- SUPERVISION NEWSLETTER

EU securitisations: 2023 in figures

15 May 2024

Securitisation is an important building block in the EU capital markets union as it helps banks to diversify funding sources and transfer credit risk, contributing to a more balanced distribution of risk across the financial sector. By transferring risks away from banks, securitisations can free up balance sheet capacity and enable banks to provide more lending to the economy.

Banks directly supervised by the ECB generally use securitisation either to reduce the amount of capital they need to maintain or for funding purposes. Banks can only reduce their capital requirements if the securitisation transaction in question transfers a significant amount of risk to third parties. This is determined by the competent authority, which assesses whether the transaction complies with the significant risk transfer (SRT) criteria stipulated in the Capital Requirements Regulation as well as with the authority’s expectations. On the basis of this assessment, it evaluates whether the bank’s capital requirements can justifiably be reduced.

Securitisations carried out exclusively for funding purposes do not require individual supervisory assessments. Banks typically employ these funding transactions to create collateral for use in the Eurosystem’s monetary policy operations.

Banks can use cash or synthetic securitisation structures. In a cash (or traditional) transaction, the bank sells a portfolio of loans to a special purpose vehicle, which issues securitisation bonds, backed by the loans, to external investors. With a synthetic transaction, the bank keeps the portfolio on its balance sheet while transferring the associated credit risk through guarantees or credit derivatives. Synthetic transactions are faster and easier to execute but, unlike cash transactions, have no secondary market. While SRT transactions can be carried out using either cash or synthetic structures, funding deals only use cash structures since the effective sale of assets means the bank also benefits from a liquidity inflow.

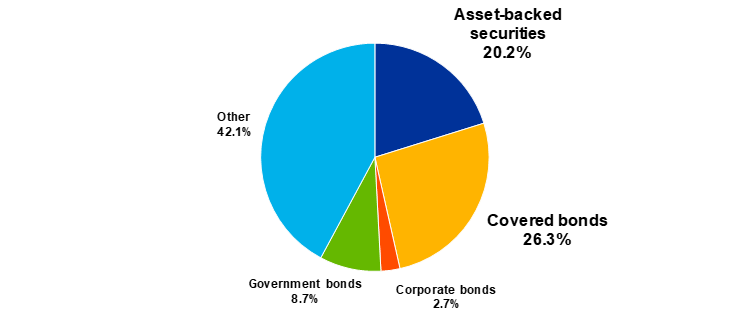

According to ECB data from 30 June 2023, banks’ stock of outstanding securitisations amounted to €1.2 trillion, split between capital relief (SRT) and funding (non-SRT) transactions. At origination, banks retain the major portion of SRT instruments – only about 15% of the notional volume is placed with third-party investors. Around 70% of the funding instruments retained by the originating banks are asset-backed securities pledged as collateral for Eurosystem credit operations.

Distribution of collateral pledged to the Eurosystem

Source: Eurosystem collateral data.

Note: Data refer to the fourth quarter of 2023.

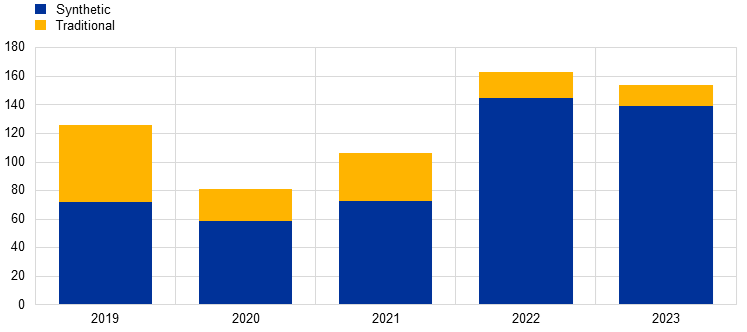

Focusing on SRT transactions and based on provisional data, the volume of instruments backed by performing loans and originated by banks under direct ECB supervision declined slightly in 2023 to around €154 billion (from €163 billion in 2022). Synthetic transactions continued to account for the largest share of transactions in the performing loans segment (90.5%), showing that banks execute SRT transactions to optimise their capital situation. Cash transactions were on a declining path, from 45% in 2019 to less than 10% in 2023. Corporate loans continued to be the largest class of securitised assets.

Evolution of the SRT market: transactions with performing loans

(total notional volumes in EUR billions)

Source: ECB data.

The volume of transactions in instruments based on non-performing loans decreased continuously over the last three years. Only a small number of these transactions were executed in 2023, with a total notional volume of €2.1 billion. This trend mirrors the reduction in non-performing loan ratios across the banking system as a whole.

The ECB will continue to monitor developments in the securitisation market, focusing on the key role played by banks as well as risks stemming from their retention of securitised instruments. If banks were to increase the placement of securitisation instruments with external investors, this could help to invigorate and deepen Europe’s capital markets and ultimately benefit its economy.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts