- SUPERVISION NEWSLETTER

Complex exposures to private equity and credit funds require sophisticated risk management

13 November 2024

Authors: Michelle-Christine Galbarz, Mike Lobbens, Philipp Marquardt, Maria Manuela Villarreal Fraile

Private equity and private credit markets have grown strongly over recent years, including in Europe, and banks are exposed to these markets through many different channels. Earlier this year, the European Central Bank (ECB) launched an exploratory review of bank exposures to private equity and private credit funds in order to better understand these channels and to assess banks’ risk management approaches. This article provides an overview of the findings and outlines future actions.

Shifts in private equity and private credit markets

The environment in which private equity and private credit funds operate have undergone significant changes which have led to some important shifts in these markets. The ECB published an article in its May 2024 Financial Stability Review that delves into private markets and their recent growth.

In private equity markets the number of initial public offerings (IPO’s) has decreased sharply. Funds have typically used IPOs as an exit path to liquidate investments. The decline in their use means that funds have resorted to other ways to give pay-outs to investors, most notably the use of leverage at the fund level. This additional layer of leverage can be a source of risk and creates a more opaque environment for market participants and supervisors.

Private credit markets have seen significant growth in recent years, driven by demand from both borrowers and investors. As private credit funds have expanded their operations, through larger deals and by moving into the investment grade space, competition between banks and private credit funds has increased. This introduces the risk of a potential deterioration in lending standards. Banks have also contributed to the private credit market growth by providing financing to private credit funds and their investors. In addition, an increasing number of banks are partnering with asset managers to enter the private credit market themselves through a variety of business models.

Different types of exposure to private equity and private credit funds

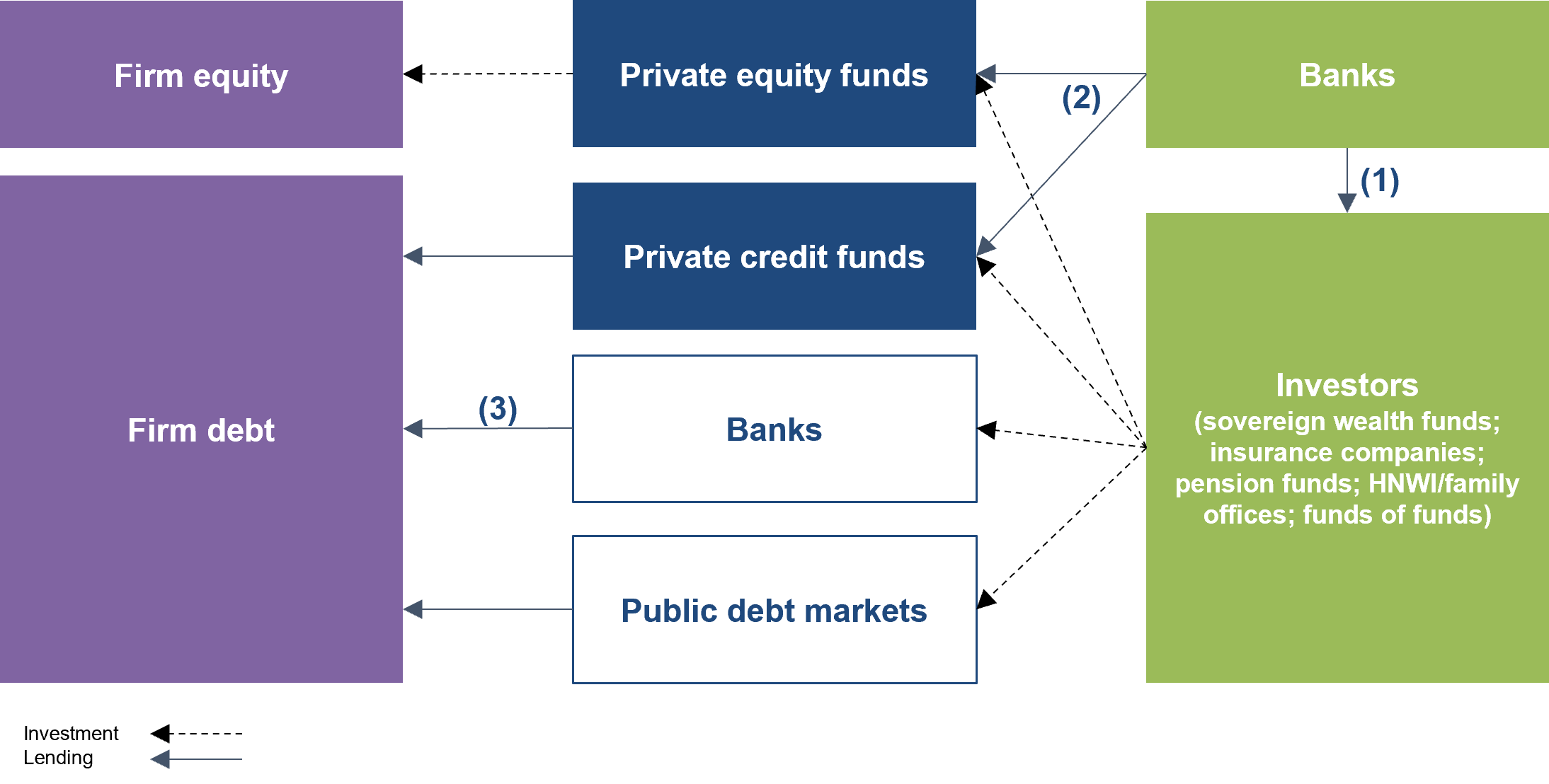

Fund managers and investors use bank financing to introduce leverage, finance investments and provide bridge financing. This financing can happen at different levels: (1) “upstream” to investors in the funds, (2) “midstream" to the funds directly, or (3) “downstream” to companies in the funds’ portfolios (see the figure below).

In addition to these credit exposures to investors, funds and portfolio companies, banks also have exposures to funds through the derivatives they offer to clients – usually to provide hedging against adverse movements in interest rates or exchange rates.

Figure 1

Title: Bank exposures to private equity and private credit funds, schematic simplified presentation

Source: ECB

Exploratory analysis of banks’ exposures and risk management approaches

In response to the market changes and the interlinkages between banks and private equity and private credit funds, the ECB launched an exploratory review earlier this year. This involved talking to banks, audit firms, market participants and foreign supervisory authorities. Information on banks’ exposures and risk management approaches was gathered from a sub-sample of banks through data collection and a survey. The focus was on private equity and private credit funds in a narrow sense, and hence the analysis excluded certain fund types, such as real estate and infrastructure funds.

Size and composition of bank exposures

The results of the survey showed that the overall exposure to private equity and private credit funds is significant, with credit risk being the main risk. The review found very heterogenous exposures across banks: several global systemically important universal banks (G-SIBs) have very broad product offerings to both private equity and private credit funds, while other banks choose either to focus on private equity funds only or to provide a more limited product offering (e.g. subscription finance). While banks subject to European banking supervision generally appear to be less involved in the private equity and private credit segment than some of their larger US peers, a number of banks do have high exposures, and the contribution this segment makes to their profits is considerable. In addition, this market segment also leads to ancillary income, for example through advisory work and IPOs.

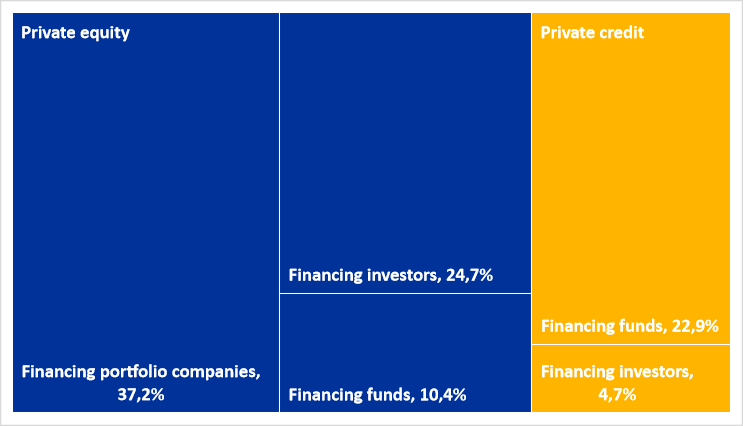

The bulk of banks’ exposures are to the private equity domain, with key concentrations in portfolio company financing and investor financing. Conversely, private credit exposures seem more limited and largely focused on fund-level financing with a limited pocket of investor financing and no reported portfolio company exposures (see chart below for a breakdown). Lastly, counterparty credit risk (CCR) exposures from derivatives appear quite limited and mainly stem from funds and portfolio companies hedging their risks. Banks carry out this business as an ancillary service to their financing activities. The CCR exposures are quite concentrated in a few banks, mostly the larger G-SIBs.

An important takeaway from the survey is that banks are not able to systematically identify transactions where they are co-lenders to portfolio companies alongside private credit funds. Banks are better able to identify transactions where the borrower is owned by a private equity fund, although recent supervisory investigations also revealed weaknesses in bank processes in this area. The failure to properly identify – on an aggregate level – exposures to companies that also borrow from private credit funds means that this exposure is almost certainly understated and the concentration risk cannot be properly identified and managed.

Chart 1

Title: Bank exposures to private equity and private credit funds, split by type

Source: consolidated bank data – gross carrying amount - reference date 31/12/2023, ECB calculations

Observations on risk management approaches

The exploratory review found that the management of risks associated with bank exposures to private equity and private credit funds is largely fragmented. Banks typically manage such risks either at product type level or at client type level. This approach fails to holistically capture the risks generated by these exposures. This becomes clear in cases where, for example, a bank has financed portfolio company X, which is owned by fund Y, which in turn has also received finance from the same bank. In addition, some of the investors in fund Y may have borrowed from the bank against their investment in the fund, and fund Y may also have hedged its exposures to interest rate and foreign exchange movements by purchasing derivatives from the bank. Looking at risks at the level of the individual product or client type is not sufficient to provide a good understanding and management of the risks. Banks need to be able to aggregate exposures across obligor type and instrument type.

The review also found different levels of sophistication in banks’ risk appetite frameworks for these exposures. Moreover, banks appear overly reliant on valuations provided by the fund, and this reliance appears to be only partly mitigated by independent reviews and structural transaction features. Lastly, data on these types of exposure are scarce and scattered, and the structure of private equity and private credit markets is often opaque.

Supervisory actions going forward

The ECB’s exploratory review has shown that banks’ exposures to private equity and private credit funds are significant and that risk management approaches appear not to have caught up with the developments in this market segment. Given that the exposures involve complex, multi-layered risks, with leverage entering at several levels, sophisticated approaches are key to effectively managing these risks.

The ECB will therefore continue monitoring bank exposures closely and will outline a set of supervisory expectations for the risk management of exposures to private equity and private credit funds. Banks will be asked to submit information on their risk management approach as well as a gap assessment against the ECB’s expectations. The ECB will then follow up with banks on an individual basis to ensure that the supervisory expectations are met.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts