- SPEECH

Introductory statement

Speech by Andrea Enria, Chair of the Supervisory Board of the ECB, at the press conference on the results of the 2022 SREP cycle

Frankfurt am Main, 8 February 2023

Jump to the transcript of the questions and answersToday we are publishing the results of our annual supervisory review and evaluation process, or SREP, for the European banks under the ECB’s direct supervision. The SREP reflects supervisors’ comprehensive assessment of the banks’ risk profile and the overall viability and sustainability of their business. This assessment determines how much additional own funds we as supervisors require banks to maintain in order to be resilient to the risks they face. It also determines what actions we ask the banks to take to be able to effectively manage risks and ensure their business model is prudentially sustainable.

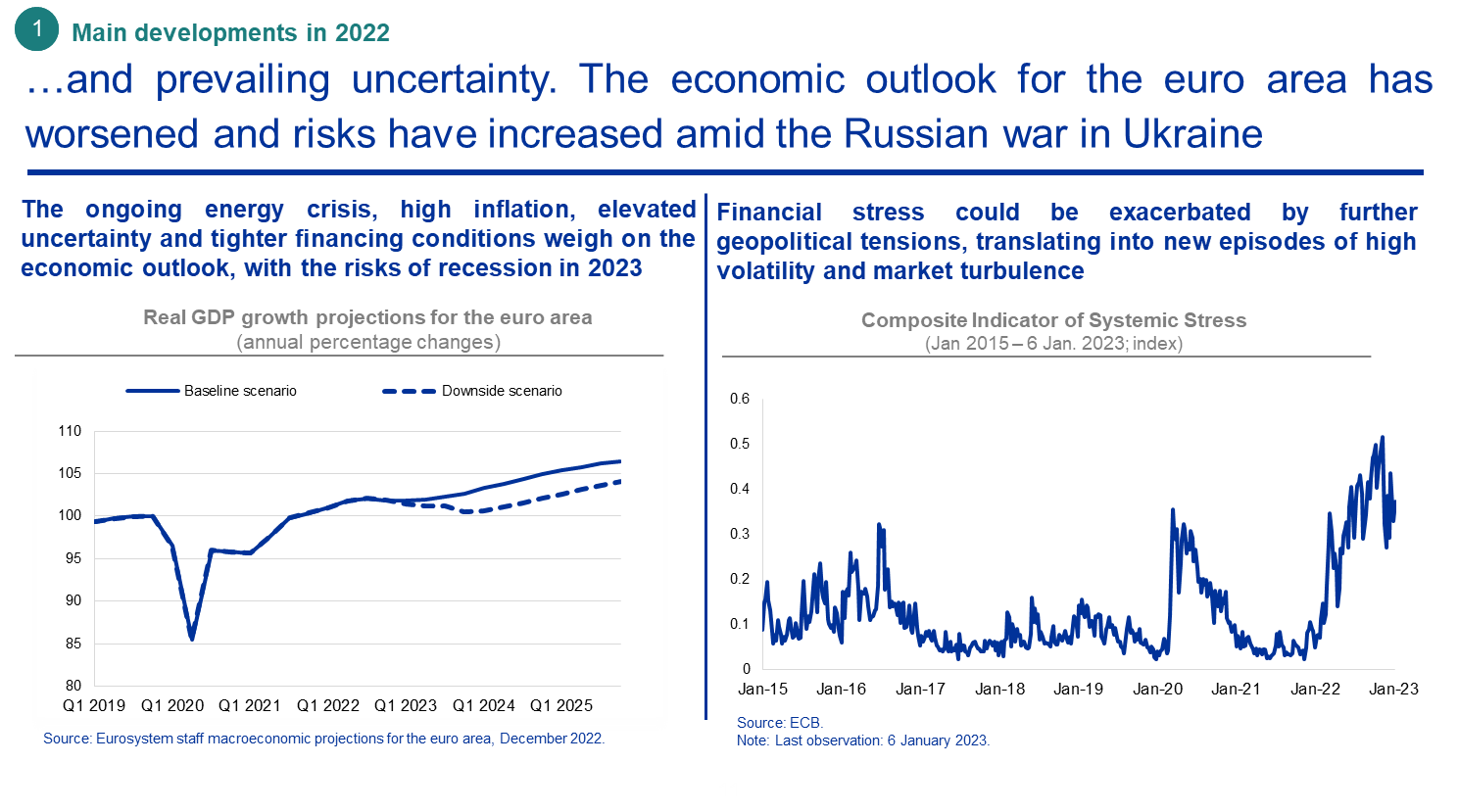

In a year marked by the macro-financial and geopolitical fallout from the Russian war in Ukraine, with persistently high levels of inflation and rapidly normalising monetary policy conditions, significant banks saw their profitability boosted by interest rate margins not seen for more than a decade. The capital and liquidity position of these banks remained very solid, while asset quality kept improving.

The overall SREP assessment is broadly similar to last year’s. While taking into account the positive performance of the banking sector in 2022, the supervisory stance reflects persistent concerns about banks’ governance and internal risk controls. Deficiencies in these areas become even more concerning in light of the pronounced uncertainty over the energy crisis and the macroeconomic outlook as well as the pressure that interest rate normalisation may put on specific bank portfolios, business lines and financial markets.

The prudential requirements and qualitative measures that we have established in the SREP are geared towards making sure banks are sufficiently resilient and can better manage these risks. This is central to our overall objective of contributing to the safety and soundness of the banking system and the stability of the financial system within the banking union.

In my remarks I will first look at the positive performance of the banking sector in 2022. I will then explain the factors that weigh negatively on our overall assessment. Finally, I will go into more detail about specific areas of supervisory attention that we are asking banks to focus on.

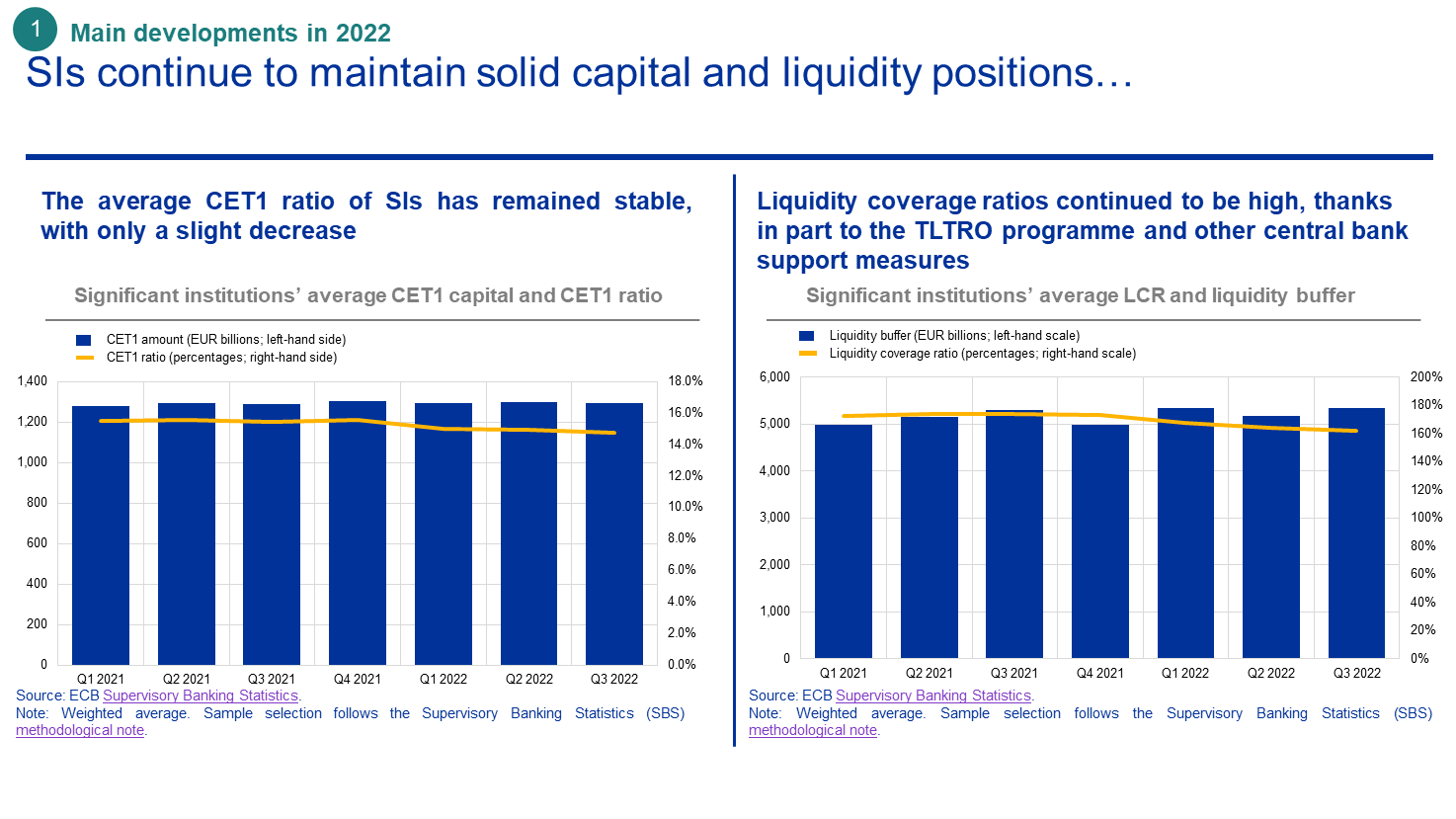

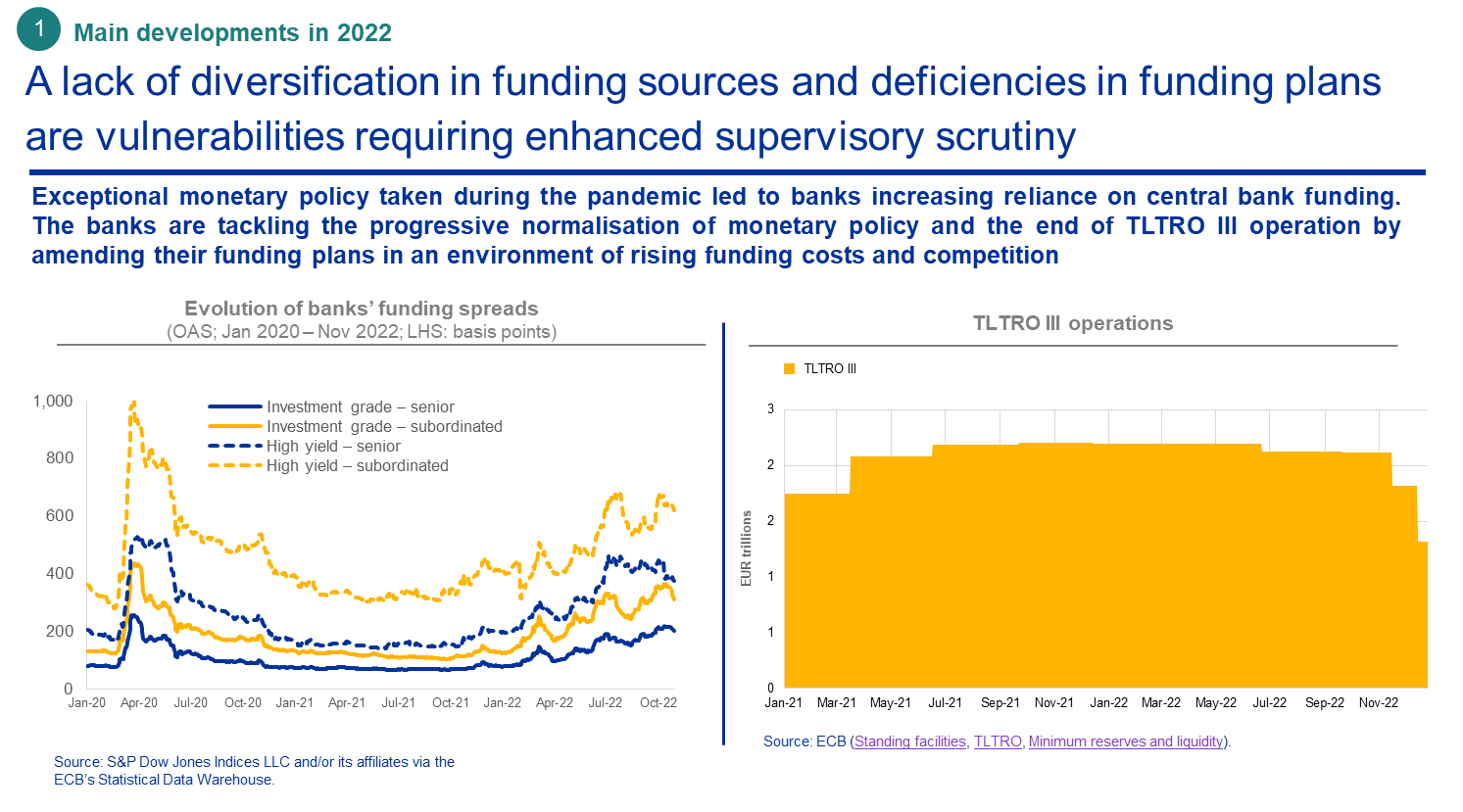

Let me start by giving you an overview of where the banks stand in terms of their prudential situation. Overall, significant banks continue to maintain solid capital and liquidity positions. Their average Common Equity Tier 1 (CET1) ratio remained slightly below 15%, only marginally lower than the year before. Liquidity coverage ratios continued to be high, at 162% on average, thanks in part to the targeted longer-term refinancing operations (TLTROs) and other central bank support measures.

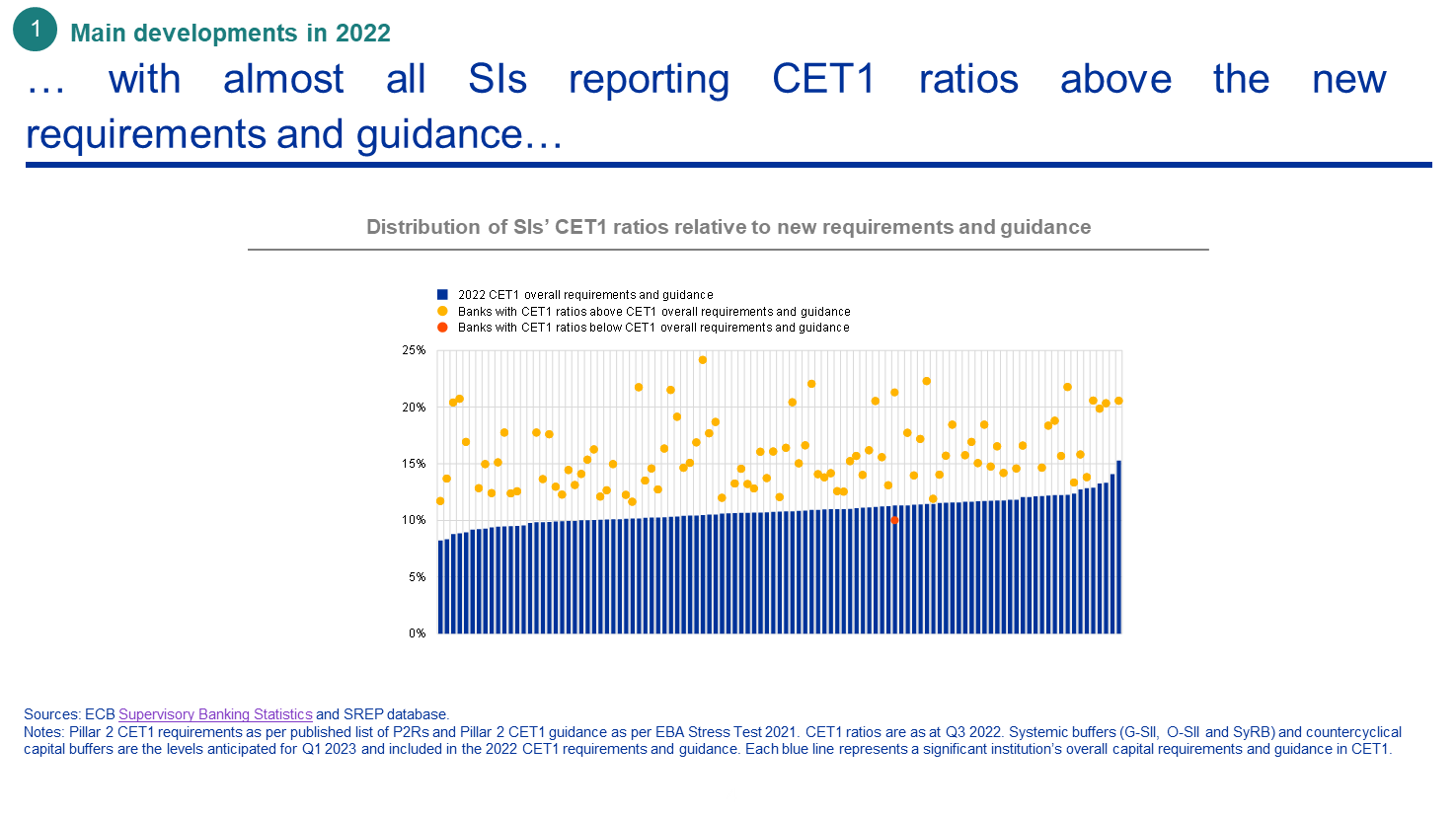

Almost all significant banks reported CET1 ratios above new requirements and guidance. In 2021, six banks dipped into the Pillar 2 guidance, using the flexibility granted during the Covid period. As at end-September 2022, only one bank was still slightly below the Pillar 2 guidance.

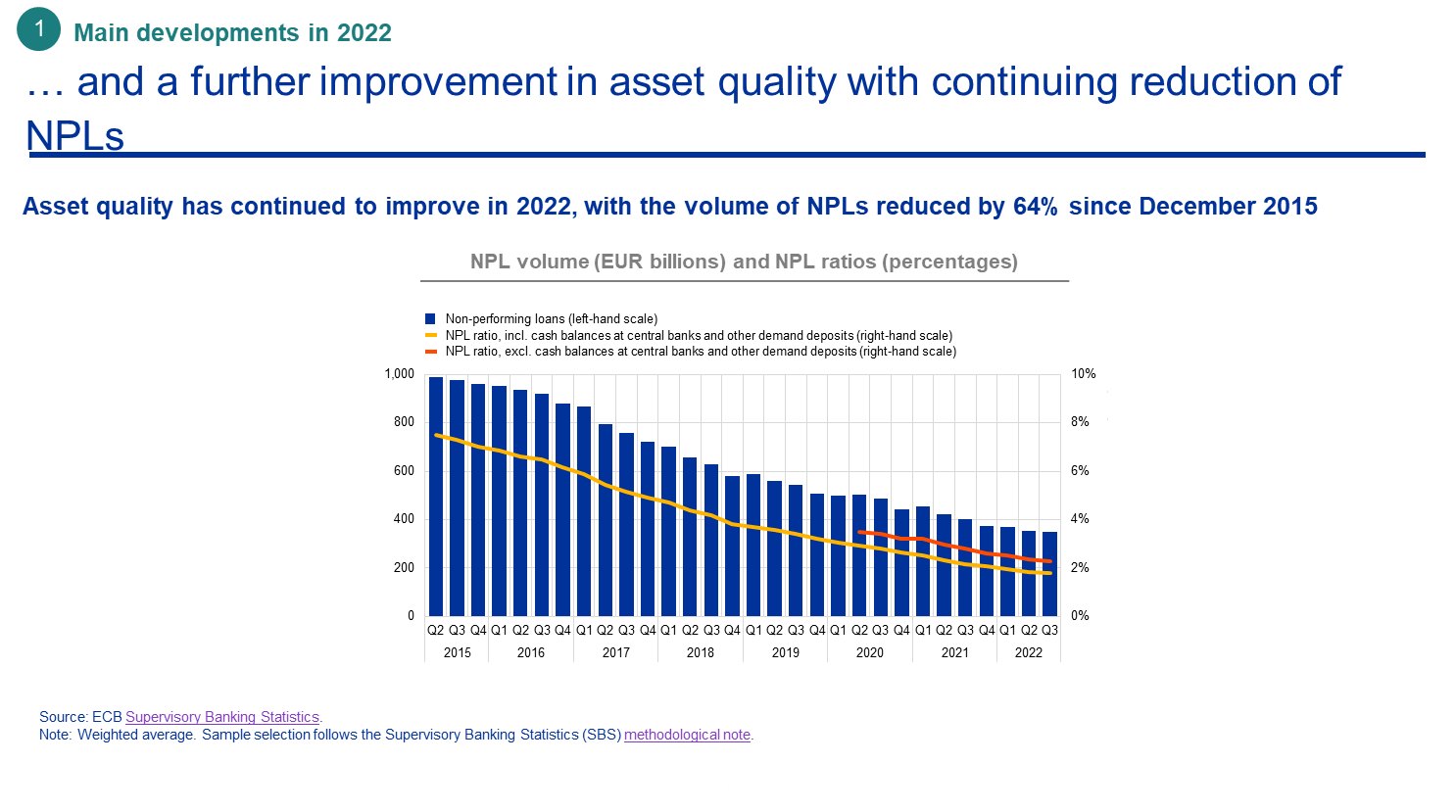

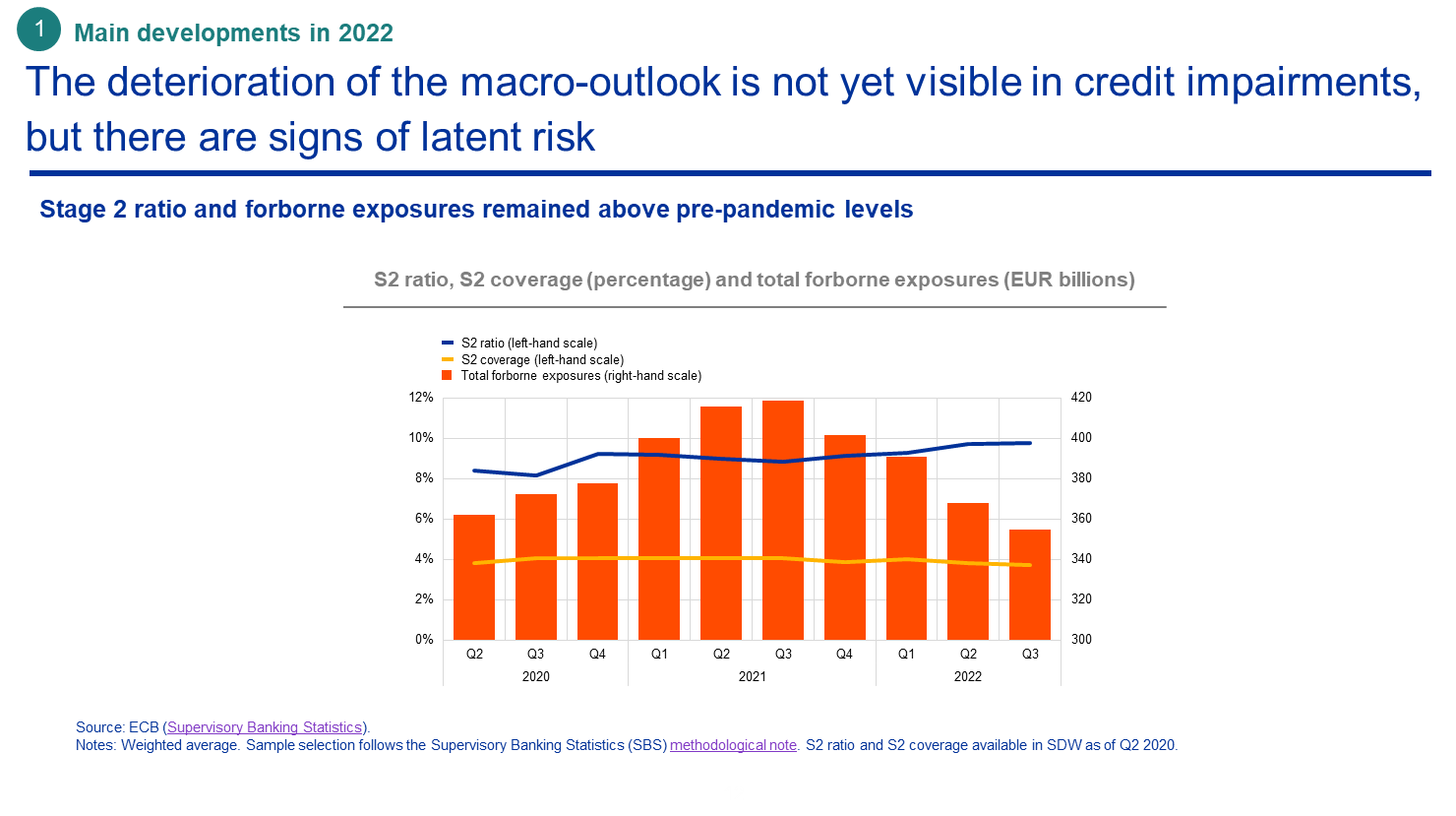

Asset quality kept improving in 2022. The volume of non-performing exposures (NPEs) held by significant banks dropped to €349 billion by the end of September 2022, the lowest level since supervisory data on significant banks were first published in 2015. This was mainly driven by asset disposals and the securitisation of loan portfolios in a few countries. The average NPE ratio continued its downward trend, reaching a new low of 1.8% in the third quarter of 2022, driven by this decrease in the NPE stock as well as continued credit growth.

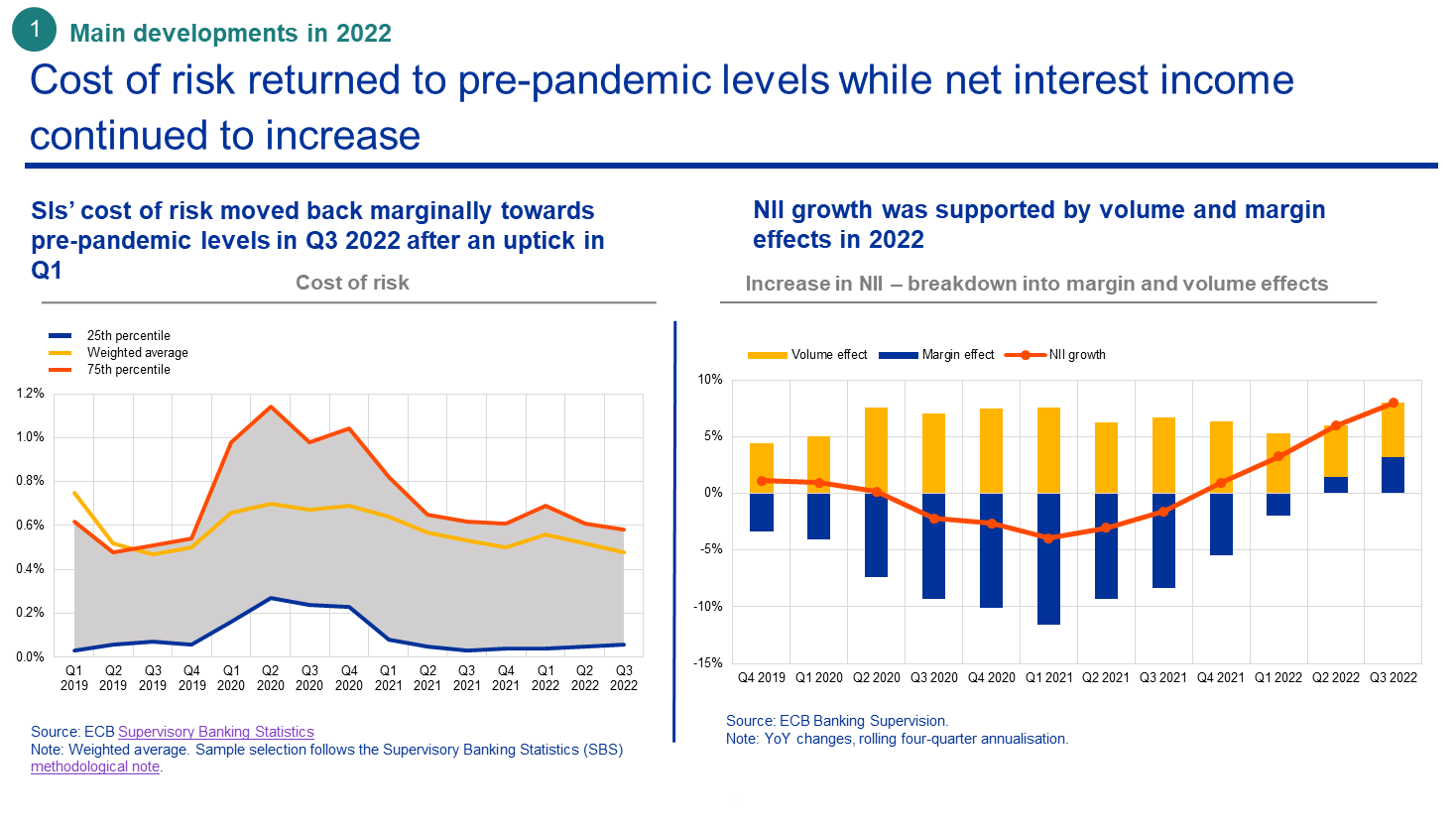

Banks’ cost of risk, which had steadily fallen in 2021 as the economy recovered from the pandemic, recorded only a short-lived uptick in the first quarter of 2022 as some banks significantly increased their provisioning on exposures that could be affected by the Russian war in Ukraine, before falling to pre-pandemic levels.

This suggests that, so far, no tangible credit risk has materialised as a result of the war-induced macroeconomic shock, although there are some signs of latent risk. Despite the shock, banks’ expectations on asset quality remain positive.

At the core of banks’ positive performance in 2022 lies the interest rate normalisation process and the boost that this long-awaited shift provided to net interest income. In 2022, for the first time in several years, net interest income increased not only due to expanding lending volumes but also due to expanding net interest margins, as the increase in interest rates that banks can charge for new loans exceeded the rise in their funding costs.

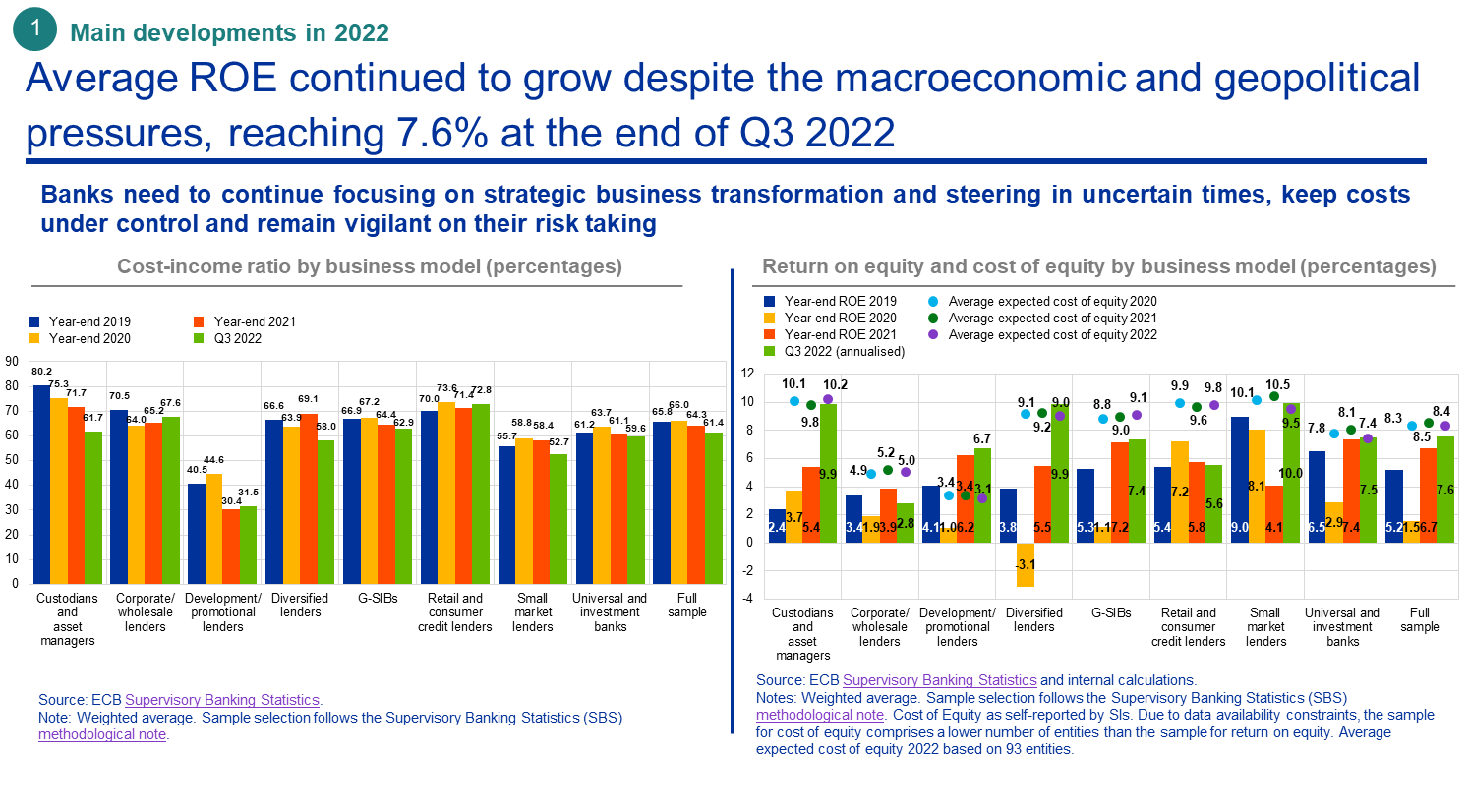

Along with the contained cost of risk and growing net interest income, 2022 also saw a slight improvement in banks’ cost efficiency, with the average cost-to-income ratio falling to just over 61%. Overall, these are the main driving factors that pushed banks’ average return on equity to 7.6% in the third quarter of 2022, the highest profitability level since the start of European banking supervision.

Banks and analysts alike expect the profitability outlook to remain equally positive this year. According to our evidence, if the macroeconomy develops as currently expected, further orderly increases in interest rates will indeed likely support the sector’s average earnings.

However, adverse scenarios and differentiated implications across banks require close attention. For specific portfolios and business lines, the costs associated with a deterioration in asset quality may outweigh the income benefits as interest rates keep increasing. Asset and liability management strategies excessively focused on carry trade may prove incompatible with the new monetary policy environment. Overall, the interest rates adjustment path may create winners and losers. I will come back to this when discussing the macroeconomic and credit risk outlook.

Before I do, let me turn to the overall SREP scores for 2022. A higher score reflects higher risks to the viability of the bank stemming from one or more features of its risk profile.

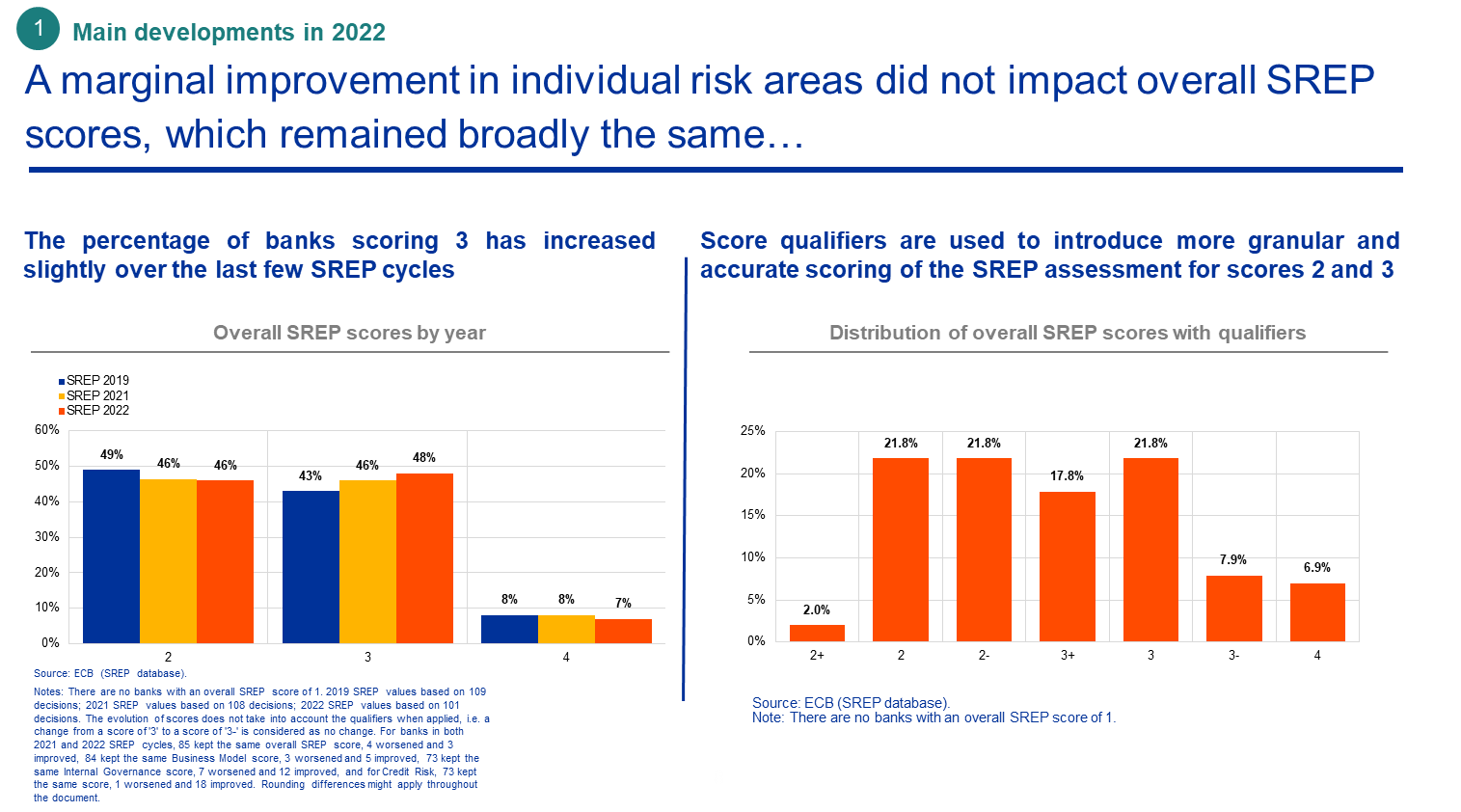

In 2022, more than 90% of the significant banks received the same overall SREP score as in 2021. A slight improvement in the average outcome is driven by a minor increase in the percentage of banks receiving a score of 3, and, accordingly, a decrease in the percentage of banks receiving a score of 4. One change that we introduced to the disclosure of the scoring in 2022 is the addition of “score qualifiers”, which are only applicable to scores 2 and 3. This means banks can now receive a score of 2 plus, 2, and 2 minus, and similarly 3 plus, 3, and 3 minus. The qualifiers provide a more granular and differentiated supervisory assessment, allowing for a more precise reflection of the year-to-year evolution. This should become more apparent in the next cycle, when banks will be able to compare their qualified scores with those they have received now for the first time.

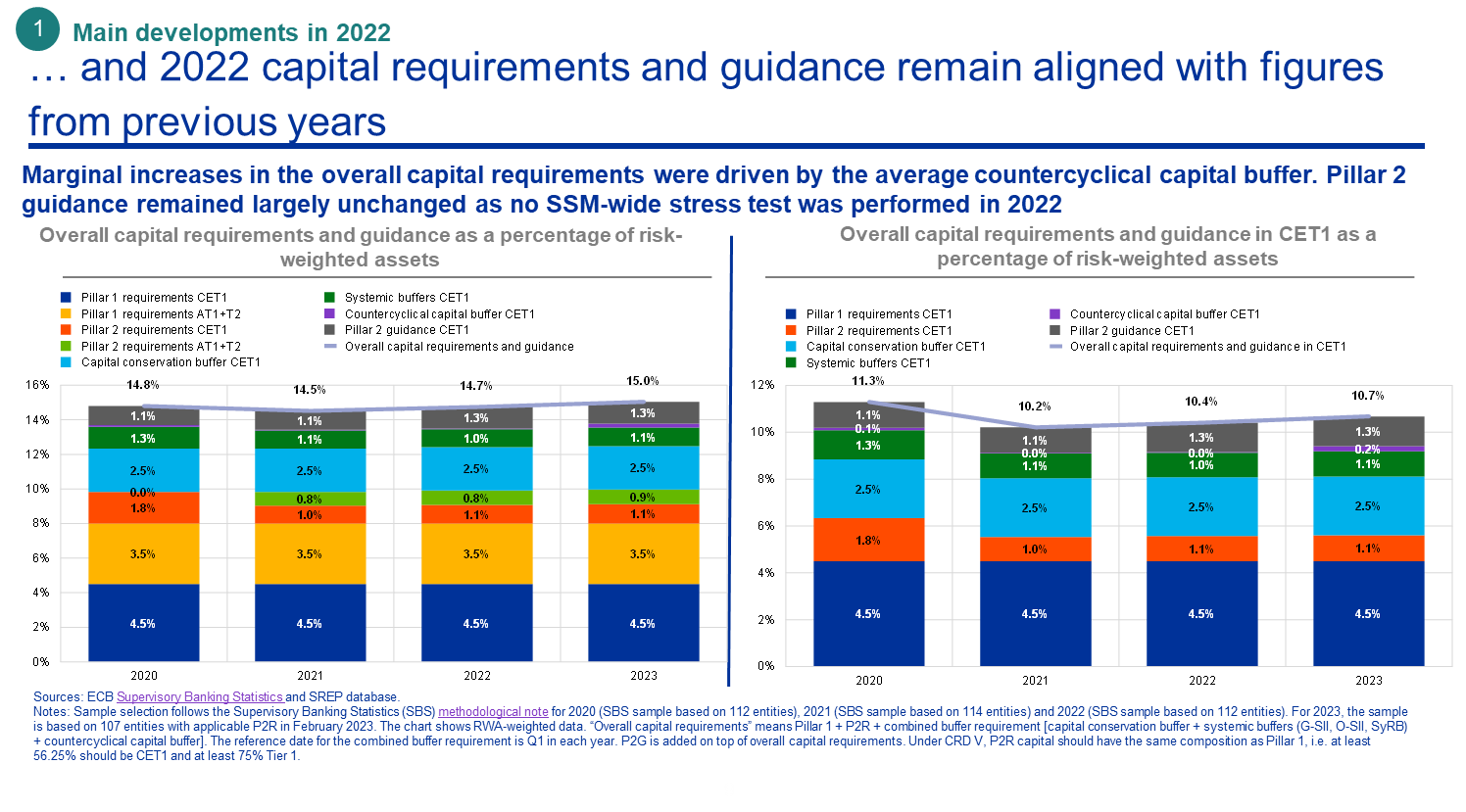

Reflecting these SREP scores, the weighted average of overall capital requirements and guidance remained largely stable compared with past years, with a slight increase in the requirements applicable in 2023, driven mainly by an increase in macroprudential requirements in some participating Member States. The average overall capital requirement (in total capital) will stand at 15.0% of risk-weighted assets – an increase of 29 basis points compared with the previous year.

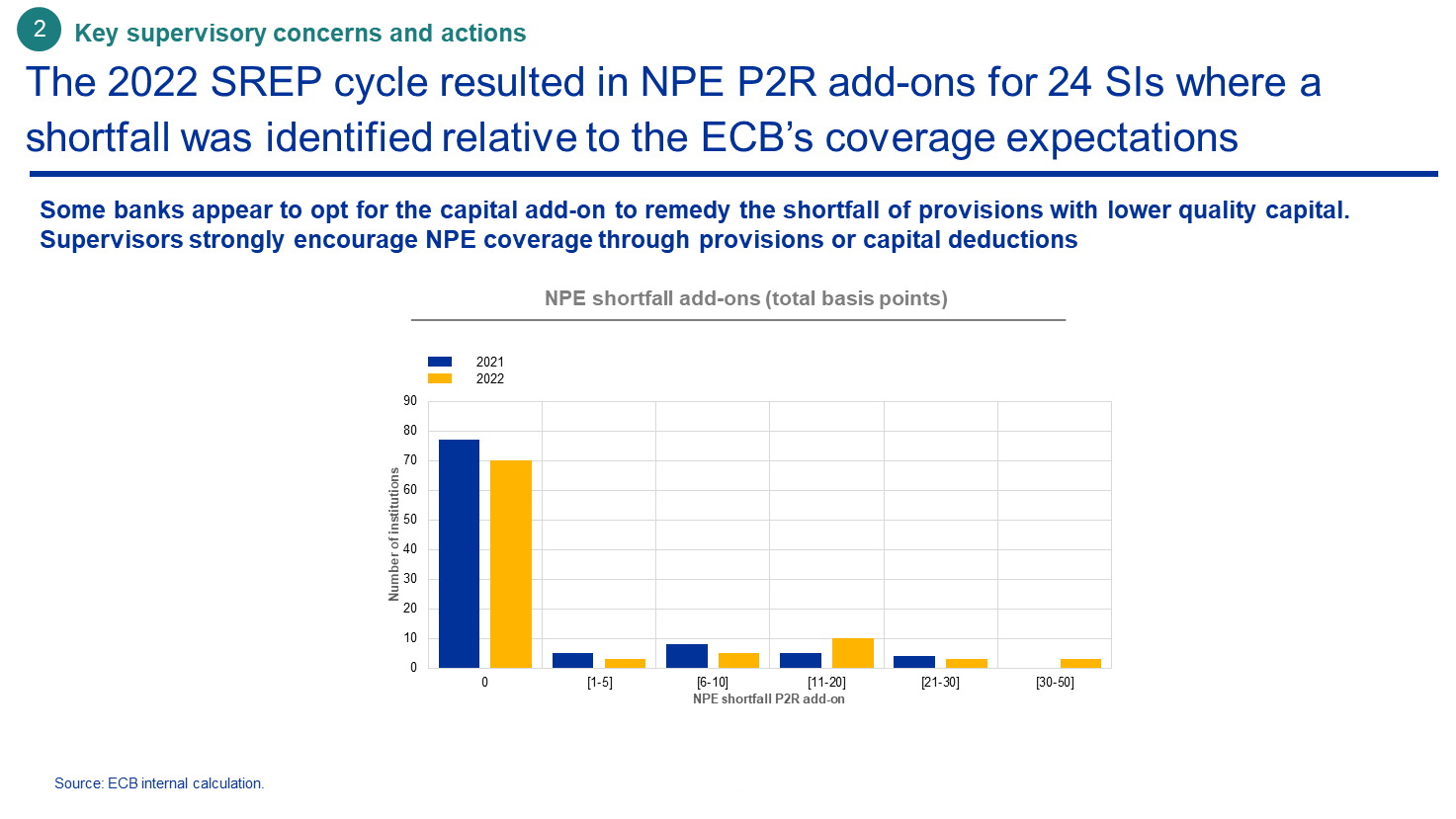

Average Pillar 2 requirements remained in line with previous years, at 2% of risk-weighted assets (1.9% in the previous SREP cycle), additionally incorporating a Pillar 2 requirement add-on for those banks that report insufficient coverage of NPEs relative to our expectations, and a Pillar 2 requirement add-on for leveraged finance, introduced during the 2022 SREP cycle.

Given that no capital stress test was performed on directly supervised banks in 2022, Pillar 2 guidance remained largely unchanged compared with 2021, at 1.3%.

Considering all these developments together, bank profitability has seen a marked improvement, NPEs are at record lows and the banks have solid capital and liquidity positions. Why, then, did the SREP scores hardly change compared with the previous year?

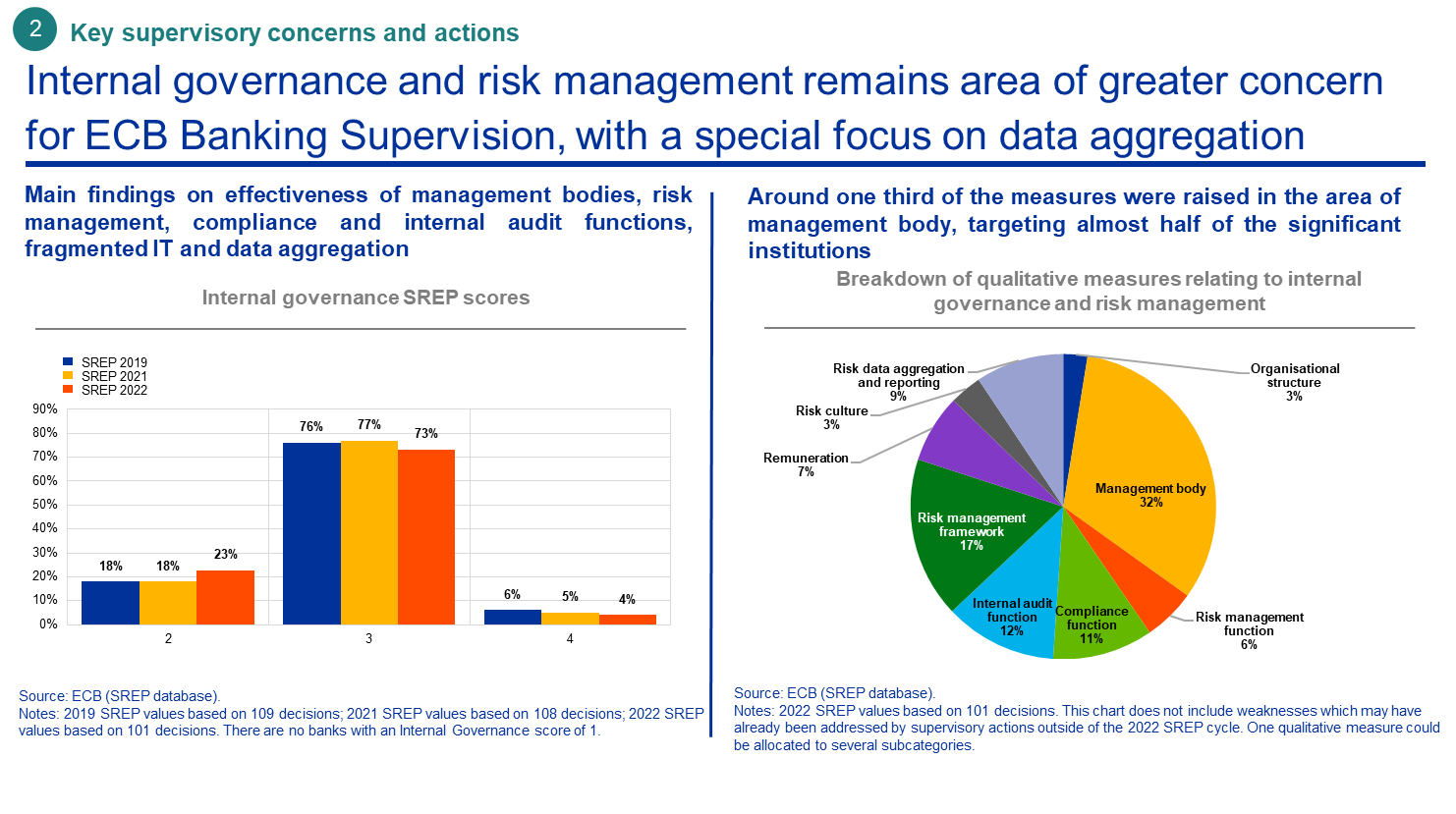

A key factor putting downward pressure on supervisory stance is the persistent weakness of internal controls. Risk control deficiencies are still affecting credit risk scores, and we had a number of findings on the effectiveness of management bodies, risk management, compliance and internal audit functions. Many banks have fragmented IT landscapes and deficient risk data aggregation capabilities, which makes it difficult for their management bodies to have the information they need to be able to manage risks and steer the strategy of their organisation.

Our concerns about banks’ risk controls and governance are exacerbated by the highly uncertain external environment, as backward-looking indicators of risk levels might provide an inaccurate picture of the sector’s resilience.

The euro area economic outlook deteriorated during 2022. Banks now face a period of lower growth and possible recession, with persistently high inflation and significant uncertainty over energy supplies. While rising interest rates are boosting banks’ profitability right now, they may also affect the ability of customers across a number of portfolios and business lines to pay back their debts, thus posing a threat to banks’ asset quality. Consumer lending, real estate lending and leveraged finance are notable examples of areas of supervisory focus.

Furthermore, as highlighted by the failure of Archegos in 2021, and more recently the stress episodes observed in energy derivatives clearing and the UK market for liability-driven investments, the risk of financial market segments turning disorderly has increased. This can have a negative impact on the concentrated exposures some banks have to certain corporates and highly leveraged non-bank financial institutions.

Banks need to prepare for the potential adverse impacts of the uncertain environment on their business, which may materialise as a result of interest rates rising higher and faster than currently expected and/or economic activity experiencing a sharper downturn.

Some signs of latent risk are there, highlighting the need for a prudent approach to risk management and provisioning. Although headline NPE figures continued to improve, bad loans have already started to increase in specific portfolios, such as consumer finance. The dynamic of underperforming (Stage 2) loans, whose average ratio slightly increased in 2022, will have to be closely monitored.

Importantly, the assessment of the credit risk outlook at this point should not simply assume that the recent past can be a good predictor of future trends, for one main reason: the extraordinary monetary support measures and the massive blanket fiscal assistance to households, small and medium enterprises and corporates, which were responsible for the record-low levels of defaults during the pandemic period, can no longer be expected given the persistent inflationary pressures.

With monetary policy normalising, topics like funding costs and liquidity risk, which for several years have not been high on banks’ agendas, will increasingly shape business decisions. In the last quarter of 2022, the ECB not only raised interest rates, but also changed the terms and conditions of the third series of TLTROs and offered banks additional voluntary early repayment dates. Against the background of rising interest rates and the accelerating digital transformation, stronger competition in the market for deposits may further exacerbate funding challenges.

If risk management and strategic steering do not adapt swiftly, a more challenging funding environment may call into question overly simplistic and clearly obsolete asset and liability management strategies. Net interest income results might worsen, adding to valuation losses associated with rising rates. There is a risk that banks following certain business models might be caught off guard.

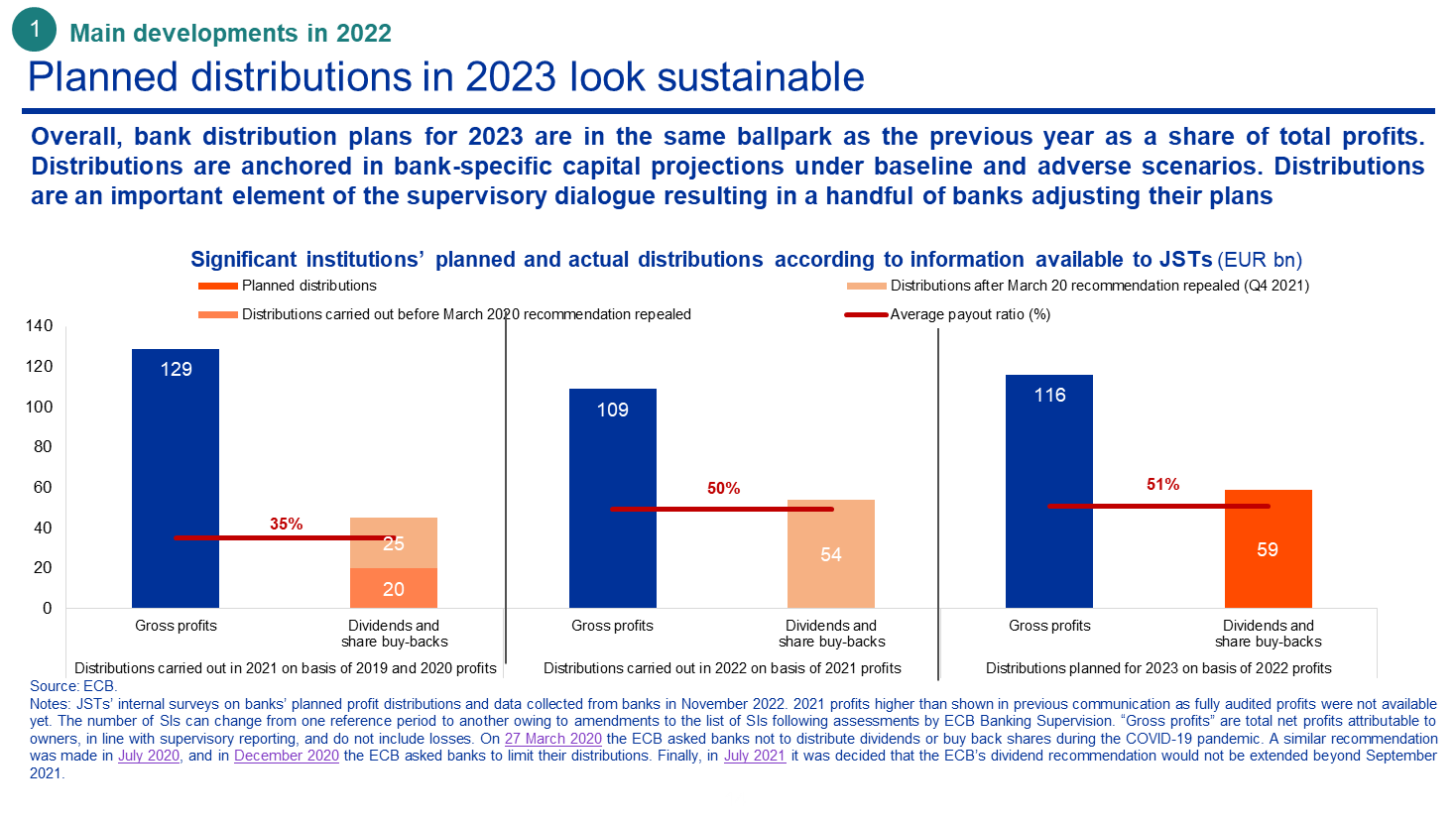

Against the backdrop of positive performance in 2022 that I have just described, significant banks have planned distributions to shareholders broadly in line with the catch-up in distributions they had made in 2022 coming out of the pandemic restrictions. Based on current information, significant banks will this year distribute 51% of their 2022 gross profits. As part of the supervisory dialogue, and taking into account the uncertain macro-financial outlook and bank-specific circumstances, supervisors have scrutinised banks’ forward-looking capital trajectories, finding that virtually all of them are compatible with the planned distributions. In a limited number of cases, banks have reduced distribution amounts following the supervisory dialogue. Some banks planning sizeable distributions have wisely chosen to stagger different tranches of their planned share buybacks throughout the year, to remain flexible in response to macroeconomic developments.

Banks take strategic initiatives, but structural challenges remain

I would now like to take a closer look at our main concerns at present and the key supervisory actions we have taken or plan to take to address them.

To facilitate tangible progress where it is most needed, the ECB is determined to make full use of all the supervisory tools and powers available to it under EU and national law. Where qualitative measures have not been effective enough in ensuring banks follow up and remediate identified weaknesses in a timely manner, targeted Pillar 2 capital requirements, enforcement measures or sanctions may be used to ensure that appropriate progress is made. To make its supervision even more effective, where banks’ progress is too slow and their results are persistently unsatisfactory, the ECB will reconsider how it escalates supervisory measures within a clearly defined time frame. The first area which prompted the ECB to take action in response to slow progress is leveraged finance, which I will talk more about in a moment.

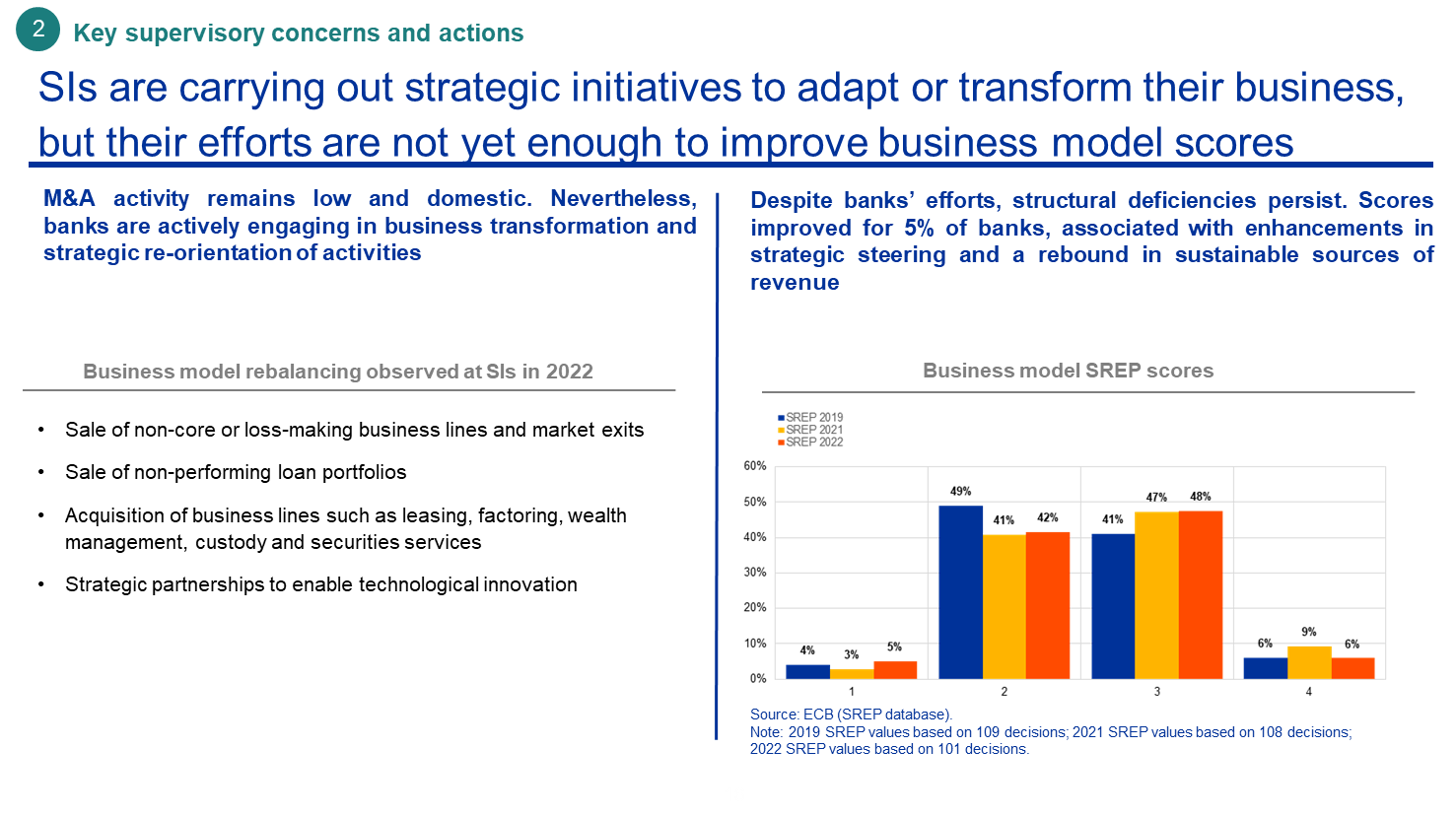

Another key focus area is business model sustainability. Consolidation efforts in the form of bank mergers and acquisitions remained modest in 2022. However, other metrics for the refocusing of business models suggest progress has been made, with several banks having actively entered into transactions involving the acquisition or sale of business lines to exit poorly performing market segments or to boost their presence and strengthen their position in markets considered core to their business model. In a similar vein, many banks are developing and starting to execute sound digital transformation strategies, although most still have a long way to go. We have launched several digitalisation-related initiatives across the banking sector, and the outcome of these initiatives will feed into the supervisory assessment in the next SREP cycle.

On the whole, while significant banks have stepped up their efforts to cut costs and refocus their business model, the results have not yet been tangible enough to meaningfully improve their SREP scores for business model.

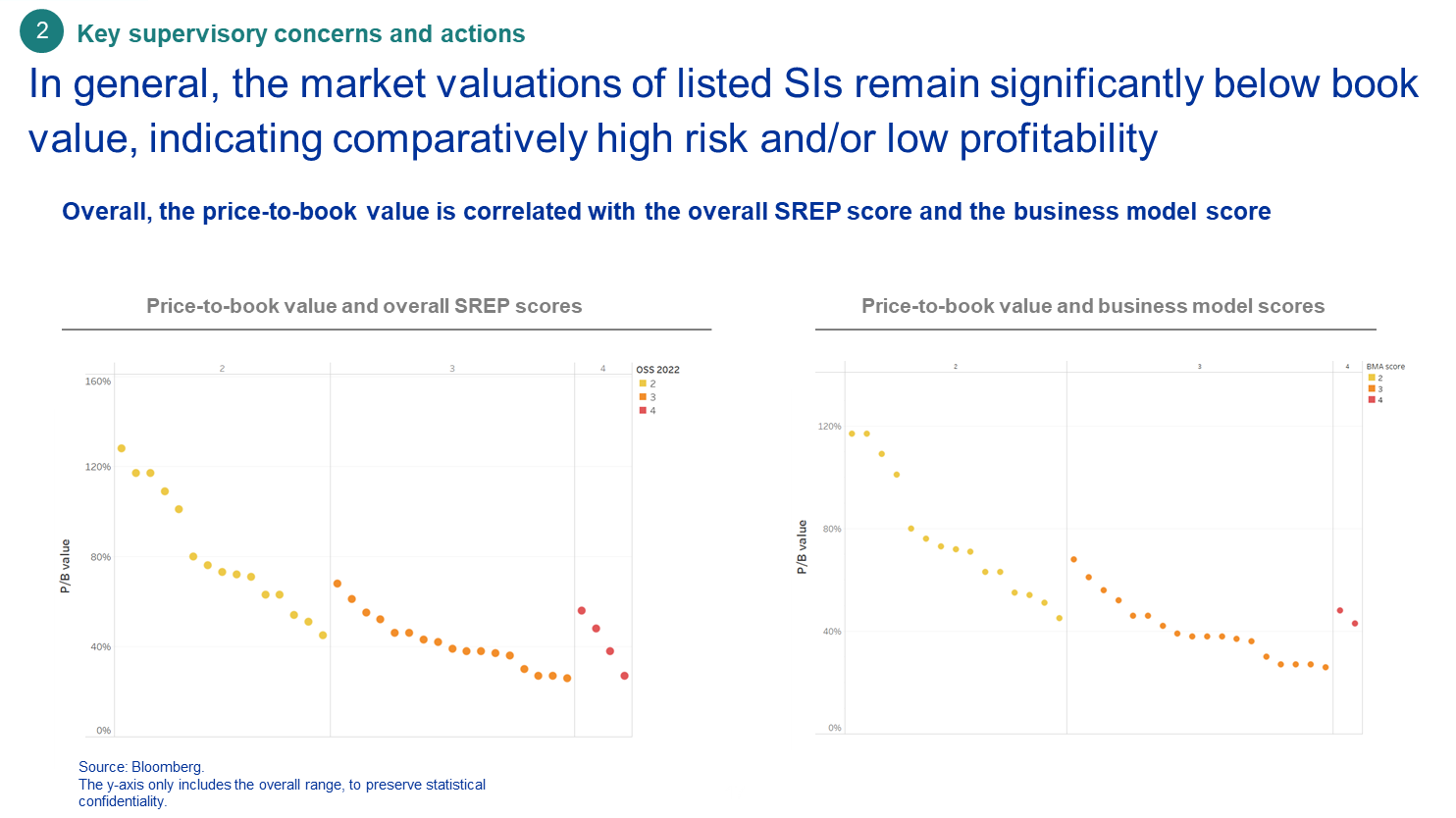

The supervisory assessment, particularly in relation to banks’ business models, is echoed by the market, as shown by the clear correlation between the SREP scores and the price-to-book ratios. The market valuations of most listed banks under our supervision are still well below the book values of these banks, despite the improvement driven by the positive results for 2022 and the optimistic outlook for 2023. To move the needle on SREP scores and market perception, banks will need to act decisively to address their remaining weaknesses. This is now a supervisory priority for us and an area where we will escalate our intervention.

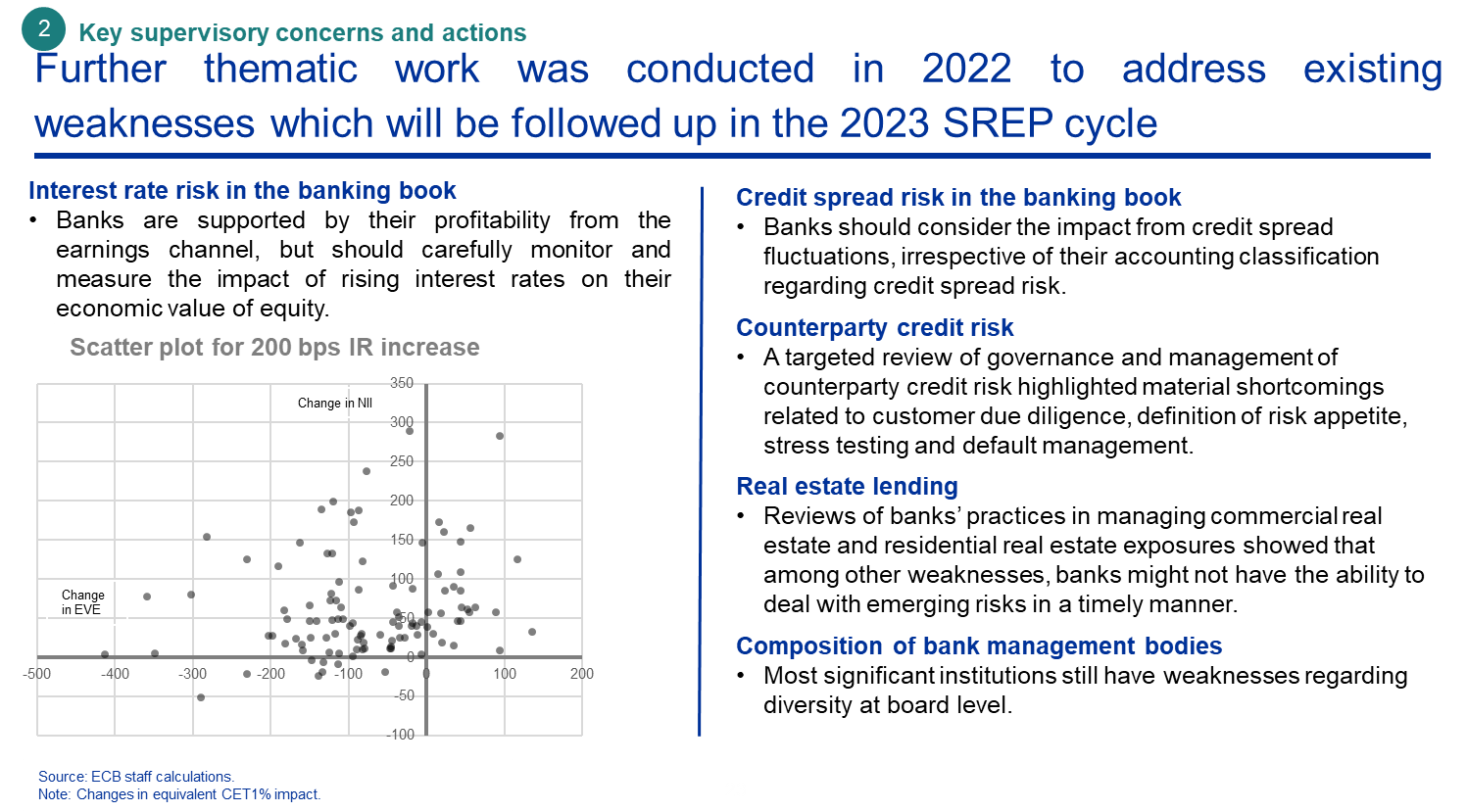

Two areas beset by continued weaknesses are internal governance and risk management which have received increasing attention by joint supervisory teams during the SREP cycle. As in previous years, the SREP produced numerous findings on the effectiveness of banks’ management bodies. Almost half of the supervised banks were subject to at least one measure concerning their management body. The composition of management bodies is often inadequate, especially in terms of the IT experience and independence of board members, and most supervised banks’ management bodies are still insufficiently diverse. The absence of a healthy challenge culture and the presence of weak decision-making procedures further hamper effective governance and strategic steering.

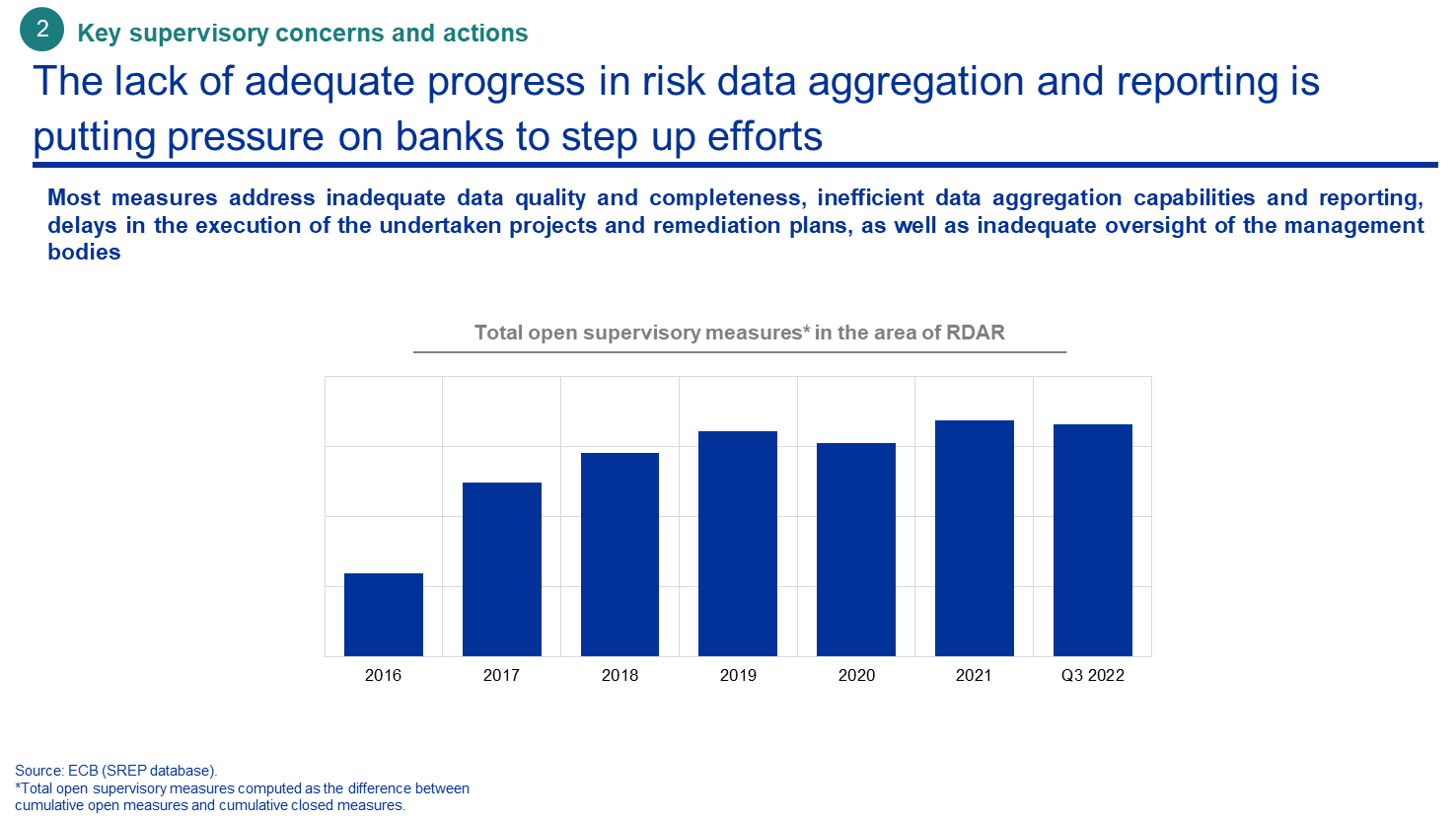

Risk data aggregation and reporting was the worst-rated sub-category of internal governance in the 2022 SREP cycle. In 2016, almost seven years ago, the ECB launched a thematic review on the topic. But despite supervisory efforts, adequate risk data aggregation and reporting capabilities are still the exception, as shown by the increasing number of outstanding supervisory measures in this area. And while the Basel Committee issued the relevant prudential standards already ten years ago, full adherence to these standards is yet to be achieved. The financial crisis was a stark reminder that a bank’s ability to manage risk-related data has a significant impact on its overall risk profile and the sustainability of its business model, especially when facing economic and financial headwinds.

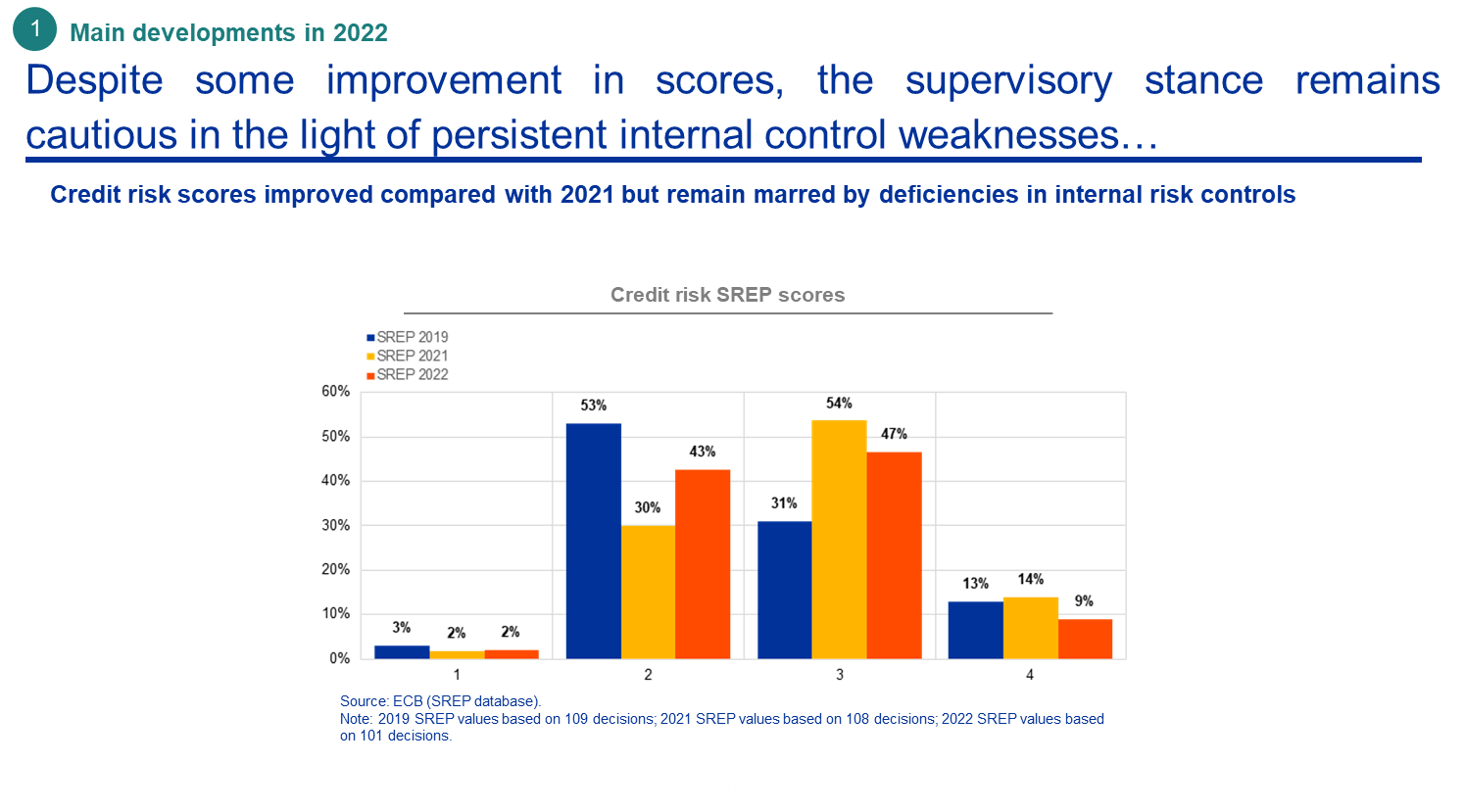

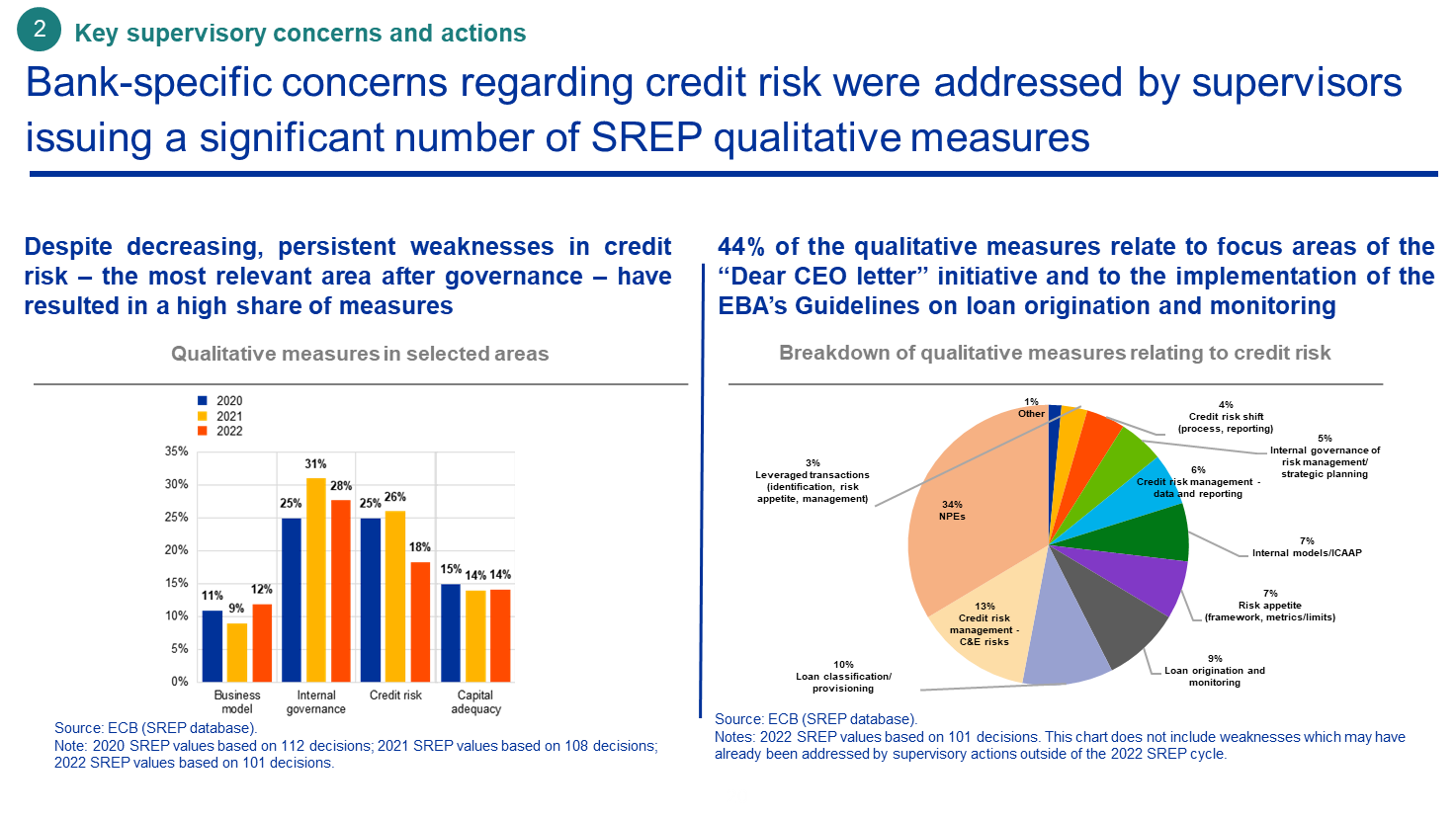

Improvements in asset quality led to a slight uptick in the average SREP scores for credit risk. However, the scores remained unchanged for more than half of supervised banks, owing to the uncertain macroeconomic outlook and signs of latent credit risk. Pockets of risk – such as exposure to leveraged finance, the uncertain macroeconomic and geopolitical outlook and persisting deficiencies in credit risk management frameworks and practices – further limited any improvements to the scores. These persistent weaknesses resulted in credit risk accounting for the second-highest share of supervisory measures after internal governance, despite the share of banks issued with qualitative measures on credit risk falling from 26% in 2021 to 18% in 2022.

The continued fall in NPEs comes on the back of the ECB’s supervisory expectations on NPE provisioning, which became applicable in 2021. To cater for any shortfalls in provisions relative to those expectations, we introduced a targeted add-on to the Pillar 2 requirements in the 2021 SREP cycle. In 2022 this add-on was applied to 24 banks. Some banks reversed the capital deductions that they had previously applied to cover the credit risk arising from NPEs, thus increasing their NPE coverage shortfall and accepting that a Pillar 2 requirement add-on measure would be imposed. As supervisors, we strongly encourage all banks to cover NPEs in accordance with the available prudential toolkit, which for loans originated after April 2019 entails legally binding requirements. We expect that the need to apply a Pillar 2 requirement add-on will only arise in a limited number of cases where, for well-justified specific and temporary circumstances, sufficient coverage cannot be achieved.

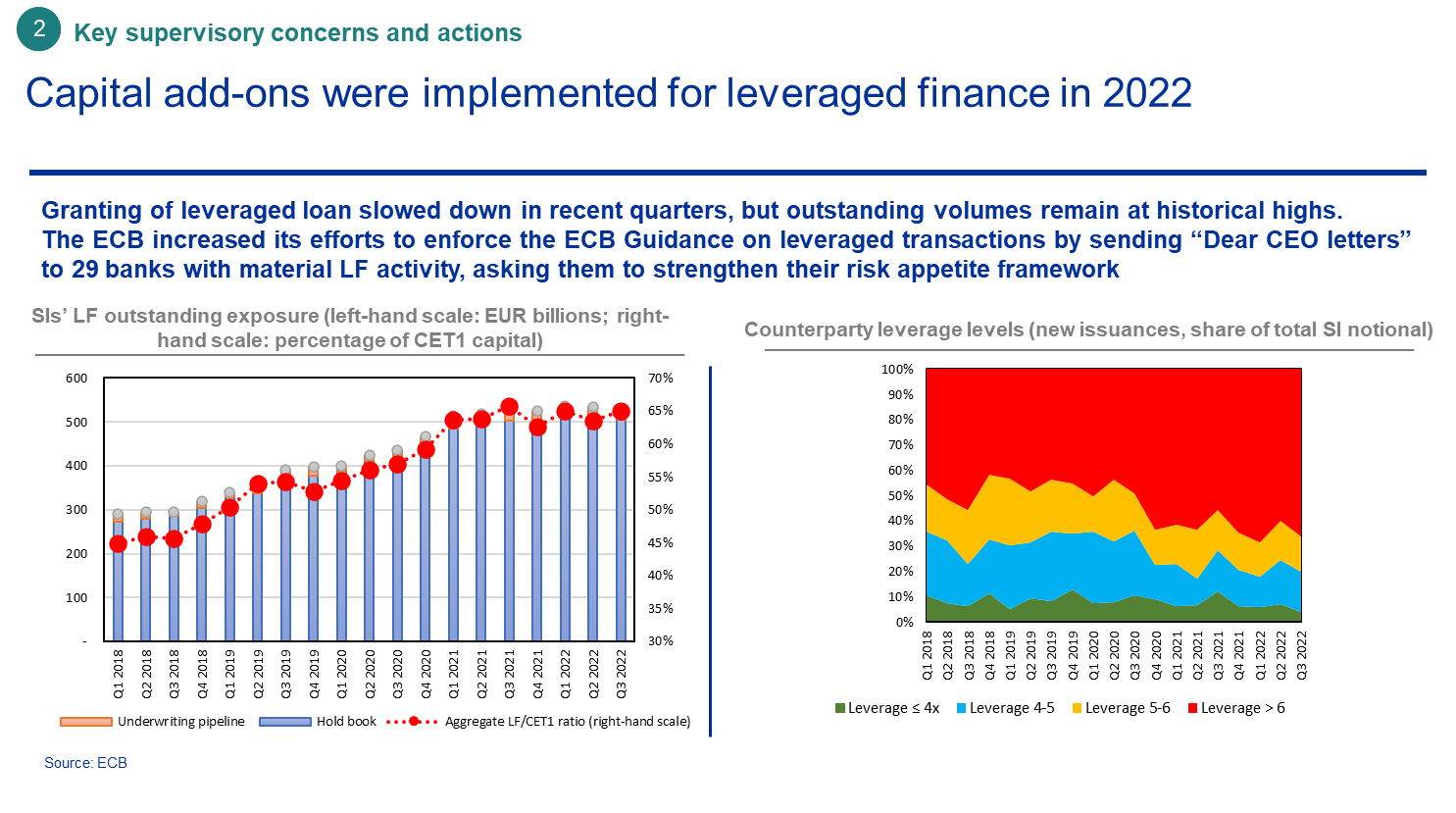

In 2022 leveraged finance was an area where the ECB decided to escalate its supervisory intervention to address concerning signs of risk build-up as well as a protracted attitude of complacency on the part of banks.

After the financial crisis, supervised banks steadily increased their volume of leveraged loans, a trend that has continued in recent years. Back in 2017, we outlined sound principles for dealing with leveraged transactions in a dedicated guidance. Nevertheless, supervised banks’ response to our guidance has fallen short, and underwriting standards have deteriorated further. Therefore, last year we provided banks with detailed expectations regarding the set-up of their internal risk appetite frameworks for leveraged transactions. For the few banks that are highly exposed to the risks of leveraged transactions or have specific deficiencies in their risk controls for this line of business, in the 2022 cycle we introduced a targeted capital add-on in their Pillar 2 requirements.

Our thematic work carried out during 2022 covered risks and vulnerabilities linked to the pandemic crisis and the normalisation of interest rates, which was further accelerated by the geopolitical shock of the Russian aggression against Ukraine.

Targeted reviews and on-site inspections of risk management practices for commercial real estate lending identified cases of deficient risk management alongside examples of good practices throughout the lending cycle, from the definition of risk appetite frameworks to loan origination, risk monitoring and classification, and loan servicing. We also found that banks were not adequately assessing climate risks in their loan portfolios, as they failed to collect sufficient data on the energy performance of the underlying collateral.

Owing to the accelerated normalisation of interest rates, we also launched a targeted review of risk management practices for residential real estate lending, focusing on identifying credit risk deficiencies in underwriting practices and the resilience of banks’ residential real estate portfolios in the current macroeconomic environment.

For interest rate and credit spread risks in the banking book, we found that banks tend to neglect the impact that changes in rates and spreads have on their economic value of equity, which is an important measure of their long-term viability and profit generation capacity. Some banks imprudently reduce their use of fair value accounting in times of financial market turmoil. And in their asset and liability management frameworks, some banks make overly optimistic assumptions when modelling behavioural components and do not design sufficiently severe stress test scenarios.

The increase in interest rates could also raise concerns for exposures generated via capital market services provided to less transparent counterparties, including non-bank financial institutions, which have engaged in aggressive search-for-yield strategies. The findings of our targeted review on counterparty credit risk focused on weak practices for customer onboarding, monitoring and assessment under stressed or default conditions as well as poor risk appetite frameworks and stress testing procedures.

Lastly, we continued to work on the composition and effectiveness of banks’ management boards, carrying out targeted reviews that involved supervisors occasionally attending the board meetings of the sample banks in order to better gauge the effectiveness of board dynamics.

Current environment reinforces need for action on digitalisation and climate change

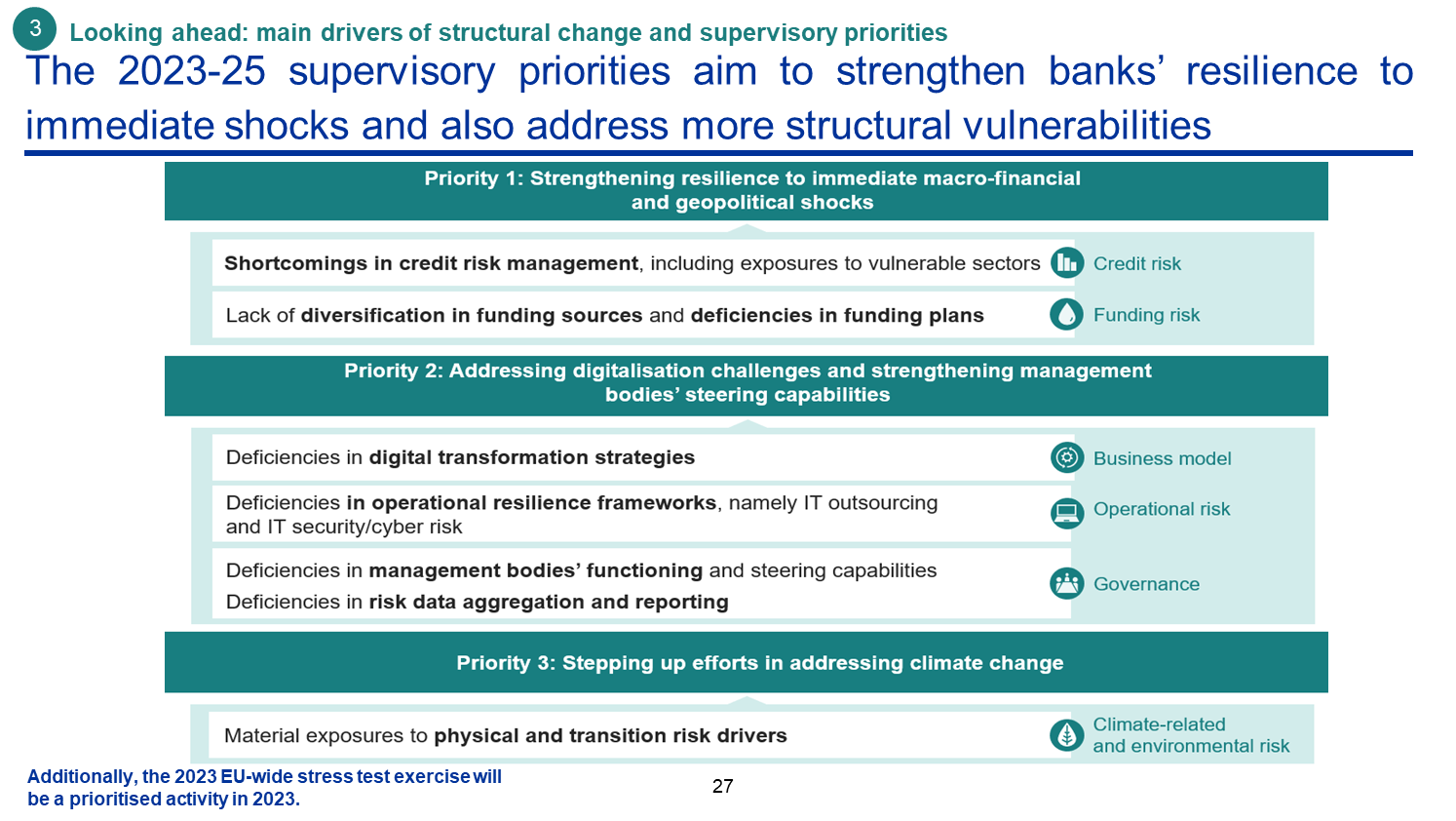

As part of the 2021 supervisory assessment cycle, we had indicated that to safeguard the viability of their business models and to stay abreast of current and future risks, banks would need to urgently tackle two main structural challenges: digitalisation and climate change. Russia’s war against Ukraine has only heightened the pressing need to address these two issues in a strategic and comprehensive manner.

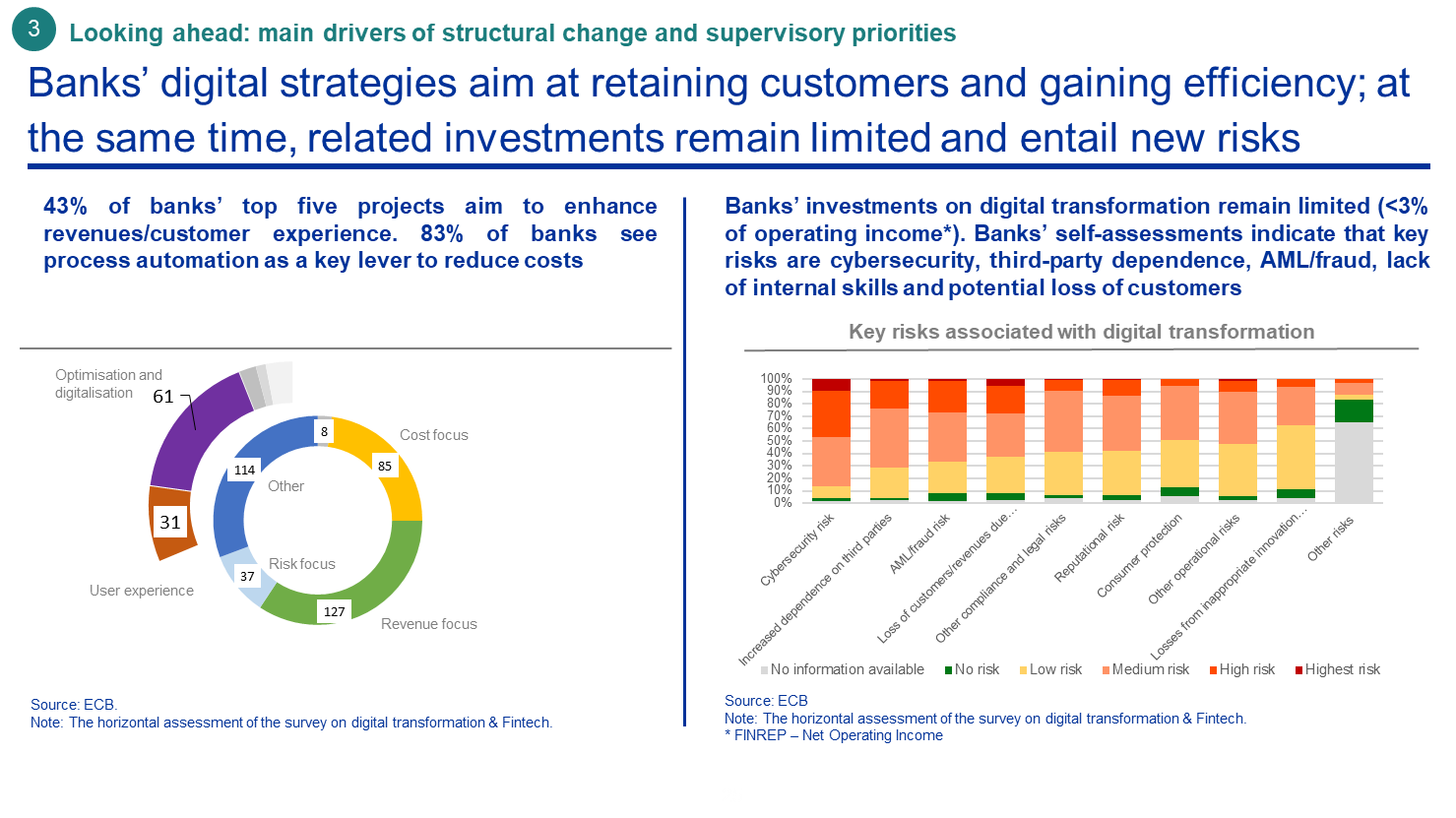

The risk of cyberattacks has increased further in the current environment, having already grown during the pandemic. Now more than ever, banks need to tackle structural deficiencies in their outsourcing arrangements and in their IT security and cyber resilience frameworks. The digitalisation of banking and financial services also exacerbates other risks such as fraud, money-laundering, a lack of internal IT skills and the potential loss of customers owing to changes in consumer preferences and the increasing competition from fintech companies.

Most of banks’ digital projects are aimed at attracting and retaining customers and improving cost efficiency. However, the size of banks’ investments remains limited. In 2021 supervised banks’ investments in their digital transformation averaged just 2.8% of net operating income.

To monitor the healthy adoption of digital transformation as a means to support robust business models, ECB Banking Supervision has launched several digitalisation-related initiatives across the banking sector. The outcome of these initiatives will feed into the supervisory assessment in the next SREP cycle.

As Europe diversifies away from Russian oil and gas, transition risks are increasing. These and growing physical risks demand a proactive and comprehensive response from banks. They need to identify, assess and manage their climate-related and environmental (C&E) risks and transparently and truthfully disclose their exposures to these risks.

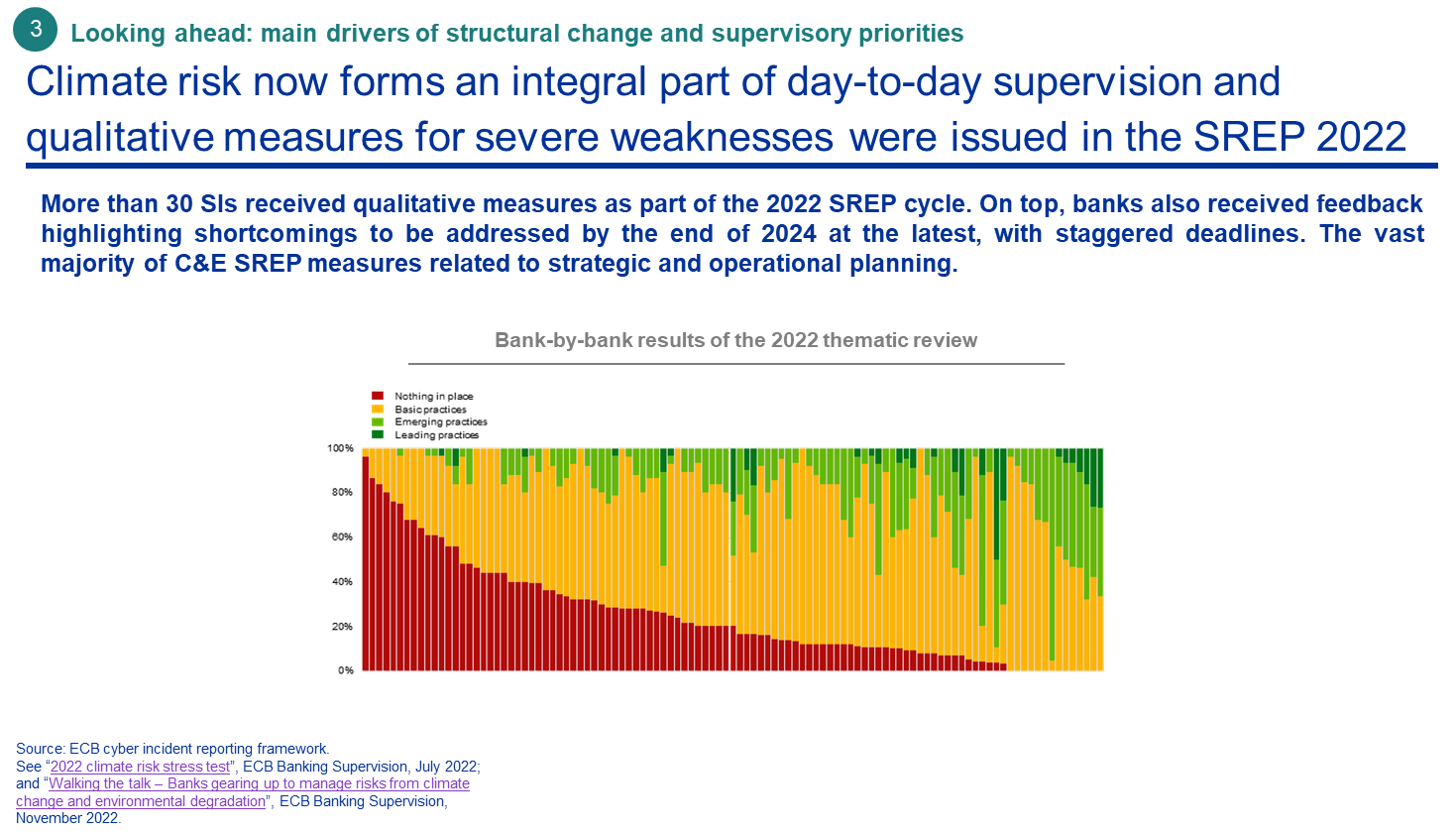

As in previous years, in 2022 we dedicated significant supervisory efforts to this end in the form of the thematic review on climate-related and environmental risk and the climate stress test. More than 30 significant banks have received over 40 qualitative measures on C&E risks as part of the SREP. For a small number of banks, the qualitative integration of C&E risks affected the SREP scores without, in this specific cycle, translating into overall higher capital requirements. The SREP measures for C&E risks were issued mostly in the areas of governance and business models, but some also concerned credit, market and operational risks. The vast majority of the qualitative measures targeted banks’ strategic and operational plans for C&E risks, indicating that supervisors view planning as a crucial tool for better risk management.

In an effort to increase the effectiveness of our supervisory actions, we provided banks with a clear timeline for remedial action, requiring them to submit a materiality assessment of C&E risks by the end of March 2023 and their updated operational plans, together with adequate quantitative monitoring and risk appetite frameworks, by the end of 2023. The deadline for full compliance with our expectations is set at the end of 2024.

Climate change and the digital transformation will certainly continue to be supervisory priorities, as will the functioning of banks’ management bodies. As I mentioned before, to further improve banks’ governance we intend to escalate supervisory action on risk data aggregation and reporting. And to make sure that banks can navigate the macro-financial environment, alongside our work on credit risk we will also increase our focus on liquidity and funding risk.

The risk landscape has been constantly evolving, with new exogenous shocks presenting both banks and supervisors with daunting new challenges. As it reaches a more mature stage, European banking supervision is not only working to ensure banks remain resilient to shocks. It is also striving to make its supervisory interventions more effective and enforceable for long-lasting and unresolved issues affecting the banking sector.

We intend to apply the same rigour to the evaluation of our internal processes as we do to our supervision of banks, with the aim of becoming a more efficient, agile and impactful supervisor. Several initiatives are ongoing. We are asking our supervisors to apply a supervisory risk tolerance framework, which will allow them to increase focus on bank-specific needs, de-prioritising parts of the comprehensive supervisory manual. Prioritisation will apply to the time element too, as the SREP assessment will gradually be turned into a multi-year process. Meanwhile, we will also strive to further improve the clarity of our SREP and other supervisory communications, and continue to increase transparency over our methodologies. These and other aspects of the supervisory process may also benefit from the informal external advice we have sought from a group of high-level international experts. We will provide more information on this transformation process in due course.

Thank you very much for your attention. I now look forward to your questions.

[This transcript was updated on 9 February 2023 at 20:00 CET to correct the answer to the 5thquestion: In the response Amazon Web Services was erroneously identified as the IT service provider at issue. In fact, the IT service provider at issue is another one.]

I have two questions, if I may. The first one is on counterparty credit risk. You've mentioned this a couple of times as being something of a point of attention. Is it something which could be escalated from a point of attention to something which turns into the next leveraged loans story, where you actually have capital add-ons and a bit of a fight on your hands with the industry?

Then the second is, this is your last year as Chair of the Supervisory Board. Last year you had a bit of a big bang in terms of getting the Basel Committee to recognise the euro area as a single jurisdiction. You must've been pretty happy about that. Do you have another big bang planned for this year, maybe the first cross-border liquidity waiver granted or actually requested, or something else along those lines? Maybe you want to take a chance to tell us what your key deliverable this year is.

Enria: On the counterparty credit risk, yes, it has been an area of focus, definitely. We've done quite an in-depth thematic review. We reported and I did a blog post in January reporting on the results. Indeed there are several weaknesses that we identified in the risk management frameworks in terms of the on-boarding processes, the monitoring. Especially I think that when you talk of exposures to non-bank financial institutions, we realised that even the banks that do a proper on-boarding of customers, sometimes they lose track of the actual concentration of portfolios of these counterparts and of the actual leverage these counterparts are taking in their day-to-day business. So, we gave a number of indications to banks on a one-to-one basis and we expect this to be remedied pretty fast.

Again, this is part of the normal SREP process. We are not launching ad-hoc targeted Pillar 2 add-ons but of course if some shortfalls are not remedied within a certain timeframe, then yes, capital add-ons could be part of the intervention from our side. I don't expect major confrontation. I think it's also in the interests of the industry to take all these issues and see how damaging it could be.

On the last year: well, let's say we will do the wrapping up towards the end of the year. I think it's a little bit early. On the point you mentioned specifically, I think that there are a number of areas in which I am very pleased with the progress that we achieved, one in which I honestly ranked pretty high when I started my mandate, and where I am disappointed is indeed the integration that we have achieved in the Banking Union. If I look at what we have done in terms of messages, in terms of communication on mergers or waivers or the possibility to use more the instrument of branches, I think that we put all the instruments on the table. I think it's also up to the industry a little bit to take them up and develop them.

I must say that with the price-to-book where they have been so far, expecting banks to focus on growing the business, and especially growing the business on a cross-border basis, was maybe a little bit too much. But now that the situation gets a bit rosier – let's hope we don't have another shock this year – I think that we could see also something more in terms of cross-border developments. But maybe not during my mandate.

My question is about internal models: how happy are you with banks' internal models? Do they need adjusting?

Enria: Well, we have done as you know a very long process of review of banks' internal models, the so-called TRIM; the Targeted Review of Internal Models. We have had a number of findings and we keep following up. Now, let's say there are regular on-site investigations by our teams on internal models and when we go frequently, we find issues to be adjusted. There isn't really a generalised dissatisfaction. There are issues in individual banks that need to be fixed from time to time, and so I would say more business as usual in the area of internal models. One point on which we raised attention from banks is that the internal model landscape is pretty complex. So, there are – I can't remember how many models we have – but more than 3000 for sure. Some banks have internal models that cover very small portfolios for which there is only a marginal impact.

The amount of attention that needs to be given to these models from the supervisors and from the banks is probably disproportionate. So, we have launched an initiative to simplify the internal model landscape. Now that also we are moving to the implementation of the final Basel package, I think that also the benefits from the use of internal models are going to be more contained with the output floor. So, we expect to see more simplification in the model landscape, but in general let's say business as usual. We do have a bottleneck. Several banks are complaining because following TRIM and following the EBA guidelines, banks need to make a lot of adjustments to their models. So, we are unable to follow up as fast as we would like because of resource bottlenecks, so everybody needs to be patient and we will have to take a little bit longer than we would like to deal with all the issues which require our attention.

One question is more to Mr Elderson: have ESG deficiencies or deficiencies in the processes and risk management of ESG caused any SREP add-on to the banks in the cycle now?

To Mr Enria: the Pillar 2 Guidance of banks is still not published; is there any initiative or plan to change that, to give more transparency?

Elderson: Thank you very much and good morning from my side as well. On ESG a little bit more generally, and then I get to your point: maybe it's good to point out that we have a medium-term strategy that we follow quite closely. Publishing our supervisory expectations at the end of 2020, asking banks to do self-assessments in 2021, asking banks to do action plans done last year, as the Chair has explained, and the bottom-up stress test, the thematic review. Then this year we have set, and the Chair referred to this as well, interim deadlines by the end of March, by the end of this year, leading up to full compliance with all our expectations by the end of 2024. So, I think that is the strategy that we are following. The thematic review and the stress test have led to a number of findings. They have been integrated in the SREP process on a bank-by-bank basis. This can lead to effects in the scores, and then I think as the Chair has said, in this cycle this has not led to banks having higher overall capital requirements – but that could of course be different in the years to come.

Enria: With reference to the Pillar 2 Guidance: there are at the moment no plans to publish it. Of course, there is guidance from ESMA that says that in certain conditions, it could be an obligation for listed banks to publish it, and in some countries actually it is published. I personally would have a preference to publish it, honestly, but I also understand the fact that some supervisors and some banks also fear that if you publish the Guidance, instead of being a buffer available for use, it could be perceived by markets as a hard-wired minimum and therefore lose its role as a usable buffer. So, this is a little bit the terms of the debate. For the moment, no publication is foreseen.

We have however given last year already – two years ago actually – in 2021 a disclosure of how we determine the Guidance in terms of buckets. This should give at least clarity on the drivers and the ballpark figures.

My first question is on loan volumes: do you expect a decline or a slowdown in loan volumes considering also that monetary policy is now restrictive, and like the pandemic phase, we have seen negative signs from the Bank Lending Survey in this sense?

My second question is on the 24 banks that fell short of the ECB´s expectations on NPLs: could you tell us more: were you surprised? Should they increase their coverage by a lot?

Enria: Well, on the loan volumes the information you refer to, the results of the Bank Lending Survey which were published last week, are indeed signalling a quite important reduction in volumes and a tightening of lending standards. There is also a sharp decrease in demand. It has been particularly striking in the indication of demand for mortgages in some countries. In France and Germany, the tightening has been very significant, more than 90 per cent according to the metrics in the Bank Lending Survey. So, this is indeed a normal outcome of a very steady and fast normalisation of monetary policy: the bank lending channel is working as expected.

In terms of impact on the banks' balance sheets and profitability, this would of course reduce a little bit the volume effect on the net interest income, but let's say overall the expectations mentioned of analysts and banks and also according to our models in the baseline scenario in which we avoid recession, or we stay in a very shallow and short recession, the effect on the margins will still be very powerful and the effect on overall profitability should be positive. Of course in adverse scenarios things can change quite significantly.

On the 24 banks falling short of expectations, were we surprised? To be honest, the answer is yes. I was surprised. Seeing our expectations, that there is legislation now in place saying that loans underwritten after 2019 will have the legal obligation to be provisioned or written down according to a certain schedule, we would've expected that banks adjust their valuations in line with these reference points. We have seen instead last year some banks reversing deductions and instead accepting the higher Pillar 2 requirements. Our reading is that this might be, to some extent as I was mentioning, due to the fact that if you do a deduction, you have a 100 per cent hit on the capital position. If you take a Pillar 2 add-on, you have to have higher capital requirements that you can fulfil only up to 56 per cent with the common equity tier 1 capital and for the rest also with additional tier 1 and tier 2 capital.

So, the quality of capital impact would be less steep, and also in terms of signalling you publish a higher capital ratio. Our strong expectation from the supervisory point of view is that banks actually take all the shortfall in coverage with direct tools, i.e. with provisioning and with deductions. Anyway, that is the framework we are in. This will happen anyway as soon as the new legislation is basically applied to an increasing amount of loans. The loans originated before 2019, the legacy NPLs, will start disappearing from the balance sheets.

You've highlighted the deficiencies in risk data aggregation and I'd like to know: what is the reason for the deficiencies? Is it because of lack of management attention, or is it perhaps more a lack of ability of banks because of the problems in their IT, for example?

Secondly, I'd like to know whether there have been many concerns about cyberattacks from Russia during the Ukraine war. I'd like to know how these attacks have developed.

If I may, perhaps a third question is on the investment of banks and digitalisation. It's now nearly 3% of the operating profits. My question is: is that enough or sufficient?

Enria: On the risk data aggregation and reporting: to be honest with you, I might be wrong, but my impression is that it's not an issue of lack of management attention. It's an issue of cost. We have sometimes legacy IT systems which result from a sequence of bank mergers. So, getting to the bottom of it, being able to really integrate IT systems and produce fast, reliable and accurate data, requires heavy investment. Heavy investment today depresses the profit today, and creates positive results for tomorrow, which is still to come. So, sometimes today's management does not have the right incentive to undertake these quite sizable investments. That is why probably we need to escalate the supervisory pressure to make this happen. As I mentioned, this issue has been raised now for several years and it is time to have it fixed.

Cyberattacks: we noticed an increase in attacks during the pandemic and after Russia´s invasion of Ukraine. The level remained stable at this heightened level compared to the past. To be honest, the level of damage, the impact of these attacks, has not been massive so there hasn't been major damage caused. But of course it is an area in which banks need to devote a lot of attention. Lessons from the COVID and the war are that for instance: during the COVID pandemic we realised that banks were outsourcing critical functions to India. There was a moment of great concern because it was not clear whether remote working in India during the pandemic would've been enabling the banks to still have the same functions fulfilled properly. Eventually there was no major issue – but there was a lot of remediation to be taken fast by the banks.

Other cases during the war: there were banks that had IT centres in Russia that were servicing the group as a whole globally, which needed to scramble to move the stuff out of these IT centres and to ring-fence their own IT centres to avoid contamination of the rest of the group. There has been a bank that actually defaulted because it was a subsidiary of a Russian bank in the Netherlands; Amsterdam Trade Bank. The parent company was in the sanctions list and Amazon Web Services – which was the its main provider of IT services[1] stopped providing the service. So, the bank was not able to fulfil its function anymore. So, it is to say that if you outsource critical IT functions of your bank, the way in which you do it could be really important for the continuity of services.

Investment in digitalisation, yes, we think they are a little bit on the low side in terms of the challenge that we have. The overall amounts of course are important but we think that maybe if you want to have a visible palpable impact on business models, this is the moment to do it. The pandemic raised awareness on the side of banks that by doing so, they can have important improvements on the cost side, on the ability to connect with customers, retain customers, gain new customers so there is new attention from the commercial point of view. Of course, from our side there needs to be also attention on the risk point of view.

You answered a great question on cyber. I don't know to what extent the SREP has also looked at some crypto exposure but I was just wondering if there was any analysis of that, if there's anything you could share.

Then very finally, there is this idea that we might introduce artificial intelligence into the SREP in the future. I'm just wondering, how would that work?

Enria: On crypto exposures, the short answer is: there aren´t many. The size and number of these exposures is pretty contained. We are seeing what is now called the crypto winter in 2022, with major defaults and adjustments in that market. The impact on the European banking sector was negligible, basically, so there was no effect. We have seen something in some smaller banks in the US but nothing really in the European banks. Of course, now with the Basel guidance, which has been approved in December and which by the way was to a large extent driven also by our colleague Korbinian Ibel, we expect that there will be a quite strict, robust set of rules guiding the exposure of banks to this sector.

In terms of artificial intelligence, it is true we are using more artificial intelligence in our processes. The objective is to be able to first of all reduce heavy paper-based types of tasks, like reviewing very thick application packages using for instance natural language processing tools. But we also have projects now to use artificial intelligence to create a network analysis of for instance interconnections between banks and ownership structures. So, there is a lot there. Not yet becoming the backbone of the SREP but still contributing to a more effective supervisory action on our side.

I would like to ask a Greece-specific issue: there are deferred tax credits and they account for over half of the total assets in significant institutions in Greece. So, I wonder is it an issue of concern for you and what do you expect the Greek banks to do to reduce this record-high DTC ratio?

Enria: Well, first of all let me say that deferred tax credits are there for a good reason because they were created in a very massive process of cleaning of the banks' balance sheet in Greece that has proceeded at a very good pace in recent years. By generating capital impact to clean the balance sheets, to sell, securitise non-performing exposures, banks are also generating these deferred tax credits. Now, it is an issue that means also that the quality of capital is to a large extent affected by these types of components. The ECB already gave in an opinion some time ago, a couple of years ago if I remember well, some indications on how the overall framework, also the regulatory framework for DTC could be adjusted to give a better remediation to this problem. I think there is not that much that banks can actually do, so it's more an issue of design of the framework for DTC, I would say.

I have one question on governance because it is one of your main concerns and you have imposed qualitative measures. Is it widespread? Are there many banks involved? Are you happy with the way the banks are responding? Do banks understand how you want them to respond to governance issues?

Enria: The area of governance – as we say, as we've shown also in the charts – is the area where we have most findings and measures. So, it's the area where we are raising most issues to many banks, honestly. It's a mixed picture. To some extent, I have to acknowledge that several banks have moved. The number of independents in boards has increased. The diversity in boards has increased. The distinction of roles, for instance the issue of executive chairs, has been to a large extent remedied and there is now a better interaction there. So, there are a number of areas in which we have seen good progress but all in all, this is an area in which still we see that the findings remain there for a long period of time. We think that the banks understand what we want from them but sometimes they are not reacting as fast and decisively as we would expect them to do.

That is one area in which I think we are planning to have a little bit more of an escalation process: setting clear deadlines within which we want this issue to be resolved and if not, there will be consequences.

I have one question on the CET1 requirement. I saw that last year, only one bank was below its CET1 requirement and guidance versus six banks in 2021. Could you explain a little bit what was the development there and what you see at the end of this last year, how it will possibly evolve in the year to come.

Enria: very simple short answer: we made the Pillar 2 buffers, the so-called Pillar 2 Guidance, the P2G, available for banks to use. Several banks actually dipped into these buffers and took the opportunity to maybe clean their balance sheets or make progress and then raised capital, and came back within clear timeframes in accordance with plans that they shared with their supervisors to come back in line with the guidance. That is exactly the same we expect also for the last bank that was still actually in September below the levels. The chart is a bit maybe misleading because it puts the requirements at the beginning of the year against the level in September of last year, but as I say, that's the information we have.

Anyway, what we expect of course is that all the banks stay above requirements and guidance, and if there were to be additional tensions, of course the Pillar 2 Guidance, the buffer is always there to be used. So, we are not particularly concerned by the fact that six banks during the pandemic dipped in the buffers. Actually that was useful to some extent to remedy the situation, clean the balance sheets, then raise capital and come back into full compliance.

Just two quick questions, if I may. One, a follow-up question on the internal models one: Deutsche Bank has said they're actually delaying a decision on share buybacks because the internal model impact may be pretty big. Intesa is shedding assets because of the internal model review. I was just wondering if you can tell us if any other banks are expected to see similarly big impacts from this, and just how many banks are undergoing this at the moment.

The second question on counterparty credit risk: this is driven by Archegos and the big hit, especially Credit Suisse, not euro area banks, took from this. It was pretty much prime brokerage. I was just wondering: what business areas in banks are you looking at? Mostly in prime brokerage? On the other hand, Archegos was a sort of family office, so are you also looking at wealth management? How much is fixed-income trading also part of this? Products that are selling there are typically not the kind of way you would expect that kind of hit.

Enria: Internal models, let me make this clear. There is no strategy here. We are not telling our inspectors, “go out there and hammer the banks on internal models” or “find a way to raise capital requirements”. That is not what is happening there; it's business as usual. So, we do have banks that as a result of TRIM or of the EBA guidance and the new rule are asking for approval of new models, or we are going there to check the models that they have already in place because sometimes the supervisors are not convinced that the risk density of certain portfolios is in the right place. Our inspectors go there, they have findings, and sometimes these findings are material, and this leads to a request for remediation. Until the models are changed to remediate these findings, the bank is asked to have a multiplier, for instance, on risk-weighted assets, so that gives some safety on the level of risk to also ensure a level playing field with competitors.

There´s no strategy. As I mentioned, many models need to change now because of the new EBA guidance or the results of our TRIM investigations. This means there are many inspections. Actually much less than there are requested, so we are not able to do them all. We are lagging behind, but it's again business as usual. No specific strategic objective there.

On counterparty credit risk: yes, prime brokerage, we did also a specific investigation there but it's not only on prime brokerage. It's any time that you have significant exposures because you take as a counterparty in derivatives business certain counterparts. For instance, also in the area of commodity trading, we are seeing a lot of positions taken by the European banks. We got a little bit nervous when commodity prices started seeing a lot of volatility. There could be specific transactions dealing with private equity or hedge funds which are dealing with LBOs, leveraged buyouts. So, there could be a variety of business that could be covered. What is important is to make sure that the risk management of banks is in the right place.

I wanted to ask about European banks with exposure to Russia in particular, and whether you're happy for the banks to continue to remain with sizeable activities in Russia given the situation on the ground in Ukraine. Or are you pushing for them to present plans for exiting and to act on those plans?

Enria: Well, of course we are putting all our efforts and pressure to make sure that banks actively manage the risks which are entailed by these exposures: cross-border exposures, direct presence in the country. What we have seen is that many banks have taken action, honestly, in different ways. Some banks exited the market, selling the subsidiary in Russia. The window for doing that has been closing a bit because now the attitude of the Russian authorities in front of requests from European banks to exit and sell the business has become a little bit more hostile. But many banks have reduced the cross-border business provision significantly for the cross-border business, or have started a sort of dual steering. So, keeping in their prudential and risk management the Russian subsidiary separate from the rest of the group.

We are following this closely and of course any opportunity for the banks to further reduce or exit from that type of business would be something that we would view favourably from the supervisory perspective.

Mr Enria, how can European banks close the gap to US peers in terms of profitability and stock market value?

Enria: Well, I am not an analyst. Maybe it's not my business to do that, but what I can say is that what we have seen right now is that the negative low interest rate environment was a significant drag for the business model of European banks. So, having a normalisation of interest rates is already a positive effect. That was not in their hands, to some extent. The areas in which we have focussed our attention very much, which are the levers that the banks can pull, have been cost efficiency and strategic steer. We have seen that the banks which have a management and a board, which have a better grip on the strategic steer of the bank, are being able to exit segments of business which are not profitable and getting a sufficient scale in the areas of business where they have a competitive advantage.

These are the banks which have been most successful in closing the gap, and finally as I mentioned before, also the investment in IT and digitalisation are also another important lever. So, these are the areas in which we have been pushing banks to focus their attention.

The IT service provider at issue is not Amazon Web Services.

Ευρωπαϊκή Κεντρική Τράπεζα

Γενική Διεύθυνση Επικοινωνίας

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Η αναπαραγωγή επιτρέπεται εφόσον γίνεται αναφορά στην πηγή.

Εκπρόσωποι Τύπου-

8 February 2023