- SUPERVISION NEWSLETTER

Room for improving valuation risk management

19 May 2021

Persistently low interest rates and competition from global banks under a different regulatory regime have sent European banks on a search for higher yields. To achieve better returns, banks have set up creative, innovative and bespoke strategies which involve products that tend to pose a higher risk of overvaluation of assets (if the products are bought) or undervaluation of liabilities (if they are sold) than “plain vanilla” financial instruments. Most of these products are traded in over-the-counter markets and are typically measured at fair value using complex financial statistical models developed by the banks themselves. Valuation risk is an area of concern for banking supervisors because overvalued assets or undervalued liabilities can lead to inflated capital buffers and capital ratios.

Valuation risk is the risk of loss arising from the difference between the price of an instrument reported on a bank’s balance sheet – as determined by accounting rules – and the actual price a bank would obtain if it sold that instrument (if it is an asset) or the price a bank would pay to buy it or transfer it to a third party (in the case of a liability). Factors contributing to valuation risk include the use of data for which no market information is available (i.e. unobservable inputs), market instability and poor verification of data by those responsible for determining the value of the instrument. These factors make it extremely challenging for banks to determine the fair and prudent value of such complex products with a reasonable level of confidence.

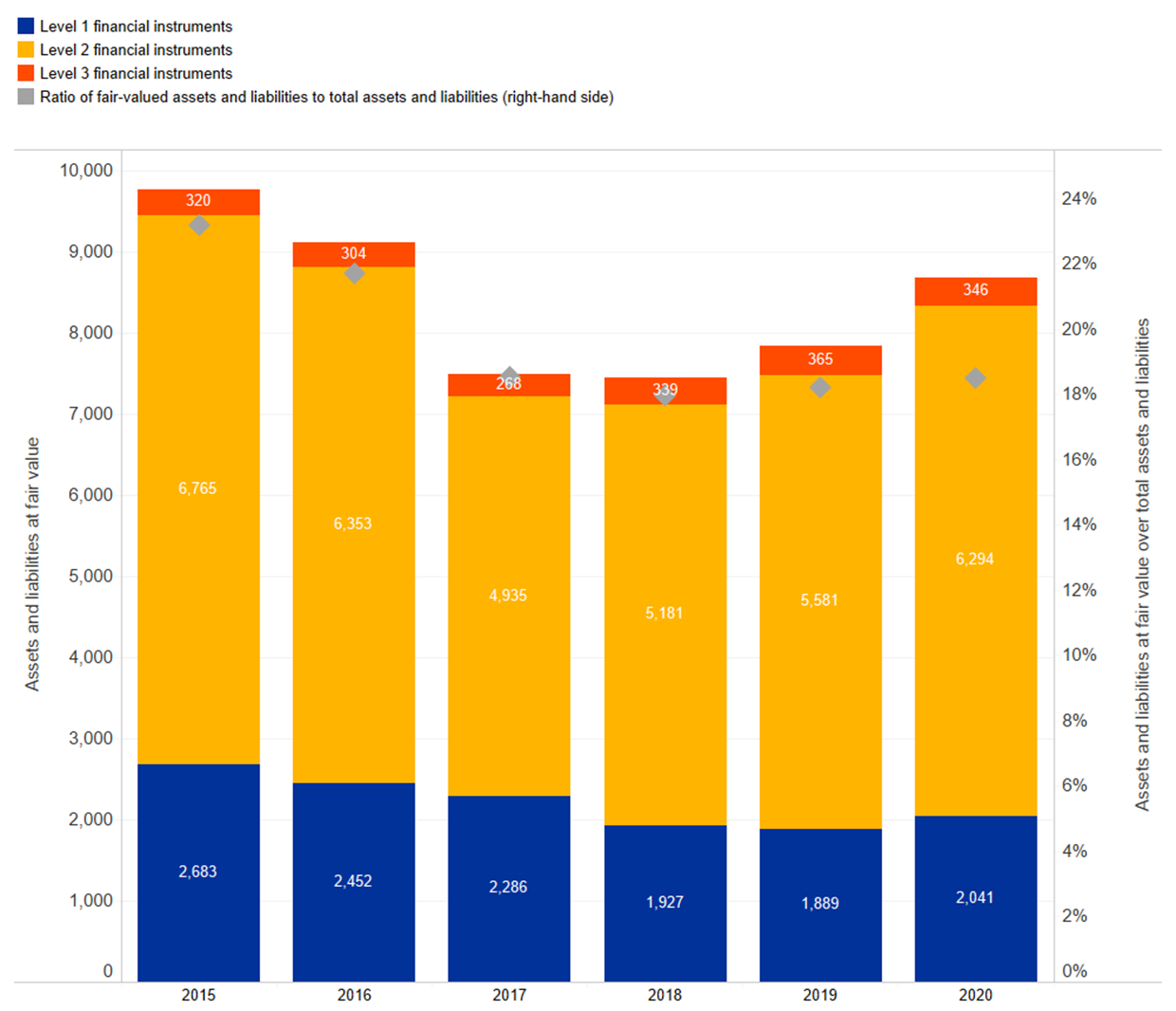

This risk is particularly relevant for banks with high volumes of fair-valued instruments whose valuation is model-based or involves unobservable inputs and is thus very subjective (known as Level 3 exposures). For banks under the ECB’s direct supervision, Level 2 and Level 3 fair-valued instruments are sizeable, representing two-thirds of these banks’ total fair-valued assets and liabilities of around €9 trillion. Level 2 instruments, whose measurement is based on observable inputs other than quoted market prices, and Level 3 instruments represent 495% and 23%, respectively, of the highest-quality (Common Equity Tier 1) capital of the banks directly supervised by the ECB.

Evolution of total assets and liabilities measured at fair value between 2015 and 2020

(left-hand scale: EUR billions; right-hand scale: percentages)

Source: Banks’ supervisory reporting (COREP).

Notes: The data refer to the assets and liabilities of all banks directly supervised by the ECB. Level 1 financial instruments have quoted prices in an active market and fully observable inputs. Level 2 instruments are valued using models based on directly or indirectly observable inputs. Level 3 financial instruments are valued using models based on a number of unobservable inputs.

In the light of the global financial crisis, when the prices for certain instruments in financial markets and those reported in banks’ financial statements differed significantly, supervisors see sound and prudent management of valuation risk as vital for the stability of the financial system. This is why the ECB launched a three-year on-site inspection campaign on valuation risk in 2019. This on-site initiative aims to promote a level playing field for banks, is based on a common revised methodology and provides a consistent follow-up of findings from on-site missions. By the end of 2021 the ECB expects to have carried out inspections – remotely during the pandemic – of around 20 banks holding large and complex fair-valued portfolios, representing 70% of all banks with fair-valued exposures supervised by the ECB.

The on-site campaign involves qualitative and quantitative assessments of the main components of banks’ valuation frameworks. The assessments pay particular attention to valuation uncertainty, observability of valuation inputs, model risk, fair value classification, recognition of profits when instruments are first recorded in the balance sheet (often referred to as day one profits), independence of price verification, market data quality control and prudent valuation practices. Owing to the interconnectedness of the accounting and prudential frameworks, it is important to understand the impact that the valuation options available under the accounting rules could have on a bank’s prudential position.

Overall, the interim results of the on-site campaign reveal that banks’ practices are very diverse. This is because accounting standards give banks some discretion to define and measure the observability of valuation inputs, classify instruments within the fair value hierarchy, measure day one profit and to determine an exit price (i.e. the price at which a bank would sell an instrument). This divergence in practices presents a real challenge when assessing valuation risk from the supervisory perspective. The campaign has highlighted severe weaknesses in banks’ internal valuation risk frameworks, including in:

- the incorporation of valuation risk in risk appetite frameworks and overall risk management;

- the level of detail of the observations and assessments of market parameters, models, credit and funding-related valuation adjustments for the recognition of day one profits and fair value classification;

- the independence of valuation control;

- the role of internal audit as a third line of defence against valuation risk;

- the scope of the valuation framework;

- the use of market risk premia to align accounting or prudent adjustments with forward-looking valuation measurements;

- the management of market data to ensure reliable valuation inputs.

These weaknesses were observed in most of the banks reviewed by the ECB. The results highlight the need for greater convergence of market practices based on a prudent valuation framework that adequately addresses valuation risk, provides for independent control over model risks and ensures sound market data management.

Valuation risk is still a material risk: the large volatility in banks’ publicly reported financial results during the market turmoil of 2020 was due in no small part to downward valuation adjustments of fair-valued positions. In extreme cases, it could have a significant impact on banks’ capital positions. Therefore, the ECB is stepping up its efforts to promote the prudent management of valuation risk. The Joint Supervisory Teams responsible for the inspected banks will follow up closely and, where necessary, impose remedial actions adapted to the severity of the findings to ensure that these banks are actively seeking to better understand, monitor and mitigate their valuation risk. Moreover, the ECB will be working with a number of banking federations to improve information-sharing between banks and supervisors on major valuation risk management topics. Those initiatives will be complemented by discussions on outstanding regulatory valuation issues with the European Banking Authority and other regulatory bodies, including the International Accounting Standards Board, the Basel Committee and the European Securities and Markets Authority.

Banca centrale europea

Direzione Generale Comunicazione

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

La riproduzione è consentita purché venga citata la fonte.

Contatti per i media