- SUPERVISION NEWSLETTER

A new high for significant risk transfer securitisations

16 August 2023

One of the priorities of the EU capital markets union is to revive the EU securitisation market in a sustainable and prudent manner in order to improve the financing of the EU economy. So far, securitisation has overall only played a limited role in Europe and has not reached its potential to provide additional funding for the economy. In the last years, however, the ECB has observed some positive developments in the significant risk transfer (SRT) segment of the EU securitisation market.

Securitisation is an important risk management tool for banks, allowing them to transfer credit risk to external investors. Securitisations that meet the regulatory criteria for significant risk transfer also free up lending capacity, because banks can then release part of the capital they had to hold for the risks of the underlying exposures.

The Capital Requirements Regulation establishes standardised tests to assess whether the share of credit risk transferred is significant. In the SRT assessment, the supervisor evaluates whether the bank’s capital requirements can justifiably be reduced – that is, whether this reduction is in line with the credit risk transferred to third parties. This ensures that a bank is not in a weaker capital position after originating an SRT transaction.

There are two types of SRT securitisations: traditional and synthetic. With traditional (or cash) transactions, the bank effectively sells assets. By doing this, the bank benefits not only from a capital release due to the balance sheet reduction, but also from an inflow of liquidity. Traditional transactions can also be used to remove non-performing loans (NPLs) from banks’ balance sheets. On the other hand, synthetic transactions allow banks to keep the underlying loans on their balance sheet. The credit risk is transferred through derivatives or guarantees. Both types of transactions can be labelled as simple, transparent and standardised (STS) securitisations if they comply with the criteria laid down in the Securitisation Regulation. STS securitisations draw a more beneficial capital treatment, which is an incentive for originators and investors.

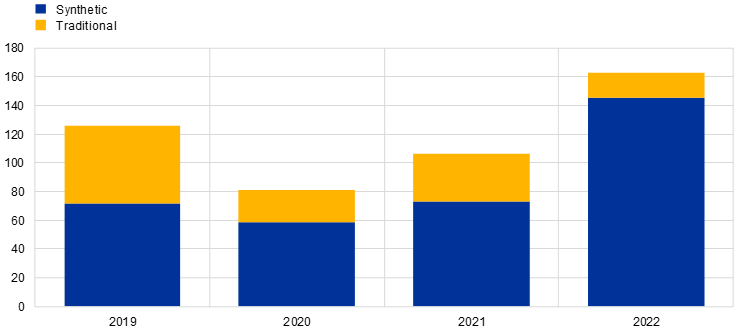

Overall, 2022 was a positive year for SRT securitisations: more than 30 banks issued 118 SRT securitisations, worth a total notional amount of more than €170 billion (Chart 1). This value is significantly higher than in previous years, with the continuation of the marked growth observed in 2021. Generally, the SRT market continues to grow as these transactions allow banks, that operate in an environment with capital pressure, to benefit from a partial capital release. The ECB notes that the previous peak of slightly above €120 billion in 2019 (before the pandemic) was surpassed in 2022 and that synthetic transactions continue to dominate the SRT segment with a share of more than 85% in the overall notional. The majority of transactions (110 out of 118) involved performing loans and accounted for a notional volume of €163 billion. Out of these 110 transactions, 72 are synthetic, with a total notional volume of €145 billion; the remaining 38 are traditional securitisations, and they have a notional value of €18 billion. Banks often prefer synthetic securitisations to obtain capital relief, because they tend to be cheaper and easier to execute due to their bilateral nature, implying in general a direct interaction with a guarantor.

Chart 1

Evolution of the SRT market: transactions with performing loans

Total notional volumes (EUR billions)

Source: ECB data.

Looking at the asset classes behind SRT transactions, trends differ between synthetic and traditional deals. Synthetic securitisations predominantly use loans to corporates and to small and medium-sized entities (SMEs), as well as residential mortgages and auto loans. On the other hand, traditional securitisations are mostly built on commercial mortgages portfolios, auto loans, consumer loans and leasing exposures. Of note, only a small volume of residential mortgages are found in traditional deals.

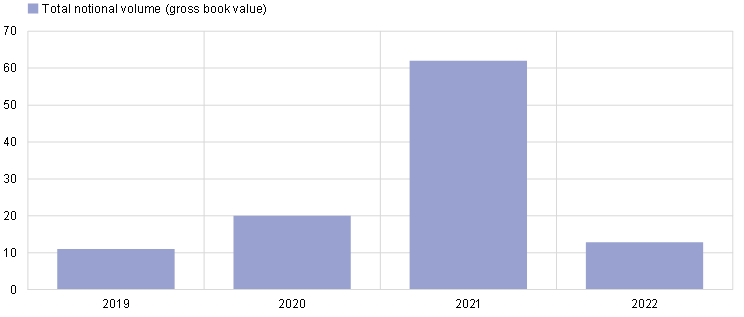

In 2022 the volume of NPL securitisations declined to €13 billion (compared with €60 billion in 2021), and only eight transactions of this type were executed (Chart 2). This decline was mainly related to the substantial reduction of banks’ NPL volumes over recent years and a reduced recourse to state guarantee schemes in 2022. Aiming to boost banks’ balance sheet quality, Italy and Greece set out state guarantee schemes to help banks offload NPLs via securitisations. Under these schemes, banks sell junior securitisation positions to external investors and retain the senior tranche that is guaranteed by the state in exchange for a fee. To date, these guarantees have never been called by any bank. The Italian State guarantee scheme was discontinued in the course of 2022. Like synthetic transactions with performing loans, the majority of NPL securitisations use loans to corporates and SMEs.

Chart 2

Evolution of the SRT market: transactions with non-performing loans

EUR billions

Source: ECB data.

If banks wish to originate SRT securitisations, they should consult ECB Banking Supervision. The precise procedure for this notification, as well as all the information banks are expected to provide, is outlined in the Public guidance on the recognition of significant credit risk transfer. Banks should notify the ECB about new originations at least three months in advance. Supervisors will then perform a thorough and holistic assessment of the transaction features to ensure that they meet all regulatory and supervisory requirements. The ECB will continue monitoring SRT transactions to ensure that they remain sound, and it will address any shortcomings in the regular annual Supervisory Review and Evaluation Process.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts