- PRESS RELEASE

2018 stress test of Greek banks shows average capital depletion of 9 percentage points in adverse scenario

- In adverse scenario, the average Common Equity Tier 1 capital depletion was 9 percentage points, equivalent to €15.5 billion

- Exercise conducted following the same methodology and approach as the EU-wide EBA stress test but with an accelerated timeline

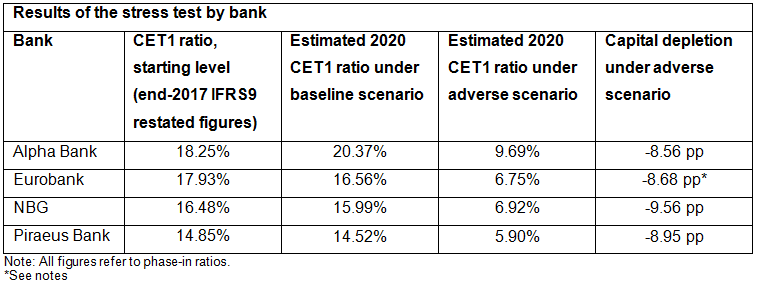

The results of the 2018 stress test of Greek significant institutions show that the average capital depletion under the adverse scenario, which covered a three-year period and assumed static balance sheets, was 9 percentage points, equivalent to €15.5 billion. The capital depletion stood at 8.56 percentage points for Alpha Bank, 8.68 percentage points for Eurobank, 9.56 percentage points for the National Bank of Greece (NBG) and 8.95 percentage points for Piraeus Bank.

The four banks underwent a stress test following the same methodology and approach as the EU-wide EBA exercise, but with an accelerated timetable in order to complete the test before the end of the European Stability Mechanism’s Stability Support Programme for Greece in August.

The stress test is not a pass or fail exercise. Its results, together with other relevant supervisory information, are used to form an overall supervisory assessment of the banks’ situation.

The stress test results were mainly driven by the following risk drivers:

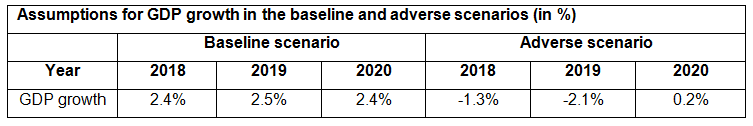

- Credit risk: while the negative impact of credit risk on CET1 ratios was on average around 260 basis points in the baseline scenario, it increased to 850 basis points in the adverse scenario.

- Net Interest Income (NII): NII under the adverse scenario declined by 22.5% compared with the baseline scenario.

The stress test scenarios include the following real GDP projections for Greece as outlined in the table below.

Detailed results and information on the outcome of the exercise can be found in the disclosure templates on the ECB’s banking supervision website.

Please also refer to the Frequently Asked Questions.

For media queries, please contact Nicos Keranis, tel.: +49 69 1344 7806 and +49 172 758 7237

Notes:

- Due to the static balance sheet assumption, divestments not completed before the end of 2017 were not taken into account in the stress test. This results in lower capital ratios than if divestments with a positive capital impact were considered in the final impact.

- The difference between the starting-level CET1 and estimated 2020 CET1 for Eurobank excludes a negative impact of 250 basis points related to the phase-out of grandfathered preference shares subscribed by the Greek State. These preference shares were converted into Tier 2 instruments in January 2018 and, due to the static balance sheet assumption, have not been included in the stress test results.

For more information on the scenario used please refer to the 2018 EU-wide stress test methodological note.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts