Close cooperation with the ECB: an entryway to banking union

EU Member States whose currency is not the euro can participate in the Single Supervisory Mechanism (SSM) by requesting the establishment of close cooperation between the ECB and their national competent authority (NCA). Once close cooperation has been established, these Member States can join both the SSM and the Single Resolution Mechanism.

The entryway to the banking union for non-euro area Member States

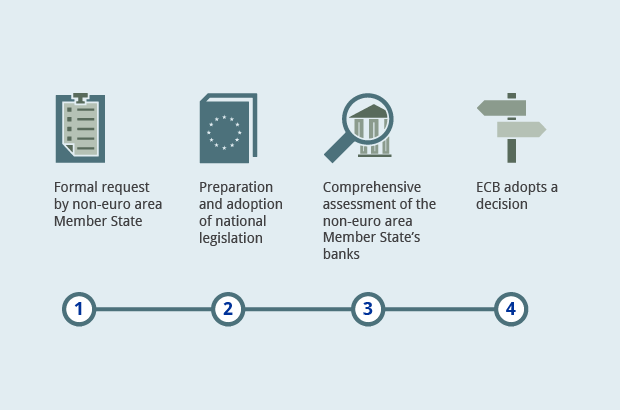

As described in the SSM Regulation and in the ECB Decision on close cooperation (ECB/2014/5), the process of establishing close cooperation starts with a formal request by the non-euro area Member State to join the SSM. Bulgaria is the first non-euro area Member State to have submitted such a request.

The pathway to close cooperation entails two main steps. The first consists of the preparation and adoption of national legislation which allows the ECB to exercise its supervisory tasks within the framework of close cooperation, and an ECB assessment of that legislation. The second comprises a comprehensive assessment of the banks of the Member State concerned, similar to the one conducted on euro area banks in 2014 before the SSM was set up. In addition, the ECB can request information and provide technical support to the national supervisory authority to facilitate its smooth transition to the SSM supervisory approach.

As with all comprehensive assessments conducted by the ECB, the general objectives are to

- enhance the quality of information available on the condition of banks

- identify problems and implement the necessary corrective actions, and

- assess whether banks are fundamentally sound.

The exercise comprises an asset quality review that assesses the valuation of balance sheet exposures and a stress test which assesses the resilience of banks under a stressed macroeconomic scenario, typically including an economic downturn.

At the end of this assessment phase, the ECB adopts a decision which indicates how supervisory tasks will be transferred to the ECB and when the close cooperation will start. This will be conditional on the progress made in implementing any measures required as a result of the comprehensive assessment.

Supervision under close cooperation

Once close cooperation is established, the NCA of the country concerned is in a position comparable to all other NCAs of Member States participating in the SSM. This entails, among other things:

- the identification of significant institutions (SIs), which will fall under the direct supervision of the ECB, and of less significant banks, which will remain under the direct supervision of the NCA;

- the creation of Joint Supervisory Teams for the supervision of SIs;

- the participation of a representative of the NCA on the Supervisory Board, with the same rights and obligations as all other members (including voting rights).

Some procedural adjustments are also necessary to take into account the constraints imposed by the EU Treaties.

For example, the Member State in close cooperation is not represented in the Governing Council, which comprises only the members of the Executive Board of the ECB and the governors of the national central banks of the euro area Member States. For this reason, under the SSM Regulation a special procedure allows the NCA in close cooperation to express disagreement with the Supervisory Board’s draft decisions and with any objections by the Governing Council to those draft decisions. If no agreement is reached, the Member State may opt to terminate close cooperation.

In addition, ECB legal acts (including decisions on banks) will not have direct effect in the Member State in close cooperation, as the latter does not form part of the euro area. Therefore, the ECB will not adopt decisions addressed to banks in the Member State concerned, but rather instructions addressed to the NCA, which will in turn adopt the required national administrative measures addressed to banks.

Overall, the establishment of close cooperation opens participation in the banking union to non-euro area Member States, thus contributing to the safety and soundness of banks and fostering the process of financial integration across the Single Market.

Den Europæiske Centralbank

Generaldirektoratet Kommunikation

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Tyskland

- +49 69 1344 7455

- media@ecb.europa.eu

Eftertryk tilladt med kildeangivelse.

Pressekontakt