- THE SUPERVISION BLOG

Charting the course: our supervisory priorities

Blog post by Kerstin af Jochnick, Member of the Supervisory Board of the ECB, and Mario Quagliariello, Director of Supervisory Strategy and Risk

12 December 2022

ECB Banking Supervision has today published the Single Supervisory Mechanism (SSM) supervisory priorities for 2023-2025.

In this blog post, we want to turn a spotlight on some key elements of our revised strategy. The regular revision of our priorities builds on the updated assessment of the main risks and vulnerabilities of the euro area banking sector, the progress made on the priorities endorsed last year and the outcome of the annual Supervisory Review and Evaluation Process (SREP).

The ongoing Russian aggression against Ukraine and its adverse economic and financial impact have led to high uncertainty that calls for extreme prudence and the need for both banks and supervisors to swiftly adapt to a rapidly changing environment. When reviewing the medium-term strategy of ECB Banking Supervision, we tried to strike a balance between two overarching objectives: on the one hand, making the necessary effort to strengthen the resilience of the banking sector to immediate macro-financial and geopolitical shocks, which should be the main priority in the near term; and, on the other hand, ensuring that supervised institutions stay focused on addressing the structural vulnerabilities that were identified last year, because these remain highly relevant in the current context. In the remainder of this blog post, we look first at the situation of the supervised institutions and then we turn to some of the key risks banks are facing along with the main vulnerabilities identified and their implications for our supervisory priorities going forward.

Banks overall are showing sound capital and liquidity positions and performed well during the first half of 2022

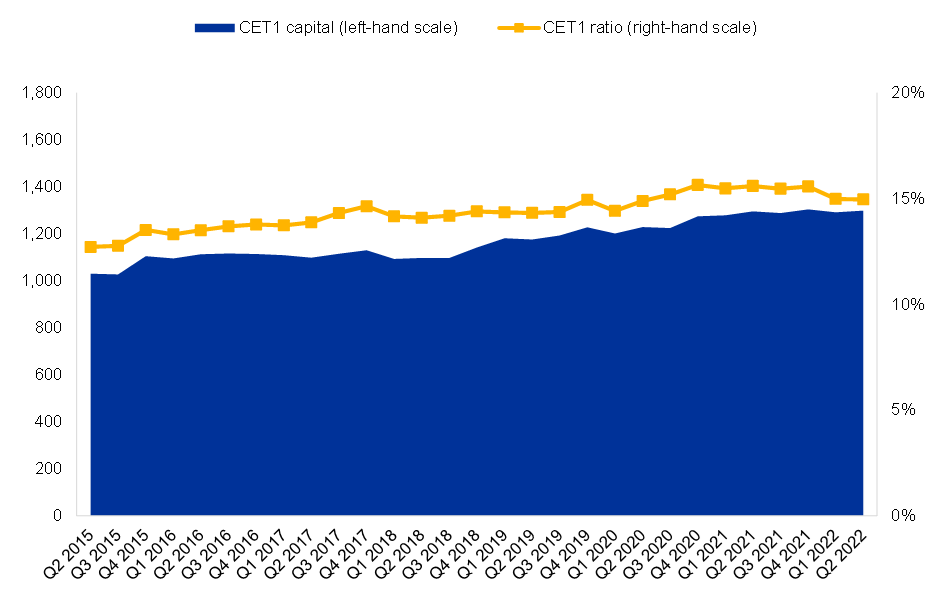

On aggregate, banks under direct ECB supervision remained robust in the first half of 2022. Although the average Common Equity Tier 1 (CET1) ratio has slightly declined since the peak in the third quarter of 2020, to around 15%, it has remained comfortably above the regulatory minimum requirements (Chart 1). The continuation of this trend has also been confirmed by the preliminary data we have received for the third quarter of 2022.

Chart 1

Common Equity Tier 1 (CET1) capital and capital ratios

(left-hand scale: EUR billions; right-hand scale: percentages)

Sources: ECB Supervisory Banking Statistics.

Notes: This chart shows the transitional CET1 ratio. The sample for Q2 2022 comprises 111 SIs. The number of SIs can change from one reference period to another owing to amendments to the list of SIs following assessment by ECB Banking Supervision.

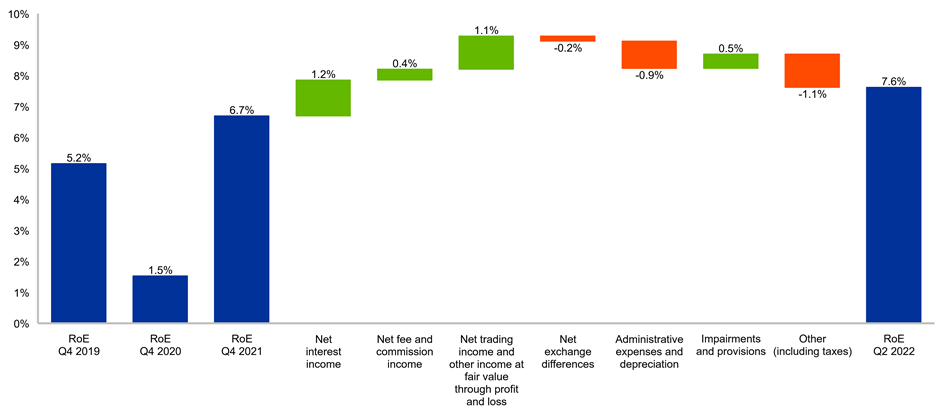

While still insufficient to cover the cost of equity, the profitability of banks continued to improve in the first half of 2022, supported both by the economic rebound following the progressive easing of restrictions related to the coronavirus (COVID-19) pandemic and by the stepwise normalisation of interest rates. In this context, increases in both lending volumes and net interest margins, as well as the partial release of provisions accumulated during the pandemic, led banks to report an aggregate return on equity (RoE) of 7.6% in June 2022 (Chart 2), the highest level since European banking supervision was established. Data from preliminary supervisory reporting also suggest sustained profitability levels in the third quarter of 2022.

Chart 2

Return on equity – annualised decomposition

(percentages)

Sources: ECB Supervisory Banking Statistics.

Notes: The sample for Q2 2022 comprises 111 SIs. The number of SIs can change from one reference period to another owing to amendments to the list of SIs following assessment by ECB Banking Supervision.

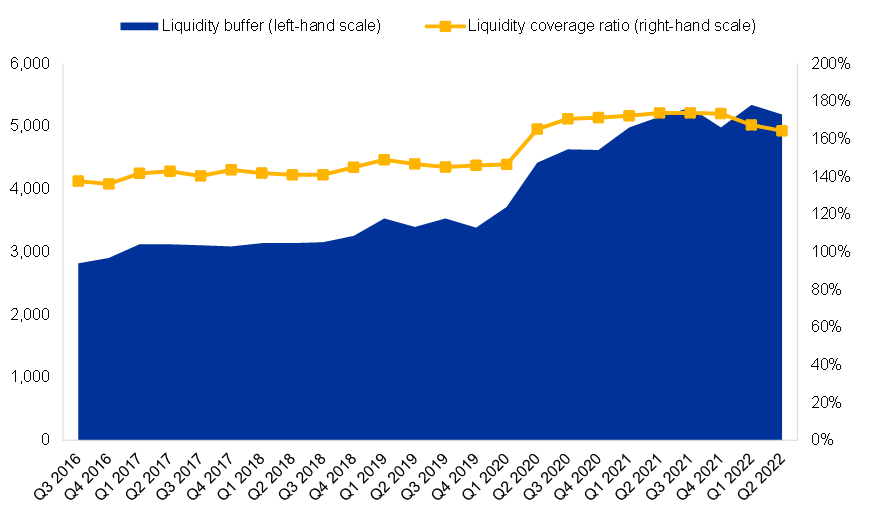

Despite some decrease in aggregate figures observed since the end of 2021, banks also seem well-positioned in terms of liquidity, with an aggregate liquidity coverage ratio (LCR) of around 160% (Chart 3) and a net stable funding ratio (NSFR) of 127%. While these ratios reflect the overall sound resilience of banks, they are partly the result of a prolonged period of extraordinary monetary policy that is now being progressively withdrawn. We must therefore remain cautious of undercurrents: supervisors need to look below the surface to see what might not be immediately apparent.

Chart 3

Liquidity buffer and liquidity coverage ratio

(left-hand scale: EUR billions; right-hand scale: percentages)

Sources: ECB Supervisory Banking Statistics.

Notes: The sample for Q2 2022 comprises 111 SIs. The number of SIs can change from one reference period to another owing to amendments to the list of SIs following assessment by ECB Banking Supervision.

Banks should address immediate risks stemming from the current macroeconomic shocks

While the banking sector has thus far proven to be resilient to the fallout from the war in Ukraine, downside risks have increased as a result. In the near term, we are concerned about the repercussions of the macroeconomic environment and financial market dynamics for asset quality and banks’ funding.

As regards credit risk, volumes of non-performing loans (NPLs) continued to trend down to reach a new low of 1.8% in June 2022, and preliminary supervisory data suggest that this declining trend has also continued in the third quarter. At the same time, higher interest rates and a sluggish or possibly recessionary growth outlook may challenge the debt-servicing capacity of borrowers going forward. This may particularly be the case for highly indebted households and corporates. Since the materialisation of credit losses tends to lag that of market risk losses in an economic downturn, it is important to look beyond the headline downward trend in NPLs for possible early warning signs. In this regard, the ratio of underperforming (stage 2 loans) to total loans increased to 9.7% in June 2022, which was above the peak observed during the pandemic (Chart 4). It currently looks like the share of stage 2 loans has stayed around the same level in the third quarter.

Chart 4

Volumes of stage 2 and stage 3 loans and advances

(EUR billions)

Sources: ECB Supervisory Banking Statistics.

Notes: The sample for Q2 2022 comprises 111 SIs. The number of SIs in the sample can change from one reference period to another owing to amendments to (i) the list of SIs following assessments by ECB Banking Supervision and (ii) banks’ reporting requirements.

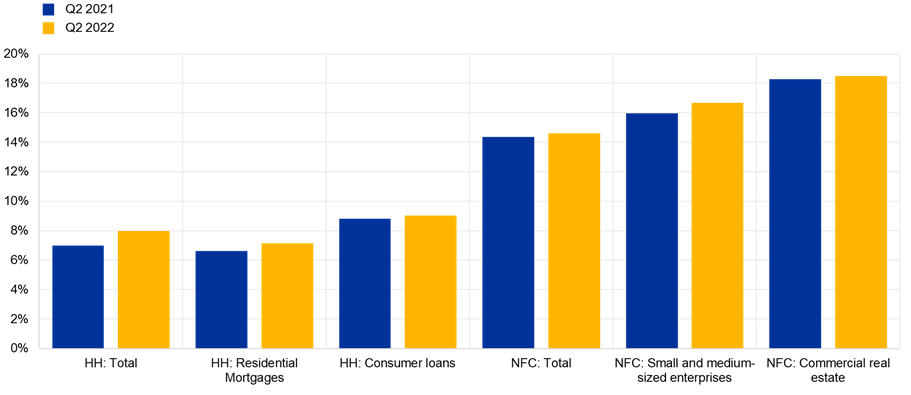

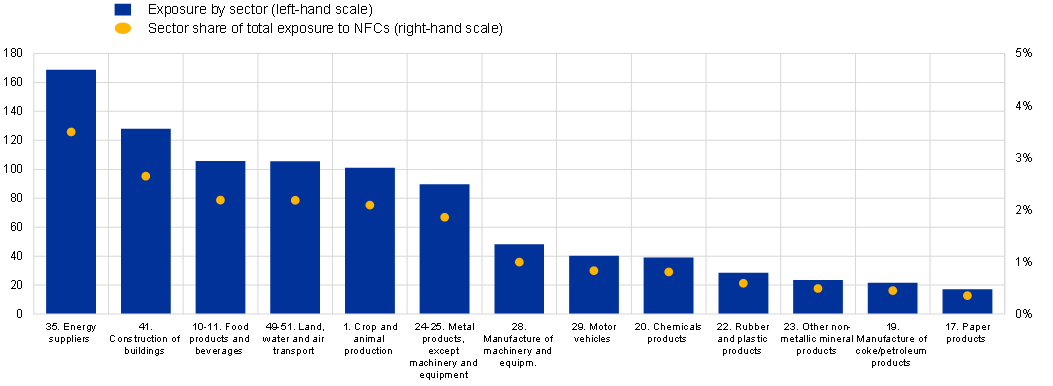

Moreover, while the increase in the share of stage 2 loans has been broad-based among non-financial corporates and households (Chart 5), some counterparties may be more strongly affected than others going forward. This is especially the case for firms that are more sensitive to energy price shocks (Chart 6) and more affected by supply chain disruptions. Not surprisingly, an above-average share of stage 2 exposures has been observed in several corresponding industry sectors. Moreover, surging interest rates and higher construction costs are likely to negatively affect the commercial real estate market, especially the office sector, which is already reeling from the shift in work practices and search for quality arising from the pandemic.

Chart 5

Share of stage 2 loans in loans to households (HHs) and non-financial corporations (NFCs)

(percentages)

Sources: ECB and ECB calculations.

Notes: The sample for Q2 2022 comprises 111 SIs. The number of SIs in the sample can change from one reference period to another owing to amendments to (i) the list of SIs following assessments by ECB Banking Supervision and (ii) banks’ reporting requirements.

Chart 6

Exposure to sectors identified as vulnerable to the current energy price shock

(left-hand scale: EUR billions; right-hand scale: percentages; Q2 2022)

Sources: ECB and ECB calculations.

Note: The sample comprises credit institutions reporting the selected data points to AnaCredit as at June 2022.

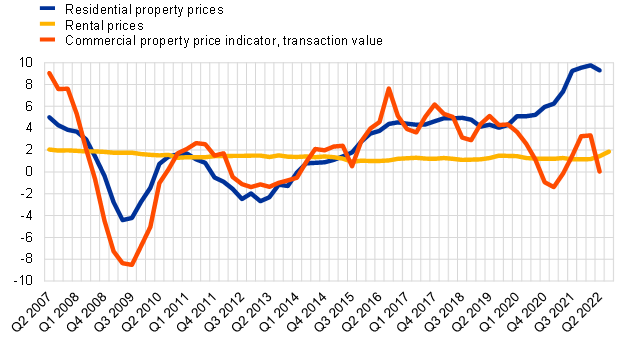

The increase in the cost of living is also affecting the retail sector and especially lower-income households, which spend a larger portion of their income on energy and food. In fact, banks’ consumer loan portfolios are already experiencing a surge in delinquency rates. Moreover, with rising interest rates, homeowners may also find it more difficult to service their debt, especially those with variable rate mortgages. This renders banks vulnerable to a sharp correction in some property markets, especially the residential real estate segment, given the price dynamics observed in recent years (Chart 7).

Chart 7

Developments in euro area real estate prices

(year-on-year growth, percentages)

Sources: ECB and ECB calculations.

Note: Latest observations: Q2 2022 for residential property prices and the commercial property price indicator; Q3 2022 for rental prices.

The potential materialisation of credit risk going forward implies that banks’ credit risk management frameworks will remain key to safeguarding resilience in this domain. Compared to our priorities in the wake of the Great Financial Crisis, we shifted the focus from quantitative targets in terms of the reduction of non-performing legacy assets to the effectiveness of banks’ governance and risk management. The supervisory work programme developed last year, which aims to tackle deficiencies in banks’ credit risk management frameworks, thus remains suitable in our view to address the challenges stemming from the current environment. In this context, we will continue to engage with banks under our supervision to ensure that such deficiencies are remedied and gaps vis-à-vis our supervisory expectations are addressed. We will also scrutinise banks’ loan origination and monitoring practices, focusing in particular on their residential real estate portfolios, and initiate targeted reviews of the IFRS 9 provisioning framework to ensure fair and timely recognition of expected credit losses in banks’ balance sheets. Finally, we will also look closely at banks’ management of their exposures to sectors more vulnerable to the current macro-financial environment and conduct, for example, targeted on-site inspections on exposures to energy and commodity traders.

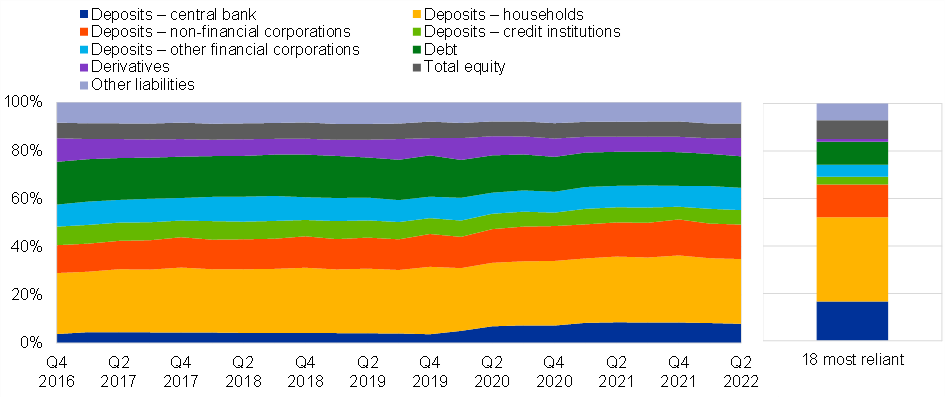

Another area which will require greater supervisory focus going forward is funding risk. This has risen to the forefront of our near-term agenda in the light of the sharp turning of the interest rate cycle. The exceptional monetary policy measures introduced during the pandemic provided banks with abundant liquidity at reduced costs. During this period, banks increased their relative reliance on central bank funding at the expense of wholesale funding (Chart 8). In particular, banks accessed exceptional amounts of funding through the third series of targeted longer-term refinancing operations (TLTRO III) during this period.

Chart 8

Banks’ funding structure (left panel) and breakdown for banks most reliant on central bank funding (right panel)

(percentages)

Sources: ECB and ECB calculations.

Notes: The number of SIs can change from one reference period to another owing to amendments to the list of SIs following assessments by ECB Banking Supervision. The category “other liabilities” includes other liabilities, provisions, deposits from general government and deposits from NFCs. Data on the 18 SIs most reliant on central bank funding refer to Q2 2022.

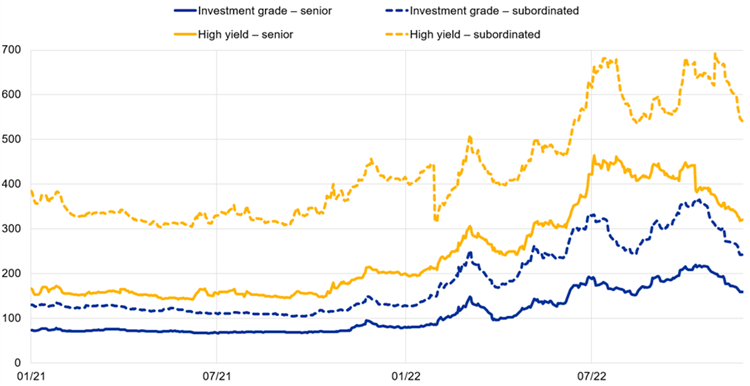

However, the sharp increase in inflation observed since the outbreak of the war in Ukraine, and the subsequent tightening of monetary policies in advanced economies, marked the end of the “lower for longer” era. The direct consequence for banks has been an increase in central bank funding costs (including as a result of adjustments to the terms of TLTRO III) and wider spreads in wholesale markets (Chart 9). While interest rates may increase further, the provision of extraordinary central bank liquidity will gradually be phased out. TLTRO III funds, in particular, will have to be repaid by the end of 2024 at the latest. Looking ahead, banks may thus face funding challenges when returning to more wholesale sources of funding at a time when these are becoming more expensive and investors’ risk appetite has decreased. This may also have an impact on banks’ profitability and their ability to maintain their current liquidity and funding ratios.

Chart 9

Option-adjusted spreads on financial institutions’ debt instruments

(basis points)

Sources: Markit iBoxx via the ECB’s Statistical Data Warehouse.

Note: Option-adjusted spreads on subordinated/senior debt instruments of financial institutions in the euro area.

Our work to better understand the risks which banks may face in this domain has already started, with an assessment of banks’ positioning for an increase in interest rates and of their risk management practices in relation to interest rate and credit spread risks. In the coming months, we will strengthen our engagement with a number of banks which have more vulnerable funding structures and/or weaker liquidity and funding risk management practices. We are also planning to examine banks’ exit strategies from TLTRO funding, as well as their liquidity and funding planning more broadly, with a view to identifying potential shortcomings in this area.

Banks should strengthen their efforts to tackle structural vulnerabilities

In the medium term, banks should be cognisant of the need to tackle other important challenges beyond those posed by the current high-inflation environment. IT security/cyber risk and climate-related and environmental risk stand out among these, and will continue to feature among our supervisory priorities.

Concerning the former, the digital transformation taking place in the banking sector and the increased reliance on new technologies and third-party service providers have increased complexity and interconnectivity within the financial system. Cyberattacks in particular have become a major challenge to banks’ operational resilience in recent years, being especially difficult to handle both because of the growing complexity and fast-changing nature of the related threats and because of their cross-border dimension.

The current geopolitical situation is posing new challenges in this regard. While the threat of massive cyberattacks on the European banking sector in response to the sanctions imposed by the European Union and other advanced economies on Russia has not yet materialised, the number of cyber incidents reported by supervised institutions has been following a rising trend in 2022 (Chart 10). However, the total number of reported cyber incidents seems relatively stable, and similar to the level observed in 2021, and their actual impact has been contained so far.

Chart 10

Cyber incidents reported to the ECB by quarter

(units)

Source: ECB cyber incident reporting framework.

This calls for extreme prudence and enhanced monitoring both by banks and by supervisors. We will keep engaging closely and in a targeted manner with banks, through dedicated horizontal reviews and on-site inspections, with the objective of strengthening their IT security and cyber resilience frameworks.

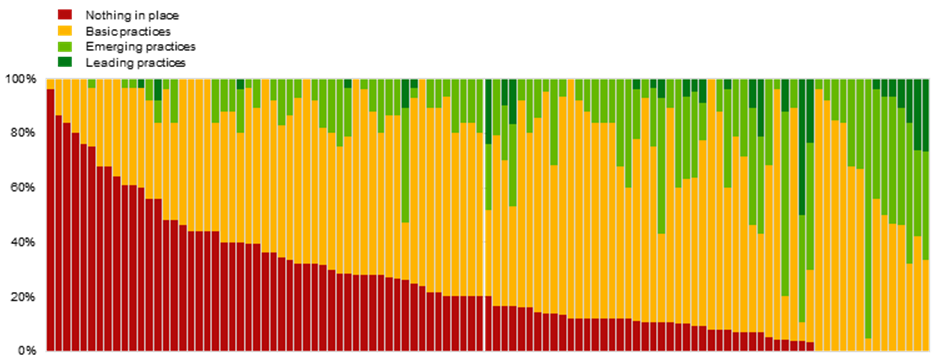

Concerning climate-related and environmental risk, this has become a key pillar of ECB Banking Supervision’s strategy and now forms an integral part of the SREP and our ongoing dialogue with supervised institutions. We conducted our very first climate stress test this year, together with a thematic review of climate-related and environmental risks.[1] Both exercises revealed that, despite all the progress banks have made, material gaps remain vis-à-vis our supervisory expectations (Chart 11).

Chart 11

Bank-by-bank results of the 2022 thematic review

(gaps vis-à-vis supervisory expectations by institution, percentages)

Sources: ECB and ECB calculations.

Note: Supervisory assessment of 107 significant institutions’ responses to the 2022 thematic review on climate-related and environmental risks.

By the end of 2024 we expect supervised banks to be fully aligned with our expectations on these risks. To this end, several supervisory activities will be conducted to ensure that steady progress is achieved by banks on this front.

Sound internal governance and effective strategic steering are the key elements to ensure that banks can adjust to the growing challenges in a sustainable manner. Therefore, addressing deficiencies in the functioning, oversight and composition of banks’ management bodies remains on our list of priorities. We have noted the progress made by banks this year in improving their gender diversity policies and will continue our engagement to address remaining deficiencies related to the functioning of management bodies. Supervisors will also follow up on tackling persistent deficiencies identified in the area of risk data aggregation and reporting, which is also crucial for effective steering and sound decision-making.

We stand ready to adapt our priorities in line with the evolving risk landscape

While the main indicators suggest that the banking sector continues to be healthy and resilient overall, banks should remain prudent and attentive to the particular combination of risks currently stemming from macro-financial and geopolitical shocks and should devote all the necessary efforts to proactively identifying, monitoring and mitigating such risks. This should be their main priority in the near term, and it will be ours.

It would be short-sighted to focus only on what lies directly ahead of us. We also need to keep the medium-term horizon on our radar, giving appropriate attention to the major shifts generated by the ongoing digitalisation of banking services and by climate change. In particular, banks need to adapt to current trends in consumer preferences for digital banking channels and growing competition from new entrants to financial markets to ensure the sustainability of their business models in the years to come. The increasingly visible adverse impacts of climate change and the acceleration of the climate transition agenda require banks to step up their efforts in adapting their business strategies and risk management frameworks, also aligning them with supervisory expectations. At the same time, banks should not lose sight of long-standing deficiencies, such as governance-related issues, and we will consistently push for change in the areas we have prioritised.

To conclude, prudence and staying alert to a rapidly changing environment are essential in the current uncertain economic and geopolitical context. As the macro-financial situation is evolving fast, we will remain vigilant and stand ready to adapt our priorities whenever the environment in which banks operate requires it. We will also continue engaging effectively with banks that show material deficiencies, and follow up with decisive measures wherever those deficiencies are not sufficiently addressed.

See “2022 climate risk stress test”, ECB Banking Supervision, July 2022; and “Walking the talk – Banks gearing up to manage risks from climate change and environmental degradation”, ECB Banking Supervision, November 2022.