- SUPERVISION NEWSLETTER

More effective fit and proper decisions

17 November 2022

Bank directors must be capable of taking decisions that ensure their organisations are prudently and soundly managed. They must also be of good repute and free from conflicts of interest that could hinder effective management and balanced decision-making. This is important not only for the safety and soundness of the bank itself, but also for the wider banking sector, as it will reinforce the general public’s trust in those who manage the euro area financial sector. The European Central Bank (ECB), in close cooperation with national competent authorities, therefore carries out fit and proper assessments to determine whether prospective board members of a supervised bank are suitable for their roles.

In the face of any concerns about a board member’s fitness and propriety, the ECB may issue a decision with “ancillary provisions” attached. These are conditions, obligations or recommendations that appointees must fulfil to address these concerns. When the ECB identifies a material need – a gap in a certain area of banking knowledge for instance – it may impose a requirement for the board member to complete further training. For further information on ancillary provisions, see Section 7 of the ECB’s Guide to fit and proper assessments.

Experience has shown that ancillary provisions are most effective when setting out concrete, legally enforceable expectations for the bank or board member, according to clear timelines. To further enhance the effectiveness of its fit and proper decisions, the ECB has revised its policy for ancillary provisions.

Going forward, fit and proper decisions will entail deadlines and requirements that will address real corrective needs to ensure board members are suitable. These principles will further clarify ancillary provisions, which will in turn make it easier for both banks and supervisors to follow them up, and as such increase the effectiveness of fit and proper decisions. Thanks to the revised policy, newly appointed board members and their organisations will now know exactly what they need to do to meet the prescribed requirements and within what time frame.

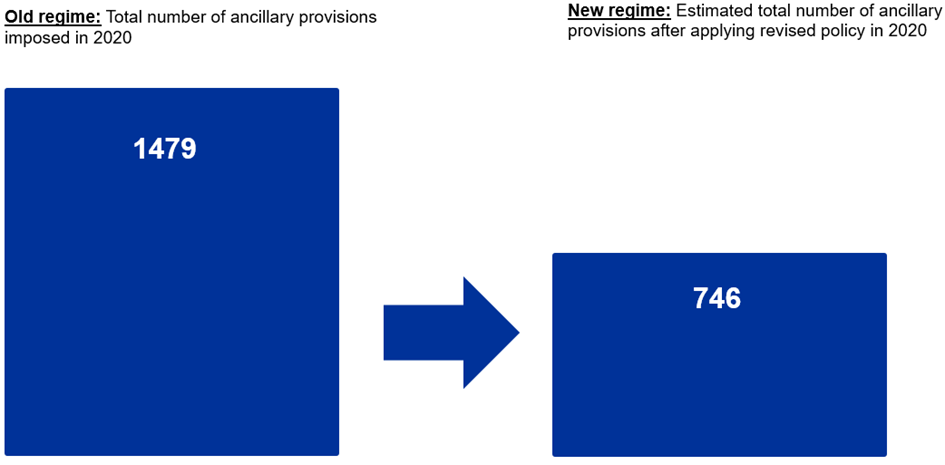

The new policy also implies that the ECB will no longer impose obligations without deadlines, or obligations merely referring to and recalling the legal obligations and internal policies which banks have to comply with in any case. This means that the total number of ancillary provisions will fall significantly (see Chart 1), while conversely the ancillary provisions which will be imposed will provide banks and supervisors with a sharper focus, making such provisions a more effective supervisory tool than before.

The revised policy for the use of ancillary provisions is another step in the ECB’s more intrusive and streamlined approach to fit and proper assessments, and its efforts to improve the governance of banks.

Chart 1

Estimated impact of revised framework

Estimated drop in total number of ancillary provision due to revised policy

Source: ECB, based on internal data.

Europeiska centralbanken

Generaldirektorat Kommunikation och språktjänster

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Tyskland

- +49 69 1344 7455

- media@ecb.europa.eu

Texten får återges om källan anges.

Kontakt för media