- SPEECH

The art and science of good supervision

Speech by Elizabeth McCaul, Member of the Supervisory Board of the ECB, at the conference “SSM Regulation, ten years since” organised by Banca d’Italia

Rome, 20 October 2023

Introduction

I am deeply honoured and excited to participate in this conference to celebrate the tenth anniversary of the Single Supervisory Mechanism (SSM) Regulation.

I remember distinctly the overwhelming sense of awe I felt when I attended my first Supervisory Board meeting in 2019 after being appointed ECB Representative to the Supervisory Board. Even though the SSM was then only a few years old, it had already achieved a remarkable level of sophisticated supervisory prowess. In just a few short years, the SSM had not only bundled oversight of its complex portfolio of supervised institutions within an elaborate governance framework. It had also become one of the largest and most respected supervisors in the world.

And believe me: this is no small feat. I would even argue that the establishment of the banking union and along with it the arrival of European banking supervision was the greatest step in European integration since the Maastricht Treaty and the creation of the euro.

Now that we are celebrating ten years of the SSM Regulation, I would like to take stock of what has been achieved and look at the journey ahead, because of course there is always more we can do to make our supervision even more effective.

I will focus less on the legal framework and more on the evolution of our supervisory approach, especially in the current complex environment.

Some would say that supervision is not a science but an art. It is fitting here in Rome, home of countless unparalleled artworks, that I thought I would ask you to think about supervision as art. However, even the great Renaissance masters like Michelangelo, Raphael or Da Vinci knew to combine art with maths and science to achieve improbably perfect masterpieces like the Sistine Chapel frescoes, the “School of Athens” or “The Last Supper”.

Of course, I would not dare compare the SSM to the Sistine Chapel, but still: let us for a moment imagine the SSM as a work of art.

A supervisor, just like a painter, must choose the right tool or brush to do the best possible job. Capital is an effective tool, but qualitative measures and remediation and enforcement actions are often more suited to bringing about targeted and effective change in banks. Sometimes the painter needs to pay special attention to the finer brushstrokes, to make sure that the details and the perspective are accurate.

However, choosing the right tool also depends on the material we are working with, be it the regulatory and institutional framework in which we supervise banks, or the canvas or type of surface on which we paint.

Over these ten years, the SSM has created a firm foundation to build on. Banks’ balance sheets are much more resilient than a decade ago and trust in the European banking sector has been re-established. No less important is the supervisory culture and trust we have built within the system, among the various national competent authorities coming together in the Supervisory Board.

We can now put our next brush strokes on the foundation of trust that has been established across European banking supervision. We can afford to encourage the use of more supervisory judgement to dive deep where it matters: becoming more agile, more risk-sensitive and more effective as supervisors.

This does not mean that we should lose the consistency and the methodological rigour that we have achieved. But we do need a cultural shift towards further use of risk-based supervision and requiring banks to remedy weaknesses in a timely and effective manner. It is not enough to identify the cracks; we also need to mend them. Or rather: we need to put the full weight behind our efforts to make sure that the banks mend them. And mend them properly by correcting the root causes in a sustainable fashion and avoiding temporary fixes that do not address the heart of the problem.

Finally, we have to understand the wider context to depict the correct perspective in our artwork.

Good supervision is not only about bringing about effective change in banks’ risk management. It is also about understanding the wider landscape in which banks operate to maintain a clear view of the relevant risks.

The context in which we supervisors must do our work is that of a structural transformation of the financial sector. First, there is a massive shift of historically traditional banking services to sectors outside the remit of banking supervision, like credit intermediation, leading to exponential growth of the non-bank financial intermediation (NBFI) sector. Second, we are seeing a digital revolution with new players in the banking market, a reconfiguration of the banking value chain and rapid technological progress in fields such as generative artificial intelligence. And third, we are facing unprecedented macroeconomic and geopolitical uncertainty.

These are seismic changes. To remain effective, supervisors will need to keep a steady hand while holding the metaphorical paintbrush. Looking towards the next ten years, I see two themes that must be reflected on the canvas of supervision: first, how we can most effectively deploy and calibrate our supervisory tools in each individual institution, and second, how we can do so amid the seismic changes taking place around us.

The tools of good supervision

Let me look now at the question of how we can make our supervision more effective.

In April, we published the report[1] of an external high-level expert group which had been tasked with assessing our Supervisory Review and Evaluation Process (SREP) and how it interacts with our other supervisory activities.

The report concluded that we are now sufficiently mature “to reallocate resources from procedural tasks to more risk-based, in-depth supervisory assessments, which can contribute more effectively to promote banks’ resilience”.

This was also the message of a recent speech by our Chair Andrea Enria[2]: we are moving towards a new stage in the evolution of European banking supervision, focusing on its effectiveness. The first stage was about harmonising the rules and practice of the game and creating trust in the system, also given the wide diversity in the exercise of national supervision in the past. Having created a foundation of trust, we can now build on it to achieve the most effective outcomes.

Make no mistake: this does not mean less supervision, or a “light touch” approach; what we are looking for is more focused and impactful supervision targeting the most material risks. Good supervision is not about doing everything but about doing the right things: the recently introduced risk tolerance framework and the multi-year assessment for the SREP allow for that flexibility and agility.

To date, European banking supervision has correctly focused on strengthening the capital stack and using capital to induce banks to significantly improve their balance sheets. Take, for example, the successful reduction of non-performing loans (NPLs) from around €1 trillion in 2014 to €343 billion in the second quarter of 2023, largely thanks to capital add-ons for NPLs.

Compared with the United States[3], I think European banking supervision can further improve the way it uses qualitative measures to make them enforceable and legally binding. We need to be upfront about supervisory standards so banks know exactly what to fix. Where banks are too slow to remediate their weaknesses, we will apply supervisory measures with clearly defined objectives and timelines, focused on root causes, rather than on symptoms. We will make full use of the available measures, remediation tools and enforcement actions, including, if necessary, sanctions for severe or long-standing issues.

These changes will neither increase nor decrease capital requirements. We have simply attained the level of maturity in our supervision to recognise that capital alone cannot address all risks. To exercise the most effective and impactful supervision, supervisors need to make full use of their toolkit, including capital charges, to trigger changes that will improve banks’ ability to hold and manage risk.

Following the global financial crisis, the International Monetary Fund (IMF) published a landmark paper[4] highlighting that “supervisors must be willing and empowered to take timely and effective action, to intrude on decision-making, to question common wisdom, and to take unpopular decisions”. I think these lessons are as relevant now as they were then. Recently, the IMF reflected on the lessons learnt from the bank failures of March 2023 and found that “structural transformations add to the mandate and complexity of banking supervision”. [5] Indeed, our job has not become easier.

This brings me to my next topic: the growth of non-bank financial intermediation and the associated risks to the financial sector.

The broader context – understanding the risk landscape

I recently rewatched the film “Hank: 5 Years from the Brink”, which ends with a warning by former US Treasury Secretary Hank Paulson of the risks emanating from the shadow banking, or NBFI sector, particularly given its rapid growth and insufficient regulation. Ten years on from the film’s airing in 2013, I think these concerns are even more valid: to wit, we have not paid sufficient heed to the warning to date and the sector has now expanded. We need to close the data gaps and strengthen the regulatory and supervisory oversight of the NBFI sector, especially in a cross-border context.

The numbers are truly staggering. By one measure, the NBFI sector in the euro area has doubled since the global financial crisis, up from €15 trillion in 2008 to €31 trillion today.[6] It now accounts for half of the financial sector.

I would like to highlight three types of risks emanating from this growth: leverage, liquidity and counterparty credit risk.

First, the build-up of financial and synthetic leverage which can propagate risks across the entire financial system and lead to major disruptions. Many of you may remember the collapse of Long-Term Capital Management in 1998. More recently, the default of Archegos Capital Management in March 2021 due to losses from leveraged equity trades was another stark reminder of the inherent risks of leverage, which also showed that Hank Paulson’s warning has been paid little heed.

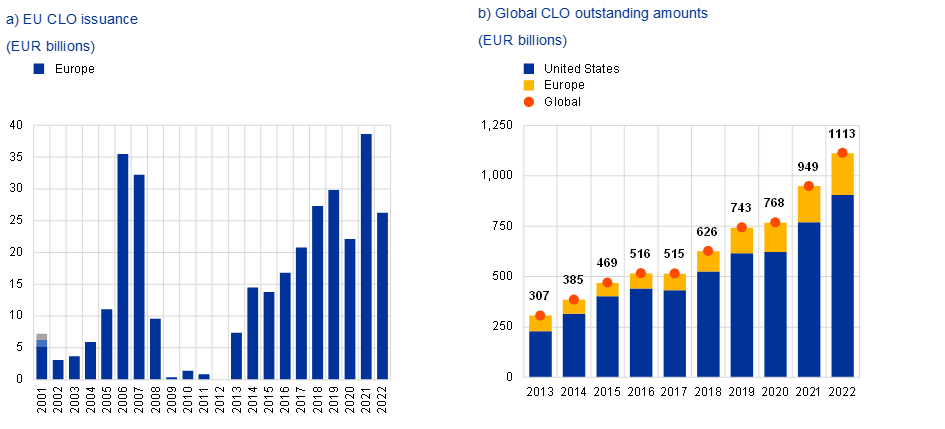

Take, for example, the leveraged finance market.[7] Non-banks now hold a substantial amount of leveraged loans, which are also often syndicated and sold, serving as collateral in collateralised loan obligations (CLOs).

The European market for CLOs has grown markedly over the past few years and, more worryingly, the CLOs are mainly backed by covenant-lite loans − the refinancing of which during the coming maturity wall in the next few years in a higher-rate environment could entail significant issues. CLOs could be further restricted in participating in refinancing due to internal rating mechanisms, etc. Another dimension would be the private credit markets which have grown exponentially and where losses could also be materialising in the system. On top of this, we see banks that took severe losses on the pipeline of leverage finance, and we see indications that they are less willing to syndicate loans than they were in the past.

EU CLO market doubled in four years, driven by new issuance

Chart 1

Sources: S&P LCD, Bloomberg, JP Morgan, AFME and ESRB.

Note: Figures are based on institutional leveraged loans.

The CLO market for commercial real estate deserves particular attention in this regard in view of the turning of the real estate cycle.[8] More generally, the common exposures of banks and non-banks can be a source of systemic risk. For example, euro area real estate investment funds have a large market footprint in several euro area countries where the commercial real estate outlook has deteriorated sharply. As recently highlighted by the Chairman of the Federal Deposit Insurance Corporation (FDIC) Martin J. Gruenberg, CLOs have not been tested by a prolonged economic downturn and the opaque interconnected exposures between banks and non-banks deserve our undivided attention.[9]

Thus, as also recently stressed by the IMF and the Financial Stability Board (FSB), the data gaps preventing a proper assessment of the vulnerabilities associated with NBFI leverage need to be reduced.[10] To make the market more transparent, we should further harmonise, enhance and expand reporting requirements and facilitate information sharing between authorities. I am not convinced that this can be done just by looking at bank exposures to NBFIs: we would need stronger separate reporting frameworks for substantial NBFI sectors. I am also very interested in an initiative by the Bank for International Settlements and the Hong Kong Monetary Authority to combine data from diverse sources, including granular supervisory data, to produce an integrated framework for NBFI monitoring, including early warning indicators.[11]

The second risk concerns liquidity. As we saw in the United Kingdom in September 2022, liquidity stress in the NBFI sector can easily spill into the broader financial sector. Pension funds and investment funds using liability-driven investment (LDI) strategies faced large collateral requests in repo transactions and margin calls in interest rate derivatives, resulting in fire sales until the Bank of England intervened. Within the European Union, most LDI investment funds are domiciled in Luxembourg and Ireland. Following the events in the United Kingdom, the Central Bank of Ireland and the Commission de Surveillance du Secteur Financier asked LDI fund managers to maintain an appropriate level of resilience to absorb potential market shocks.[12] More should be done to harmonise and improve oversight of this sector, including strengthening governance and adherence to risk limits for illiquid assets, especially given the growth vis-à-vis GDP[13] and the interconnectedness to the banking sector through a variety of financing vehicles and funding management.

More generally, liquidity mismatches remain a significant structural vulnerability in the NBFI sector. Open-ended investment funds may hold relatively illiquid assets while still allowing investors to redeem shares on a daily basis. Such liquidity mismatches make these funds vulnerable to runs as investors have an incentive to redeem ahead of others.

From the banking sector’s perspective, there is a risk that stress in the NBFI sector could lead to banks receiving less funding from NBFI entities via deposits or repos. Indeed, such funding is the most likely and strongest spillover channel from NBFIs to banks.[14]

Third are counterparty risks created by banks’ derivative exposures to NBFIs. Following on our targeted review of counterparty credit risk (CCR) last year and a number of on-site missions, we presented our report on CCR governance and management[15] for a public consultation, which ended on 14 July. The report highlights the good practices we observed in the market as well as areas for improvement, such as customer due diligence, the definition of risk appetite, default management processes and stress-testing frameworks. It notes that there is still room for improvement in how, on a firm-wide basis, CCR is mitigated, monitored and managed when a counterparty is in trouble or defaults.

By assessing and managing the risks of non-banks, banks can play a pivotal role in shedding light on the less-regulated financial sector and helping to mitigate systemic risk.[16]

Conclusion

We all know that it is difficult to make predictions − especially about the future! So I will not attempt to predict from where the next crisis will come.

Still, as good supervisors we need to be forward-looking: intrusive in our approach and comprehensive in our understanding. We supervisors need to survey the ground we walk on to make sure we have a solid footing, while at the same time keeping an eye on the horizon to appreciate the wider perspective.

In the end, good supervision is an art. Like the great artists of the Renaissance, supervisors master their art by embracing the rigours of maths and science while carefully choosing the right brushes for the right circumstances.

Thank you very much for your attention.

ECB (2023), Assessment of the European Central Bank’s Supervisory Review and Evaluation Process, April.

Enria, A. (2023), A new stage for European banking supervision, keynote speech at the 22nd Handelsblatt Annual Conference on Banking Supervision.

McCaul, E. (2022), “Is the water bluer on the other side of the pond?”, Revue bancaire et financière.

International Monetary Fund (2010), “The Making of Good Supervision: Learning to Say ‘No’”, IMF staff position note, May.

International Monetary Fund (2023), Good Supervision: Lessons from the Field, Working Papers series, September.

Under a broad measure of the NBFI sector, which includes other financial institutions (OFIs), also referred to as the “OFI residual”, the numbers would be even higher: €25 trillion in 2009 and €49 trillion in the last quarter of 2022.

McCaul, E. (2022), “Supervising leveraged lending”, speech at AFME’s 17th Annual European Leveraged Finance Conference, 20 September.

ESRB (2023), “EU Non-bank Financial Intermediation Risk Monitor 2023”, June.

Gruenberg, M. J. (2023), “Remarks at the Exchequer Club on the Financial Stability Risks of Nonbank Financial Institutions”, 20 September.

IMF (2023), “Global Financial Stability Report Chapter 2: Nonbank Financial Intermediaries: Vulnerabilities amid Tighter Financial Conditions”, April; FSB (2023), “The Financial Stability Implications of Leverage in Non-Bank Financial Intermediation”, 6 September.

Cheng, K., Liu, Z., Pezzini, S. and Yu, L. (2023), “Building an integrated surveillance framework for highly leveraged NBFIs – lessons from the HKMA”, BIS Papers, No 137, August.

ESMA (2022), ESMA welcomes NCAs’ work to maintain resilience of liability driven investment funds, November.

The market-based finance sector in Ireland is the largest component of the financial system, with total assets at almost 15 times gross domestic product. See IMF (2022), Ireland: Financial System Stability Assessment; IMF Country Report No. 22/215; June.

Franceschi, E., Grodzicki, M., Kagerer, B., Kaufmann, C., Lenoci, F., Mingarelli, L., Pancaro, C. and Senner, R. (2023), “Key linkages between banks and the non-bank financial sector”, Financial Stability Review, ECB, May.

ECB (2023), Sound practices in counterparty credit risk governance and management, June.

Enria, A. (2023) “The role of banks in mitigating systemic risks arising in the non-bank financial sector”, speech at the ECB conference on Counterparty Credit Risk, 20 June.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts