- SUPERVISION NEWSLETTER

Leveraged lending: banks exposed to risks amid COVID-19

Frankfurt am Main, 13 May 2020

Markets for leveraged loans – i.e. loans to highly indebted borrowers – have grown rapidly in recent years, with issuance activity concentrated in the United States and Europe. This activity involves banks, which originate leveraged loans and hold a substantial portion of these on their books, and a wide range of market participants. Banks have entered leveraged loan markets because these loans generate higher interest income in a low interest rate environment and fee income on origination. Some leveraged loans are also traded on the secondary market. Banks are therefore exposed to markets for leveraged loans and securitised leveraged loans (known as collateralised loan obligations, or CLOs) directly, through their holdings of leveraged loans and CLOs, and indirectly, through their exposure to entities investing or participating in these markets.

Like many other asset classes, global leveraged loan markets are currently facing headwinds not seen since the financial crisis of 2008-09. The economic fallout from the coronavirus (COVID-19) pandemic has led to wide-scale sell-offs and a collapse in prices, both in Europe and the United States. Pricing adjustments have been particularly severe in the secondary market. In Europe, the S&P European Leveraged Loan Index dropped by 14.78% in March, the largest decline since its inception in 2002. In the United States, the S&P/LSTA Leveraged Loan Index fell by 12.37% in March, the second steepest monthly decline in the 23-year history of the Index. By March, primary market activity for leveraged loans had come to a near-complete halt.

Current market conditions draw attention to the specific risks stemming from leveraged loans. They represent a real-life test for banks’ underwriting standards and risk management frameworks. Indeed, recent years have been characterised by buoyant credit origination, with an increase in borrowers’ leverage levels and changes in loan documentation. At the end of 2019 the 26 most active directly supervised banks had a total exposure to leveraged loans of €417 billion, representing 20% of their corporate loan books on average. More than half of the €165 billion of new transactions underwritten in 2019 (by one bank, several banks or a syndicate) were “covenant-lite”, which entails fewer borrower restrictions and weaker lender protection, or had no covenant protection. Furthermore, almost half had leverage levels at origination exceeding six times total debt divided by earnings before interest, taxes, depreciation and amortisation (EBITDA), a measure used as a proxy for a borrower’s cash-flow generation.

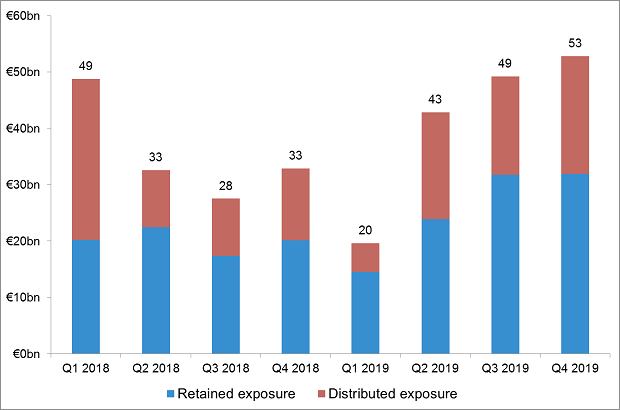

Chart 1

Newly underwritten transactions by the most active directly supervised banks

Source: ECB Banking Supervision.

Notes: Retained exposure refers to the underwritten exposures that banks keep on their books. Distributed exposure refers to the underwritten exposures that are distributed to third-party investors. The sample comprises 26 banks for Q4 2019, 25 banks for Q3 2019 and 18 banks for Q1 2018 to Q2 2019.

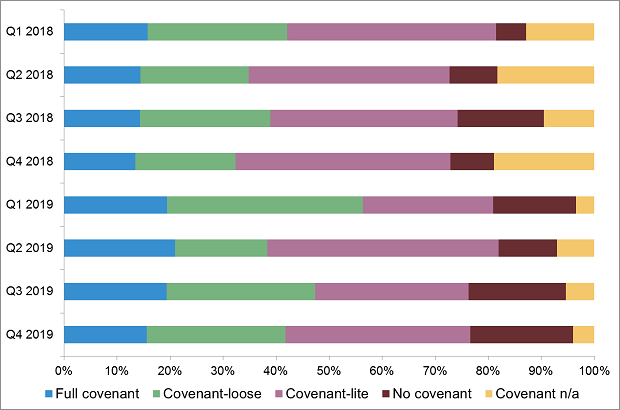

Chart 2

Newly underwritten transactions by covenant type

Source: ECB Banking Supervision.

Note: Covenant n/a = not reported by significant institution.

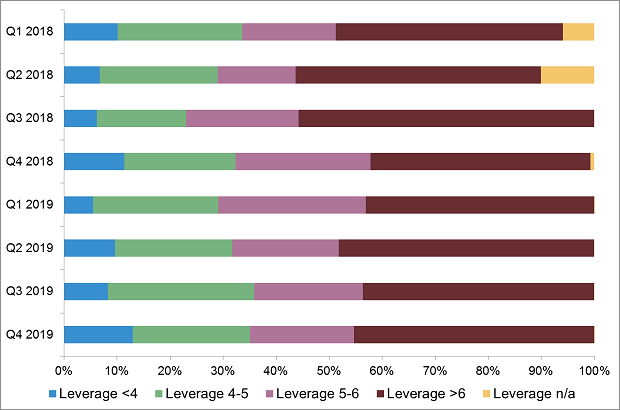

Chart 3

Newly underwritten transactions by leverage level

Source: ECB Banking Supervision.

Notes: Leverage refers to the ratio of total debt to EBITDA of the borrower, as per the ECB Guidance on leveraged transactions. Leverage n/a = not reported by significant institution.

Against this background, the ECB is closely monitoring the situation for significant institutions under its direct supervision. The supervisory expectations set out in the ECB Guidance on leveraged transactions published in 2017 are more important than ever for ensuring prudent lending, risk management and financial stability, and remain the point of reference for dealing with the current situation and preparing for the future.

Banks that are active in leveraged loan markets need to take into account several dimensions. First and foremost, they need to carefully and comprehensively assess the resilience of their leveraged loan and CLO portfolios under various economic scenarios, taking into account direct and indirect risks, and interactions with other portfolios under current market conditions. The unprecedented public sector support measures can be expected to have a positive impact on default and recovery rates. Nevertheless, borrower requests for additional liquidity, drawing on both committed and uncommitted credit facilities, and requests for covenant holidays and related forbearance measures pose additional risks to banks.

Banks may also need to deal with syndicated loan pipeline positions in a context where investor demand may not come back: failed syndications could potentially result in substantial “hung” positions for banks – i.e. positions stemming from underwritten loans that cannot be placed with investors – which would have a direct impact on profits and capital. Finally, more limited primary syndication activity and fewer loan issuances over a certain period of time will reduce fee and commission income.

Going forward, the current circumstances should also provide an opportunity for banks, regulators and supervisors to verify a number of assumptions, revisit certain market practices and further strengthen risk management and data aggregation approaches.

Benchmarking exercises and on-site and off-site work carried out by the ECB in recent years show that progress has been made in these areas. However, the findings also revealed persistent shortcomings in banks’ risk management frameworks in relation to some of the supervisory expectations outlined in the ECB Guidance. For example, in a number of cases banks did not have a group-wide risk appetite for underwriting and syndication activities that adequately reflected all underlying risks and factored in their capital constraints. In addition, the limit systems put in place by banks were often not comprehensive enough, failed to sufficiently factor in forward-looking analyses of market conditions and risk drivers (including under stressed conditions), or had no defined stress loss limits. Furthermore, the stress-testing architecture and framework for syndication pipelines and leveraged loan portfolios were often underdeveloped.

The 2019 Supervisory Review and Evaluation Process (SREP) took into account the shortcomings mentioned above and banks received detailed recommendations and qualitative requirements. In 2020 ECB Banking Supervision is carefully assessing the progress made in these areas, as well as banks’ ability to adequately deal with the current stressed conditions. The outcomes of these assessments will be reflected in supervisory measures, as appropriate. The ECB will also continue to support the work of international fora – including the Financial Stability Board and the Basel Committee on Banking Supervision – to develop a comprehensive, and possibly more consistent, view of the trends and risks of the global leveraged loan markets.

In the meantime, there should be no doubt as to what banks need to do. They must continue to ensure the quality of their internal risk management and information system processes in relation to leveraged lending. They must also use the current circumstances and the slowdown in origination to learn how best to carry out these activities and manage the associated risks in the future.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts