- SUPERVISION NEWSLETTER

Credit underwriting standards: a challenge for smaller banks

17 February 2021

Lending is the main source of revenue for banks and the key driver of the risks to which they are exposed. To manage credit risk, banks assess how risky a loan is when they lend money to a borrower. This enables them to lend at interest rates that reflect the underlying risk. Robust credit underwriting standards – i.e. the terms and conditions under which banks grant loans – are therefore crucial to ensure that banks remain resilient. Banks that relax their credit underwriting standards, especially if not supported by adequate capital resources to bear the risks and robust risk management practices, may set themselves up for a wave of non-performing loans. A survey of less significant institutions, the small and medium-sized banks that are directly supervised by national authorities, has highlighted the challenges that banks face in this area.

In the current period of low interest rates, loosening credit underwriting standards has become a search-for-yield strategy to bolster earnings. The ECB has identified this strategy as one of the key vulnerabilities of banks under European banking supervision. Before the outbreak of the coronavirus (COVID-19) pandemic, small and medium-sized banks generated relatively strong loan growth, exceeding that of their larger peers. In view of this, the national supervisory authorities and the ECB launched a survey in 2019 on a representative sample of less significant institutions’ credit underwriting standards. This survey was not dissimilar to the 2019 exercise carried out for significant institutions, although some adjustments were made to take into account the size and complexity of the less significant institutions.

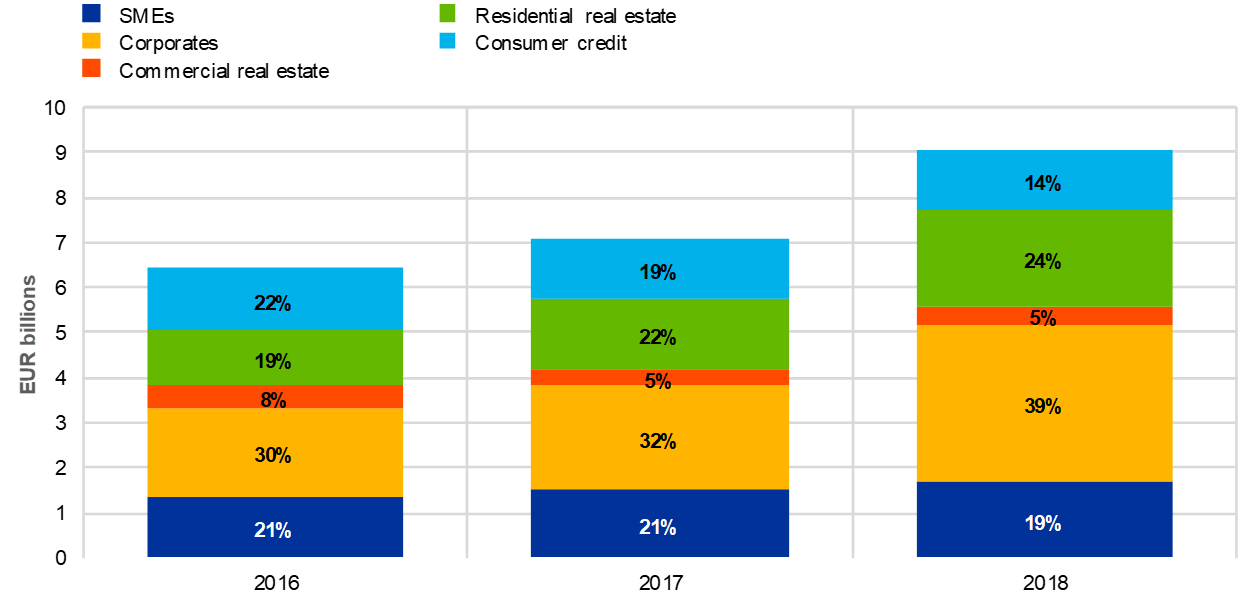

In line with the supervisory priorities, the aim of the survey was to investigate how banks’ lending practices changed between 2016 and 2018 and to identify patterns and vulnerabilities for individual banks, their business models and their loan portfolios (commercial real estate, residential real estate, small and medium-sized enterprises, corporates, consumer credit and leveraged finance). The results of the survey paint a quantitative picture of the evolution of loan growth and credit risk, and a qualitative picture of how banks adjusted their risk and business strategies to cope with increased market competition.

A key finding is that most of the 200 banks surveyed faced significant challenges in terms of their ability to retrieve key credit risk indicators and the data quality of these indicators. This raises concerns about banks’ IT capabilities as well as their overall risk governance. Another key finding is that, owing primarily to intense competition, the interest rates banks charged on loans only weakly reflected the underlying credit risk of those loans. This lack of risk-based pricing may undermine banks’ ability to cover future loan losses.

The survey also found that, overall, smaller banks generated much higher loan growth than their larger peers. This was accompanied by deteriorating key risk indicators (for example, an increase in the debt burden of borrowers) and is a supervisory concern. On average, the banks in the sample increased their new lending by approximately 15% annually between 2016 and 2018. Residential real estate portfolios saw the strongest growth, with new lending almost doubling over the same period.

New business volume (net of renegotiations) reported by smaller European banks in 2016-18

Source: ECB Banking Supervision.

Notes: New business volume refers to new lending by all the less significant institutions in the survey. Percentages may not add up to 100 owing to rounding.

Moreover, the survey revealed that intense market competition put further pressure on lending margins and forced banks to adjust their business and risk strategies by launching new products and expanding into new geographical markets. There was a decline in average lending margins (i.e. the difference between banks’ interest rates on loans and their funding costs) across all portfolios except commercial real estate, which saw a slight increase in the average margin. Consumer credit was the most profitable business for smaller banks, generating the highest average margin.

So, what are the next steps for the national competent authorities (NCAs) and the ECB? “The assessment of the quality of banks’ lending standards and practices has provided us with valuable insights. We look forward to carrying out follow-up work in cooperation with colleagues from the ECB and other NCAs,” said supervisors from De Nederlandsche Bank. The insights from this survey can be used to identify individual banks and specific loan portfolios that are particularly vulnerable in the current environment of heightened risks, one that is characterised by economic uncertainties from the COVID-19 pandemic. The ECB and the NCAs will follow up with the banks on the findings and monitor the progress made in addressing them. This will be done as part of the ongoing supervision and oversight of less significant institutions, as credit risk remains a key vulnerability of these banks and therefore a top supervisory priority for the ECB and the national supervisors.

Bank Ċentrali Ewropew

Direttorat Ġenerali Komunikazzjoni

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, il-Ġermanja

- +49 69 1344 7455

- media@ecb.europa.eu

Ir-riproduzzjoni hija permessa sakemm jissemma s-sors.

Kuntatti għall-midja