- PRESS RELEASE

ECB publishes supervisory banking statistics for the second quarter of 2022

7 October 2022

- Aggregate Common Equity Tier 1 ratio stable at 14.96% in second quarter of 2022 (compared with 14.99% in previous quarter and 15.60% in the same quarter last year)

- Aggregated annualised return on equity up to 7.62% in second quarter of 2022 (compared with 6.04% in first quarter of 2022 and 6.92% in the same quarter last year)

- Aggregate non-performing loans ratio fell further to 1.85% (or 2.35% excluding cash balances), down from 1.95% in previous quarter (2.51% respectively), while loans that show a significant increase in credit risk (stage 2 loans) continued to grow, standing at 9.72% (up from 9.28% in previous quarter)

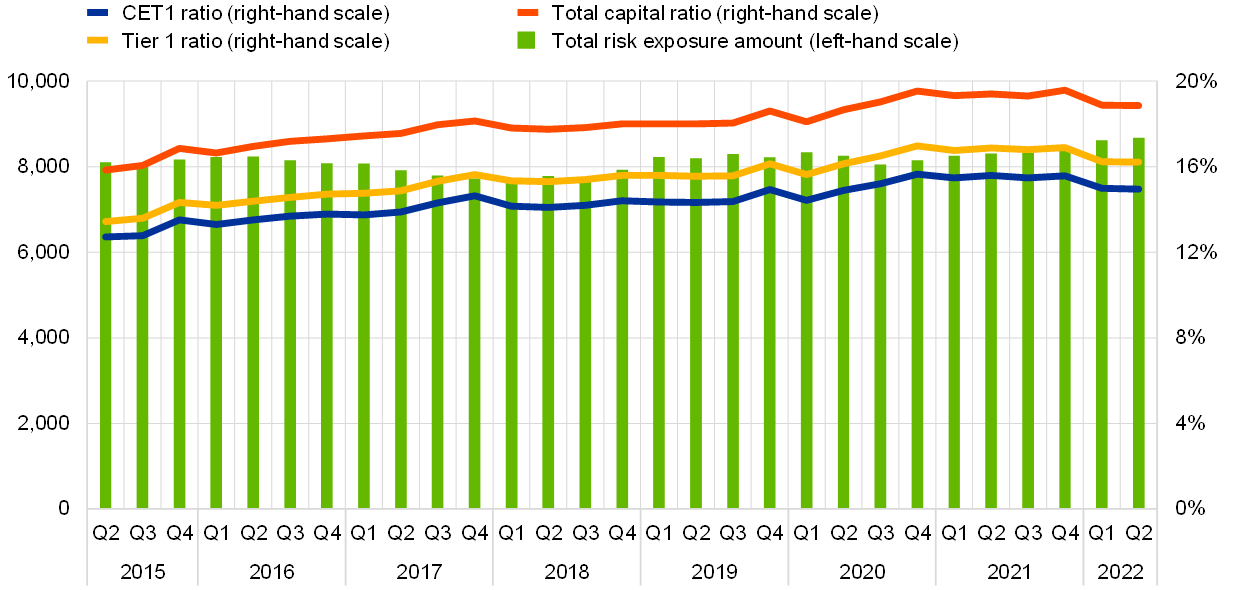

Capital adequacy

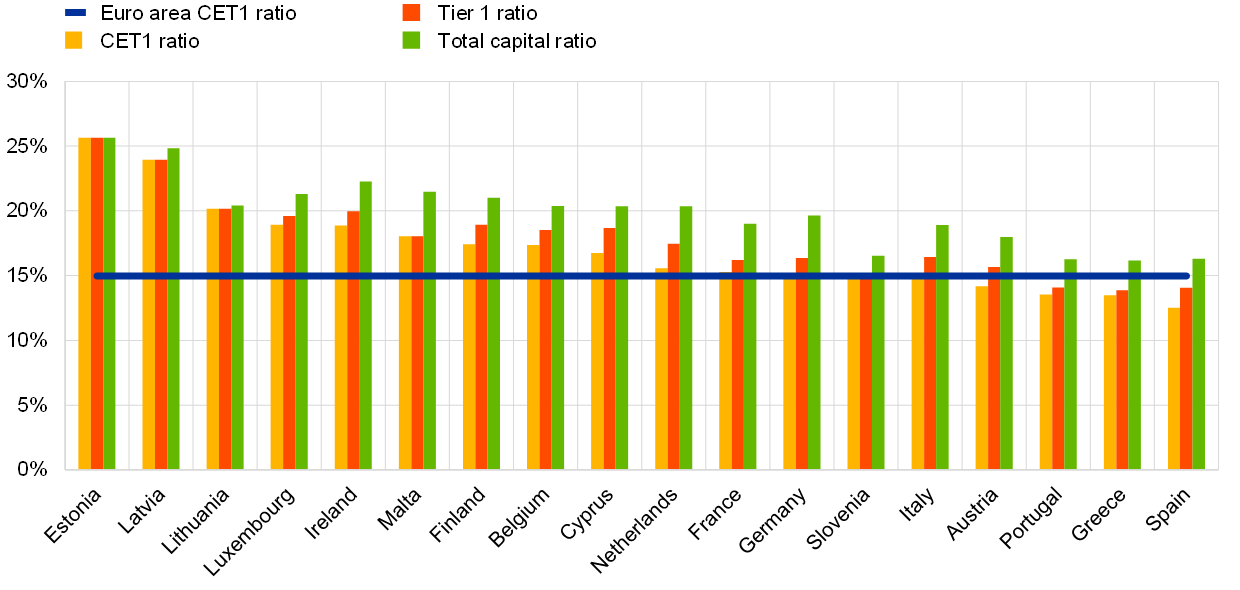

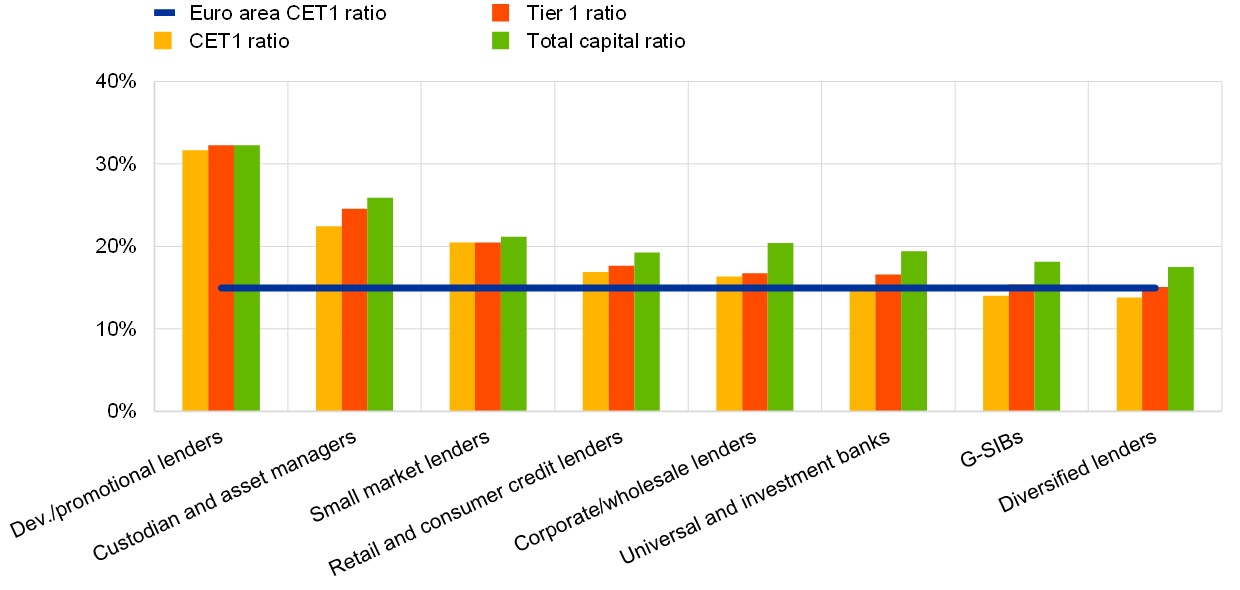

The aggregate capital ratios of significant institutions (i.e. those banks that are supervised directly by the ECB) were stable in the second quarter of 2022. The aggregate Common Equity Tier 1 (CET1) ratio stood at 14.96%, the aggregate Tier 1 ratio stood at 16.22% and the aggregate total capital ratio stood at 18.85%. Aggregate CET1 ratios at country level ranged from 12.51% in Spain to 25.64% in Estonia. Across Single Supervisory Mechanism business model categories, diversified lenders reported the lowest aggregate CET1 ratio (13.81%) and development/promotional lenders reported the highest (31.65%).

Chart 1

Capital ratios and their components by reference period

(EUR billions; percentages)

Source: ECB.

Chart 2

Capital ratios by country for the second quarter of 2022

(percentages)

Source: ECB.

Note: Some countries participating in European banking supervision are not included in this chart, either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation in that country.

Chart 3

Capital ratios by business model for the second quarter of 2022

(percentages)

Source: ECB.

Notes: “G-SIBs” stands for global systemically important banks. “Dev./promotional lenders” stands for Development/promotional lenders.

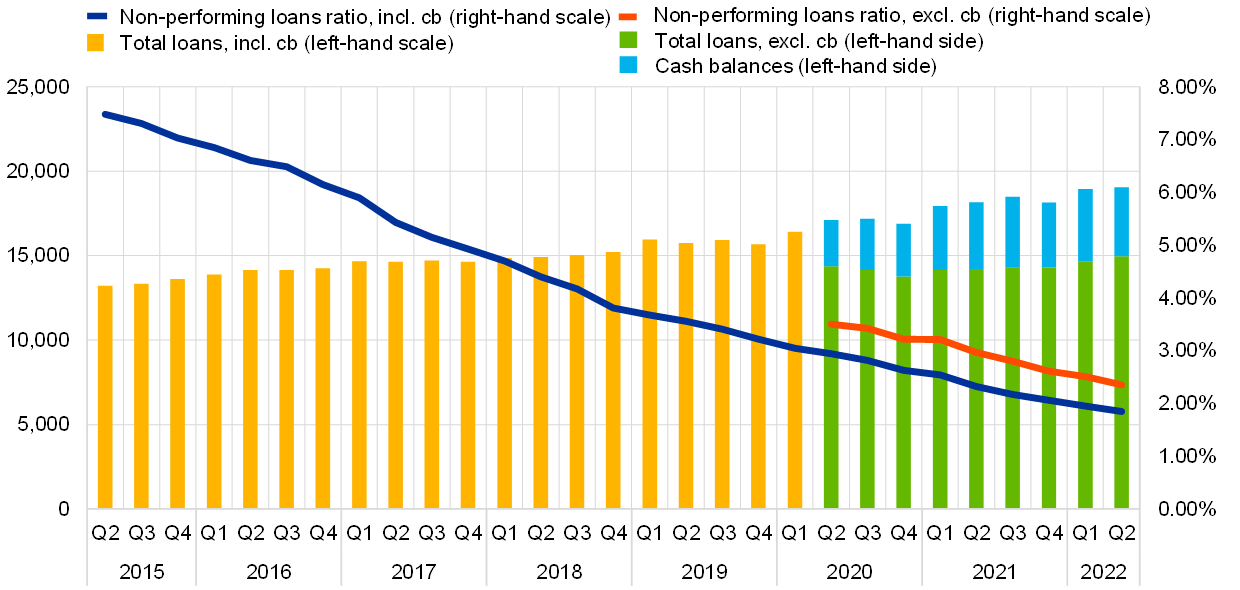

Asset quality

The aggregate non-performing loans (NPL) ratio including cash balances at central banks and other demand deposits decreased further to 1.85% in the second quarter of 2022. The decrease was driven by a further reduction in the stock of NPLs to €352 billion (compared with €369 billion in the previous quarter) as well as an increase in total loans and advances to €19,049 billion (compared with €18,963 billion in the previous quarter). The NPL ratio excluding cash balances at central banks and other demand deposits decreased to 2.35% in the second quarter of 2022.

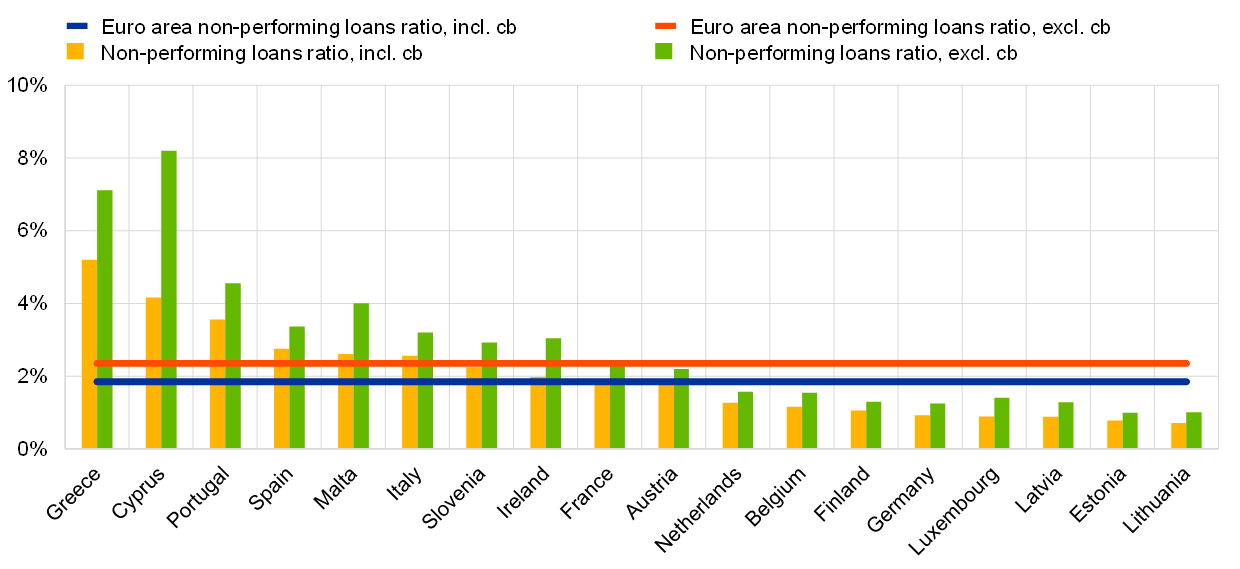

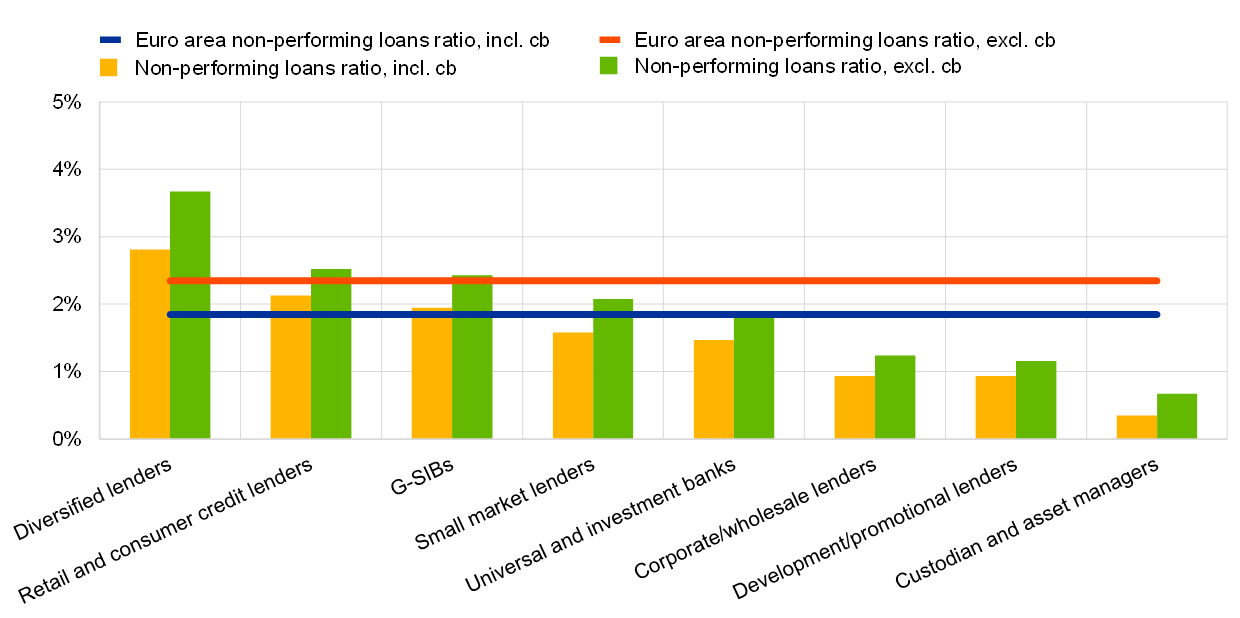

At country level, the average NPL ratio excluding cash balances (green bars on Chart 5) ranged from 1.00% in Estonia to 8.20% in Cyprus. Across business model categories, custodians and asset managers reported the lowest aggregate NPL ratio (0.67%) and diversified lenders reported the highest (3.67%).

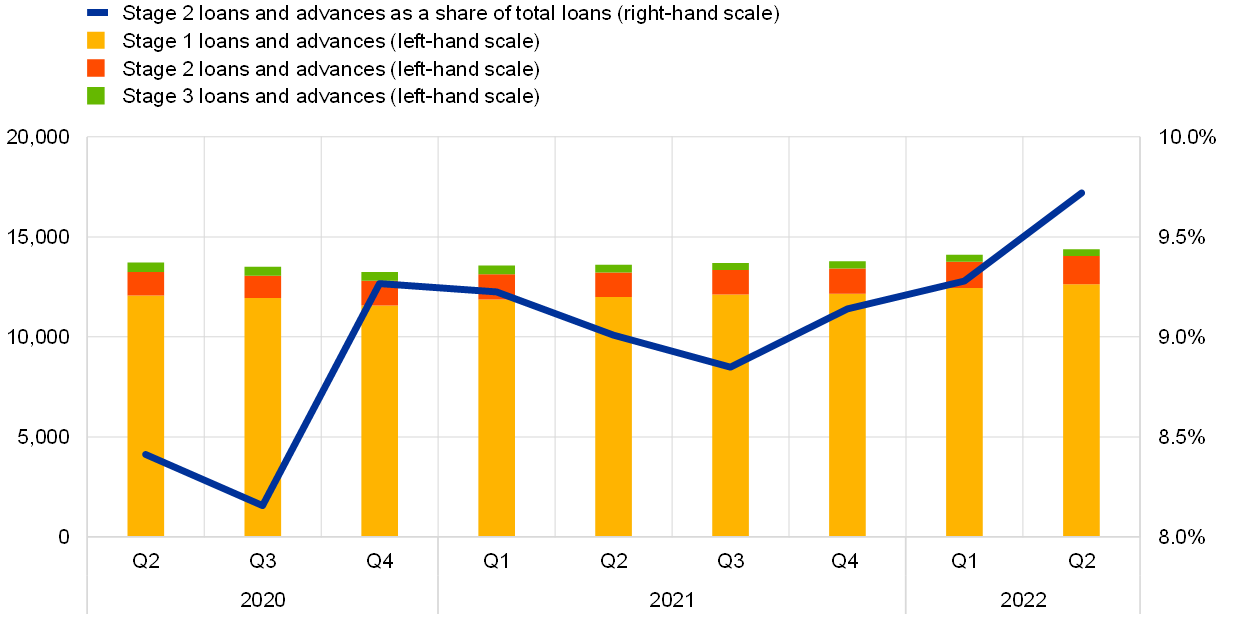

Aggregate stage 2 loans as a share of total loans continued to increase in the second quarter of 2022, reaching 9.72% (up from 9.28% in the previous quarter). The stock of stage 2 loans amounted to €1,399 billion (compared with €1,311 billion in the previous quarter).

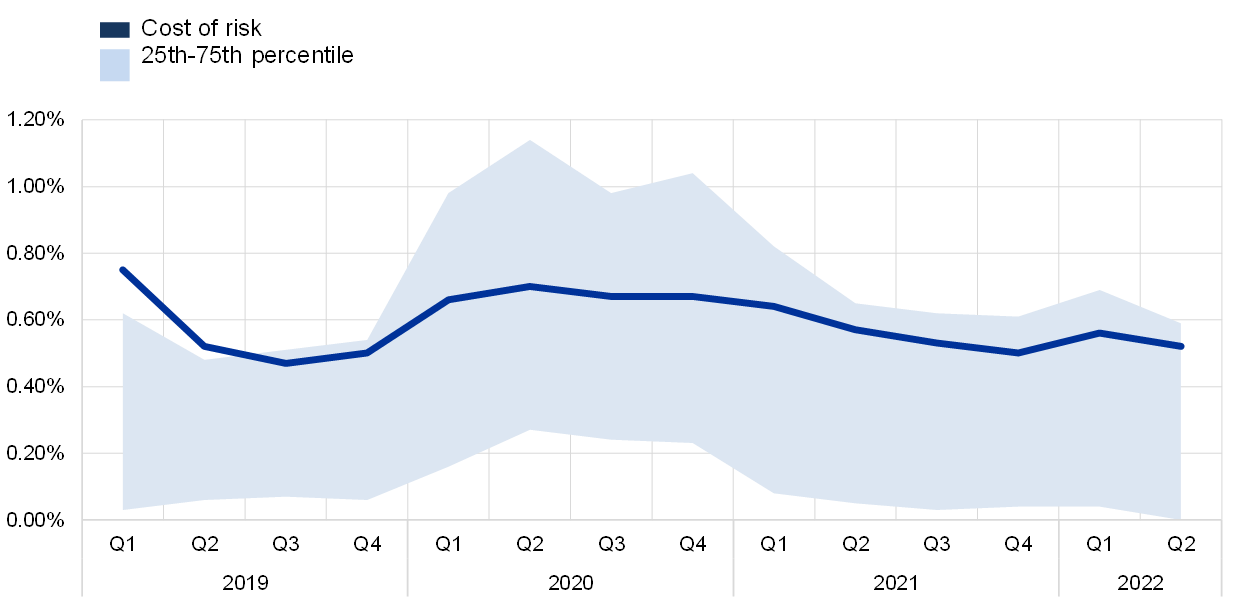

Cost of risk stood at an aggregate level of 0.52% in the second quarter of 2022 (down from 0.56% in the previous quarter). Across significant institutions, the interquartile range narrowed to 0.59 percentage points (down from 0.65 percentage points in the previous quarter).

Chart 4

Non-performing loans by reference period

(EUR billions; percentages)

Source: ECB.

Note: “cb” stands for cash balances at central banks and other demand deposits.

Chart 5

Non-performing loans ratio by country for the second quarter of 2022

(percentages)

Source: ECB.

Notes: Some countries participating in European banking supervision are not included in this chart, either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation in that country. “cb” stands for cash balances at central banks and other demand deposits.

Chart 6

Non-performing loans ratio by business model for the second quarter of 2022

(percentages)

Source: ECB.

Note: “G-SIBs” stands for global systemically important banks. “Dev./promotional lenders” stands for Development/promotional lenders. “cb” stands for cash balances at central banks and other demand deposits.

Chart 7

Loans and advances subject to impairment review by reference period

(EUR billions; percentages)

Source: ECB.

Note: Stage 1 includes assets where credit risk has not increased significantly since initial recognition, Stage 2 includes assets that have had a significant increase in credit risk since initial recognition, while Stage 3 includes assets that have objective evidence of impairment at the reporting date.

Chart 8

Cost of risk by reference period

(percentages)

Source: ECB.

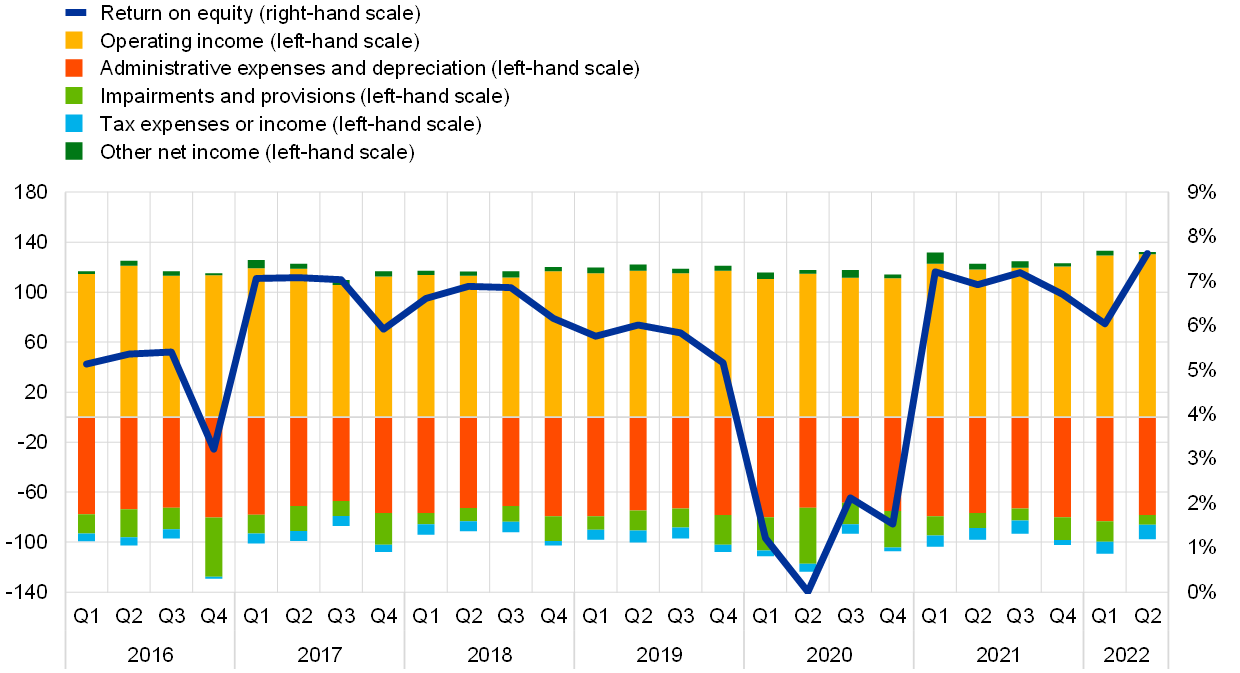

Return on equity

The aggregated annualised return on equity increased to 7.62% in the second quarter of 2022 (compared with 6.04% in the first quarter of 2022). Decreases in impairments and provisions were the main drivers of aggregate net profit or loss (the numerator of the return on equity).

Chart 9

Return on equity and composition of net profit and loss by reference period

(EUR billions; percentages)

Source: ECB.

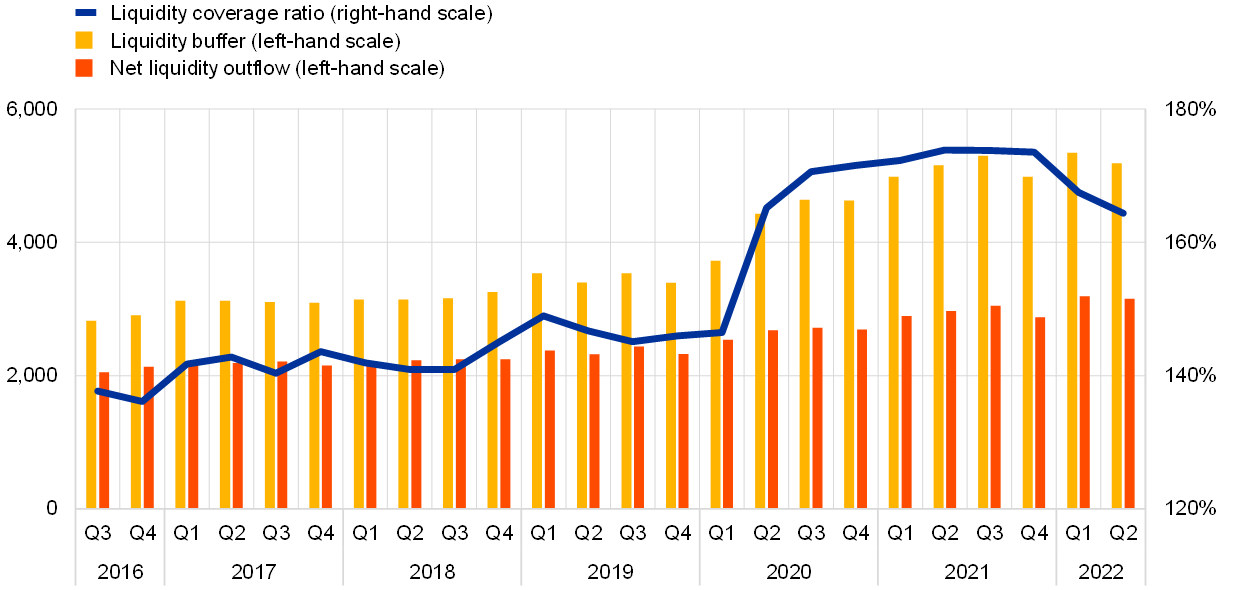

Liquidity and funding

The aggregate liquidity coverage ratio stood at 164.36% in the second quarter of 2022, down from 167.46% in the previous quarter. Both the liquidity buffer and the net liquidity outflow decreased compared with the previous quarter (by €155 billion and €34 billion respectively).

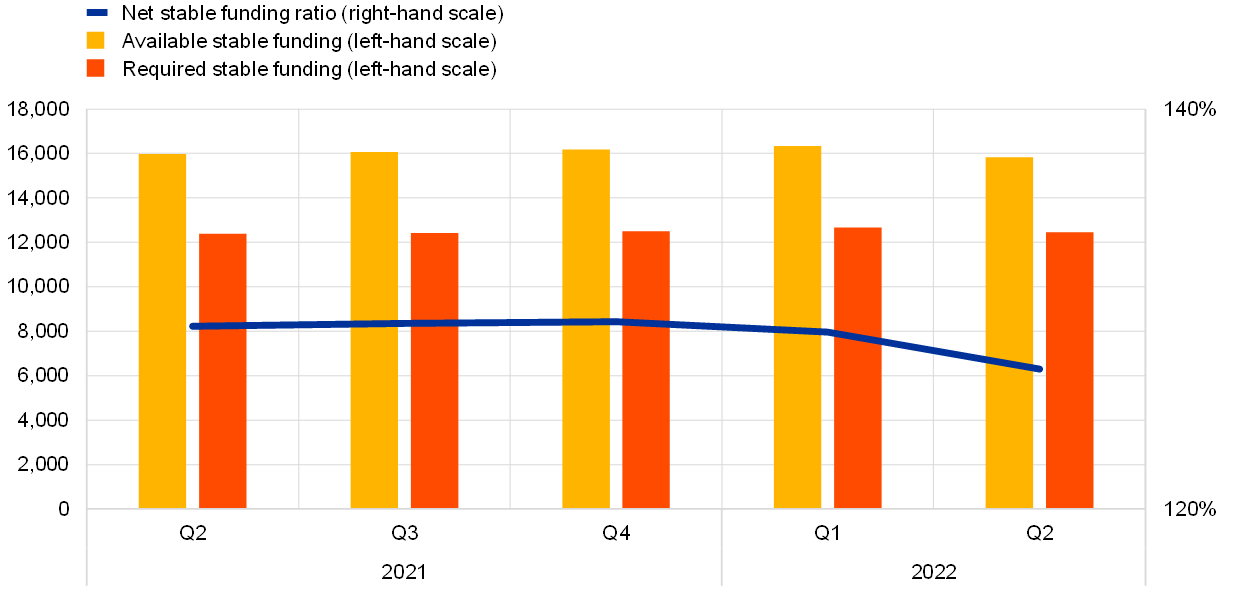

The aggregate net stable funding ratio stood at 127.00% in the second quarter of 2022, down from 128.85% in the previous quarter. This change was driven by a decrease of €501 billion in available stable funding, while there was a relatively smaller decrease of €209 billion in required stable funding.

Chart 10

Liquidity coverage ratio and its components by reference period

(EUR billions; percentages)

Source: ECB.

Chart 11

Net stable funding ratio and its components by reference period

(EUR billions; percentages)

Source: ECB.

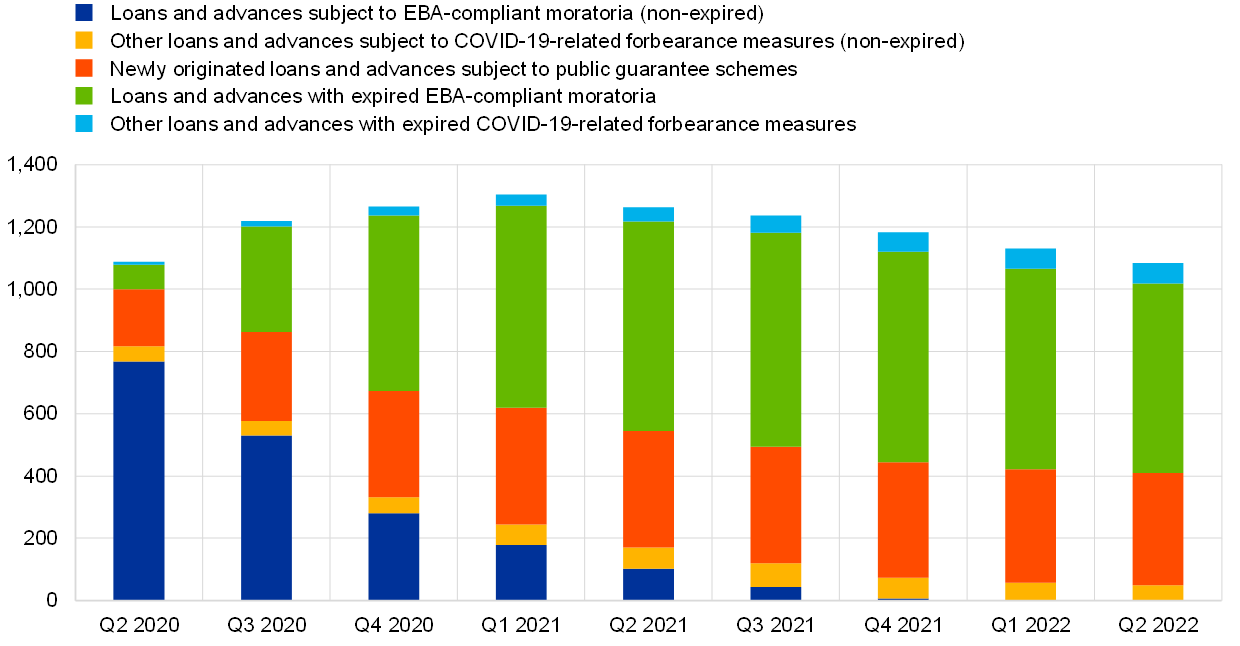

Loans and advances subject to COVID-19-related measures

In the second quarter of 2022 total non-expired loans and advances subject to COVID-19-related measures decreased further to €410 billion, down from €421 billion in the previous quarter. The decrease was driven by other loans and advances subject to COVID-19-related forbearance measures, which declined to €48 billion from €55 billion in the previous quarter.

Chart 12

Loans and advances subject to COVID-19-related measures by reference period

(EUR billions)

Source: ECB.

Note: “EBA” stands for European Banking Authority.

Factors affecting changes

Supervisory banking statistics are calculated by aggregating the data that are reported by banks which report COREP (capital adequacy information) and FINREP (financial information) at the relevant point in time. Consequently, changes from one quarter to the next can be influenced by the following factors:

- changes in the sample of reporting institutions;

- mergers and acquisitions;

- reclassifications (e.g. portfolio shifts as a result of certain assets being reclassified from one accounting portfolio to another).

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- The complete set of Supervisory banking statistics with additional quantitative risk indicators is available on the ECB’s banking supervision website.

Banco Central Europeu

Direção-Geral de Comunicação

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemanha

- +49 69 1344 7455

- media@ecb.europa.eu

A reprodução é permitida, desde que a fonte esteja identificada.

Contactos de imprensa