- SUPERVISION NEWSLETTER

Banking on resilience: navigating persistent and emerging issues

15 February 2023

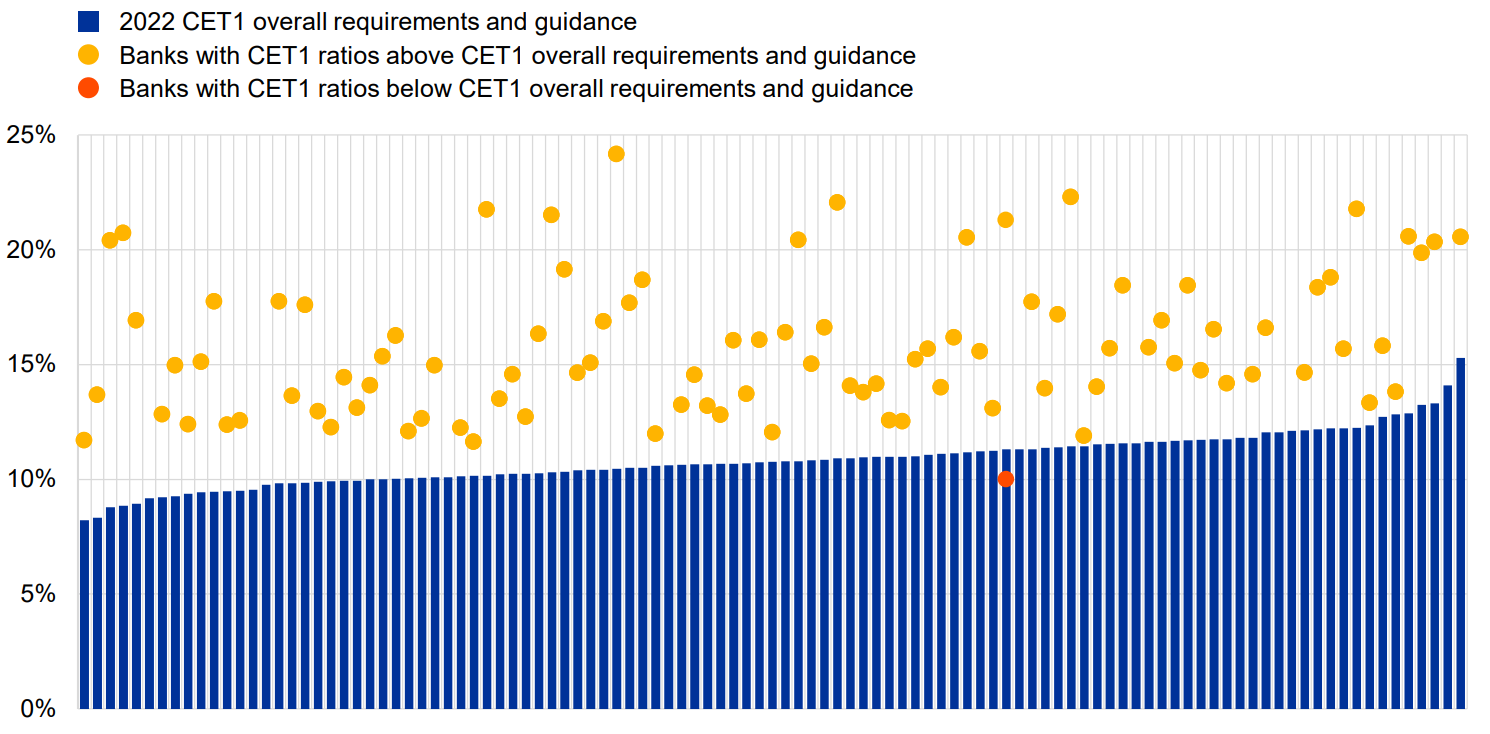

The year 2022 was one of turbulence and change. Russia’s war against Ukraine brought about deteriorating economic conditions and unusual financial market dynamics, while most major economies also experienced an exit from a low interest rate environment. This boosted banks’ profitability by interest rate margins not seen for more than a decade. European banks also faced these exceptional circumstances with solid capital and liquidity positions. Overall, they proved resistant – in a desired and also undesirable sense. On the one hand, banks showed resilience to external shocks and increased their profitability despite coping with complex changes. On the other, they also showed inertia in some supervisory areas which have been under scrutiny for some time and where action is long overdue. This led to the scores for the Supervisory Review and Evaluation Process (SREP) remaining stable overall (Chart 1), with only marginal increases in the overall capital requirements and Pillar 2 guidance largely unchanged (Chart 2).

Chart 1

Overall SREP scores by year

Sources: ECB (SREP database). SREP 2022 values based on 101 decisions, SREP 2021 values based on 108 decisions, SREP 2019 values based on 109 decisions. There are no banks with an overall SREP score of 1.

Notes: The evolution of scores does not take into account the qualifiers when applied, i.e. a change from a score of '3' to a score of '3-' is considered as no change. For banks in both 2021 and 2022 SREP cycles, 85 kept the same overall SREP score, 4 worsened and 3 improved; 84 kept the same Business Model score, 3 worsened and 5 improved; 73 kept the same Internal Governance score, 7 worsened and 12 improved and for Credit Risk, 73 kept the same score, 1 worsened and 18 improved.

Chart 2

Overall capital requirements and guidance as a percentage of risk-weighted assets

Source: ECB Supervisory Banking Statistics

Notes: Sample selection follows the Supervisory Banking Statistics (SBS) methodological note for Q1 2020 (SBS sample based on 112 entities), Q1 2021 (SBS sample based on 114 entities), Q1 2022 (SBS sample based on 112 entities). For 2023 the sample is based on 107 entities with applicable Pillar 2 requirements as of February 2023.

For the 2022 cycle supervisors focused on three key questions: How did banks weather the extraordinary changes in the economic environment? What pain points continue to exist? And what are the emerging issues that could compromise their current resilience?

Looking at the results of the SREP in more detail, the 2022 assessment revealed largely positive developments, but also some messages of caution.

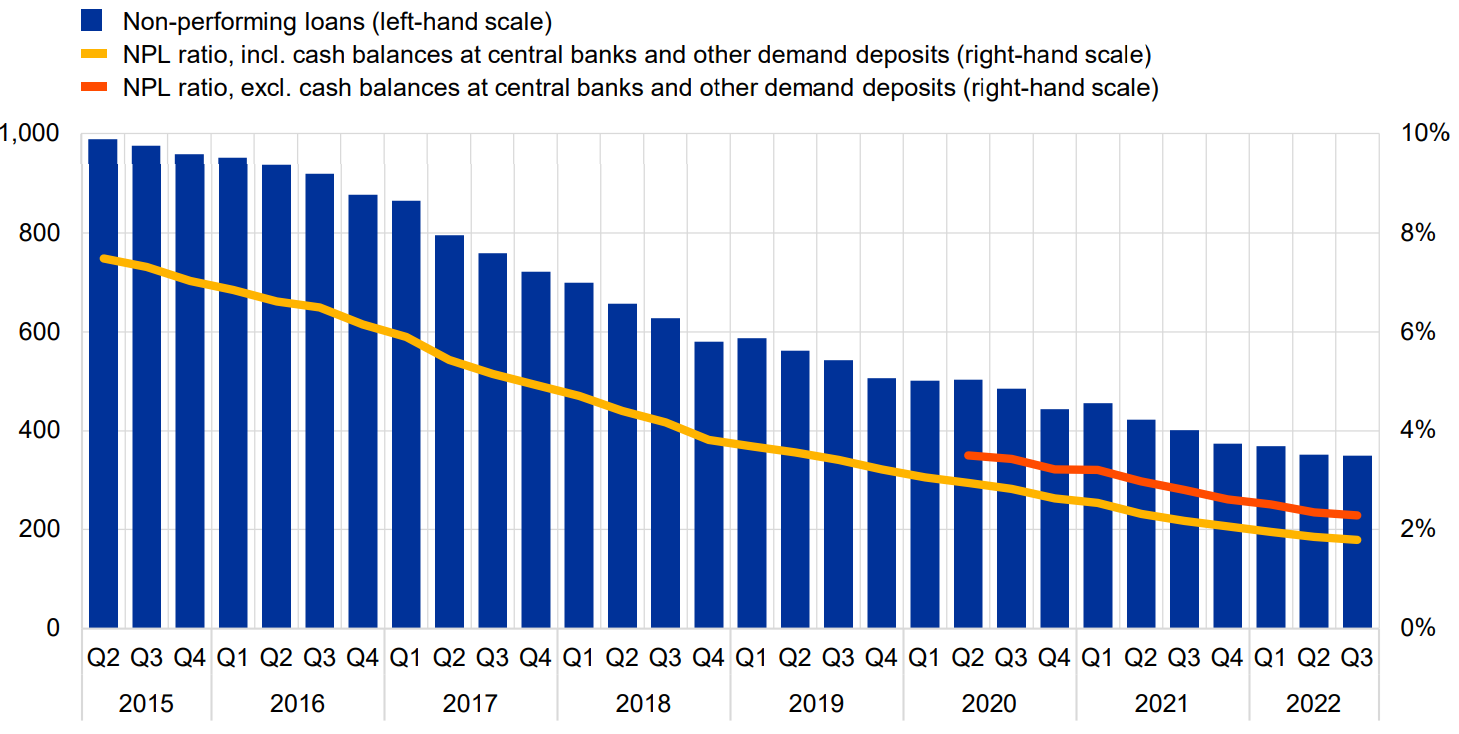

Banks profited from the interest rate increase and entered the year with strong capital and liquidity positions. Most of them reported Common Equity Tier 1 ratios above the new requirements and guidance stemming from the previous SREP cycle (Chart 3), which supervisors viewed very positively. On another bright note, asset quality improved further, and non-performing loans (NPLs) were reduced to their lowest level since supervisory data were first published in 2015 (Chart 4).

Chart 3

Distribution of significant institutions’ CET1 ratios relative to new requirements and guidance

Sources: ECB Supervisory Banking Statistics and SREP Database.

Notes: Pillar 2 CET1 requirements as per published list of P2Rs and Pillar 2 CET1 guidance as per EBA Stress Test 2021. CET1 ratios are as at Q3 2022. Systemic buffers (G-SII, O-SII and SyRB) and countercyclical capital buffers are the levels anticipated for Q1 2023 and included in the 2022 CET1 requirements and guidance. Each blue line represents a significant institution’s overall capital requirements and guidance in CET1.

Chart 4

Non-performing loans volume and ratios

Sources: ECB Supervisory Banking Statistics.

Notes: weighted average, sample selection follows the Supervisory Banking Statistics (SBS) methodological note.

Even though banks continued to improve their profitability and return on equity, two major issues from previous years remain and will thus require supervisory action in the future:

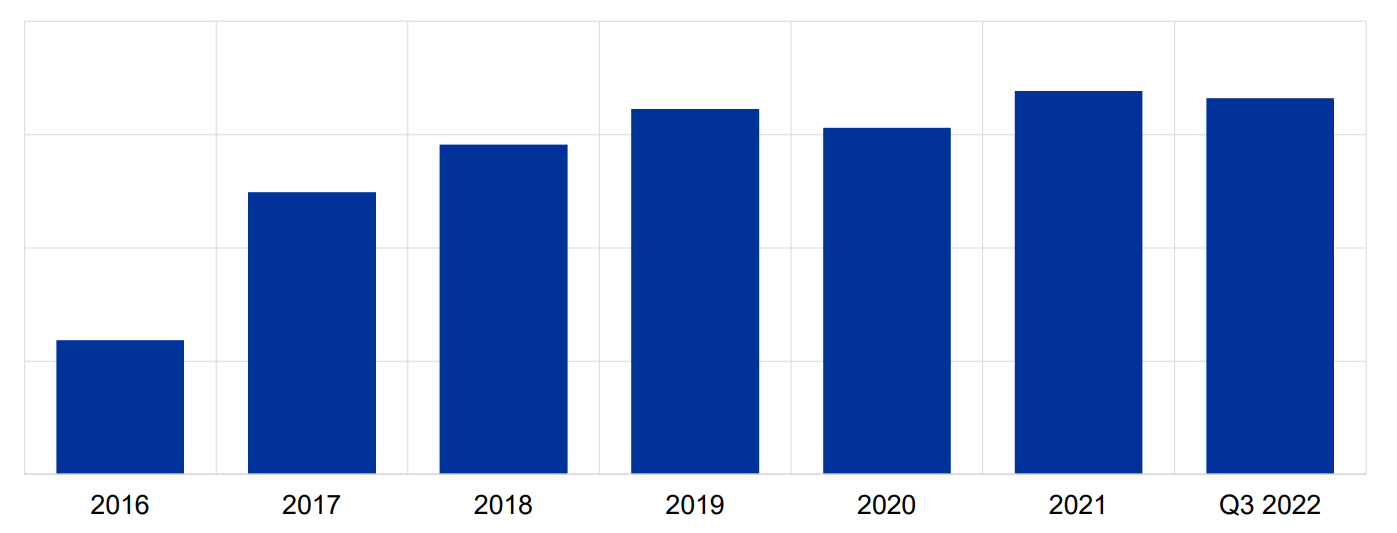

Banks continued to show weaknesses in their internal governance and risk management. This can be especially dangerous in a volatile and risky market environment. Here, supervisors highlighted in particular banks’ inaction regarding risk data aggregation and reporting (RDAR, Chart 5). Even though the financial industry has witnessed the importance of RDAR, it continues to make little progress in this area and needs to step up its efforts. That is why supervisors continue to pay special attention to these shortcomings and will maintain pressure on banks to address them – whether during “exceptional” or “normal” times.

Chart 5

Total open supervisory measures in the area of risk data aggregation and reporting (RDAR)

Sources: ECB (SREP database).

Note: Total open supervisory measures computed as a difference between the cumulative open measures and cumulative closed measures

The 2022 SREP also showed that European banks did not improve their business model scores. While some progress has been made in refocusing business models and digital transformation strategies, banks often do not bring to the table sufficient strategic steering and execution. This makes it difficult to create more sustainable sources of revenue and adapt to the mid- or long-term changes they are facing. This weakness is reflected in banks maintaining market values which are still well below their book values. Supervisors will therefore intensify their efforts to help bring about the necessary shift.

Besides these persistent weaknesses, banks also need to tackle two emerging structural challenges: digitalisation and climate change.

Given the increased risk of cyberattacks, banks need to tackle deficiencies in their outsourcing arrangements and IT security and cyber resilience frameworks. However, the size of banks’ investments in this area remains limited. To address this, ECB Banking Supervision has launched several digitalisation-related initiatives, which will feed into the supervisory assessment in the next SREP cycle.

Banks also need to better identify, assess, manage and transparently disclose their exposures to climate-related and environmental (C&E) risks. Qualitative measures have been applied as part of the SREP, mostly in the areas of governance and business models, but some also concerning credit, market and operational risks. As a next step, supervisors have asked banks to take concrete actions for compliance by the end of 2024.

While the 2022 SREP painted an overall positive picture, banks are advised to address longer-standing weaknesses and prepare for emerging structural change. By taking these issues seriously banks can become more resilient and successful, despite the challenges of an uncertain future.

Den Europæiske Centralbank

Generaldirektoratet Kommunikation

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Tyskland

- +49 69 1344 7455

- media@ecb.europa.eu

Eftertryk tilladt med kildeangivelse.

Pressekontakt