Streamlining supervision, safeguarding resilience: the ECB’s agenda for more effective, efficient and risk-based European banking supervision

Executive summary

This report outlines the European Central Bank’s (ECB) ongoing agenda to increase the effectiveness, efficiency and risk focus of European banking supervision. Together with the national competent authorities (NCAs) participating in the Single Supervisory Mechanism (SSM), the ECB has been advancing a series of initiatives aimed at simplifying and streamlining European banking supervision, thereby reducing undue complexities, while ensuring supervisors preserve their capacity to tackle new and emerging risks. In furthering these aims, the initiatives will support the ECB in protecting the safety and soundness of credit institutions and the stability of the financial system.

This reform agenda is a response to the evolving risk landscape. Promoting banks’ resilience to geopolitical and macro-financial risks is a key priority for the ECB. Risk management in an environment characterised by heightened uncertainty and increased non-traditional risks, such as cyberattacks and climate and nature-related risks, has become increasingly challenging for banks. In addition, banks need to find and implement strategic responses to the digitalisation of financial services. At the same time, strengthening banks’ operational resilience – another priority for the ECB – requires agility and capacity-building also on the part of supervisors.

Over the past decade, European banking supervision has been steadily adapting. It has moved from its start-up phase, in which supervisory processes were codified and standardised, towards a more agile, risk-focused model. The current reforms consolidate this long-running evolution, while adapting supervision to a changing environment. The reforms have three main objectives:

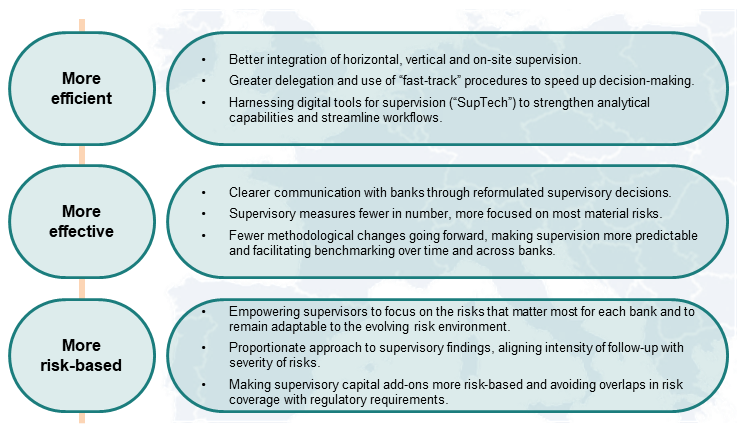

- Increasing efficiency: European banking supervision needs to respond to evolving risks and dynamic changes in financial markets within the scope of its finite resources. Streamlining routine procedures, agility and continuous training are key to improving efficiency. This involves close coordination between all supervisory activities and teams – cross-cutting (horizontal) teams, individual (vertical) bank supervisors, and on-site inspectors. Strengthening coordination and integrating the planning of all supervisory activities helps achieve synergies and ensure that banks experience an integrated, streamlined interface with supervisors. The Joint Supervisory Teams (JSTs) are, and will remain, the main point of contact for banks with the supervisor. The ongoing reforms are empowering the JSTs to exercise judgement and focus on the risks that matter most for each bank. In implementing this reform agenda, the ECB is harnessing gains from digital tools for supervision (SupTech) to focus resources on the areas that matter most and create space to tackle new risks.

- Ensuring effectiveness: Supervisory effectiveness requires the identification of relevant weaknesses and the root causes of supervisory findings, clear communication with banks about supervisory expectations, and a strategy for potentially escalating supervisory measures. Across its activities, the ECB has been using a more targeted approach to prioritising its activities and reducing the number of supervisory measures it takes. It is developing methodologies for structured assessments of its effectiveness. These evaluations are also designed to increase transparency and foster trust with external stakeholders, including the European Parliament.

- Focusing on relevant risks: All supervisory activity must be proportionate to underlying risks. Not every risk must be addressed with the same intensity for each bank every year. In 2023 the ECB thus developed a risk tolerance framework and a multi-year approach to its supervision, which provides practical guidance to supervisory teams on how to achieve this proportionality in everyday supervision. It has also developed a new tiered approach for following up on supervisory findings, aligning supervisory engagement with risk severity.

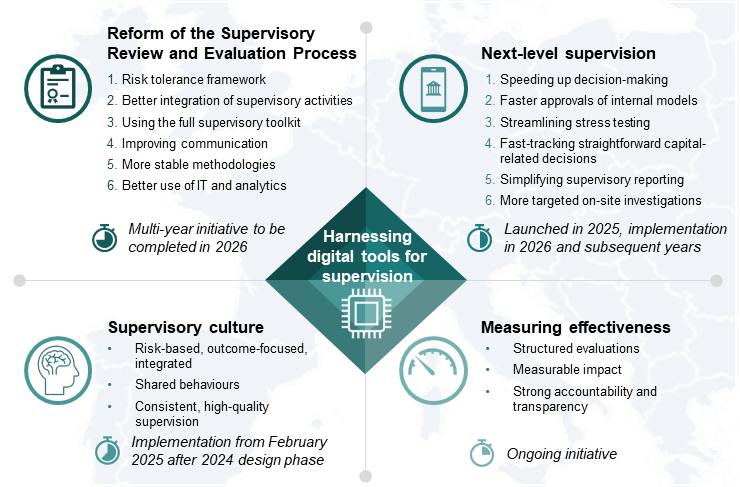

In 2024 a comprehensive set of measures to improve the Supervisory Review and Evaluation Process (SREP) was decided upon. Key elements of the SREP reforms are already in place, and they will be fully implemented in 2026. The reforms are based on the recommendations of an independent expert group to the Chair of the Supervisory Board, which was commissioned in 2022 and delivered its final report in 2023.[1] This has been a first step towards making European banking supervision more efficient and effective.

In 2025 a second broad set of reforms was initiated with the “Next-level supervision” project. The project covers all key supervisory activities, including authorisations, capital-related decisions, internal model investigations, stress testing and on-site inspections. One of the key objectives of these initiatives is to streamline and simplify European banking supervision. The elements of this project were identified and agreed upon in 2025 and will be implemented in 2026.

Looking to 2026 and beyond, the focus of the ECB will be on continuing to implement these reforms effectively. The effects of the reforms will be monitored continuously against the key objectives – efficiency, effectiveness and risk focus. Progress with reform implementation will be communicated transparently, including through progress updates in future annual reports on the ECB’s supervisory activities.

European banking supervision will continue to evolve and adapt to changing external conditions. Additional initiatives will be launched in 2026. This will include reviewing the application of the proportionality principle in the supervision of small and non-complex credit institutions (SNCIs). The ECB will also review its supervisory guides, with a view to considering updating some of them, ensuring that the information they contain is accessible and maximising their usefulness in providing transparency on the ECB’s supervisory approaches.

The SREP reform and next-level supervision project are underpinned by the “SSM supervisory culture” initiative, launched in February 2025. This initiative aims to embed a shared culture of risk-based, integrated and efficient supervision across the ECB and NCAs. An initial two-year activation plan for 2025-2026, agreed by the Supervisory Board, promotes consistent communication, shared behaviours, staff training and collaboration. By fostering cultural alignment, the initiative ensures that the SREP and next-level supervision reforms are implemented cohesively and effectively across the European banking union.

The ECB’s reform agenda takes into account feedback received from different stakeholders, and it has clear benefits for them. As regards benefits for the industry, improvements in the efficiency of processes and in the clarity of communication reduce the costs of supervisory compliance. As regards policymakers and the wider public, the objectives of these reforms allow the ECB to better deliver its mandate while further enhancing transparency and accountability. Elements of the reforms will also improve the data infrastructure, with benefits for analysts and researchers.

Figure 1

The ECB’s agenda for more efficient, effective and risk-based European banking supervision

The ECB is publishing this report simultaneously with the recommendations of the ECB Governing Council’s High-Level Task Force (HLTF) on Simplification. The HLTF recommendations call for legislative changes to simplify the prudential regulatory, supervisory and reporting frameworks. The initiatives described in this report constitute work that the ECB and NCAs, in the context of the SSM, are doing within their respective mandates under existing legislation. The initiatives complement the HLTF recommendations, while remaining fully implementable independently of those recommendations.

In advancing the current and planned initiatives, the ECB remains committed to preserving banking sector resilience. Increasing efficiency will not come at the cost of lowering supervisory standards. On the contrary: it is essential for supervisors to remain forward-looking and decisive, to be able to challenge banks’ management bodies in a rigorous manner, and to intervene where risks to the viability of individual institutions or risks to financial stability are identified. The ECB and NCAs thus remain firmly committed to upholding the highest international standards for supervision. To this end, the current and planned initiatives aim to address the recommendations made by the International Monetary Fund (IMF) in its recent review of European banking supervision, particularly regarding the need to adopt a more risk-based and proportionate supervisory approach.[2]

Collectively, the initiatives described in this report reflect the ECB’s ongoing commitment to simplifying and streamlining European banking supervision and ensuring that it remains fit for the challenges of the next decade. By increasing efficiency and effectiveness and further embedding its risk-based approach, the ECB is optimising its resources to address emerging risks and foster financial stability. With these reforms, the ECB is also contributing to reducing administrative costs for European banks through improved supervisory interactions, in terms of the frequency and coordination of supervisory activities and via increased transparency. In this way, the reforms promote a European banking sector that is resilient and well-positioned to support the financing needs of businesses and households, safeguarding stability in an ever-changing financial and economic landscape.

Figure 2

Steps towards achieving the objectives of the reforms

Summary of ongoing measures

Deliverable | Description | Implementation time frame1 |

|---|---|---|

Reform of the supervisory review and evaluation process | ||

More focused risk assessments | Multi-year approach focusing on most relevant risks. | Multi-year approach in place since 2023. |

Better coordination | More integrated planning between vertical and horizontal teams and onsite inspectors when defining the Supervisory Examination Programme for individual banks, ensuring better planning for banks and supervisors. | More integrated planning since March 2022. |

Supervisory Examination Programme for 2026 to be shared with banks by end-2025. | ||

Using the full supervisory toolkit | Remedial actions commensurate with severity of findings. | Tiered approach to supervisory findings and measures implemented since July 2025. |

Improving communication | SREP outcomes communicated earlier with more time for dialogue with banks. | Optimised SREP timeline with earlier communication of interim and final results from H2 2024. |

Streamlined SREP decisions from 2025. | ||

Information Management System (IMAS) portal allows direct access to findings and measures since H2 2025. | ||

More stable methodologies | Limiting future changes for more predictable supervision and better benchmarking. | Revised P2R methodology to be implemented in the 2026 SREP cycle.2 |

Better use of IT systems and analytics | Using digital tools to automate routine tasks and free up resources | Expansion of IMAS portal functionalities since Jan 2021. Other improvements ongoing.3 |

“Next-level supervision” | ||

Faster decision-making | More delegation and streamlined routine decisions, e.g., fit and proper (FAP), authorisations assessments and use of digital tools.3 | Streamlined decisions planned for H2 2026 and ongoing as digital tools are being implemented. |

Fast-track process for significant risk transfer securitisations (SRT). | SRT fast-track process to be implemented from H1 2026. | |

Risk-based internal model approvals | More risk-based approaches for approvals of model changes, approving changes at an earlier stage in the process and avoiding need for banks to maintain multiple model versions in parallel. Investment in pro-active and risk-focused internal model supervision. | H2 2026. |

Streamlined stress tests | Less intensive data requirements and lower administrative costs for banks. | Beginning with the 2026 thematic stress test and the 2027 EU-wide stress test. |

Faster capital-related approvals | Fast-track process for standardised applications to streamline approvals.3 | H1 2026. |

Reporting costs | Refining and strengthening horizontal reporting requests. | H1 2026. |

Materiality thresholds for reporting resubmissions. | H2 2026. | |

Further refinements to the Short-Term Exercise. | H1 2027. | |

More efficient and targeted on-site investigations | Efficiency improvements (e.g. more concise reports, closer interaction between onsite and JST activities) | H1 2026. |

More targeted on-site investigations. | H2 2026. | |

Additional planned initiatives | ||

Reviewing ECB guides | Streamlining and updating ECB Guides and other published supervisory expectations. | Project to run throughout 2026 and onwards. |

Increasing proportionality | Reviewing application of proportionality in supervision of less significant institutions and especially small and non-complex institutions (SNCI). | H1 2026. |

Introducing the SNCI category in the ECB FinRep Regulation. | H1 2027.4 | |

1) The ECB is monitoring progress on the implementation across all of the reform initiatives and will report on the implementation in its annual reports on its supervisory activities.

2) Finalisation of liquidity methodology for the SREP in 2027.

3) First round of enhancements in the core IT system supporting the SREP completed in 2025. Investment in technology is a continuous process. New digital tools are expected to become available also in subsequent years.

4) Time frame dependent on EBA work on reporting requirements for SNCIs.

1 Introduction

Stable banks are the foundation of a strong economy. Since the Single Supervisory Mechanism (SSM) was established over a decade ago, European banks have become more stable, with more capital and lower levels of non-performing loans. The banking sector remained resilient through recent shocks, supporting households and firms and helping stabilise the economy. This can be attributed to the current regulatory and supervisory framework, although the banking sector also benefited from the fiscal policy support provided to households and firms during difficult times.

The environment in which banks are operating is changing fast. As technology changes and the risk landscape evolves, supervision must be responsive and adaptable to new challenges, while remaining as efficient and effective as possible. European banking supervision is conducted with finite resources; it needs to have the flexibility to redeploy them efficiently to tackle emerging risks. Against this background, it is necessary to tackle undue complexity in supervision, enabling resources to be focused on the issues that matter most, without compromising banks’ resilience.

Four complementary initiatives, which are detailed in the following sections of this report, are currently ongoing:

- Reform of the Supervisory Review and Evaluation Process

- The “Next-level supervision” project

- The “SSM supervisory culture” initiative

- Assessing supervisory effectiveness

These initiatives amount to a comprehensive agenda to make European banking supervision more efficient, effective and risk-based. They are being carried out jointly by the ECB and NCAs, steered by the ECB’s Supervisory Board. The overarching objective is to enable the ECB to continue to perform its tasks effectively, contributing to the public good of financial stability. In so doing, the reforms will facilitate better interactions between the ECB and its key stakeholders, including the banking industry, leveraging technological advancements to speed up routine supervisory processes and reduce administrative costs.

The ECB regularly engages with the European Parliament and the EU Council, providing updates on supervisory developments and plans. By publishing the current document, the ECB is seeking to promote wider transparency on how it intends to adapt European banking supervision to keep it fit for purpose over the next decade. As the entities subject to supervision, banks are naturally the main addressees of this document. At the same time, transparency is vital to ensuring that a broad range of stakeholders, including civil society groups, academics and the broader public, can increase their understanding of the ECB’s work and their trust in the banking system.

The initiatives described in this document have been devised drawing on extensive input from external stakeholders. These include the banking industry, policymakers and the public, the European Court of Auditors, the report by the independent expert group the ECB commissioned in 2022 to assess the effectiveness and efficiency of the SREP, as well as the findings of the recent euro area Financial Sector Assessment Program (FSAP) assessment conducted by the IMF.[3]

The ECB monitors indicators of the efficiency, effectiveness and risk focus of its supervision. The ECB will report on the progress it has achieved in implementing the changes described in this document in future annual reports on its supervisory activities.

The reforms constitute changes that the ECB is implementing within existing EU legislation. In addition, in April 2025 the ECB’s Governing Council established a High-Level Task Force on Simplification to consider legislative changes to further simplify the prudential landscape in the EU. The task force consulted the ECB’s Supervisory Board on supervisory matters and its recommendations, published simultaneously with this report, complement the work of the ECB to increase the efficiency, effectiveness and risk-based focus of supervision.

2 Reform of the Supervisory Review and Evaluation Process

The ECB regularly assesses the soundness of banks under its direct supervision through the Supervisory Review and Evaluation Process (SREP). This process has always been a cornerstone of European banking supervision, providing a structured and risk-based approach to evaluating institutions. However, the environment in which banks are operating is evolving rapidly – shaped by structural shifts, external shocks and emerging risks – creating conditions of heightened uncertainty.

In response, and following an external review, the ECB has launched a comprehensive reform of the SREP to increase its effectiveness and efficiency. The SREP reform has been structured around the following six components:

- More focused risk assessments

- Better integration of supervisory activities

- Using the full supervisory toolkit

- Improving communication

- More stable methodologies

- Better use of IT systems and analytics

2.1 More focused risk assessments

In 2023 the ECB introduced a new risk tolerance framework (RTF) which empowered supervisors to prioritise areas where their efforts are deemed to be most impactful, following a risk-based approach. The RTF is a tool that combines top-down guidance in the form of the supervisory priorities and bottom-up assessments on key vulnerabilities by supervisory teams. It applies across all supervisory processes.

Building on the RTF, the ECB developed a multi-year approach[4] for the SREP as a practical application of this prioritisation framework. Instead of assessing all risks every year for each bank, supervisors now perform a core annual assessment, complemented by targeted reviews of selected risk “modules”. The decision as to which modules to assess is based on banks’ risk profiles, materiality, supervisory priorities, recent changes and emerging risks, over a multi-year period. These developments ensure more risk-based and proportional supervision, especially for low-risk banks and subsidiaries, without weakening supervisory standards.

Benefits for stakeholders

More focused risk assessments concentrate supervisory attention and dialogue on material and emerging risks, strengthening the ECB’s ability to promote resilience and financial stability. Multi-year plans remain adaptable to changes in the external environment. Via discussions with their supervisors, banks are kept informed of the risks that are under higher scrutiny and which require more attention from the supervisor and from the bank.

2.2 Better integration of supervisory activities

Effective supervision requires a structured, comprehensive and consistent view of banks’ risks, based on different supervisory activities. The ECB performs various supervisory tasks and activities, the outcome of which feed into the SREP. They include on-site inspections, internal model investigations, deep dive analyses by JSTs and horizontal thematic reviews. As the main point of contact for each bank, the JSTs play a key role in ensuring integrated planning across these activities. Assimilating information across these activities allows JSTs to make an integrated assessment of how banks are situated in the evolving risk environment in which they operate.

To deliver more predictability and efficiency, the ECB is coordinating the planning of on-site inspections and other horizontal activities (e.g. targeted analyses) to avoid duplication of activities related to the same topic for the same institutions. The ECB has, for example, already taken steps to better integrate fit-and-proper (FAP) assessments into the overall SREP governance assessments, and this will continue. The ECB is also strengthening the integration of horizontal activities and on-site inspections into the SREP (see also Section 3.6).

Benefits for stakeholders

Improving the integration and planning of different supervisory activities exploits synergies, avoids duplicating efforts or requests to banks and enables the ECB to provide banks with a clearer overview of supervisory plans. A tangible result of the work done so far is that the Supervisory Examination Programme[5] for the following year is now communicated before year-end, giving banks more time to prepare and align their internal planning.[6]

2.3 Using the full supervisory toolkit

Supervision is not only about identifying risks – it is also about ensuring that risks are properly managed by banks. Follow-up by the supervisory teams on identified shortcomings and related requests to banks to remediate shortcomings should be proportionate and focused on the most severe issues. The introduction of a tiered approach to following up on measures (Box 1) enables a simpler follow-up process for low severity issues. At the same time, it enables resources to be allocated to more material issues.

The ECB is also placing greater emphasis on timely remedial action and on issuing qualitative measures to banks as soon as a finding is identified. As a result, SREP decisions focus on the most structural and severe issues. This has led to a reduction in new qualitative SREP measures, from about 700 in 2021 to less than 400 in 2025, reflecting both more targeted use of supervisory tools and more timely action outside the annual SREP cycle.

The reformed SREP is making supervision more effective and intrusive by using the full range of supervisory tools that the law makes available. When remediation of identified weaknesses is insufficient, ECB Banking Supervision will expeditiously increase the severity of supervisory tools and swiftly move up the escalation ladder.

Benefits for stakeholders

Banks benefit from greater transparency and predictability. They are informed earlier of supervisory concerns and potential findings, and the escalation ladder provides a clear view of the severity of issues and the corresponding supervisory response – from informal engagement to binding measures or enforcement. This clarity helps banks to understand the level of supervisory pressure being applied and to anticipate what steps will follow.

Fewer findings in SREP decisions, thanks to earlier communication and targeted escalation, reduce complexity and make supervisory expectations easier to act upon.

Box 1

Remediation of findings and measures

The ECB’s remediation strategy and escalation framework

Remediating supervisory shortcomings (or “findings”) in a timely manner is key for supervisory effectiveness. The ECB expects banks to document how they have resolved the findings and to provide confirmation of this to their supervisors. This has helped improve banks’ resilience over the years, but the process is resource-intensive and has led to an accumulation of outstanding findings requiring remediation.

The ECB is developing its remediation strategy to promote early identification of weaknesses, clear communication of supervisory expectations and consistent follow-up. Supervisors adopt an ex-ante escalation approach, tailoring their response to the severity and persistence of issues, while setting intermediate deadlines and applying increasing pressure where necessary.

In this context, the ECB actively uses the full range of supervisory instruments available, in accordance with the proportionality principle, from recommendations and heightened supervisory dialogue to binding requirements and, where appropriate, enforcement measures and sanctions. The Supervisory Board has underlined its clear willingness to act when banks fail to remediate findings in a timely manner. The ECB is upgrading its technology for analysing and following up on supervisory findings.

Tiered approach to following up on low severity findings[7]

Effective as of 10 July 2025, the ECB has implemented a new tiered model for following up on findings (and related measures) which aligns effort with risk severity. Material deficiencies (F3-F4) will remain subject to full supervisory engagement, including reviews of banks’ action plans, evidence validation and iterative dialogue. Low severity issues (F1-F2) stemming from any supervisory action will convert into a new type of measure (“reminders to comply/address”). Banks will be required to self-certify, via the ECB’s information management system (IMAS) portal, that they have addressed these low severity findings and keep documentary evidence supporting that certification for the following five years. Supervisors will perform sample checks on the evidence provided from time to time. This risk-based reprioritisation is expected to speed up the resolution of material issues and enhance banks’ internal governance of the follow-up of findings.

2.4 Improving communication

The ECB is improving communication and fostering constructive, bank-specific dialogue through clearer and more focused SREP decisions.[8] Key risk drivers and supervisory concerns are highlighted up front, with more detailed explanations provided in annexes. The sections in the SREP decision that are devoted to subsidiaries and parent financial holding companies have been shortened, mainly focusing on risk drivers, requirements and the entities’ contribution to the group’s risks. The new format presents qualitative requirements and recommendations in separate annexes and is aligned with the current practice for follow-up letters for on-site inspections. This will enable banks to quickly identify the key actions they have been asked to carry out.

The Supervisory Dialogue, in which JSTs discuss the draft outcomes of the SREP assessment with banks’ management bodies, now takes place between mid-June and mid-July, with draft decisions issued by the end of July. The right-to-be-heard period for banks has been extended from two to four weeks. The final SREP outcome is communicated by the end of October, six weeks earlier than it was in previous SREP cycles.

The recent changes to the SREP decisions follow other improvements in the ECB’s communication around its supervisory activities. Since 2016 the ECB has published its SREP methodology on an annual basis. A major step was taken in 2020 with the disclosure of bank-specific Pillar 2 Requirements and aggregated SREP results. From 2023 onward, transparency was increased further through the publication of detailed stress test methodologies and more in-depth explanations of the aggregated SREP results.

Benefits for stakeholders

The new, streamlined SREP decision format increases transparency and helps banks understand the SREP outcomes more easily. It does not entail a change in supervisory focus or a reduction in supervisory attention, but rather brings more clarity on the issues supervisors consider more severe. Together with the more focused risk assessment, it facilitates a better supervisory dialogue with banks. Banks receive their SREP decisions earlier, giving them more time for capital and strategic planning, without compromising rigour or expected standards of resilience.

2.5 More stable methodologies

When performing the SREP, JSTs follow prescribed methodologies for assessing various elements of banks’ risk profiles, such as their business models, their governance arrangements and the different categories of financial or non-financial risk to which they are exposed. In recent years, the ECB, together with the NCAs, has comprehensively reviewed the SREP risk-assessment methodologies, adapting them to reflect the supervisory experience gained in the first years of operation of the SSM. Methodological reviews also allowed the ECB to establish a more modular risk-assessment approach, facilitating the implementation of the risk-based multi-year approach.

Going forward, the ECB is now able to keep new methodological changes to a minimum. The objective of having stable methodologies needs to be balanced with the need to adapt to changes arising from the external environment. Future methodological reviews may be carried out, where needed, to tackle evolving risks, emerging priorities or in response to regulatory changes.

Benefits for stakeholders

More stable methodologies ensure greater consistency over time, making supervision more predictable for banks and improving the benchmarking of outcomes over time and across banks.

One core element of the SREP reform is a revised methodology for setting Pillar 2 requirements (P2R), making the ECB’s methodology simpler and more robust (Box 2).

Box 2

Making Pillar 2 simpler and more risk-based, and avoiding overlaps with Pillar 1

The Pillar 2 Requirement (P2R) is a bank-specific capital requirement set by supervisors to cover risks which are not or are not sufficiently covered under Pillar 1. P2R applies in addition to the uniform Pillar 1 requirements that are determined in accordance with the Capital Requirements Regulation (CRR).

In 2025 the ECB revised its methodology for setting P2R. Under the previous methodology, the P2R level was selected from a range associated with the weighted average of SREP risk scores. The P2R was then broken down risk by risk, based on figures from the bank’s internal capital adequacy assessment process (ICAAP).

The new methodology reduces complexity by creating a more direct link between the P2R and individual Pillar 2 risk drivers, as assessed in the SREP. Using the revised methodology, JSTs assign separate add-ons risk by risk to each Pillar 2 risk element within narrower decision ranges based on SREP scores, and identify any material risk drivers that show an outlier profile and should not be diluted into the corresponding score.

The revised Pillar 2 methodology avoids overlaps between Pillar 1 and Pillar 2 requirements. JSTs check whether a certain SREP score may be strongly correlated to risks that are already covered by Pillar 1 requirements in accordance with the CRR. For instance, JSTs check whether deductions of expected losses under the internal ratings-based approach might cover provisioning gaps identified in the SREP assessment of credit risk. JSTs also check whether risks stemming from trading activities covered by Pillar 1 materially affect the outcome of the SREP assessment for market risk.

When setting the P2R, JSTs will not take into account weaknesses identified in the Pillar 1 risk models, since such weaknesses are already addressed in the supervision of internal models. Special attention will be given to internal models that are no longer permitted under CRR III (e.g. the former advanced measurement approach for operational risk) and to those institutions that are bound by the new output floor in line with Article 104a, paragraph 6, sub-paragraph (b) of the Capital Requirements Directive. If overlaps are identified, JSTs adjust the Pillar 2 requirements accordingly on a case-by-case basis.

Further details of the new P2R methodology and examples how potential overlaps between Pillar 1 and Pillar 2 requirements are addressed can be found on the ECB’s banking supervision website.

2.6 Better use of IT systems and analytics

Using and advancing state-of-the-art IT and analytical tools to support routine tasks frees up resources and time to work on key bank-specific risks. The ECB has prioritised technical solutions that enable more effective interactions with banks and end-to-end digitalised supervisory processes facilitating automation and more consistency (Box 3). The IT strategy for the years 2024-28 foresees continued investment in supervisory technology applications to improve efficiency, access to data, risk analysis, consistency of decision-making and collaboration. As one element of this strategy, the ECB is exploring how generative Artificial Intelligence (AI) and large language models can reduce decision-making time, improve the efficiency and effectiveness of supervisory assessments and streamline internal workflows.

Benefits for stakeholders

As one example of the better use of IT systems, the ECB’s information management system (IMAS) portal[9] allows banks to submit information related to supervisory processes, track their status and exchange information with supervisors. Banks now have an overview of outstanding supervisory measures at all times, including the description, severity and deadline in the IMAS portal. Banks can submit documentation to close the measure and are notified of status changes.

3 Next-level supervision

In addition to reforming the SREP, the ECB is achieving gains in effectiveness and efficiency across its supervisory activities as part of the “Next-level supervision” project, allowing supervisors to maintain a clear focus on relevant risks. Informed by a comprehensive survey carried out among the authorities participating in the SSM and industry input, six key areas for reform were identified:

- Decision-making

- Internal models

- Stress testing

- Capital-related decisions

- Reporting

- On-site inspections

Across each of these six areas of work, the ECB is increasing its use of digital tools for supervision, also known as “SupTech” (Box 3). In addition, ensuring supervision is proportionate to banks’ size, systemic relevance and risk profiles is an important cross-cutting theme. While the ECB’s work to increase the efficiency and effectiveness of supervisory processes is most directly relevant for significant institutions (SIs), important aspects regarding the proportionality of these processes for less significant institutions (LSIs) are also being considered (Box 4 and Section 6).

Box 3

Digitalisation

Since the inception of the SSM, the ECB has consistently invested in improving the technology it needs to carry out its tasks. Supervisory work is increasingly relying on innovative solutions via the launch of more advanced supervisory technology (also known as SupTech). Automation, advanced analytics and collaboration solutions are at the heart of these tools.

Harnessing new technologies is essential for implementing the agreed initiatives, which require the creation of end-to-end digital processes. Key existing tools include IMAS, the ECB’s main internal platform for supervisory assessments, Atlas, which fully digitalises internal decision-making processes, and the newly developed SSM Portal, a single gateway for banks that will consolidate several existing portals into one.

With the integration of this technological infrastructure under way, internal workflows will be streamlined, and manual processes will be digitalised. This will improve efficiency via end-to-end digitalisation of supervision and interactions with banks – from banks submitting data, through analysis and decision-making, to clear and consistent communication via the SSM Portal.

3.1 Speeding up decision-making

The ECB has the authority to make supervisory decisions that banks are legally required to follow. Its decisions must be supported by clear reasoning which sets out the material facts, legal reasons and supervisory considerations underlying the decision. Whether related to fit-and-proper (FAP) assessments, common procedures such as licensing or approvals of qualifying holdings, or any other supervisory decision, decision-making must be timely, risk-based and efficient. Delays or inefficiencies can disrupt governance structures in banks, create uncertainty and undermine public and market confidence.

The ECB’s current approach to decision-making has upheld high standards and has played a key role in increasing financial stability since the global financial crisis. However, the growing complexity stemming from diverse banking models, national regulations, and the need to manage new and emerging risks has resulted in a high number of supervisory decisions that need to be processed every year, posing administrative challenges for both supervised banks and the ECB.

To tackle these challenges, the ECB has focused on streamlining decision-making processes, reducing administrative barriers and promoting the harmonisation of regulations at national and European level, while upholding a risk-based supervisory approach that prioritises the most complex and high-risk cases. As early as 2017 the ECB introduced a comprehensive delegation framework, under which ECB senior managers were empowered to adopt certain supervisory decisions subject to specific criteria. Delegation significantly expedites the decision-making process for banks.[10]

Ongoing initiatives

More than half of all supervisory decisions are now adopted by ECB senior managers via delegated decision-making, thus enabling the Supervisory Board and Governing Council to focus on the most sensitive and complex supervisory decisions. The ECB is now working to expand the scope of delegated decision-making, which is also in line with the recommendation made by the IMF in its 2025 FSAP assessment.[11] For example, going forward, delegated decision-making might also be possible for mergers, divisions and material acquisitions of holdings. Work is in progress to explore the expansion of the material scope of the delegation framework for other types of ECB decisions, such as acquisitions of qualifying holdings.

In addition, in 2025 the ECB implemented a risk-based strategy for common procedures, which covers 90% of all SSM common procedures, with resources now directed to the most complex and impactful cases, enabling more efficient and risk-based processing of applications for NCAs and the ECB. The risk-based approach uses a traffic light system to classify risk and complexity and aims to make the assessment of common procedures more effective and efficient. The strategy is expected to have a positive impact on supervised banks, as well as proposed acquirers who interact with the ECB (via reduced interaction in more straightforward cases and faster processing times).

The ECB is also further automating and digitalising its FAP processes, in particular how it requests information and documents from known appointees.[12] This involves extending the functionalities of relevant FAP tools, such as the FAP questionnaire and the IMAS Portal, so that submission of new information is more efficient and documentation requests are streamlined.

Benefits for stakeholders

These initiatives provide tangible benefits for supervisors, banks and, ultimately, the broader public. Banks can expect faster processing times. For example, the average processing time for FAP assessments, which account for over 50% of all ECB decisions, was reduced from 109 days in 2023 to 97 days in 2024 – well within the limit of 120 days foreseen in the European Banking Authority (EBA) Guidelines[13] – thanks to digital tools and a fast-track decision-making procedure.

The risk-based strategy for common procedures, expanding delegation frameworks and automating routine tasks are expected to further reduce processing times and minimise unnecessary interactions with banks. Ultimately, streamlining the ECB’s decision-making processes will be to the benefit of the broader public in so far as it will enable the ECB to better work towards its supervisory objective of contributing to the safety and soundness of credit institutions and the stability of the financial system.

3.2 Faster approvals of internal models

The supervision of internal models in the EU takes place in accordance with the Capital Requirements Regulation, the Capital Requirements Directive and the EBA’s regulatory technical standards and relevant guidelines. The overarching goals of internal model supervision are to ensure that banks’ models meet all legal requirements, provide a reliable basis for calculating risk-based capital requirements and support effective internal governance and risk management within banks. Under EU law, supervisors must approve the initial use of these models as well as material changes and continue to approve and monitor their implementation.

Since the inception of the SSM, the ECB has taken significant steps to improve the quality and consistency of internal models to ensure a level playing field for European banks and reduce unwarranted variability in risk-weighted assets (RWAs). Notably, the Targeted Review of Internal Models (TRIM), conducted between 2016 and 2021, combined detailed methodological work with 200 on-site internal model investigations across 65 SIs.[14]

The TRIM project significantly improved the consistency of internal model supervision for banks, reducing unjustified variability in RWAs. The ECB Guide to Internal Models was a key deliverable of the project and continues to serve as the backbone of internal model supervision within European banking supervision. Ongoing efforts such as internal model investigations (IMIs) and model monitoring have built on the achievements of TRIM to ensure that banks maintain high standards in their use of internal models.

Alongside the TRIM project, in 2020 the Supervisory Board approved the IMI intensity framework, which introduced a more structured, proportionate approach to resource allocation for the assessment of material changes or extensions and initial model approvals. This intensity framework helped align supervisory efforts with the materiality and complexity of the underlying requests, fostering a more targeted and risk-based use of resources.

Despite these developments, supervision of internal models remains resource-intensive and is largely driven by banks’ requests to make material changes to their models. The compliance-focused nature of internal model supervision reflects the importance of maintaining resilience, ensuring models meet legal requirements, and ensuring a level playing field for all SIs. However, internal model-related supervisory processes – including granting permission for material model changes – require specialised expertise, posing operative challenges for both supervisors and banks, which were the starting point for the proposals developed as part of the Next-level supervision project.

Ongoing initiatives

The ECB is pursuing several initiatives to further streamline internal model supervision and improve efficiency. Following an initial design phase in 2025, in 2026 the ECB will implement the following key measures:

- Embedding model strategies within supervisory plans. The ECB is aligning internal model-related supervisory activities with the broader supervisory strategies of the JSTs. The objective is to enable the ECB to adopt a more strategic and proactive approach to overseeing internal models, further supporting supervisors’ ability to focus on the areas of greatest risk and impact. Relatedly, the ECB is encouraging banks to focus their models on key strategic portfolios, while adopting less sophisticated approaches for smaller portfolios.[15]

- Shortening the time needed for approvals of material changes. The ECB is working to reduce the currently lengthy time frame needed to approve material changes to internal models including by approving changes at an earlier stage in the process, while at the same time ensuring that levels of RWAs calculated using internal models in banks remain adequate.

- Streamlining internal processes. The ECB is taking advantage of the risk tolerance framework to accelerate and simplify the processes used in the supervision of internal models, without compromising scrutiny.

The common objective of all these intended simplification initiatives is to shift the ECB’s model supervision away from a largely reactive approach, driven by banks’ requests for model changes, towards a more proactive approach, whereby the ECB increasingly focuses its attention on areas of concern or on potential blind spots, for example by performing more dedicated and focused internal model investigations. This shift will be the next major step after the TRIM project to maintain and further strengthen the high quality of the internal models currently in place.

Furthermore, the EBA’s ongoing review of the regulatory technical standards on model changes and assessment methodology for the internal ratings-based approach provides an additional opportunity to further reduce the number of changes requiring supervisory approval and to introduce more proportionality in the methods used to assess internal models. This would enable the ECB to further streamline processes without compromising the quality or reliability of internal models, freeing up resources for more proactive supervision of internal models.

Benefits for stakeholders

The proposed changes are expected to deliver significant improvements in terms of balancing efficiency with a focus on risk. By the end of 2026, it is expected that less time will be needed for approvals, relieving banks from the need to maintain several model versions in parallel during the model approval process.

The impact of embedding model strategies into JST plans will already begin to be felt in 2026 and will enable supervisors to focus more on high-risk areas, improving oversight and resilience. Overall, the ECB’s objective is to transform internal model supervision into a more streamlined, risk-based process that continuously supports the resilience of the banking sector.

Meeting this objective would be further aided by changes to regulatory technical standards that would limit the number of model changes requiring supervisory approval. Such changes are subject to the European legislative process and are outside the remit of the ECB. Moreover, it is expected that supervised entities will concentrate their efforts on the most critical aspects of their internal model landscape, while maintaining adequate oversight of potentially remaining weaknesses.

3.3 Streamlining stress testing

A key lesson from the global financial crisis of 2007-2009 was that traditional risk-assessment approaches, which often relied on historical data and static assumptions, were insufficient to capture the complex interplay of risks under stressed conditions. In response, stress-testing frameworks were developed to assess banks’ ability to withstand adverse economic and financial scenarios, providing a forward-looking perspective on risks that might materialise under severe but plausible circumstances. These exercises have since become a vital tool for identifying vulnerabilities, increasing transparency and fostering trust in the financial system.

Over the past decade, supervisory stress tests have grown in sophistication and scope, helping to strengthen the resilience of the banking sector. They support critical dialogue between supervisors and banks, enabling early identification of weaknesses and guiding timely corrective actions. Stress tests also provide stakeholders – including investors, depositors and policymakers – with confidence in banks’ capacity to weather adverse conditions, thereby supporting financial stability.

The current stress-testing framework includes EU-wide stress tests conducted by the European Banking Authority, SSM thematic stress tests and supervisory assessments of banks’ internal capital adequacy assessment processes (ICAAP). This framework was designed to provide a robust and comprehensive evaluation of banks’ ability to withstand adverse scenarios.

However, as stress-testing frameworks have evolved, they have also become more complex and resource-intensive for both supervisors and banks. While the rigour of these exercises is essential, complex processes can hinder the ability to respond swiftly to emerging risks and entail significant compliance costs. Simplifying the stress-testing framework, without compromising its robustness, is therefore imperative to ensure it remains an effective and agile tool for safeguarding the financial system.

Ongoing initiatives

The ECB has taken steps in previous stress test cycles to streamline its stress-testing work. For instance, in the context of the 2023 and 2025 stress tests the ECB introduced further proportionality elements, more risk-based data quality assurance and reductions in data submission cycles, actions which have demonstrated the potential for efficiency gains and lower compliance costs.

Additionally, increased use of supervisory desktop tools and targeted exploratory scenario analyses, combined, where needed, with information from banks’ own ICAAP stress tests, offers new ways to assess resilience while reducing the resource intensity of bottom-up stress tests.

In line with the recommendations of the High-Level Task Force on Simplification, the ECB is taking further steps to improve the efficiency and effectiveness of its stress-testing framework. While some of these steps involve coordination with external stakeholders, notably the EBA, others fall entirely within the scope of the ECB’s supervisory tasks. The actions the ECB is currently taking can be grouped into the following focus areas:

- Sample and proportionality. Every two years the EBA carries out an EU-wide stress test in cooperation with the ECB, the European Systemic Risk Board and the national supervisory authorities, which covers the largest significant banks directly supervised by the ECB. In parallel, the ECB conducts its own SSM stress test of medium-sized banks that are not included in the EBA sample owing to their smaller size. Ahead of the 2027 EU-wide stress test the ECB is working to make the process even more proportionate for SSM significant institutions that are not included in EBA sample. The aim is to optimise the conduct of the bottom-up stress tests to balance costs, with a focus on the most systemic institutions and most relevant supervisory objectives.

- SSM thematic stress tests. The ECB will streamline the thematic stress test process by increasing the use of supervisory desktop tools and targeted exploratory scenario analyses, drawing on information from banks’ own ICAAP stress tests where needed. In fact, the 2026 SSM geopolitical risk reverse stress test to be conducted in the context of banks’ ICAAP submissions already represents a step in this direction. The aim is to significantly reduce resource demands for both banks and supervisors, while enabling forward-looking risk-based assessments to be conducted in a more flexible manner.

- Quality assurance (QA). Ahead of the 2027 EU-wide stress test, the ECB is working on optimising the QA process by introducing a more targeted and risk-based approach. Conducting the QA at a more aggregated level and further enhancing the prioritisation of QA issues should also help ease the workload for participating banks.

The ECB is also collaborating with the EBA with a view to making the EU-wide stress test more efficient and effective. For example, in the area of stress test data reporting, the ECB is working together with the EBA to simplify the stress test templates. The goal is to significantly reduce the number of reported data cells and to align them more closely with regular supervisory reporting, easing compliance costs.

Benefits for stakeholders

The proposed changes are expected to deliver significant benefits. These include:

- a more proportionate and risk-based approach to stress testing, allowing supervisors to focus on the most significant risks and vulnerabilities;

- the simplification of EBA stress test templates, including a better alignment between stress test data and regular supervisory reporting, easing compliance costs for banks and facilitating the quality assurance work of supervisors;

- a streamlined quality assurance approach, which aims to ensure more efficient use of stress test resources for the benefit of both banks and supervisors;

- more agility and flexibility in supervisory assessments, enabling quicker responses to emerging risks; and

- retaining the role of the stress tests in terms of providing transparency and fostering market discipline.

By increasing the use of targeted exploratory scenario analyses and of banks’ own ICAAP stress tests, combined with the employment of supervisory desktop tools, the framework will continue to foster strong risk management practices within banks while maintaining robust oversight and risk-based, forward-looking supervisory assessment capabilities. The overall streamlining of the stress-testing framework will then allow for the development of more top-down oriented stress test models, with the objective of leading to a reduction in the burden on administrative resources.

3.4 Fast-tracking straightforward capital-related decisions

Ensuring the adequacy of banks’ capital (or “own funds”) is the foundation for ensuring a safe and sound banking system. Banks rely on their capital buffers to absorb losses when risks materialise, enabling them to continue serving businesses and households even during economic downturns. Ensuring well founded supervisory decisions related to own funds – be it the inclusion of interim profits in Common Equity Tier 1 (CET1) capital or approvals of share buybacks – is, therefore, of critical importance for safeguarding financial resilience and stability.

The ECB processes over 250 such own funds-related decisions annually, ranging from routine transactions with limited risk implications to complex cases requiring a deeper analysis of banks’ capital positions. The current process involves detailed manual assessments by JSTs and often requires input from senior decision-makers to ensure consistency and robustness. While this approach has supported prudence and resilience, the experience the ECB has gathered in past years, combined with the use of new supervisory technologies offers the opportunity to speed up the processing of low-risk cases.

Ongoing initiatives

The ECB has already taken steps to streamline low-risk decisions related to banks’ own funds. For example, in 2015, it introduced an “Umbrella Decision” that allows banks to include interim profits in regulatory capital, without the need for a separate ECB decision, where specific criteria are met. Since 2018, it has also delegated decision-making authority to ECB senior managers for certain transactions, which account for more than 80% of the applications submitted by banks every year. These initiatives have reduced the administrative workload and improved processing times while preserving the integrity of the decision-making process.

Building on these initiatives, the ECB will introduce a “fast-track” process to streamline the approval of some low-risk own funds transactions that, under the already applicable framework, can be delegated to ECB senior managers.

This initiative aims to further shorten processing time down to two weeks for the simplest cases, once the IT infrastructure is fully in place, reducing the administrative workload for both banks and supervisory teams, while ensuring that banks remain resilient. Key features of the fast-track process include:

- Standardised applications. A new, standardised application template will simplify the process for banks, ensuring that all required information is submitted in a clear and structured manner through a dedicated portal. This will also facilitate the automated extraction of information by JSTs.

- Increasing automation. JSTs will no longer need to manually compile internal documents. Instead, draft decisions will be generated automatically using IT tools, to be reviewed by the JSTs before finalisation.

- Accelerated processing. Eligible transactions will be subject to expedited decision-making, helping reduce turnaround times significantly. The ECB is also working with the Single Resolution Board to streamline consultation between JSTs and Internal Resolution Teams, which is mandatory for certain decisions.

In addition to meeting the criteria for delegation of the decision to ECB senior managers, transactions eligible for the fast-track process will need to comply with certain risk-based criteria. More complex transactions, such as share buybacks, will also be eligible, provided that the impact on the applicant bank’s risk profile is low, as assessed based on qualitative and quantitative criteria. The criteria will be disclosed to banks through a dedicated communication before the initiation of the new process.

Transactions falling outside of the fast track, both delegated and not delegated, may still be authorised, but will follow the current process and timeline.

The fast-track process will be operational starting in the first quarter of 2026.

Benefits for stakeholders

Straightforward transactions will be processed at a fraction of today’s turnaround times, allowing banks to execute capital management strategies more quickly and effectively.[16] By introducing standardised templates for all capital-related transactions, the fast-track process will reduce administrative tasks and enable automation of procedures for both banks and supervisors. Reducing the administrative workload will also allow supervisory teams to allocate their time more efficiently and calibrate their supervisory assessments in a risk-based manner. This will ensure that high-impact or higher-risk transactions continue to be scrutinised in depth, safeguarding and bolstering the banking system’s resilience.

3.5 Simplifying supervisory reporting

Supervisors rely on accurate, timely and comprehensive reporting to monitor risks, enforce prudential regulations and take prompt action to safeguard financial stability. In the same vein, public disclosure requirements enhance market transparency, facilitating analysis and research for external stakeholders. Banks provide this information through standardised reporting frameworks designed to ensure consistency and comparability across institutions.

The current reporting framework has evolved gradually, shaped by the need to address diverse supervisory and policy priorities at both national and European level. The introduction of EU-wide reporting standards, such as FINREP and COREP, marked a significant step towards harmonisation, while proportionality measures have sought to reduce reporting obligations for smaller institutions. For example, simplified reporting frameworks have been introduced for SNCIs.

Despite these efforts, the European reporting landscape remains somewhat fragmented, with parallel data flows across statistical, prudential and resolution domains, as well as between European and national authorities. Moreover, reporting requirements have expanded over time, driving up costs for banks.

In the area of regulatory reporting, the ECB’s competencies are concentrated in its powers to issue ad-hoc information requests, while most permanent requirements originate from the CRR and related Implementing Technical Standards, as well as national legislation.[17] To achieve impactful streamlining of the reporting landscape, European and national regulatory and supervisory authorities need to take concerted actions within their respective scope of responsibilities. This includes the timely and coordinated implementation of certain measures to increase the efficiency and effectiveness of the reporting landscape, as described below. It also includes commitment from relevant stakeholders to put in place legislative amendments as stipulated in the recommendations of the ECB High-Level Task Force on Simplification (HLTF).[18]

Ongoing initiatives

The ECB is working to streamline the reporting process and reduce costs for banks, while maintaining the quality and relevance of the data that is collected. This involves close collaboration with the EBA and the Single Resolution Board (SRB) on topics such as streamlining Implementing Technical Standards (ITS) on supervisory reporting, change management for reporting processes, data validation and proportionality. It also involves cooperating with other authorities in relation to, for instance, macroprudential, statistical and resolution reporting. The work is focused on developing a comprehensive, risk-based approach to supervisory reporting.

The initiatives described below are concrete, short- to medium-term changes the ECB is implementing, or proposals it intends to take forward, and affect microprudential reporting and disclosures in particular. These initiatives complement the HLTF recommendations on reporting, which are aimed at establishing high-level principles, providing a forward-looking vision and highlighting the need to set up an appropriate legal framework. Key initiatives include:

- Collecting comprehensive industry feedback. The ECB developed and circulated a structured questionnaire to gather industry proposals on simplifying the reporting landscape and processes and followed up with a dedicated workshop in October 2025. The inputs have been used to shape and prioritise the ECB’s initiatives and stances on supervisory reporting and disclosures.

- Fostering integration and innovation. The ECB fully supports and is contributing to the long-term vision of an integrated bank reporting framework across the different reporting mandates. The ECB is actively participating in initiatives to align definitions and reporting concepts via the Joint Bank Reporting Committee (JBRC) and Banks’ Integrated Reporting Dictionary (BIRD) initiatives. Furthermore, the ECB is developing proposals on how to streamline data quality assessment processes by further integrating the additional data quality checks it publishes into the EBA’s validation rule framework.

- Streamlining the stock of existing reporting requirements. The ECB is stocktaking existing reporting requirements with the aim of reducing overall reporting obligations by addressing overlaps, lowering frequencies where possible and applying the principle of proportionality. As a major supervisory data user, the ECB has identified “least used templates” and is reviewing the existing reporting requirements within its remit. The 2026 Short Term Exercise reporting package, through which the ECB obtains information that is relevant to the SREP, has been reduced by approximately 18.5%, with further initiatives envisaged for 2027. The ECB is also committed to continuing its regular, risk-based exercises to identify opportunities to streamline ad-hoc reporting and reduce related obligations.

- Controlling new regular and ad-hoc requests. Together with the EBA, the ECB will publish an inventory of data collections to improve transparency for market participants and help avoid overlapping data requests, operationalising the requirements of the Better Data Sharing Regulation. The ECB will work with the EBA and competent authorities to stabilise reporting requests, review lead times for reporting implementation and establish regular holistic reviews of data collections. A revised governance framework will ensure a more controlled and integrated process for requesting new information, one that prioritises need-to-have data and embeds early planning and coordination with other authorities via the JBRC. Moreover, the ECB will conduct periodic assessments of its own reporting requirements every three to five years, aimed at decommissioning reporting that is no longer relevant. At European level, the ECB will support the EBA in developing common standards for ad-hoc data collections.

- Focusing on material data errors. Current legal frameworks lack clear provisions for immaterial deviations or acceptable tolerances, leading to an unnecessary administrative burden. Introducing exemptions for immaterial revisions is key to reducing reporting costs and allowing banks to focus their resources more effectively on core reporting tasks. The ECB, together with the NCAs, is advancing a proposal to introduce risk-based materiality thresholds for supervisory reporting, to the extent that this is technically and legally feasible under the existing legislative framework. More broadly, the HLTF recommendation to define materiality thresholds or supervisory tolerance margins for minor reporting errors in level 1 legislation would establish a firm legal basis for exempting immaterial corrections from resubmission requirements.

Box 4

Focus on proportionality in reporting

Among the above-mentioned initiatives, specific actions are aimed at increasing proportionality in reporting for small and non-complex institutions (SNCIs). Under EU legislation, banks that meet a set of predefined regulatory criteria are considered SNCIs and are subject to certain simplified prudential requirements, including in the area of reporting. As part of the work to streamline the stock of existing reporting requirements, the ECB will work on consistently integrating the SNCI concept within the ECB FINREP regulation. In cooperation with the EBA, the ECB is also reviewing the frequency of certain ITS templates for SNCIs or enhancing proportionality via risk-based reporting triggers, leveraging on the materiality of certain risks to determine when banks are required to complete certain reporting templates. This could be relevant for larger banks as well. Similarly, the ECB actively supports the EBA’s work on disclosure and is providing advice on plans to enable automated disclosure extraction for SNCIs (as also mentioned in the HLTF report) and on potential further reductions of disclosure requirements for SNCIs. Looking beyond disclosure and reporting, the ECB and NCAs are actively working on reinforcing the use of proportionality already granted by the existing framework. This work will be carried forward in 2026 (Section 6).

Benefits for stakeholders

The proposed changes are designed to deliver significant benefits, including:

- Reduced costs. By streamlining the stock of reporting requirements, fine-tuning reporting processes in the short term and establishing an integrated reporting framework in the long term, the reporting requirements banks face will be reduced, supporting the European Commission’s cost-reduction targets. Furthermore, materiality thresholds for resubmissions are expected to reduce monitoring costs, especially for smaller institutions, while maintaining the expected data quality standards.

- More efficient and effective supervisory processes. Streamlined reporting and fewer resubmissions will enable supervisors to process and analyse data more quickly, facilitating timely and effective supervisory actions. In addition, the increased coverage and use of the BIRD will improve data quality, leading to fewer errors and consequently fewer resubmissions.

- More transparency and predictability. Publishing an extract of the data collection database will increase transparency and accountability in the reporting process. Furthermore, stabilising and clarifying expectations on reporting needs will enable market participants to understand reporting requirements better.

3.6 More targeted on-site investigations

On-site investigations – on-site inspections (OSIs) and internal model investigations (IMIs) – are an essential tool for banking supervisors to obtain independent verification that adequate policies, procedures and controls exist at banks, as recognised in international standards.[19] They provide a means for supervisors to gain a detailed understanding of a bank’s condition based on in-depth assessment of risks, internal controls, governance and business models. On-site investigations complement the continuous work of JSTs and horizontal supervisory analyses, creating a holistic supervision framework and providing JSTs with the detailed information and in-depth insights they need for impactful and targeted follow-up actions.

Historically, the demand for on-site investigations has exceeded the available capacity of ECB supervisors. On-site inspections have relied heavily on resources from NCAs, which provide around 85% of SSM inspectors. This model has enabled the ECB to leverage local expertise while applying a consistent supervisory approach across jurisdictions, fostering a level playing field in the European banking market.

In recent years, the ECB has taken several initiatives to improve the efficiency and effectiveness of on-site supervisory processes, including:

- Integrated planning across on-site investigations, horizontal analyses and JST supervision, with greater use of strategic top-down guidance for on-site investigations in accordance with ECB supervisory priorities and JST needs. In addition, the ECB now communicates the Supervisory Examination Programme (SEP) earlier, facilitating timelier feedback and preparation by banks.

- Development of cross-border and mixed-team missions, as well as on-site investigations conducted under coordinated approaches, to further promote a level playing field and optimise use of supervisory resources.[20]

- Implementation of new tools and comprehensive inspection methodologies, including those for specific risk areas, to boost efficiency and effectiveness.

Despite these improvements, however, challenges remain. Recent external reviews, such as the independent expert group’s assessment of the SREP, which concluded in 2023, as well as feedback from JSTs, NCAs and the banking industry, have identified areas where on-site supervisory practices could be further harmonised across inspection teams and further progress could be made towards our goals of risk orientation, efficiency, effectiveness and quality outcomes. This includes the end-to-end duration of on-site investigations, the identification of topics and coordination between horizontal functions (on-site supervisory teams, horizontal analyses) and vertical functions (JSTs). It also includes the follow-up to the findings from on-site investigations (Box 1).

Ongoing initiatives

The ECB and NCAs are working on a range of improvements to increase the efficiency and effectiveness of on-site investigations. These improvements have been agreed in 2025 and will be implemented in the course of 2026. These improvements are designed to achieve more targeted investigations, in line with the development of the risk tolerance framework for on-site supervision and the drive for more streamlined end-to-end on-site processes. Key initiatives include:

- Streamlining and fine-tuning processes. The ECB is reviewing and streamlining its internal and external guidelines related to on-site supervision with a view to simplifying processes and improving information sharing. The ECB is also increasing its use of SupTech tools to support inspectors and JSTs in drafting and processing supervisory findings and measures. This will complement the recently introduced tiered approach (Section 2) to following up on findings.

- Speaking with one voice. The ECB is promoting a pan-European approach and a “one SSM” team spirit in all on-site activities, in line with the SSM supervisory culture initiative (Section 4). This includes improved internal coordination and better information sharing between on-site inspectors, NCAs, horizontal and vertical teams. It will also involve encouraging greater JST participation in on-site investigations to ensure seamless integration with ongoing supervision.

- Fostering proportionality and quality. The ECB will increasingly make use of more focused investigations with smaller teams and shorter durations. These focused missions will be used based on a risk-based assessment in line with supervisory priorities as well as the specific priorities of individual banks. The outcome of inspections will be communicated in a more concise way, while maintaining clarity and quality.

Benefits for stakeholders

- Improved risk focus and higher quality. On-site investigations protect depositors and borrowers against risky lending and mismanagement. By becoming more agile and risk-focused, banks’ potential weaknesses can be identified and addressed more quickly and efficiently. A more targeted approach to on-site investigations to complement the existing framework will ensure that supervisory efforts are more risk-based and proportionate, enhancing the overall impact of on-site activities and focusing the work of supervisors and supervised institutions on what matters most. Concretely, the ECB will complement and balance its toolset with shorter on-site investigations with a more targeted scope, providing concise assessments in support of targeted and swift remediations.

- Greater consistency. All supervisors, inspectors and JSTs need to speak with one voice and ensure consistent communication with banks. Strengthened coordination and a pan-European approach will help achieve this goal. Concretely, the ECB will enhance interaction and the sharing of information across different teams within the SSM and ensure fluid access to information, limiting the potential for duplicate queries or requests.

- Lower costs. To reduce the costs of translation of on-site investigation reports and to streamline processing times, an option that is further being explored is to invite internationally active banks to choose to receive inspection reports and provide comments in English, if they have not already done so.

- Higher efficiency. Streamlined processes and digital tools will reduce the administrative workload for inspectors and banks, allowing resources to be allocated more efficiently.

- Greater transparency and accountability. The ECB will publish information tracking the progress of these initiatives, such as the number and intensity of on-site investigations carried out and their average duration.

4 SSM supervisory culture initiative

The SREP reform and the Next-level supervision project are reshaping how the ECB supervises banks. Their success depends on embedding a shared supervisory culture in European banking supervision – one that ensures reforms are implemented consistently and effectively across the banking union.

In February 2025 the Supervisory Board launched the “SSM supervisory culture initiative”. This initiative provides the cultural backbone for the SREP reform and Next-level supervision project, aligning how the ECB works and how it makes decisions with its strategic ambitions.

The initiative is anchored in three strategic themes that define the target SSM culture – supervision must be risk-based, integrated, efficient and effective. To translate these themes into practice, an initial two-year activation plan for 2025-2026 is being implemented. Focus areas include promoting consistent and clear communication across the SSM, common behaviours and training, staff exchanges across the ECB and NCAs to foster collaboration and integration, and role-modelling around risk-based supervision.

Together, this work will provide the cultural fabric that supports the different reform projects, helping them to reinforce each other rather than simply evolve in silos. By shaping behaviours, improving collaboration and strengthening leadership, the supervisory culture initiative will help ensure that the ongoing reforms are durable and impactful across European banking supervision.

5 Evaluating supervisory effectiveness

Successful supervision requires continuous monitoring of the effects of supervisory processes and tools, including the use of judgement, and of outcomes in terms of banks’ resilience and how risks are being managed. The ECB is thus developing methodologies for evaluating supervisory effectiveness with a view to fostering more outcome-oriented supervision and strengthening accountability.

When starting a new supervisory activity that addresses, for example, the supervisory priorities, a clear and concrete definition of the intended outcome for each priority is crafted to allow the pursuit of that outcome to be monitored. In addition, assessing the effectiveness of other supervisory processes and the use of judgement in supervision is important. General evaluations will be based on different analytical tools, including expert judgement. They will be customised for each activity and will rely on a mix of inputs, including qualitative and/or quantitative metrics.

By examining the results of supervisory actions and addressing identified vulnerabilities, a continuous feedback loop is created between the objectives of supervision, supervisory strategies and tools, and outcomes. These evaluations of supervisory effectiveness provide a basis for reallocating resources across supervisory activities and adjusting the strategy as needed. Overall, this process enhances both efficiency and resilience.

Clear evaluation of supervisory outcomes is designed to strengthen trust in supervision by increasing transparency towards external stakeholders regarding supervisory achievements – this also strengthens the ECB’s accountability to the European Parliament. Evaluations may also identify good practices in conducting supervisory actions as well as policies, tools and activities that have proven effective.

6 Implementation and follow-up