The Supervisory Review and Evaluation Process: what’s new?

So far, one of the important achievements of European banking supervision has been to harmonise the main tool of banking supervision, the Supervisory Review and Evaluation Process (SREP). Banks are now being assessed by the same yardstick across the euro area. This is a marked improvement from complying with supervisory requirements of up to 19 different national authorities.

In a sense, the SREP is like a medical scanner, except it’s for banks. It gives supervisors deep insights into banks, and helps them to diagnose problems and prescribe solutions.

Throughout the year, supervisors thoroughly assess the individual risk profile of each significant institution from four different angles: the bank’s business model, its governance and risk management as well as potential risks to the bank’s capital and liquidity. Each assessment combines data-driven analysis with expert judgement.

Drawing on the assessment, ECB Banking Supervision determines how much additional capital and liquidity each bank should hold, as well as other qualitative measures necessary to address its weaknesses.

The SREP is based on a harmonised methodology, which ensures that banks are assessed with a common yardstick in a holistic and forward-looking manner that takes into account their individual characteristics. The SREP methodology is being steadily refined in order to keep pace with economic, legislative and supervisory developments.

SREP 2016: introducing P2R and P2G

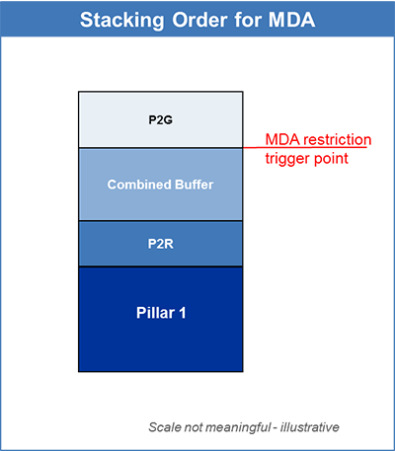

The most notable SREP development this year has been the introduction of the so-called Pillar 2 guidance. The capital demand resulting from the SREP now consists of two parts. One is the Pillar 2 requirement or P2R, which covers risks underestimated or not covered by Pillar 1. The other is the Pillar 2 guidance or P2G, which indicates to banks the adequate level of capital to be maintained in order to have sufficient capital as a buffer to withstand stressed situations, in particular as assessed on the basis of the adverse scenario in the supervisory stress tests. While P2R are binding and breaches can have direct legal consequences for banks, P2G is not binding. Nevertheless, ECB Banking Supervision certainly expects banks to comply with P2G.

According to the information update published by the European Banking Authority on 1 July 2016[1], the P2G sits on top of the so-called combined buffer requirements[2] (see figure below[3]). This means that if a bank violates P2G, there will be no automatic restrictions imposed on distributions such as dividends and bonuses. Instead, supervisors will carefully consider the reasons and circumstances and may define individually tailored supervisory measures. Should the bank’s capital supply not improve and the bank not be able to restore its capital buffer, or even if it declined further, leading to a breach of the combined buffers, automatic restrictions could be imposed on the bank’s distributable amount.

P2G is not determined mechanistically; it relies on a wide range of information. One important factor is the quantitative outcome of supervisory stress tests, in particular: the fall in the Common Equity Tier 1 (CET1) ratio that a bank experiences over the stress test period in the adverse scenario. At the same time, qualitative information drawn from the stress test has been factored into the SREP requirements on internal governance. ECB Banking Supervision stated last year that it regards the current level of capital in the euro area’s banking system as satisfactory and that it intends to keep the supervisory capital demand stable, all things being equal. With the introduction of P2G, the trigger point for automatic restrictions (“MDA trigger”) has gone down in many cases.

- Information update on the 2016 EU-wide stress test.

- The combined buffer requirements refer to the total Common Equity Tier 1 capital required to meet the requirement for the capital conservation buffer extended by the following, as applicable: (a) an institution-specific countercyclical capital buffer; (b) a G-SII buffer; (c) an O-SII buffer; (d) a systemic risk buffer.

- MDA: Maximum Distributable Amount as defined in Article 141 of Directive No 2013/36 (Capital Requirements Directive, CRD IV).

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts