FAQs on the intermediate EU parent undertaking requirement

Section 1 – General information

What is an intermediate EU parent undertaking? Why does it matter?

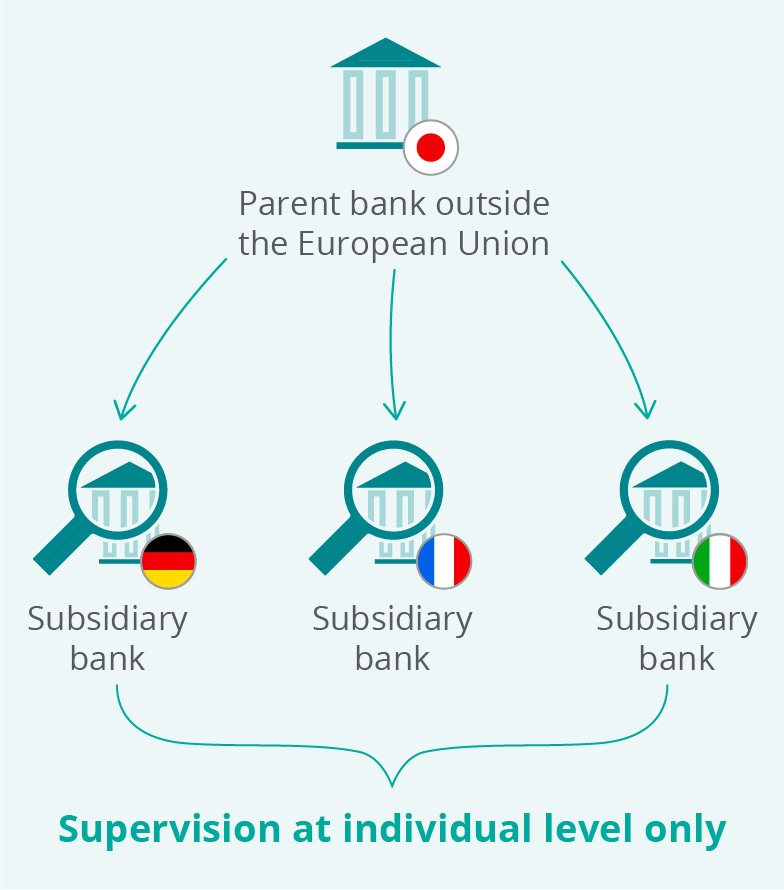

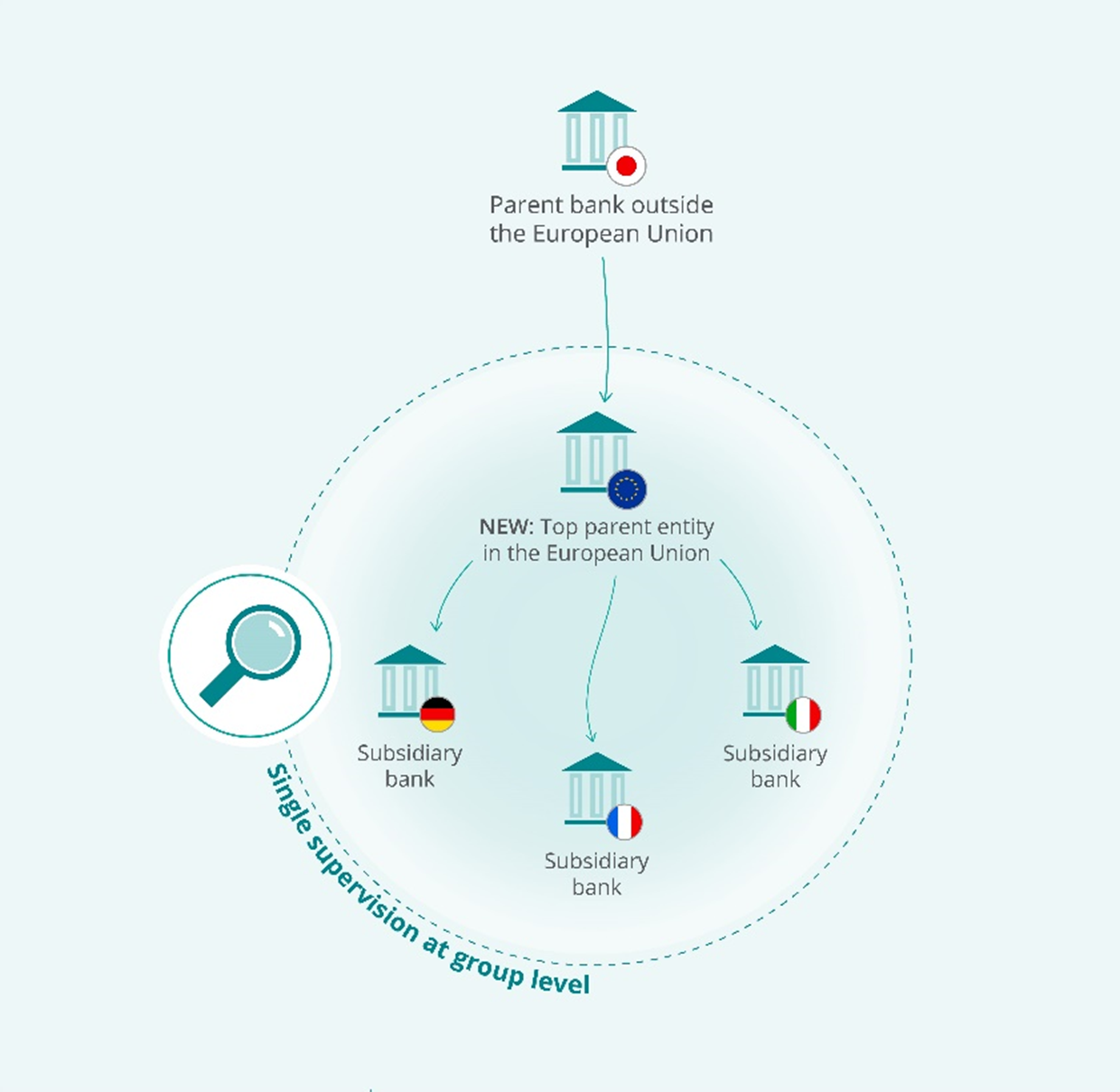

When two institutions (banks and investment firms) in the European Union belong to the same third-country group, they have to establish a single intermediate parent entity (or in certain limited cases, two intermediate parent entities) in the EU, provided that the EU assets of the third-country group they belong to exceed a certain threshold. This intermediate parent entity is called an intermediate EU parent undertaking (IPU).

Establishing a single parent entity in the EU allows for single consolidated supervision of the third-country group’s EU activities, as opposed to individual supervision of several standalone entities.

* The countries and legal entities selected in the example are for illustration only.

What is the intermediate EU parent undertaking requirement in Article 21b of the Capital Requirements Directive and when does it come into force?

Article 21b of Directive 2013/36/EU (the Capital Requirements Directive – CRD) requires banks and investment firms in the European Union that are subsidiaries of third-country groups to set up a single intermediate EU parent undertaking (IPU). The requirement applies if the third-country group has two or more institutions (banks and investment firms) established in the EU with a combined total asset value, within the EU, of at least €40 billion, including the assets of the third-country group’s branches in the EU.

Exceptionally, competent authorities can exempt institutions from this requirement and allow two IPUs to be set up, provided that certain conditions set out in the CRD are fulfilled.

The requirement to set up an IPU has been applicable since 29 December 2020 (or the date of the Member State’s transposition of the CRD, if later). However, a transitional regime applies: third-country groups that, on 27 June 2019, operated in the EU (including the United Kingdom) through more than one institution and which had assets of at least €40 billion have until 30 December 2023 to comply with the requirement to establish one or, as the case may be, two IPUs.

What is the rationale behind the requirement to set up an intermediate EU parent undertaking?

From a supervisory perspective, establishing an intermediate EU parent undertaking allows all of the third-country group’s EU institutions (banks and investment firms) to be consolidated under a common EU parent entity. This means that a consolidating supervisor is able to evaluate the risks and financial safety and soundness of the entire group in the EU and, accordingly, to apply the prudential requirements on a consolidated basis.

Which entities can be an intermediate EU parent undertaking?

Article 21b CRD states that an intermediate EU parent undertaking (IPU) must be a credit institution, a financial holding company or a mixed financial holding company. Where all of the third-country group’s subsidiaries in the EU are investment firms, or where a second IPU must be set up in connection with investment services activities to comply with a mandatory separation requirement, the IPU (or the second IPU) may be an investment firm.

What happens to third-country group branches in the EU when an intermediate EU parent undertaking is set up?

The assets of the third-country group’s branches in the EU are included in the calculation of the total assets of the third-country group, but these third-country branches are not required to move under the umbrella of the intermediate EU parent undertaking (IPU). They can remain branches of third-country parent and continue to be supervised by the relevant national competent authorities.

Is the ECB always the supervisor of the group under the intermediate EU parent undertaking?

No. European banking supervision’s significance criteria and allocation of competences apply as usual. The intermediate EU parent undertakings which meet the significance criteria will be directly supervised by the ECB. Those classified as less significant institutions will be directly supervised by national supervisors. The supervision of third-country branches remains a competence of the relevant national competent authorities.

When is the €40 billion intermediate EU parent undertaking threshold considered to be reached? What is expected of institutions (banks and investment firms) whose parent entity is located in a third country?

- The European Banking Authority’s intermediate EU parent undertaking (IPU) guidelines can already provide useful guidance on this question at this stage. In particular, under these guidelines, the IPU threshold is deemed to be reached when the average total value of a third-country group’s EU assets equals or exceeds €40 billion over the previous four quarters. Total assets are the sum of the assets of the EU parent institutions, consolidated in accordance with Article 18 CRR at the highest level of consolidation, plus the assets of the standalone institutions based in the EU that are subsidiaries of the same third-country group, plus the assets of the EU branches of the same third-country group.

- Significant institutions that have a parent entity located in a third country should assess whether they meet the IPU requirement, or expect to meet it in the foreseeable future, and liaise with the ECB, via their respective joint supervisory team, on their plans for complying with the CRD as transposed in national legislation.

Section 2 – Setting up an intermediate EU parent undertaking

What procedures are involved in setting up an intermediate EU parent undertaking?

- In most cases, operationalising the intermediate EU parent undertaking (IPU) requirement triggers some form of restructuring on the part of the third-country group, which could, for example, take the form of a change in the chain of control (requiring authorisation by way of a qualifying holding procedure) or the establishment of a new parent undertaking. In the case of a financial holding company, the latest revision of the Capital Requirements Directive (CRD V) introduces a new approval requirement (Article 21a of CRD). In the case of a credit institution or investment firm, the corresponding licensing procedures in accordance with Article 8 or 8a of CRD V, or Article 5(1) of Directive 2014/65/EU, respectively, will apply.

For further information, please see the ECB Banking Supervision authorisations webpage.

Section 3 – Requesting a second intermediate EU parent undertaking

Under what conditions are two intermediate EU parent undertakings allowed?

In accordance with Article 21b(2) CRD, competent authorities may allow two intermediate EU parent undertakings (IPUs) to be set up if they determine either of the following conditions to be true:

- establishing a single IPU would be incompatible with a mandatory requirement for separation of activities imposed by the rules or supervisory authorities of the third country where the ultimate parent undertaking of the third-country group has its head office (“Condition (a)”);

- establishing a single IPU would render resolvability less efficient than in the case of two intermediate EU parent undertakings according to an assessment carried out by the competent resolution authority of the intermediate EU parent undertaking (“Condition (b)”).

Banks looking to apply for this exemption should contact their supervisor.

Are there any limits to the activities that can be undertaken by the second intermediate EU parent undertaking and its group, if it is authorised on the grounds that third-country laws impose a mandatory requirement for separation of activities?

Yes. The second intermediate EU parent undertaking (IPU) should be set up for the purpose of allowing the third-country group to continue providing services subject to structural separation (“segregated services”). This means that the second IPU – and the institutions in its group – should only perform services that are segregated from the activities of the first IPU, following the requirements of the supervisory authorities of the third country related to the separation rules and taking into account the overall structure of the third-country group.