Feedback on the input provided by the European Parliament as part of its Resolution on Banking Union 2023

ECB Banking Supervision welcomes the European Parliament’s “Resolution on Banking Union – Annual Report 2023” of 16 January 2024. [1] To continue the dialogue between the European Parliament and the ECB and underline our strong commitment to accountability, ECB Banking Supervision hereby replies to the comments and suggestions provided by the European Parliament in the Resolution.

The feedback focuses on nine key issues raised in the Resolution:

Topic raised by the European Parliament | ECB Banking Supervision feedback | |||

|---|---|---|---|---|

Risks | 1 | Banking sector resilience | The 2023 stress test and recent data indicate a high level of resilience in the European banking sector amid economic challenges. Yet in the longer term banks will not be immune to risks and unexpected events. | |

2 | Interest rate and asset quality risks | Risks arising from the monetary and financial market environment remain a key concern. Concrete actions are already being taken to identify, prevent and mitigate such risks should a shock occur. | ||

3 | Banks’ exposures to environmental, social and governance (ESG) risks | Recent regulatory developments will help improve ESG risk management at individual institutions and promote financial stability. ECB Banking Supervision is working closely with the European Banking Authority (EBA) to assess whether and how regulatory capital requirements should reflect sustainability risk considerations. It will also continue to monitor and work on climate-related regulatory initiatives at EU level. | ||

4 | Non-performing loans (NPLs) and the NPL secondary market | Reducing NPLs remains a priority. Although they have diminished significantly over the last ten years, further improvements are needed. This will require a robust legal framework and additional measures. | ||

5 | Impact of Russia’s war in Ukraine | Since the start of Russia’s war in Ukraine ECB Banking Supervision has engaged in intense monitoring and dialogue with all the supervised institutions that had/have subsidiaries in Russia. Activities in Russia have been substantially reduced. | ||

Banking union and capital markets union | 6 | The crisis management and deposit insurance (CMDI) framework and European deposit insurance scheme (EDIS) | The rise in macro-financial and geopolitical risks makes crisis preparedness essential: the CMDI review should be urgently adopted, which in turn should pave the way for the completion of the banking union and establishment of EDIS. | |

7 | Integration of the EU banking sector | There is a need for a more integrated banking union and further cross-border consolidation of banking groups. Achieving progress on the capital markets union is also key to mobilising the private investment needed to advance the climate and digital transitions, increase private risk sharing and the EU’s resilience to shocks, and improve the EU’s competitiveness in a fast-changing and more challenging geopolitical landscape. | ||

Governance | 8 | Anti-money laundering (AML) | ECB Banking Supervision values its work with the AML/countering the financing of terrorism (CFT) authorities and has significantly stepped up such cooperation. It also looks forward to working closely with the new AML authority. | |

9 | Diversity in financial institution boards | ECB Banking Supervision is addressing the lack of diversity in the boards of supervised banks through the Supervisory Review and Evaluation Process (SREP), as well as through fit and proper assessments. Further progress is needed. | ||

1 Banking sector resilience

The Resolution conveys a positive assessment of the health of the EU banking sector, which has become more resilient in the last 15 years as a result of the creation of the Single Supervisory Mechanism (SSM). Moreover, the Resolution welcomes the results of the 2023 EU-wide stress test. The European Parliament also takes note that the EU/European Economic Area banking sector shows rising profitability: since asset quality risks are looming and profitability is expected to decrease soon, the Resolution encourages the use of current profits to build buffers, thus safeguarding the stability of the financial system in the future. The Resolution also underlines the positive effects of the temporary recommendation to suspend dividend distributions and share buy-backs during the COVID-19 pandemic. However, it regrets the slight fall in the liquidity coverage ratio to 158% in the second quarter of 2023, from 164% in the second quarter of 2022.

The results of the 2023 stress test confirm that the banking sector could withstand a very severe economic downturn. The adverse scenario for this exercise was much harsher than in previous stress tests, and included sharp interest rate hikes, high inflation and a significant decline in asset prices. In addition, the exercise showed that unrealised losses stemming from rising interest rates in banks’ securities portfolios are contained, and would remain manageable even under an adverse scenario.

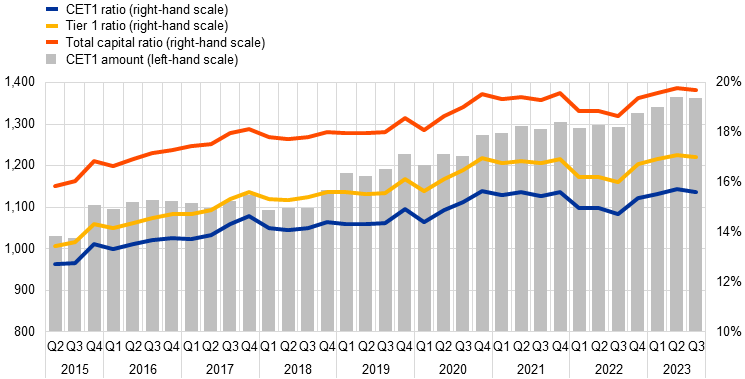

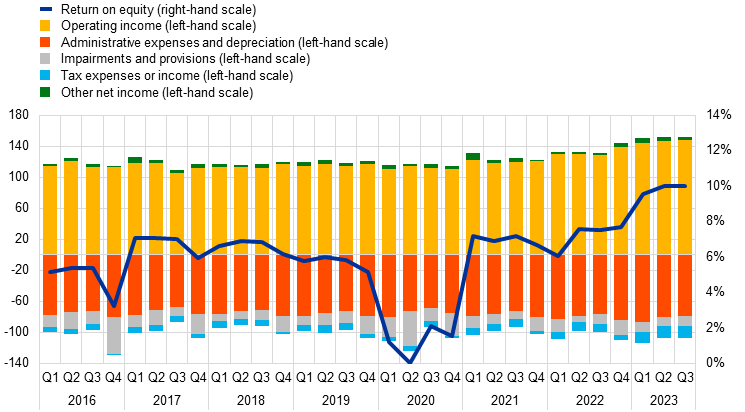

Recent data confirm the good health of the European banking sector. Looking at figures for the third quarter of 2023, banks remained well capitalised with an aggregate Common Equity Tier 1 (CET1) ratio of 15.6% (Chart 1). They also had substantial liquidity buffers, with a liquidity coverage ratio of 159% in the same period, down on the ratios recorded in 2022 but well above regulatory requirements and pre-pandemic levels. This drop versus 2022 partly reflects the effect of the repayment of targeted longer-term refinancing operations in June 2023. In addition, profitability has recently strengthened further on the back of rising net interest margins, which have compensated for slowing bank lending volumes (see Chart 2). Current levels of banking sector profitability may provide an opportunity for some countries to implement additional targeted increases in macroprudential buffers, which would increase macroprudential space and help to preserve banking sector resilience. The current improved profitability may also be an opportunity for banks to invest in order to address structural challenges such as the green transition and digitalisation.

Chart 1

Capital ratios and their components, significant institutions

(EUR billions; right-hand scale: percentages)

Source: ECB supervisory banking statistics.

Chart 2

Return on equity and composition of net profits and losses, significant institutions

(EUR billions; right-hand scale: percentages)

Source: ECB supervisory banking statistics.

Nevertheless, banks will not be immune to risks and unexpected events in the longer term. The current high level of profitability provides an opportunity to build buffers to cushion future shocks. Supervision must be adapted to the new environment. Heightened macroeconomic and geopolitical risks coupled with changes in the competitive environment leave banks exposed to new risks. This will require close attention, and it is one of ECB Banking Supervision’s supervisory priorities. Finally, it remains uncertain how higher interest rates will affect credit losses and depositor behaviour.

The temporary recommendation to suspend dividend distribution during the pandemic was an exceptional measure for special circumstances, as ECB Banking Supervision has previously explained. Supervisors have returned to the usual practice of discussing capital trajectories and dividend or share buy-back plans on a bank-by-bank basis.[2]

2 Interest rate risk and risk of asset quality deterioration

The Resolution highlights banks’ exposures to interest rate risks stemming from further changes in interest rate levels, also noting that such exposures depend on banks’ asset structure and business model. It therefore calls on supervisors to continue assessing these risks. The Resolution further highlights the risk of asset quality deterioration due to the current macroeconomic situation, and the need for banks to prepare. It then flags the importance of prudent risk management and appropriate provisioning and invites the European Commission as well as national and EU supervisory authorities to prepare for a potential deterioration in asset quality.

Risks arising from the monetary and financial market environment remain a key concern for ECB Banking Supervision. Strengthening the resilience to immediate macro-financial and geopolitical shocks has therefore been identified as one of the supervisory priorities for 2024-2026. Moreover, ECB Banking Supervision has enhanced its scrutiny and monitoring of interest rate risk in the banking book (IRRBB) and of credit spread risk in the banking book (CSRBB). In this context, supervisors continue to regularly test the sensitivity of banks’ income and of the economic value of their equity to interest rate and credit spread shocks. The recent market turmoil relating to regional banks in the United States served as an additional warning that the full pass-through of higher interest rates has not yet taken place, while there is high uncertainty as regards the magnitude of future shocks and the extent to which credit quality could deteriorate. While the banks supervised by the ECB do not exhibit comparable vulnerabilities in terms of interest rate risk (such as large amounts of unrealised losses on investment securities or reliance on a concentrated, uninsured deposit base), those with more concentrated and volatile liability structures, or weaker business profiles in general, may remain at risk.

Concrete actions are already being taken to identify, prevent and mitigate such risks should a shock occur. To monitor interest rate risks, off-site supervisors and on-site inspectors are assessing individual banks' risk management and requesting remedial action where needed. Moreover, the 2023 stress test assessed banks’ vulnerabilities under very harsh macroeconomic scenarios, including increases in interest rates. The results show that the euro area banking system could withstand a severe economic downturn. For instance, the three years of severe economic stress would cut the CET1 ratio of supervised banks by 4.8 percentage points to 10.4%, still well above regulatory requirements.[3] Furthermore, a data collection exercise published in parallel to the stress test results showed the amount of euro area banks’ net unrealised losses to be contained and manageable even under an adverse scenario.[4]

3 Banks’ exposures to ESG risks

The Resolution emphasises the key role of the banking sector in facilitating the transition to a carbon-neutral economy and acknowledges the ongoing reduction of EU banks' exposure to energy-intensive corporates. At the same time, it underlines the increasing risks for banks from asset stranding as a consequence of the green transition, and the impact of possible abrupt repricing of fossil fuel asset values in financial markets on financial stability. The Resolution also takes note of the inclusion of climate and nature-related risks in the ECB’s supervisory priorities for the coming years and in its supervisory practices.

ECB Banking Supervision has identified climate-related and environmental (C&E) risks as a threat to banks and financial stability overall and has therefore integrated them into its supervisory priorities since 2019. In November 2020 ECB Banking Supervision published its Guide on climate-related and environmental risks, which explained the supervisory expectations relating to C&E risk management and disclosure. It then conducted a climate stress testing exercise and a thematic review in 2022. On the basis of these exercises, it has set intermediate and bank-specific deadlines for banks to align their frameworks with the supervisory expectations by the end of 2024. Supervisors had already required banks to reach specific milestones in March 2023. Banks were asked, for example, to make an explicit assessment of the impact of C&E risks in the short, medium and long term across their portfolios. This has led to increased supervisory activities on C&E transition and physical risks. Supervisors have, for example, listed good practices and issued binding supervisory decisions, which envisage periodic penalty payments for the most serious cases where banks fail to comply with the requirements. ECB Banking Supervision is also actively contributing to the ongoing assessment exercise for the one-off “Fit-for-55” climate risk scenario analysis, which is aimed at gauging the financial sector's resilience in light of the EU's goal of reducing net greenhouse gas emissions by 55% by 2030. ECB Banking Supervision will contribute in particular by extensive data that it is collecting on banks’ starting points in terms of resilience. The data collected will feed into the ECB’s top-down climate risk stress test models and will serve the supervisory objective of taking stock of progress made by banks in handling climate-relevant data and adopting ECB Banking Supervision’s good practices for climate stress testing. Better management of C&E risks by banks can have a positive impact on the financing of the transition to a carbon-neutral economy.

As for the prudential framework, ECB Banking Supervision welcomes the latest amendments to the Capital Requirements Regulation and the Capital Requirements Directive – CRR III and CRD VI – which have enhanced the regulatory and supervisory framework for ESG risks and will help to better address the threats that these risks pose to individual institutions and financial stability. Supervisors will be required to assess banks’ exposures to ESG risks, as well as the arrangements, strategies, processes and mechanisms they use to manage them, as part of the SREP. Banks will be required to develop prudential transition plans, and explicit supervisory powers have been introduced allowing the authorities to act on the targets and measures included in such plans. Further amendments include a requirement for banks to update the valuation of collateral more frequently if there is high likelihood of it becoming affected by ESG factors, as well as a preferential treatment for market risk exposures to carbon trading. As regards Pillar 3 disclosures, banks will be required to report information on their exposures to ESG risks to ensure that supervisors have at their disposal granular, comprehensive and comparable data.

Furthermore, ECB Banking Supervision is working closely with the EBA to assess whether and how regulatory capital requirements should reflect sustainability risk considerations. ECB Banking Supervision actively supports the EBA’s work related to its new mandate on ESG risks. ECB Banking Supervision actively contributed to the update of the Basel Committee on Banking Supervision’s Core principles for effective banking supervision to reflect considerations on climate risk. In parallel, It participates in the Basel’s Committee Task Force on Climate-related Financial Risks.

4 NPLs and the NPL secondary market

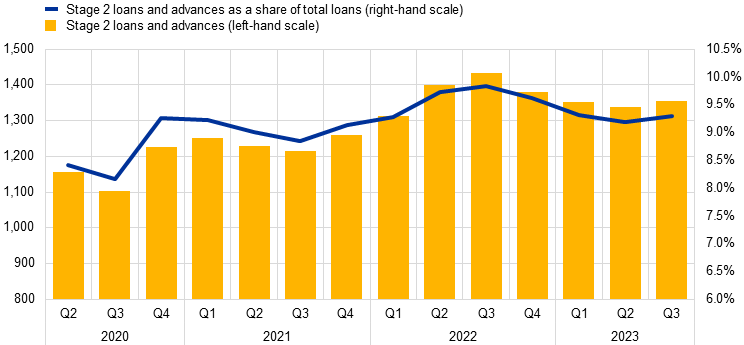

The Resolution calls for a further reduction of NPLs and asks supervisors to monitor the development of stage 2 loans.

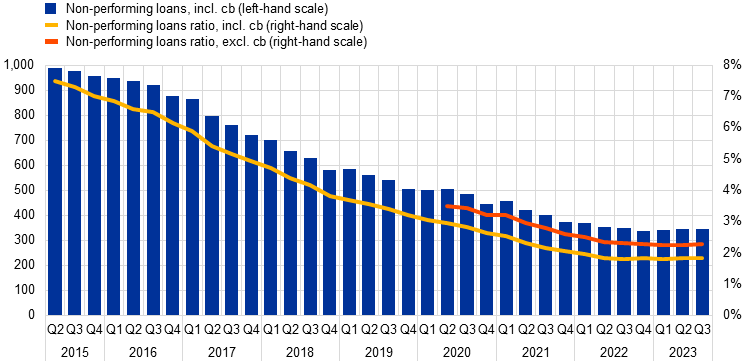

ECB Banking Supervision confirms that NPL reduction is one of its key priorities. In part thanks to supervisory actions, the volume of NPLs at significant institutions, i.e. banks supervised directly by the ECB, has decreased from €1 trillion to slightly below €345 billion since the establishment of ECB Banking Supervision (see Chart 3). However, owing to the current economic situation and the decrease in legacy assets from the last financial crisis – the disposal of which has driven the decline in NPL ratios over recent years – NPLs fell less quickly in 2022 (see Chart 4). Furthermore, data from the first nine months of 2023 show a gradual, albeit modest, increase in the volume of NPLs (+1.8%), driven primarily by commercial real estate and consumer credit loans.[5] Further early signs of deterioration in credit quality can also be observed in the increase in early arrears in loans both to households and to non-financial corporations. That is why supervisors have focused their recent work on vulnerable sectors such as commercial real estate or small and medium-sized enterprises at risk of default. The identification, recognition and management of credit risk remain top priorities for ECB Banking Supervision, and planned action as presented in the SSM supervisory priorities for 2024-2026 includes targeted reviews focusing on the resilience of portfolios more sensitive to the current macro-financial situation and exposed to refinancing risk, as well as several on-site inspections, internal model investigations and deep dive assessments.

Chart 3

NPLs, significant institutions

(EUR billions; right-hand scale: percentages)

Source: ECB supervisory banking statistics.

Note: “cb” refers to cash balances at central banks and other demand deposits.

Chart 4

Loans and advances subject to impairment review, significant institutions

(EUR billions; right-hand scale: percentages)

Source: ECB supervisory banking statistics.

Note: Stage 2 loans and advances are assets that have shown a significant increase in credit risk since initial recognition.

The Resolution refers to the development of the secondary market in NPLs, and in particular to the lack of progress on the Directive on accelerated extrajudicial collateral enforcement (AECE).[6]

The successful resolution of NPLs requires a well-functioning legal framework providing legal certainty to all parties as well as incentives for the repayment of loans, so that banks can continue to lend, benefiting borrowers and lenders alike. Significant progress has been made since 2014 in removing impediments to the timely resolution of NPLs, creating broader and deeper secondary markets for NPLs and developing a credit servicing industry. The Council of the European Union’s 2017 action plan on NPLs included several legislative initiatives to support banks’ progress towards reducing their NPLs and mitigate the build-up of large NPL stocks.[7] Among them, the Restructuring and Insolvency Directive[8], adopted in 2019, requires Member States to maintain or introduce effective preventive restructuring frameworks. Against this background, further progress on the AECE Directive is welcomed.

ECB Banking Supervision also notes that additional measures have been taken to support the reduction of NPLs. These include the update to the Credit Servicing Directive[9] – which is about to enter into force – and the European Commission’s December 2022 proposal for a directive to harmonise certain aspects of insolvency law[10]. Moreover, to develop secondary markets for NPLs it is important to continue to make progress on enhancing the quality and comparability of NPL data across countries.

5 Impact of Russia’s war in Ukraine on the banking sector

The Resolution highlights the reduced direct exposures to Russia and Ukraine in the banking sector, with banks actively decreasing such exposures. It invites supervisory institutions and ECB Banking Supervision to assist EU banks still operating in Russia to make an orderly exit from the Russian market.

Since the start of Russia’s war in Ukraine ECB Banking Supervision has engaged in intense monitoring and dialogue with all the supervised institutions that had/have subsidiaries in Russia. ECB Banking Supervision has observed that, while most of these institutions still maintain Russian banking subsidiaries, they have been downsizing their activities. At aggregate level, supervised institutions reduced their on-balance-sheet exposures by around 50% between the end of 2021 and the end of the third quarter of 2023. Most banks active in Russia also decided not to accept any new business there, where legally permissible, and are exploring different avenues for exit strategies, such as selling their activities or progressively winding down their business in Russia. ECB Banking Supervision has asked these banks to push ahead with their downscaling and exit strategies by creating clear roadmaps and by regularly reporting to their management bodies and to ECB Banking Supervision on the progress being made as well as explaining any delays and/or impediments to execution of their plans.[11]

6 The CMDI framework and EDIS

On the CMDI review proposal, the Resolution is broadly aligned with the ECB’s views – as laid out in the ECB’s opinion of 5 July 2023[12]. The Resolution calls for the scope of resolution to be expanded, for the public interest assessment to be clarified, for taxpayers to be insulated from the cost of bank failures and for the scope of State aid to be limited, as well as for the mitigation of any measures which could create excessive moral hazard. The Resolution also calls for a rapid and effective adoption of the text.

The Resolution additionally underlines that while the CMDI review is not a substitute for EDIS, a more standardised framework should assist in addressing obstacles to the establishment of EDIS. The Resolution refers to the calls made by the Chair of the Supervisory Board of the ECB and by the Chair of the Committee on Economic and Monetary Affairs (ECON) of the European Parliament with the coordinators of six political groups for the resumption of work to establish EDIS. ,[13]

ECB Banking Supervision stresses the need to adopt the CMDI review swiftly, in order to further enhance and harmonise our framework. The rise in macro-financial and geopolitical risks makes crisis preparedness even more essential, adding urgency to the adoption of this review. A more harmonised crisis management framework would enable authorities to manage bank crises more efficiently, especially through the expansion of the scope of resolution to include smaller and medium-sized banks. A element in the achievement of this goal will be to make better use of industry-funded safety nets in scenarios where financial stability is at risk and thereby avoid using taxpayer money.

ECB Banking Supervision also reiterates its support for the establishment of EDIS. The adoption of the CMDI review is also important to prepare the ground for the completion of banking union, including, most importantly, the establishment of EDIS. A fully risk-sharing EDIS will ensure high and uniform levels of depositor protection as well as increase the resilience and integration of the financial system. As long as deposit insurance remains at the national level, the sovereign-bank nexus will continue to be a source of fragmentation in the banking union, as confidence in the safety of bank deposits may differ across countries.

7 Integration of the EU banking sector

The Resolution calls on the European Commission to retain the completion of the banking union and the capital markets union as key priorities for the remainder of its current mandate and for the next. It states the importance of these projects to supporting growth and the digital and sustainable transitions, as well as to increasing financial stability.

The Resolution invites the Commission to assess impediments to cross-border mergers as well as potential incentives for ring-fencing. It also mentions that excessive concentration should be avoided because institutions that are “too big to fail” could entail risks to financial stability.

The Resolution claims that banks’ exposures to sovereign debt remain high in the banking union and should be reduced, in line with the objective to break the sovereign-bank nexus. The Resolution also recalls that the creation of an EU safe asset could help to mitigate these negative feedback loops.

ECB Banking Supervision agrees on the need for a more integrated banking union as well as for further cross-border consolidation of banking groups. A more integrated banking union, including EDIS, would help to make the European banking sector more resilient. The lack of progress in the cross-border integration of banking business reduces the potential for private risk sharing and diversification in the European banking market, with adverse consequences for financial stability. The potential concerns related to an increase in the size of European banks would be counterbalanced by the positive effects of risk diversification across Member States. ECB Banking Supervision fully acknowledges the potential risks arising from bank size and uses all available supervisory tools to address those issues, such as capital surcharges for systemically important financial institutions, in close cooperation with other authorities in charge of financial stability and resolution. [14]

Progress in the integration of the banking sector also supports the capital markets union agenda. A more resilient and integrated banking system supports the smooth functioning and further integration of capital markets. Vice versa, more cross-border financial services activities and a wider investor base for capital market-based funding instruments makes the financial system more resilient. Making progress on the capital markets union would develop deeper, more liquid and efficient EU capital markets, and thus increase private investment to support economic growth and accelerate the green and digital transitions.

ECB Banking Supervision acknowledges the risks associated with the sovereign-bank nexus. This is why it closely monitors banks’ holdings of sovereign debt, including sensitivity to shocks in risk-free interest rates and credit spreads, as part of its continuous supervisory work. Progress in completing the banking union would provide further reassurance that vulnerabilities in the banking sector will be identified and tackled in a timely manner, and cross-border integration of the banking sector would naturally reduce exposures to domestic sovereign debt.

8 AML

The Resolution asks the European Commission to establish an EU-level database to enhance coordination among banks, address gaps in Member States' implementation of sanctions, and evaluate how EU banks implement sanctions. The Resolution also refers to the European Parliament’s position on the anti-money laundering authority (AMLA) regulation proposal.

ECB Banking Supervision values its work with the AML/CFT authorities and has significantly stepped up such cooperation. As an example, it has engaged in numerous exchanges with national AML/CFT authorities in the EEA since 2019, when it signed a multilateral agreement with them on the practical modalities for exchanging information. Furthermore, ECB Banking Supervision has formalised its participation as an observer in AML/CFT colleges for more than 60 banks. It has also contributed to the EBA database on AML/CFT material weaknesses (European Reporting system for material CFT/AML weaknesses – EuReCa). The information provided by AML/CFT authorities directly feeds into the ECB’s different supervisory processes, in particular in the SREP analysis, fit and proper assessments and authorisation procedures. ECB Banking Supervision welcomes the political agreement on a strong AML authority. It also agrees with the European Parliament’s proposals to simplify the current tools for cooperation between AML/CFT and prudential authorities, with the creation of a central data hub to facilitate information exchange. The database that AMLA will set up, will be an important element of the information exchange between AML/CFT and prudential supervisors. ECB Banking Supervision supported the proposals made by the European Parliament in its report on the proposed AMLA regulation to further widen the scope of the database and hopes they can be considered in a future review of the legislation. ECB Banking Supervision stands ready to work with the new authority, AML/CFT supervisors and the EBA during the transition phase.

9 Diversity in financial institution boards

The Resolution identifies insufficient diversity and gender imbalances in the management bodies of financial institutions, and thus calls on supervisory authorities to utilise their supervisory powers to address these gaps.

ECB Banking Supervision is addressing the lack of diversity in the boards of supervised banks through the SREP, as well as through fit and proper assessments[15]. Diverse boards (in terms of gender, experience, knowledge and other aspects) are better placed to avoid “groupthink”, to oversee and challenge more effectively, as well as to take better decisions, thanks to a broader range of views and perspectives. ECB Banking Supervision has further enhanced its focus on diversity. Banks lacking diversity policies and gender targets have been addressed directly and progress has been registered, although at slow pace. ECB Banking Supervision has also updated its methodology and revised its tools which guide banks towards ensuring a more gender-balanced composition of boards: for instance, gender diversity is included as part of the assessment of the collective suitability of boards in fit and proper assessments, although ECB Banking Supervision’s power is constrained and dependent on the applicable legal framework in each country. [16] ECB Banking Supervision will continue to actively foster diversity in supervised banks’ boards in conjunction with national competent authorities (NCAs).

10 ECB governance: gender balance in the Governing Council and Supervisory Board of the ECB and the selection procedure for the Chair of the Supervisory Board

The Resolution mentions that the Governing Council and Supervisory Board of the ECB, and the Single Resolution Board, are not gender-balanced, and calls on actors to ensure that future appointments close the gap. In addition, the Resolution regrets that, as part of the selection procedure for the Chair of the Supervisory Board, the ECB disregarded the feedback from the European Parliament. It asks the ECB to duly consider the European Parliament’s opinion in the upcoming selection procedures.

The governance issues related to the ECB raised in the Resolution are not in the remit of ECB Banking Supervision. However, ECB Banking Supervision supports the ECB’s statements on these matters. As regards the lack of gender balance in the Governing Council and Supervisory Board, the ECB has called on Member States to ensure gender balance in their upcoming proposals for shortlists and appointments. In terms of the current composition of the Supervisory Board, out of six ECB members of the Supervisory Board, who are either proposed or appointed by the Governing Council, four are women (including the Chair); out of the 21 other members, seven are women.[17] As regards the selection process for the Chair of the Supervisory Board, the ECB was rigorous and transparent, in full respect of all relevant provisions. The process is set out in the SSM Regulation[18], the Interinstitutional Agreement between the European Parliament and the ECB[19] and the Memorandum of Understanding between the EU Council and the ECB[20].

© European Central Bank, 2024

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.bankingsupervision.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the SSM glossary (available in English only).

The text of the European Parliament Resolution on Banking Union – Annual Report 2023 as adopted is available on the European Parliament’s website.

See “Restrictions on dividends and variable remuneration” in the FAQs on ECB supervisory measures in reaction to the coronavirus, on the ECB’s banking supervision website.

See “Stress test shows euro area banking sector could withstand severe economic downturn”, press release, ECB Banking Supervision, 28 July 2023.

See “Overall amount of unrealised losses in euro area banks bond portfolios contained”, press release, ECB Banking Supervision, 28 July 2023

See Proposal for a regulation of the European Parliament and of the Council amending Regulation (EU) 2017/2402 laying down a general framework for securitisation and creating a specific framework for simple, transparent and standardised securitisation”, European Parliament, 12 March 2019, available at: https://oeil.secure.europarl.europa.eu/oeil/popups/ficheprocedure.do?reference=2018/0063B(COD)&l=en.

See “Council conclusions on Action plan to tackle non-performing loans in Europe”, press release, Council of the European Union, 11 July 2017.

Directive (EU) 2021/2167 of the European Parliament and of the Council of 24 November 2021 on credit servicers and credit purchasers and amending Directives 2008/48/EC and 2014/17/EU (OJ L 438, 8.12.2021, p. 1).

See “Letter from Andrea Enria, Chair of the Supervisory Board, to Ms Esther de Lange and Ms Rasa Juknevičienė, Members of the European Parliament, on banking supervision”, ECB, 27 June 2023.

Opinion of the European Central Bank of 5 July 2023 on amendments to the Union crisis management and deposit insurance framework (CON/2023/19) (OJ C 307, 31.8.2023, p.19).

See “Key MEPs call for breaking deadlock on bank deposit insurance scheme”, press release, European Parliament, 7 December 2022.

As an example, the ECB announced in November 2022 a revised floor methodology for assessing capital buffers for other systemically important institutions (O-SIIs) proposed by national authorities. Effective since 1 January 2024, the revised floor methodology strengthens the capacity of systemically important banks to absorb losses and continue to provide key financial services to the real economy.

Fit and proper assessments look into whether members of the management body of a supervised credit institution (and key function holders where relevant under national law) are suitable for their roles.

An assessment of collective suitability evaluates whether a bank's leadership team has, collectively, the necessary skills, integrity and experience to manage the bank effectively and responsibly.

The Supervisory Board is composed of one representative of the NCA of each participating country (21 countries including Bulgaria, which is in close cooperation). Of the 21 NCA representatives, six are women. Where the competent authority is not a central bank (which is the case in six countries), the Supervisory Board member can be accompanied by a representative of the national central bank (NCB). Of these six additional representatives, one is a woman.

Council Regulation (EU) No 1024/2013 of 15 October conferring specific tasks on the European Central Bank concerning policies relating to the prudential supervision of credit institutions (OJ L 287, 29.10.2013, p. 63).