- THE SUPERVISION BLOG

Keeping a tight lid on non-performing loans

Blog post by Elizabeth McCaul, Member of the Supervisory Board of the ECB, and Korbinian Ibel, Director General of Universal & Diversified Institutions

10 October 2023

Ever since it began supervising banks, addressing the issue of non-performing loans (NPLs) has been a key priority for the ECB and remains so today. The joint efforts of banks, policymakers and supervisors have so far proven to be effective in reducing NPLs to a fraction of what they were a few years ago. That is why we are very concerned about legislative proposals which could undermine the effective resolution of NPLs. Instead of putting our hard-won achievements at risk during this time of economic uncertainty, we need to continue strengthening the frameworks which enable the reduction of NPLs and prevent their build-up. Households and small and medium-sized enterprises benefit when banks are equipped to maintain lending volumes and healthy balance sheets. And this in turn underpins the health of our economy.

NPLs are a fact of life for banks. There will always be some borrowers who are unable to repay their loans. History has taught us that when NPLs build up and remain unresolved, they weigh on banks’ profitability and take up valuable resources. This ultimately restricts banks’ ability to fulfil their important role of providing households and firms with access to credit, since it prevents them from granting new loans. In the current uncertain economic environment, we need to remain focused on continuing to reduce NPLs and preventing their build-up in the first place.

As early as 2017 we asked banks with high levels of NPLs to develop ambitious and credible strategies to reduce them. In a similar vein, legislators adopted clear provisioning rules based on a uniform provisioning calendar. This facilitates the process of reducing NPLs. Resolving NPLs is costly, takes time and requires very detailed calibration of the pace of reduction to ensure that the financing of the overall economy is not adversely affected.

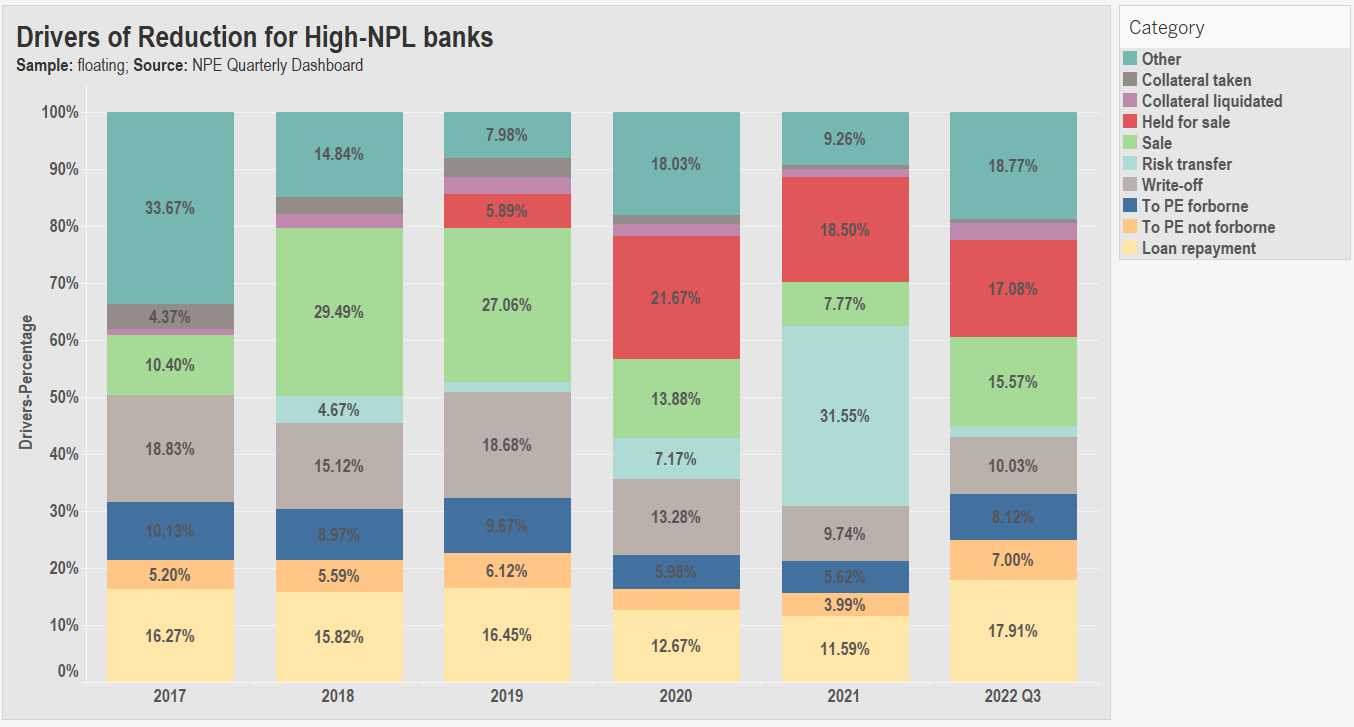

Banks can manage NPLs in a variety of ways. They need flexibility to choose which approach they should take and which mix of tools is the most appropriate to use. To achieve the right balance, they must take account of the specific characteristics of the NPLs on their books and their individual operational environment. All approaches have something in common: they rely on a well-functioning legal framework that enables NPLs to be resolved.

Our supervisory approach encourages banks to significantly reduce their holdings of NPLs. However, ensuring NPLs are resolved successfully and at an appropriate pace requires much more than a strong, well-calibrated supervisory approach. Policymakers have different tools at their disposal to resolve NPLs, which have also played a significant role in the reductions achieved to date. We have benefited greatly from the significant progress made in removing impediments to the timely resolution of NPLs in the last few years. Policy initiatives that play a crucial role in helping banks make progress towards reducing their NPLs include improvements to insolvency and foreclosure frameworks, more efficient judicial processes, the development of an NPL servicing industry and the creation of broader and deeper NPL markets.

In the past, a significant portion of NPL growth was attributed to the absence of quick ways for banks to resolve issues affecting distressed borrowers. Specifically, when a loan became non-performing and banks determined there were no possible measures to return the client to a performing status, the legal frameworks in place were often inadequate. They did not allow banks to take swift ownership of collateral and recoup value from the loan. When banks know that they cannot resolve bad loans, they restrict lending to more risky customers. Weak insolvency and foreclosure frameworks ultimately harm consumers and firms. And the vulnerable members of society, who are meant to be protected by these legal and judicial processes, ultimately suffer the most harm, as their access to credit vanishes. As part of the bigger picture, easy-to-navigate and coherent insolvency, foreclosure and judicial processes that enable speedy resolution are crucial. Fiscal measures to support borrowers who have trouble repaying their debt are also critically important, especially in times of crisis, such as during the COVID-19 pandemic. Such measures, if properly designed and implemented, can achieve balanced and sustainable solutions for both borrowers and lenders.

Over the past decade, our supervisory approach has proven to be very effective in reducing NPLs and preventing further build-up that could arise from uncertain economic conditions. It has taken years to significantly reduce NPLs to the level they are at today, with the result that banks entered the current period of economic uncertainty created by the pandemic, Russia’s invasion of Ukraine and the rising interest rate environment armed with strong balance sheets. The work of reducing NPLs remains unfinished, and it would be unwise to now interfere with the existing supervisory strategy and legal framework which has proven to be successful.

As banking supervisors, we pay very close attention to any developments and legislative proposals that could reverse the progress that has been made. Effective legal frameworks – and speedy judicial processes to implement them – are a cornerstone of banks’ ability to successfully reduce NPLs. We are deeply concerned about measures that may create undue delays in legal proceedings and affect the recoverability and value of assets. We will continue to strenuously and publicly oppose any initiatives that could undermine the current success. On the contrary, we need to continue to strengthen the frameworks which enable the reduction of NPLs and prevent their build up in the first place. This allows banks to maintain lending volumes and greatly supports the credit needs of households and small and medium-sized enterprises – particularly the most vulnerable – and contributes to the smooth and stable functioning of our economy.