- PRESS RELEASE

ECB publishes supervisory banking statistics on significant institutions for the fourth quarter of 2024

20 March 2025

- Aggregate Common Equity Tier 1 ratio at 15.86% in fourth quarter of 2024, up from 15.74% in previous quarter but stable compared with 15.87% one year ago

- Aggregated annualised return on equity at 9.54% in fourth quarter of 2024, down from 10.09% in previous quarter but up from 9.32% one year ago

- Aggregate non-performing loans ratio (excluding cash balances) stable at 2.28% compared with 2.31% in previous quarter and 2.30% in fourth quarter of 2023

- Share of loans showing significant increase in credit risk (stage 2 loans) at 9.93%, up from 9.74% in previous quarter and from 9.73% one year ago

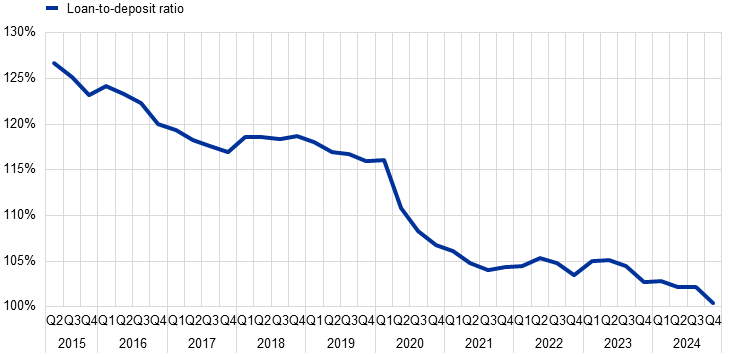

- Aggregated loan-to-deposit ratio at 100.43%, the lowest value reported since 2015

Capital adequacy

In the fourth quarter of 2024, the aggregate capital ratios of significant institutions (banks supervised directly by the ECB) were up from the previous quarter, while remaining stable compared with the same period last year. The aggregate Common Equity Tier 1 (CET1) ratio stood at 15.86%, the aggregate Tier 1 ratio stood at 17.33% and the aggregate total capital ratio stood at 19.99%. This quarterly development was driven by the increase in the capital amounts (numerators), which outweighed the growth of the total risk exposure (denominator). Across countries, the CET1 ratio ranged from 12.88% in Spain to 22.05% in Latvia in the fourth quarter of 2024.

Chart 1

Capital ratios and CET1 amount

Source: ECB.

Chart 2

CET1 ratios by country

Source: ECB.

Notes: “SSM” stands for “Single Supervisory Mechanism”. Some countries participating in European banking supervision are not included in this chart, either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation in that country.

Asset quality

The non-performing loans (NPL) ratio excluding cash balances at central banks and other demand deposits stood at 2.28% in the fourth quarter of 2024. The stock of NPLs (numerator) decreased by €4.09 billion (-1.13%), while the total amount of loans and advances (denominator) rose by €21.19 billion (0.14%). As a result, the ratio decreased by 3 basis points compared with the previous quarter.

At sector level, the NPL ratio for loans to non-financial corporations (NFCs) was 3.52%, down from 3.65% in the previous quarter but slightly up from 3.48% a year ago. Meanwhile for loans to households, the ratio remained stable at 2.23%, compared with 2.25% in the previous quarter and 2.19% one year ago. The NPL ratio for loans to NFCs collateralised by commercial immovable property stood at 4.60%, up from 4.56% in the previous quarter and from 4.53% one year ago. The NPL ratio stood at 4.75% for loans to small and medium-sized enterprises, down from 4.88% in the previous quarter but up from 4.62% a year ago.

Aggregate stage 2 loans as a share of total loans increased to 9.93% (from 9.74% in the previous quarter). The ratio for loans to NFCs decreased to 13.93% but the ratio for loans to households increased to 9.64% (from 14.03% and 9.18% in the previous quarter, respectively).

Chart 3

Non-performing loans

(EUR billions)

Source: ECB.

Note: “cb” stands for cash balances and other demand deposits.

Chart 4

Non-performing loans by counterparty sector

a) Breakdown of NFC portfolio by segment | b) Breakdown of household portfolio by segment |

|---|---|

|  |

Source: ECB.

Chart 5

Stage 2 loans and advances as a share of total loans and advances subject to impairment review

Source: ECB.

Note: Stage 2 includes assets that have shown a significant increase in credit risk since initial recognition.

Profitability

The aggregated annualised return on equity stood at 9.54% in the fourth quarter of 2024 compared to 10.09% in the previous quarter and 9.32% one year ago.

Following the increase in 2022 and 2023, the aggregated net interest margin reached 1.60% in the fourth quarter of 2023 and has remained quite stable since then. Net interest margin across countries ranged from 0.89% in France to 3.54% in Slovenia in the fourth quarter of 2024.

Chart 6

Return on equity and net interest margin

Source: ECB.

Chart 7

Net interest margins (NIM) by country

Source: ECB.

Notes: “SSM” stands for “Single Supervisory Mechanism”. Some countries participating in European banking supervision are not included in this chart, either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation in that country.

Loan-to-deposit ratio

In the fourth quarter of 2024, the aggregated ratio of loans to deposits to/from non-financial corporations and households was 100.43%. This marks a decrease from 102.13% in the previous quarter and from 102.74% in the same period last year. This is the lowest value recorded since the start of the time series in 2015.

Chart 8

Loan-to-deposit ratio

Source: ECB.

Factors affecting changes

Supervisory banking statistics are calculated by aggregating the data reported by banks which report COREP (capital adequacy information) and FINREP (financial information) data at the relevant point in time. Consequently, changes from one quarter to the next can be influenced by the following factors:

- changes in the sample of reporting institutions;

- mergers and acquisitions;

- reclassifications (e.g. portfolio shifts as a result of certain assets being reclassified from one accounting portfolio to another).

For media queries, please contact Nicos Keranis, tel.: +49 172 758 7237.

Notes

- The complete set of Supervisory banking statistics with additional quantitative risk indicators is available on the ECB’s banking supervision website. The time series are also available for download from the ECB Data Portal.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts