- SPEECH

Banks’ credit risk management and IFRS 9 provisioning during the COVID-19 crisis

Speech by Elizabeth McCaul, Member of the Supervisory Board of the ECB, at IFRS 9 Insights ahead of year-end, EY’s Accounting and Regulatory webcast series

Frankfurt am Main, 24 November 2021

Thank you for inviting me to this webcast in the EY’s Accounting and Regulatory series.

Let me first mention EY’s interesting quarterly analysis which compares IFRS 9 provisioning across 19 large European banks. This analysis shows how disclosures contribute to the transparency of asset quality and so create market discipline for banks’ risk assessment and provisioning approaches.

As banking supervisors, we very much welcome this. We strive to promote transparency by providing guidance to the banking sector and sharing our supervisory findings, especially in times of crises. Today, I will touch on some of that guidance and present some supervisory findings on banks’ credit risk controls and provisioning approaches since the outbreak of the COVID-19 crisis. Although the pandemic may evolve to a more endemic state in 2022, the impact of the COVID-19 crisis on banks’ asset quality of banks will remain a supervisory priority. I will therefore conclude with some thoughts about possible next steps.

Guidance on credit risk management in the pandemic

Right from the start of the COVID-19 crisis, the ECB understood the importance of strong credit risk controls to avoid any build-up of non-performing loans (NPLs) on banks’ balance sheets. We know from past experience that accurate evaluation, coupled with asset quality transparency, is critical for maintaining trust in the banking sector throughout any crisis. To be sure, the pandemic presents unique challenges for managing credit risk. In particular, the public support measures and the flexibility introduced to cushion households, businesses and the economy as a whole, while important, can also mask true underlying creditworthiness. Robust risk management is needed to underpin strong credit risk assessment and reporting.

With the principles of accuracy and transparency in mind, we provided forward guidance in several letters to CEOs of banks under our direct supervision as the effects of the pandemic continued to unfold. I will focus on the most relevant ones here.

In our letter of 1 April 2020 we provided guidance to mitigate volatility in institutions’ regulatory capital and financial statements stemming from IFRS 9 accounting practices. Our aim was to avoid procyclical tightening effects on bank lending and to ensure that, despite the uncertainty, institutions’ disclosures remain reliable, consistent and comparable.

Our letter of 28 July 2020 was a wake-up call to banks, including those with less experience of high NPL levels, to act early to prevent losses by enhancing their operational capacity for dealing with a surge in arrears and with distressed debtors.

Finally, our letter of 4 December 2020 asked banks to improve the identification and measurement of credit risk, covering areas such as forbearance flagging, unlikely-to-pay (UTP) assessments and the IFRS 9 staging of loans and provisioning.

We also conducted a deep-dive horizontal review of the strength of credit risk controls among significant banks in the euro area. The outcomes, published on 19 July 2021, provide insight into both good and deficient practices. Let me highlight some important conclusions here.

- The good news was that we found most banks fully or broadly compliant with our expectations. Some others are employing good practices that will help them identify emerging credit risk as support measures are phased out. Examples of such practices are: conducting more frequent credit assessment reviews; incorporating sectoral and stressed corporate client analysis into UTP assessments; and performing granular forecasting based on a portfolio/geography matrix and vulnerable sector analysis.

- When it comes to flagging forbearance correctly, we observed that a significant number of banks do not always include all of the criteria relevant for effectively identifying financial difficulties.

- We came across banks that failed to collect new information in a structured way in their UTP assessments, and we saw cases where an appropriate UTP assessment is being performed but not translated into an NPL classification.

- We saw varying examples of loans being kept in stage 1 rather than transferred to stage 2, despite evidence of a significant increase in credit risk.

- Some banks use biased approaches which artificially stabilise provisions by using, for example, a limited number of scenarios predicting future losses which do not reflect the full range of uncertainty.

New insights on NPLs, forbearance flagging and staging

European banking supervision’s Joint Supervisory Teams are still following up on these and other letters to CEOs, especially with banks where we identified weaknesses. While this work is ongoing, we see some good signs and some warning signals.

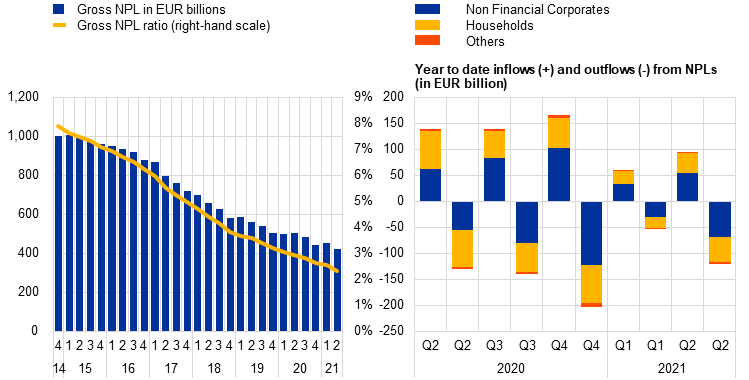

Looking at the risk levels, there are positive signs. We see the NPL ratio continuing to decline, standing at 2.3% at the end of June 2021, well below its pre-pandemic level, as shown in Chart 1 (left hand side). The main driver behind this downward trend is that banks are reducing their pre-pandemic stock of NPLs through write-offs and risks transfers (sales, securitisations).

Relatively low new NPL inflows in the first half of 2021, also shown in Chart 1 (right-hand side), of course signal good news too. But we should not celebrate too soon because the real impact of the crisis may be masked by support measures to increase liquidity and cushion households and businesses from the economic effects of the pandemic.

Chart 1

Positive signs: Non-performing loans continue to decrease through bank risk transfers and reduced inflows

Source: ECB reporting

There are a few warning signs. For example, we are closely monitoring a variety of potential early indicators of any masking effects on true credit quality. One such potential indicator is the forbearance rate, which increased substantially from 1.65% in the fourth quarter of 2020 to 1.97% in the second quarter of 2021 across most countries. While part of this increase may be attributed to banks improving their forbearance flagging, concerns remain about whether forbearance rates are adequately reflected in the numbers. Our experience in monitoring banks with high NPLs tells us that historical default rates for forborne loans are typically around 15 percentage points higher than for non-forborne loans. An increase in the forbearance ratio may hence be an early warning of further inflows into NPLs in the near future, albeit that the extent and timing of any such inflows is uncertain.

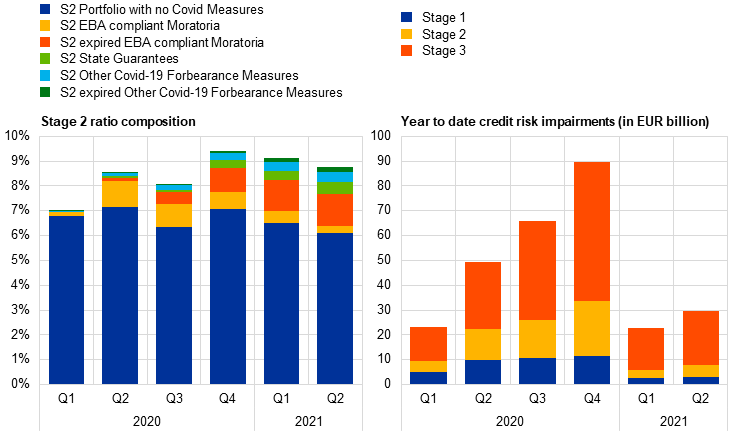

Second, and delving deeper into the share of stage 2 loans as shown in Chart 2 (left-hand side), we see a gradual decrease in the stage 2 ratio to 8.6%, driven mainly by a reduction in exposures not covered by COVID-19 support measures. The share of stage 2 exposures that benefitted from European Banking Authority (EBA) moratoria or public guarantees continues to increase, suggesting that these exposures carry more inherent risk, even though the transfer of loans with a public guarantee to stage 2 has negligible or no impact on bank profitability and capital.

Finally, impairments booked in the second half of 2021 decreased by 40% compared with the same period in 2020 (Chart 2, right hand side), and this trend is also reflected in a further decrease in the cost of risk from a peak of 70 basis points in the second quarter of 2020 to 52 basis points in the corresponding period of 2021. Almost 40% of banks reported a negative cost of risk in the first half of 2021, which raises some concern because it may be that we have not yet reached the peak of the crisis in terms of asset quality deterioration.

Chart 2

Warning signals: Increase of transfer of loans supported with COVID 19 measures to Stage 2 and strong decrease credit risk impairments in the second quarter of 2021 compared to the second quarter of 2020

Source: ECB reporting

Our findings on IFRS 9 provisioning

In the area of IFRS 9 provisioning, we have seen banks’ practices increasingly harmonising since the beginning of the COVID-19 crisis. This makes peer analysis more efficacious and increases transparency, which in turn improves investability in euro area banks in cases where lack of transparency and comparability act as deterrents. The IFRS 9 benchmarking exercises we conducted also point towards some convergence in provisioning practices among banks. We like to think that our guidance in this area was helpful, as shown by the following findings.

First, the IFRS 9 baseline scenarios for 2021-24 applied by banks are more strongly anchored in the macroeconomic projections of the ECB and national central banks. We no longer see overly optimistic or highly hypothetical scenarios. Instead, the fact that banks are incorporating more reliable macroeconomic forecasts for specific years (if available) reduces unwarranted variation in provisioning levels of European banks.

Second, banks are basing their accounting provisions on more robust methodologies. Compared with pre-pandemic years, the probability of default (PD) models used by banks for provisioning have become less sensitive to highly judgemental and uncertain GDP growth expectations, which do not have much accounting relevance in longer-term horizons. In the end, they follow a more through-the-cycle and less point-in-time rationale, but this is justified given the low statistical relevance of long-term specific forecasts. Looking ahead, we expect banks to remain consistent and maintain the lower and more realistic macro-sensitivity of their expected credit loss calibrations. This will help to increase the relevance of provisions for a longer period of time and avoid unwarranted procyclical effects in the current upswing.

Third, having noticed some undue delays in IFRS 9 stage adjustments in 2020, despite a significant increase in credit risk, we recommended that banks consider a threefold increase in the PD of an obligor as a hard backstop measure to transfer exposures from stage 1 to stage 2. The IFRS 9 benchmarking data for the second half of 2020 show a substantial reduction in the level and dispersion among banks of the share of loans kept in stage 1 despite a tripling of the PD estimates at re-rating. This shows that our recommendation was successfully implemented.

Although this convergence of provisioning practices is a step forward towards implementing IFRS 9, we must not become complacent. For example, we still see a wide variation in stage 3 classifications across banks. Our hypothesis is that this material variability in default classification stems from bank-specific implementations of the definition of default and UTP assessment. And so we will continue to follow up with banks on these issues in the coming year.

Next steps

Looking ahead, you will not be surprised to hear that our main priority for 2022 is for banks to emerge healthy from the pandemic. In order to achieve this, we have formulated several strategic objectives. I will now focus on our objectives and activities in the area of credit risk.

First, the improvement of banks’ credit risk management practices remains key, especially with regard to the timely identification, forward-looking measurement and mitigation of credit risks. This means that Joint Supervisory Teams and/or our on-site banking inspectors will perform follow-up sessions and remediation reviews, particularly in banks that were identified as having weaknesses in these areas as well as in the relevant aspects of the IFRS 9 provisioning framework.

Our second objective is to strengthen banks’ management of exposures to sectors vulnerable to the impact of COVID-19. While the risk of a spike in corporate defaults seems lower on the back of the recovery, banks’ exposures to more indebted companies in vulnerable sectors remain susceptible to asset quality deterioration and losses. This seems particularly relevant to banks’ exposures to the commercial real estate market, which has seen a downturn following a demand shift triggered by the pandemic.

Finally, we are concerned about increasing risks in the market for leveraged loans, which is driven by the search for yield in an environment of sustained low interest rates. Leveraged issuances have continued to increase in Europe and elsewhere, and this has been accompanied by a loosening of lending standards. Our objective is to prevent the build-up of unmitigated risks in this segment, and our activities will include targeted on-site inspections, taking account of underwriting standards, and the management of syndication risk, bank’s risk appetite and capital requirements.

Conclusion

Let me conclude.

All in all, the fears of “cliff effects” coming out of the crisis have not materialised so far. This is of course good news for us as banking supervisors, but it is too early to declare victory. Uncertainty will persist for some time yet, with mixed signals on the potential size and exact timing of the impact of the crisis on banks’ asset quality. In this context, the fourth pandemic wave surging across some euro area countries now raises new uncertainties about additional impact on asset quality.

Almost two years on, we are hopeful that the end of the COVID-19 crisis is coming into sight. At the same time, there may be some delay until the crisis has had its full impact on banks’ exposures. Strong credit risk management practices and discipline in IFRS 9 provisioning approaches therefore remain key to safeguarding the visibility of asset quality on banks’ balance sheets, and this transparency will be critical for supporting the economic recovery.

Európai Központi Bank

Kommunikációs Főigazgatóság

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Németország

- +49 69 1344 7455

- media@ecb.europa.eu

A sokszorosítás a forrás megnevezésével engedélyezett.

Médiakapcsolatok