- THE SUPERVISION BLOG

Reviewing the Pillar 2 requirement methodology

11 March 2025

Maintaining adequate levels of capital allows banks to provide stable financial services to the real economy and absorb losses in difficult times. This is why European law sets minimum capital requirements that all banks must meet. But banks also face risks that are not covered by these Pillar 1 requirements. This blog post explains how the ECB addresses these risks through its Pillar 2 requirements, and how we are changing our approach to ensure that banks remain safe and sound in an evolving risk landscape.

Capital requirements 101

Banks finance their operations through different funding sources: deposits are the largest source, accounting for 64% of liabilities, followed by bonds (17%) and capital (7%).[1] Capital is crucial for enabling banks to provide services and fund the real economy in a sustainable way. Unlike debt financing, it is directly available to absorb potential losses, which protects depositors and taxpayers in the event of a bank failure. Capital is also an important source of funding for long-term investments as it has no fixed maturity. Banks need sufficient levels of capital to ensure the safety and soundness of their operations and of the financial system. One key objective of European banking supervision is therefore to ensure that banks maintain adequate levels of capital.

We need a strong regulatory framework to ensure that banks’ capital requirements are commensurate with their risks and that banks remain solvent. Both aims are at the core of the Basel framework, which consists of three main pillars:

- Pillar 1 – Minimum capital requirements

- Pillar 2 – Supervisory review

- Pillar 3 – Market discipline

Pillar 1 clearly establishes the minimum amount of capital that banks need to fund themselves: the riskier the assets a bank holds, the higher its capital should be. The level of risk is measured using risk-weighted assets (RWA); under Pillar 1, banks need to maintain a minimum capital requirement equivalent to 8% of their RWA. Risk weights are determined using either standardised approaches or internal model-based approaches. Pillar 1 requirements apply to credit, market and operational risks.[2] Supervisors assess whether the minimum levels of capital adequately cover the risks each bank is exposed to.

However, supervision is not a box-ticking exercise. Some risks, such as the potential impact of unexpected interest rate changes, shortcomings in risk controls or weak business models, are not covered at all or only partially covered by Pillar 1 requirements. That is why the Basel Committee on Banking Supervision established Pillar 2 as part of the Basel framework.[3] In the European Union, Pillar 2 capital requirements are the result of the Supervisory Review and Evaluation Process (SREP), which includes an assessment of the risks identified and an associated scoring system. Both Pillar 1 and Pillar 2 requirements are binding for banks. Non-compliance may lead to supervisory measures being implemented, which could be escalated further if necessary.

As one component of a broader review of the Supervisory Review and Evaluation Process to make European banking supervision more efficient and effective[4], the Supervisory Board has now decided to develop a revised methodology for setting Pillar 2 capital requirements.

Why does the Pillar 2 requirement methodology need to be reviewed?

The ECB’s current Pillar 2 requirement methodology has been instrumental in ensuring that supervised banks are adequately capitalised. Greater resilience has helped banks withstand the economic shocks of the last few years, including the COVID-19 pandemic, the banking turmoil in early 2023 and the macroeconomic uncertainty triggered by recent geopolitical tensions. But the impact of these shocks on the real economy has also been buffered by policy support to firms and households, which has indirectly protected banks’ balance sheets.

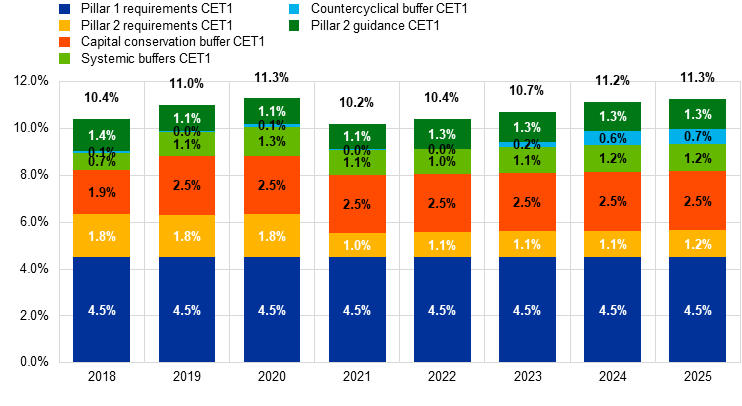

Chart 1

Change in overall capital requirements and Pillar 2 guidance in Common Equity Tier 1 (CET1)

(as a percentage of RWA)

Sources: ECB Supervisory Banking Statistics and SREP database.

Notes: The sample selection follows the MethodologicalSupervisory note for the publication of aggregated Banking Statistics for significant institutions for 2018 (sample of supervisory banking statistics for the first quarter of 2018 based on 109 entities), 2019 (sample of supervisory banking statistics for the first quarter of 2019 based on 114 entities), 2020 (sample of supervisory banking statistics for the first quarter of 2020 based on 112 entities), 2021 (sample of supervisory banking statistics for the first quarter of 2021 based on 114 entities), 2022 (sample of supervisory banking statistics for the first quarter of 2022 based on 112 entities), 2023 (sample of supervisory banking statistics for the first quarter of 2023 based on 111 entities) and 2024 (sample of supervisory banking statistics for the first quarter of 2024 based on 110 entities).

For 2025 the sample is based on 109 entities with Pillar 2 requirements applicable in January 2025. The chart shows RWA-weighted data for the second quarter of 2024. “Overall capital requirements” refers to Pillar 1 minimum requirement + Pillar 2 requirement + combined buffer requirements (i.e. the capital conservation buffer + systemic buffers (global systemically important institution (G-SII) buffer, other systemically important institution (O-SII) buffer, systemic risk buffer (SRB)) + countercyclical capital buffer (CCyB)). The reference period for the combined buffer requirement is the first quarter of each year. For the first quarter of 2025, buffers are estimated based on the announced rates applicable at that date. Estimated values are shown by a coloured pattern. Pillar 2 guidance is added on top of the overall capital requirements.

It is worth noting that the Pillar 2 requirements have remained broadly stable over time, except for the regulation-driven change in 2021. The composition of Pillar 2 requirements was amended by Directive (EU) 2019/878 (Capital Requirements Directive V (CRD V)), which came into effect on 1 January 2021. Under the CRD V, the Pillar 2 capital requirement should have the same composition as Pillar 1, i.e. at least 56.25% should be in CET1 and at least 75% should be in Tier 1 capital as a minimum requirement, leading to the aggregate reduction in CET1 capital from 1.8% to 1.0%. By way of derogation from the first sub-paragraph of the CRD V, the competent authority may require the institution to meet its additional own funds requirement with a higher portion of Tier 1 capital, or Common Equity Tier 1 capital, where necessary, taking into account the specific circumstances of the institution.

At the same time, the environment in which banks are operating has been changing. Banks are facing many evolving risks, including macroeconomic and geopolitical risks, climate and environmental risks, and more intense competition owing to increased digitalisation. The policy space available to buffer future shocks may, arguably, have become more limited. The better capitalised the banks are, the more resilient they are, and the better they can deal with evolving risks and uncertainties.

In response to changes in the external environment, European banking supervision is enhancing its efficiency and effectiveness and following up more quickly on unresolved findings. To this end, the Supervisory Board decided to review the SREP, taking into account recommendations made by an independent expert group.[5] When reviewing the Pillar 2 requirement methodology, we had two objectives:

- Robustness: Pillar 2 requirements are driven by the supervisory risk assessment in the SREP and focus on risks that are not covered or not sufficiently covered under Pillar 1. While comprehensive risk coverage is key to effective supervision, we are also making sure that risks are not counted twice.

- Simplification: We are making the methodology more intuitive by reducing procedural complexity.

Maintaining such a strong link between Pillar 2 capital requirements and the SREP is crucial. The SREP is the backbone of our supervision. It draws on a wealth of information, including key risk indicators from supervisory reporting, the internal capital adequacy assessment process (ICAAP) and other bank-specific information as well as findings from on-site inspections, horizontal reviews and peer analyses. The SREP is a well-established process which ensures that capital requirements are based on a comprehensive assessment of each bank’s risk profile. Consistent SREP methodologies level the playing field for all banks, while consistent SREP decisions ensure that we are transparent with banks when explaining the rationale behind our assessments. Transparency about our methodologies is also a key part of our accountability to the public.

How will the new methodology work?

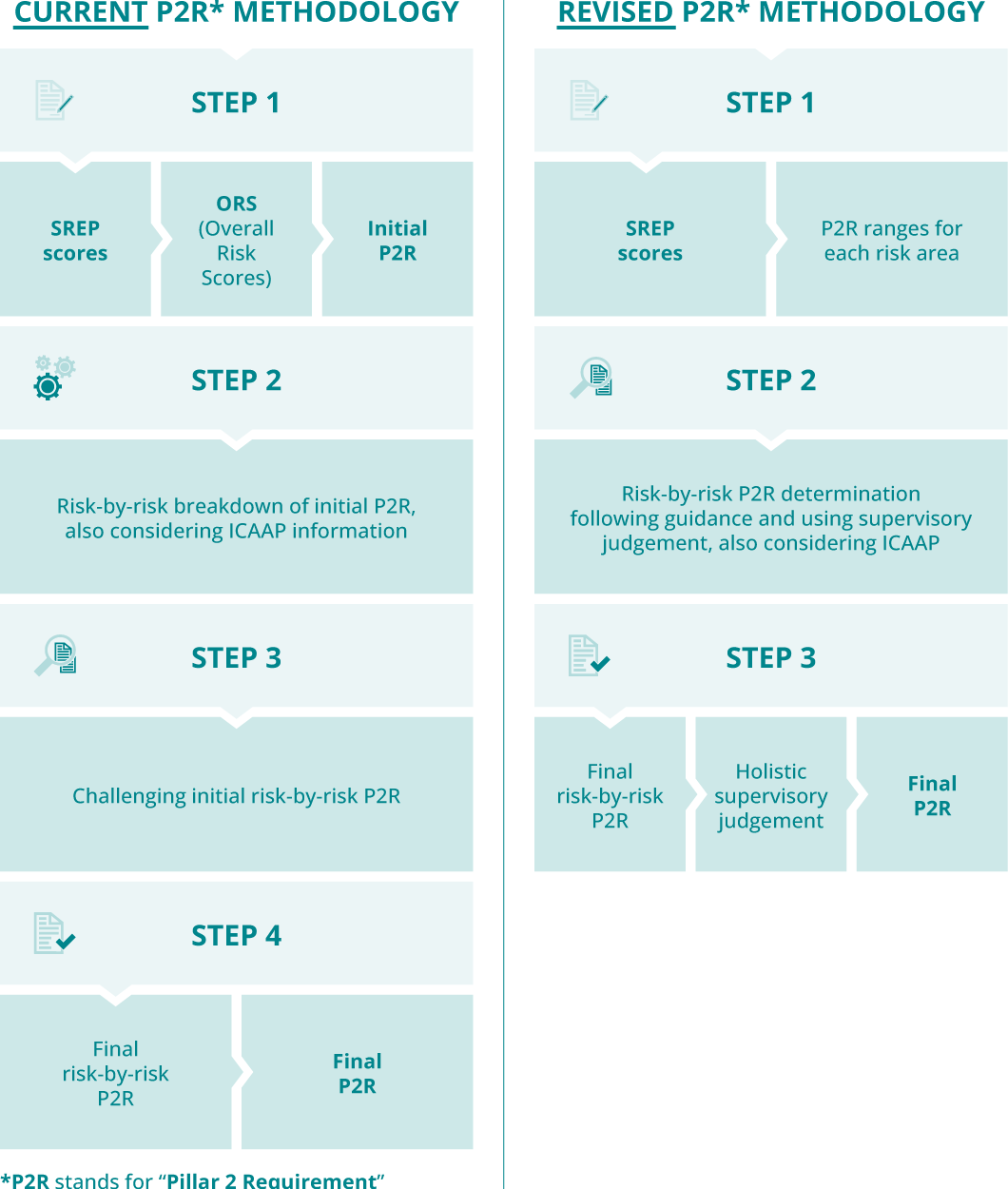

Under the current methodology, supervisors perform a four-step process to determine the Pillar 2 requirements. A bank’s overall risks – as reflected in its Overall Risk Score – provide the starting point for determining its Pillar 2 capital requirement (Step 1), which is then broken down into the different risk areas using information from the bank’s ICAAP (Step 2). These initial Pillar 2 requirement values are assessed and approved by supervisors (Step 3) based on a number of sources, including peer benchmarking and supervisory judgement. The results of this assessment process are then aggregated again (Step 4) to determine the final Pillar 2 requirement.

Figure 1

Current and revised methodologies for setting Pillar 2 requirements

Source: ECB.

In the revised methodology, Pillar 2 requirements will be driven more directly by relevant areas of risk, and higher risks will continue to result in worse SREP scores and a higher Pillar 2 requirement. While information from banks’ ICAAP outcomes will no longer directly affect the Pillar 2 requirement, the supervisory assessment of the quality of banks’ ICAAPs will continue to feed into the SREP assessments of business models, internal governance and overall risk management.

Overall, the new approach will have fewer procedural steps and will simplify the link between capital requirements and the underlying SREP risk assessment. This, in turn, will inform the discussions between supervisors and bank management teams, and make it easier for banks to understand and act on Pillar 2 outcomes.

Furthermore, the new methodology will more effectively address potentially long-standing weaknesses, such as those related to internal controls or governance issues. Pillar 2 capital requirements can be influenced more directly if such weaknesses are not resolved promptly and if other supervisory measures prove to be insufficient.

Supervisory judgement is particularly important in an environment of rapidly evolving risks, where past trends may not allow for sufficiently forward-looking risk assessments. The new Pillar 2 requirement methodology will allow supervisors to exercise judgement as they score individual risk elements, apply the risk-by-risk approach to determine capital requirements for each relevant risk area individually and assess a bank’s overall risk profile, which might be more complex than the sum of its individual parts.

How supervisors exercise judgement will be carefully monitored, as benchmarking will remain a cornerstone of our supervision. The ability to compare a bank’s performance against that of its peers has been a significant improvement in European banking supervision compared with national supervision. Qualitative and quantitative benchmarking by our second line of defence function will ensure that supervisory judgement is applied fairly and consistently.

In line with its current practice, the ECB will continue to use SREP decisions to communicate Pillar 2 requirements, together with information on the main risk drivers, to banks. We will also continue to publish the consolidated Pillar 2 requirements for banks under European banking supervision annually on our website.

What impact will the review have?

The review of the Pillar 2 requirement methodology aims to simplify our processes, make it easier for banks to understand and act on Pillar 2 outcomes and make banking supervision more effective. It will not change the way we review and assess the risks facing individual banks. As the revised methodology remains closely linked to the SREP assessments, reflecting our supervisory view on each bank’s risk profile, we do not expect the introduction of the new methodology to lead to abrupt changes in capital requirements. Pillar 2 capital requirements for European banks will continue to reflect their individual risk profiles and the internal controls they have in place to address these risks.

The methodology will be thoroughly tested internally in 2025 and be applied starting from the 2026 SREP cycle. Pillar 2 requirements based on the new methodology will take effect as of 1 January 2027.

See Table T02.04.1 in ECB (2024), Supervisory Banking Statistics for significant institutions – Third quarter 2024, Frankfurt am Main, December. The asset to capital ratio reported above differs from the leverage ratio owing to differences in the denominator underlying the calculation. The remaining sources of funding include derivatives and other liabilities.

Pillar 1 capital requirements are established in Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (OJ L 176, 27.6.2013, p. 1).

In addition to Pillar 1 and Pillar 2 requirements, the Capital Requirements Directive (Directive 2013/36/EU) establishes an institution-specific countercyclical buffer, capital conservation buffer, systemic risk buffer and global systemically important institution (G-SII) and other systemically important institution (O-SII) buffers referred to as the “combined buffer requirement”. The same directive also establishes institution-specific Pillar 2 guidance to indicate the level of capital the supervisor expects institutions to maintain in addition to their binding capital requirements to ensure they can absorb potential losses resulting from adverse scenarios.

Buch, C. (2024), “Reforming the SREP: an important milestone towards more efficient and effective supervision in a new risk environment”, The Supervision Blog, 28 May.

ECB (2023), “ECB welcomes expert group recommendations on European banking supervision”, press release, 17 April.