- SUPERVISION NEWSLETTER

Smaller banks’ lending and credit risk

17 November 2022

The European Central Bank (ECB) directly supervises approximately 110 of the largest banks, or “significant institutions”. As the ECB is also responsible for the functioning of European banking supervision as a whole, it also oversees national authorities’ work in supervising smaller banks, or “less significant institutions”. This continuous oversight is important to ensure there is a level playing field also for the smaller banks – which make up roughly 18% of the total assets of the euro area banking sector, corresponding to about 45% of the euro area’s GDP.

Credit risk is a core focus area in supervision and oversight of smaller banks. These banks are also subject to harmonised European rules on coverage of non-performing exposures in the context of regulatory capital calculation and guidelines on key aspects such as managing non-performing and forborne exposures, as well as loan origination. Accordingly, European supervisors agreed on a common framework for regular monitoring. The aim of this harmonised monitoring is to analyse trends in smaller banks, to provide benchmarking information to supervisors and, ultimately, to guarantee a sound banking system. The first results of the monitoring exercise, which included a sample of approximately 2,000 banks, provide interesting insights into banks’ credit risk over the past three years. While more detailed findings will be published in a dedicated report in December 2022, here we offer a short overview of one common observation: there are large differences across countries and banks when looking at loan growth, non-performing loans, and portfolio composition.

Over the past three years smaller European banks were generally well disposed to granting loans, with sustained positive loan growth on aggregate, and no signs of pandemic-related restraint. However, the evolution of loan volumes varied significantly across countries and across banks. About a third of the banks in the sample either expanded their loan volumes very significantly (at annual rates exceeding 10%), or saw similarly large reductions over the past three years. While partially driven by bank mergers, this trend suggests a very dynamic competitive environment.

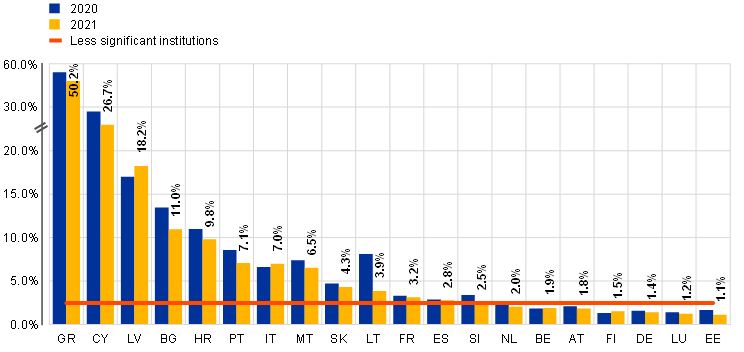

While increasing their loan volumes, the smaller banks also continued to reduce their non-performing loan (NPL) ratios (Chart 1) despite the pandemic: the average NPL ratio of smaller banks under European banking supervision decreased from 2.2% at the end of 2018 to 1.6% at the end of 2021. Despite this downward trend, NPL levels continue to vary materially across countries and banks: while the NPL ratio of most remained below 2.5%, it exceeded 5% for 157 banks at the end of 2021. European banking supervisors pay special attention to these cases, including setting requirements for intensified, strategic NPL reduction efforts.

Chart 1

Non-performing exposure ratios of smaller banks (excluding cash) by country

Source: ECB calculations based on the list of supervised entities.

Note: Number of less significant institutions (excluding branches) at the highest level of consolidation (excl. financial market infrastructures).

The composition of smaller banks’ loan portfolios varies greatly across countries. In some countries households or businesses make up less than 10%, respectively, while for others they account for more than 80%, reflecting a high degree of business model specialisation. Portfolio composition is important from a credit risk perspective, because specific risk drivers and certain elements of risk management can vary significantly across customer segments. Loans to small and medium-sized companies and commercial real estate projects have proved to be particularly risky, with NPL ratios in these sub-segments exceeding 10% in most countries. And while default rates across smaller banks generally showed a decreasing trend in most countries in 2021, the current macroeconomic environment presents numerous challenges, requiring banks to stay alert and manage emerging risks actively.

The differences across countries and across banks under European banking supervision show that each smaller bank is different and must therefore adapt its credit risk management to its specific circumstances. However, comparisons can also make banks and supervisors aware of more general trends reflecting a country’s economy or a specific type of customer portfolio. Such comparisons and benchmarking can help in learning from peers and in identifying risks that might affect similar banks or countries. Therefore, European banking supervision will continue efforts to harmonise supervision and track smaller banks’ credit risk to guarantee a stable banking system across the banking union. A dedicated report will be published in December 2022 and provide updated insights into the structure of smaller banks’ operations, their current risk situation, and key supervisory activities.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts