- PRESS RELEASE

ECB publishes supervisory banking statistics for the second quarter of 2020

6 October 2020

- Capital ratios of significant institutions increase in second quarter of 2020, with aggregate total capital ratio back to year-end levels at 18.64% (up from 18.11% in first quarter of 2020)

- Aggregate NPL ratio declines further to stand at 2.94%, lowest level since data first published in 2015

- Liquidity coverage ratio increases significantly to 165.46% (up from 146.57% in first quarter of 2020)

- Annualised return on equity falls to aggregate level of 0.01% at end of second quarter of 2020, down from 6.01% a year earlier

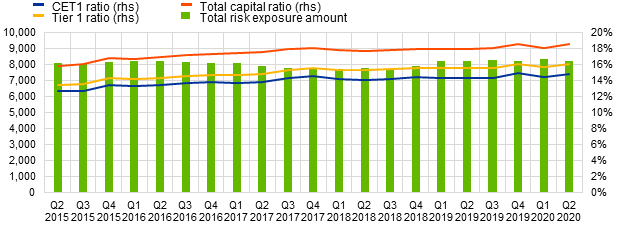

Capital adequacy

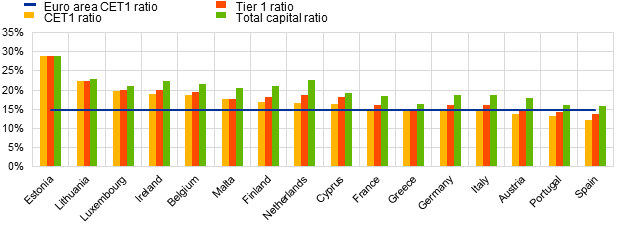

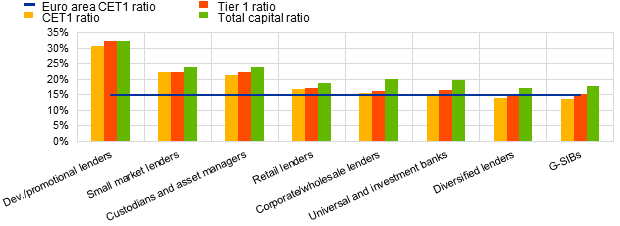

Aggregate capital ratios for significant institutions (i.e. banks supervised directly by the ECB) increased in the second quarter of 2020 compared with the previous quarter. The aggregate Common Equity Tier 1 (CET1) ratio stood at 14.87%, the aggregate Tier 1 ratio stood at 16.12%, and the aggregate total capital ratio stood at 18.64%. Aggregate CET1 capital ratios at country level ranged from 12.25% in Spain to 28.80% in Estonia. Across SSM business models, global systemically important banks (G-SIBs) reported the lowest aggregate CET1 capital ratio (13.77%) and development/promotional lenders reported the highest (30.72%).

Chart 1

Total capital ratio and its components by reference period

(EUR billions; percentages)

Source: ECB.

Chart 2

Capital ratios by country for the second quarter of 2020

(percentages)

Source: ECB.

Note: Some countries participating in European banking supervision are not included in this chart, either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation in that country.

Chart 3

Capital ratios by business model for the second quarter of 2020

(percentages)

Source: ECB.

Note: “Dev./promotional lenders” refers to development and promotional lenders; “retail lenders” refers to retail and consumer credit lenders.

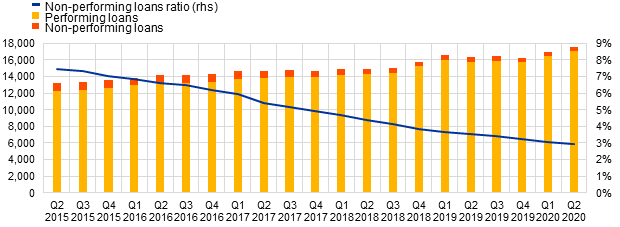

Asset quality

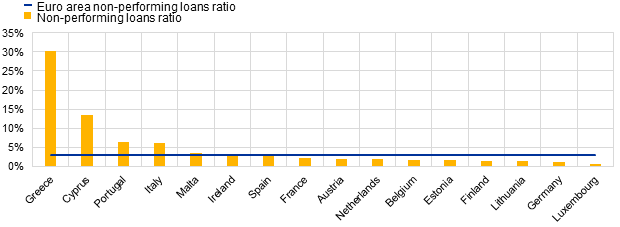

The aggregate non-performing loans ratio (NPL ratio) improved further, standing at 2.94% in the second quarter of 2020. While the stock of NPLs increased slightly, by 0.47%, the gross carrying amount of loans and advances (including cash balances at central banks) increased by 4.16%. At country level, the average NPL ratio ranged from 0.70% in Luxembourg to 30.31% in Greece.

Chart 4

Non-performing loans by reference period

(EUR billions; percentages)

Source: ECB.

Chart 5

Non-performing loans ratio by country for the second quarter of 2020

(percentages)

Source: ECB.

Note: Some countries participating in European banking supervision are not included in this chart, either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation in that country.

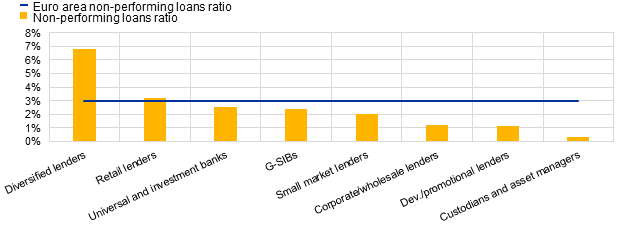

Chart 6

Non-performing loans ratio by business model for the second quarter of 2020

(percentages)

Source: ECB.

Note: “Dev./promotional lenders” refers to development and promotional lenders; “retail lenders” refers to retail and consumer credit lenders.

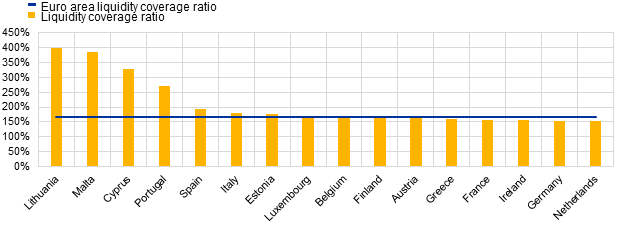

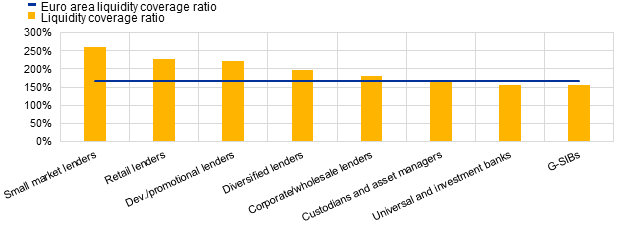

Liquidity

The aggregate liquidity coverage ratio rose to 165.46% in the second quarter of 2020, up from 146.57% in the previous quarter, driven mainly by an 18.90 percentage point increase in the liquidity buffer. Across SSM business models, G-SIBs reported the lowest aggregate ratio (155.06%), while small market lenders reported the highest (259.46%).

Chart 7

Liquidity coverage ratio by reference period

(EUR billions; percentages)

Source: ECB.

Chart 8

Liquidity coverage ratio by country for the second quarter of 2020

(percentages)

Source: ECB.

Note: Some countries participating in European banking supervision are not included in this chart, either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation in that country.

Chart 9

Liquidity coverage ratio by business model for the second quarter of 2020

(percentages)

Source: ECB.

Note: “Dev./promotional lenders” refers to development and promotional lenders; “retail lenders” refers to retail and consumer credit lenders.

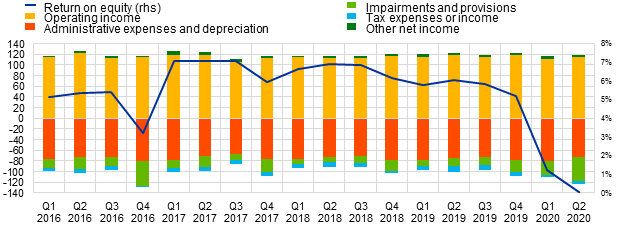

Return on equity

The annualised Return on Equity (RoE) fell significantly to stand at an aggregate level of 0.01% in the second quarter of 2020, down from 6.01% in the second quarter of 2019. The decline in aggregate net profits was driven mainly by an increase in impairments and provisions (which amounted to €45.00 billion in the second quarter of 2020, compared to €16.03 billion in the second quarter of 2019).

Chart 10

Return on equity and composition of net profit and loss by reference period

(EUR billions; percentages)

Source: ECB.

Factors affecting changes

Supervisory banking statistics are calculated by aggregating the data that are reported by banks which report COREP (capital adequacy information) and FINREP (financial information) at the relevant point in time. Consequently, changes in the amounts shown from one quarter to another can be influenced by the following factors:

- changes in the sample of reporting institutions;

- mergers and acquisitions;

- reclassifications (e.g. portfolio shifts as a result of certain assets being reclassified from one accounting portfolio to another).

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- The complete set of Supervisory banking statistics with additional quantitative risk indicators is available on the ECB’s banking supervision website.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts