Introduction

This report has been prepared by the SSM Network of Enforcement and Sanctions Experts to present comprehensive statistics on sanctioning activities in relation to breaches of prudential requirements carried out in 2022 by the ECB and the national competent authorities (NCAs) of Member States participating in the Single Supervisory Mechanism (SSM).[1]

The activities covered in the report include formal sanctioning proceedings conducted by competent authorities within the scope of their respective powers,[2] in particular the imposition of administrative penalties for breaches of prudential requirements by supervised entities (groups) or other legal or natural persons falling under the scope of prudential supervision in the context of the SSM.[3]

The statistics are presented in aggregate for the whole SSM. Data have therefore been collected and compiled using standardised categories to ensure information is harmonised and can be meaningfully compared.[4]

Main findings

The main focus of formal sanctioning proceedings conducted and penalties imposed in the SSM in 2022 by competent authorities was on breaches of prudential requirements[5] in the area of internal governance, in line with the SSM Supervisory Priorities for 2022-2024, and in particular the general objective of further improvements in banks’ governance. This was combined with material sanctioning activities for infringements related to supervisory reporting, which were almost at the same level as in the previous year.

There were a notable number of proceedings conducted in the areas of large exposures, qualifying holdings, own funds and public disclosure, and also penalties imposed in relation to reporting, large exposures, qualifying holdings, own funds and public disclosure.

Developments in the pursuit of breaches in other areas of prudential supervision were observed in 2022. The number of proceedings and penalties related to large exposures continued its upward trend, and there was also a rise in both the number of proceedings and penalties imposed in the areas of qualifying holdings, own funds and public disclosure.

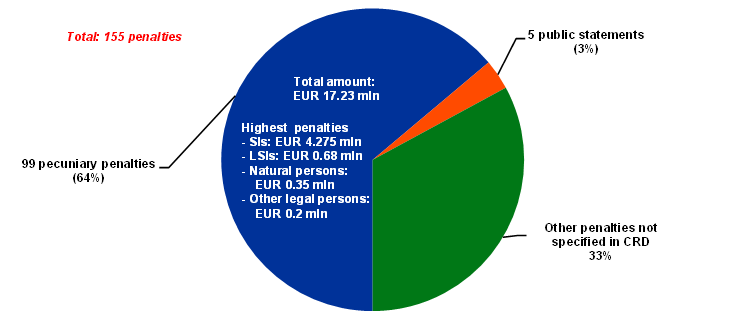

Overall, 155 administrative penalties were imposed in 2022 by competent authorities in the SSM on persons responsible for breaches of prudential requirements. These were mainly pecuniary penalties (64%) and totalled around €17.23 million. The highest pecuniary penalty in 2022 was imposed on a significant institution (SI)[6] and amounted to €4.275 million. For other types of persons sanctioned in 2022, the highest pecuniary penalties were as follows: less significant institutions (LSIs) €680,000; natural persons €350,000, and other legal persons falling within the remit of the competent authorities’ sanctioning activities €200,000. The remaining 36% consisted of penalties of a non-pecuniary nature.

Sanctioning activities mainly concerned LSIs, which accounted for 60% of all proceedings conducted and 59% of all administrative penalties imposed. They were followed by natural persons, which accounted for 25% of all proceedings conducted and 22% of all administrative penalties imposed. By the end of 2022, most proceedings ongoing continued to concern LSIs.

Based on the statistics for formal proceedings ongoing at the end of 2022, governance is expected to stay in the spotlight of SSM sanctioning activities. This also remains one of the SSM Supervisory Priorities for 2023-2025.

Sanctioning proceedings conducted in the SSM in 2022

Overall figures

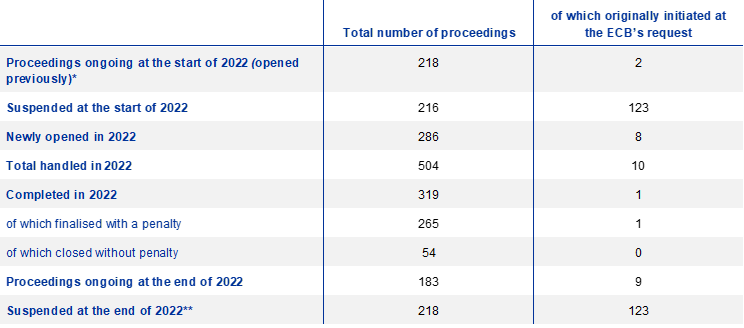

At the beginning of 2022, 218 formal sanctioning proceedings[7] were actively being conducted by competent authorities in the SSM (Table 1). Of these, two had been opened in previous years by NCAs acting at the ECB’s request pursuant to Article 18(5) of the SSM Regulation.[8] During the year, 286 new formal sanctioning proceedings were opened.

Table 1

Number of formal sanctioning proceedings conducted in 2022

*This number does not include three proceedings which were erroneously reported in the 2021 Annual Report. It also excludes the suspended proceedings which are listed separately.

**This number includes 216 proceedings suspended before 2022 due to criminal proceedings pending before national courts against the same person(s) in connection with the same facts, and two additional proceedings suspended in 2022 due to administrative proceedings pending before national courts which may have an impact on the sanctioning proceedings.

Together with proceedings ongoing at the beginning of 2022, the competent authorities comprising the SSM conducted a total of 504 formal sanctioning proceedings during the year. Out of these, 319 were completed in 2022, two were suspended, and 183 proceedings were ongoing at the end of the year.

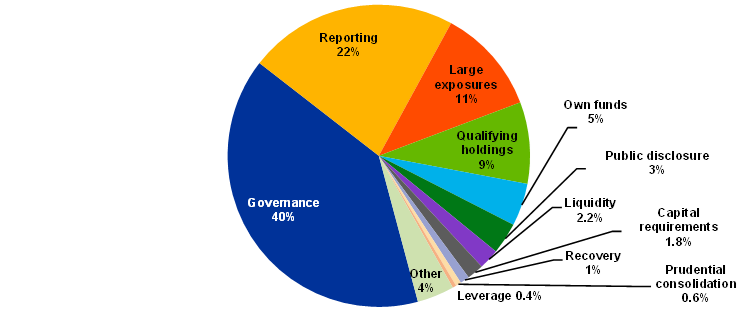

The highest number of proceedings handled in 2022 related to breaches in the area of internal governance (40%), followed by reporting (22%), large exposures (11%), qualifying holdings (9%), own funds (5%) and public disclosure (3%).

Chart 1 presents a breakdown of the proceedings conducted in 2022 by area of infringement.

Chart 1

Formal sanctioning proceedings conducted in 2022 by area of infringement

(percentages)

*“Other” consisted of breaches concerning the business of taking deposits or other repayable funds from the public without being a credit institution.

In internal governance, the sanctioning proceedings conducted in 2022 again related predominantly to risk management and internal controls, and to organisational requirements (including with regard to management body functions and committees).

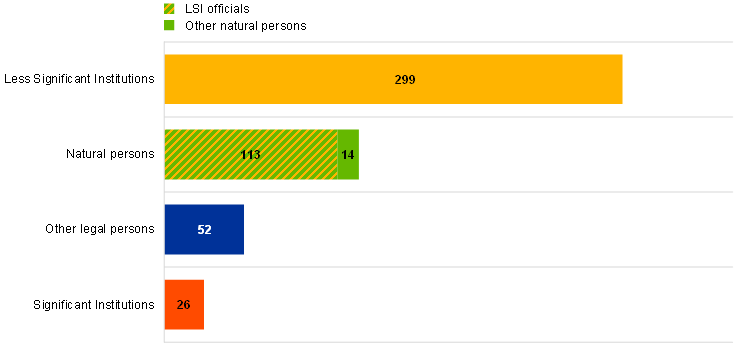

As regards the types of person subject to proceedings, of the 504 conducted in 2022, 60% concerned LSIs, while 25% concerned natural persons potentially responsible for committing breaches, of which 89% were officials at LSIs.

A further 10% of all proceedings conducted in 2022 concerned other legal persons falling within the remit of the competent authorities; the remaining 5% concerned SIs.

Chart 2 presents a breakdown of the proceedings conducted in 2022 by type of person concerned.

Chart 2

Number of formal sanctioning proceedings conducted in 2022 by type of person concerned

Proceedings completed by the year-end

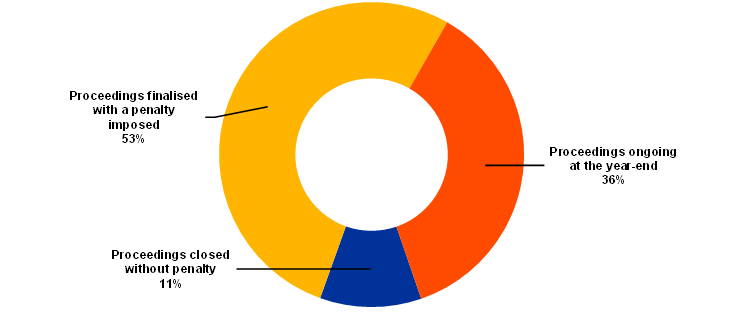

319 formal sanctioning proceedings in 2022 (64% of the total conducted) ended with a decision either to impose a penalty or to close proceedings without imposing any penalty (Table 1 and Chart 3).

Chart 3

Outcome of formal sanctioning proceedings conducted in 2022

(percentages)

Note: The above chart does not include the two proceedings concerning governance breaches which were suspended over the year.

See Section 3 for further information on the proceedings finalised with a penalty.

Of the 319 proceedings completed in 2022, 54 (17%) were closed without a penalty being imposed.[9] Nevertheless, a significant number of these proceedings resulted in formal confirmation of wrongdoer's liability (43%), while in others, after closer assessment, it was concluded that no breach had been committed (39%).

The third most common reason for closure was that the (alleged) breach was not sufficiently material or severe; this applied in 7% of the proceedings closed without a penalty. The figure for some countries may also reflect policy considerations taken into account by the national legislator or competent authority in deciding which infringements should be pursued.

Other reasons for closing proceedings included lack of a relevant legal basis (2% of proceedings closed without a penalty). The remaining 9% of proceedings closed without a penalty were done so on other grounds.

Most of the proceedings closed without a penalty referred to (alleged) breaches in the areas of internal governance (35%) and reporting (28%).

Proceedings ongoing and suspended at year-end

At the end of 2022, 183 formal sanctioning proceedings (36% of the total conducted) were ongoing, of which nine had been opened by NCAs at the ECB’s request in previous years pursuant to Article 18(5) of the SSM Regulation.

The majority of the proceedings ongoing at the end of 2022 related to suspected breaches in the areas of internal governance (49%), large exposures (16%) and reporting (14%).

In addition, 216 proceedings opened and suspended before 2022 (of which 123 had been opened by NCAs at the ECB’s request in previous years pursuant to Article 18(5) of the SSM Regulation) remained suspended throughout the year,[10] while two additional proceedings were suspended in 2022[11].

Administrative penalties imposed in 2022

Overall figures

Of the 319 formal sanctioning proceedings completed in 2022, 265 (83%) resulted in the imposition of a total of 155 administrative penalties (99 pecuniary and 56 non-pecuniary).

Chart 4 presents an overview of the administrative penalties imposed by competent authorities in 2022 for breaches of prudential requirements.

Chart 4

Administrative penalties imposed by competent authorities in 2022

(percentages)

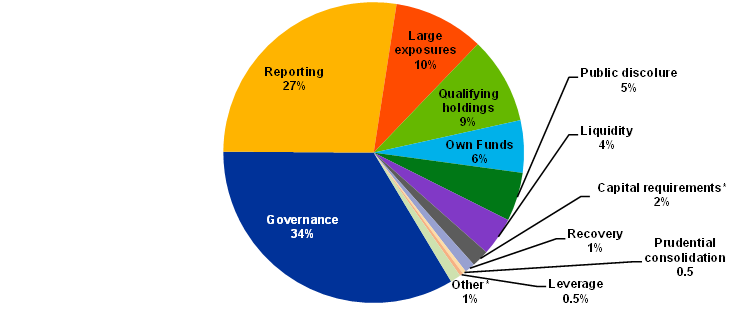

Most administrative penalties were imposed for breaches committed in the areas of internal governance (34%), followed by reporting (27%), large exposures (10%), qualifying holdings (9%), own funds (6%), public disclosure (5%), liquidity (4%) and capital requirements (2%).

Chart 5 presents a breakdown of the breaches sanctioned with an administrative penalty in 2022 by area of infringement.

Chart 5

Administrative penalties imposed in 2022 by area of infringement

(percentages)

*“Other” consisted of breaches concerning carrying out the business of taking deposits or other repayable funds from the public without being a credit institution.

Within the area of internal governance, proceedings finalised with a penalty being imposed related mainly to risk management and internal controls.

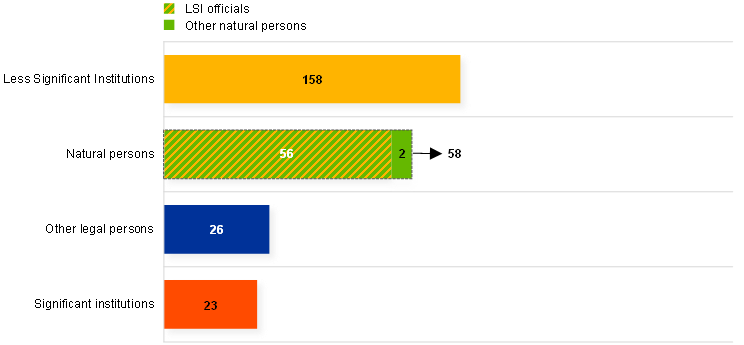

In terms of the types of persons sanctioned, of the 265 proceedings where an administrative penalty was imposed, 158 (59%) concerned LSIs, 58 (22%) were related to natural persons, 26 (10%) related to other legal persons falling within the remit of the competent authorities, while the remaining 23 (9%) concerned SIs.

Chart 6 presents a breakdown of proceedings finalised with an administrative penalty in 2022 by type of person sanctioned.

Chart 6

Number of proceedings finalised with an administrative penalty in 2022 by type of person sanctioned

Pecuniary penalties

Of the 155 administrative penalties imposed in 2022 for breaches of prudential requirements, 64% (99) were of a pecuniary nature for an overall aggregate amount of around €17.23 million. One pecuniary penalty was imposed by NCAs in national proceedings opened at the ECB’s request pursuant to Article 18(5) of the SSM Regulation.

The highest pecuniary penalty imposed in 2022 concerned an SI and amounted to €4.275 million. As regards other persons sanctioned in 2022, the highest pecuniary penalties were as follows: LSIs €680,000; natural persons €350,000 and other legal persons €200,000.

Most pecuniary penalties were imposed in relation to breaches committed in the areas of internal governance (42%) and reporting (24%).

Other penalties

Besides the pecuniary penalties mentioned, the competent authorities also imposed 56 penalties of a non-pecuniary nature as an outcome of formal sanctioning proceedings (representing 36% of the total number of administrative penalties imposed). No such non-pecuniary penalties were imposed by NCAs in national proceedings opened at the ECB’s request pursuant to Article 18(5) of the SSM Regulation.

This category of penalties included such measures as public statements and other penalties not specified in the Capital Requirements Directive comprising mainly written warnings.[12]

Most of those penalties were imposed in relation to breaches committed in the areas of reporting and qualifying holdings (39% each).

© European Central Bank, 2023

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.bankingsupervision.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

The cut-off date for the data included in this report was 31 December 2022.

For specific terminology please refer to the SSM glossary (available in English only).

PDF ISBN , ISSN , doi:

HTML ISBN , ISSN , doi:

Since the Capital Requirements Directive (Directive 2013/36/EU) currently ensures only a minimum level of harmonisation with regard to sanctioning, material differences remain in the national laws transposing the Directive applied by the competent authorities when exercising their sanctioning powers. In particular, breaches of the prudential requirements set out in European Union law are not always sanctionable under the national law of participating Member States. Other aspects may also affect a competent authority’s decision to pursue a breach, e.g. the length of the limitation period, a statutory obligation to open a procedure in the event a breach is identified or discretion to close a case solely for reasons of proportionality.

The ECB can directly impose pecuniary penalties on significant institutions that breach directly applicable acts of European Union law, including ECB decisions or regulations, and on less significant institutions for breaches of ECB regulations or decisions imposing obligations vis-à-vis the ECB on those entities. In cases of breaches of national law implementing European Union directives, breaches of “common procedures” rules in the case of less significant institutions, breaches committed by natural persons, or when a non-pecuniary penalty has to be imposed, the ECB may request the relevant NCA to open national sanctioning proceedings, pursuant to Article 18(5) of the SSM Regulation (Council Regulation (EU) No 1024/2013). The ECB may also address such a request to an NCA where penalties may be imposed under national legislation which confers specific powers on the NCA currently not provided for by the relevant European Union law. This does not affect an NCA’s ability to open proceedings on its own initiative under national law for tasks not conferred on the ECB.

The report does not cover activities of the ECB and the NCAs which fall outside the scope of prudential supervision within the SSM. In particular, information on sanctioning activities related to payment systems, markets in financial instruments, investment services, prevention of the use of the financial system for the purpose of money laundering and terrorist financing, and consumer protection are excluded from the scope of the report.

The statistics presented in this report are calculated using different data categories to those applied by the competent authorities for supervisory disclosure under Article 143 of Directive 2013/36/EU. The scope of the sanctioning activities is also wider than that specified in Annex IV (Part 5 ‒ Data on supervisory measures and administrative penalties) to Commission Implementing Regulation (EU) No 650/2014 laying down implementing technical standards on supervisory disclosure.

Prudential requirements relate in particular to own funds and capital requirements, large exposure limits, liquidity, leverage, prudential consolidation, reporting and the public disclosure of information in respect of these areas. They also relate to internal governance, including fit and proper criteria, risk management and internal controls, organisational arrangements and remuneration policies and practices. The scope of prudential supervision also covers other requirements such as authorisation requirements (licensing) and requirements for the acquisition of qualifying holdings.

The respective supervisory roles and responsibilities of the ECB and the NCAs are allocated on the basis of the significance of the supervised entities. Significant institutions are all supervised entities (i.e. credit institutions, financial holding companies, mixed financial holding companies and branches established in participating Member States by credit institutions established in non-participating Member States) that are classified as “significant” according to the criteria set out in Article 6(4) of the SSM Regulation and thereby directly supervised by the ECB. Less significant institutions are entities under the ECB’s indirect supervision, i.e. they are directly supervised by the NCAs, subject to the oversight of the ECB. Under certain conditions, the ECB can also take over the direct supervision of a less significant institution.

For the purposes of this report, the term “proceeding” is not the same as “sanctioning case”. If a sanctioning case concerns different infringements, these are reported and calculated as multiple proceedings.

Council Regulation (EU) No 1024/2013. See the explanation in footnote 2. For the purposes of this report, a proceeding is considered as “opened” either (i) when a formal act declaring the opening of the sanctioning proceedings is adopted by the relevant decision-making body of the competent authority before the persons concerned are formally granted the right to be heard for the first time on the facts established and objections raised against them; or (ii) when the person concerned is formally granted the right to be heard for the first time on the facts established and objections raised against them.

Proceedings “closed” means proceedings formally completed with a decision not to impose a penalty adopted by the decision-making body of the ECB or the relevant NCA. It also includes (where applicable) ECB proceedings opened pursuant to Article 18(5) of the SSM Regulation which were ultimately closed without a request being addressed to the relevant NCA.

The proceedings were suspended due to criminal proceedings pending before national courts against the same person(s) in connection with the same facts.

Suspended due to a case pending before the administrative court which should clarify a preliminary question under administrative law that is of significance for the sanctioning proceedings.

In some participating Member States, these measures are categorised differently under national law and may be imposed not as a penalty, but rather as a supervisory or enforcement measure. The data presented in the report does not include such measures since they are not adopted as an outcome of formal sanctioning proceedings.