- SUPERVISION NEWSLETTER

Stronger collaboration on non-EU banks

21 February 2024

Banks from all over the world provide services to customers in the EU. There are different ways for international banks to enter the EU market: they can set-up subsidiary banks or operate through a network of branches. Many use a mix of both approaches, which also has an impact on supervision. For banks headquartered outside the EU, so-called third-country groups, the responsibilities and regulatory requirements differ between branches and subsidiaries.

Subsidiary banks established in countries that are part of the banking union are subject to European banking supervision and the EU rulebook. These subsidiaries are also free to provide services to customers in other EU Member States. They can establish their own branches there, either under the group’s EU passport or provide services directly across the borders within the Single Market. By contrast, branches of third-country groups in the EU are supervised at national level, based on national regulatory requirements. This means that entities belonging to the same third-country group can have different supervisors within the EU and can be subject to different regulatory requirements. The different requirements for third-country branches can create an uneven playing field, preventing supervisors from having a clear overview of the activities of third-country banks in the EU.

To address this, the ECB and the affected national supervisors of third-country branches in participating Member States signed a multilateral memorandum of cooperation on 19 January 2024. It aims to ensure that all activities of third-country groups in the EU are subject to comprehensive supervision. The memorandum will also help foster the supervisory framework and coordinate activities. It provides ample opportunity for exchanges of information on third-country branches and subsidiaries, including on the licensing of new third-country branches. For third-country groups with a more significant footprint in Member States participating in European banking supervision, the memorandum establishes supervisory fora as a closer form of cooperation among the authorities supervising different entities of the same third-country group. Participating authorities are also expected to hold regular meetings on the activities of third-country groups in their respective jurisdictions.

Another goal of the memorandum is to operationalise new supervisory cooperation requirements enshrined in the Capital Requirements Directive V, which entered into force in December 2020. The new requirements have three aims. First, they should ensure all activities of a third-country group in the EU are subject to comprehensive supervision. Second, they should block attempts to circumvent the requirements applicable to third-country groups. Third, they should prevent any detrimental impact on the financial stability of the EU. These new requirements were an important step towards coordinated supervision and monitoring of the potential risks associated with third-country branches.

Even if the footprint of third-country branches in the EU remains limited overall, with an estimated market share of 0.2% of total EU banking assets, the need for supervisory cooperation has grown as activity through third-country branches has increased. In a report published in June 2021, the European Banking Authority (EBA) noted an increased presence of third-country branches in the EU, with total assets reaching €510 billion. Although these branches operate only in the country where they are established, the current framework still allows potential for arbitrage, given supervisors’ patchy overview of the activities of such groups’ branches. For instance, third-country banking groups could mimic the benefits of an EU passport by establishing a network of branches in several countries, which would fall under different supervisory and regulatory frameworks.

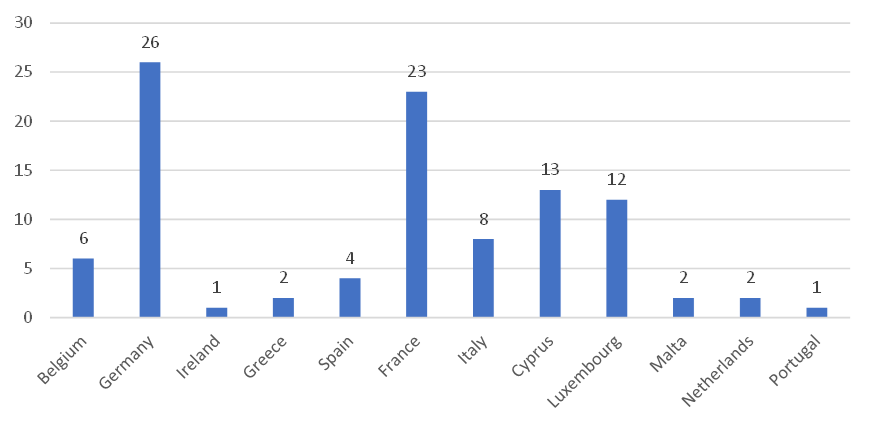

Information from the second annual notification exercise that the EBA conducted in 2023 (based on data from the end of 2022) shows that Member States participating in European banking supervision host a sizeable number of third-country branches, although they are not evenly spread across all the Member States.

Chart

Number of third-country branches under European banking supervision (as of end-2022)

Sources: EBA, ECB calculations.

The new Capital Requirements Directive VI, provisionally approved by the EU Council and Parliament in December 2023, will bring significant additional improvements. In particular it will introduce harmonised minimum standards for authorising or withdrawing authorisation from branches. It will also increase harmonisation in internal governance, risk controlling and reporting requirements. Finally, it will require some larger third-country branches to be included within EU supervisory colleges, as well as those branches with substantial deposit-taking activities or from jurisdictions where the requirements are not fully equivalent to the EU’s. In this regard, the application of Capital Requirements Directive VI provisions to supervisory cooperation on third-country branches will probably require a review of the memorandum in due course. However, as the Capital Requirements Directive VI first has to be transposed into national law, these new rules will only become applicable 30 months after their publication in the EU’s Official Journal. In the meantime, the memorandum will help European banking supervision to step up its supervision of third-country groups.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts