- Supervision newsletter

Supervisors’ reaction to the war in Ukraine

18 May 2022

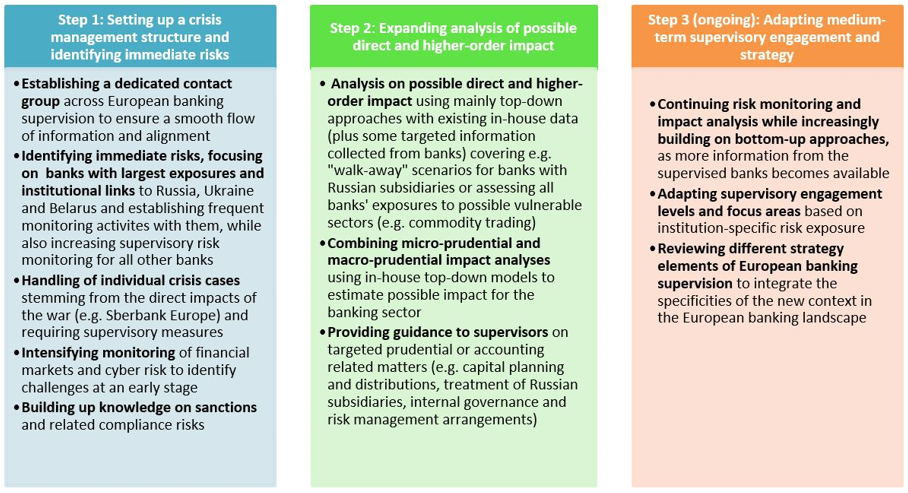

At the start of this year, some dark clouds from strained Russian-Ukrainian relations appeared at the horizon but the possibility of a war in Europe seemed remote. Unfortunately, since then, this risk materialised fast. It has also required a swift reaction from European banking supervisors. Initially, supervisors and banks were faced with far more questions than answers. The supervisory concerns spanned over the full spectrum of risks, including direct and indirect exposures to Russia, cyber-attacks, banks’ operational preparedness for sanctions and countermeasures as well as concerns on potential impacts on trade, growth and inflation. In this situation, the Supervisory Board of the ECB acknowledged very quickly that the only option to handle this challenge was to get all relevant stakeholders within European banking supervision to move forward jointly. The Single Supervisory Mechanism responded to this challenging new reality in three steps.

Step 1: Setting up crisis management structure and identifying immediate risks

As a first step, the Supervisory Board established a contact group which bundled together the relevant information and expertise needed across European banking supervision. One of the group’s main tasks was to prepare an overview of those significant and less significant banks that seemed most exposed to risks stemming from the military conflict and its possible further escalation. These were mainly banks with Russian owners, banks possessing subsidiaries in Russia or Ukraine and banks showing sizeable Russian exposures on their balance sheets. A daily supervisory monitoring was established for those banks, while the frequency of supervisory interactions was increased for all to ensure that possible new emerging risks and potential impacts are identified quickly.

An impact analysis revealed that direct exposures to Russia were manageable for banks on aggregate, with some exceptions that started to become visible within a few weeks. In particular banks with Russian ownership faced and continue to face strong challenges linked to reputational and operational concerns, also following the application of Western sanctions. The operational disruptions and reputation damage had a high and fast-moving impact on a few individual institutions (including Sberbank Europe, RCB Bank and Amsterdam Trade Bank), which have been wound down or restructured as a consequence, without however causing further contagion to the banking sector.

Of course, European supervisors also kept a close eye on banks with operations in Ukraine as their subsidiaries in the country faced significant challenges to continue providing banking services to the local population and to support local staff in their relocation to safer places where necessary. Supervisors also intensified their monitoring of financial markets and cyber risk activities. While turbulence started to emerge relatively fast in specific financial market segments (e.g. for commodities and energy traders), banks’ cyber risk remained unexpectedly low in that phase. Even if cyber risks have not materialised yet, banks should stay on high alert. Ongoing monitoring and ready-to-use emergency plans should allow them to take swift countermeasures, if needed.

Step 2: Expanding analysis of possible direct and higher-order impact

Notwithstanding the overall reassuring results of the initial analysis of direct impacts on banks, supervisors also needed to deal with some bank-specific crisis cases and higher-order impacts, as well as a large number of remaining uncertainties.

A few larger banks with subsidiaries in Russia had elevated exposures to the conflict region. For these banks, supervisors had to estimate the impact of a worst case scenario, the so-called “walk-away” scenario, which assumed that banks would (have to) abandon their subsidiaries and write down their cross-border exposures to the region. The outcome of that top-down analysis suggested that the affected banks were strong enough to cope with the fall-out: the average CET1 capital depletion in this extreme scenario was approximately 90 basis points before taxes, and individual banks’ capital depletion figures remained below 200 basis points. This would not jeopardise the banks’ continued compliance with supervisory requirements and buffers. Meanwhile, a number of banks have provided their own analysis on this matter with broadly comparable results.

After assessing the direct impacts on banks, supervisors focused on risks stemming from any indirect effects with a more medium-term perspective. Such risks may materialise through different channels, including through exposures to vulnerable sectors (e.g. those facing value chain disruptions or increasing energy prices) or the consequences of the increasingly negative macroeconomic outlook.

Regarding exposures to vulnerable sectors, loan-level information on banks’ corporate clients (available via the Anacredit database) allowed supervisors to identify banks that seemed particularly exposed to such sectors at an early stage, and to define monitoring and follow-up needs on a bank-by-bank basis. Energy and commodity trading companies received particular attention in this context given Russia’s strong role in Europe’s energy imports and the heightened volatility in commodity markets. A targeted deep-dive analysis of banks’ business relations with key traders gave supervisors a first overview of risks stemming from this business segment. Going forward, these insights will be refined and will inform future supervisory discussions with relevant banks.

Furthermore, the uncertainty linked to the ongoing war is likely to have a significant impact on the European economy. To form a combined picture of the micro- and macroprudential implications of the war on significant institutions under European banking supervision, ECB experts have performed a top-down desktop vulnerability analysis using stress test assumptions. This assessment is very sensitive to assumptions made and thus will be updated as the macroeconomic developments require. The analysis revealed that some banks might need to take action to maintain compliance with minimum capital requirements in adverse circumstances, but the overall shortfall remained contained even under the most adverse scenario.

European banking supervision has broadly refrained from one-size-fits-all guidance towards banks in this situation. Instead, supervisors’ focus has been on a tailored assessment on a bank-by-bank basis. For instance, supervisors evaluate individual banks’ plans for dividend distributions or share buybacks in light of the effect the deterioration of the macroeconomic outlook is likely to have on their capital trajectories.

Step 3 (ongoing): Adapting medium-term supervisory engagement and strategy

For banks and supervisors alike, a full and prompt return to the pre-war business environment is becoming increasingly unlikely as some economic fundamentals seem to have changed in Europe. Therefore, in the upcoming months, European banking supervisors will try to deepen their understanding of the medium- to long-term consequences and will adapt the supervisory engagement and focus areas to the new landscape. In this work they will build on the ongoing supervisory dialogue with, and the information retrieved from, the supervised institutions.

The crisis has broadly confirmed the ECB’s supervisory priorities, particularly credit risk remains the major area of attention for banks, although attention is shifting from services sectors particularly hit by the pandemic to energy-intensive sectors and areas of business vulnerable to upward shifts in interest rates. Outsourcing, IT and cyber risk also remain relevant. At the same time, as additional sanctions are being considered and implemented, both bankers and supervisors need to remain highly attentive to identify possible new pockets of risk and remain prepared to address those in an agile manner.

Európai Központi Bank

Kommunikációs Főigazgatóság

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Németország

- +49 69 1344 7455

- media@ecb.europa.eu

A sokszorosítás a forrás megnevezésével engedélyezett.

Médiakapcsolatok