- SPEECH

Change as a constant: trends and shifts in the financial sector

Speech by Elizabeth McCaul, Member of the Supervisory Board of the ECB, at the workshop on “The Future of Globalization: Politics, Business, Lifestyle, Brands” organised by the Consiglio Per le Relazioni tra Italia e Stati Uniti

Milan, 20 June 2023

Introduction

Many thanks to the Council for the United States and Italy for inviting me to this exciting conference.

The Greek philosopher Heraclitus tells us that there is nothing permanent except change. The financial sector is no exception to this truth. Tech stores don’t yet offer crystal balls – maybe they will one day, but for now we are living in a world where we cannot predict the future. But we can and must be forward-looking in our risk assessments. And we must make sure we are well equipped for whatever the future holds. In this spirit, I would like to focus my remarks today on three fundamental shifts in finance and the challenges they pose to us as supervisors.

First, I would like to talk about the bank failures we have recently witnessed and the challenges associated with high inflation and rising interest rates.

Second, I will discuss the shift in lending from the banking sector to other market participants and the interconnectedness between banks and the non-bank financial intermediation (NBFI) sector.

My third point relates to the impact of the digital transformation on the competitive landscape in banking. The financial value chain is fragmenting and being reshaped, which poses challenges for the “supervisability” of the financial sector

Recent crisis events and risks from rising interest rates

A great deal has already been said about the recent crisis events and their underlying causes. While there is no direct read-across from the US events to the banks we supervise in the euro area, I think we would all benefit from looking carefully at the weaknesses these events have revealed and the lessons we can learn.

Failure to properly manage risks is at the core of bank failures. And more often than not, inadequate risk management is the direct result of poor governance.[1] In recent crisis cases, we saw excessive growth strategies combined with a lack of commensurate risk management. This should be a flashing warning light for any supervisor. As the Federal Reserve’s report on Silicon Valley Bank (SVB) explained so clearly, the bank’s management team failed to manage basic interest and liquidity risk and its board of directors failed to oversee the management team and hold it accountable. These events have quite rightly raised questions about governance and risk management in banks and the perils of unrealised losses from “held-to-maturity” portfolios in an environment of rising interest rates. And questions are being asked about the effectiveness of supervision not only in the United States but also in Switzerland, following the arranged takeover of Credit Suisse by UBS. And in their brutally honest reviews of what went wrong, the Federal Reserve and the Federal Deposit Insurance Corporation have – to their credit – acknowledged a failure to take forceful and sufficiently swift supervisory action.[2]

SVB is more than a textbook case of mismanagement. It also showed how a bank run today happens far more quickly than in the past: USD 42 billion left the bank in just five hours. The bank’s highly networked and concentrated depositor base seems to have been one of the key factors behind the unprecedented speed of deposit withdrawals. But we should also consider the impact of social media and digitalisation here. Social media enabled depositors to instantly share their concerns about a bank run, and digitalisation made it possible for them to immediately withdraw their funds. We may need to assess how factors such as a highly concentrated deposit base and a particular reliance on uninsured deposits can be addressed in the Pillar 2 framework. I will return to the broader impact of digitalisation on the financial landscape later in my speech.

Before looking beyond the banking sector, I would like to highlight some other risks for banks in an environment of rising interest rates, most of all the turning real estate cycle. Mortgage loan origination and house prices have slowed down significantly and commercial real estate markets are showing clear signs of a downturn. Commercial real estate markets are becoming increasingly bifurcated and non-prime assets in particular have become less attractive to investors. Climate risk – including both transition and physical risks – also poses challenges for the sector.

ECB Banking Supervision identified banks’ exposures to commercial real estate as key vulnerabilities early on. Last year we performed targeted reviews to assess the resilience of banks’ real estate portfolios and identify any potential credit risk deficiencies in underwriting practices. Banks should ensure that the deteriorating risk environment is properly taken into account in their provisioning practices and capital planning. They should also carry out reviews to assess the resilience of their mortgage portfolios and identify and actively address any customers that are potentially vulnerable.

Let me now turn to the non-bank financial institution sector.

Non-bank financial intermediation and counterparty credit risk

The NBFI sector has grown at a steady pace since the great financial crisis, outstripping the pace of growth in the banking sector for many years. The expansion of collective investment vehicles, such as hedge funds, money market funds and other investment funds, is a key driver of NBFI growth.

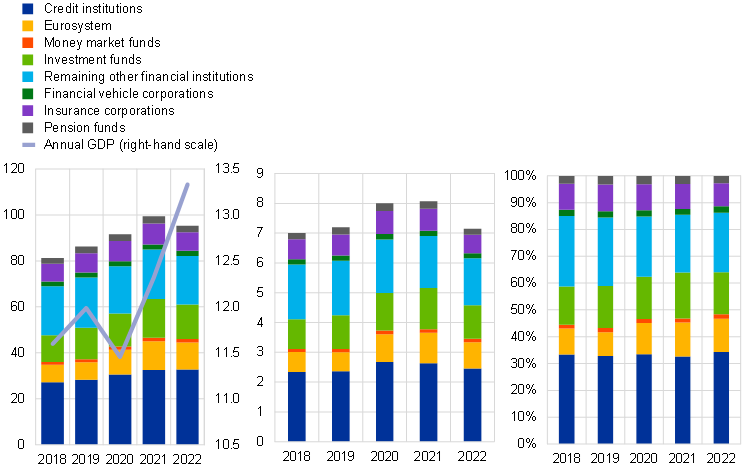

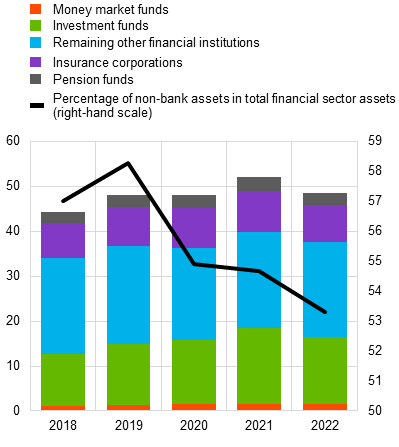

In 2021 the NBFI sector grew to USD 239.3 trillion and its share of total global financial assets increased to 49.2%.[3] The US market grew from USD 43.83 trillion in 2009 to USD 85.3 trillion in 2021. And of greater relevance, the total assets held by non-bank financial institutions in the euro area almost doubled from €25 trillion in 2009 to around €49 trillion in the last quarter of 2022, representing more than half of the financial system.[4] In recent years, the size of the NBFI sector as a share of the euro area financial sector has stabilised and even declined slightly. This may be partly related to market valuation dynamics, so the extent to which these developments are structural or conjectural in nature will need to be examined.

Chart 1

Total financial assets of the euro area financial sector

(EUR trillions (left panel, both scales); ratio to nominal GDP (middle panel); percentages (right panel); annual data: 2018‑22)

Sources: Euro area accounts reports and ECB calculations.

Note: The aggregated (non-consolidated) assets of sub-sectors include financial assets and exclude non-financial assets.

Chart 2

Total assets of the non-bank financial sector

(left-hand scale: EUR trillions; right-hand scale: percentages)

Sources: Euro area accounts reports and ECB calculations.

Note: The aggregated (non-consolidated) assets of sub-sectors include financial assets and exclude non-financial assets.

But why should we be concerned about this from a banking supervision perspective?

Banks and NBFI entities are connected via loans, securities, derivative exposures and funding dependencies.[5] Indirect links between banks and non-banks, such as the correlation to common exposures, can also be a source of risk. For example, euro area real estate investment funds have a large market footprint in several euro area countries where the outlook for commercial real estate markets has deteriorated sharply.[6] These linkages with the NBFI sector expose banks to liquidity, market and credit risks. The liquidity channel could be particularly relevant, as NBFI entities primarily maintain their liquidity buffers as deposits and very short-term repo transactions with banks, while the NBFI sector is an important source of funding for euro area banks.

In addition, banks’ derivative exposures to NBFI entities create counterparty risks. As a follow-up to last year’s targeted review on counterparty credit risk (CCR), we recently launched a public consultation on our report on CCR governance and management.[7] The report highlights good practices we observed in the market as well as areas for improvement, such as customer due diligence, the definition of risk appetite, default management processes and stress testing frameworks. There is still room for improvement in how, on a firm-wide basis, CCR is mitigated, monitored and managed when a counterparty is in trouble or defaults.

We will further engage with banks and follow-up on those areas where deficiencies were identified. This may be through off-site work or, in some cases, on-site inspections.

Let me now move to the third fundamental shift.

The impact of the digital transformation on the financial sector

With the digital transformation, we are seeing new players entering the market and therefore the financial value chain. This raises questions not only about the “supervisability” of the financial sector, but also about the emergence of new systemic risks and the issue of “too complex and too big to fail”.[8]

First, in the crypto world there are companies operating internationally and claiming to have no headquarters at all. This lack of a traditional central point of entry poses challenges for our current regulatory and supervisory approaches. To effectively supervise these entities, we need a prudent and consolidated approach similar to that used for traditional players in the financial market – one that is capable of capturing close links and control-based relationships. This may require adjustments to our legislative framework as well as new mechanisms that will enable supervisors to cooperate effectively across borders.[9] This is particularly important, as approaches differ across jurisdictions. Whether crypto-assets should be treated as general transferable securities or subject to bespoke regulatory regimes, as well as how the scopes of these regimes should be delineated, are topics that should be addressed and where close cooperation between the EU and the US is particularly welcome.[10]

Second, in some cases the financial services value chain is spread across different players. Instead of a traditional banking group that is vertically and horizontally integrated, different entities may oversee customer interaction, back or middle office, infrastructure and balance sheet operations. This could lead to supervisory and oversight responsibilities becoming blurred, risks going undetected or risks being dealt with in isolation, with no consideration of the overall impact. Indeed, the more complex the mixed-activity group, fintech or large big tech group, the more difficult it will be for supervisors to have a full picture of the risks stemming from group-wide internal interdependencies or of the group’s exact role in the financial market and the associated risks.

Now that banks can provide banking-as-a-service to big tech companies and big tech companies can provide software-as-a-service to banks, we are looking at a potentially complex web of interdependencies that bring about systemic, correlation and concentration risks.

While the EU footprint of mixed-activity groups, fintechs and large big tech firms in the area of bank-like activities is still small, Apple’s recently launched savings account managed by Goldman Sachs reportedly brought in around USD 1 billion in deposits in the first four days. This shows how fast the situation could change.

In my view, requirements for major non-bank players should be strengthened to ensure a level playing field. To achieve this, we need to make such players subject to prudential regulation and consolidation. This would help to ensure that group-wide risks and interdependencies do not go undetected and that concentration risks are identified. It could also reduce opportunities for regulatory arbitrage, preventing groups from concealing their significance via complex organisational structures. In this way, it would help to level the playing field between big techs and incumbent institutions.

Conclusion

Let me conclude.

As supervisors, we need to have a clear picture of how the financial landscape is changing. But we don’t need a crystal ball to see where risks are emerging. Today, I have highlighted three areas that warrant particular attention.

First, the impact of rising interest rates and the lessons learned from recent bank failures.

Second, the linkages between banks and non-bank entities.

Third, the impact of the digital transformation on the financial landscape and the challenges this poses for the “supervisability” of the sector.

We need to properly understand these shifts and trends in the financial sector to ensure that substantial risks do not go undetected, and thus can be addressed.

Thank you for your attention.

Enria, A. (2023), “Well-run banks don’t fail – why governance is an enduring theme in banking crises”, speech at the 22nd Annual International Conference on Policy Challenges for the Financial Sector organised by the World Bank, International Monetary Fund and Federal Reserve System, Washington, D.C., 1 June.

Board of Governors of the Federal Reserve System (2023), “Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank”, 28 April and Federal Deposit Insurance Corporation (2023), “FDIC Releases Comprehensive Overview of Deposit Insurance System, Including Options for Deposit Insurance Reform”, 1 May.

Financial Stability Board (2022), “Global Monitoring Report on Non-Bank Financial Intermediation”, 20 December.

All NBFI figures use a broad measure of NBFI, composed of all financial institutions that are not central banks, banks or public financial institutions, which include Other Financial Institutions (OFI), sometimes also referred to as the “OFI residual”.

Franceschi, E., Grodzicki, M., Kagerer, B., Kaufmann, C., Lenoci, F., Mingarelli, L., Pancaro, C. and Senner, R. (2023), “Key linkages between banks and the non-bank financial sector”, Financial Stability Review, ECB, May.

Daly, P., Dekker, L., O’Sullivan, S., Ryan, E. and Wedow, M. (2023), “The growing role of investment funds in euro area real estate markets: risks and policy considerations”, Macroprudential Bulletin, Issue 20, ECB, April.

ECB Banking Supervision (2023), “Sound practices in counterparty credit risk governance and management”, June.

Carstens, A. (2023), “Big techs in finance: forging a new regulatory path”, speech at the BIS conference “Big techs in finance – implications for public policy”, Basel, Switzerland, 8 February.

McCaul, E. (2023), “Mind the gap: we need better oversight of crypto activities”, The Supervision Blog, 5 April.

Zetsche, D.A., Buckley, R.P., Arner, D.W. and van Ek, M.C. (2023), “Remaining regulatory challenges in digital finance and crypto-assets after MiCA”, publication for the Committee on Economic and Monetary Affairs (ECON), Policy Department for Economic, Scientific and Quality of Life Policies, European Parliament, Luxembourg, May.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts