Developments in residential real estate lending: a mixed picture

Vulnerabilities in residential real estate lending have been a trigger for several financial crises and have come under increased scrutiny by supervisors. Residential real estate lending is a key activity for euro area banks, accounting for about 14% of the area’s total banking sector assets, which is equivalent to around 40% of euro area GDP. With house price growth in the euro area currently accelerating, partly supported by low interest rates, and in conjunction with signs that lending standards are easing, supervisors are closely monitoring banks to ensure that they take risks in a prudent manner.

As part of its ongoing analyses, ECB Banking Supervision, in collaboration with the national supervisory authorities, has been assessing the credit risks related to residential real estate exposures in euro area countries. These credit risk assessments take into account the size of the banking sector’s exposure, the probability of risk materialising and the losses that banks would incur if it did. Credit risks related to mortgage exposures are assessed using a horizontal approach, which allows for a comparison of lending practices across the euro area. ECB Banking Supervision has developed tools for supervisors that summarise the findings from the yearly risk assessment of residential real estate lending markets. These tools are incorporated into the Supervisory Review and Evaluation Process and used to facilitate supervisors’ assessments of euro area mortgage lending portfolios. Given that real estate lending is a major component of credit risk for many SSM banks, it is also a recurring topic in the continuous supervisory dialogue.

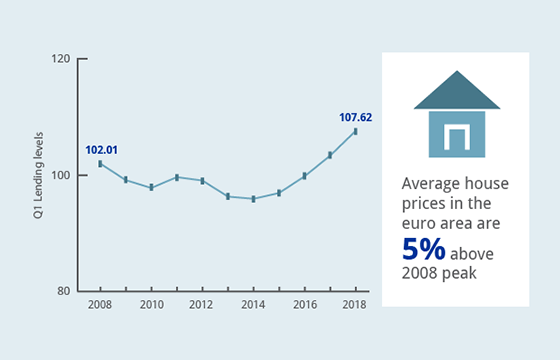

Source: ECB calculations based on Eurostat and national data

The results of the assessment show that although no national residential real estate lending practices are currently marked as high risk, there are some pockets of vulnerability that may require more scrutiny. General market developments show that residential property prices have continued to accelerate, increasing by 4.7% over the course of 2017. On average, house prices in the euro area are now 5% above the peak reached in the second quarter of 2008. Although house price developments at individual country level do not yet signal pronounced risks from a microprudential perspective, there are signs of sharp increases in parts of the euro area. Mortgage lending in the euro area exhibits an annual growth rate of 3.5% (April 2018), and therefore does not yet send out a strong signal of a potential build-up of credit-fuelled bubbles. However, heterogeneity in terms of both mortgage lending and house price developments across the euro area is pronounced.

One notable development is that the aggregate trend of mortgage lending to move away from variable interest rates has reversed. At the beginning of 2007 the share of new loans issued at variable interest rates represented almost 50% of all new lending, but in January 2017 that share was just 13%. However, since then the proportion of variable interest rate loans has again risen, to 21% in April 2018. This could raise concerns for banking supervisors as borrowers with variable rate loans will face higher payments if interest rates increase. A macroeconomic perspective, from which developments in the aggregate economy are studied, may not reveal the associated underlying credit risks. Such a viewpoint would focus on the fact that a potential interest rate rise is likely to be backed by a stronger economic situation in which aggregate household income increases as a result of lower unemployment rates and higher pay levels. A supervisory perspective, however, which looks at individual lending relationships between banks and borrowers, is able to unveil potential vulnerabilities related to the fact that income does not rise equally for all borrowers. This could in turn lead to a deterioration of some borrowers’ debt servicing capacity. Furthermore, high household debt, as seen in some euro area countries, could further increase the probability of borrowers defaulting.

There are some indications that lending standards are easing. On average, banks now allow borrowers to finance a slightly higher amount of the value of their house with a loan. This is indicated by a higher loan-to-value ratio on new loans, which increased from 77% in 2016 to 78% in 2017. The share of new loans with a relatively high loan-to-value ratio (over 80%) also increased in the same period, from 40% to 42%. This picture is confirmed by the banks themselves, as the results of the ECB Bank Lending Survey indicate that they are easing credit standards. However, these results should be interpreted with caution given the limited availability of data.

In conclusion, developments in residential real estate lending in the euro area present a mixed picture. Although there is no evidence that euro area banks are currently exposed to a high-risk mortgage lending environment, for some the risk of losses on their residential real estate lending portfolios is increasing. This requires closer scrutiny by supervisors.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts