Dialogue: a cornerstone of supervision

An open, effective and continuous dialogue between banks and supervisors is a key supervisory practice.

Transparency is at the core of the legal framework on which the Single Supervisory Mechanism (SSM) is based. On the one hand, the principle of accountability set out in Articles 20 and 21 of Council Regulation (EU) No 1024/2013 (the “SSM Regulation”) ensures that ECB Banking Supervision engages in continuous dialogue with the European Parliament, the Council and national parliaments.

And on the other, the principle of due process set out in Article 22 of the same Regulation and specified in Article 31 of Regulation (EU) No 468/2014 of the European Central Bank (the SSM Framework Regulation) establishes a formal supervisory dialogue (also called “right to be heard”) between ECB Banking Supervision and the banks it directly supervises.

SREP communication and transparency

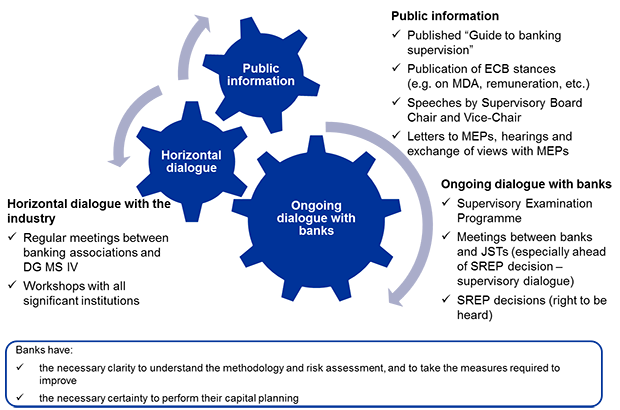

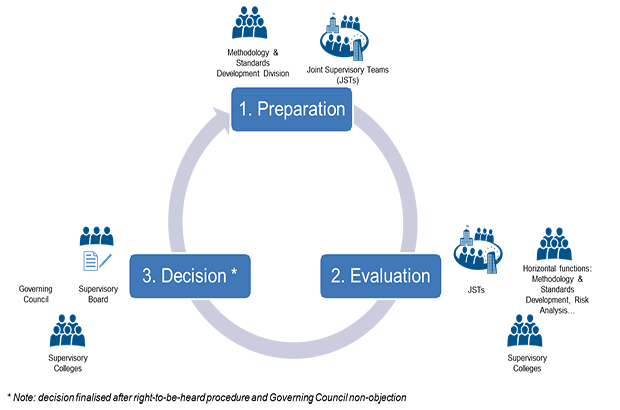

An approach based on formal and informal supervisory dialogues was developed as part of the methodology and standards governing the Supervisory Review and Evaluation Process (SREP). The objective is to ensure effective and mutually-beneficial interaction with banks during both the evaluation and the decision phase (see diagram below). Beyond the well-defined formal supervisory dialogue, a continuous, less formal interaction with banks is needed to perform efficient and sound supervision. Let us take the example of the SREP cycle.

The SREP cycle

During the evaluation phase, the Joint Supervisory Teams (JSTs) hold an informal supervisory dialogue with banks. This is the opportunity for the JSTs to explain their assessment and describe any potential quantitative (capital or liquidity) and qualitative remedial measures they are considering to address the shortcomings highlighted by the assessment. The JSTs use the first-hand information provided by the banks and report it to the Supervisory Board. To complement this, Directorate General Microprudential Supervision IV maintains an ongoing dialogue on methodological aspects with industry bodies and stands ready to support JSTs in their meetings with banks.

These informal exchanges facilitate a better mutual understanding. Bankers receive information on the assessment methodology, the outcome of the methodology applied to the risk profile of their bank, and the score they receive, also in comparison with their peers. This information is based on a harmonised format developed horizontally by the Methodologies and Standards Development Division. For supervisors, this dialogue contributes to the efficiency of the SREP in that the conclusions of the assessment are shared in advance of the final decisions and discussed with the banks. This results in measures being better understood and, most likely, better implemented by the banks.

During the decision phase and after the Supervisory Board has approved the draft decisions, the formal part of the supervisory dialogue takes place through the right to be heard. Banks have two weeks to provide written comments and/or ask for meetings to express their views before the final decisions are adopted by the ECB. The supervisor has to consider and respond to all comments received during this period, and may amend the draft decision before its final adoption.

As part of the SREP, the informal supervisory dialogue is fed by a number of supervisory projects. These include thematic reviews initiated by the ECB on issues such as risk governance and risk appetite (RIGA) and the business model assessment and profitability review, to name but two.

All of this illustrates that the supervisory dialogue is a key component of supervisors’ toolkit to incentivise banks to improve their risk management, with outcomes beneficial to both banks and supervisors. In this respect, the supervisory dialogue is not a “one-way street”. Dialogue must go both ways: supervisors want to operate with the banks they supervise under the “no surprise” principle, so that bankers immediately inform their supervisor of any new significant development – positive or negative – related to their institution.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts