A closer look at time commitment of non-executive directors

Non-executive directors play a crucial role in the governance of banks. They are supposed to oversee, monitor and challenge the management function, in particular with regard to the effectiveness of internal controls and the soundness of governance structures. To this end, they must maintain a good understanding of the bank’s business and main risks, and prepare for and participate in management body meetings. This cannot be achieved without sufficient time commitment on their part.

But what is a sufficient time commitment for a non-executive director? There seems to be no easy, one-size-fits-all answer to this question. On the one hand, having multiple mandates, particularly in addition to a full-time position, could limit directors’ ability to exercise effective oversight. But on the other, having multiple responsibilities could in fact be beneficial for directors, by enabling them to draw on a broader set of experiences in their non-executive role.

Fully aware of this, supervisors always apply a case-by-case approach when assessing the time commitment of non-executive directors. For fit and proper assessments, supervised banks have to declare, in detail, how much time prospective non-executive directors intend to allocate to their oversight function and how much time they will commit to all positions they hold. These declarations are then assessed, taking into account the appointee’s background, their function and responsibilities as a board member, and the specificities and context of the supervised bank. For such assessments, ECB Banking Supervision has developed specific policies, which are summarised in the Guide to fit and proper assessments. In addition, ECB Banking Supervision regularly discusses its expectations regarding adequate time commitment with banks.

Nevertheless, time commitment is a recurring issue in the fit and proper assessment of non-executive directors. In 2018, supervisors saw the need to impose conditions, obligations or recommendations for around 20% of the non-executive directors assessed in order to address concerns related to time commitment. In many cases non‑executive directors held a very high number of mandates, had a high overall time commitment or committed too little time to their oversight function in the bank.

To increase its knowledge of non-executive directors’ time allocation and to inform upcoming assessments performed by both supervisors and banks, ECB Banking Supervision conducted a benchmarking exercise on the declared time commitment of non-executive directors in euro area countries, based on fit and proper applications received in 2018. While the report on the exercise provides valuable information on the current situation regarding the declared time commitment of non-executive directors, it will not lead to any definitions of what constitutes a sufficient time commitment. Nor will it affect the principle of proportionality and the established case-by-case approach to assessment, as described above.

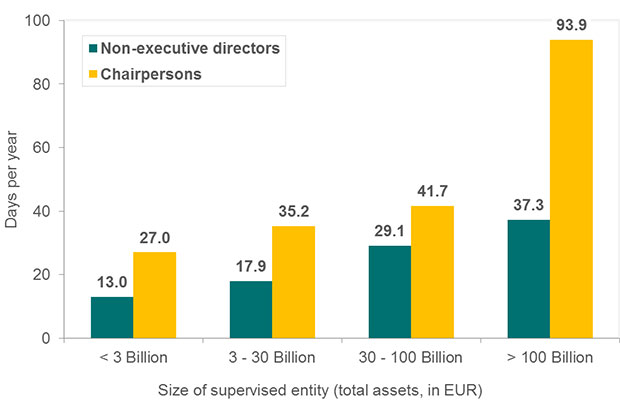

Report on declared time commitment of non-executive directors in the SSMThe results show an average declared time commitment of 22 days per year for regular non‑executive directors and 42 days per year for chairpersons. The actual figures varied considerably: from 2 to 116 days for regular non-executive directors and 6 to 156 days for chairpersons.

The amount of time that non-executives said they would devote to their oversight function was strongly linked to the size of the bank and to their specific level of responsibility on the board. Non‑executive directors in larger banks and those with additional responsibilities, for example as members of board committees, tended to say they would devote more time to their role.

Average time commitment declared by non-executive directors and chairpersons by size of the supervised entity

The benchmarking exercise also revealed that a large proportion of non-executive directors intended to devote only a few days per year to their function. For instance, 24% of non-executive directors said they would devote less than ten days per year to their oversight role. Another notable finding concerned the declared time commitment of non-executive directors relative to the number of board meetings they needed to attend in a year. Results showed that, for 37% of non-executive directors, the declared time commitment equated to less than two days per board meeting. This is somewhat low, considering that each board meeting requires time for preparation, attendance and follow-up and that directors should devote time not only to the board meetings themselves but also to ongoing oversight.

The results of the benchmarking exercise should further support banks in fulfilling their responsibility to assess the suitability of non-executive directors. ECB Banking Supervision will continue to follow up on the time commitment of non‑executive directors in fit and proper assessments and in ongoing governance supervision. It will also continue the dialogue with banks on the role of non-executive directors and will follow up on the accuracy of their declared time commitment.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts