- SUPERVISION NEWSLETTER

Internal ratings-based (IRB) approach: new developments

16 August 2023

Internal models are key to banks’ risk management and capital calculations: with the ECB’s permission, banks can use internal models to determine their risk-weighted assets – and, therefore, how much capital they need in order to cover their risks.

Changing economic conditions naturally alter debtors’ risk situations, and the coronavirus (COVID-19) pandemic posed extraordinary challenges for banks’ management of credit risk, including as regards their internal models. Recent analysis by the ECB has found that many IRB models do not yet incorporate data from the COVID-19 pandemic, as most banks have postponed the recalibration of their probability of default (PD) and loss given default (LGD) models. This approach is in line with the principles established by the European Banking Authority: before banks put pandemic-related data in their models, they need to carefully assess whether any decline in default rates (or loss rates) represents a sustainable development (rather than being driven by governments’ COVID-19 support measures or other temporary factors). This will allow banks to avoid biasing their models. For some banks, PD estimates declined during the pandemic (mainly for the retail sector), which requires careful monitoring going forward: it may indicate that PD models are overreacting to economic conditions as a result of the pandemic support measures.

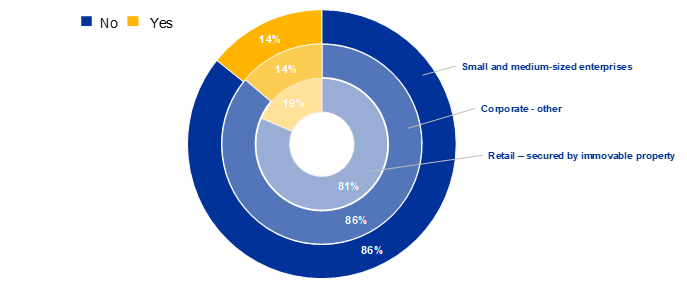

Chart 1

Have PD models been recalibrated to already incorporate COVID-19 data?

Source: ECB supervisory information.

Notes: This chart is based on survey data, which were collected in January 2023 from SSM banks using the IRB approach (with a reference date of December 2022). Banks were asked, for each of the exposure classes in question, whether their most relevant PD model had been recalibrated to include COVID-19 data.

How banks recalibrate internal models is an essential part of the supervisor’s assessment in an internal model investigation. ECB Banking Supervision will continue to assess whether banks are properly analysing the representativeness of COVID-19 data and making necessary adjustments or applying suitable margins of conservatism. It is therefore essential that banks keep thoroughly analysing and properly justifying and documenting the approaches they are following – especially where default or loss rates declined during the pandemic.

In a similar vein, regulators and supervisors must regularly assess whether (i) the rules on internal models and (ii) any supporting information provided remain fit for purpose. Consequently, the ECB has revised its Guide to internal models in response to recent developments in regulatory requirements and in order to clarify existing rules where necessary. That revised guide is the subject of a public consultation (which runs until 15 September 2023) and will be finalised thereafter.

The ECB guide to internal models has proved to be a very useful tool, as it contributes to a common understanding of regulatory requirements and helps to ensure consistent implementation of the rules on internal models. Among other things, the revised guide details the ECB’s understanding of the relevant provisions in order to ensure a common and consistent approach to the definition of default. Furthermore, since several banks intend to reduce complexity by streamlining their internal model landscapes for credit risk, the guide now provides additional guidance on how banks can ask to switch back to the simpler standardised approach. This will help banks and supervisors alike to maintain a level playing field while ensuring compliance with regulatory requirements.

Going forward, the ECB will continue to scrutinise banks’ internal model approaches, including the question of whether and how banks adapt their internal models to COVID-19 data or climate-related risks. This will help to ensure that risks are properly measured by internal models and covered by an appropriate level of capital.

ECB Banking Supervision conducts all assessments in line with the Guide to internal models, which describes in a detailed and operational manner the ECB’s supervisory stance and expectations with respect to EU regulation on internal models. The forthcoming implementation of the new Capital Requirements Regulation and, in particular, the Fundamental Review of the Trading Book may trigger further expectations and thus clarifications to this guide, which will be communicated in due course.

Europeiska centralbanken

Generaldirektorat Kommunikation och språktjänster

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Tyskland

- +49 69 1344 7455

- media@ecb.europa.eu

Texten får återges om källan anges.

Kontakt för media