- Supervision newsletter

Securitisations: meeting significant risk transfer criteria

18 May 2022

Securitisation allows banks to transfer the risk of certain exposures and free up lending capacity, as regulatory capital may be released and used for loans to the real economy. But this capital can only be released if the securitisation transaction meets significant risk transfer (SRT) criteria as laid down in prudential regulation, and supervisors check on banks’ compliance with these criteria. The banks are required to notify the ECB at least three months in advance of the expected closing date of the transaction. After supervisors have received this notification, they will start assessing whether the significant risk transfer criteria are met.

SRT transactions can be done with performing and non-performing assets. Banks that securitise performing assets typically pursue capital release, while securitisations of non-performing assets mainly intend to clean the balance sheet of the bank. Banks may use cash or synthetic securitisation structures in SRT transactions: if banks use cash structures, they sell the underlying loans and thereby remove them from their balance sheets. In a synthetic structure, they transfer the risk via credit derivatives or guarantees but keep holding the underlying exposures. A significant majority of performing asset SRT transactions are synthetic, while most SRT transactions with non-performing loans are done via cash transactions.

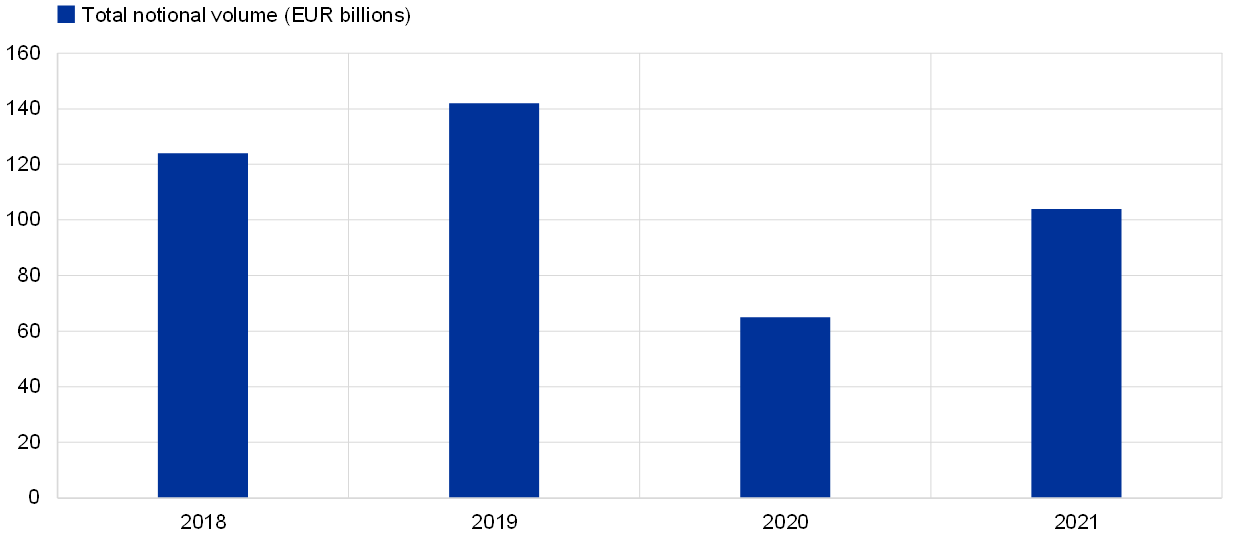

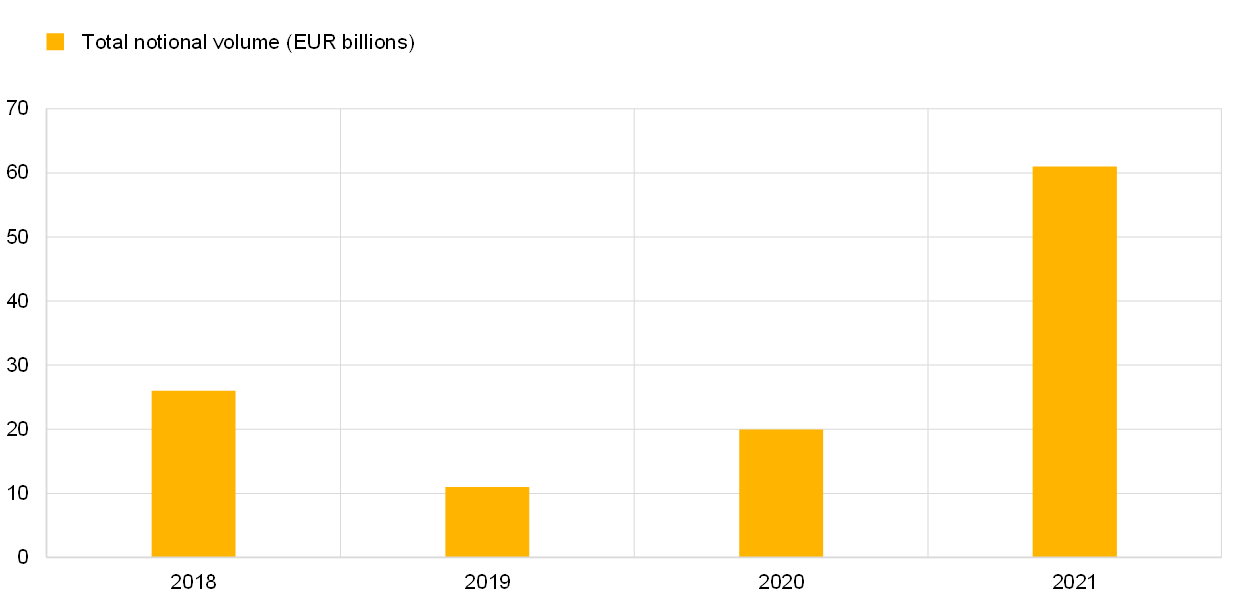

Since 2018, the number and notional volume of transactions have increased, for both performing and non-performing assets. During this period, around 30 banks were active in transactions with performing loans and 13 banks securitised non-performing loans. The notional volume of securitisations of performing loans peaked at EUR 142 billion in 2019, dropped significantly during the pandemic but picked up again in 2021, reaching EUR 104 billion. For securitisations with non-performing loans, the notional volume reached a record high of EUR 60 billion in 2021, a steep increase compared to previous years.

Evolution of the SRT market: transactions with performing loans

Source: ECB data

Evolution of the SRT market: transactions with non-performing loans

Source: ECB data

European banking supervision grants SRT following a comprehensive review of the transaction, in line with the rules laid down in the Capital Requirements Regulation (Article 244 for cash transactions and Article 245 for synthetic transactions) and supported by Guidelines issued by the European Banking Authority. Once supervisors confirm that a significant risk transfer is in place, the bank stops reserving capital for the underlying portfolio and starts allocating capital for the securitisation tranches that it must keep on its books. The overall net effect is that the bank saves capital, as capital requirements for retained securitisation tranches are lower than those for the (non-securitised) underlying portfolio.

Supervisors keep a close eye on securitisations as not every transaction may be successful, potentially harming the bank: if a bank does not sell all the securitisation positions, it will hold these tranches on its books, thus keeping some of the risk. This risk may materialise if effective losses are higher than the losses estimated at the time the bank originated the securitisation transaction. In that situation, the bank may face an ad hoc capital need which can only be covered if the bank has extra capital available for unforeseen situations. If not, the bank could experience a capital shortfall, which is detrimental to its financial soundness.

This is why it is crucial to ensure that banks have a robust SRT set-up, not only at origination but also throughout the life of the transaction. Meeting the SRT criteria throughout the life of the transaction supports healthy capital levels of banks. European banking supervision thus regularly assesses structural features of securitisations, such as granularity, amortisation, call options, excess spread and early-termination events. In addition, supervisors review the performance of outstanding SRT transactions on an ongoing basis. If they detect deficiencies, banks will be asked to address these.

Banco Central Europeo

Dirección General de Comunicación

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemania

- +49 69 1344 7455

- media@ecb.europa.eu

Se permite la reproducción, siempre que se cite la fuente.

Contactos de prensa