- SUPERVISION NEWSLETTER

The clock is ticking for banks to manage climate and environmental risks

18 August 2021

Climate change, environmental degradation and their related effects are some of the greatest challenges facing Europe and the world today. In its Guide on climate-related and environmental risks published in November 2020, ECB Banking Supervision shared 13 supervisory expectations for banks with a view to directly addressing these risks, which are taking an increasingly large toll on the economy. Banks are also exposed, as climate change and environmental degradation affect their balance sheets through physical and transition risks. “Climate-related and environmental risks cannot just be an afterthought – they pose a very real challenge today and could have serious implications tomorrow,” said Frank Elderson, Vice-Chair of the ECB’s Supervisory Board, when stressing the urgent need for action.

Once the guide was published, ECB Banking Supervision asked banks to assess themselves against the 13 expectations – which cover current practices for managing and disclosing climate-related and environmental (C&E) risks – and to submit action plans detailing how they would bring their practices into line with the guide. This article shares some of the preliminary findings on current practices and plans, based on supervisors’ assessments of these submissions. In sum, the preliminary results show that banks have made some progress in adapting their practices, but it is still too slow. If it continues at this pace, many banks will not meet the supervisory expectations any time soon. ECB Banking Supervision therefore urges banks to take swifter action.

Banks’ current practices fall short of supervisory expectations

Banks have been candid about their need to improve. As at February 2021, they deemed the vast majority of their practices to be only partially or not at all aligned with the supervisory expectations. The preliminary results of the assessment show that banks have started laying the groundwork for reflecting C&E risks in their current structures: roughly half of banks are adapting their governance arrangements, including by allocating dedicated resources and assigning responsibilities. However, very few banks have incorporated sound C&E risk management processes or clearly integrated C&E risks into their strategies or risk mitigation processes. By contrast, those banks that already systematically assess C&E risks report that these risks have, or will have, a material impact on their risk profile.

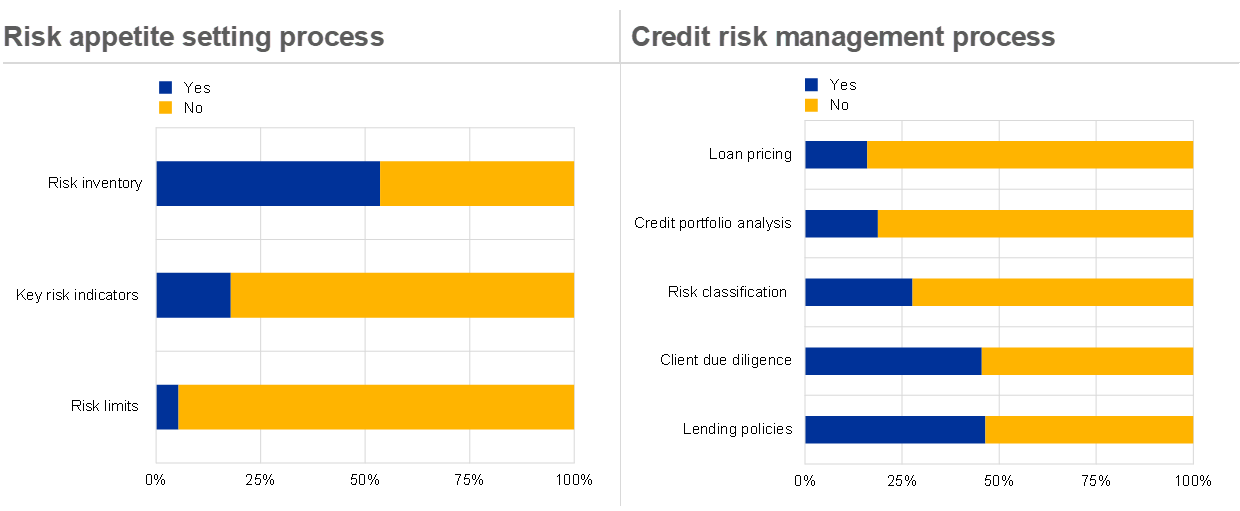

While banks have started to include C&E risks in the risk inventory, only a handful have set key risk indicators or have concrete risk limits (Chart 1, left-hand panel). This means that banks cannot properly control or manage those risks. Sound governance and management oversight will also be hampered unless banks implement, monitor and report on key risk indicators and risk limits. For instance, senior management will not be in a position to adequately steer a bank’s strategy and risk profile if the internal reports do not reflect C&E risk drivers.

Looking at credit risk management, banks have not yet considered C&E risks in all stages of credit-granting and monitoring processes (Chart 1, right-hand panel). While almost half of the banks have integrated C&E risks into their lending policies and client due diligence, most are still lacking a sound risk classification structure or loan pricing framework for C&E risks. In other words, these banks are generally not yet in a position to identify, manage and monitor C&E risks at counterparty level.

Chart 1

Integration of C&E risks in risk appetite setting and credit management processes

Source: Preliminary results of the supervisory assessment following the ECB Guide on climate-related and environmental risks.

Note: The blue bar refers to the percentage of banks that had integrated C&E risks in the respective process as at February 2021.

Banks have started to address gaps through plans setting out their future work

Almost all banks have developed implementation plans in line with the ECB guide, and many have started to gradually improve their practices. It is important that implementation plans clearly outline a road map with verifiable milestones and establish a robust process for implementing and monitoring them. In many cases, banks have made considerable efforts to develop plans that aim to materially improve their practices, in some cases also taking intermediate steps to fill data and/or methodological gaps. This in itself is good news.

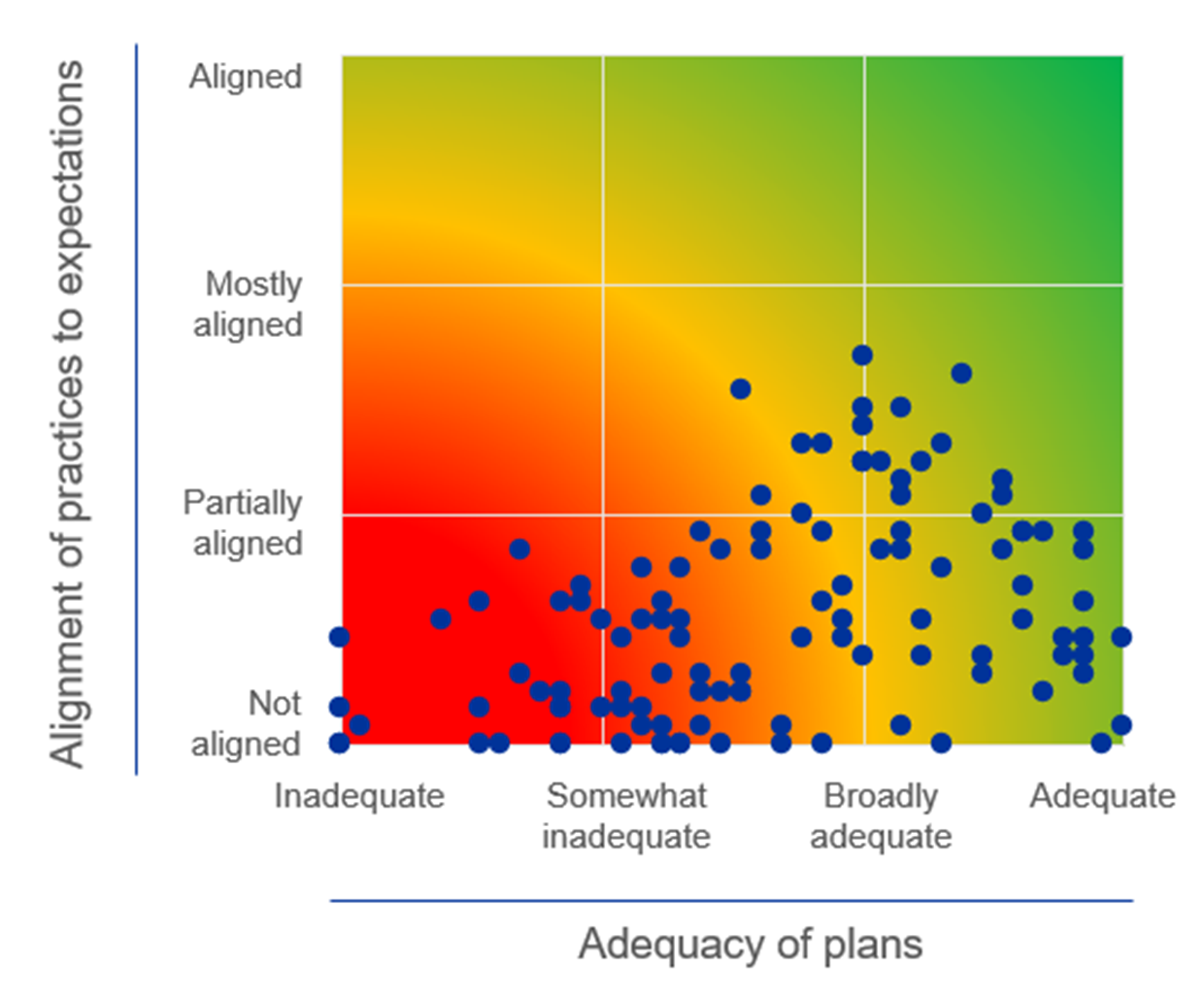

Based on the ECB’s assessment of current practices, Chart 2 shows that implementing the plans will lead to considerable progress, but they do not yet comprehensively ensure that most banks can properly manage C&E risks. Only one-third of banks have plans in place that are at least broadly adequate, and thus fairly effectively address any gaps in their strategy, risk management and disclosure arrangements (Chart 2, right-hand column). Roughly two-thirds of banks have failed to sufficiently tailor their plans to the supervisory expectations, with many plans lacking operational details on how their deliverables will actually be produced (Chart 2, left-hand and middle columns). Even more worryingly, one-fifth of those banks have (somewhat) inadequate plans that suggest that their C&E risk practices will improve only slightly, if at all (Chart 2, bottom-left square). In other words, these banks have significant gaps in their current practices but do not have credible plans to ensure sound management of C&E risks in the future.

