- SPEECH

Exogenous shocks and endogenous challenges: five years of European banking supervision (and beyond)

Speech by Andrea Enria, Chair of the Supervisory Board of the ECB, at the London School of Economics, Financial Markets Group

London, 30 October 2023

Introduction

Thank you for inviting me to speak today at the LSE’s Financial Markets Group. I will look back on and assess my five years at the helm of European banking supervision now that my mandate is about to come to an end.

We would all probably agree that the past five years have not been easy. But they have not been boring either. Indeed, if you allow me to invoke the ironic expression “may you live in interesting times” retroactively, we have been through an extremely interesting period, full of unexpected events that we could well have done without.

I will start by explaining how we brought the Single Supervisory Mechanism (SSM) to the next stage of its development after a successful start-up phase.

The events that shaped the SSM’s trajectory include the exogenous shocks of the past five years – a pandemic, a war at the borders of the European Union, and an unexpected flare in inflation with a fast exit from a low interest rate environment.

But I will also touch upon the endogenous challenges we still face: making our supervision more effective in repairing banks’ governance, business models and internal controls, while respecting the private nature of the banking business; and supervising a banking sector segmented along national lines, while the banking union remains incomplete, with the political discussions on its institutional framework hampered by a lack of urgency and red lines set by individual Member States.

Moving out of the SSM’s start-up phase

European banking supervision celebrates its tenth anniversary next year. But the political decision leading to the centralisation of prudential supervision at the ECB dates back to 2012, during the sovereign debt crisis in the euro area.[1]

In the early summer of that year, we were undergoing an existential crisis for the euro area and the European banking sector.

The close interconnection between the banking sector and its sovereign, the infamous doom loop, was threatening the fiscal viability of some Member States and the stability of their banking sectors. The damage to banks’ lending activities was having a serious adverse impact on the euro area’s recovery following the great financial crisis, leading to a painful double-dip recession.

To deepen our understanding of the root causes of these developments and the rationale for establishing a banking union, I would like to recall a seminal lecture by Tommaso Padoa-Schioppa given here at the Financial Markets Group almost 25 years ago.[2]

The main thrust of Padoa-Schioppa’s analysis was that, before the creation of the single European currency, the jurisdiction of monetary policy and that of banking supervision had never been separated.

But he argued that this unprecedented institutional set-up could still work, and also effectively manage financial crises, provided that “…cooperation among banking supervisors, which is largely voluntary but which finds no obstacles in existing Directives or in the Treaty, will allow a sort of euro area collective supervisor to emerge that can act as effectively as if there were a single supervisor”.

Alas, far from taking this area-wide perspective, when the Lehman crisis affected the European markets, national authorities took a “chacun pour soi” attitude, as aptly characterised by Jacques de Larosière in his report on the financial crisis[3]: ring-fencing behaviour at the national level deepened the impact of the crisis; well-integrated pan-European banking groups had to be split along national lines, with massive destruction of value, to enable local crisis management tools and backstop measures to be activated; and national budgets were burdened with very expensive bailout packages to prevent the meltdown of the domestic banking sectors.

Those difficult times, and the political debates that culminated in centralising supervision at the European level, influenced the SSM’s agenda during its start-up phase and the five years of my mandate.

In fact, while the decision to set up a single European supervisor at the ECB was broadly shared as a response to the failure of the previous institutional set-up to deal with the twin crises – the great financial crisis and the sovereign debt crisis –, establishing the other components of the European safety net has proven far more controversial politically.

Setting up guarantees to finance resolution processes, especially the provision of central bank liquidity after resolution, and establishing a European deposit insurance scheme are still proving elusive because some finance ministers are reluctant to provide fiscal facilities that could be used to backstop banks in other Member States.

But from day one it was crystal clear that a key condition for moving towards completion of the banking union was to successfully repair banks’ balance sheets, bringing all European banks to a comparable level in terms of capital adequacy and, especially, asset quality.

Responsibility for cleaning up banks’ balance sheets from the heavy legacy of non-performing loans (NPLs) inherited from the crisis lay squarely with the SSM. This essential first step for a successful banking union was a key focus during its start-up phase and was still a priority when I became Chair of the ECB’s Supervisory Board in 2019.[4]

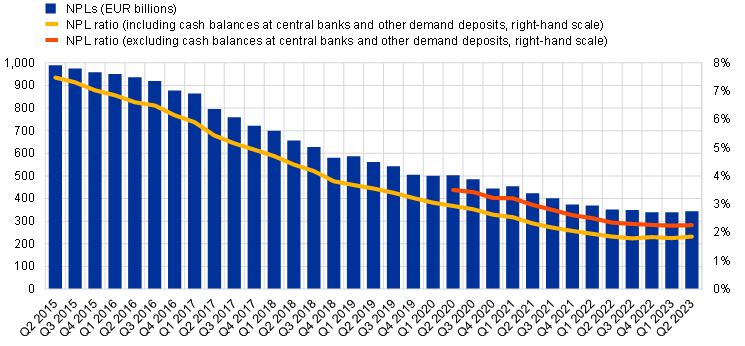

Looking at the euro area banking sector today, we may argue that the mission of repairing banks’ balance sheets has been fundamentally accomplished. At the start of banking union, NPLs in the euro area banking sector amounted to more than €1 trillion, for a total share of NPLs on banks’ balance sheets of 8%, compared with less than €340 billion and 1.8% respectively for the second quarter of 2023.

Although we don’t have harmonised data series going back to the period before the great financial crisis, I think this is likely to be one the lowest NPL ratios ever recorded in the countries participating in the banking union.

The ECB Guidance setting out supervisory expectations for the coverage of legacy NPLs[5] played a major role in cleaning up banks’ balance sheets. It clearly stated that any shortfall in provisioning would trigger a specific capital add-on, always taking into account bank-specific circumstances in line with our supervisory mandate.

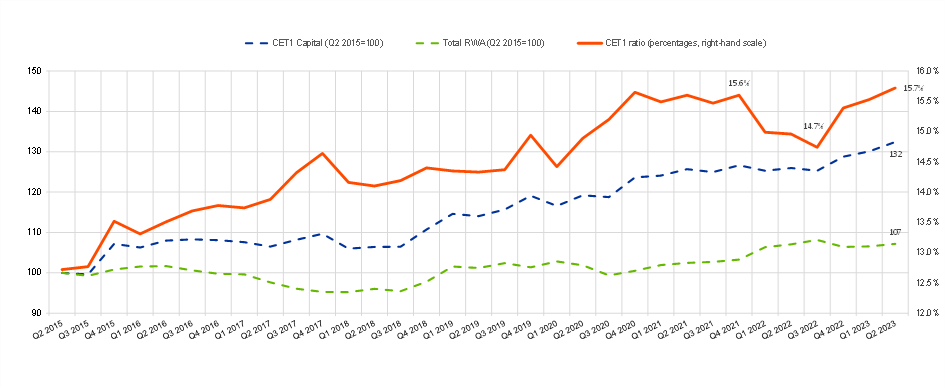

Other traditional indicators of balance sheet strength, such as capital and liquidity ratios, signal that the long journey to address the heavy legacy of the financial and sovereign debt crises is nearing an end. Common Equity Tier 1 (CET1) ratios are at historic highs (15.7%).

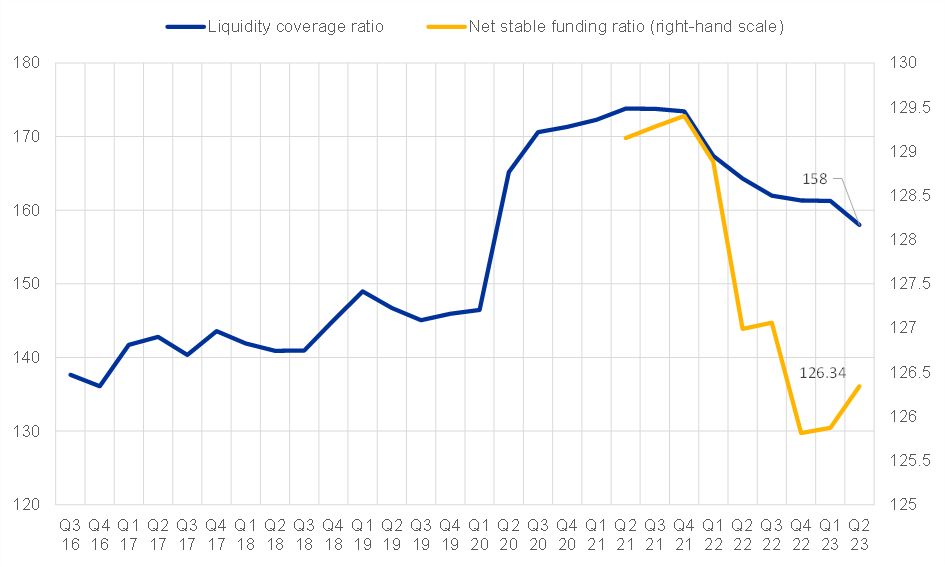

Meanwhile, liquidity ratios remain well above minimum regulatory requirements, despite the recent drop that occurred in tandem with the smooth reimbursement of extraordinary central bank facilities (targeted longer-term refinancing operations) and the normalisation of monetary policy.

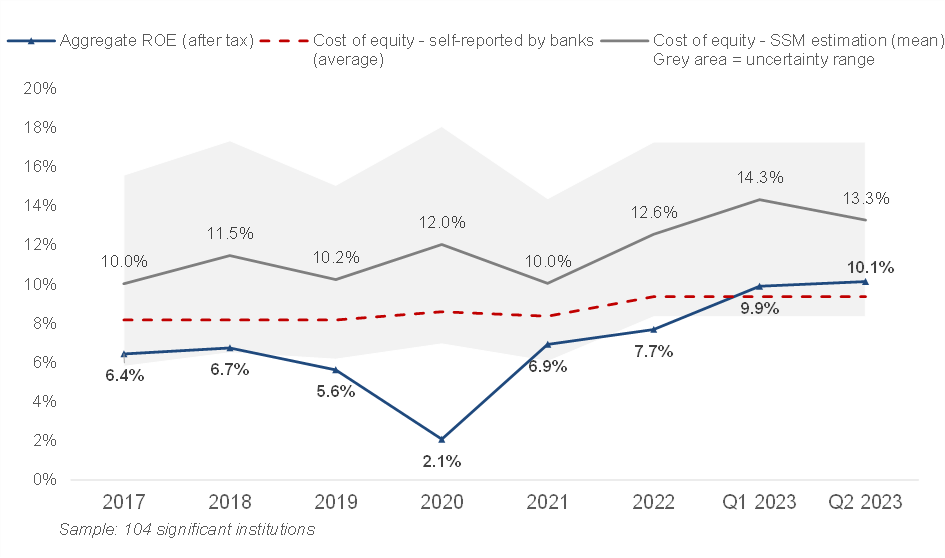

Bank profitability has also markedly improved recently on the back of the rapid exit from the low interest rate environment, which has supported an increase in net interest income and return on equity to levels not seen in a long time.

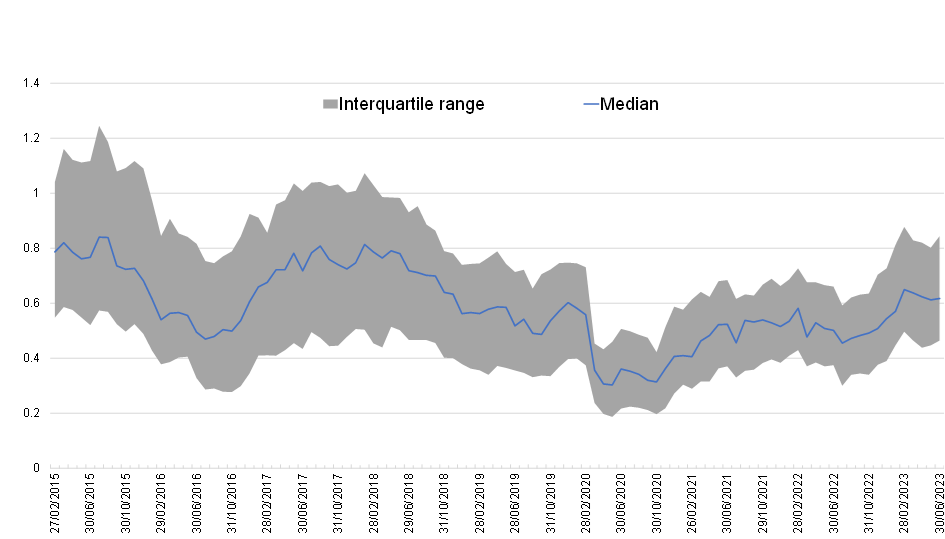

Chart 4

Profitability: return on equity vs cost of equity

Source: Supervisory Banking Statistics and internal calculations.

Notes: Weighted average. Sample selection follows the Supervisory Banking Statistics methodological note. Cost of equity as self-reported by significant institutions. Due to data availability constraints, the sample for cost of equity comprises a lower number of entities than the sample for return on equity. Average expected cost of equity in 2022 is based on 93 entities.

A sustainable, recurrent stream of profits is essential to withstand shocks, but also to attract equity investors and enable banks to tap capital markets if necessary. The legacy of the twin crises is still difficult to shake off here, as investors have yet to be convinced of the longer-term sustainability of European banks’ profitability and are still applying a steep discount to equity valuations.

Chart 5

Profitability: Price-to-book ratio for publicly listed significant institutions

Source: ECB calculations.

So, I believe we have made remarkable progress in repairing banks’ balance sheets since the start of the banking union. While there is no room for complacency − as banks are still operating in a heightened risk environment − this is nonetheless a sound achievement.

The second challenge in exiting the start-up phase of the SSM and moving towards a more mature organisation related to the supervisory culture. In a nutshell, I would define it as a transition from a highly codified, procedure-heavy approach towards a more risk-focused, judgement-based, agile and nimble supervision.

The gravity of the situation back in 2012 led to an extraordinarily swift implementation of the political decision to entrust the ECB with direct supervisory responsibilities. The enactment of the SSM’s founding regulation was probably one of the fastest legislative procedures in the whole history of the European Community and the European Union, especially for a project of that magnitude.

Considering that the euro area banking sector is the largest in the world in terms of assets,[6] the sheer complexity of establishing a centralised EU framework for prudential supervision should not be underestimated. In fact, it was the first time that a European institution was entrusted with exclusive administrative powers in an EU shared competence, the internal market for the banking sector.

The urgency to set up a new centralised prudential supervisory authority inevitably resulted in heavily codified methodologies and procedures. These were needed to support a working model which relied significantly on the active collaboration of staff from all the national supervisory authorities of the participating Member States. Harmonising the different supervisory practices of these authorities was a huge effort.

When you bring together 19 national supervisory cultures[7] you need to codify your supervisory approach as much as possible in order to guarantee trust, equal treatment and a level playing field.

This was particularly apparent in our Supervisory Review and Evaluation Process (SREP), which was extremely rigid and codified at the outset and gave our supervisory teams little room for applying discretion in individual circumstances. In many cases, this heavily constrained approach led to criticisms – from both banks and investors − of inflexibility and lack of transparency. As it was very difficult to tailor the methodology to banks’ individual circumstances, it was not always easy to explain the risk drivers behind a particular supervisory decision, for example a specific capital add-on.

However, this hard-wired approach, strongly focused on capital requirements and the need to converge towards common yardsticks, was essential to resolutely drive the repair of banks’ balance sheets across the banking union. And as I said earlier, it proved very successful. Still, as the group of international supervisory experts[8] who we mandated to conduct an independent review of our supervisory process noted, “…what got you here is not necessarily going to get you there”.[9] Our supervision needs to evolve and improve.

On joining the ECB, I was confronted with two types of negative feedback on our supervisory processes. One came from our staff, at the ECB and in national competent authorities; the other from the banks under our supervision.

Our staff complained of being bogged down in burdensome, box-ticking processes and not having enough time to focus on the actual risks facing the banks under their direct responsibility. They called for a more risk-focused approach, clearly aimed at tackling identified priorities.

Meanwhile, the banking industry called for more transparency, clarity and predictability from the supervisor. Banks objected to being sent a large number of recommendations, without a clear indication of what they should prioritise in order to improve their scores and capital requirements.

Over the past few years, we have made some progress in changing our supervisory culture and our internal organisational set-up.

We revised our process for setting supervisory priorities and developed a risk tolerance framework that enables supervisory teams to adapt those priorities to the specific situation of the banks under their direct supervision. Supervisors are thus able to focus their time and resources on the specific risks that matter most in their case.

And the development of a multi-year SREP allows our supervisory teams to concentrate on the most urgent issues in any given year rather than having to cover everything each year.

While empowering our supervisors by giving them more discretion, we have also established an internal second line of defence responsible for carrying out a rigorous benchmarking of the supervisory decisions and ensuring the consistency of supervisory outcomes. The intent is to leave more leeway for supervisory judgment, achieving consistency through independent internal checks rather than methodological constraints embedded in our manuals.

This effort to make our supervisory interventions more targeted is also reflected in our communication towards the banks. We now send “executive” letters indicating the issues on which they should focus their remediation efforts in order to improve their scores and reduce their supervisory capital add-ons.

We also genuinely tried to enhance the transparency of our supervisory approach and actions. In early 2020, we published, for the first time, all the Pillar 2 capital requirements of significant credit institutions, allowing market participants to have a better understanding of our assessment of individual banks. We also published our methodology for setting the Pillar 2 capital buffers (known as the Pillar 2 Guidance, or P2G) for individual banks, which, together with the disclosure of the stress tests results, should provide analysts and market participants with a comprehensive overview of the additional capital we expect banks to maintain to protect themselves from adverse macroeconomic and financial developments.

And we have also disclosed more of our SREP methodology and published documents providing details of our supervisory approaches in areas such as internal models, mergers and acquisitions, qualified holdings, leveraged transactions, counterparty credit risk and fit and proper assessments, to quote just a few.

We have done our best to preserve the confidentiality of some aspects of our methodologies, while providing supervised entities, analysts and market participants with sufficient information to better understand how our supervisory processes work and better anticipate our actions.

But while we were busy planning and implementing our organisational transformation, I would have never imagined that the trajectory of the SSM, and therefore our way of meeting those challenges, would be so severely affected by an extraordinary sequence of exogenous shocks. It was the reaction to those shocks that framed the SSM’s path towards a more mature organisation.

Exogenous shocks: Brexit, pandemic, war and inflation

In early 2019 we experienced an exogenous shock that we had been expecting and preparing for: Brexit. The ECB had already framed its policy of “no-empty shells” to deal with the relocation of global banks’ business from London to the euro area.[10] While flexible in applying this principle, the ECB has always been adamant that it would not allow banks to be set up within the banking union if they had no real strategic and risk management capabilities, relying only on the direct and exclusive steer of their parent companies in the United Kingdom or elsewhere.

In implementing this basic prudential principle, I have always been highly aware of the risk of taking an excessively territorial approach to supervision within the SSM. We needed to acknowledge that international subsidiaries are part of a larger economic entity and that good collaboration between supervisors is essential for effectively supervising international groups; trying to segment risks along national borders and ring-fencing local establishments would be a shortcut to nowhere.

We then began to focus on material risks that were taken in our jurisdiction and required adequate local risk management and strategic capabilities. To that end, we have always cooperated closely with our fellow supervisors, in particular the Bank of England and the US Federal Reserve. We have always sought to avoid conflicting messages and requirements for globally active banks. I believe that our desk-mapping review[11] strengthened the SSM’s reputation as an internationally open and collaborative supervisor.

The first unexpected exogenous shock was the COVID-19 pandemic. And what a shock it was, in every sense.

First of all, policymakers were facing an unprecedented level of uncertainty at the time, particularly regarding the economic outlook across the EU.

This was an event of incomparable magnitude, considering especially the lockdowns and other extraordinary measures necessary to preserve public health. As nobody knew when the first vaccines would be available and how effective they would be, it was impossible to estimate how long the shock would persist.

The first macroeconomic projections after the start of the pandemic forecast a contraction of euro area GDP for 2020 of 8.7% in the baseline scenario and 12.6% in a plausible severe scenario.[12]

On introducing adverse scenarios into our models to predict the likely deterioration in asset quality, we concluded that there was a tangible probability of all the progress over the preceding years being reversed, bringing the amount of NPLs back to the levels seen after the financial and sovereign debt crises.

Our main concern was the inherent tendency of the banking sector to act as a shock amplifier, with a knee-jerk increase in risk aversion by banks leading to a deeper and more prolonged recession.

The large and coordinated stimulus provided by fiscal and monetary authorities managed to steer the euro area economy through the pandemic virtually unscathed. Indeed, since the pandemic struck, we have been witnessing the lowest levels of corporate defaults on record in European peacetime history. But I think that the prompt reaction of the SSM was also instrumental in smoothing out the shock and supporting lending to our economy at a time of heightened uncertainty.

Starting with our first policy initiatives in March 2020[13], we encouraged banks to use all their available capital and liquidity buffers, including the Pillar 2 Guidance, in order to keep the credit channels to the real economy open. And we also advised national macroprudential authorities to release the countercyclical capital buffers and other national buffers.[14]

And the quantitative relief came in tandem with significant operational relief, since we postponed by six months the existing deadlines for remedial actions in the context of on-site inspections, Targeted Review of Internal Models (TRIM) investigations and internal model investigations. New decisions on the outcome of such supervisory activities were also postponed for six months. And we paused our regular cycle for the SREP, by adopting what we dubbed a pragmatic SREP, which essentially involved replicating the outcomes of the 2019 cycle for 2020. We also announced that we would be fully flexible in assessing individual banks’ ongoing NPL reduction strategies, taking into account that the crisis was likely to impair the banks’ ability to dispose of deteriorated assets through market transactions.[15]

But while we were providing banks with as much supervisory flexibility as possible and encouraging them to use all available prudential buffers, we also took action to protect their capital positions. Considering the extremely uncertain macroeconomic and financial environment, we recommended[16] that banks temporarily refrain from distributions to shareholders in order to bolster their capital positions and withstand the potential impact of the shock.

Some investors reacted to this measure with dismay. This was despite the fact that banks in other key jurisdictions – no doubt under pressure from their own supervisors – had also committed to postponing or significantly reducing their distributions. So, it appears to be more difficult to use moral suasion in a multi-country jurisdiction such as the banking union.

In line with our commitment, we phased out our recommendation in September 2021 and banks caught up with extraordinary dividend payments and share buy-backs. As supervisors, meanwhile, we returned to our business-as-usual scrutiny of the feasibility of individual banks’ distribution plans.

And I believe that our decision and its overall objective have been validated by various analyses that have shown how our recommendation strengthened banks’ lending capacity, especially for those banks that had limited capital buffers above the trigger for the maximum distributable amount.[17]

Another important component of our supervisory response to the pandemic was our focus on internal credit risk controls together with our increased use of sectoral analyses. As the government support measures – including payment moratoria – reduced visibility on risk levels, we sent two rounds of Dear CEO letters, asking the banks to strengthen their credit risk controls to ensure that they were able to identify early signs of deterioration in the credit standing of their borrowers and take early remedial actions. We also started to perform very granular analysis of exposures to sectors that had been hit particularly hard by the pandemic restrictions, and this granular analysis of specific sectors is now standard practice in our supervision.

But just as we were emerging from the worst of the pandemic, we were faced with a second unexpected exogenous shock at the end of February 2022, when Russia launched its invasion of Ukraine.

This shock was similar in nature to the pandemic but very different in terms of how it unfolded.[18] In the early days of the invasion, it was probably reasonable to expect that the European banking system would only be affected through the direct channel of credit exposures to the Russian and Ukrainian economies. We immediately assessed these exposures as being very limited in relative terms.

But it soon became clear that the geopolitical tensions in the area would spill over into an energy shock with a significant impact on economic growth and inflation, also due to the rapid increase in food and commodity prices. This ruled out a repeat of the sizeable monetary and fiscal stimulus that had played a significant role, alongside our supervisory actions, in mitigating the negative impact of the pandemic on banks’ balance sheets and the wider economy.

We shifted the focus of our sectoral analyses onto the borrowers that were most sensitive to energy prices, such as those in the manufacturing and shipping sectors. And we paid particular attention to commodity trading - a very opaque segment of financial activity, with a few firms operating with high leverage - and to margin calls, for example on energy derivatives.

We made cyber risk a higher supervisory priority, as state-sponsored attacks became more likely in the new geopolitical reality. And we put greater pressure on relevant European banks with subsidiaries in Russia to significantly downsize and exit the country, as it became increasingly difficult – if not almost impossible – for banks with significant operations in Russia to steer the business and monitor the transactions carried out by their banking subsidiaries there. This lack of visibility exposes them to the risk of contravening the international sanctions imposed on Russian natural and legal persons and to significant reputational risk.

The combination of the fast recovery from the pandemic shock and the Russian invasion of Ukraine triggered an unexpected spike in inflation, followed by a tightening of monetary policy at an unprecedented pace.

The rapid exit from the low interest rate environment was good news for banks, as net interest margins typically widen during a hiking cycle. And after years of negative interest rate policy, the pass-through of higher interest rates to depositors was slower than in previous cycles, with lending continuing to grow for a while owing to the typical lags in the transmission of monetary policy.

Yet when inflation started to rise in the second half of 2021, it was already clear to us that our supervisory focus should shift towards interest rate and credit spread risks. Liquidity and funding risk also moved up our list of supervisory priorities as extraordinary central banking facilities started to be scaled back and the higher interest rate environment started to affect funding costs.

The banking market turmoil in the Spring of 2023, triggered by crises at a few US regional banks and the crisis at Credit Suisse, was a new chapter in this upsetting series of events. The rapid shift in interest rates caught some banks off guard owing to weaknesses in their business models and poor management of interest rate risk in the banking book.

In the United States, unrealised losses on securities portfolios held at book value prompted massive – and very fast – outflows of uninsured deposits. This unsettled banking markets across several jurisdictions. Investors started hunting for the next weak link, looking at banks on a mark-to-market basis and focusing their attention on firms whose business models were not very sustainable.

European banks managed to navigate this turmoil unscathed, thanks to their well-diversified funding structures, the progress made in refocusing their business models and improving their profitability, and the scrutiny of our supervisors since the first signs of inflationary pressures. That said, this was also an important reminder for European banks and authorities alike, including us at the ECB, of the importance of good bank governance, effective internal controls and impactful supervision – a topic I will come back to shortly.

Endogenous challenges: supervisory effectiveness and the lack of cross-border integration in an incomplete banking union

Let me now turn to what I think we could call endogenous challenges for European banking supervision.

The first challenge has been clearly recognised and discussed relatively recently. It is not limited to European supervision, but rather affects the whole global supervisory community. It is the challenge of supervisory effectiveness.

Supervisory effectiveness can be described as the supervisory authority’s ability to ensure that banks take prompt and effective remedial action against any deficiencies that have been identified. Some important assessments in the immediate aftermath of the great financial crisis briefly alluded to this[19], but it was then neglected in the reform agenda that followed.

In fact, the focus of attention was almost exclusively on reinforcing the existing quantitative prudential requirements (for capital) or introducing new requirements (for leverage and liquidity). Little attention was given to the “qualitative” elements of supervision in areas, such as governance, internal controls and business model analysis, that no single regulatory measure can easily capture.

In the end, this attitude has also weakened the effectiveness and reliability of quantitative requirements, as the fact that a bank meets such requirements does not guarantee its viability. Credit Suisse’s demise is a case in point.

My colleagues at the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) clearly highlighted this challenge in their candid reports[20] on the lessons learned from the crises at Silicon Valley Bank and Signature Bank, which triggered the turmoil in banking markets. The Federal Reserve acknowledged that its supervisors failed to escalate actions despite the growing evidence of weaknesses at the banks.

Similarly, a report by a group of independent international experts[21] recommended that the ECB should establish more timely and forceful escalation processes to ensure that qualitative supervisory measures are followed up on effectively. The Basel Committee on Banking Supervision’s report on the 2023 banking turmoil[22] and an IMF paper on good supervision[23] also highlighted the need to focus on supervisory effectiveness.

Why is this seemingly self-evident fact – that supervision should be effective – so relevant? As I said, European banking supervision has been particularly effective in several quantitative areas, achieving major progress in cleaning up the balance sheets of European banks.

But in other areas – such as bank governance, internal controls and business model sustainability – achieving measurable progress has been much more difficult. These areas are subject to the largest number of supervisory findings in our SREP and many of our recommendations remain open for a relatively long time, without the underlying issues being remediated in a satisfactory way

It isn’t always easy for supervisors to escalate these issues, as they could be accused of intruding in areas, such as board dynamics or choices related to their business mix, which should remain the responsibility of banks’ boards and management bodies. But a failure to tackle weaknesses that have been identified could lead to existential threats for banks, as we saw at Credit Suisse and some US regional banks in the Spring of 2023.

Our track record at the ECB is mixed: we have had some success in driving effective remediation and changes in internal governance, but in some cases, progress has been disappointingly slow.

I understand that the issue of supervisory effectiveness might not resonate with an academic audience, as it doesn’t lend itself particularly well to quantitative analyses or sharp theoretical discussions.

Academic analysis tends to focus more on regulatory solutions, setting out the incentives for and constraints on banks. And it is not surprising that, after the turmoil of last spring, a new flurry of research points to the need to strengthen requirements and start a new round of financial reforms.

I have also noticed a keen interest in radical solutions, which would tackle the issue of banks’ instability once and for all through a strict yet simple set of regulatory requirements. For instance, we have once again seen calls to move to “narrow banking”, which would require deposit-taking institutions to invest only in risk-free assets. But the case of Silicon Valley Bank has shown that this does not eliminate risks.

In my view, there is no philosopher’s stone-like rule that can remove the need for effective supervision, if we are to continue relying on banks’ key functions in maturity transformation and risk management. No regulatory requirement will ever be able to capture the most extreme business models stemming from poor managerial choices.

But academic research would of course help us in successfully meeting the challenge of ensuring effective supervision.

The second endogenous challenge relates to cross-border integration in the euro area banking sector. And, unlike the first challenge, this is very specific to European banking supervision. It has its roots in the creation of the SSM itself, which was conceived as a key tool to break the sovereign-bank nexus that had proven to be so disruptive to our economies and to the institutional set-up of Economic and Monetary Union.

Enabling banks, irrespective of the country in which they are established, to consider the banking union as their home jurisdiction, where they can conduct their business seamlessly, is key to providing one of the most fundamental missing elements of the European monetary union: ex ante private mechanisms of risk-sharing.

Banks with fully integrated business across the banking union could easily offset losses stemming from an asymmetric shock hitting one Member State with profits that they have made in others.

And in the event of a banking crisis, banks from other Member States could take over entire failing banks or individual business lines, helping the authorities to manage the crisis more effectively than in a scenario where only the national safety net can be activated.

It is well known that, by design, the introduction of European banking supervision was only the first step in a broader institutional overhaul: the creation of a fully- fledged European banking union.

In fact, since the initial proposal,[24] a Single Resolution Mechanism for banking resolution and a single deposit guarantee scheme were also envisaged.

A centralised framework for banking supervision was a logical and political precondition for establishing the other two pillars of the banking union – but, again, it was only the start. These pillars are sometimes presented as three separate strands that could effectively work in parallel, or even in the absence of the other missing elements. But I strongly believe in the unitary, and self-reinforcing, nature of the banking union across these three pillars – or branches, as I believe it more correct to call them.[25]

Unfortunately, political agreement on a European deposit insurance scheme remains elusive for a number of reasons. Several attempts have been held back by national red lines and conditions, which mask the political reluctance of individual Member States to underwrite what is perceived to be a joint and several guarantee for a very large amount of insured deposits – approaching €8 trillion at the end of this year.

In fact, the FDIC’s experience shows that good mechanisms of private risk-sharing (i.e. an integrated banking market) and effective crisis management tools, in particular purchase and assumption transactions enabling business to be sold and the creation of bridge banks, significantly reduce the need to activate any fiscal backstops.

Still, in the absence of a European deposit insurance scheme, Member States fought to maintain a number of constraints in European legislation that prevent banking groups from pooling capital, liquidity and other financial resources within the euro area and making them flow freely across legal entities in the various Member States participating in the banking union.

Subsidiaries within Member States are often granted waivers from capital and liquidity requirements in view of the support provided by the parent company. However, the use of these waivers is vastly constrained and, in the limited instances allowed under applicable legislation, they are in practice never used for subsidiaries in other Member States of the banking union.

The problem with this reasoning is its logical vicious circle, its endogeneity, if you will.

The lack of a truly integrated safety net leads to Member States ring-fencing business within national boundaries.

In turn, the segmentation of banking markets along national lines impairs private risk-sharing mechanisms and increases the likelihood of national deposit guarantee schemes being activated and possibly depleted, which would in turn lead to their fiscal backstops being activated. Knowing this, Member States are reluctant to pool deposit guarantee funds across the banking union. And this explains why negotiations on a European deposit insurance scheme are at a standstill.[26]

An incomplete banking union is the reason why cross-border banking groups are ring-fenced along national lines and cross-border integration does not happen. But the absence of cross-border integration is one of the fundamental reasons why the banking union cannot be completed.[27]

I am not here to look for excuses. I can readily admit that the lack of cross-border integration is one of the missed achievements during my five years as Chair. I would still argue, however, that we have done everything we could to foster the cross-border integration of the European banking sector and deliver a real single market within the single prudential jurisdiction.

We published a Guide on our approach to mergers in the banking sector, clarifying that we would not create obstacles to bank consolidation and would treat cross-border mergers within the banking union as domestic mergers.[28]

We also indicated our willingness to pursue practical solutions for activating cross-border liquidity waivers within the banking union, suggesting mechanisms that could address the concerns of national authorities during times of stress.[29]

Drawing on our experience of the corporate reorganisations of foreign banks relocating to the euro area after Brexit, we encouraged cross-border groups under our supervision to restructure in a similar way through cross-border mergers into a single legal entity incorporated as a Societas Europaea in one Member State, with branches in other Member States.[30]

And we proposed that the crisis management framework could be strengthened by giving resolution authorities a wider range of options. They could have recourse to sale of business and bridge bank tools for mid-size banks, using existing resources in the Single Resolution Fund and national deposit guarantee schemes on a least cost basis.[31] The European Commission’s proposal on the reform of the crisis management and deposit insurance legislation goes in the same direction and I sincerely hope that it will soon be approved, without major amendments.[32]

These attempts to foster banking integration within the current legal framework have so far not proved successful. We created options, but banks decided not to take advantage of them. Solid economic reasons could explain this reluctance. Market valuations remain depressed and banks have preferred to return capital to their shareholders, as a way of bringing their stock prices closer to their book values, rather than embarking on mergers and acquisitions.

And when banks did pursue consolidation strategies, they were driven more by cost-efficiency benefits related to overlapping networks of branches in local markets than by an aim to diversify revenues through cross-border deals.

But in some cases, banks also stopped pursuing projects as a result of concerns raised by national authorities. If the industry does not take full ownership of the goal of achieving market integration and does not fight for it, it will be difficult to make real progress.

The lack of support from individual Member States may also be an unfortunate side effect of the success of our incomplete banking union during its first nine years of existence.

Why embark on politically sensitive discussions when current arrangements are already playing a significant role in bolstering the stability of our banking sector? As the British saying goes, “if it ain’t broke, don’t fix it”. But the very same approach was also prevalent in the run-up to the great financial crisis, when the voices calling for financial reforms were disregarded.

The harsh reality is that the lack of integration creates a dangerous fault line in our institutional set-up, and this cannot be fixed by effective supervision alone. But if the system breaks down again, repairing it could prove to be very difficult and expensive.

Conclusion

Let me conclude.

In my remarks today, I wanted to provide an assessment of my time at the helm of European banking supervision. It has been a privilege and an honour to lead European banking supervision through the last five challenging yet interesting years.

I personally think that there are a number of achievements that we can be proud of, but we must also acknowledge some failures. In particular, establishing an integrated European banking market appears impossible at the moment, and this is clearly one of the most significant shortcomings of the European monetary union and the European banking union. I have tried to describe the vicious circles, the endogenous challenges, that an incomplete institutional framework and a fragmented banking sector create. In my view, it is fundamental that we break those vicious circles and complete the European banking union. I sincerely hope that concrete progress can be made in the new legislature starting next year.

But despite all those difficulties, we should not be disheartened. European integration is still the wave of the future.

As I approach the end of my five years as Supervisory Board Chair, I leave a European banking sector that is better capitalised, with much-improved asset quality, ample liquidity and rising profitability. A banking sector that proved resilient to the exogenous shocks hitting the European Union. And a banking sector that was able to act countercyclically as a shock absorber and not as a shock amplifier.

We have devoted considerable effort to making the SSM, as the mechanism for collaboration between the ECB and national competent authorities, better integrated. And making our supervision more risk-focused, more agile and better equipped to tackle the most urgent supervisory priorities as they emerge.

We are a complex organisation: our Supervisory Board counts 27 voting members, a number we would find surprisingly large on the board of a commercial bank; we have many internal networks, committees and expert groups engaged in extensive discussions; and we have rather cumbersome procedures and a complex legal framework, including various rules that differ across Member States[33].

But this complexity makes for lively internal debates, protects against groupthink and strengthens our internal checks and balances. Most importantly, we have been agile in the face of shocks, rapidly adjusting our focus and communicating effectively, with a single voice, to the banking industry and markets at large. This is the beauty of EU institutions: looking at their organisational structures and decision-making processes, you might think that they could never work, not in good times and even less so in times of crisis; but they do, not least thanks to the commitment and passion of their staff and the clear benefits brought by mixing different cultures and learning from each other.

Paraphrasing Ludwig Wittgenstein, one of the greatest European philosophers of the 20th century, we could say that the most remarkable aspect of European Economic and Monetary Union and the European banking union is not how they are but that they are – that they simply exist.[34]

Thank you very much for your attention.

Padoa-Schioppa, T. (1999), “EMU and banking supervision”, lecture at the London School of Economics, Financial Markets Group, 24 February.

Report of the high-level group on financial supervision in the EU chaired by Jacques de Larosière, 25 February 2009.

Enria, A. (2019), “Supervising banks – Principles and priorities”, speech at the SSM & EBF Boardroom dialogue, Frankfurt am Main, 7 March.

ECB Banking Supervision (2018), Addendum to the ECB Guidance to banks on nonperforming loans: supervisory expectations for prudential provisioning of non-performing exposures, March; ECB Banking Supervision (2019), Communication on supervisory coverage expectations for NPEs, 22 August.

At the end of the first quarter of 2023, total assets in the euro area banking sector were above €31 trillion, of which more than €26 trillion was held by 111 significant credit institutions under direct ECB supervision. By comparison, even though calculations may vary due to differences in accounting standards and volatility in the exchange rate, total assets of the US banking sector at the end of the same quarter were slightly less than €21 trillion (FRED economic data).

The establishment of close cooperation with Croatia and Bulgaria in October 2020 brought the number of countries participating in European banking supervision to 21. On joining the euro area on 1 January 2023, Croatia became a fully-fledged member of the SSM.

ECB (2023), “ECB welcomes expert group recommendations on European banking supervision”, press release, 17 April; Assessment of the European Central Bank’s Supervisory Review and Evaluation Process, Report by the Expert Group to the Chair of the Supervisory Board of the ECB.

ECB (2023), “What got you here won’t get you there”, Interview with Fernando Restoy, Supervision Newsletter, 17 May.

Enria, A. (2023), “Brexit and the EU banking sector: from the fundamental freedoms of the Internal Market to third country status”, contribution for the Revue d’économie financière special issue on Brexit, 26 January.

Enria., A. (2022), “The desks mapping review – integrating Brexit banks into European banking supervision”, The Supervision Blog, 19 May.

ECB (2020), “Eurosystem staff macroeconomic projections for the euro area countries”, June.

ECB (2020) “ECB Banking Supervision provides temporary capital and operational relief in reaction to coronavirus”, press release, 12 March.

In fact, only seven national authorities in the euro area had activated the countercyclical capital buffer (CCyB). See de Guindos, L. (2019), “Welcome remarks” at the ECB Forum on Banking Supervision, Frankfurt am Main, 6 November .The available CCyB represented only a very limited amount of capital relative to the other prudential requirements. Limited availability of countercyclical capital constrains the macroprudential authorities’ room for manoeuvre, making it harder to support the economy in a severe downturn. Most national authorities released the macroprudential buffers in the wake of the COVID-19 crisis. On the national macroprudential measures after the COVID-19 outbreak and the systemic lack of countercyclical capacity, see also Adrian, T. (2021), “Macroprudential Responses to the COVID-19 Pandemic and Outlook”, speech at the 5th European Systemic Risk Board Annual Conference, 8 December.

For a comprehensive overview of all the pandemic relief measures, see Frequently Asked Questions on ECB supervisory measures in reaction to the coronavirus.

Recommendation of the European Central Bank of 27 March 2020 on dividend distributions during the COVID-19 pandemic and repealing Recommendation ECB/2020/1 (ECB/2020/19), OJ C 102I, 30.3.2020, p. 1.

Dautovic, E. et al. (2021), “Evaluating the benefits of euro area dividend distribution recommendations on lending and provisioning”, Macroprudential Bulletin, ECB, June.

Enria, A. (2022), “Better safe than sorry: banking supervision in the wake of exogenous shocks”, keynote speech at the Austrian Financial Market Authority Supervisory Conference 2022, Vienna, 4 October.

See, for instance, Viñals, J. et al. (2010), “The Making of Good Supervision: Learning to Say “No””, IMF Staff Position Note, 18 May. See also Financial Stability Board (2010), “Intensity and Effectiveness of SIFI Supervision – Recommendations for enhanced supervision”, 2 November.

Board of Governors of the Federal Reserve System (2023), “Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank”, 28 April; Federal Deposit Insurance Corporation (2023), “FDIC’s supervision of Signature Bank”, 28 April.

See footnote 8.

Basel Committee on Banking Supervision (2023), “Report on the 2023 banking turmoil”, October.

Adrian, T. et al. (2023), “Good Supervision: Lessons from the Field”, IMF Working Paper, No 2023/181, 6 September.

Van Rompuy, H. (2012), “Towards a genuine Economic and Monetary Union”, Report by President of the European Council, 26 June; Van Rompuy, H., Barroso, J.M., Juncker, J.-C. and Draghi, M. (2012), “Towards a genuine Economic and Monetary Union”, 5 December.

Enria, A. (2022), “Of temples and trees: on the road to completing the European banking union”, speech at the Institut Montaigne, Paris, 17 May.

See “Eurogroup statement on the future of the Banking Union of 16 June 2022”; and “Remarks by Paschal Donohoe following the Eurogroup meeting of 16 June 2022”. For a better understanding of the statement and the remarks, see also “Remarks by Paschal Donohoe following the video conference of the Eurogroup of 3 May 2022”. The European Commission’s legislative proposal to establish a European deposit insurance scheme was published almost eight years ago. See Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) 806/2014 in order to establish a European Deposit Insurance Scheme, European Commission, COM(2015) 586 final, 24 November 2015.

For a succinct explanation of this position with specific reference to cross-border liquidity waivers, the only waivers available under the EU legal framework for supervisory authorities but which have never been granted, see Praet, P. (2016), “The importance of a genuine banking union for monetary policy”, speech at the EMU Forum 2016, Oesterreichische Nationalbank, Vienna, 24 November. The same reasoning can easily be applied to capital waivers, where ring-fencing already exists at the legislative level. “The current incomplete banking union is asymmetric: while decisions on liquidity waivers are taken at European level, the relevant risk-sharing mechanisms are still national. In each country, bank depositors are protected by the national guarantee scheme. If a bank fails and the Single Resolution Fund does not have sufficient resources available to finance its resolution, which may well be the case for some time, until the common element of the SRF is sufficiently advanced, it is a national credit line that backs the SRF. In this context, the ECB’s Supervisory Board decided this spring that there should always be a floor on the liquidity coverage ratio for those subsidiaries that are significant on a stand-alone basis. This is to ensure that they hold a sufficient level of high-quality liquid assets to respond to liquidity needs at national level. Liquidity ring-fencing reflects the absence of a common fiscal backstop in the banking union” (emphasis added).

ECB Banking Supervision (2021), Guide on the supervisory approach to consolidation in the banking sector, 12 January.

Enria, A. and Fernandez-Bollo, E. (2020), “Fostering the cross-border integration of banking groups in the banking union”, The Supervision Blog, 9 October.

Enria, A. (2021), “How can we make the most of an incomplete banking union?”, speech at the Eurofi Financial Forum, Ljubljana, 9 September.

Enria, A. (2022), “Of temples and trees: on the road to completing the European banking union”, op. cit., footnote 25.

Communication from the Commission to the European Parliament, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions on the review of the crisis management and deposit insurance framework contributing to completing the Banking Union, European Commission, COM(2023) 225 final, 18 April 2023.

On the complex interaction between European law and national law in the SSM Legal Framework see Bassani, G. (2019), The Legal Framework applicable to the Single Supervisory Mechanism. Tapestry or Patchwork?, Kluwer Law International

Drawn from Ludwig Wittgenstein: “Nicht wie die Welt ist, ist das Mystische, sondern dass sie ist” (Not how the world is, is the mystical, but that it is). See Wittgenstein, L. (1922), Tractatus Logico-Philosophicus: Logisch-philosophische Abhandlung, Kegan Paul, Trench, Trubner and co. Ltd., London, 6.44.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts