- SUPERVISION NEWSLETTER

Getting prepared for benchmark rate reforms – the final stretch

19 May 2021

As mentioned in August 2020, benchmark rates play a fundamental role in the financial system, as they are used as the basis for a wide range of financial contracts, including derivatives, mortgages and overdrafts. Global benchmark rates are undergoing reforms and preparing for the changes continues to be a significant challenge for banks. There is a lot of work ahead: the end of the London interbank offered rate (LIBOR) is imminent (except for certain tenors of USD LIBOR) and the euro overnight index average (EONIA) will be discontinued on 3 January 2022 and replaced by the euro short-term rate (€STR). In addition, the euro interbank offered rate (EURIBOR) was recently reformed, but preparations need to be made for its potential future unavailability. It is crucial that banks actively manage these transitions by reducing their legacy contracts and, where necessary, amending the wording of other affected contracts to provide clarity on these changes.

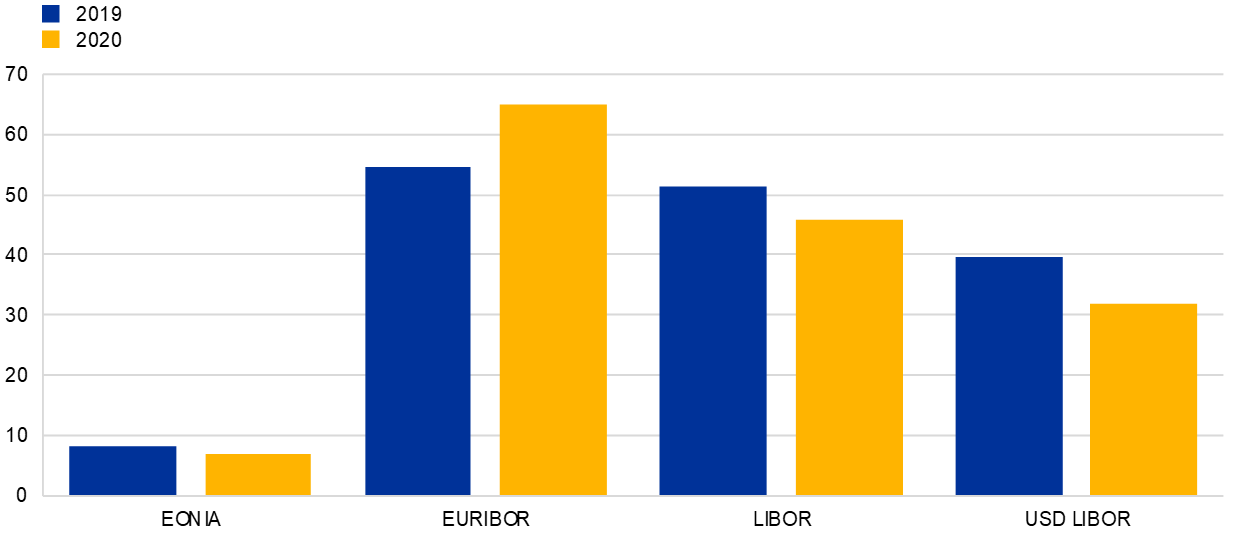

In December 2020 the ECB carried out an assessment of the impact of the reforms on banks subject to European banking supervision. It aimed to gain a comprehensive picture of banks’ exposure to key benchmark rates, their preparedness for the transitions, and the progress made since the 2019 assessment exercise. Data showed that the number of contracts referencing LIBOR and EONIA rates dropped from 3.9 million in 2019 to 2.2 million in 2020, mostly driven by a reduction of EONIA contracts from 2.0 million in 2019 to 0.4 million in 2020. However, total LIBOR and EONIA exposures only decreased from €59.6 trillion to €52.7 trillion over the same period (Chart 1). On aggregate, banks hold more than €48 trillion of LIBOR exposures (with five banks holding 78% of these exposures), mainly through derivatives contracts linked to the USD LIBOR.

Chart 1

Banks’ exposures to reference rates in 2019 and 2020

(EUR trillions)

Source: ECB data collections 2019 and 2020.

Notes: USD LIBOR amounts are included in LIBOR figures. 2020 data have been adjusted to ensure comparability with 2019 data.

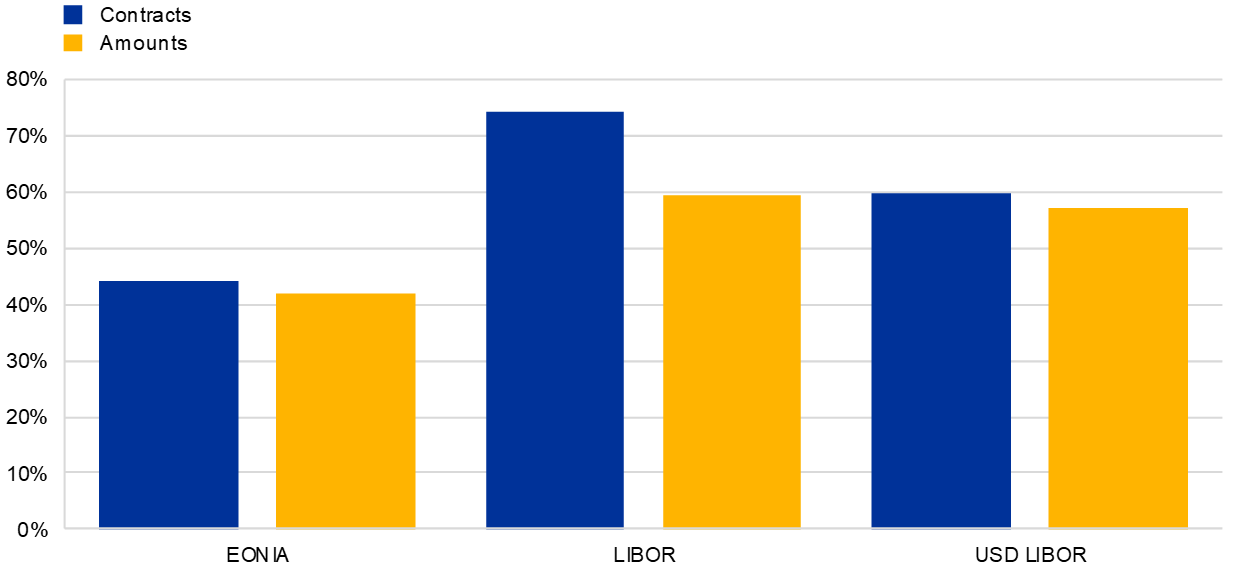

EONIA exposures decreased from €8 trillion to €7 trillion, and approximately 44% of outstanding contracts referencing EONIA will mature after the date when it is due to be discontinued. While banks have made clear progress in reducing deposits and debt securities linked to EONIA, they are lagging behind on loans and derivatives, in particular derivatives that are not centrally cleared. These account for 47% of total EONIA exposures that expire after the discontinuation date. In addition, 41% of these contracts do not include fallback clauses, which increases the transition risk. In the case of LIBOR, 74% of outstanding contracts across all financial instruments mature after the LIBOR discontinuation date (Chart 2). Of these, 53% do not have fallback clauses and thus carry transition risk.

Chart 2

Contracts expiring after 31 December 2021

(as a percentage of total stock)

Source: ECB data collections 2019 and 2020.

Note: 2020 data have been adjusted to ensure comparability with 2019 data.

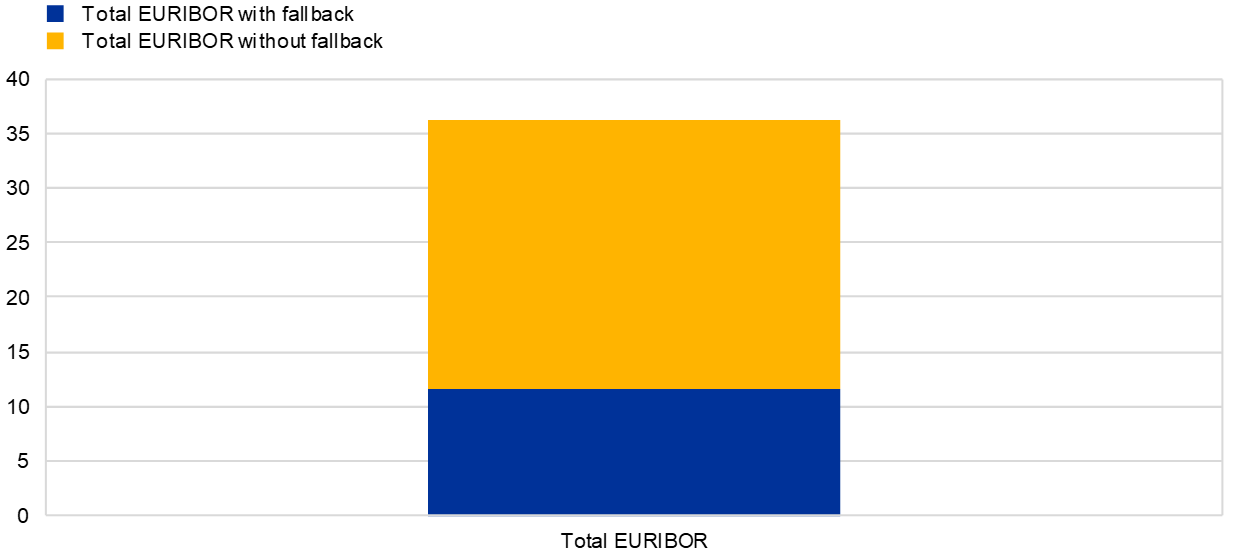

Similarly, 67% of contracts referencing EURIBOR lack fallback clauses (Chart 3).

In view of these results, banks are encouraged to identify and address legal and operational risks associated with repapering EURIBOR, LIBOR, and EONIA contracts and to step up their efforts to introduce fallback provisions.

Chart 3

EURIBOR contracts and fallback mechanisms

(number of contracts in millions)

Source: ECB data collection 2020.

There is still much work to be done. Banks need to thoroughly and continuously assess their preparedness for the benchmark rate reforms and act quickly to reduce legacy exposures to rates that will be discontinued, introducing fallback provisions where needed. Therefore, banks are encouraged to transition to the €STR well ahead of the discontinuation of EONIA on 3 January 2022 and cease issuing LIBOR contracts as soon as possible. ECB Banking Supervision will continue to closely monitor banks’ progress and is engaging with them to promote swift action.

Europese Centrale Bank

Directoraat-generaal Communicatie

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Duitsland

- +49 69 1344 7455

- media@ecb.europa.eu

Reproductie is alleen toegestaan met bronvermelding.

Contactpersonen voor de media