Chart 2

How banks’ practices align with the expectations mapped against the adequacy of their plans to advance those practices

Source: Preliminary results of the supervisory assessment following the ECB Guide on climate-related and environmental risks.

Notes: Aggregated scores are based on equally weighting the individual scores for the 13 expectations set out in the ECB guide. The alignment of practices to expectations summarises banks’ C&E risk management practices across 53 areas, including business model, governance, risk management and disclosures. The adequacy of plans summarises the extent to which banks comprehensively consider the supervisory expectations in their implementation plans.

The adequacy of the banks’ plans varies considerably across the 13 supervisory expectations set out in the ECB guide. Over 60% of banks considered the expectations on the management body, organisational structure and stress testing to a reasonable degree. Allocating responsibility for C&E risks to the management body is widely addressed in the plans. Similarly, most plans also cover the organisational integration of these risks across the three lines of defence. Banks also anticipate making progress with stress testing their capital adequacy, which is likely in preparation for the ECB’s upcoming climate risk stress test in 2022.

Operational risk management, liquidity risk management, reporting and disclosures require the most work. Less than around two-fifths of banks have developed plans that are (broadly) adequate in those areas. Often the plans do not foresee any assessment of how many of their activities are exposed to liability and/or litigation risks driven by C&E factors. Similarly, plans do not often indicate whether disclosure policies include the key considerations that underpin the materiality assessment of C&E risks, or whether banks’ financed greenhouse gas emissions will be disclosed. These poor results are consistent with the outcomes contained in the ECB report on institutions’ climate-related and environmental disclosures published in November 2020.

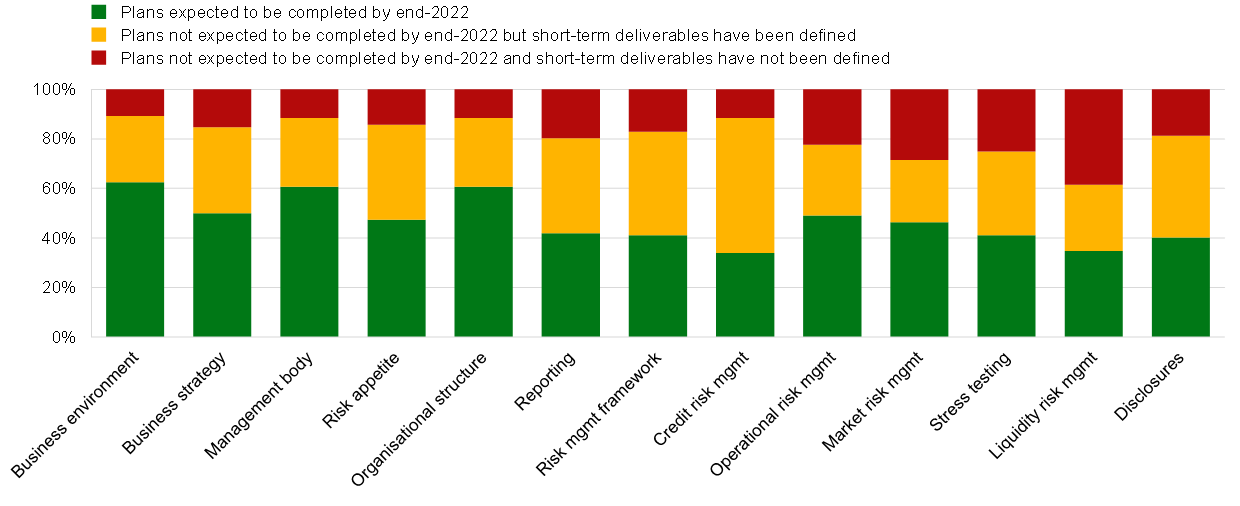

Banks need to speed up their efforts

Banks were also asked to share timelines for the expected completion of their plans, covering all 13 supervisory expectations. For practices related to the business environment, management body and organisational structure, roughly 60% of banks envisage meeting the supervisory expectations by the end of 2022 (Chart 3). However, less than 35% of banks expect their credit and liquidity risk management practices to be aligned in a timely manner. It is clear that many bank practices will not meet the supervisory expectations in the near future. This is rather alarming as banks are crucial to financial stability, so their strategies, risk management and disclosure arrangements need to be sound. The ECB expects banks to adequately manage C&E risks in a timely fashion.

Chart 3

Banks’ projections on the timing of their alignment with the expectations and short-term deliverables

Source: Preliminary results of the supervisory assessment following the ECB Guide on climate-related and environmental risks.

Note: “Short-term deliverables” refers to deliverables that banks plan to produce by the end of 2021.

Owing to the evolving nature of C&E risk management, the ECB is aware that data and methodological gaps may make it difficult to fully implement the supervisory expectations in some cases. Here, the ECB encourages banks to adopt a strategic approach and to take intermediate steps as appropriate. Some banks have already made progress in this regard, as seen in the good practices below. However, a considerable number of banks are taking longer and do not plan to produce any short-term deliverables before the end of 2021. This is true for more than 20% of banks in the areas of reporting, stress testing, market risk, operational risk and liquidity risk management (Chart 3). When accurate or complete data are unavailable, the ECB expects banks to assess their data needs for sound risk management, and to determine how current and future gaps will be filled. In reality, however, only a few banks have made any effort to take stock of their data needs to start accounting for C&E risks.

The ECB did identify a number of good practices showing that banks are taking a strategic approach to the design and implementation of their plans. These good practices relate to the operationalisation of the plans (i.e. the way in which plans are implemented) and the substance of the plans (the degree to which the plans are addressing existing gaps in practices).

Examples of good practices

These good practices show the value of taking a strategic approach to C&E risks and that it is already possible to advance risk management. Therefore, the ECB emphasises the need for banks to take intermediate steps when data or methodological gaps exist. They should use qualitative metrics, develop proxies with the data sources that are available and adjust their strategies accordingly to enhance their resilience against C&E risks. However, some of the supervisory expectations do not have considerable data needs, so banks should meet these expectations more quickly.

Banks and supervisors have busy months ahead

The Joint Supervisory Teams have started to discuss banks’ practices and implementation plans, focusing on the areas where banks deviate from the ECB guide and providing findings from peer benchmarking. All banks will receive a detailed feedback letter and will be asked to take decisive action to address identified shortcomings. In some cases, where banks are extreme outliers, the ECB will impose a qualitative supervisory measure as part of the 2021 Supervisory Review and Evaluation Process.

Later this year, the ECB intends to publish a report that sets out more good examples of how banks have effectively developed their practices and plans. In addition to the climate risk stress test, ECB Banking Supervision will conduct a full supervisory review in 2022, including an in-depth analysis of the extent to which banks have incorporated C&E risks into their strategy and risk frameworks.

The ECB will also give greater prominence to environmental risks beyond climate-related risks, such as risks of biodiversity loss and pollution. First indications show that these risks are of a similar magnitude to climate-related risks. In a recent report, 50 of the world’s leading biodiversity and climate experts highlight that climate change and biodiversity loss cannot be managed in isolation. At European level, the European Commission has set ambitious targets to reduce pollution and biodiversity loss. Banks’ risk management is therefore expected to take a holistic approach to identify, monitor and manage all material climate-related and wider environmental risk drivers.

ECB Banking Supervision calls on all banks to swiftly implement the supervisory feedback and to meet the supervisory expectations in a timely fashion. Banks and supervisors alike must take decisive action to ensure the financial system is resilient to possible distress caused by climate change and environmental degradation, which are undoubtedly two major risk drivers for the European banking sector.

Eiropas Centrālā banka

Komunikācijas ģenerāldirektorāts

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Pārpublicējot obligāta avota norāde.

Kontaktinformācija plašsaziņas līdzekļu pārstāvjiem