- THE SUPERVISION BLOG

Provisioning for a clean balance sheet

Blog post by Elizabeth McCaul, Member of the Supervisory Board of the ECB

Frankfurt am Main, 30 November 2021

All banks take risks. When a bank grants a loan there is always a risk that the borrower may not pay it back. To remain safe and sound, banks need to manage their credit risk and keep enough money aside in case some of their loans become non-performing. Our worst fears about an increase in credit risk thankfully have not materialised. So far, the pandemic has not resulted in a tsunami of non-performing loans (NPLs)[1] that one could have predicted. But, these are still uncertain times. A fourth wave is unfolding, and new variants threaten. Ultimately, public support measures will be phased out, perhaps revealing some underlying asset quality weaknesses. And, structural changes in our ways of working and taking leisure may emerge post pandemic, which could have the effect of creating additional NPLs. So, it is not yet time to declare victory. Moreover, past crises have taught us that NPLs weigh on banks’ profitability and absorb valuable resources, restricting banks’ capacity to grant loans and thus damaging the outlook for jobs and growth. That is why following through on previously announced supervisory NPL coverage expectations is crucial to ensure that banks remain part of the solution as we look to the recovery.

Supervisory expectations for NPLs

A European banking law was adopted in April 2019 known as the NPL backstop, requiring banks to book minimum levels of provisions for NPLs based on a uniform provisioning calendar and to apply a deduction to their capital to the extent their provisions fall short.

The NPL backstop is an effective tool to prevent the excessive build-up of new NPLs on bank balance sheets by creating buffers which allow banks to promptly tackle NPLs through sales or write-offs. However, the backstop only applies to NPLs arising from loans granted after 26 April 2019. But what about loans granted earlier than that? Can banks simply wait to see what loan repayment performance will look like over time without taking provisioning actions to address their older stocks of NPLs?

The answer, of course, is no. In 2017 and 2018, banking supervisors stepped in to make sure that the loans that had been non-performing for years would be subject to strong supervisory oversight and actions. The NPL Guidance published in 2017 heralded the strongest push to date to address NPLs. It outlined our expectations for how banks should manage and ultimately reduce the stock of NPLs with specific NPL reduction strategies and provisioning. Following publication, we engaged with banks to define and regularly update their NPL strategies. We also specified our supervisory expectations for a bank’s level of prudential provisions for NPLs. Bank-specific coverage expectations published in 2018 have been in effect since the end of 2020[2].

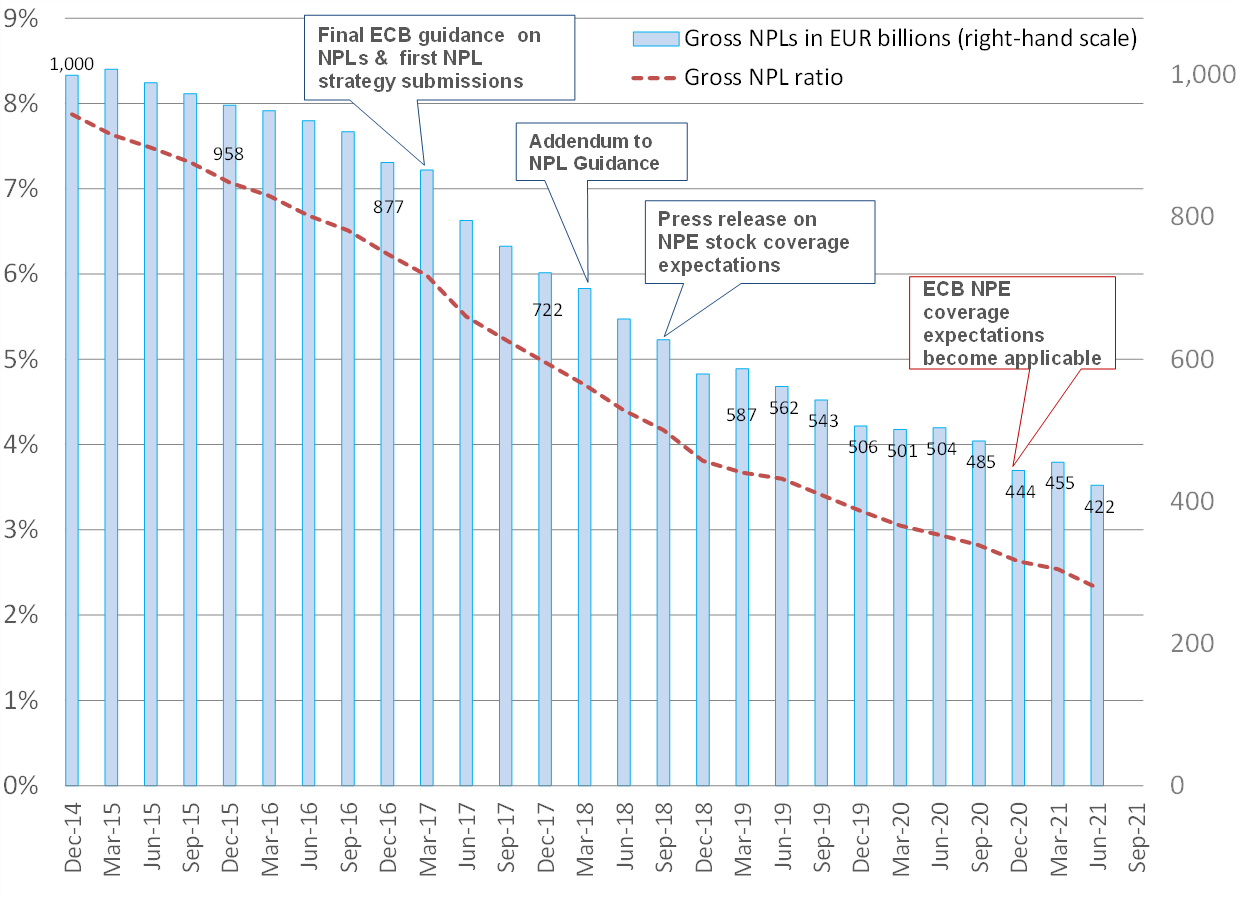

Indeed, and quite positively, banks stepped up efforts following these supervisory actions. And overall, since the start of the banking union in 2014, the average NPL ratio of supervised banks has fallen from 8% (€1 trillion) to 2.3% (€422 billion) in June this year.

By any measure this is an impressive reduction, continuing to drop even during the pandemic.

Chart 1

NPL reduction 2014-2021

Source: ECB

While the decline in NPLs has accelerated over the past 4 years, particularly rapidly in countries with high NPL ratios, we must keep a close eye on any pandemic-related effects that may yet increase the stock of NPLs on the balance sheets of supervised banks.

Imposing a capital add-on in cases of under provisioning

As announced in 2018, we are implementing the bank-specific approach in our Supervisory Review and Evaluation Process (SREP) to ensure banks deliver on our supervisory provisioning expectations for covering credit risk from NPLs.

With the delivery of our SREP decisions at the end of this year, the ECB will impose a Pillar 2 Requirement add-on on banks that have not booked enough provisions to cover credit risk on the non-performing loans they granted before 26 April 2019. This means we are about to increase the capital requirements of some banks to compensate for any shortfall against our prudential expectations regarding provisions on non-performing loans.

This will achieve the important objective that risk is properly mitigated in banks which are not complying with our coverage expectations, a crucial step also in the event that new pandemic-induced risks emerge. The ECB is not aiming to punish banks that are not yet compliant with our coverage expectations. Rather, we want to incentivise adequate provisioning that, in turn, will facilitate the resolution of older NPLs.

Setting the right incentives

In the SREP 2021 process and dialogue, supervisors have discussed bank-specific circumstances with individual banks and the need for any applicable Pillar 2 Requirement add-on, incentivizing some banks to take additional provisions or capital deductions. We are pleased to see that with this shift in supervisory incentives banks are moving already in the right direction. Most banks that were previously falling short of our supervisory expectations for NPL provisioning are now booking more provisions, which will reduce the Pillar 2 Requirement add-on.

After issuance of the SREP decisions, banks that actively continue to reduce any shortfall in provisions with regard to our expectations will be able to lower this new add-on swiftly, without waiting for the next SREP assessment. This way, banks that are taking initiatives to address loans that have been non-performing for some years, will quickly see the benefits in terms of capital requirements. The updated Pillar 2 Requirements will also be disclosed on the ECB’s banking supervision website.

From a supervisory perspective, booking additional provisions is an option that is readily available, but there are other avenues for closing the gaps. For example, banks can pursue NPL disposal opportunities or consider directly subtracting a given amount from their Common Equity Tier 1 capital. All of these avenues reduce exposures to credit risk.

The year in figures

When we began our dialogue with individual supervised banks earlier this year, the overall picture indicated a system-wide provisioning shortfall of €13.5 billion as of December 2020. In the meantime, roughly half of the banks have managed to fully cover their specific shortfall, mainly via Common Equity Tier 1 capital deductions and NPL disposals. During 2021 the overall shortfall has declined by €7.7 billion, to €5.8 billion. If banks were to close the remaining €5.8 billion gap, their aggregate capital ratio would decline by about 7 basis points. Currently, we only expect one in four banks to ultimately have a shortfall and, therefore, an add-on in their next SREP decision. But these figures can still change, of course.

Conclusion

History has taught us that addressing NPLs once they have accumulated is simply not enough. The longer a bank takes to clean its balance sheet, the higher its costs. Delay ultimately leads to these costs being passed on and acting as a drag on the overall economy. Banks need to identify distressed debtors earlier, offer solutions to viable debtors and avoid delaying action on non-viable ones. Reducing the stock of NPLs benefits not only the strength of an individual bank, but importantly also households, businesses and the economy as a whole.

The ECB’s efforts to tackle NPLs have been extremely effective. NPLs on bank balance sheets have decreased significantly since 2014 and we expect that applying the coverage expectations will help reduce them even more. If banks build on the reduction in NPLs they have achieved so far by promptly and accurately identifying, classifying and managing new NPLs, they will be more robust and better positioned to support the economic recovery and withstand any pandemic deterioration in asset quality.

- In this blog, the term non-performing loans (NPLs) is used while non-performing exposures (NPEs) is a wider concept encompassing also non-performing debt securities. The ECB guidance and the EU law introducing the NPL backstop both apply to the wider concept of NPEs.

- This Communication provides an overview of the ECB coverage expectations for NPLs for the stock (NPLs as at 31 March 2018) and the flows, i.e. the new NPLs subject to the Addendum (NPLs as of 1 April 2018 of loans originated before 26 April 2019).