- SUPERVISION NEWSLETTER

Challenging banks’ capacity to recover from severe crises

18 August 2021

Banks’ ability to absorb shocks is crucial to a stable banking system. The February 2021 Supervision Newsletter explained how ECB Banking Supervision has been analysing banks’ crisis preparedness by challenging their overall recovery capacity (ORC), i.e. the extent to which banks can recover from a severe stress situation by implementing recovery options. This article presents some key findings from this analysis, focusing on capital recovery capacity.

ECB Banking Supervision assessed the credibility of recovery options under a very severe stress scenario. Supervisors verified banks’ assumed capital and liquidity gains resulting from the implementation of recovery options and challenged the underlying assumptions used by banks. They then formed an opinion on the quality of banks’ own assessments of their ORC and identified issues warranting supervisory attention.

Overall, the analysis showed that most banks had somewhat overestimated their ORC. In their assessments, supervisors concluded that recovery options restoring liquidity were largely effective but that banks’ ability to strengthen their capital base through recovery options was 15% lower than estimated by the banks themselves. This is partly related to different views on the feasibility of options in a severe stress situation: almost 30% of the recovery options that banks declared to be highly feasible in a stress situation were not considered as such by ECB Banking Supervision.

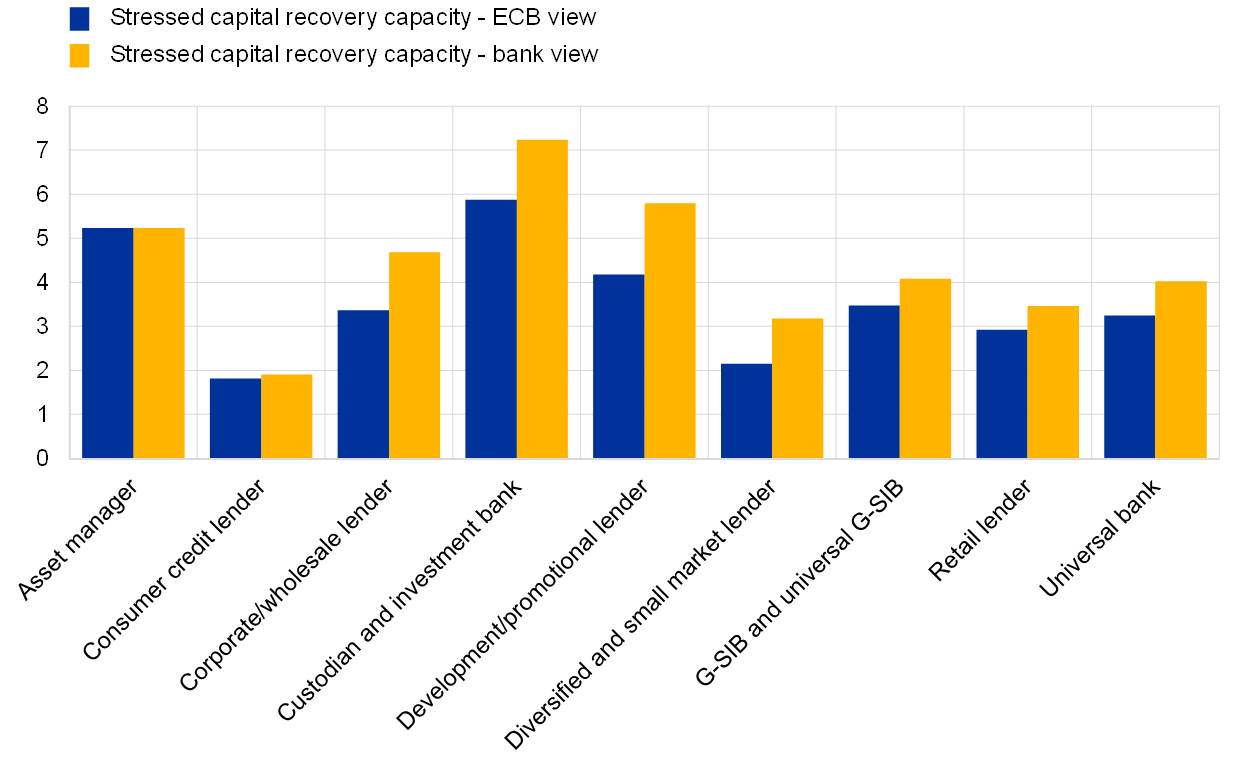

Notwithstanding the above, the analysis showed differences across banks, as the stressed capital recovery capacity – measured in terms of the Common Equity Tier 1 (CET1) ratio – varies between banks with different business models (Chart 1). For recovery options with a high and medium feasibility, banks focusing on asset management, custodian services, investment banking and promotional lending have a somewhat higher capital recovery capacity than banks with other types of business model, such as universal banks (irrespective of their global presence). This suggests that a bank’s business model may play a role in its capital recovery capacity. However, a more modest cross-border presence, local specificities or bank-specific challenges should not be used to justify relatively low capital recovery capacity values. The ECB’s analysis shows that banks can still increase their capital recovery capacity by taking preparatory measures to improve the feasibility of recovery options or by broadening their pool of recovery options. In particular, banks with a relatively low ORC should perform a cost-benefit analysis to assess whether the medium to long-term benefits of a higher capital recovery capacity (i.e. an increased resilience to shocks) outweigh the short-term costs of investing in preparatory measures and their potential impact on profitability.

Chart 1

Available capital recovery capacity under a severe stress scenario

(CET1 ratio in percentage points)

Source: ECB Banking Supervision.

Another key finding concerns the time that banks assume they need to implement recovery options related to capital increases and disposals of entities. For 25% of the recovery options of this type that were analysed, the suggested implementation time is too short. Conversely, ECB Banking Supervision found that recovery options involving cost savings, commercial measures and risk reduction measures had the most realistic timing. Unsurprisingly, these recovery options are exclusively or mainly under banks’ own control, which allows banks to define the implementation time more accurately. This confirms the fourth finding: when external factors come into play, for example in assessments of market dependencies and market appetite, some banks find it difficult to set realistic timelines.

It is clear from the assessment that some banks need to improve their ORC by increasing the credibility of their capital-related recovery options. ECB Banking Supervision considers these improvements vital, and the Joint Supervisory Teams are discussing what would be feasible, based on a cost-benefit analysis, with those banks reporting a low ORC. The 2021-22 recovery plan assessment cycle will again focus on the credibility of recovery options and the available ORC, and any findings will be reflected in the future supervisory approach.

Ευρωπαϊκή Κεντρική Τράπεζα

Γενική Διεύθυνση Επικοινωνίας

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Η αναπαραγωγή επιτρέπεται εφόσον γίνεται αναφορά στην πηγή.

Εκπρόσωποι Τύπου