounting models and credit risk management frameworks.

- Internal model investigations and follow-ups by JSTs to assess IRB model changes related to new regulatory requirements[3] and follow-ups of previous targeted review of internal models (TRIM) findings.

Follow-up activities performed as part of the regular supervisory work

While issuances of leveraged loans have slowed down in recent quarters, with issuers and investors adjusting to macroeconomic uncertainties, supervised institutions’ outstanding volumes and underlying vulnerabilities remain high given the nature of the counterparties (high-yield/low credit rating and/or high leverage) and the instruments (typically floating rate and covenant-lite loans). This year ECB Banking Supervision has increased its efforts to strengthen banks’ adherence to the supervisory expectations laid down in ECB guidance. Going forward, supervisors will follow up on banks’ responses to this exercise with a view to closing outstanding gaps relative to the corresponding supervisory expectations. ECB Banking Supervision stands ready to impose additional capital charges on supervised institutions showing insufficient progress in addressing these gaps.

While substantial supervisory work has been undertaken in 2022 to tackle vulnerabilities stemming from banks’ material sensitivities to interest rate and credit spreads and from their exposures to counterparty credit risk, the related risks have not receded and the likelihood of observing further episodes of high volatility and repricing in financial markets in the months to come remains high. Against this background, supervised institutions are expected to continue to closely monitor and prudently manage the underlying risks, which are still highly relevant and material in the current context. Supervisory efforts will be pursued accordingly, with a targeted follow-up by JSTs expected in 2023 based on the outcome of the targeted reviews conducted this year.

Prioritised vulnerability: Lack of diversification in funding sources and deficiencies in funding plans

Strategic objective: Banks reporting a high concentration of funding sources, in particular less stable ones, should diversify their funding structure by developing and executing sound and credible multi-year funding plans, taking into account challenges stemming from changing funding conditions.

During the first half of 2022, on average, supervised institutions reported comfortable liquidity coverage ratios (LCRs) and net stable funding ratios (NSFRs), which is a clear sign of resilience to the materialisation of potential liquidity and funding shocks. Nevertheless, a lack of funding diversification makes some institutions more vulnerable to market disturbances. The exceptional monetary policy measures introduced at the onset of the pandemic led some banks in particular to increase their central bank funding (e.g. via the third series of targeted longer-term refinancing operations, TLTRO III) and consequently to downscale the share of market-based funding (e.g. via commercial papers and covered bonds). The expected repayments, at maturity or upon early redemption, will require banks to further diversify their funding sources and replace part of their central bank funding with more expensive and possibly shorter-term alternatives, which will put pressure on their prudential ratios and profitability, particularly in an environment of increasing economic risks and progressive monetary policy tightening. Risks stemming from banks’ high reliance on TLTRO III funding and their related exit strategies require continued supervisory scrutiny, as highlighted by some JSTs in this year’s SREP. In this context, supervised institutions will be asked to develop, execute and adjust as needed a sound and reliable liquidity and funding plan, covering exit strategies and mitigation of rollover risks and concentrations in funding structures.

Main activities part of the supervisory priorities work programme

- Targeted review of TLTRO III exit strategies for selected banks which have a material reliance on this funding source and are more vulnerable to increases in market funding costs. This targeted review will be complemented by a broader analysis of banks’ liquidity and funding plans aimed at identifying weak practices and more vulnerable institutions, including targeted OSIs where appropriate. JSTs to follow up on the findings of these exercises and enquire about the development and execution of sound remedial action plans, including via targeted OSIs.

2.2.2 Priority 2: Addressing digitalisation challenges and strengthening management bodies’ steering capabilities

Supervised institutions should keep a strong focus on addressing structural challenges and risks stemming from the digitalisation of their banking services with a view to ensuring the resilience and sustainability of their business models. While strong internal governance and effective strategic steering by management bodies are key for the development and execution of successful digital transformation strategies, banks also need to tackle vulnerabilities and risks stemming from a greater operational reliance on IT systems, third-party services and innovative technologies. At the same time, banks are operating in a highly volatile and uncertain environment. Taking decisive steps towards achieving strong strategic steering, sound governance and proper risk data aggregation and reporting capabilities can help banks to support the sustainability of their business models against the challenges ahead.

Prioritised vulnerability: Deficiencies in digital transformation strategies

Strategic objective: Banks should develop and execute sound digital transformation plans through adequate arrangements (e.g. business strategy, risk management, etc.) in order to strengthen their business model sustainability and mitigate risks related to the use of innovative technologies.

Supervised institutions are continuously developing, executing and adjusting strategies to support the digitalisation of their banking services and practices to address continuously evolving consumer needs and preferences. At the same time, the adoption of new technologies can also support efficiency gains which contribute to improving banks’ profitability. Although supervised institutions have recently reported stronger profitability on the back of higher interest rate expectations, an intensification of competition with digital champions in the banking sector and digital natives from outside the sector – e.g. financial technology (fintech) and bigtech players – may put banks’ business models at risk if they fail to adapt in time to the evolving landscape. Against this background and following this year’s prioritised initiatives aimed at better understanding and benchmarking banks’ practices, ECB Banking Supervision will continue its efforts in this area and will conduct targeted OSIs and targeted reviews of specific aspects of banks’ digital transformation strategies and use of innovative technologies. JSTs will also follow up outlier institutions identified in these exercises with a view to complementing the overall strategy and inducing banks to address any structural deficiencies found.

Main activities part of the supervisory priorities work programme

- Publication of supervisory expectations on digital transformation strategies as well as the outcome of the benchmarking exercise carried out in 2022.[4]

- Targeted reviews of (a) banks’ digital transformation strategies and (b) their use of innovative technologies, complemented by JST follow-up with banks where material deficiencies are identified.

- Targeted OSIs on digital transformation, combining both the IT and business model dimensions of the strategies.

Prioritised vulnerability: Deficiencies in operational resilience frameworks, namely IT outsourcing and IT security/cyber risks

Strategic objective: Banks should have robust outsourcing risk arrangements as well as IT security and cyber resilience frameworks to proactively tackle any unmitigated risks which could lead to material disruption of critical activities or services, while ensuring adherence to the relevant regulatory requirements and supervisory expectations.

The digital transformation taking place in the banking sector and the increased reliance on technologies and third-party service providers for delivering banking services have brought additional complexity and interconnections within the financial system, leading to heightened operational resilience challenges for banks around the globe. While supervised institutions have demonstrated strong resilience during the pandemic, with limited operational losses reported in a context of heightened risk, the war in Ukraine is bringing new challenges. Some of the concrete concerns, also raised by a number of JSTs in the context of the 2022 SREP exercise, relate to heightened risks stemming from the outsourcing of certain activities or critical services to countries adversely affected by sanctions regimes (or facing higher geopolitical risks) which may be more vulnerable, for instance, to a possible increase in retaliatory cyberattacks in response to Western sanctions against Russia.

Furthermore, high reliance on third parties for critical IT services and deficiencies in IT outsourcing arrangements continue to present a material vulnerability which could result in increasing losses owing to the unavailability or poor quality of outsourced services. Against this background, ECB Banking Supervision will continue to review banks’ outsourcing arrangements and cybersecurity measures and will conduct targeted reviews and OSIs to follow up on any identified deficiencies.

Main activities part of the supervisory priorities work programme

- Data collection and horizontal analysis of outsourcing registers to identify interconnections among significant institutions and third-party providers and potential concentrations in certain providers.

- Targeted reviews of outsourcing arrangements, cybersecurity measures and IT risk controls.

- Targeted OSIs of outsourcing and cyber security management.

Prioritised vulnerability: Deficiencies in management bodies’ functioning and steering capabilities

Strategic objective: Banks should effectively address material deficiencies in the functioning, oversight and composition of their management bodies by developing and swiftly implementing sound remedial action plans, adhering to supervisory expectations.

Sound internal governance arrangements and effective strategic steering are crucial in ensuring the sustainability of banks’ business models, both during crises and in normal times, and in successfully adapting to ongoing trends, such as digitalisation and the green transition. The collective suitability, including adequate collective knowledge, skills and experience, and the diversity of banks’ management bodies strengthen their risk oversight role and are essential to their effective functioning.

Banks have made progress in adapting their diversity policies, including as a consequence of the supervisory follow-up in early 2022 of banks which did not have such policies in place or internal targets for gender diversity at board level. Some areas still require attention, such as compliance with internal or national gender representation targets in management bodies or insufficient skills diversity on boards, including, but not limited to, IT/cyber risk expertise. Moreover, there are still weaknesses in the succession planning process and in the capacity of boards to provide oversight and challenge management functions, including within the related committees. This may also be linked to persistent weaknesses in the area of formal independence in the management bodies of some institutions.

ECB Banking Supervision will continue to strive to achieve progress in these areas through targeted reviews, OSIs and targeted risk-based fit and proper (FAP) assessments and reassessments. In addition, supervisors will also update and publish supervisory expectations on governance and risk management.

Main activities part of the supervisory priorities work programme

- Targeted reviews of the effectiveness of banks’ management bodies and targeted OSIs.

- Update and external publication of the supervisory expectations regarding banks’ governance arrangements and risk management.[5]

Prioritised vulnerability: Deficiencies in risk data aggregation and reporting

Strategic objective: Banks should effectively address long-lasting deficiencies and have adequate and efficient risk data aggregation and reporting frameworks in place in order to support efficient steering by management bodies and to address supervisors’ expectations, including in times of crisis.

Access to timely and accurate data and reports is a prerequisite for effective strategic steering, effective risk management and sound decision-making, both in normal times and in periods of stress. Against this background, ECB Banking Supervision has been paying close attention to supervised institutions’ data quality, risk data aggregation capabilities and risk reporting practices. Material deficiencies in these areas have repeatedly been identified in annual SREP exercises, as banks’ have been showing slow and insufficient progress in closing gaps with respect to supervisory expectations and compliance with the Basel Committee on Banking Supervision principles for effective risk data aggregation and risk reporting. The main vulnerabilities relate to weak oversight of management bodies, fragmented and non-harmonised IT landscapes, low capacity for aggregating data at group level, and the limited scope and ambitions of banks’ remediation plans.

ECB Banking Supervision will accordingly strengthen its efforts to ensure that supervised institutions deliver substantial progress in remedying the identified structural shortcomings.

Main activities part of the supervisory priorities work programme

- Refinement and communication to banks of supervisory expectations related to the implementation of risk data aggregation and risk reporting principles.

- Targeted engagement and horizontal analysis across JSTs and/or OSIs for banks with persistent shortcomings.

- OSI campaign on risk data aggregation and reporting (extension from 2022).

2.2.3 Priority 3: Stepping up efforts in addressing climate change

The need to address the challenges and grasp the opportunities of climate transition and adaptation is becoming urgent for banks. Climate change can no longer be regarded only as a long-term or emerging risk, since its impact is already visible and is expected to grow materially in the years to come.[6]

Prioritised vulnerability: Material exposures to physical and transition risk drivers

Strategic objective: Banks should adequately incorporate climate-related and environmental (C&E) risks within their business strategy and their governance and risk management frameworks in order to mitigate and disclose such risks, aligning their practices with current regulatory requirements and supervisory expectations.

Risks associated with climate change are accelerating and are already materialising. The intensification of extreme weather events affecting Europe[7] highlighted the increasing likelihood and severity of physical risk losses. At the same time, the energy market disruption caused by the Russia-Ukraine war has further underlined the need for Europe to maintain momentum in the transition to renewable energy sources. In this context, the REPowerEU Plan[8] announced in May 2022 is aimed at reducing Europe’s dependency on Russian fossil fuels already in the short term and accelerating the energy transition.

The results of the 2022 ECB climate risk stress test[9] and thematic review[10] have demonstrated that banks are making progress in incorporating C&E risks into their business operations, risk management frameworks and disclosure practices. However, banks’ income-generating capacity relies heavily on higher-emitting sectors, and considerable gaps remain in terms of their alignment with the ECB’s supervisory expectations[11]. These gaps relate to, among other things, the lack of robust materiality assessments of banks’ exposures to C&E risks, the development of appropriate data governance and risk quantification approaches, performance and risk appetite indicators, limits and thresholds, and robust climate risk stress-testing frameworks. Against this background, supervisors will follow up on the deficiencies identified during these exercises, monitor progress and take enforcement action if necessary. For this purpose, supervisors have set institution-specific remediation timelines for achieving full alignment with expectations by the end of 2024.

In addition, supervisors will perform targeted deep dives and OSIs, assess banks’ compliance with new implementing technical standards (ITS) reporting and Pillar 3 disclosure requirements and with supervisory expectations, and prepare for the review of banks’ transition planning capabilities.

Main activities part of the supervisory priorities work programme

- Targeted deep dives to follow up on shortcomings identified in the context of the 2022 climate risk stress test and thematic review.

- Review of banks’ compliance with new ITS reporting and Pillar 3 disclosure requirements related to climate risk, and benchmarking of banks’ practices against supervisory expectations.

- Deep dives on reputational and litigation risk associated with climate-related and environmental strategies and risk profiles for selected banks.

- Preparatory work for reviews of banks’ transition planning capabilities and readiness for environmental, social and governance (ESG) related mandates expected in the sixth Capital Requirements Directive (CRD VI).

- Targeted OSIs on climate-related aspects, either on a stand-alone basis or within reviews of individual risks (e.g. credit risk, governance, business model).

© European Central Bank, 2022

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.bankingsupervision.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the SSM glossary (available in English only).

PDF ISBN 978-92-899-3924-9, ISSN 2599-8420, doi:10.2866/81566 QB-CK-22-001-EN-N

HTML ISBN 978-92-899-3927-0, ISSN 2599-8420, doi:10.2866/728 QB-CK-22-001-EN-Q

Letter to banks on Identification and measurement of credit risk in the context of the coronavirus (COVID-19) pandemic, ECB Banking Supervision, December 2020.

A targeted review is a horizontal project/review covering a large but targeted set of supervised institutions (a smaller sample than a thematic review).

See, for example, Progress report on the IRB roadmap, EBA, July 2019.

See key planned supervisory activities from last year’s prioritised vulnerability on “Deficiencies in banks’ digital transformation strategies” in ECB Banking Supervision – Supervisory priorities for 2022-2024, ECB Banking Supervision, December 2021.

See “SSM supervisory statement on governance and risk appetite”, ECB, June 2016.

Indeed, more than 80% of banks acknowledge that they are materially exposed to climate risks, with more than 70% seeing risk in their current business planning horizon of three to five years. See “Walking the talk – Banks gearing up to manage risks from climate change and environmental degradation”, ECB Banking Supervision, November 2022.

“Economic losses from weather and climate-related extremes in Europe reached around half a trillion euros over past 40 years”, European Environment Agency, 3 February 2022.

REPowerEU Plan, European Commission, May 2022.

“2022 climate risk stress test”, ECB Banking Supervision, July 2022.

ibid.

As set out in the “Guide on climate-related and environmental risks”, ECB, November 2020.