- SUPERVISION NEWSLETTER

Benefits from advanced technology infrastructure in supervision

14 May 2025

Author: Frederik Hoppe

Technological innovation has driven structural changes across all sectors of the global economy, including the banking industry. The sector is rapidly transforming as new institutions enter the market, reshaping the financial value chain. Traditional banks are adopting new business models that incorporate fintech intermediaries into essential business processes. They are also utilising artificial intelligence (AI) to revolutionise customer interfaces and data management, improve credit assessments, enhance customer support and more. Meanwhile, the volume of data created, consumed and stored in banking and other sectors worldwide is growing.

Banking supervisors must embrace digital transformation and foster an innovative supervisory culture to adapt to this fast-changing environment. Technology must be leveraged to manage the increasing data volumes and new risks stemming from banks’ use of AI and innovative business models. This will allow supervisors to remain efficient and effective in fulfilling their mandate to ensure the safety and soundness of the banking system. Since the start of European banking supervision with the Single Supervisory Mechanism (SSM) in 2014, the ECB’s supervisory arm has come a long way. It has developed and continuously improved a set of core IT systems, launched a comprehensive digitalisation strategy and created cutting-edge supervisory technology (suptech) tools in collaboration with the national competent authorities (NCAs).

This advanced tech infrastructure not only helps supervisors perform their roles more efficiently and effectively, but it ultimately also benefits the supervised banks. It enables easier communication, faster performance of supervisory tasks and greater resource efficiency, and earlier detection of risks to the banking sector. This article describes parts of the supervisory IT landscape and how it is benefiting society by improving the way supervision is conducted.

Improving interaction between banks and supervisors

The development of major tech platforms has made communication between banks and supervisors more streamlined, secure and transparent. In this section we focus on three platforms that currently play a key role in bank-supervisor interaction: the IMAS portal, CASPER and the STAR portal.

The IMAS portal: the digital gateway to European banking supervision

The IMAS portal was developed in order to modernise information exchange and collaboration in banking supervision. In this process, input from supervised entities was taken into consideration. Launched in 2020, IMAS provides banks with a secure, digital way to submit information on specific supervisory processes – and to follow up on them. For instance, banks can use online forms to submit applications for acquisitions of qualifying holdings or notifications of third-party arrangements, or they can access all outstanding supervisory measures issued in relation to the bank. Subsequently, banks can monitor the status of these processes online and exchange further information and messages about them with the supervisor. The IMAS portal therefore reduces operational risk and significantly reduces manual effort on both sides. Moreover, it increases transparency for supervised institutions about the progress of supervisory procedures.

CASPER: a versatile platform for efficient data collection and validation

Complementing the IMAS portal, the centralised submission platform “CASPER” is a comprehensive platform that does more than merely receive data. It primarily handles ad hoc data collections covering banking risks of particular interest to the ECB, beyond the regulatory reporting under the European Banking Authority’s framework. By enabling self-service data collection within short time frames, CASPER generates significant efficiencies for supervisors. Serving the entire ECB, CASPER streamlines the processing and validation of files and optimises data workflows. Since its widespread adoption in 2022 CASPER has been offering a secure, automated, consistent and efficient channel for banks to use for submitting data requested by the ECB – and to follow up on their submissions if needed.

On CASPER, banks can access the templates they are required to use for specific data collections. They can also easily check the data quality of their input, based on instant data validation. To further decrease the manual effort involved in data collection, banks can automatically submit reports through application programming interfaces which build a bridge between applications running on the bank’s side and the supervisor’s side, allowing them to communicate with each other. Once the data and other supporting information have been submitted successfully, CASPER notifies the supervisors, who then start their analysis.

CASPER covers a wide range of regular and ad hoc data reporting use cases within European banking supervision, such as the short-term exercise[1] data collection, and it replaces submissions by email or on less user-friendly platforms with limited functionalities. In addition to reducing manual processing risks and speeding up the validation process, CASPER simplifies and harmonises data submission for banks. This leads to economies of scale for banking supervision by reducing the need for additional IT solutions which support data collections.

The external STAR portal: simplifying the management of stress test exercises

Another major IT platform used for interaction and data exchange between banks and supervisors is the external stress tests account reporting (STAR) portal. Introduced in 2017, the platform allows banks to collaborate digitally and securely with the ECB and NCAs during stress test exercises and to exchange market-sensitive data.

Banks input their data into the external STAR portal and can use the automated pre-validation functionality to detect data quality issues. If banks have questions about the process or methodology for the stress test exercise, they can communicate with the ECB through the portal, where supervisors provide an extensive collection of questions and answers. Once the data have been submitted via the external STAR portal, supervisors run further quality checks in the internal STAR portal which is not accessible to banks. In its internal portal, STAR automatically flags outlier values, helping supervisors focus on these. Supervisors then use STAR to compare banks’ stress test projections with those based on supervisory models and also to compare the results across banks. Any guidance for banks on further refining the data input and or on the outcome of these checks and comparisons is communicated back to them using the external STAR portal.

STAR’s functionalities streamline the communication between banks and supervisors and make sure that it is transparent during the time-sensitive stress test exercises. STAR harmonises the execution of the different stress test exercises conducted at ECB and SSM level, and enables supervisors to efficiently handle large amounts of data. Finally, STAR has helped to create a database of past stress test exercises, making results easily accessible, traceable and comparable. Going forward, the STAR portal will be integrated with the IMAS portal and CASPER to further simplify the interaction between banks and supervisors.

Speeding up the performance of supervisory tasks

A responsive supervisor with fast processing times is crucial to reducing uncertainty for banks and other financial market participants. By streamlining and automating the interaction between banks and supervisors, the IMAS portal, the external STAR portal and CASPER help ensure supervisory tasks are completed on time. In addition, suptech applications such as Heimdall, RPAs and Athena are making a major contribution to speeding up supervisory processes.

Heimdall: leveraging machine reading technology in fit and proper procedures

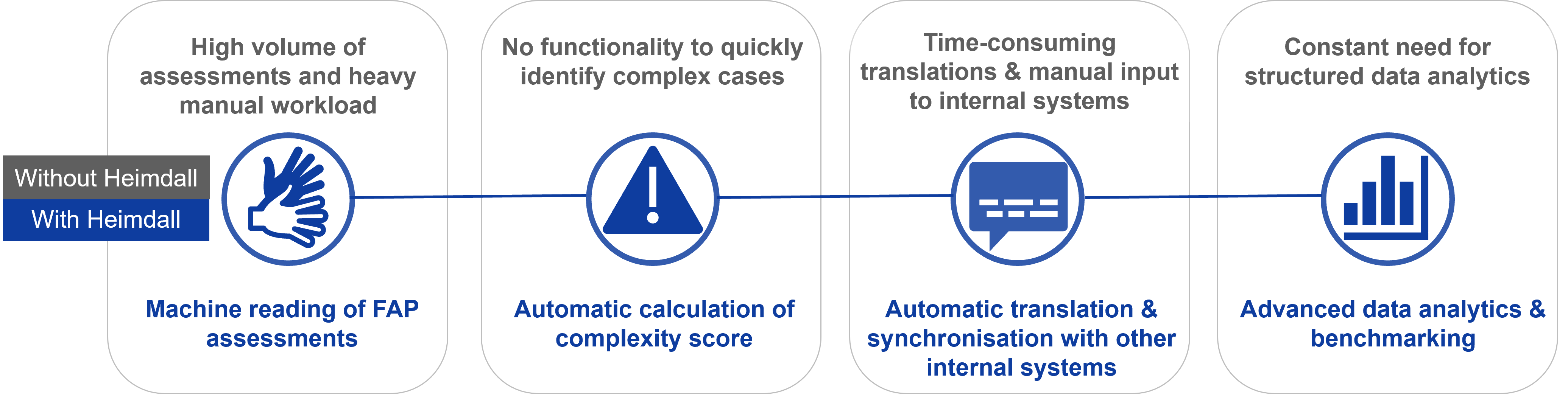

Most supervisory decisions relate to fit and proper (FAP) assessments. FAP decisions are one example of the application of machine reading technology to banking supervision. When banks intend to appoint a new board member or key function holder, the supervisor must assess the candidate’s suitability for the position. Banks submit a questionnaire on the candidate through the IMAS portal. Based on this questionnaire, FAP experts at the ECB and NCAs assess the candidate’s suitability for the position with the help of the Heimdall tool. The use of Heimdall became widespread as of late 2023 and speeds up the process on supervisory side. The tool uses machine reading to automatically translate the completed questionnaire into English and process the information provided, e.g. by flagging potential issues based on a set of evaluation criteria. During the assessment, supervisors from the ECB and NCAs can easily collaborate, navigate through the repository of past FAP assessments and conduct statistical analyses that facilitate peer comparison and benchmarking between banks. Once the assessment has been completed, the result is shared seamlessly with the bank through the IMAS portal, where the bank is automatically informed of the outcome and can follow up on any supervisory requirements attached to the FAP assessment.

Heimdall has ensured consistency in FAP decisions and contributed to reducing the processing time for FAP assessments from 109 days in 2023 to 97 days in 2024. Those appointed to bank boards are informed earlier about the result of their FAP assessment and consequently their appointment, which in turn increases certainty for the bank and market participants, such as shareholders or potential investors.

Robotic process automations: automating routine tasks

Another way of speeding up supervisory actions is the use of software robots for tedious and repetitive tasks. Currently, over one hundred robotic process automations (RPAs) have been deployed within European banking supervision – and the number is growing. The implementation of RPAs has increased efficiency, with tasks being completed up to 15 times faster than using manual processes. This automation also reduces manual and operational errors. For instance, as part of the computation of the Pillar 2 Guidance (P2G) for banks, a robot facilitates the calculations and the business process of the supervisory team in charge of setting the bank’s final P2G. As a consequence, the team concerned can disclose the resulting guidance in good time, which in turn provides greater certainty for all stakeholders.

Athena: using AI to facilitate textual analysis

AI solutions have enabled supervisors to perform a variety of tasks in a shorter time frame. A major tool making use of AI is Athena, which is designed to assist supervisors with textual analysis and text generation. Athena employs advanced natural language processing techniques, including sentiment analysis, summarisation and classification, to provide insights into banks and their risks. For instance during an on-site inspection (OSI) banks send many documents to the inspectors, often in their national language, which need to be analysed. Athena’s automatic translation functionality quickly and securely provides inspectors with English translated versions of all the documentation. Supervisors can select the documents they would like to focus on for their analysis and ask Athena a list of questions that they need to address. Athena applies generative AI to the documents provided and other data indicated by the supervisor in order to answer these questions, specifying the exact sources of the information.

With the help of Athena, supervisors can analyse more documentation faster and ensure efficient use of the bank’s time. While Heimdall, RPA and Athena all enable the supervisor to engage with banks in good time, they also lead to efficiency gains at the ECB and in NCAs. Nonetheless, the supervisory process remains rigorous – and human experience and judgement are naturally a crucial component of any supervisory decision.

Boosting efficiency and managing the cost of supervision

Efficient supervision is essential for ensuring that the financial system remains sound, and that the costs, which are the basis for supervisory fees paid by banks, remain contained. The ECB, mindful of this, prioritises efficiency in supervisory IT projects. This is where applications like OSICredit and Agora come in, together with the Olympus project.

OSICredit: automating business processes for credit risk inspections

OSICredit supports on-site inspections on credit risk by boosting the efficiency of internal processes. This tool went live in 2020 and automates the end-to-end business processes of supervisors conducting credit risk OSIs. During such inspections, supervisors verify the credit quality of portfolios by reviewing banks’ credit files on a loan-by-loan basis.

For instance, an OSI may involve inspecting a large mortgage portfolio at a bank with millions of debtors. As part of the OSI, the bank pre-validates and submits its loan tapes, which contain detailed information about individual mortgage loans, through the IMAS portal. The loan tape data are automatically transferred from IMAS portal to OSICredit, which provides additional automatic data quality checks for supervisors and offers functionalities for running ad hoc data analyses, visualising the data and slicing it into different sub-portfolios. The inspector can then select samples of credit files with the help of the application, e.g. using its machine learning capabilities to automatically identify credit files of particular interest. The individual credit file review is conducted and centrally documented in OSICredit, and the results can be aggregated for reporting purposes.

By performing these steps within a single application, OSICredit massively simplifies the inspectors’ work and further harmonises their approach to credit risk OSIs. In combination with more stable and standardised loan tape templates, which were introduced in 2020 in response to feedback from the banking sector, OSICredit contributes to a faster credit quality review process and a shorter average duration of inspections. In addition, it makes it easier to compare and benchmark the results of credit risk missions.

Agora: unifying the supervisory data infrastructure

Another tool that significantly enhances the efficiency of banking supervision is Agora. Agora creates a unified data infrastructure that consolidates all necessary internal and external prudential data into a single platform. This system supports the integration and horizontal analysis of large datasets, helps supervisors gain new insights and ensures consistency in their quantitative tools and analysis.

Agora harmonises different master datasets and makes the data accessible to all banking supervisors from the ECB and NCAs, while respecting existing access rights. This increases comparability and efficiency, generates more new insights, reduces the risk of duplicated work and limits the use of silo solutions within the organisation.

Agora also lowers the entry barrier for new users working across large datasets by aligning data structures and utilising technologies that are already well known. This results in lower costs despite the ever growing volume of data available to supervisors. In addition, users are able to find prudential information with the support of AI and can “chat” directly with their data, without writing queries or sifting through databases, leading to further efficiencies.

Olympus: building a shared and integrated IT landscape across European banking supervision

The Olympus project aims to optimise the internal IT landscape and increase efficiency by enhancing the usability and integration of IT solutions at the ECB and NCAs. Olympus entails several initiatives working towards this goal, following the motto “one team – one technology”. Among others, a single supervisory cockpit will be created that will provide supervisors with direct access to essential IT applications, alerts and data notifications from relevant internal and external data sources. The cockpit will leverage AI for advanced search and query functions.

Olympus will also lay the foundations for sharing platforms and capabilities with other authorities which support financial stability and European integration. This would cover NCAs, peer authorities and possibly even supervisory institutions in candidate countries for EU membership.

Detecting risks to the banking sector at an earlier stage

A safe and sound banking sector is at the core of the ECB’s supervisory mandate. Effective supervision safeguards stability, improves risk management, and enhances trust, all of which contribute to long-term resilience of individual banks and the entire sector. The early detection of weaknesses at a specific bank and a prompt supervisory reaction can help to reduce the risk of collapse and prevent contagion to other banks or across the whole sector. Below is a glimpse of two applications supervisors are currently using (Navi) and working on (Delphi) which will further improve the early identification of issues.

Navi: using graph technology for data representations and analysis

Navi is a network analytics and visualisation platform that helps supervisors analyse complex networks in the financial system through interactive, graph-based representation. Navi effectively processes and displays highly interconnected data in a variety of use cases.

One key use case concerns bank authorisations, such as applications for mergers or acquisitions. To assess these applications, supervisors need a quick and clear understanding of a bank’s ownership structure. Navi streamlines this process by providing a dynamic view of ownership links and interdependencies, helping supervisors identify potential risks or conflicts of interest early on. For instance, when assessing the application of a specific bank, supervisors can easily focus on institutions which own more than a certain percentage of it using Navi’s filtering capabilities. Supervisors can explore the graphical representation of the bank’s network and further customise it to carry out a “deep dive” on specific connections. Furthermore, Navi allows advanced algorithms to be run on the graphs to uncover hidden patterns or detect anomalies. The platform also allows supervisors to share their analyses and collaborate seamlessly with other supervisors across European banking supervision. These functionalities contribute to fast, transparent and well-informed decisions on bank authorisations.

Another use case relates to banks’ exposures to non-bank financial institutions (NBFIs). When an NBFI is in financial distress, the above-mentioned functionalities in Navi help supervisors to quickly understand how specific NBFIs are connected within the financial sector and which supervised banks may be affected. This allows the supervisor to take appropriate action promptly and to mitigate risks before they escalate, thereby avoiding cascading losses across the sector. It strengthens the resilience of the broader banking system and increases confidence in its safety and soundness.

Delphi: analysing social media to detect market risk sooner

Through the Delphi tool, supervisors monitor the banks’ market behaviour using publicly available, quantitative market indicators. Supervisors can structurally explore news from different sources via a single platform which might help comprehend banks’ behaviour in the market. News-based monitoring of banks can enable immediate supervisory action to prevent possible losses for banks. Delphi can help early detection and mitigation of panic fuelled by news, giving supervisors the chance to react in time. In the future, supervisors would receive alerts not only based on news but also on social media activity, allowing them to quickly identify a potential crisis and take appropriate action.

Outlook and conclusion

European banking supervision’s commitment to digitalisation and innovation has transformed the supervisory landscape. Technology has been enhancing the interaction between banks and supervisors, speeding up the performance of supervisory tasks, as well as boosting efficiency and effectiveness.

Going forward, investments in technology will continue to yield substantial benefits. Beyond the Olympus project, major initiatives include the integration of generative AI, and streamlined data collection platforms.

Generative AI is setting to play a transformative role in many supervisory processes. In addition to chatting with information sources, which is already possible with the Athena tool, current generative AI projects under development at the ECB focus on supporting compliance checks, assisting in programming, and advancing search capabilities and data classification. While generative AI will increasingly support supervisors in these ways, supervisors will remain integral to final decision-making, ensuring that technology merely complements human judgement rather than replacing it. The ECB is committed to accelerating AI initiatives in a safe and responsible manner and adheres to the EU AI Act's risk framework and transparency requirements.

Work is in progress to reduce complexity and address industry feedback in the platforms currently used for interaction. In the near future, the vision is of a unified portal, the SSM portal, promising to consolidate data collection processes by merging the IMAS and external STAR portals into a single channel and integrating it more deeply with CASPER. This initiative aims to further reduce reporting costs, harmonise user experiences (e.g. login procedures and user interfaces) and streamline supervisory interactions.

These initiatives are just a few examples of the many efforts under way to use technology to take banking supervision to the next level. As European banking supervision continues to innovate and to integrate new technologies, efficiency, transparency and adaptability will increase. This progress will not only strengthen the European banking sector but also help prepare it for the emerging challenges and opportunities of tomorrow.

The author would like to thank the following contributors: Andreas Tittel, Benedikt Dominikus Achatz, Donatas Janulaitis, Filippo Bartoli, Kara Igumnow, Krzysztof Kusidlo, Luis Esguevillas, Marcello De Rosa, Sigrid Griesshaber, Tom Timmermann.

The short-term exercise (STE) collects additional information in the context of the Supervisory Review and Evaluation Process.

Europejski Bank Centralny

Dyrekcja Generalna ds. Komunikacji

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Niemcy

- +49 69 1344 7455

- media@ecb.europa.eu

Przedruk dozwolony pod warunkiem podania źródła.

Kontakt z mediami