- SUPERVISION NEWSLETTER

Keeping a close eye on real estate risk

16 February 2022

ECB Banking Supervision identified banks’ exposures towards the commercial and residential real estate sectors as a key vulnerability in its risk assessment for 2022-24. The commercial real estate (CRE) sector is considered vulnerable to the impact of the pandemic, while medium-term risks of price corrections continue to grow in the residential real estate (RRE) sector, with signs of a potential overvaluation in housing prices and elevated household indebtedness.

Banks’ exposures to the CRE sector are substantial, accounting for around 8% of supervised banks’ total loans and over 20% of their total corporate loans. In absolute values, CRE exposures are particularly high in Germany, France and Italy. In other countries such as Cyprus, Slovenia and Estonia, their relative size is material, with CRE exposures accounting for over 40% of total corporate loans.

Chart 1

CRE exposures by country

(left-hand scale: percentages; right-hand scale: EUR billions)

Source: FINREP data.

Notes: Data as at the fourth quarter of 2020. CRE exposures as defined in ESRB Recommendation ESRB/2019/3.

Supervisors have identified the CRE sector as vulnerable owing to a number of concerns.

- The pandemic hit the CRE markets at the peak of a cycle. At the onset of the pandemic, financial market-based valuations, such as real estate investment trust indices, fell sharply and transaction activity in CRE markets dropped to half their normal levels, suggesting that risks were beginning to materialise in the market (see the November 2020 Financial Stability Review).

- The increase in remote working and online shopping may give rise to structural changes in the market for offices and retail properties, with rents expected to fall in the medium term. This may weaken the financial position of borrowers and would lead to higher credit losses for banks that have a high proportion of bullet loans, fully unsecured loans or non-recourse loans.

- If market prices decrease, the value of banks’ collateral will also go down. This means higher loan-to-value ratios and, consequently, may force banks to increase their provisions to cover credit risk.

- The prolonged supply chain issues caused by the pandemic have led to a significant increase in construction costs. Banks with portfolios containing a high level of exposures to properties under development will therefore be at higher risk.

- In the EU, buildings account for approximately 40% of energy consumption and 36% of greenhouse gas emissions, and around 35% of its buildings are over 50 years old. The CRE sector is therefore heavily exposed to climate-related transition risk. The first signs of its potential impact can be seen in the poor outlook for the non-prime segment, which has already seen a drop in demand (see the November 2021 Financial Stability Review). In addition, the sector is also facing potential climate-related physical risks.

Given these risks, it is crucial that banks have robust credit risk management frameworks in place to identify and classify distressed borrowers at an early stage and to mitigate any vulnerabilities in the CRE market. To investigate how prepared banks are to deal with risks potentially materialising in the CRE market, ECB Banking Supervision is carrying out a targeted review of a sample of banks with material CRE exposures. Supervisors will assess climate-related risks as part of this review. With the European Commission proposing future minimum standards on Energy Performance Certificates – which will require the worst performing buildings in terms of energy efficiency to be renovated before a certain deadline – and some countries, like the Netherlands, having already implemented such standards, it is crucial to understand how banks are assessing information on collateral and managing old commercial buildings with a low energy efficiency rating.

ECB Banking Supervision is also assessing potential risks arising from the RRE sector, in particular those related to house price overvaluation and household indebtedness. As reported in the November 2021 Financial Stability Review, policy measures have helped to maintain household incomes during the pandemic, while favourable financing conditions have allowed households to obtain financing for house purchases at record low interest rates. Together with a possible preference for more living space as people worked from home, this has fuelled demand for housing during the pandemic. Residential construction has recovered, but labour shortages, global supply chain bottlenecks and input price increases are weighing on the construction sector’s ability to expand housing supply, which is putting upward pressure on house prices. As price and lending dynamics are outpacing household income growth, household indebtedness is increasing, and there is also a greater risk of collateral overvaluation and price correction in the medium term. This adds to banks’ medium-term vulnerabilities.

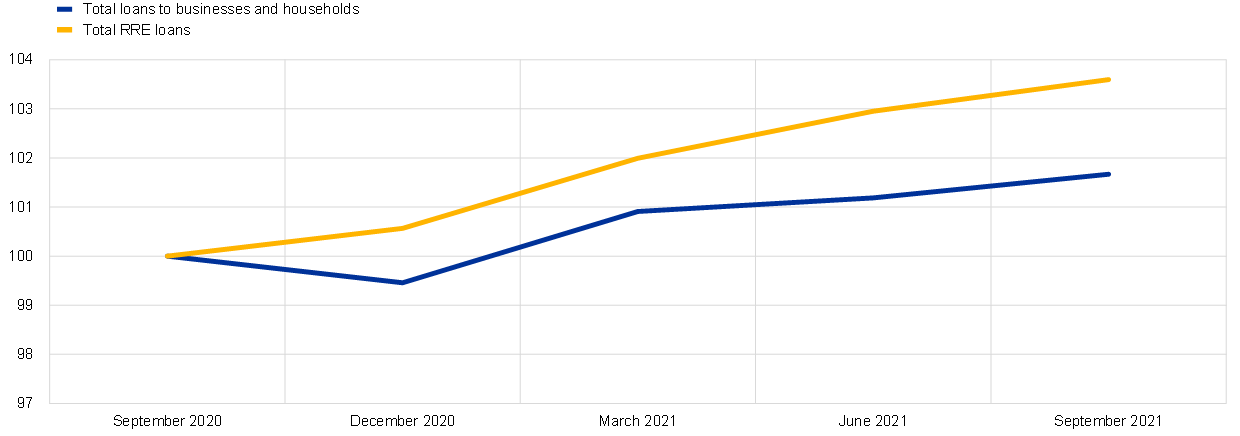

Supervisory data confirm the buoyant demand for RRE loans. When looking at aggregate figures, total loans and advances to households secured by residential property increased by 3.6% between September 2020 and September 2021. By contrast, total loans and advances to businesses and households increased by only 1.7% over the same period.

Chart 2

Evolution of supervised banks’ RRE loans and total loans to businesses and households during the pandemic

(percentages; index: September 2020 = 100%)

Source: FINREP.

Note: Consistent sample of 109 significant institutions supervised by the ECB.

The increasing risk of price corrections in euro area residential property markets and the observed rise in household indebtedness are a source of concern for supervisors. Should these risks materialise, they would have a direct impact on banks’ expected credit losses, especially as total loans secured by residential real estate account on aggregate for 26% of banks’ total loans and advances. It is therefore crucial that banks closely monitor these risks.

ECB Banking Supervision will address these concerns through different supervisory actions, including a targeted review of a sample of banks’ RRE portfolios. Drawing on the EBA Guidelines on loan origination and monitoring, supervisors will scrutinise banks’ creditworthiness assessments and lending standards for newly originated residential mortgages and will ask banks to address any deficiencies.

Den Europæiske Centralbank

Generaldirektoratet Kommunikation

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Tyskland

- +49 69 1344 7455

- media@ecb.europa.eu

Eftertryk tilladt med kildeangivelse.

Pressekontakt