- SUPERVISION NEWSLETTER

COVID-19 exposes weaknesses in banks’ recovery plans

17 February 2021

Good recovery planning makes banks more resilient to severe shocks. It is one of the measures to reduce the need for taxpayer money to support the financial system in a crisis. It also helps safeguard critical banking functions, such as lending to households and businesses. A recovery plan should identify all the credible options that a bank has to survive a range of severe but plausible stressed scenarios. As Supervisory Board member Kerstin af Jochnick noted, “The pandemic has reminded us of the importance of sound recovery plans as a crisis management tool”. An effective plan allows a bank to restore its capital and liquidity levels and return to a stable and viable position. To make sure that banks’ plans are effective, ECB Banking Supervision carries out regular benchmarking of the recovery plans prepared by the banks under its direct supervision. The findings from the 2020 benchmarking exercise – which was carried out on recovery plans submitted in 2019 – show that banks need to improve their recovery plans to adequately address the financial impact of extraordinary system-wide crises such as the coronavirus (COVID‑19) pandemic.

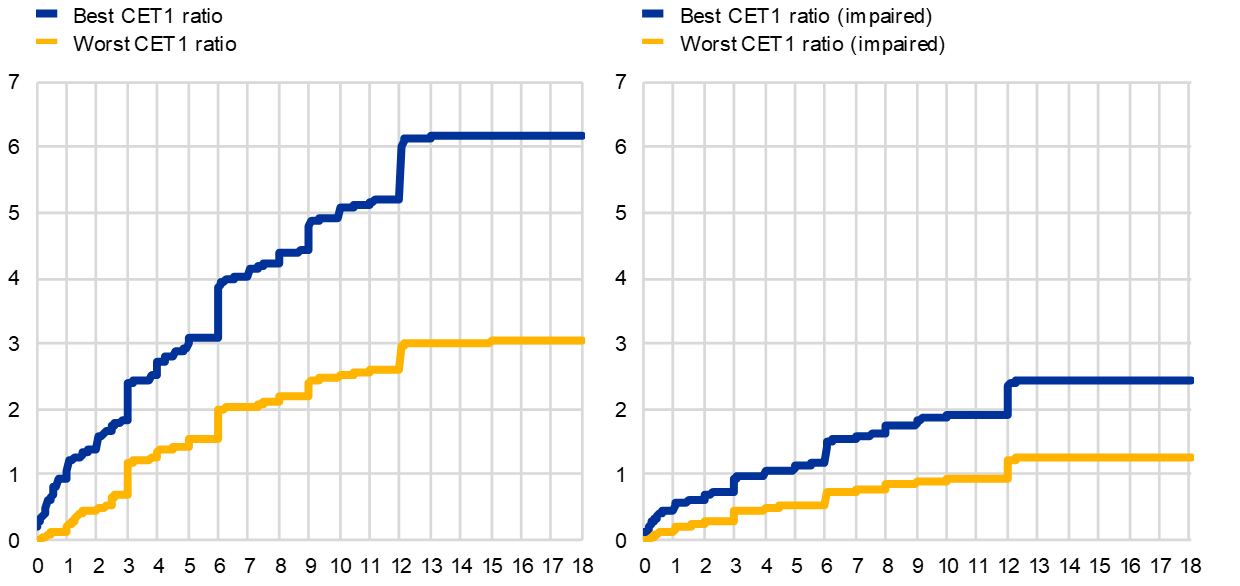

One key finding is that the pandemic stress could significantly reduce banks’ overall recovery capacity (ORC), in other words the extent to which a bank’s recovery options would allow it to recover from situations of severe financial stress. The chart below shows how certain pandemic-related market disturbances could reduce banks’ capacity to restore their capital position (presented here in terms of Common Equity Tier 1 (CET1)). If an individual bank is in a crisis, raising new share capital or selling subsidiaries can be effective recovery options. However, in a system-wide crisis capital markets could suddenly close, leaving banks unable to raise capital. Also, in the wake of a crisis, investors may be less willing to buy a bank’s subsidiary at a fair price. If these extreme scenarios were to materialise at the same time, banks would see a significant drop in the CET1 recovery capacity reported in their plans, by 60% on average.

Range of capital recovery capacity as originally calculated by banks and under pandemic stress conditions

(x-axis: time in months; y-axis: CET1 in percentage points)

Source: Recovery plans submitted by banks under direct supervision in 2019.

Notes: Capital recovery capacity is measured in terms of the CET1 ratio. The originally calculated range of capital recovery capacity is shown on the left-hand side and the range of capital recovery capacity under pandemic stress conditions is shown on the right-hand side. The pandemic stress scenario assumes that capital increases and sales of subsidiaries are not possible owing to COVID-19-related disturbances.

Looking at liquidity recovery capacity, wholesale funding is the most significant recovery option for most banks. If such funding became unavailable in a crisis situation, the liquidity recovery capacity would fall by 27%. This is less than the fall in CET1 recorded in the extreme scenarios above, but it is still significant. Moreover, not only do the extreme scenarios affect the total amount of liquidity that can be generated, they could also increase the time it takes to obtain it. The analysis showed that if a bank needed to increase its liquidity coverage ratio and wanted to mobilise 50% of its liquidity recovery capacity to do so, this would take six months in a pandemic-related scenario, compared with three months under the original assumptions.

Another key finding is that, in a severe stress scenario, banks appear to rely on a very limited number of recovery options for the bulk of their ORC: for 37.5% of the banks benchmarked, 80% of their overall recovery capacity was generated by just two recovery options. This implies that a bank’s ability to restore its financial health could be significantly lower if one or more of these options were not available, for example owing to the impact of the severe stress on market risk appetite.

A third key finding relates to recovery plan indicators, which banks use to monitor their financial health. Once a pre-defined indicator level is met (i.e. breached), this triggers an internal review process which may lead to follow-up action by the bank if deemed appropriate (such as implementing one or more recovery options). ECB Banking Supervision found that some of the recovery indicators were not fully effective against the pandemic stress. In particular, macroeconomic indicators (e.g. changes in GDP) and market-based indicators (e.g. rating downgrades) appear to be too backward-looking, with breaches occurring much later than expected when considering the unprecedented macroeconomic and market difficulties. For example, based on the situation as at 31 August 2020, only 28% of the significant banks reported breaches of relevant macroeconomic indicators to the ECB. This is despite the fact that in July 2020 the euro area economy was expected to have contracted by more than 12% in the second quarter of 2020, by far the largest decline in the history of the EU. This is cause for concern, because if a bank is slow to identify a looming threat, it may not have enough time to take measures to address it. Proper follow-up of an indicator breach is crucial for effective monitoring and enables banks to take more informed decisions and appropriate action to resolve the stress situation. A good practice adopted by some banks is to share their internal indicator dashboards with their Joint Supervisory Teams, who can then also have an overview of the indicators.

In the light of these findings, ECB Banking Supervision is paying particular attention to challenging banks’ recovery options and recovery capacity as part of its recovery plan assessments in 2021.

The aim of these assessments – which are already under way – is to gain a more realistic view of banks’ recovery capacity in times of severe stress and identify steps banks should take to improve it. ECB Banking Supervision will publish the findings from its assessment in the second quarter of 2021 and engage with individual banks to discuss their recovery plans.

Evropska centralna banka

Generalni direktorat Stiki z javnostjo

- Sonnemannstrasse 20

- 60314 Frankfurt na Majni, Nemčija

- +49 69 1344 7455

- media@ecb.europa.eu

Razmnoževanje je dovoljeno pod pogojem, da je naveden vir.

Kontakti za medije