- SUPERVISION NEWSLETTER

SREP 2021: Banks resilient overall, but risks on the horizon

16 February 2022

The 2021 supervisory cycle saw ECB Banking Supervision return to its regular Supervisory Review and Evaluation Process (SREP). This followed the pragmatic approach adopted for the 2020 assessment in response to the coronavirus (COVID-19) crisis, where supervisors had focused on the challenges from the pandemic and kept Pillar 2 requirements and guidance unchanged at 2019 levels. Overall, the 2021 results reflect the resilience of Europe’s banking sector amid the strengthening economic recovery, as well as the risks and vulnerabilities that may emerge further down the road.

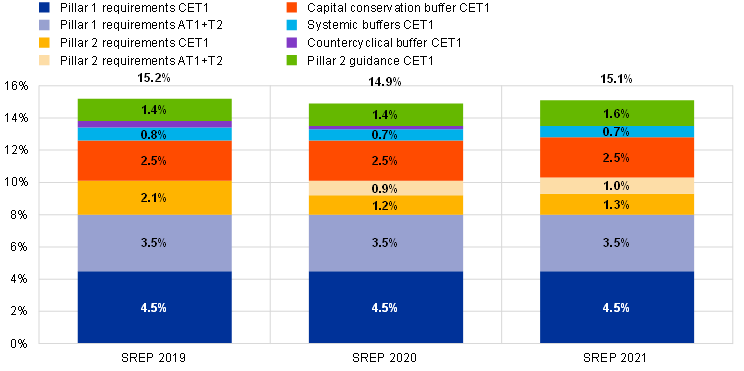

The results showed that banks are maintaining solid capital and liquidity positions, with most banks going beyond the levels required. Overall capital requirements and guidance increased in 2021 to an average of around 15.1% of risk-weighted assets, up from 14.9% in the 2020 cycle. Total Pillar 2 requirements increased to 2.3% in 2021 from 2.1% in 2020. The aggregate shortfall in provisions for non-performing exposures decreased by over 75% during the year, leaving only a small number of banks subject to fairly low add-ons in our final SREP decisions. Pillar 2 guidance also increased slightly to 1.6% from 1.4% in 2020, based on the results of the 2021 stress test. The increase in requirements and guidance was partly offset by a decline in the average countercyclical buffer from 0.2% of risk-weighted assets in 2020 to a negligible amount in 2021.

Chart 1

Overall capital requirements and guidance

Sources: SREP 2021 values based on 108 decisions; SREP 2020 values based on 112 decisions; SREP 2019 values based on 109 decisions.

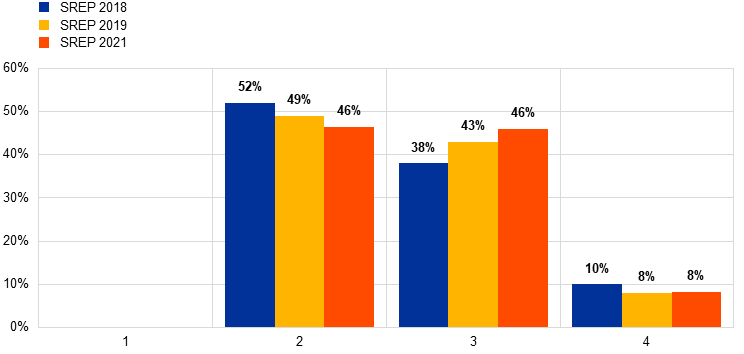

The average overall SREP score of supervised banks remained broadly stable in 2021 compared with 2019, showing the banking system’s resilience and the success of the unprecedented support measures taken by national and European authorities during the pandemic. There was only a minor increase in the number of banks awarded a score of 3 (on a scale of 1 to 4) compared with 2019, and a corresponding decrease in banks receiving a score of 2. Across the full spectrum of risk areas examined by supervisors in the SREP cycle, the areas of internal governance and risk management saw the highest number of findings and measures in 2021.

Chart 2

Overall SREP scores for 2018, 2019 and 2021

Sources: SREP 2021 values based on 108 decisions; SREP 2019 values based on 109 decisions; SREP 2018 values based on 107 decisions.

In fact, compared with the previous year, the number of risk management and internal governance measures that banks were asked to take increased by 25%. All in all, 75% of banks were asked to implement such measures, which accounted for just under a third of all measures imposed. The main findings in these areas related to ineffective supervision by banks’ management bodies, their insufficient attention to risk and compliance functions, and issues relating to their composition and collective suitability, including in terms of diversity of gender and expertise. In addition, fragmented and non-harmonised IT landscapes made it harder for some banks to gather the data needed to manage their risks. Banks’ slow progress in addressing shortcomings raised concerns about the effectiveness of their boards and their ability to steer the banks strategically.

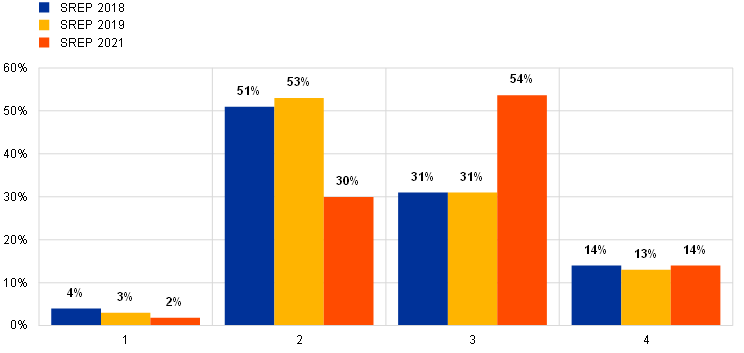

Pandemic-related credit risks in the form of increasing non-performing loans have not yet materialised, although support measures may be masking the true impact of the crisis. Supervisors are keeping a close eye on increases in forbearance ratios, the growing proportion of loans in Stage 2 that have benefited from moratoria or public guarantees, and the continuing increase in exposure to leveraged lending as the associated credit standards continue to loosen. In the 2021 SREP cycle, supervisors focused on the adequacy of credit risk processes to prevent, where possible, any excess build-up of non-performing loans on banks’ balance sheets. This intensified scrutiny led to credit risk scores being downgraded for about one-third of banks and an increase in the number of remedial actions that banks were required to take. The number of credit risk measures thus also increased, making up 26% of total measures. Overall, 70% of banks were asked to implement credit risk measures, reflecting greater supervisory scrutiny of the banks’ credit risk management practices.

Chart 3

Credit risk SREP scores for 2018, 2019 and 2021

Sources: SREP 2021 values based on 108 decisions; SREP 2019 values based on 109 decisions; SREP 2018 values based on 107 decisions.

Supervisors have repeatedly stressed how important it is for banks to correctly reflect credit quality in their balance sheets and identify and address distressed exposures in a timely manner. In the 2021 cycle, 45% of the measures in this area were related to banks’ ability to identify and react to the deterioration of credit risk, including in terms of adequacy, timeliness and the ability to capture those issues in management reporting so that appropriate action can be taken.

Looking ahead

Based on the results of the 2021 SREP cycle, ECB Banking Supervision will continue to focus on banks’ governance and credit risk management practices and, in particular, their exposure to non-financial corporate sectors, leveraged finance and risks posed by an excessive search for yield. Supervisors will also pay close attention to banks’ digitalisation strategies and their IT and cyber resilience. Last but not least, supervisors will explore how to respond to a number of evolving and emerging risks, such as those related to climate change, non-bank financial institutions and bank operations.

Banco Central Europeu

Direção-Geral de Comunicação

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemanha

- +49 69 1344 7455

- media@ecb.europa.eu

A reprodução é permitida, desde que a fonte esteja identificada.

Contactos de imprensa