Business model assessment SREP methodology

This is not the most recent release. You can find the latest version on the ECB’s banking supervision website.

The following sections provide a more detailed description of the methodology for the business model assessment (BMA) for significant institutions (SIs) as part of the Supervisory Review and Evaluation Process (SREP).

1 Introduction

The SREP BMA methodology:

- is consistent with the European Banking Authority (EBA) Guidelines on SREP and assesses whether banks are complying with the ECB’s supervisory expectations;

- is applied proportionately to SIs, taking into account the nature, scale and complexity of their activities;

- supports Joint Supervisory Teams (JSTs) in performing risk-based supervision while providing sufficient flexibility to cater for bank-specific elements – this means that the frequency, scope and depth of the assessments vary in line with European banking supervision and bank-specific priorities;

- is comprehensive and includes backward and forward-looking perspectives that consider all relevant risk components and their possible mitigants;

- draws on leading best practices and is periodically updated to ensure alignment with the EBA Guidelines on SREP and any relevant changes in regulation.

The BMA is captured by Element 1 of SREP (Figure 1).

The BMA aims at creating a sound understanding of the functioning of the institution. There are two primary outputs of the BMA.

- The first is insight into both the robustness of the business model and any major existing or potential vulnerabilities of an institution. These vulnerabilities offer a key lens through which to consider future financial performance. They also represent potential sources of follow up for the supervisor – whether in future assessments or through escalation with the institution.

- The second is a supervisory conclusion, also expressed in terms of scores for the viability and sustainability of the institution. These are defined as the capacity to generate satisfactory returns over horizons of 12 months and at least three years, respectively.

A forward-looking view of a bank’s profitability is key to understanding how its risk-adjusted profitability can enhance its capital adequacy and ultimately its resilience over the cycle. To this end, assessing an institution’s profitability allows supervisors to understand its organic capital generation capacity and, specifically, its capacity to cover costs and losses stemming from adverse risk developments.

An institution’s business can be impaired – and, accordingly, its ability to generate profits adversely affected – not because of a particular risk but owing to the sheer nature of the institution’s business model. This impairment may stem from factors either within or outside the institution. Internal factors include the inefficient design or pricing of key products, inadequate targets, reliance on an unrealistic strategy, excessive concentration of risk, poor funding and capital structures, or insufficient execution capabilities. Examples of external factors are a challenging economic environment or changes in the competitive landscape.

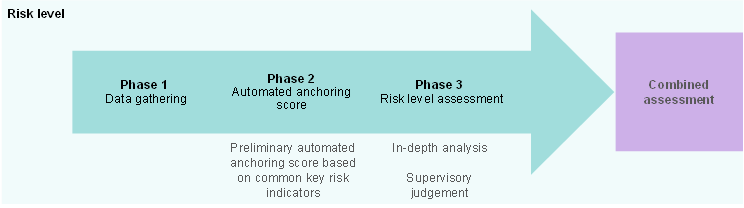

As Figure 2 indicates, the BMA is based on a risk level assessment that takes into account the inherent risk and is performed by JSTs in the following three phases:

- Phase 1: supervisors gather data and make a preliminary identification of the institution’s business model as well as the materiality of its business areas and profitability, mainly based on information provided by the institution;

- Phase 2: an automated anchoring score is generated based on common key risk indicators;

- Phase 3: supervisors carry out a more in-depth BMA centred around the current and future robustness of the business model, including the viability and sustainability assessments, taking into account supervisory judgement on the bank specificities and applying constrained judgement.

The Phase 3 score results in an overall assessment of the institution’s business model risk – expressed as a score between one (low risk) and four (high risk) with qualifiers – that can lead to the Phase 2 score being adjusted in line with the constrained judgement rules. In addition, JSTs are asked to provide a rationale for the score.

Figure 2

Overview of SREP BMA

The SREP methodology is rooted in both the EBA Guidelines on SREP and ECB documents communicating its supervisory expectations as an integral part of the SREP framework.

As the economic and regulatory environment keeps evolving, the SREP BMA methodology is updated regularly, for example to reflect the challenges posed by climate risks and digitalisation to the sustainability of institutions’ business models.

2 BMA methodology

2.1 Phase 1

The primary objective of Phase 1 is to conduct a materiality assessment of the business model and profitability, providing an overview of potential vulnerabilities and determining the key areas for the BMA to focus on. A deeper understanding of the key business areas is also crucial for selecting the most appropriate peer group. Peer group comparisons contribute significantly to any BMA as they offer insight into how an institution performs relative to the industry “standard” and to its competitors.

To complete Phase 1, JSTs can rely on various information sources, including regulatory reporting, management reporting, sector research and rating analyses. In addition, JSTs may use key risk indicators which give an overview of the institution’s business model (e.g. the main composition of assets, liabilities, and drivers of profit and loss).

2.2 Phase 2

Phase 2 produces an automatic anchoring score based on an institution’s profitability indicators, making it possible to assess the institution’s capacity to generate profits and achieve adequate returns. The Phase 2 score is risk-based, and the methodology is applied consistently across all SIs. This score serves as a starting point for JSTs to consider bank-specific circumstances in more detail and thus apply expert judgement.

The Phase 2 methodology for BMA captures different dimensions, ensuring that the preliminary assessment of an institution’s business model is sufficient and comprehensive. The use of four indicators means that overall profitability is segregated into the individual drivers of profitability, namely:

- the profitability of the institution as a percentage of its overall asset base (return on assets);

- the asset turnover (core revenue to assets);

- impairments incurred as percentage of financial assets (cost of risk);

- the efficiency of an institution (cost to income).

The scores for all quantitative risk indicators used in Phase 2 are defined by drawing a comparison between the individual values of a supervised institution and predefined thresholds aligned with the risk appetite of the Single Supervisory Mechanism (SSM).

The Phase 2 framework has a purely quantitative nature, which ensures that it is based on harmonised and consistent indicators and thresholds. The objective of the Phase 2 score is not to assess banks’ specificities, such as their business model, as such aspects are duly considered during the in-depth assessment performed by the JST in Phase 3.

2.3 Phase 3

Informed by the priorities identified during Phase 1 and 2, Phase 3 is where JSTs conduct a comprehensive bank-specific assessment, which results in the final score reflecting the institution-specific BMA. While the Phase 2 BMA score serves as an anchoring score, Phase 3 provides JSTs with the necessary flexibility to consider institution-specific aspects of the portfolios and risk dimensions. This can result in a possible adjustment of the Phase 2 score.

Supervisors consider information from various sources, including peer comparisons. During the Phase 3 assessment JSTs consider insights gained from on-site inspections, deep dives or horizontal analyses, such as targeted or thematic reviews, whenever available. Peer comparison is also embedded in this assessment and supported by various tools.

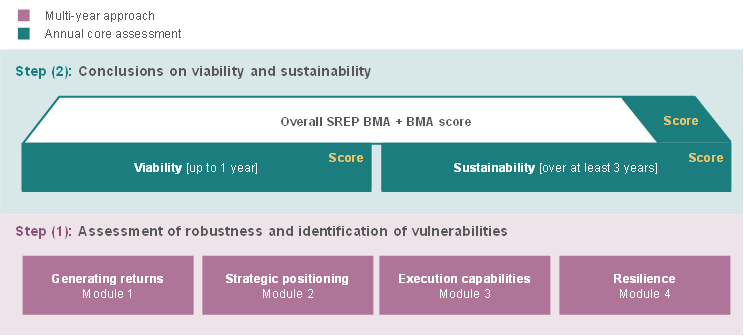

Figure 3

Overview of Phase 3 assessment

The JST captures the assessment of the business model in two steps: (1) assessment of the robustness of the business model together with the identification of vulnerabilities; and (2) conclusions on the viability and sustainability of the institution (Figure 3). To ensure a comparable but sufficiently flexible assessment, the Phase 3 methodology is harmonised across banks, although its content can be fine-tuned by JSTs. The BMA follows a multi-year approach, which necessitates some flexibility for JSTs to tailor the frequency and depth of the assessment, as not all methodological aspects and assessment components have the same relevance for all institutions.

A robust business model allows a bank to remain viable and sustainable in a changing business environment. The methodology is organised around four modules aimed at guiding the supervisor towards a holistic understanding of the robustness of the institution.

- Generation of returns: this module assesses the ability of the institution to generate stable profits in the short, medium and long term given the institution’s risk appetite and its funding and capital structures, by focusing on the following topics:

- Assessment of profitability drivers: the objective is to assess the viability of the current business model by means of a quantitative analysis of several risk indicators. These indicators should give the JST a full picture of the real and concrete strategy pursued, the extent to which the bank is achieving its targets, the level of key performance indicators and the key metrics on profitability. JSTs should perform a more in-depth analysis of the profit and loss account, balance sheet and risk weight analysis, assessing whether the institution’s strategy can address any threat to its viability that has been identified. In addition, JSTs should focus on how those risk indicators develop over time and how they compare with those of the relevant peer group. It is crucial to understand how the institution generates income or losses, the sources of costs, the sources of impairments, and changes in the income distribution mix. This information is used to identify key drivers and dependencies of business performance, and potential medium to long-term vulnerabilities as well as transformation challenges.

- Assessment of the business environment: JSTs should assess the forward-looking business environment in which the institution operates to form an understanding of the current and future trends and adequately measure the risk of the business model. Analyses may encompass market conditions such as key macroeconomic variables, market trends, the competitive landscape and other relevant developments (such as regulatory and legal changes). The analyses may also include longer-term considerations that affect the sectors in which the institution operates and thus its performance and profitability, e.g. digitalisation and climate risk.

- Forward-looking view: the purpose of this topic is to understand how the institution expects to make profits in the future, i.e. how the key drivers of profitability are expected to change and what may drive this change. To analyse this JSTs should examine the institution’s profitability forecasts and financial projections to form a supervisory view on future profitability and key forward-looking assumptions. This can be complemented by describing alternative scenarios and testing hypotheses about material profitability drivers, which may be important sources of future business risk.

- Acceptability of returns: at this stage, JSTs might already have identified warning signals as to whether the profitability of different business lines is reasonable. They should determine whether such profitability is truly sustainable or driven by tactical factors. Such factors may include under-allocation of returns, under-identification of risks, misalignment between risk appetite and practices or poor controls. Profitability may also be temporarily sustained by limited competition.

- Strategic positioning: this module assesses the quality of a bank’s business strategy. The assessment includes the bank’s diversification, complexity, or specialisation in terms of geographic locations, business lines, business sectors, products and income sources. Furthermore, it takes into account the institution’s risk appetite, also over the longer term. It focuses on the following:

- Strategy: JSTs form a view on how an institution’s management board articulates its strategy as well as the challenges and opportunities – stemming from the business environment and the institution’s positioning within it – that the strategy is responding to. JSTs should identify and assess the qualitative drivers of the institution’s strategy, achieving an understanding of what the success drivers are, what assumptions the institution makes and how ambitious and executable the strategy is. This implies understanding the gap between the envisaged business model – post execution – and the current business model, management’s track record on delivering previous strategies and forecasts, and the support from key stakeholders.

- Trade-off between diversification and complexity: diversification of the business model is an important element of a bank’s business strategy. When assessing the degree of diversification of an institution, JSTs should complete a detailed assessment of both the benefits and the risks associated with the diversification before reaching a conclusion. On the one hand, when implemented well, it can be a central element in the viability and sustainability of an institution’s business model. On the other hand, implementation of a diversification strategy can lead to increased complexity such that, for example, a lack of focus on core business can offset the diversification benefits. When assessing an institution’s business model diversification, several factors matter, such as: correlation, complexity, organisational capabilities, structural risk mitigation, market share and execution capabilities.

- Supervisory view over the cycle: JSTs assess five progressive dimensions of a bank’s business model: a) the positioning over the cycle, i.e. the procyclicality of the institution; b) the institution’s track record on delivering on its goals, i.e. the ability of the institution to pursue its strategy in the longer term while adapting to idiosyncratic and sectoral setbacks; c) the bank’s monitoring capabilities, i.e. the ability of the institution to develop market analysis and surveillance of market trends in order to project its activity over horizons longer than that of the business plan; d) the institution’s capability to adequately self-assess its current strengths and weaknesses with respect to future structural changes and to design strategic orientations for its longer-term transformation; and e) acting capacity, i.e. the extent to which the institution is already implementing steps towards adapting and transforming its business model in order to be capable of facing structural changes, emerging risks and opportunities.

- Execution capabilities: this is a holistic assessment of the institution’s ability to make use of competitive advantages and success drivers in carrying out its business and to generate returns in an effective way, e.g. cost flexibility, strong IT platforms, an effective global network, adequate scale of the business or unique product propositions. Four areas are analysed in this module.

- The cost allocation framework: the objective is to accurately reflect the profitability of business lines/units. Here, governance aspects are also important. One such aspect is the existence of a cost allocation policy which is clear and is regularly reviewed. Another aspect is having monitoring, controlling and reporting of the process in place and the results obtained from this.

- The fund transfer pricing framework: the fund transfer pricing mechanism prices lending between business lines/units so as to calculate the correct net income component for each business line/unit, product and customer. An inaccurate mechanism may give a false picture of a business line’s profitability. This may lead to other inappropriate consequences, for example involving variable renumeration or the continuation of unprofitable activities. In order to be reliable, the fund transfer pricing system should be sufficiently broad to adequately cover on-balance-sheet and off-balance-sheet assets and liabilities, while the methodology should aim to compensate the business lines/units providing the liquidity and charge the users.

- The loan pricing framework: improper loan pricing may jeopardise future profitability. Therefore it is important that: (i) the governance of the loan pricing process is well established; (ii) all the loan pricing components are accurately captured; and (iii) ex post profitability monitoring of product pricing decisions is regularly carried out and reported.

- Exposure to money laundering and financing of terrorism risks: JSTs should bear in mind that institutions may be exposed to the risk of money laundering or financing of terrorism (ML/TF). In this context, JSTs should consider the potential impact on the viability of the institution of breaches of ML/TF requirements. They should also take into account new requirements which require supervisors: (i) to provide the anti-money laundering/countering the financing of terrorism (AML/CFT) authorities with information about prudential findings and measures that are relevant for the performance of the institution’s tasks; (ii) to consistently factor AML/CFT considerations into their prudential activities; and (iii) to take prudential measures if necessary.

- Resilience to external shocks and adaptability to structural changes: the institution’s business model should be adjusted to the business environment, and able to absorb external shocks and adapt to external factors that could threaten future profitability. This module aims to continuously monitor the institution’s ability to manage key dependencies and vulnerabilities, but also the capacity to adapt its business performance to structural shifts and new developments. The latter include, among others, the impact of a more digitalised economy and of climate-related and environmental risks:

- Climate-related and environmental risks: depending on the business model, operating environment and risk profile, an institution could be concentrated in a market, sector or geographical area that is exposed to material transition and physical risks. This means it could be vulnerable to impacts of climate-related change and environmental degradation. For this reason, the JST should assess the impact of this risk on the bank’s business environment and business strategy, as well as the setting/monitoring of key performance indicators in the short, medium and long term.

- Digitalisation: JSTs assess the impact of digitalisation on the institution’s business strategy and business plan, execution capabilities and cost control, as well as revenue generation.

Weaknesses in any of these modules may be an indication of a threat to the viability and/or sustainability of the institution.

Based on the assessment performed in step (1), JSTs provide conclusions on the viability and sustainability assessments in step (2) by summarising:

- the bank’s capacity to generate acceptable returns in the context of its risk appetite and funding structure;

- reflections on any concentrations on the balance sheet or among income sources;

- the bank’s competitive position in the material markets and whether its strategy supports the consolidation of that position;

- whether the institution’s forecasts are plausible taking into account relevant internal and external factors;

- whether the strategic plans are both coherent with the current business model and also executable, given the system and management capabilities.

The assessment culminates in two scores, one for viability and another for sustainability, which are then combined into an overall score. The overall score should be accompanied by a narrative that provides a rationale for the score and a summary of the main findings.

© European Central Bank, 2025

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.bankingsupervision.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the SSM glossary (available in English only).

PDF ISBN 978-92-899-6333-6, ISSN doi:10.2866/622308 QB-09-23-592-EN-N