15 February 2023

Crypto-assets are subject to significant risk and boom-and-bust cycles, as the current “crypto winter” shows. They are not widely used in mainstream banking operations, yet the expansion of the crypto industry can also lead to crypto-asset risks spilling over into the banking sector. Most banks under ECB supervision have so far largely stayed away from crypto-assets, while some have explored opportunities to use distributed ledger technology (DLT) to increase efficiency, reduce costs and offer new services to clients (see the Survey on digital transformation and the use of fintech for more details). DLT has been used successfully for tokenised security issuances, such as the European Investment Bank’s issuance of digital bonds, while other initiatives are also under development. However, if a bank were to acquire exposures to crypto-assets – either directly or indirectly – they would face significant risks not specifically covered by the current prudential framework. Therefore, a conservative global minimum prudential framework is vital to protect the banking system from these risks. The finalisation of the Basel Committee on Banking Supervision’s (BCBS) standard on the prudential treatment of banks’ crypto-asset exposures marks an important milestone in this respect. It provides a harmonised international regulatory and supervisory approach to banks’ crypto-assets exposures and aims to balance responsible private sector innovation with sound bank risk management and financial stability. From a European Union perspective, the BCBS standard complements the forthcoming regulation of the crypto-asset sector through the Markets in Crypto-Asset regulation. As a next step, it will be key for the European Union and other Basel jurisdictions to transpose the Basel standard into their legislation by the 1 January 2025 deadline.

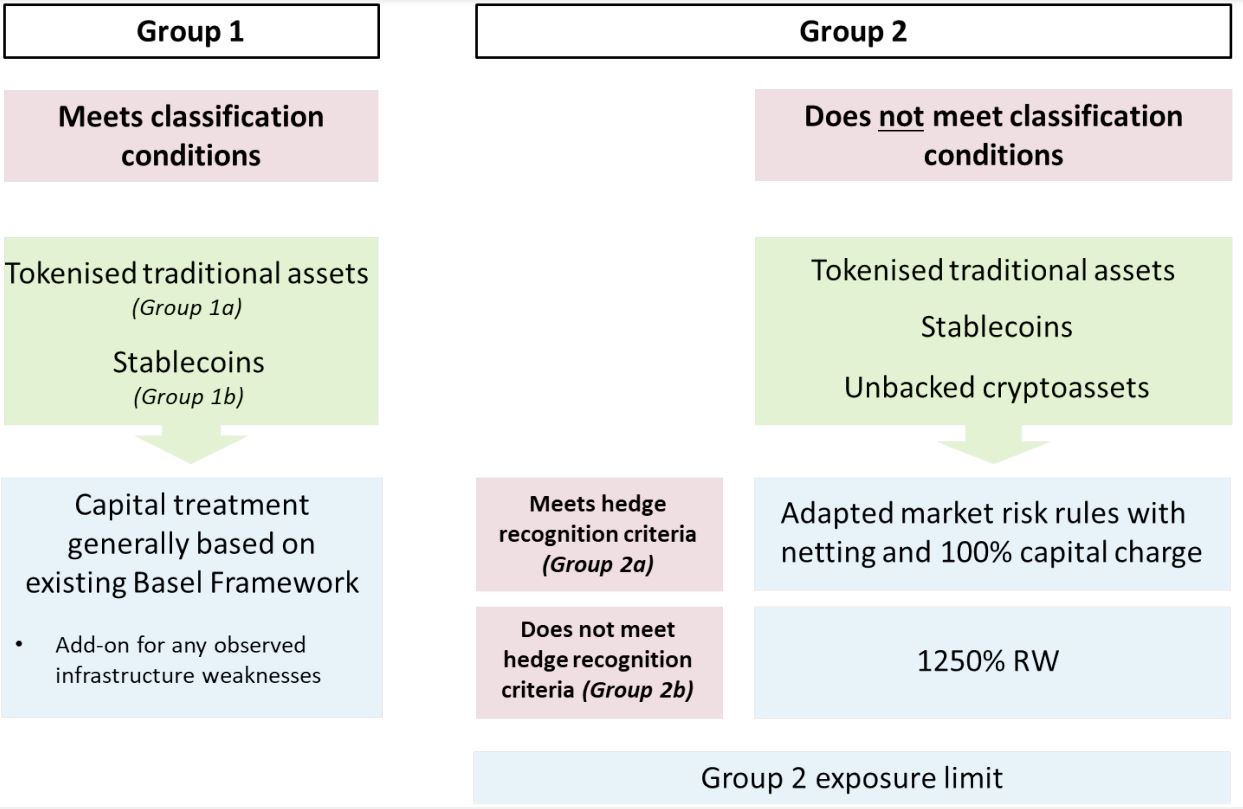

The crypto-asset concept includes a broad range of various products with different risk profiles. The BCBS standard divides crypto-assets into two groups (Figure 1).

Figure 1

Main elements for treating banks’ crypto-asset exposures

Source: Basel Committee for Banking Supervision: Prudential treatment of crypto-asset exposures, December 2022

Group 1 includes tokenised traditional assets and crypto-assets with effective stabilisation mechanisms (stablecoins). These crypto-assets must meet four classification conditions to ensure they pose a lower risk. These conditions include assigning the legally enforceable rights arising from the crypto-asset, ensuring that the asset’s underlying network sufficiently mitigates material risks, as well as considerations regarding money laundering and the soundness of the information and communications technology arrangements. Group 1 crypto-assets are subject to capital requirements based on the risk weights of the underlying exposures (i.e. the traditional assets) as set out in the existing Basel Framework. As an additional measure, supervisors can introduce an add-on to the capital requirement for Group 1 exposures if weaknesses in the underlying infrastructure, such as the distributed ledger technology, are observed.

Group 2 includes all crypto-assets that do not meet any of the four classification conditions, including tokenised traditional assets and stablecoins with ineffective stabilisation mechanisms and all so-termed unbacked crypto-assets such as bitcoin. As these crypto-assets pose additional and higher risks compared with Group 1 crypto-assets, they are subject to a newly prescribed conservative capital treatment with a risk weight of 1250%. However, for Group 2 crypto-assets that meet certain hedging recognition criteria, a limited degree of hedging (i.e. offsetting long and short positions) is permitted, with the capital charge applicable to the net position, and they are classified as Group 2a. These criteria include various thresholds, relating to the market capitalisation, trading volume and price observations that these crypto-assets and their related hedging instruments need to meet to be included in Group 2a.

In addition to the conservative capital treatment for Group 2 crypto-assets, the BCBS standard includes an exposure limit. This constrains the total amount of Group 2 crypto-assets a bank can hold to generally below 1% of Tier 1 capital. Once banks breach the 1% limit the more conservative Group 2b capital treatment will apply to the amount above 1%. If the 2% limit is breached, the entire Group exposures are subject to the Group 2b capital treatment to ensure banks have strong incentives to not significantly exceed the 1% threshold. This back-stop measure is a key policy tool to prevent the transmission of shocks from the crypto-asset market to the banking sector and hence mitigate future financial stability risks.

Other elements of the BCBS standard include clarity on applying the operational risk, liquidity, leverage and large exposures requirements to banks’ crypto-asset exposures, as well as rules on Pillar 3 disclosures. Moreover, the standard stresses that banks wishing to engage in crypto-related business need suitable governance and risk management arrangements. In particular, the decision to engage in such a business must be fully consistent with the bank’s risk appetite and its strategic objectives as set down and approved by the bank’s board. In addition, banks are expected to consider the crypto-related business in their stress test analysis.

Finally, one element of the BCBS standard is intended for supervisory authorities and includes rules on how to update supervisory practices to cater for the challenges posed by crypto-related operations. Supervisory authorities may use a range of powers to tackle shortcomings in bank’s risk management, from additional capital charges (Pillar 2) to imposing limits on risk taking and business operations.

Given the rapid pace of market developments, it is important to remain vigilant to the build-up and emergence of new risks. Over time, the Basel Committee will likely issue additional refinements or clarifications to the framework to ensure a consistent understanding and implementation of the standard, or to address emerging risks. In any case, banks should follow a cautious and gradual approach when opening up to these markets. The BCBS standard is not yet legally binding pending its transposition in the European Union. However, should banks wish to engage in this market, they are expected to comply with the standard and take it into account in their business and capital planning.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts