Foreword by Christine Lagarde, President of the ECB

The year 2020 was marked by the coronavirus (COVID-19) pandemic and the sharp economic contraction that followed. The ECB, European banking supervision and national governments worked together to deliver a coordinated response to the crisis, providing an unprecedented amount of support to keep people, firms and the economy as a whole afloat during this difficult time.

The current crisis has shown the benefits of having a single European rulebook and a single supervisor for the banking union. By holding the entire banking system to a higher common supervisory standard, ECB Banking Supervision has made sure that banks are in a better position to withstand severe shocks such as this one. In this context, I am also glad to have welcomed Croatia and Bulgaria into the banking union last year. I look forward to seeing them reap the benefits that harmonised rules and, ultimately, a single currency can have for financial stability, resilience, and economic growth.

European banks entered this crisis with sound capital and liquidity buffers and a robust operational capacity. And they have shown great resilience so far. They have been able to withstand losses, keep the credit supply broadly stable and, in doing so, prevent a large increase in corporate and household defaults.

However, once the support measures begin to expire in various European countries, more vulnerabilities are likely to emerge, as the rising indebtedness of the economy becomes apparent. As a consequence, banks will be more exposed to credit risks, which, coupled with potential market adjustments, may impair their capital positions.

At the same time, this crisis will exacerbate the structural problems that have hindered the efficiency of the European banking sector in recent years. European bank profits have been subdued for a long time and will likely remain so in 2021, with credit losses set to increase. Coupled with the current overcapacity in the banking system, this will require banks to continue to strengthen their governance, improve cost efficiency and diversify their sources of revenue in order to better support the economic recovery.

Finally, we must continue to look towards the future. In 2020 we published the ECB Guide on climate-related and environmental risks, which has put us at the forefront of addressing climate change risk at the global level. In addition, this pandemic has provided a decisive push towards digitalisation. In this context, keeping abreast of cyber and IT risks will have to be a priority.

Last but not least, we need to complete the banking union. Strengthening common European approaches wherever possible proved effective in dealing with the challenges of 2020 and will play a vital role in bringing about a sustainable recovery in the coming years.

Introductory interview with Andrea Enria, Chair of the Supervisory Board

2020 was a year like no other. What are your main takeaways from it?

It was an extraordinary and very challenging year. Not only were we faced with the unprecedented economic shock triggered by the pandemic, we also – like everybody else in Europe – suddenly found ourselves confined to our homes and only able to contact colleagues virtually. Many of us have had a relative, friend or colleague who has had the coronavirus (COVID-19). And sadly, we also lost colleagues in the pandemic.

But, despite the difficulties, we all rose to the challenge. We worked together and we delivered a swift European response to the unfolding crisis. We announced our first decisions on 12 March 2020, just three days after the first nationwide lockdown in Europe.

I was impressed by the shared sense of purpose that inspired our work. It was present at all levels: in the Supervisory Board, within and across departments, when collaborating with the national competent authorities, in the Joint Supervisory Teams (JSTs) and more broadly. This challenging year reminded us how important our role is and how fulfilling it is to work together for the public good – to safeguard financial stability in times of heightened uncertainty and considerable anxiety.

How exactly did European banking supervision contribute to the global response to the pandemic?

Our immediate goal was to ensure that banks could continue providing financial support to viable households, small businesses and corporates to avoid the devastating second-round effects of a credit crunch. This required us to shift our supervisory focus rather rapidly: we offered temporary capital and operational relief to banks to create a bit of breathing space so that they could continue lending to households, small businesses and corporates and absorb the losses generated by one of the harshest recessions on record.

These relief measures were seen as a desire to be less tough. Do you agree with this view?

In no way do the relief measures contradict our mandate to deliver stringent, high-quality banking supervision. After the crisis of 2008-09, we worked hard to ensure that banks built up capital and liquidity buffers in good times that could then be used in bad times. With the COVID-19 crisis, those bad times have come. Therefore, our actions have been in line with the letter and the spirit of the financial reforms enacted after the great financial crisis.

Moreover, we maintained our close supervisory scrutiny at all times, asking banks to properly measure and manage risks and continuously challenging their assessments to ensure a level of prudence commensurate with the heightened uncertainty generated by the pandemic.

And where does the pragmatic SREP come in?

As supervisors, we must be agile. We must adapt to the situation and adjust our actions to be more effective. While continuing to follow the European Banking Authority’s Guidelines, we decided to focus the 2020 Supervisory Review and Evaluation Process (SREP) on how banks were handling the challenges and risks to capital and liquidity arising from the crisis. At the same time, we kept Pillar 2 requirements (P2R) and Pillar 2 guidance (P2G) stable and decided not to update the SREP scores, unless changes were justified by exceptional circumstances affecting individual banks. We mainly communicated our supervisory concerns to banks through qualitative recommendations and adopted a targeted approach to collecting information for the internal capital and liquidity adequacy assessment processes. If we had conducted the SREP as in previous years, using what would have been outdated, backward-looking information, we would not have fulfilled our supervisory purpose in the extraordinary environment brought about by COVID-19.

How has the COVID-19 crisis affected European banks?

Banks entered the pandemic crisis in much better shape than at the start of the previous crisis. As the crisis took hold, some banks found themselves overwhelmed with very high levels of loan requests, particularly when State aid programmes for state-guaranteed loans and repayment moratoria were introduced. But these banks managed to adapt quickly and helped to ensure a smooth flow of credit to firms and households. Lending to firms and households continued to grow in 2020, even though we saw a slowdown in the third quarter. And compared with what happened during the great financial crisis, banks reported a much more moderate tightening of credit standards following the first wave of the pandemic.

In the second quarter of 2020 we analysed the potential vulnerabilities of our banking sector under different scenarios. We found that under a central scenario involving a very harsh recession, with euro area GDP falling by 8.7% in 2020, followed by a fairly robust recovery in 2021-22, the banking sector would be able to withstand the effects of the shock on its asset quality and capital.

Which risk emerged as the most pressing for banks during the pandemic?

The COVID-19 crisis has heightened the risk of a further build-up of non-performing loans (NPLs) through a deterioration in the asset quality of banks’ balance sheets. The high aggregate level of NPLs in the euro area had already been identified as a matter of supervisory concern going into 2020, so before the COVID-19 crisis, and there is now an added risk of severe cliff effects when public support measures start to expire.

How does ECB Banking Supervision plan to address this risk?

At the beginning of the crisis we signalled to banks that we would exercise flexibility in several areas when implementing the ECB Guidance on NPLs, so as to help them cope with the impact of the economic downturn. We also gave banks with high levels of NPLs more time, until March 2021, to submit their NPL reduction strategies.

At the same time, we sought to obtain clarity on the quality of banks’ assets and to make sure that they proactively tackle emerging NPLs. Banks must have tight loan deterioration monitoring and management strategies in place so that they are able to identify risks at an early stage and actively manage exposures to distressed customers. We will continue to keep a close eye on how effective banks are in implementing such strategies during this crisis, and we will continue to engage with banks to come up with ways of swiftly tackling impaired bank assets.

What other banking risks have emerged during the crisis?

The European banking sector was already suffering from structural inefficiency when the crisis hit. European banking supervision had already identified low profitability, low cost efficiency and concerns about the sustainability of banks’ business models as the main priorities to be addressed. The crisis has further highlighted these weaknesses as well as the urgent need to address them.

Last year you said that consolidation was one of the ways to address low profitability. Has any progress been made in this area?

Yes, it has. I think the ECB and banks have been taking steps in the right direction.

In 2020 we launched a public consultation on the Guide on the supervisory approach to consolidation in the banking sector. The final Guide, which was published at the beginning of 2021, clarifies our approach and confirms that we are supportive of well-designed and well-executed business combinations.

We are also seeing an encouraging trend of banks engaging in consolidation. Intesa Sanpaolo and UBI Banca, CaixaBank and Bankia, and Unicaja Banco and Liberbank – these banks have all been proactive in this regard, which has prompted new discussions within the boards of other banks. Not only can well-planned business combinations help banks become more cost-efficient, invest more in digital transformation and, ultimately, boost their profitability, they can also help to remove the excess capacity in the banking system that was generated in the run-up to the great financial crisis.

How is ECB Banking Supervision addressing climate-related risks?

Banks should take a strategic, forward-looking and comprehensive approach to considering climate-related risks. European supervisors are going to focus on whether banks are aligned with the expectations set out in the ECB Guide on climate-related and environmental risks, which was published in November 2020 following a public consultation. In 2021 we will be asking banks to conduct a self-assessment in the light of the supervisory expectations outlined in the Guide and to draw up action plans on that basis. We will then benchmark the banks’ self-assessments and plans and we will challenge them in the supervisory dialogue. In 2022 we will conduct a full supervisory review of banks’ practices and take concrete follow-up measures where needed.

The new Vice-Chair of the Supervisory Board, Frank Elderson, is Chair of the Network for Greening the Financial System and co-Chair of the Basel Committee on Banking Supervision’s Task Force on climate-related financial risks. He intends to harness the synergies between these roles and the work of the ECB.

In July 2020 the ECB adopted decisions to establish close cooperation with the central banks of Bulgaria and Croatia. What does this mean for European banking supervision?

For the first time, two non-euro area Member States joined the Single Supervisory Mechanism. This is an important milestone for Bulgaria and Croatia as it paves the way for the introduction of the euro in these countries.

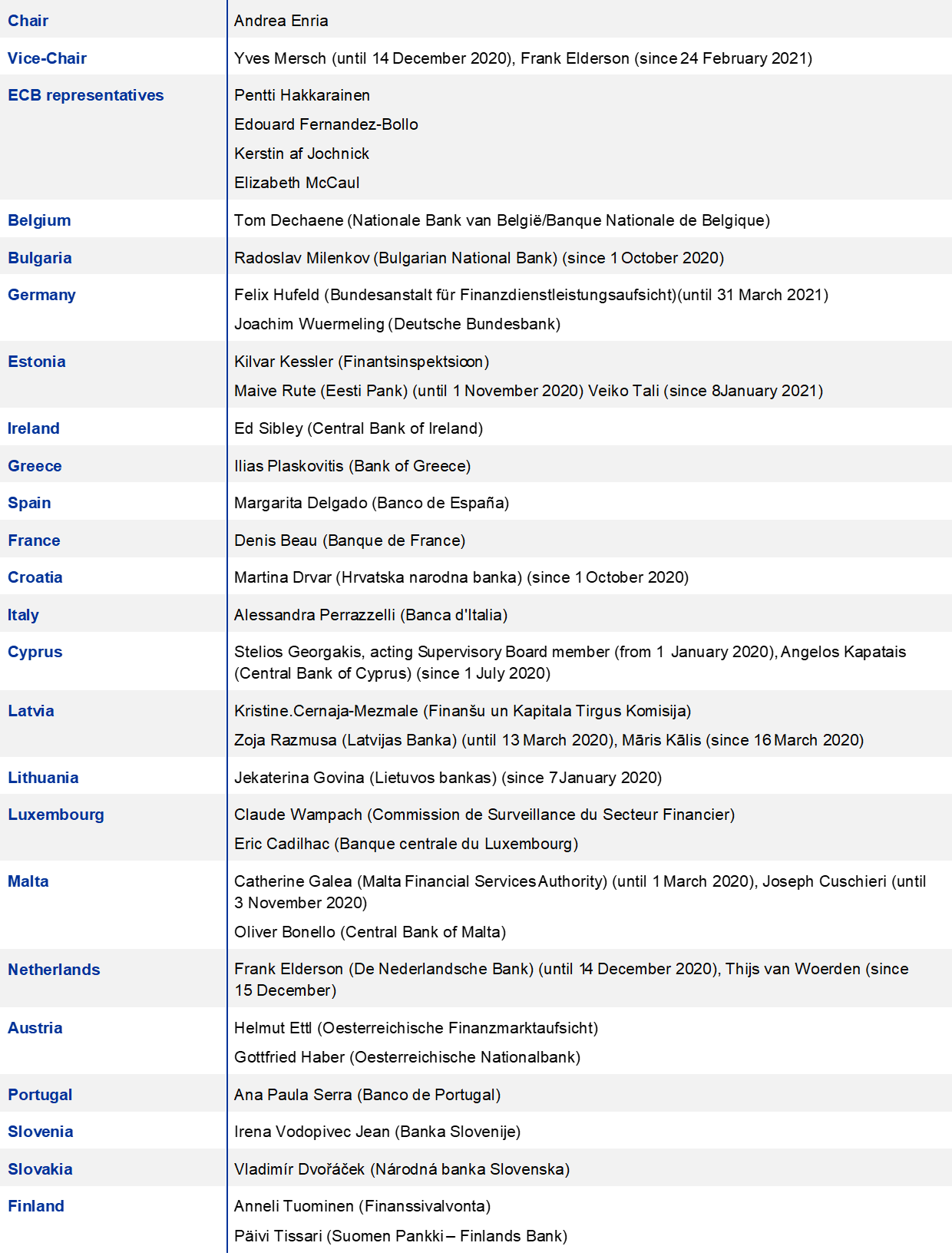

For us it means that as of October 2020, after concluding the relevant comprehensive assessments, the ECB started directly supervising five banks in Bulgaria and eight banks in Croatia. Bulgarian and Croatian supervisors became members of the relevant JSTs and representatives of the countries’ central banks became members of the Supervisory Board with the same rights and obligations as all other members, including voting rights. We were very pleased to welcome them to the family!

In 2020 the ECB contributed to the policy discussion on a European crisis management framework. What were your main points?

We highlighted some of the issues that arose in our practical experience. One example is the overlap between supervisory and early intervention measures. This has generated confusion and meant that the latter measures are rarely activated. The legislation should clearly differentiate between the two sets of tools and the ECB’s early intervention powers should be included in an EU regulation, which would prevent the unwarranted differences that arise when rules are transposed into national laws. We also raised the issue of banks that are declared “failing or likely to fail” but that, under national law, do not fulfil the criteria to trigger liquidation and licence withdrawal procedures and are thus left in a sort of limbo.

More generally, we argued that bolder steps should be taken to complete the banking union, namely by establishing a European deposit insurance scheme (EDIS) and granting broader administrative powers to the Single Resolution Board (SRB) in relation to bank liquidations. The US Federal Deposit Insurance Corporation can be a useful blueprint here. However, until then, further harmonisation at national level and more centralised coordination at the European level (for example through the SRB) would already be a step in the right direction.

Finally, in our joint blog post, Edouard Fernandez-Bollo and I proposed a more efficient approach to managing difficulties in cross-border banks. If subsidiaries and parent companies of banking groups could enter into a formal agreement to provide each other with liquidity support, which would be linked to their group recovery plans, it would help to map out how group entities could support each other when difficulties arise, taking into account local needs and restrictions. It would also make it possible to establish the appropriate triggers for providing the contractually agreed support at an early stage. This could also support more integrated management of liquidity in good times.

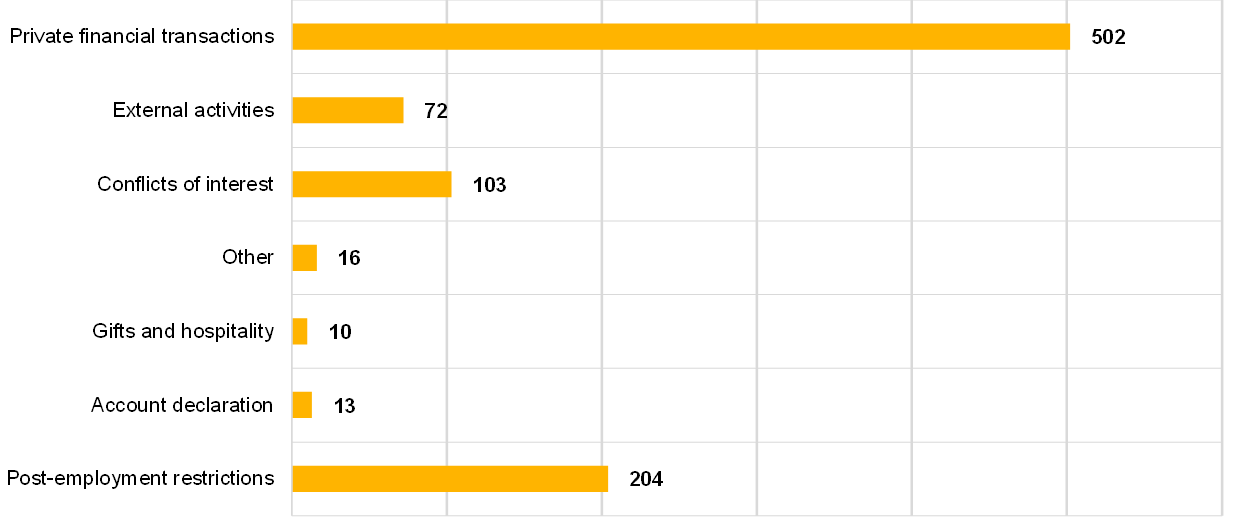

Enhancing the transparency and predictability of European banking supervision has been one of your main objectives since the beginning of your term. What progress has been made here?

Well, I certainly think that we have made supervisory outcomes and our policies more transparent.

Transparent supervisory outcomes are good for markets. We received positive feedback when we first published the bank-specific P2R in January 2020. Individual requirements provide a concrete and comprehensive insight into the supervisor’s view of a bank in terms of overall riskiness, which can help investors to take more informed decisions. And it helps banks to better assess where they stand in relation to their peers. We continued this practice in January this year.

Being transparent about our policies is good for our effectiveness and, in turn, our reputation. Supervised banks need to understand what drives our decisions and we should be consistent in our approaches so that they can form reliable expectations. I think that we were able to achieve a good level of transparency on the COVID-19 relief measures through our written and oral communications with banks and our communication with the public. This level of transparency should become our new normal.

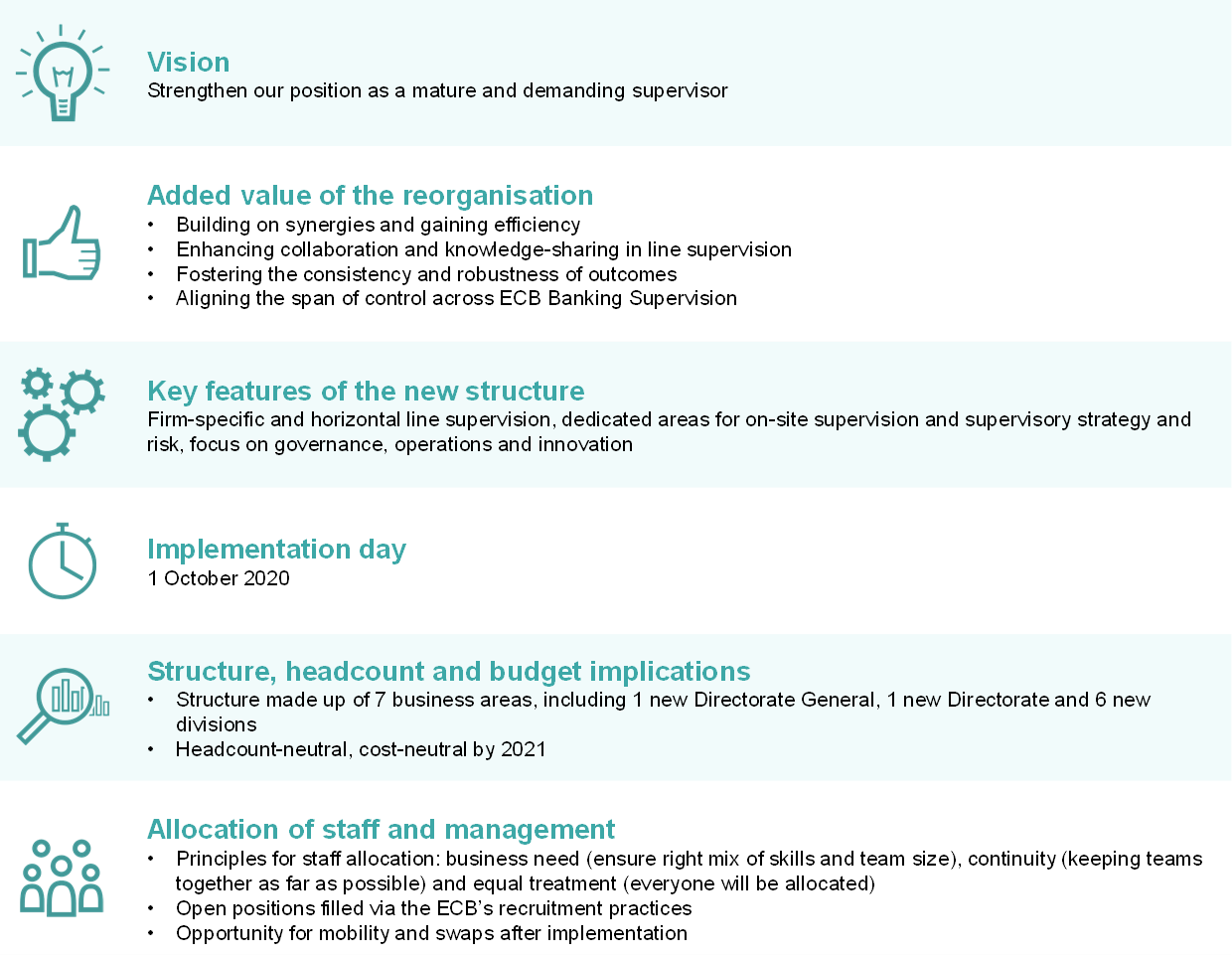

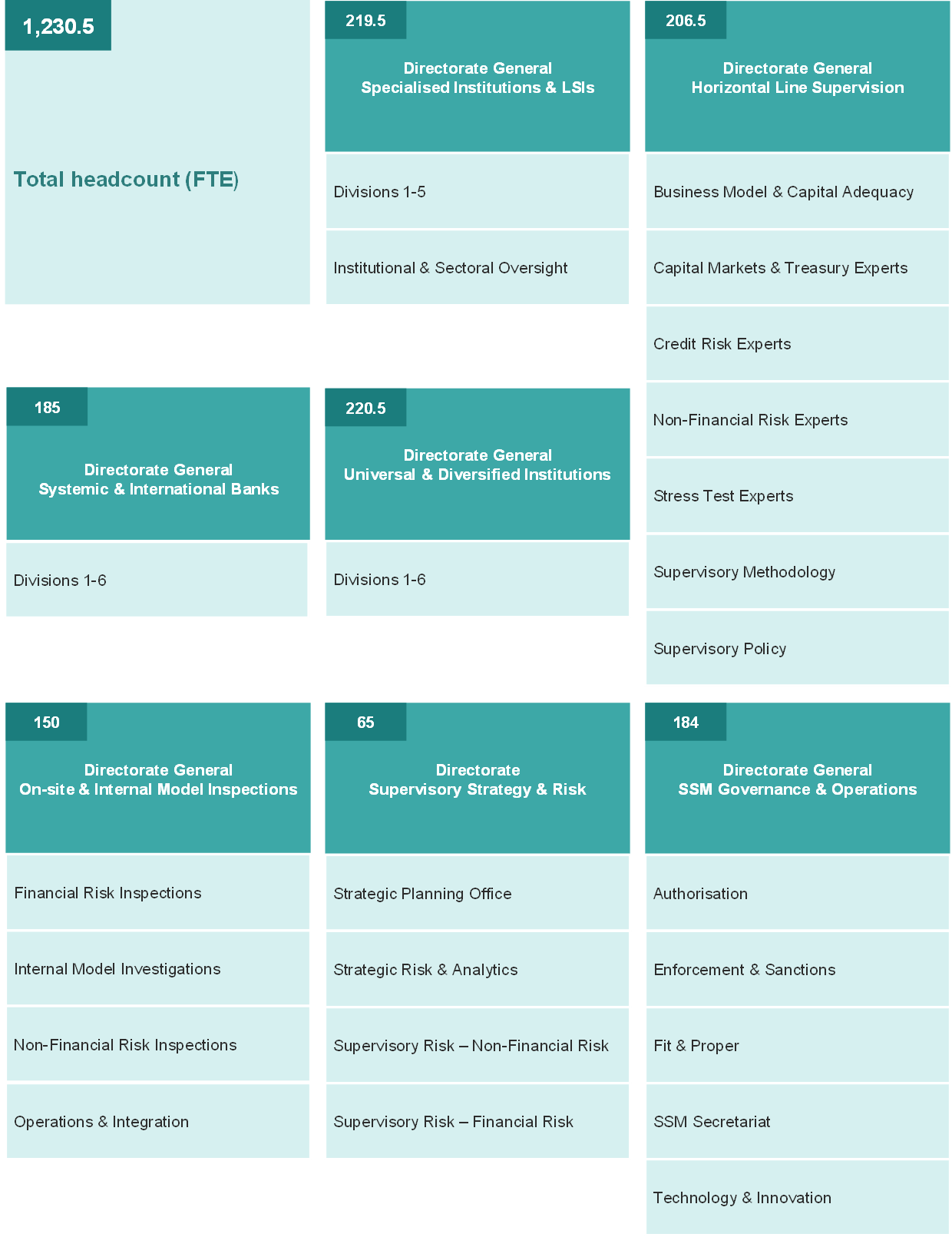

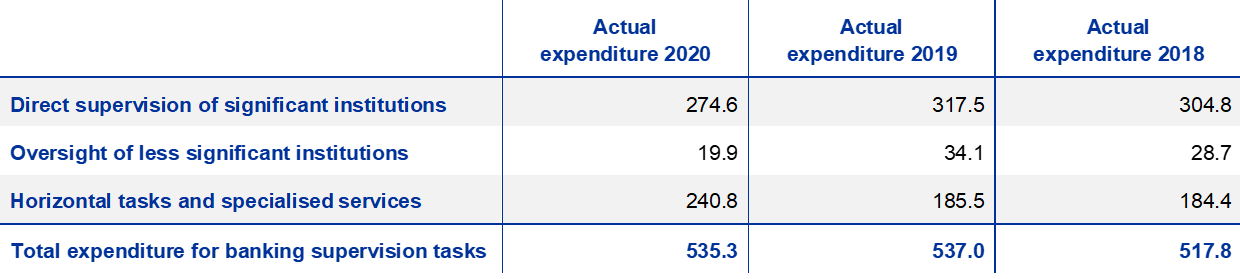

Towards the end of 2020 ECB Banking Supervision made changes to its organisational structure. Why did you do this?

After six years, it was time for ECB Banking Supervision to change from a start-up to a more mature organisation with more risk-focused supervision and increased collaboration between different teams.

To achieve this goal we structured the directorates general for bank-specific supervision according to the business models of supervised banks. We introduced a new Directorate Supervisory Strategy and Risk, which is responsible for strategic planning, proposing supervisory priorities and ensuring consistent treatment of all banks. We created a specific directorate general for on-site supervision functions and tasked the Directorate General Horizontal Line Supervision with strengthening the risk expertise of JSTs, conducting benchmarking assessments, developing policies and maintaining methodologies. A separate directorate general, called SSM Governance and Operations, supports supervisory decision-making and innovation and manages authorisation procedures. The reorganisation was driven by the desire to simplify our processes and incorporate technological innovations into supervision across different departments.

I am really proud that we were able to design and implement these changes through internal discussions and by listening to staff. Around 60 supervisors acted as change agents who, together with senior management, helped their colleagues adapt to the changes and played a large part in making the reorganisation a success.

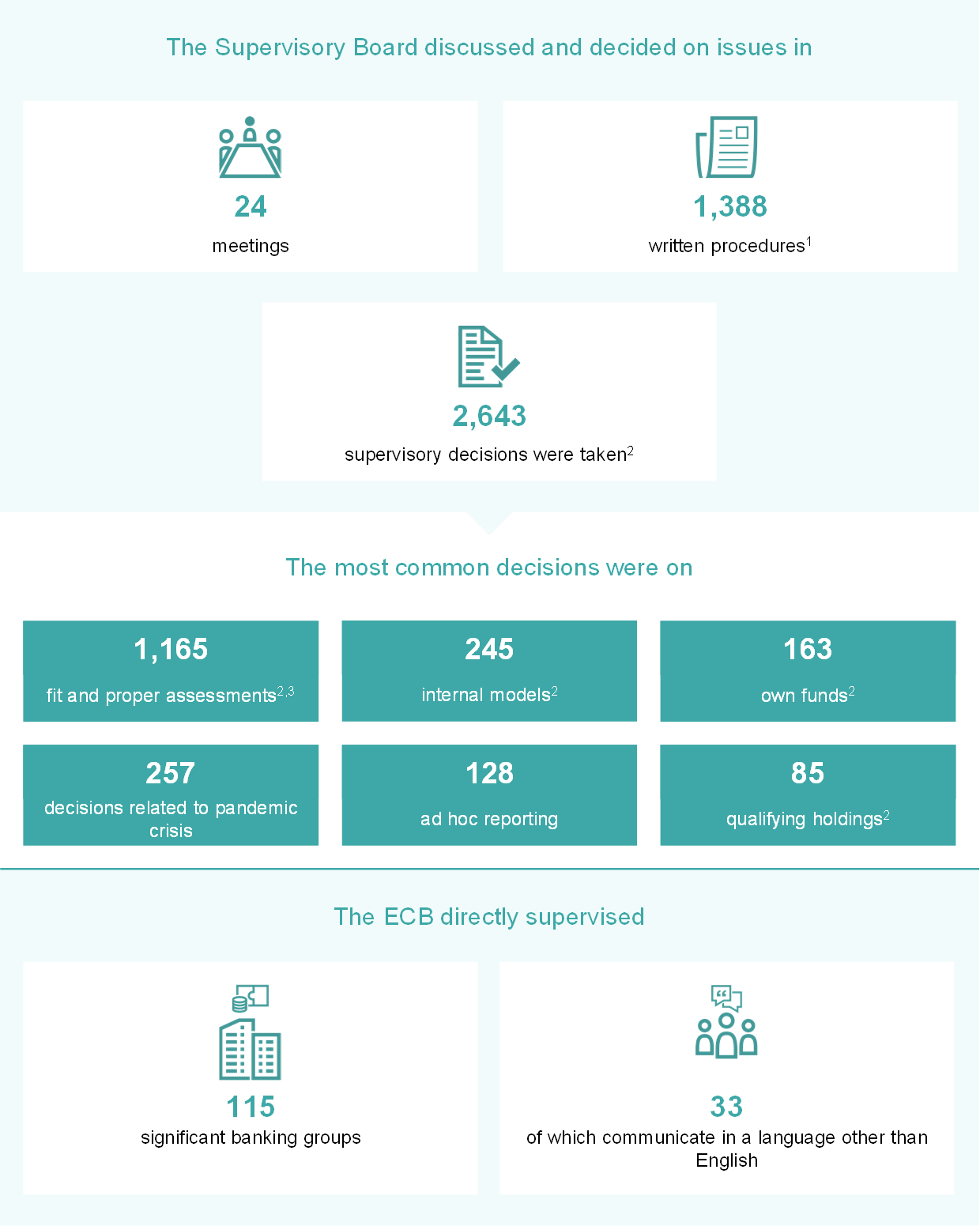

1 Banking supervision in 2020

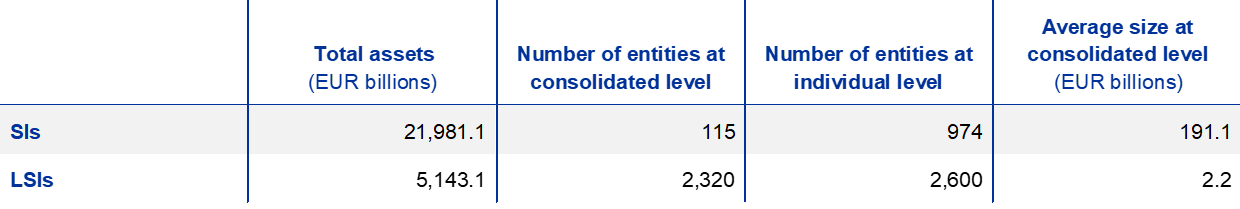

1.1 Supervised banks in 2020: performance and main risks

1.1.1 Resilience of the euro area banking sector

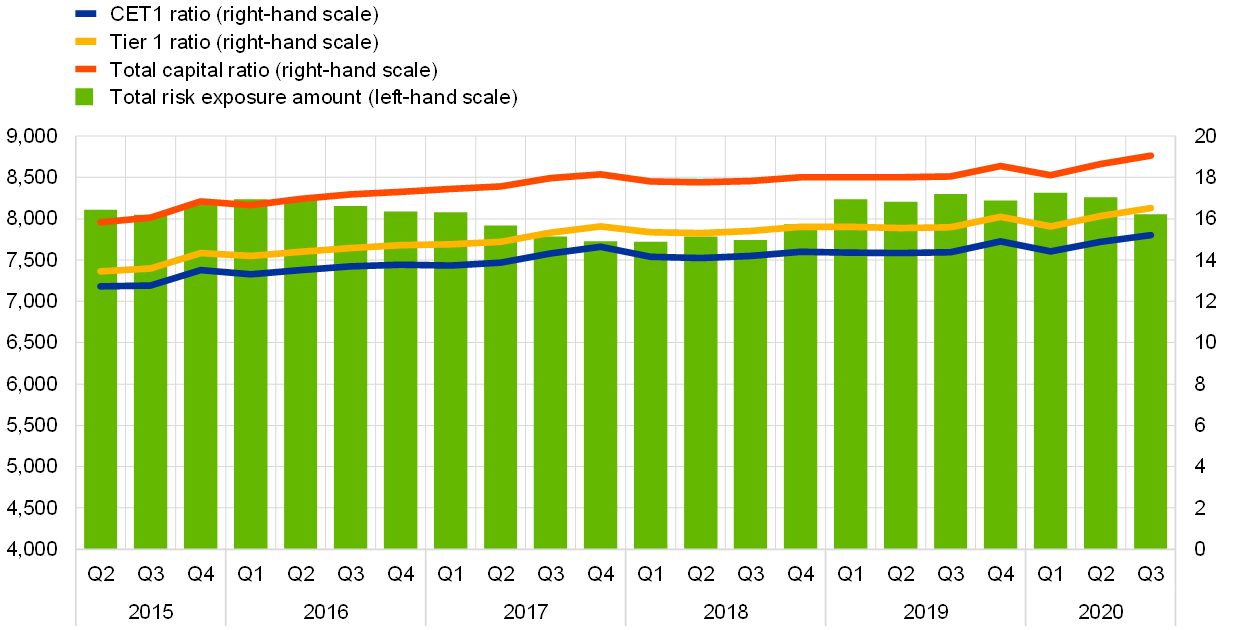

Significant institutions entered the COVID-19 crisis with stronger capital positions compared with the last financial crisis

Euro area banks entered the coronavirus (COVID-19) crisis with stronger capital positions compared with the great financial crisis. Their aggregate Common Equity Tier 1 (CET1) ratio at the end of 2019 stood at 14.9% (Chart 1) and remained broadly stable throughout 2020, standing at 15.2% in the third quarter of 2020. This was partly a result of the extraordinary supervisory, regulatory and fiscal relief measures taken in response to the crisis. Banks were also temporarily recommended not to distribute dividends or buy back shares until 1 January 2021 and to exercise extreme prudence regarding dividends, share buy-backs and variable remuneration until 30 September 2021.[1]

Chart 1

Capital ratios of significant institutions (transitional definition)

(left-hand scale: EUR billions; right-hand scale: percentages)

Source: ECB.

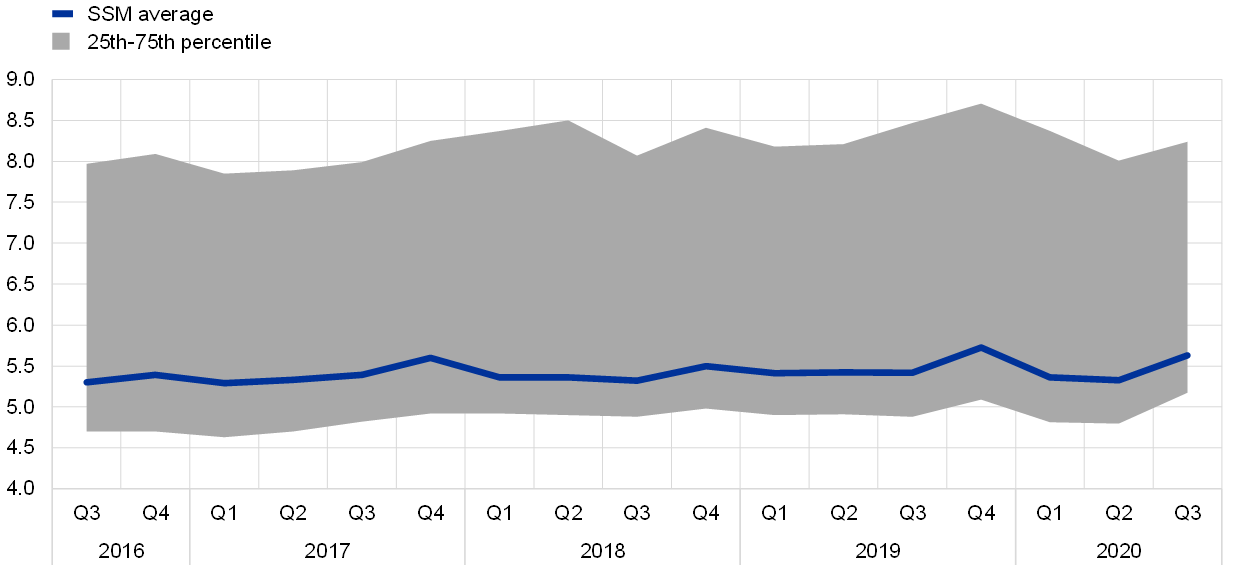

The aggregate leverage ratio has also proven robust throughout the pandemic, standing at 5.6% in the third quarter of 2020, compared with 5.7% at the end of 2019. However, risks to capital adequacy may only materialise on banks’ balance sheets later and could be amplified by cliff effects resulting from the expiry of the support measures put in place in 2020, such as moratoria, furlough schemes, government guarantees and other transitional regulatory arrangements.[2]

Chart 2

Leverage ratio of significant institutions

Source: ECB.

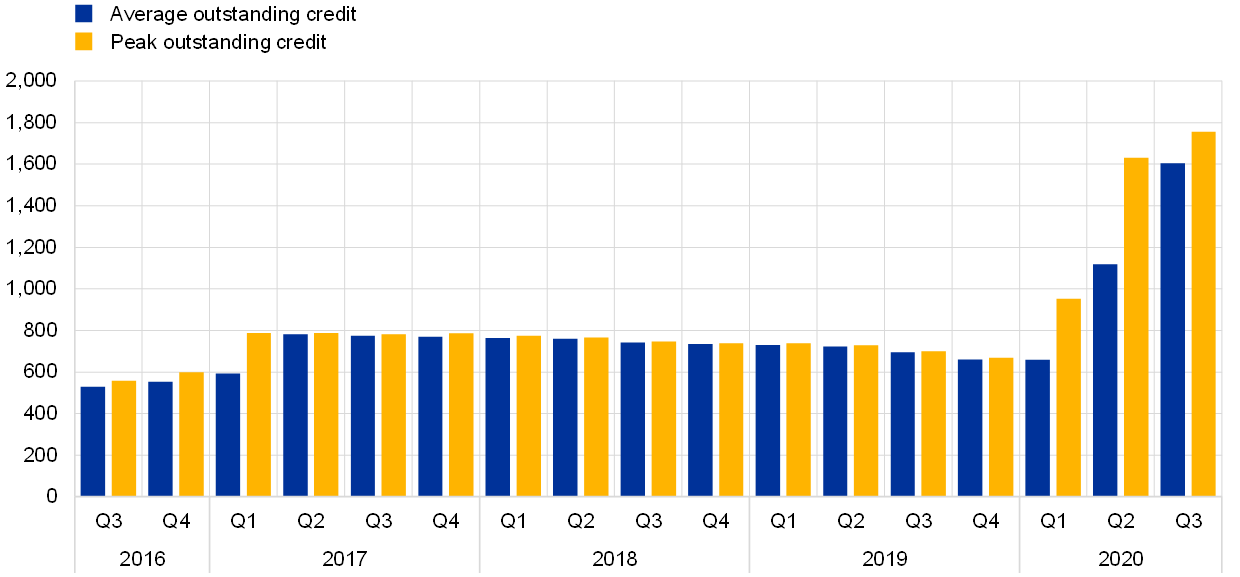

Euro area banks started the year with comfortable liquidity buffers. However, in March, severe pressure from the COVID‑19 shock started to materialise.

Euro area banks started the year with larger liquidity buffers compared with the start of the great financial crisis, as a result of the Basel III reforms. However, in the course of March 2020, severe pressure from the COVID-19 shock started to materialise. On the demand side, corporate customers from sectors affected by the crisis requested significant funding support from the banking sector by drawing down their existing committed credit lines. In addition, major volatility spikes in most financial markets triggered margin calls from central clearing counterparties, while money market funds faced unprecedented outflows and required some internationally active banks to buy back their outstanding commercial paper.

On the supply side, banks’ liquidity was constrained as well. Key funding markets dried up during March, preventing banks from issuing paper on the unsecured segment of the market, regardless of the maturity, while they were able to raise funds on the secured segment (repo) only for very short maturities. Against this background, offshore US dollar funding markets became particularly expensive when available, which further exacerbated banks’ reliance on internal liquidity buffers and on additional credit from the ECB.

As part of its response to the COVID-19 crisis, ECB Banking Supervision also allowed banks to make use of their regulatory liquidity buffer, operating temporarily below the liquidity coverage ratio (LCR) requirement.[3] In parallel, a highly accommodative monetary policy stance, including an easing of collateral eligibility rules, ensured broad access to central bank funding for banks under European banking supervision. The average outstanding credit provided by the Eurosystem increased from €659 billion in the fourth quarter of 2019 to €1,605 billion in the third quarter of 2020 (Chart 3).

Chart 3

Evolution of Eurosystem outstanding credit

(EUR billions)

Source: ECB.

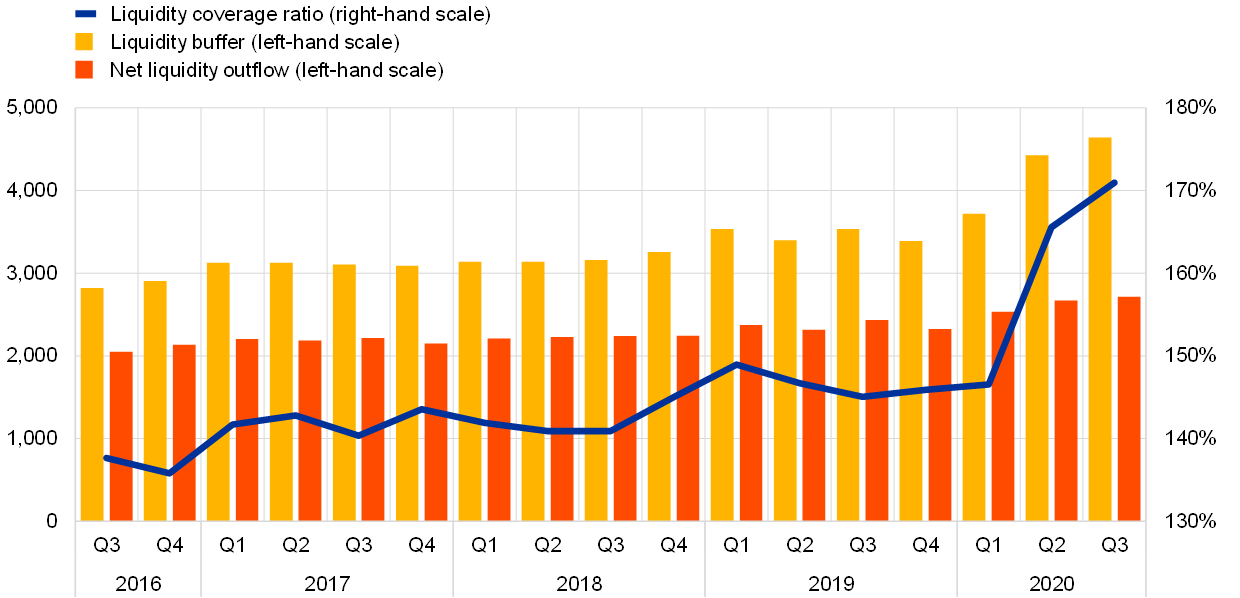

As a result of a strong and concerted policy response, market strains gradually eased in the second quarter of the year. As of April 2020, banks’ funding conditions started to improve. Some banks were again able to issue unsecured instruments, including on the subordinated segment of the market, although at higher yields with respect to pre-crisis levels; at the same time, an increase in customers’ deposits, largely driven by precautionary savings from households, provided extra liquidity buffers across the board. Overall, significant institutions (SIs) increased their liquidity buffers, as illustrated by an average LCR ratio of 170.94% in the third quarter of 2020, up from 145.91% in the fourth quarter of 2019.

Chart 4

Evolution of liquidity buffer and net liquidity outflows and LCR

(left-hand scale: EUR billions; right-hand scale: percentages)

Source: ECB.

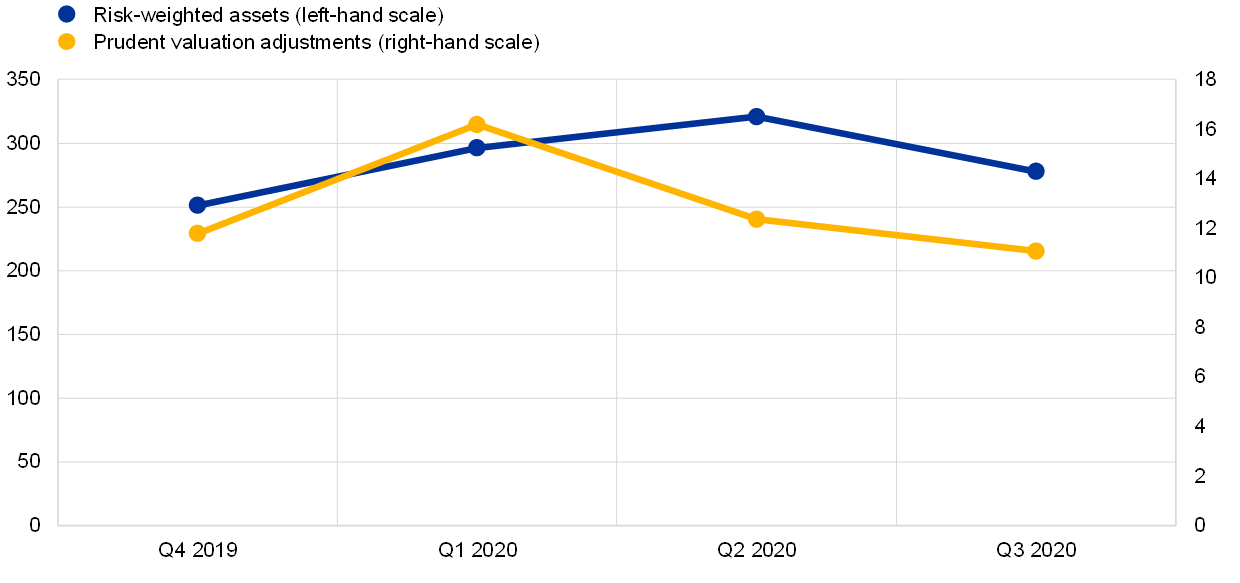

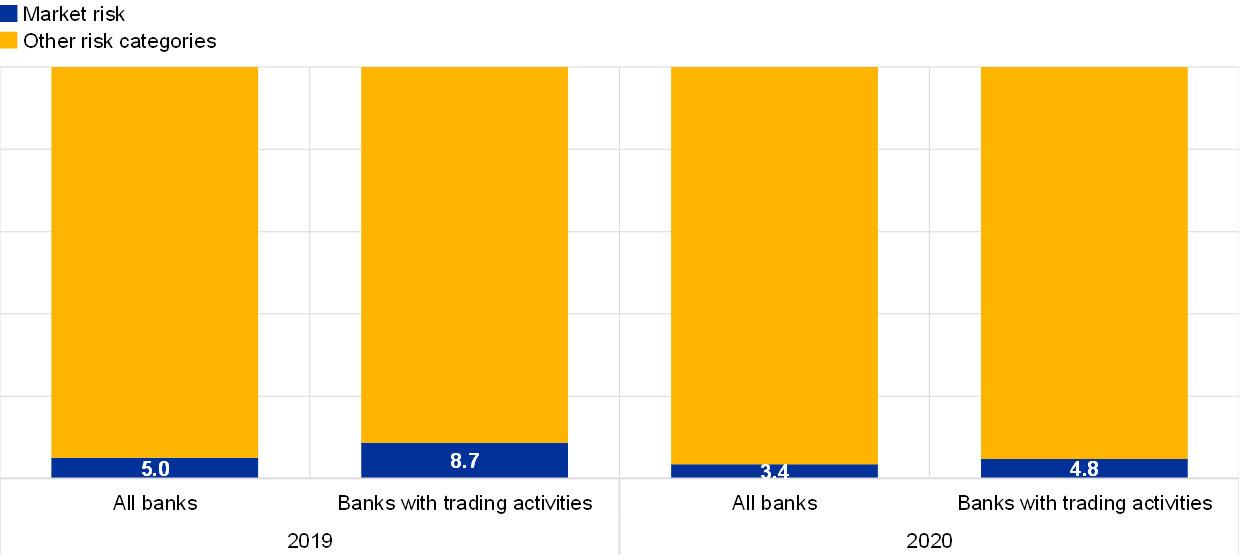

The collapse of stock prices in March had a negative impact on banks’ market risk positions

The outbreak of the COVID-19 pandemic in Europe and the United States led to a collapse in stock prices, a surge in volatility and a generalised widening of sovereign and corporate credit spreads throughout March. This had a negative impact not only on banks’ balance sheets, but also on their capital requirements for market risk based on internal models as well as their prudent valuation adjustments (especially for market price uncertainty and model risk), which are correlated with recent volatility. In response to the shock, supervisory relief measures were taken to limit the procyclical effects of the crisis on capital requirements for market risk and valuation adjustments (e.g. exclusion of certain instances of overshooting in the back-testing of internal models, increase in diversification benefits for prudent valuation adjustments). Additional relief came when market conditions improved in the second and third quarters.

Chart 5

Evolution of risk-weighted assets and prudent valuation adjustments for market risk

(EUR billions)

Source: ECB.

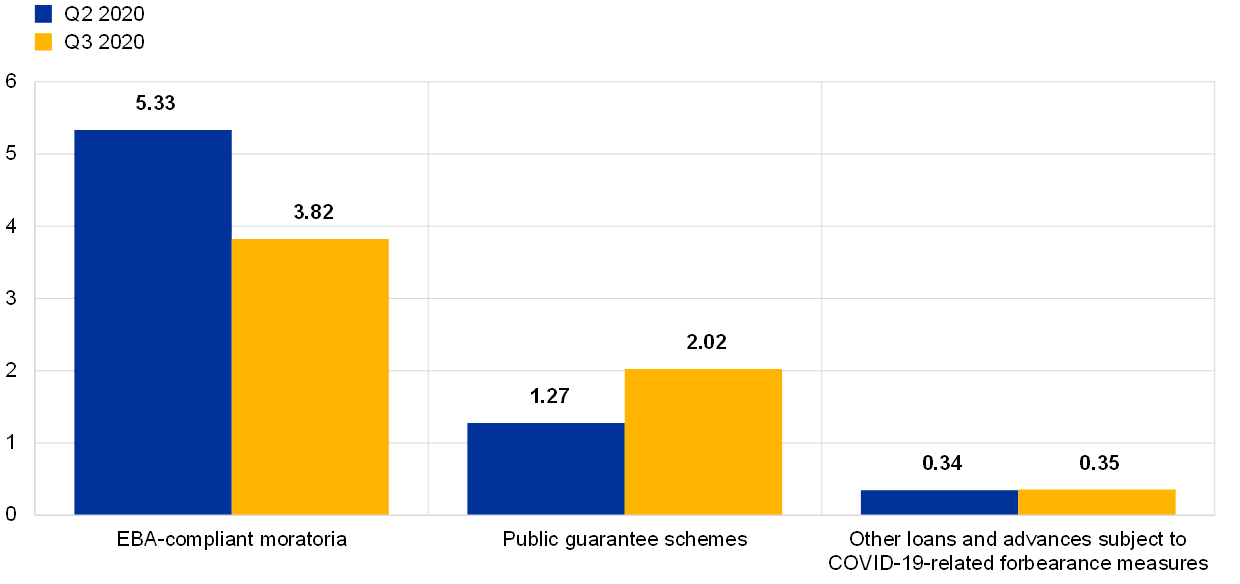

Overall, the capital and liquidity measures put in place, in combination with the extraordinary public support measures adopted by the authorities in the early stages of the COVID-19 pandemic, allowed banks to smooth out credit risk developments and continue to provide funding to the real economy. Loans and advances to households and non-financial corporations (NFCs) remained broadly stable from the outbreak of the COVID-19 pandemic onwards (-1.3% for NFCs and +0.8% for households from March to September 2020). Public guarantees were particularly relevant to the provision of funding to NFCs (€260 billion as at September 2020).

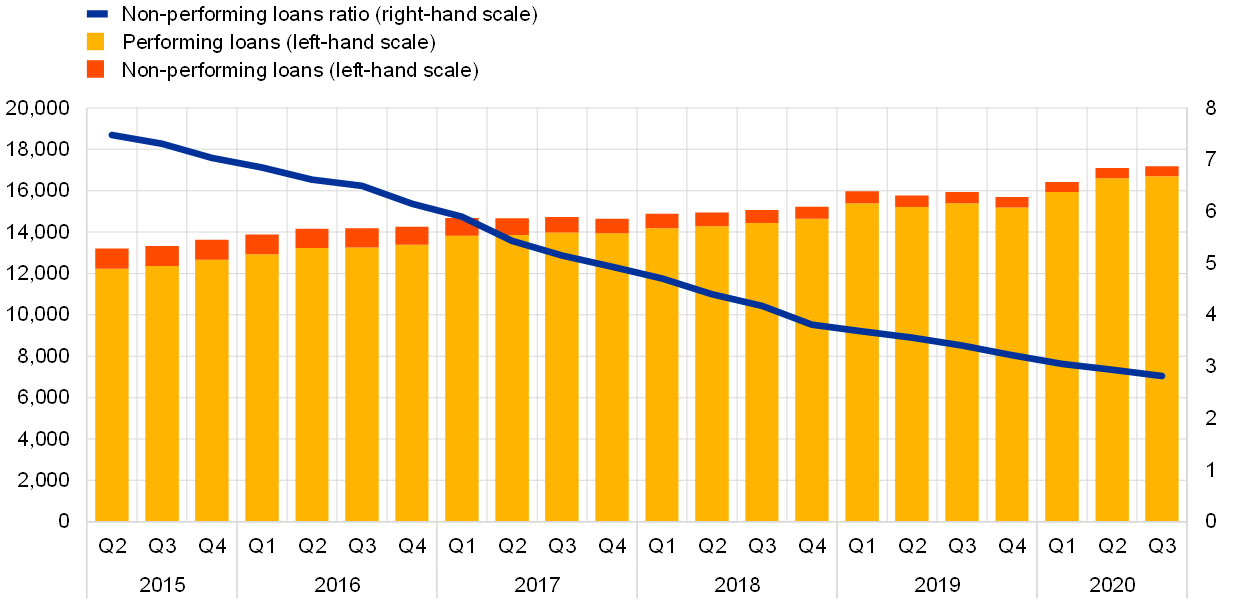

The extraordinary measures put in place to ease financing conditions and support households, small businesses and corporates also contributed to keeping the overall amount of non-performing loans (NPLs) on banks’ balance sheets broadly stable throughout the year. However, NPLs are expected to increase in the future as support measures expire. In this context, ECB Banking Supervision highlighted, in its July and December communications[4], that it is key for banks to provide appropriate solutions to viable distressed debtors in a timely manner, and thus help contain the build-up of problem assets at banks and minimise cliff effects where possible. To this end, banks should ensure that risk is adequately assessed, classified and measured on their balance sheets. They should have effective risk management practices in place to identify, assess and implement solutions which can best support these debtors while protecting banks against any negative credit risk effects. At the same time, banks should continue to effectively manage the stock of NPLs that already existed prior to the outbreak of the pandemic.

Chart 6

Evolution of SIs’ NPLs (total loans)

(left-hand scale: EUR billions; right-hand scale: percentages)

Source: ECB.

Chart 7

Loans subject to support measures as share of total loans

Source: ECB.

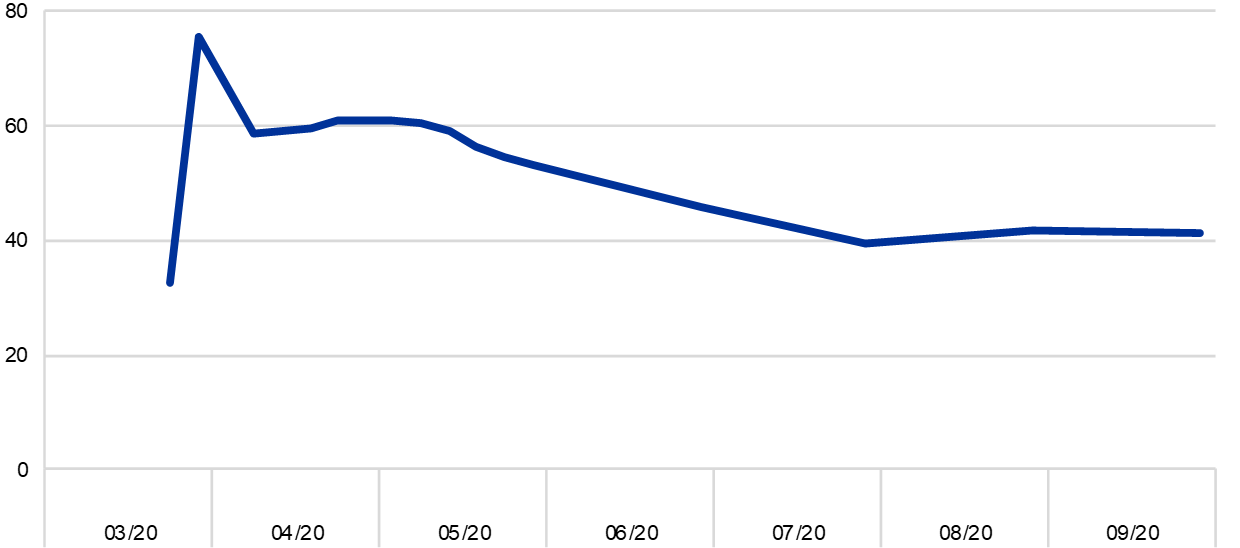

Operational risks have increased since the outbreak of the COVID-19 pandemic. However, no major operational or IT-related incidents were reported by supervised banks in 2020.

Operational risks have increased since the outbreak of the COVID-19 pandemic, reflecting the changes in banks’ operating models and additional complexities stemming from the implementation of government relief programmes. Notwithstanding this, no major operational or IT-related incidents were reported by supervised banks in 2020. Although there was an increase in the number of cyberattack attempts, in particular distributed denial of service (DDoS) and phishing attacks on banking customers facilitated by the pandemic, this had a very limited impact on the availability of ICT systems and on the amount of losses caused by these attacks.[5] At the early stages of the pandemic, SIs activated their business continuity plans, with the percentage of staff teleworking increasing notably (Chart 8). During the summer, banks started to move towards “new normal” governance arrangements, including a gradual return to the office; the renewed rise in infection rates that began in the autumn, however, reversed this trend, with many banks making remote working the preferred or mandatory solution again.

Chart 8

Remote working at SIs

(percentage of workforce working remotely)

Source: ECB.

Note: A consistent sample of SIs which reported all data points in the period considered was used.

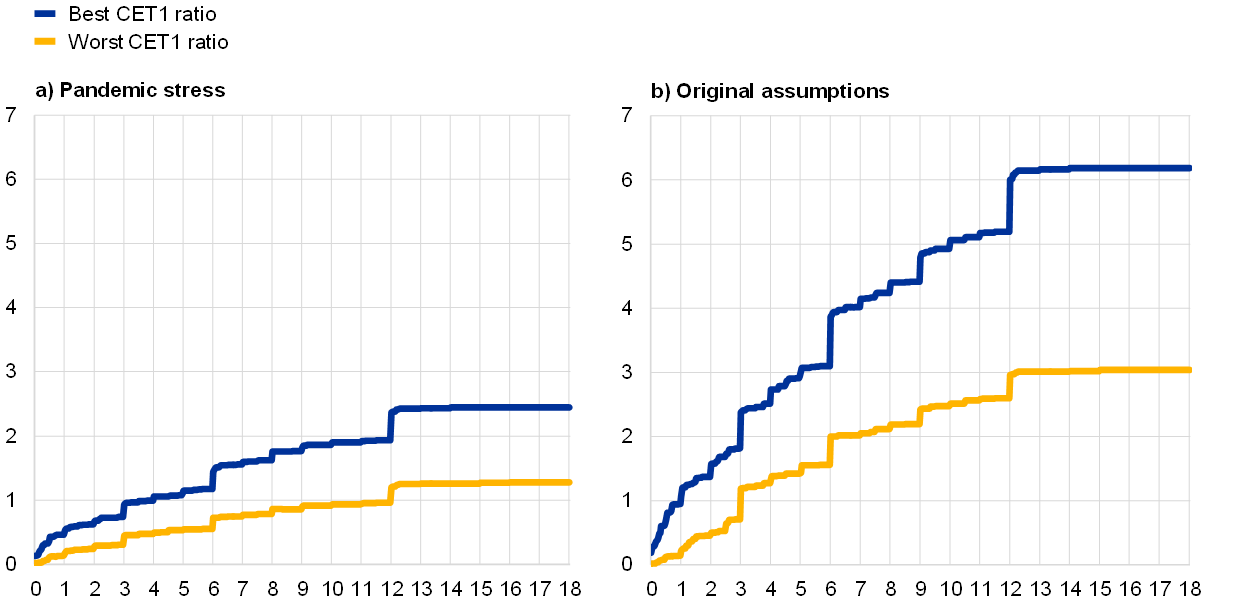

In 2020 ECB Banking Supervision conducted a vulnerability analysis (VA) of 86 SIs to estimate the impact that the COVID-19 crisis may have on the euro area banking sector. The aggregate results were published on 28 July 2020.[6] In the same way, an assessment of the credit and liquidity risk vulnerabilities that could be driven by a worsening of the economic situation has been performed for the less significant institutions (LSIs) sector.[7]

The results of this exercise showed that the euro area banking sector can broadly withstand the pandemic-induced stress. But there is still material uncertainty about the extent to which asset quality will deteriorate once the moratorium measures are lifted, particularly within the most affected economic sectors. This uncertainty around the trajectory of asset quality is reflected in the different provisioning policies adopted by banks and remains a matter of supervisory concern.

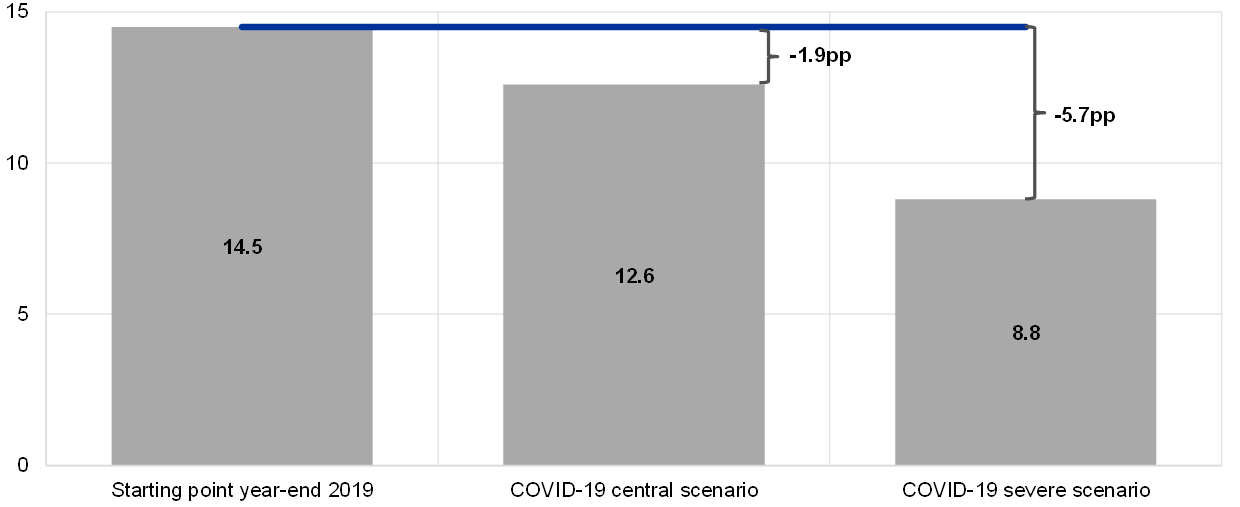

The VA tested two pandemic-related scenarios that included, to a large extent, the impact of the monetary, supervisory and fiscal relief measures taken in response to the COVID-19 crisis. In the central scenario – the one most likely to materialise according to Eurosystem staff – SIs’ average CET1 ratio dropped from 14.5% to 12.6%, confirming that banks under European banking supervision are currently sufficiently capitalised to withstand a short-lived deep recession. The existing capital buffers would broadly enable the sector to withstand also the impact of the severe scenario which assumed a deeper recession and a slower economic recovery, reducing the banks’ average CET1 ratio from 14.5% to 8.8%. Nevertheless, in this scenario some banks would need to take action to continue to meet their minimum capital requirements.

The outcome for the two scenarios confirmed that euro area banks entered the COVID-19 crisis with significantly higher capital levels and far greater resilience to withstand unexpected financial stress than was the case at the time of the great financial crisis. The results of the VA fed into the Supervisory Review and Evaluation Process (SREP) in a qualitative manner in order to help supervisors to challenge banks’ capital projections, foster consistency in the assessment of risks and promote prudent provisioning policies.[8]

Chart 9

2022 transitional CET1 ratio projections across scenarios

(percentages)

1.1.2 General performance of euro area banks

The pandemic had a negative impact on the profitability of SIs in 2020, mainly owing to a surge in impairments and provisions

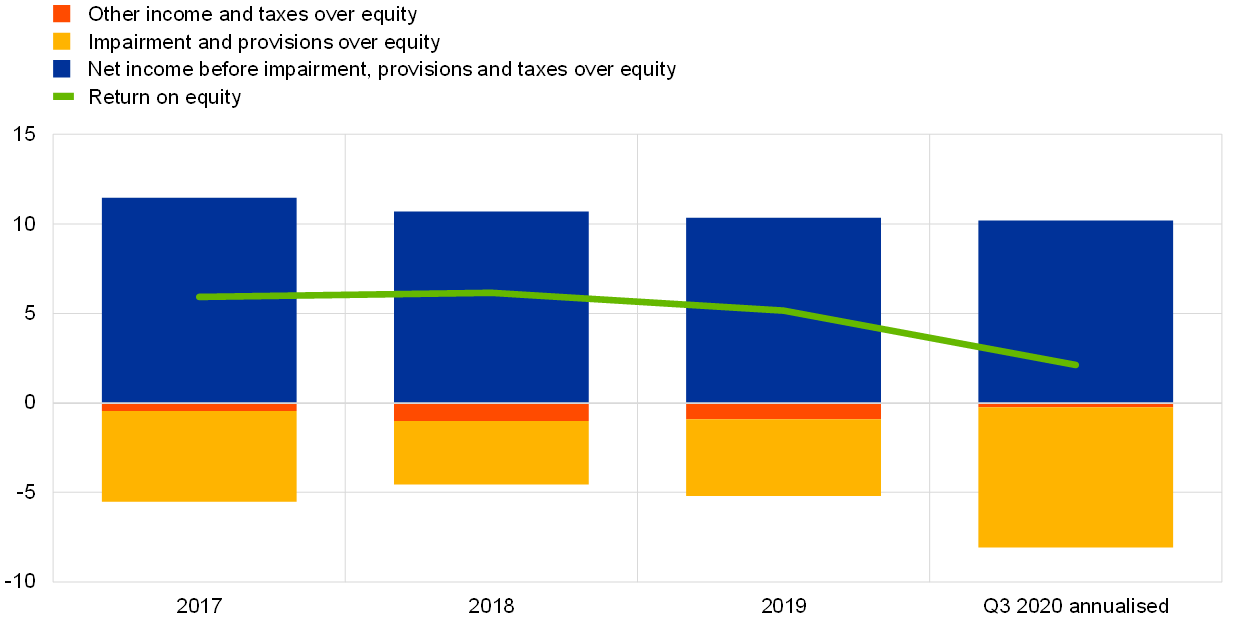

In 2020 the profitability of euro area SIs declined substantially as a result of the COVID-19 pandemic, with the aggregate annualised return on equity standing below banks’ self-reported cost of equity and decreasing to 2.1% in the first three quarters of 2020[9], from 5.2% at the end of 2019 (Chart 10). The decline in profitability was also reflected in a further drop in banks’ price-to-book ratios, which hit a new low median value of 0.3 in April 2020, making it hard for SIs to tap equity markets without significantly diluting existing shareholders.

Chart 10

SIs’ aggregate return on equity broken down by income/expense source

(percentage of equity)

Source: SSM Supervisory Statistics, for the unbalanced sample of all SIs.

The increase in loan loss impairments resulting from the deterioration of the macroeconomic environment was the main driver of the decrease in profitability. This was not accompanied by a rise in NPLs, but merely reflected the increased credit risk of many exposures. Large one-off impairment of goodwill and deferred tax assets in certain SIs accentuated the reduction in aggregate profitability.

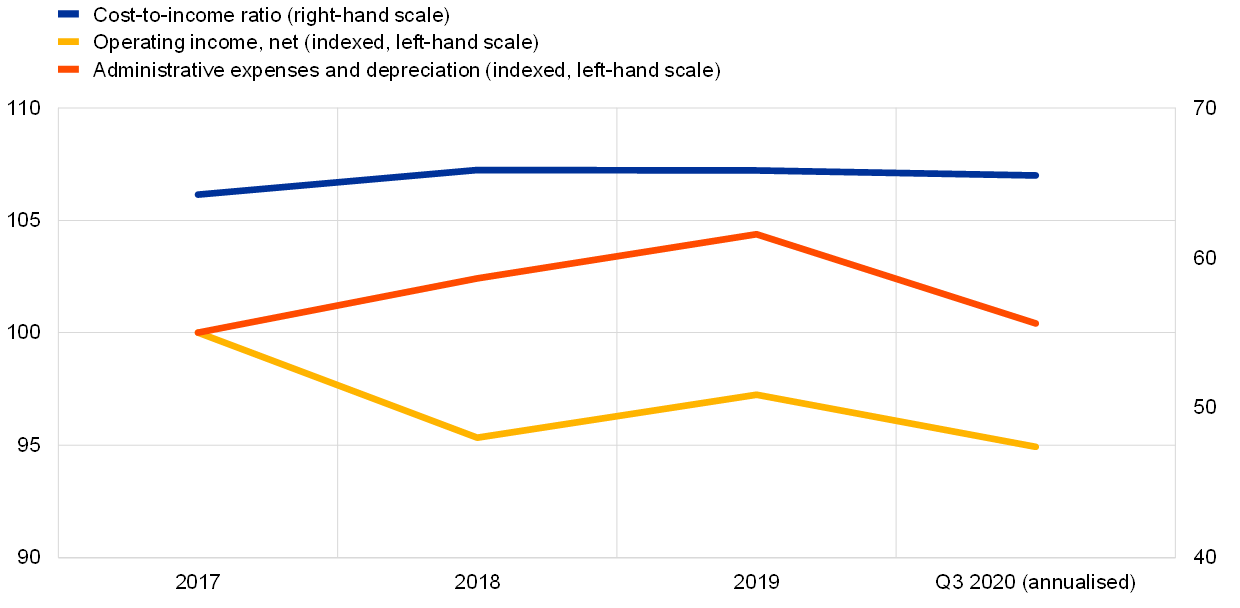

Chart 11

SIs’ cost-to-income ratios and indexed components

(percentages)

Source: SSM Supervisory Statistics, for the unbalanced sample of all SIs.

In 2020 banks’ aggregate cost-to-income ratio remained unchanged from the high level of the previous years (Chart 11). Declines on the income side were partly offset by cost reductions, so that operating income before impairment, provisions and taxes remained rather stable. On a positive note, the crisis allowed banks to increase the pace of digitalisation, which could lead to more efficient cost structures in the medium term.

To preserve operational continuity and competitiveness in the face of COVID-19 developments, SIs expanded their digital outreach to clients and increased their range of services, including online advisory services and more contactless payments. This digitalisation push, which aimed to respond to customer demand, facilitated cost reduction. Cost reductions were also a result of branch closures, reduced travel expenses and other temporary factors. Despite the increase in lending and historically low funding rates offered by the recent targeted longer-term refinancing operations, SIs’ net interest income declined further in 2020. Net fee and commission income also decreased across most of the fee-generating activities.

The profitability of LSIs in 2020 was also negatively affected by the increased level of impairments

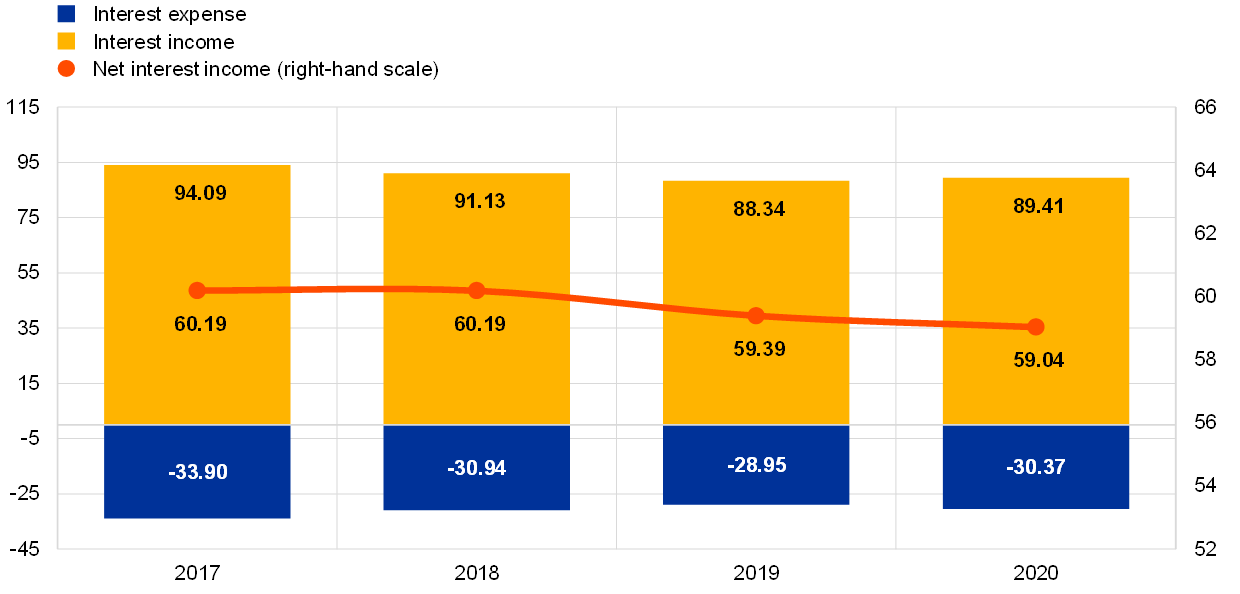

In the same way as it did for SIs, the profitability of LSIs declined in 2020 mainly owing to increased impairments and provisions as a result of deteriorated macroeconomic conditions. The average return on equity for LSIs in June 2020 was 3.5%, down from 5.1% at the end of 2019. Interest revenues, which represent the largest income component for LSIs, remained relatively stable in the first half of 2020 with respect to the previous year (Chart 12). However, net interest income decreased slightly, owing to an increase in interest expenses. Finally, LSIs’ cost of risk, measured as the ratio of financial impairments to pre-provision profits, increased sharply from 12.4% at end-2019 to 22.4% in June 2020.

Chart 12

Evolution of LSIs’ interest income, interest expenses and net interest income

(EUR billions)

Source: ECB supervisory banking statistics.

Notes: The chart is based on a changing sample of LSIs. Data for the second quarter of 2020 are annualised using a four‑quarter trailing method.

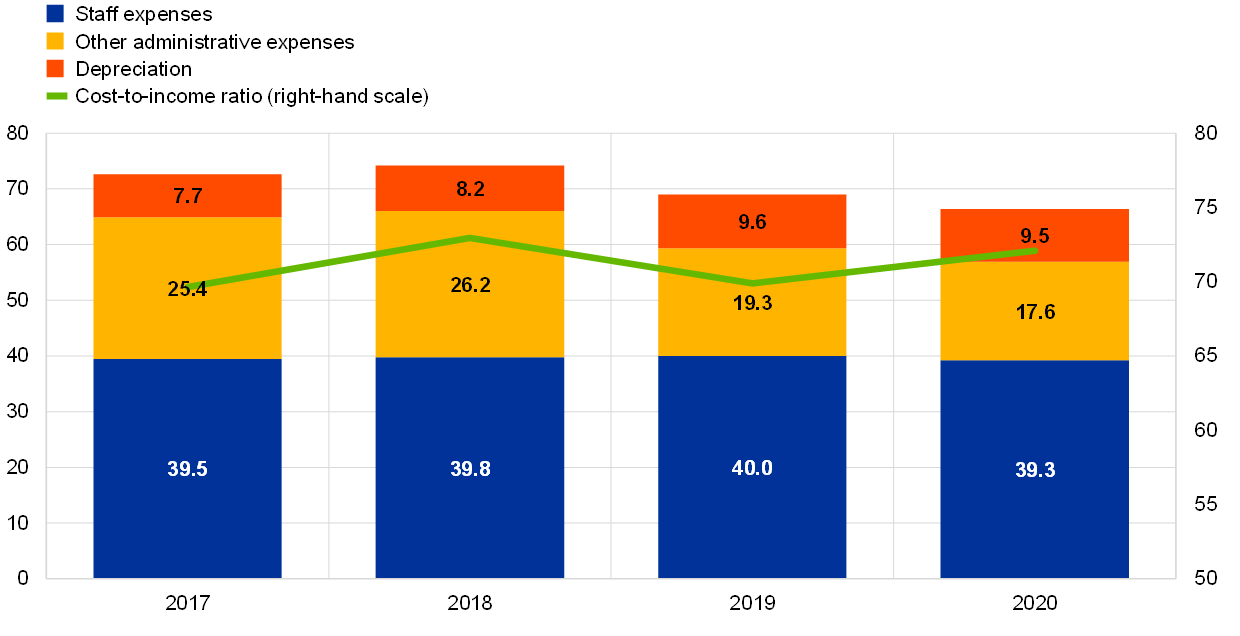

On the cost side, LSIs continued their efforts to reduce overall expenditure mainly by minimising their administrative expenses (Chart 13). The cost-to-income ratio of LSIs at the end of June 2020 was 72%, slightly higher than it was at the end of 2019 (70%). The gross NPL ratio of the LSI sector increased slightly, to 2.1%, as of the second quarter of 2020, up by 20 basis points from December 2019.

Chart 13

Overview of LSIs’ costs

(left-hand scale: EUR billions; right-hand scale: percentages)

Source: ECB supervisory banking statistics.

Notes: The chart is based on a changing sample of LSIs. Data for the second quarter of 2020 are annualised using a four‑quarter trailing method.

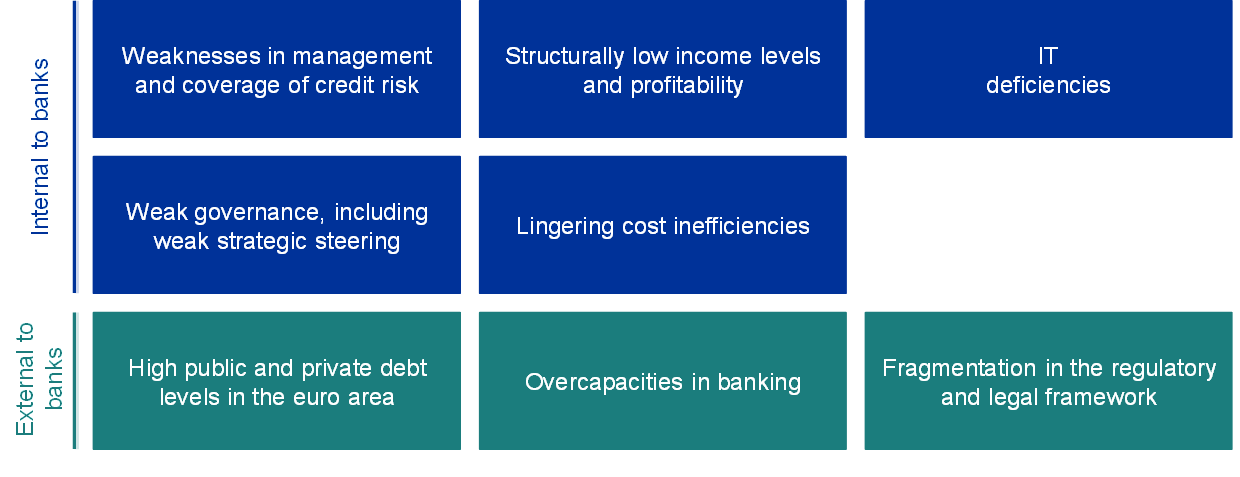

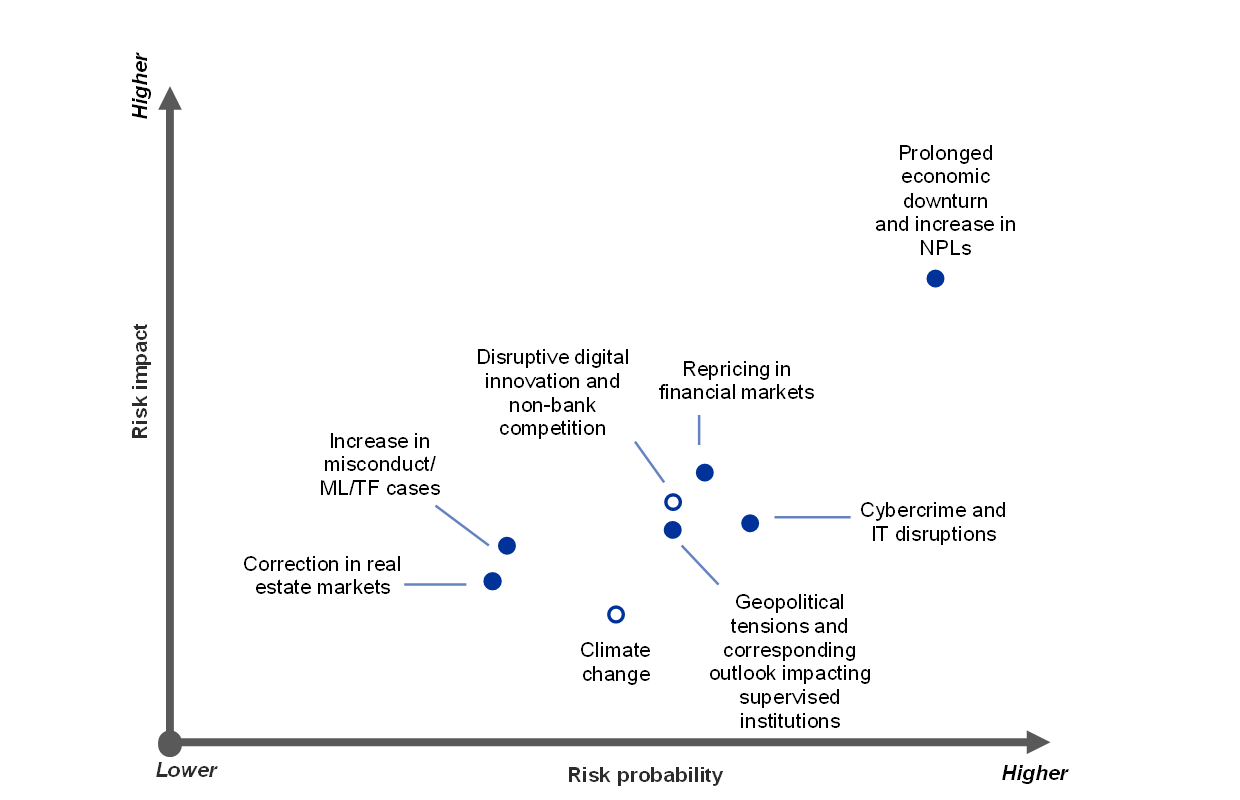

1.1.3 Main risks in the banking sector

In close cooperation with the national competent authorities (NCAs), every year ECB Banking Supervision identifies the key risks for banks in the short and medium term (over a horizon of two to three years). The 2019 exercise had originally identified the following key risk drivers for the years 2020 and beyond: (i) business model sustainability, (ii) cybercrime and IT deficiencies, and (iii) resurfacing economic, political and debt sustainability challenges in the euro area. Other risk drivers identified included the execution risk attached to banks’ strategies for NPLs, misconduct, money laundering and terrorism financing, Brexit, and climate change.

The structural weaknesses in banks’ profitability were aggravated by the pandemic-related downturn in 2020

The COVID-19 pandemic required ECB Banking Supervision to shift its supervisory focus onto the more pressing challenges stemming from the crisis and to take ad hoc measures to strengthen banks’ ability to operate in a new environment.[10] But beyond the immediate burden created by the highly uncertain economic outlook, the COVID‑19 crisis ultimately exacerbated what had already been identified as the most prominent risks to the euro area banking sector even before the outbreak of the pandemic.

The low profitability of euro area banks and the sustainability of their business models had also been a supervisory concern in past years, mainly owing to many SIs’ rigid cost structures and general difficulties in generating adequate profit margins in the context of the prolonged low interest rate environment and excess capacity in the European banking sector. The economic downturn caused by COVID‑19 pressured banks’ profitability further, owing to an increase in impairments and provisions, thus increasing the urgency for them to address structural weaknesses and accelerate the future-proofing of their business models.

The deterioration of asset quality in banks’ balance sheets is a concern as the COVID-19 crisis progresses

The still high aggregate level of NPLs in the euro area at the end of 2019 was also a matter for supervisory concern going into 2020. In this context, the COVID-19 crisis heightened the risk of further build-up of NPLs in the future, reflecting the negative effect of the pandemic on the solvency of bank borrowers.

At the start of European banking supervision, the ECB identified the need for improvements to the governance frameworks of euro area banks, and this was still the case at the end of 2019. The functioning of banks’ boards and their organisational frameworks, internal control functions, data aggregation capabilities and the quality of their data were among the areas in which shortcomings had been identified and were therefore areas of supervisory focus.

The COVID-19 crisis exacerbated weaknesses in several governance and risk management areas, most of which had been identified before the outbreak of the pandemic

The COVID-19 crisis provided further evidence of these weaknesses, namely: (i) shortcomings in reporting and data aggregation, potentially hampering banks’ decision-making processes; (ii) low involvement of the management body in its supervisory function in strategic decisions in the areas seriously affected by the crisis, such as credit risk and capital planning, and insufficient scrutiny of those decisions; (iii) insufficient proactivity of the control functions, especially risk management and compliance, in coping with the crisis, with some banks continuing to be understaffed and lacking adequate IT tools and processes to identify, measure and monitor risks.

The market turmoil observed in the first quarter of the year also exposed the market risks that banks are more susceptible to, and which prove challenging to quantify and manage, especially in times of high volatility. Losses incurred in the trading book were often a result of downward adjustments in the valuation of derivative positions, especially credit valuation adjustments and funding valuation adjustments, and an increase in basis risk embedded in arbitrage trades, such as equity arbitrage transactions. Furthermore, falling equity prices and widening credit spreads had a material impact on instruments in the banking book accounted for at fair value, while low interest rates had a negative impact not only on the profitability of the core business, but also on the quantification of pension liabilities.

Box 1

Measures taken by ECB Banking Supervision to address the COVID-19 pandemic

Since 12 March the ECB has taken a series of supervisory and operational relief measures to preserve financial stability while ensuring that banks continue to fulfil their role in funding the real economy.

Since the outbreak of the COVID-19 pandemic, ECB Banking Supervision has adopted comprehensive measures aimed at providing temporary capital and operational relief for banks in participating countries. On 12 March it decided to allow banks to operate temporarily below the level of capital defined by the Pillar 2 guidance (P2G) and the combined buffer requirement, as well as the level of liquidity defined by the liquidity coverage ratio (LCR). These temporary measures were complemented by the appropriate relaxation of the countercyclical capital buffer (CCyB) by the national macroprudential authorities. Banks were also allowed to use capital instruments that did not qualify as Common Equity Tier 1 (CET1), such as Additional Tier 1 (AT1) or Tier 2 (T2) instruments, to meet part of their Pillar 2 requirements (P2R). This brought forward the change in the capital composition of banks’ P2R that was initially scheduled to come into effect only in January 2021, as part of the latest revision of the Capital Requirements Directive (CRD V). In addition, the ECB informed banks about the measures they could take to increase operational flexibility in the implementation of their bank-specific supervisory measures. The ECB also fully supported the decision of the European Banking Authority (EBA) to postpone the EU-wide stress test by one year and extended the postponement to all banks subject to the 2020 stress test.

To ensure that banks in the banking union were able to continue to fulfil their role in funding households and corporations amid the COVID-19 shock, on 20 and 27 March ECB Banking Supervision provided further details on the operationalisation of the measures announced on 12 March and announced additional measures, such as providing further flexibility in the prudential treatment of loans backed by public support measures and offering guidance to banks on how to avoid excessive procyclical effects when applying the IFRS 9 accounting standards. In exercising flexibility, the ECB sought to balance the need to help banks absorb the impact of the current downturn on the one hand, and the need to maintain correct risk identification practices and risk management incentives on the other, as well as ensuring that only sustainable solutions for viable distressed debtors were deployed.

In response to the extraordinary levels of volatility recorded in the financial markets, on 16 April the ECB also provided clarifications on how banks could avoid an unwarranted increase in capital requirements for market risk by temporarily adjusting the supervisory component of those requirements. As well as smoothing procyclicality, this measure aimed to maintain banks' ability to provide market liquidity and to continue market-making activities. The amendment to the Capital Requirements Regulation[11] (CRR II “quick fix”) published on 26 June 2020 introduced, inter alia, additional flexibility for the competent authorities to address the extreme market volatility observed during the COVID-19 pandemic by enabling the ECB to allow banks to exclude any market risk internal model overshootings occurring between 1 January 2020 and 31 December 2021 that do not result from deficiencies in internal models.

To facilitate the implementation of monetary policies in exceptional circumstances, the CRR II “quick fix” also granted the competent authorities the discretion to temporarily allow the exclusion of certain central bank exposures from the leverage ratio total exposure measure, after consulting the relevant central bank. On 17 September the ECB exercised this discretion and announced that banks under its direct supervision were allowed to exclude certain central bank exposures from the leverage ratio total exposure measure until 27 June 2021. This decision followed the determination by the Governing Council that there were exceptional circumstances due to the COVID-19 pandemic.

Through the summer of 2020, the ECB continued to encourage banks to use their capital and liquidity buffers for lending purposes and loss absorption. In its communication in July the ECB stressed that it would not require banks to start replenishing their capital buffers before the peak in capital depletion was reached. Specifically, the ECB committed to allowing banks to operate below the P2G and the combined buffer requirement until at least end-2022, and below the LCR until at least end-2021, without automatically triggering supervisory actions. It clarified that the exact timeline would be decided on following the 2021 EU-wide stress test, and, as in every supervisory cycle, on a case-by-case basis according to the individual situation of each bank.

As the euro area banking sector had shown sufficient operational resilience throughout the spring and early summer of 2020, in July 2020 the ECB decided not to extend the six-month operational relief measures it had granted to banks in March 2020, with the exception of the submission of NPL reduction strategies for high-NPL banks. These banks were nevertheless expected to continue to actively manage their NPLs. The ECB also resumed the follow-up with banks on remedial actions following earlier SREP decisions, on-site inspections and internal model investigations. It also resumed the issuance of decisions following the targeted review of internal models (TRIM), on-site follow-up letters and internal model decisions and sent letters to banks communicating its expectations that they should have in place effective management practices and sufficient operational capacity to deal with the expected increase in distressed exposures.[12]

At the end of 2020 the ECB continued to closely monitor the COVID-19 crisis and its implications for the banking sector, in close contact with other authorities and supervised banks, standing ready to use the flexibility within its supervisory toolkit to take further action where necessary.

Recommendations on dividends

Alongside the capital relief measures taken in March, ECB Banking Supervision took steps to ensure that banks conserved capital in the light of the extraordinary uncertainty caused by the COVID-19 pandemic. On 27 March the ECB issued a Recommendation to banks on dividend distributions. To boost banks’ capacity to absorb losses and support lending to households, small businesses and corporates, banks were recommended not to pay dividends for the financial years 2019 and 2020 until at least 1 October 2020, and to refrain from share buy-backs aimed at remunerating shareholders. This was to give banks additional capacity to lend or absorb losses at a time when it was particularly needed.

On 28 July the ECB extended its Recommendation on dividend distributions until 1 January 2021, while stressing that the measures remained temporary and exceptional and were aimed at preserving banks’ capacity to absorb losses and support the economy in an environment of exceptional uncertainty. As demonstrated by the vulnerability analysis, the level of capital in the system could decline significantly if a severe scenario were to materialise. The ECB also issued a letter to banks asking them to be extremely moderate with regard to variable remuneration payments, for example by reducing the overall amount of variable pay. Where this was not possible, banks were recommended to defer a larger part of the variable remuneration and consider payments in instruments, such as own shares. As usual, the ECB continued to assess banks’ remuneration policies as part of its SREP, in particular the impact that such policies might have on banks’ ability to maintain a sound capital base. The ECB’s approach to dividends and remuneration was aligned with the related European Systemic Risk Board (ESRB) Recommendation.

Ample capital buffers remained available as of the third quarter of 2020, partly thanks to the various capital relief measures taken by the ECB and macroprudential authorities. Aggregate capital headroom increased from 2.8% to 5.3% as of the third quarter of 2020, with P2G relief contributing 1.1%, P2R frontloading adding 0.5% and dividend restrictions, IFRS 9 transitional arrangements and macroprudential buffer relief providing 0.3% each according to estimates.

The ECB reviewed its stance on dividends and remuneration in the fourth quarter of 2020. On 15 December 2020 it issued a revised Recommendation that called on banks to exercise extreme prudence on dividends and share buy-backs. To this end, the ECB asked all banks to consider not distributing any cash dividends or conducting share buy-backs, or to limit such distributions, until 30 September 2021. Given the persisting uncertainty over the economic impact of the COVID-19 pandemic, the ECB expects dividends and share buy-backs to remain below 15% of the cumulated profit for 2019-20 and not higher than 20 basis points of the CET1 ratio, whichever is lower. The ECB communicated its expectation that only profitable banks with robust capital trajectories should consider paying dividends or buying back shares, and that banks considering such distributions should contact their Joint Supervisory Team (JST) to discuss whether the level of intended distribution would be prudent. The ECB also reiterated its position on variable remuneration in a further letter to banks. The recommendation reflected an assessment of the stability of the financial system and was made in close cooperation with the ESRB.

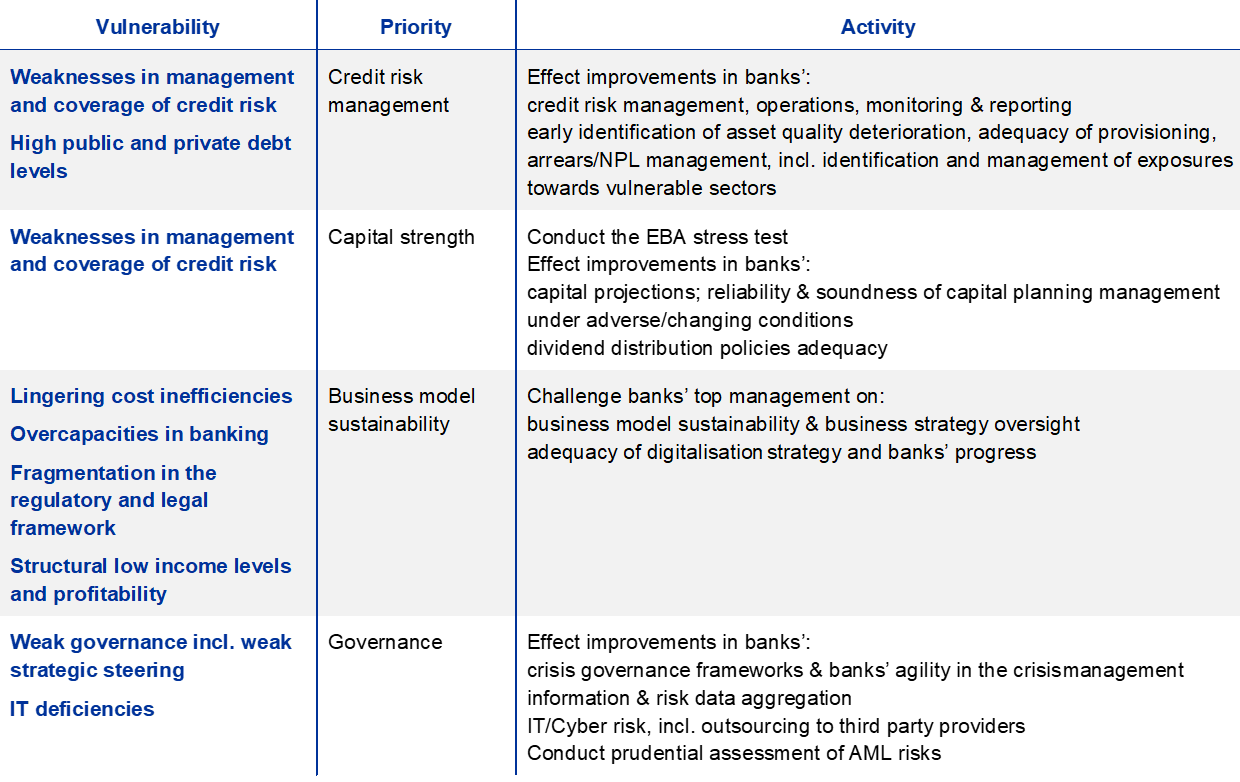

1.2 Supervisory priorities and projects in 2020

1.2.1 Supervisory priorities for 2020 and the pragmatic approach to the SREP

In 2020 the COVID-19 outbreak prompted the ECB to review its supervisory priorities, processes and activities, so as to support banks’ ability to serve the economy while addressing the operational challenges triggered by the pandemic. In this context, JSTs reprioritised their actions and shifted their focus towards banks’ ability to cope with the impact of the pandemic.

Against this background, supervisors engaged proactively with banks in order to discuss individual measures such as adjusting timetables, processes and deadlines for on-site inspections and internal model investigations. In addition, supervisors extended the deadlines for certain non-critical supervisory measures and data requests.

In the same vein, ECB Banking Supervision took a pragmatic approach to implementing its annual core activity – the Supervisory Review and Evaluation Process (SREP) – in line with the EBA Guidelines[13].

In 2020 the COVID-19 outbreak prompted the ECB to review its supervisory priorities, processes and activities. ECB Banking Supervision took a pragmatic approach to implementing its annual core activity, the SREP.

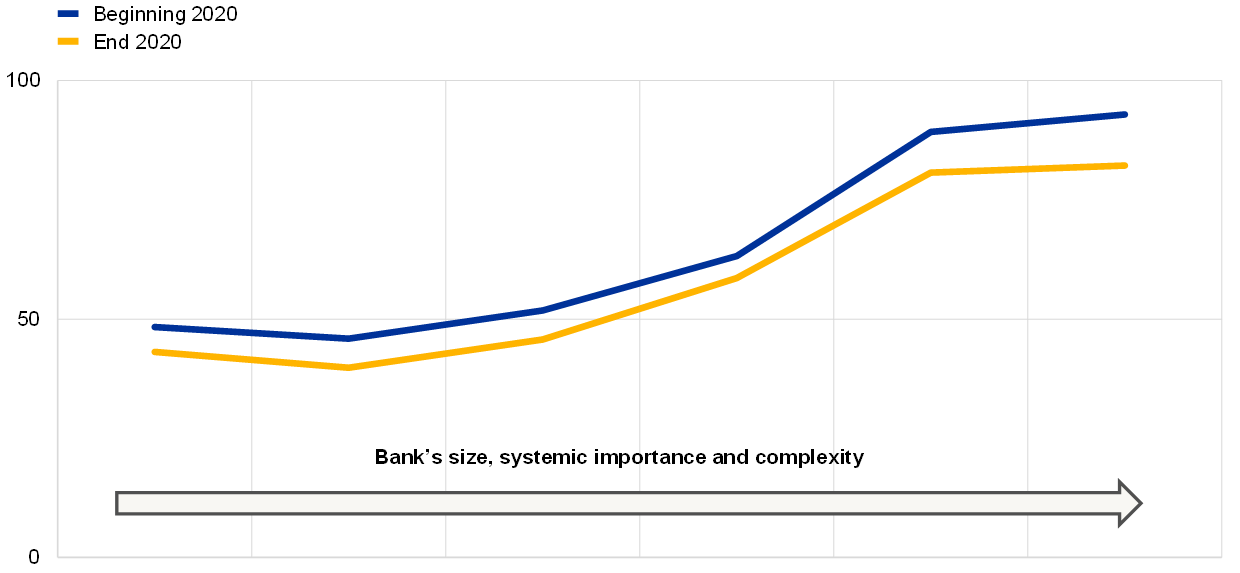

Under the 2020 pragmatic approach to the SREP, the ECB focused on banks’ ability to handle the challenges and risks to capital and liquidity arising from the ongoing crisis. As a general rule, the ECB decided to keep the capital add-ons (P2R and P2G) unchanged and not to update SREP scores, unless changes were justified by exceptional circumstances affecting an individual bank. Moreover, the ECB decided to address supervisory concerns via qualitative recommendations. In addition, the results of the ECB’s vulnerability analysis were used by JSTs to identify new vulnerabilities and to challenge banks’ financial and capital projections and were subsequently incorporated into the SREP assessments.

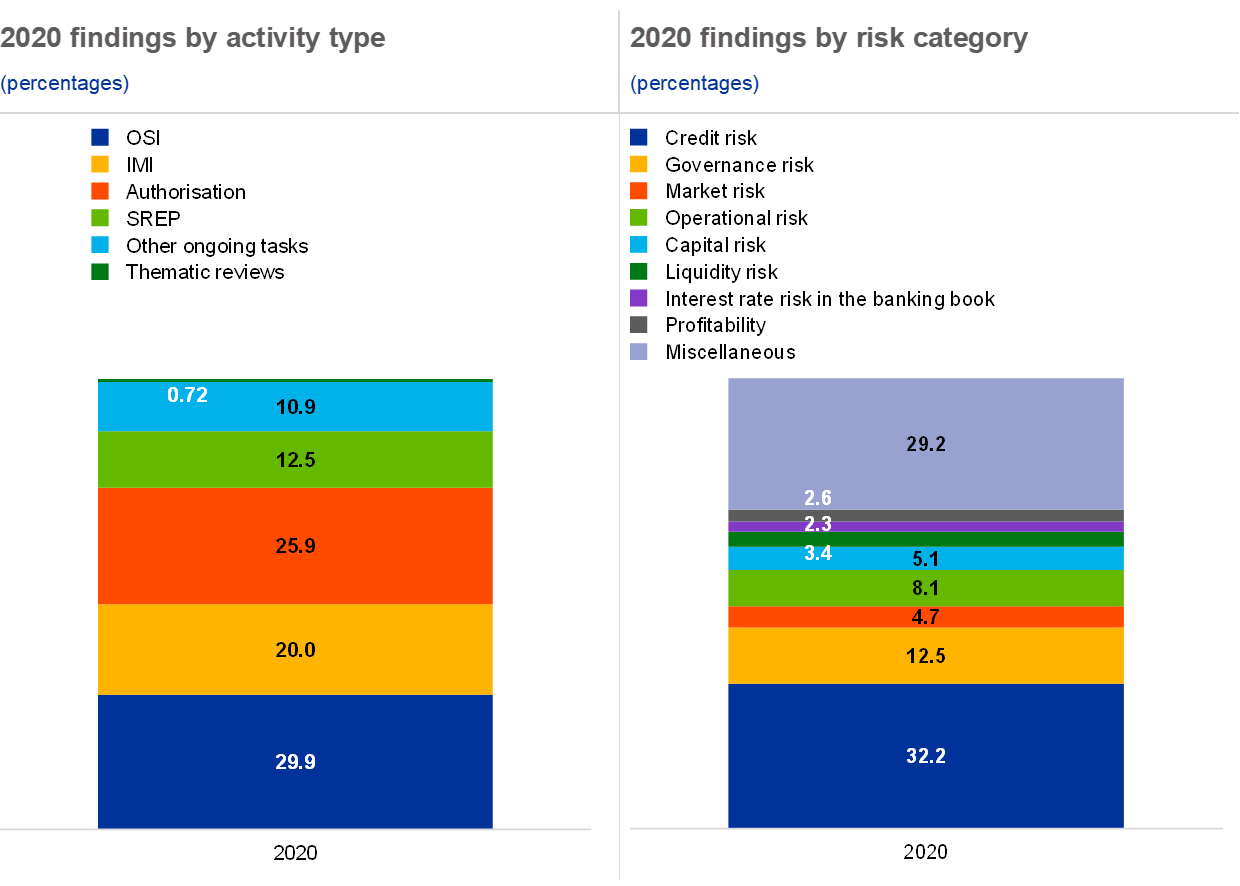

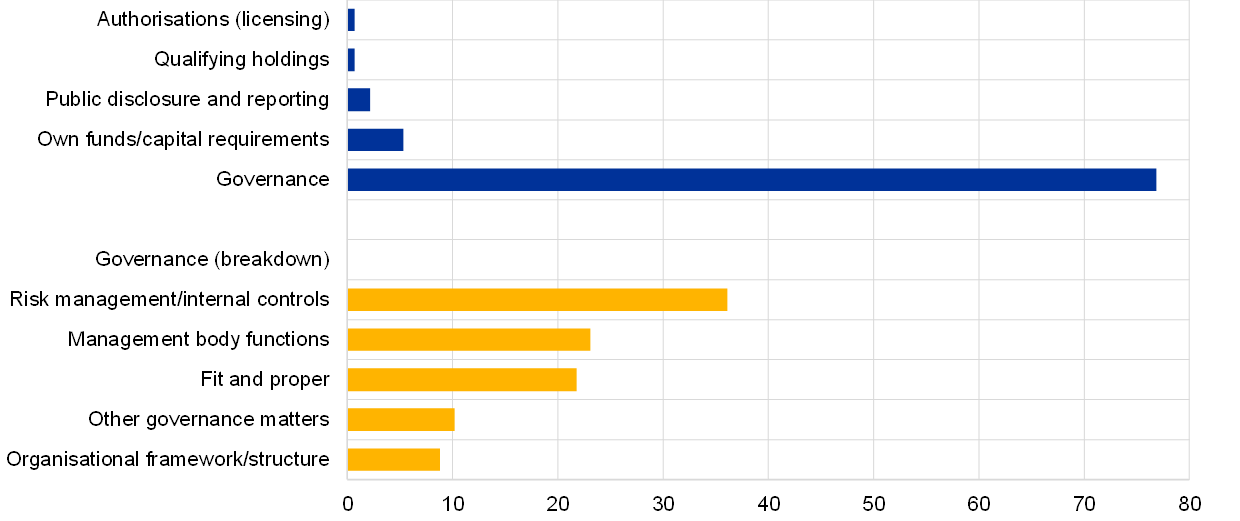

In line with the previous year’s drive to provide more transparency to banks and investors with the publication (in January 2020) of the supervisory capital requirements resulting from the SREP, in January 2021 the ECB published the aggregate SREP results with a breakdown by business model and bank-by-bank P2R with the related capital composition.[14] In this regard, in 2020 the SREP requirements and guidance for total capital, excluding systemic buffers and the countercyclical buffer, were kept stable on average at around 14%, while the CET1 capital requirement dropped from 10.6% in 2019 to 9.6% owing to the new criteria on the quality of capital for P2R. Banks were also allowed to partially use capital instruments that do not qualify as CET1 capital to meet the P2R, bringing forward a measure that was initially scheduled to come into effect in January 2021, as part of the latest revision of the Capital Requirements Directive (CRD V). In addition to capital requirements and guidance, in 2020 all banks received qualitative recommendations. Most recommendations were focused on the area of internal governance (mainly on internal control functions, the management body and new and old data aggregation issues) and credit risk (mainly regarding loan classification, provisioning and cliff effects). Compared with the previous SREP cycle (in 2019), findings on the credit risk and business model components increased significantly while findings related to internal governance and capital remained broadly stable, although the internal governance-related findings continued to be the most numerous in absolute numbers in 2020.

1.2.2 Work on credit underwriting criteria

To assess the quality of banks’ credit underwriting criteria, in 2019 ECB Banking Supervision launched a dedicated project to collect data on new loans granted by euro area banks between 2016 and 2018. The results were published in June 2020.[15] ECB Banking Supervision’s work on credit underwriting complements the ongoing strategic efforts to tackle existing NPLs.

The report on SIs highlighted some weaknesses in the way banks have granted and priced new loans in recent years; in particular, banks have been loosening their lending standards for loans to households. The analysis also found that banks with high levels of NPLs tended to grant housing loans more conservatively than other banks, and that not all banks paid sufficient attention to risk-based pricing, so as to ensure that loan pricing at least covered expected losses and costs. No evidence was found that banks using internal models to calculate capital requirements applied better risk-based pricing.

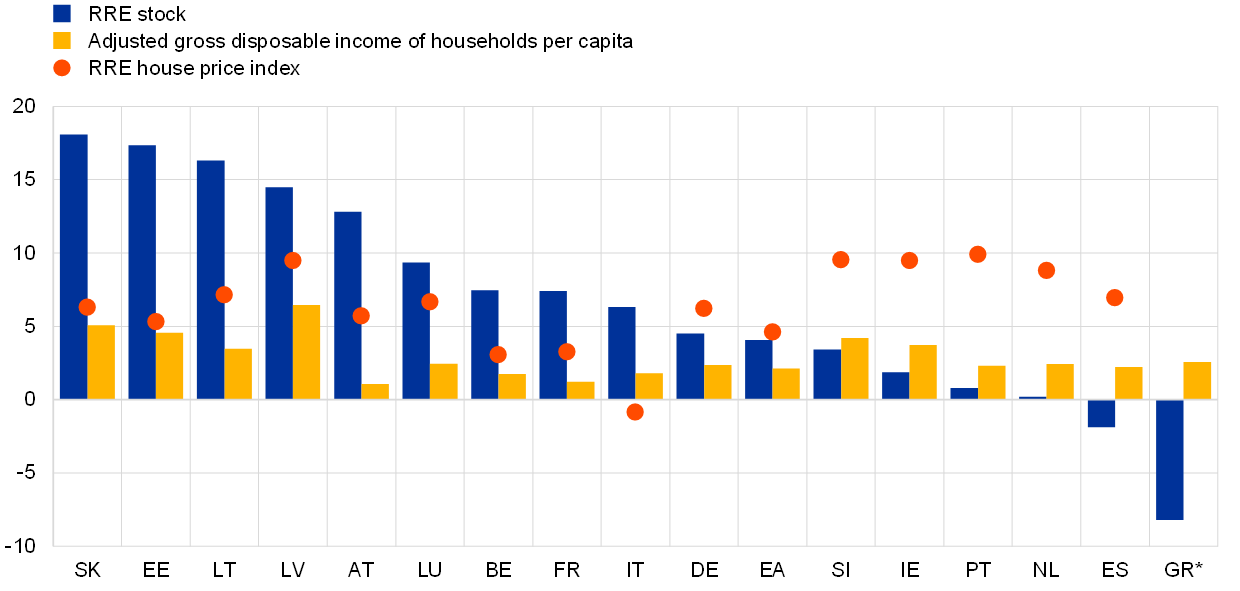

In 2019 ECB Banking Supervision launched a dedicated project to collect data on new loans granted by euro area banks. The report on SIs highlighted an increase in lending to households, fuelled in part by sharply rising house prices, but not fully backed by an increase in household income.

Lending to households increased markedly between 2016 and 2018, fuelled in part by sharply rising house prices, but not fully backed by an increase in household income (Chart 14). As a result, income-based key risk indicators (KRIs) in the residential real estate (RRE) and credit for consumption portfolios deteriorated, while pricing spreads declined.

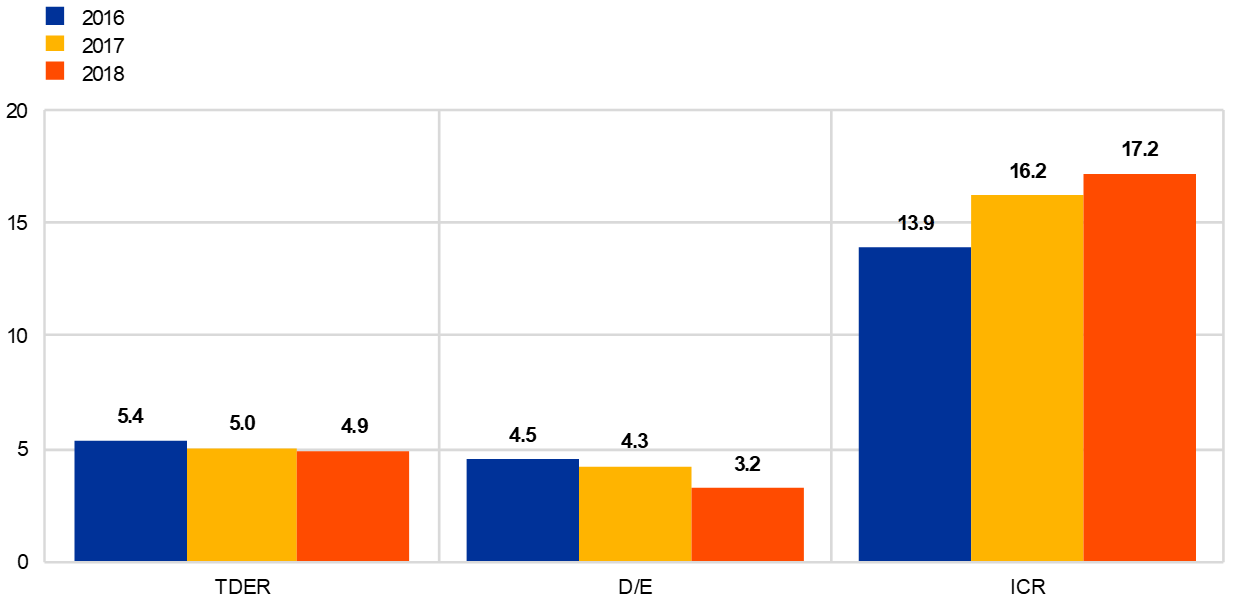

New loans granted to NFCs, however, showed a mixed picture. The KRIs for the non-financial counterparties portfolio improved (Chart 15), although loan structures became riskier and pricing spreads decreased in this portfolio. The JSTs are conducting dedicated follow-up assessments in the context of day-to-day supervision.

Chart 14

Residential real estate: loan growth and macroeconomic factors

(compound annual growth rate between 2016 and 2018; percentages)

Sources: ECB Banking Supervision credit underwriting data collection 2019, Eurostat.

Notes: Data for the house price index in 2018 were not reported for Greece. Euro area and country averages are based on balanced data.

In parallel to the SI credit underwriting exercise, ECB Banking Supervision, in close cooperation with the NCAs, conducted a horizontal SSM-wide analysis of the loan granting practices of smaller banks based on a sample of LSIs. The LSI data collection took the principle of proportionality into account. The results indicate that most LSIs sampled face significant data availability challenges with respect to credit risk indicators. LSIs exhibited a much higher loan growth than their SI peers, as well as a significant increase in the loan burden of their borrowers. Intense market competition put further pressure on LSIs’ loan margins and forced them to adjust their business and risk strategies. LSIs’ loan pricing showed very weak correlation with the underlying credit risk. The ECB and the NCAs will follow up on the findings of the LSI credit underwriting standards exercise.

Chart 15

Small and medium-sized enterprises (SMEs): improving KRIs

(NBV-weighted average TDER, D/E ratio and ICR)

Sources: ECB Banking Supervision credit underwriting data collection 2019; European Commission Annual Report on European SMEs 2017/2018 and 2018/2019.

Notes: NBV = new business volume. TDER = total debt-to-EBITDA ratio. D/E = debt-to-equity ratio. ICR = interest coverage ratio. Averages are weighted by each institution’s SME stock or available data on NBV and are based on balanced data.

1.2.3 Work on NPLs

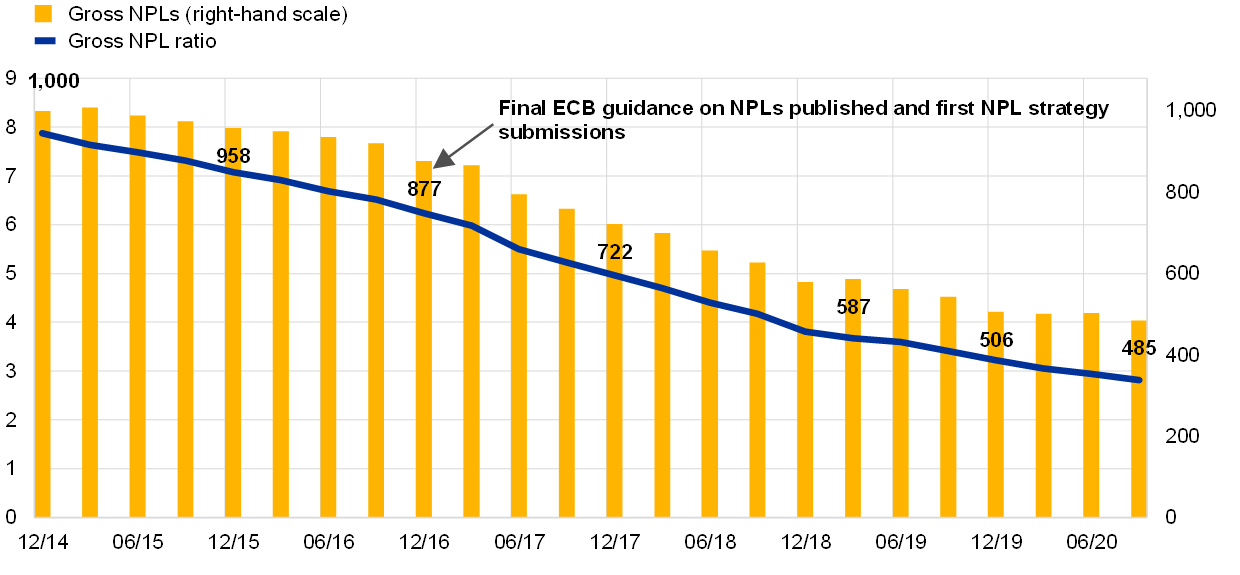

The stock of NPLs held by SIs decreased by about 50% between 2014 and 2020

The volume of NPLs held by SIs decreased from around €1 trillion (an NPL ratio of 8%) at the start of European banking supervision at the end of 2014 to €485 billion (an NPL ratio of 2.82%) at the end of September 2020, which corresponds to a reduction of around 50% (Chart 16). Similarly, for LSIs the NPL ratio has been decreasing since 2016, from 4.4% to 2.1% in June 2020.

Chart 16

Evolution of SIs’ NPLs

(left-hand scale: percentages; right-hand scale: EUR billions)

Source: ECB.

In 2019 high-NPL banks[16] reduced their NPL stock by 23%, exceeding their annual reduction target.

Chart 17

Planned NPL reduction for high-NPL banks for the full year 2019 against actual reduction in the year

(x-axis: sources of NPL increase and reduction; y-axis: EUR billions)

Source: ECB.

Note: Sample of 30 SIs.

The outbreak of the COVID-19 pandemic poses significant challenges for banks. First, SIs are expected to have to make additional efforts to further reduce their stock of NPLs, although this remained broadly stable until June 2020 and then decreased from €503 billion to €485 billion in the third quarter of 2020. Second, the adverse effects of the pandemic on the economy are expected to result in an increase of NPLs in the future. In this context, it is crucial that SIs strike the right balance between avoiding excessive procyclicality and ensuring that the risks they are facing are adequately reflected in their balance sheets.

In particular, there is a risk of severe cliff effects occurring when public support measures start to expire. Against this background, it is crucial that banks correctly identify and reflect credit risk on their balance sheets and are operationally prepared to deal with an increase in distressed debtors: a delay in recognising and acting to tackle the deterioration of asset quality would amplify procyclical effects and hamper the ability of the banking sector to support the economic recovery.

Timely and viable restructuring maximises recovery value and prevents the piling up of NPLs. High levels of NPLs lead to increased funding costs and a lower capacity to generate income, which also impair banks’ ability to support the economic recovery.

Postponing reclassification and adequate provisioning until the expiry of moratoria measures would lead to cliff effects, stronger deleveraging and, as a consequence, amplified procyclicality. Perceived inadequacy of banks’ loan valuation and classification policies would undermine the trust of investors in the banking sector and lead to increased funding costs. Strong deleveraging and increased funding costs reduce banks’ capacity to support the economic recovery.

ECB Banking Supervision responded to the outbreak of the COVID-19 pandemic with an extensive range of credit risk initiatives and external communications.[17] By complying with the EBA Guidelines on legislative and non-legislative moratoria on loan repayments[18], the ECB also offered banks flexibility on forbearance classification and assessment of distressed restructuring for exposures under moratoria that meet the criteria of the EBA Guidelines.

The ECB’s supervisory initiatives and communications are aimed at ensuring that SIs have in place effective credit risk management practices and sufficient operational capacity to ensure that credit risk is adequately assessed, classified and measured on their balance sheets. This should help to contain the deterioration of asset quality at banks, thus mitigating cliff effects wherever possible. The JSTs are engaging with SIs to follow up on their implementation of these credit risk supervisory expectations.

In addition, the ECB decided to postpone the deadline for the submission of NPL reduction strategies by high-NPL banks by 12 months, to March 2021. ECB Banking Supervision also clarified that the NPE coverage expectations remained fully in place for the stock of NPLs that had accumulated prior to the outbreak of the pandemic.

In its LSI oversight capacity, the ECB continued to assess the NCAs’ implementation of the EBA Guidelines on management of non-performing and forborne exposures[19]. Furthermore, with the support of the NCAs the ECB performed a credit risk vulnerability analysis to better understand the potential impact of the COVID-19 crisis on LSIs, also taking into account the mitigating effects of national measures. In 2021 follow-up activities will be focused, inter alia, on assessing the impact of the wind-down of national support measures on LSIs’ credit risk profiles, as well as LSIs’ readiness to deal with a potential increase in defaulting exposures.

1.2.4 Targeted review of internal models

A project spanning 2016 to 2020, the targeted review of internal models (TRIM) was designed to assess the adequacy and appropriateness of institutions’ internal models and harmonise supervisory practices relating to internal models across the Single Supervisory Mechanism (SSM). This resulted in an SSM-wide common understanding of the regulatory requirements related to internal models – the ECB Guide to Internal Models – and thus contributed to the reduction of unwarranted (i.e. non-risk-based) variability in risk-weighted assets (RWA) and a level playing field across banks in participating countries.

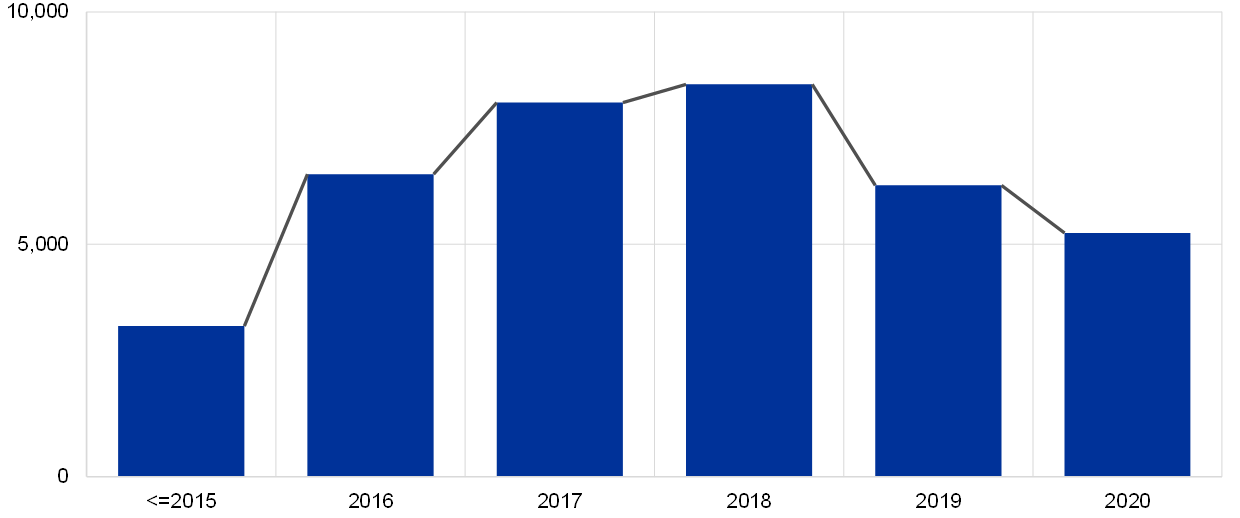

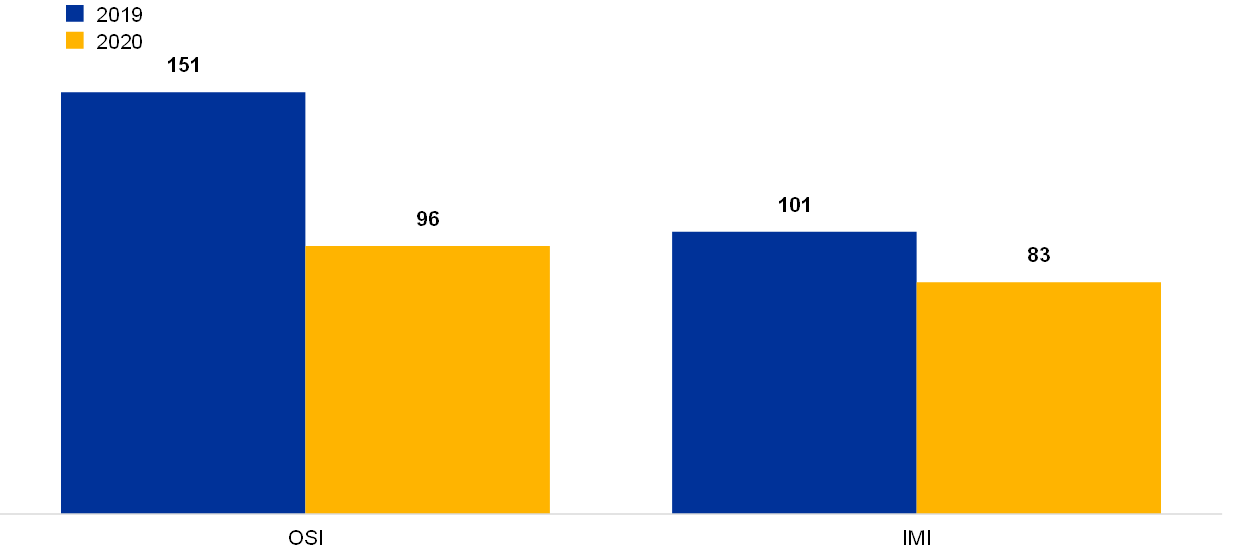

Under TRIM, 200 on-site model investigations were performed across 65 SIs

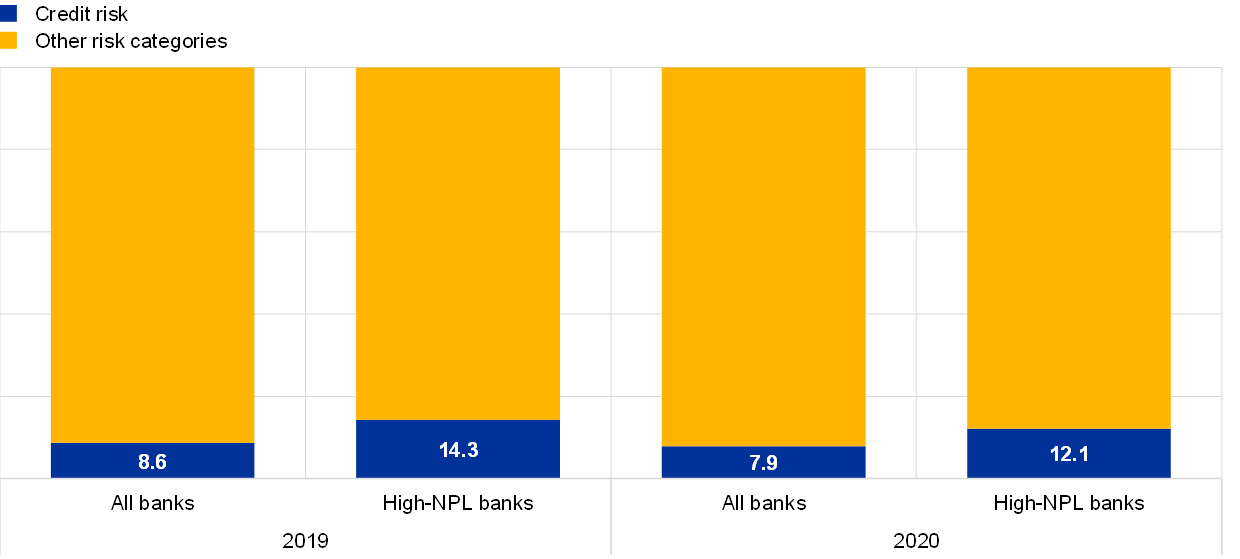

Four years on, the project is now approaching its conclusion. Under TRIM, 200 on-site model investigations were performed across 65 SIs between 2017 and 2019, covering internal models for credit, market and counterparty credit risks. A common methodological approach, based on standardised data requests and inspection techniques and tools, was developed for these investigations. In addition, several layers of quality assurance, cross comparisons and horizontal analyses were carried out in order to ensure the consistency and comparability of the outcomes of TRIM investigations.

Cases of non-compliance with regulatory requirements identified in the context of TRIM resulted in over 5,800 findings across all risk types, of which about 30% had a high severity.

As a consequence, the TRIM project entails an intense supervisory follow-up with the institutions involved, which are expected to address the shortcomings identified in combination with the implementation of new regulatory products over the coming years. Following the TRIM investigations, 179 decisions had been issued as at end-2020, containing different supervisory measures – in the form of obligations, recommendations and limitations – some of which have a substantial quantitative impact on RWA amounts.

TRIM will now be completed in the first half of 2021

The operational relief granted to institutions in March 2020 by ECB Banking Supervision in response to the COVID-19 outbreak included a six-month postponement of the issuance of TRIM decisions, on-site follow-up letters and internal model decisions not communicated to institutions by that date. As a result, the conclusion of the TRIM project was postponed from 2020 to the first half of 2021.

1.2.5 Work on ICAAP and ILAAP

Robust internal capital adequacy assessment (ICAAP) and internal liquidity adequacy assessment (ILAAP) processes are key to strengthening the resilience of banks and allowing them to continue to operate through the business cycle and withstand economic shocks. Both the ICAAP and the ILAAP aim to ensure that banks adequately measure and manage capital and liquidity risk in a structured, institution-specific way.

Capital and liquidity are key to ensuring the resilience of banks

ECB Banking Supervision has taken several measures to support banks in establishing their ICAAPs and ILAAPs as valuable risk management frameworks. Banks’ ICAAPs and ILAAPs are regularly reviewed as part of the SREP. In 2018 the ECB published guides to ICAAP and ILAAP to clarify its expectations regarding these processes. In 2019 it carried out a comprehensive analysis of the ICAAP practices of 37 SIs against the supervisory expectations it had set forth. The findings from this analysis were published in August 2020 in the ECB Report on banks’ ICAAP practices and they reveal that, while banks have significantly improved their ICAAPs in recent years, more work needs to be done, particularly in three main areas.

First, many banks still have in place inadequate data quality frameworks, which could hamper their ability to make well-informed decisions using reliable, quickly retrievable data.

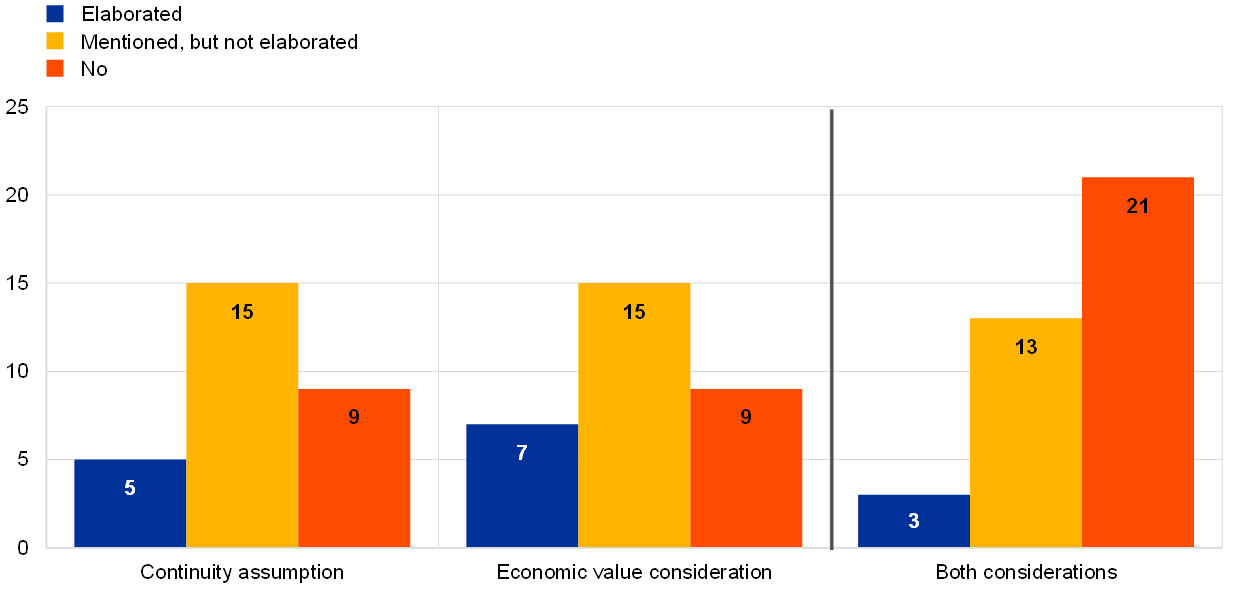

Second, many banks do not account for the full set of risks that may have a material impact on their internal capital. Weaknesses were identified, for example, in how banks evaluate AT1 and T2 instruments when determining their internal capital needs to ensure business continuity (continuity assumption), and, more broadly, in how banks define the true economic value of their capital when covering their economic risks (economic value considerations), as Chart 18 shows. When combined with a failure to identify and quantify all material economic risks, banks’ ability to ensure their economic capital adequacy may be hampered and, as a result, their overall financial resilience may be weakened.

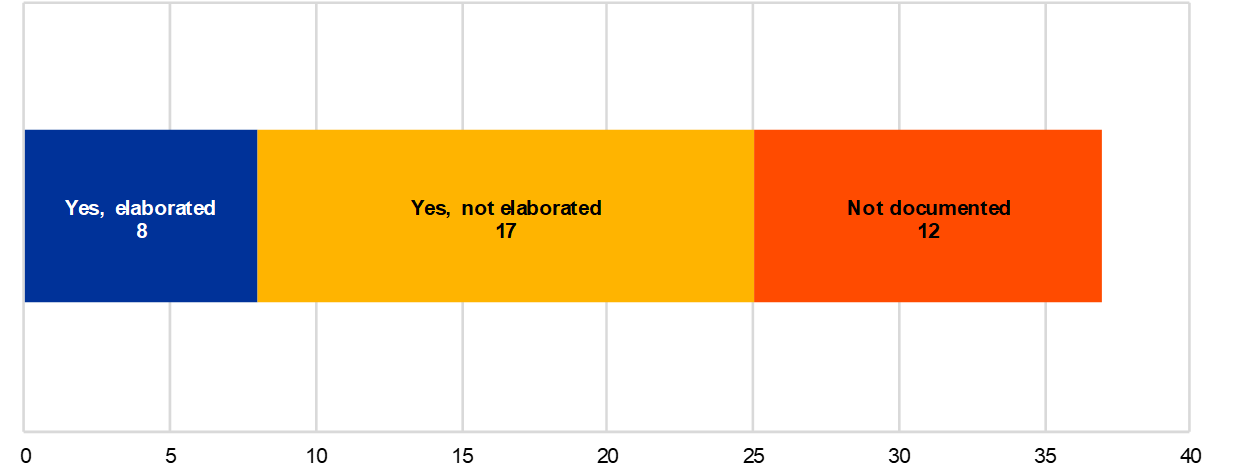

Third, stress testing has yet to become an effective, integral component of banks’ risk management practices, as Chart 19 shows. The COVID-19 pandemic has highlighted that banks are exposed to a wide range of threats that may materialise unexpectedly; however, many institutions do not systematically monitor the economic environment to identify new threats, and their stress-testing scenarios and capabilities are not regularly reviewed. This can seriously compromise banks’ ability to effectively respond to stress situations.

Chart 18

Consideration of continuity assumptions and economic value considerations in internal capital definition

Continuity assumption and economic value consideration

Source: ECB report on banks’ ICAAP practices, Chart 26.

Chart 19

Stress-testing process for identifying new threats to capital adequacy

Does the bank have a process for monitoring and identifying new threats, vulnerabilities and changes in the environment?

Source: ECB report on banks’ ICAAP practices, Chart 43.

Good ICAAP practices are as relevant in a crisis as they are in normal times

Although the above-mentioned analysis was carried out before the outbreak of COVID-19, the ECB believes that good ICAAP practices are as relevant in times of severe stress as they are in normal times. Well-designed ICAAPs are key to effective risk management, financial soundness and long-term sustainability.

The 2020 SREP assessment revealed weaknesses in banks’ stress-testing practices and in capital and liquidity planning

In the context of the 2020 pragmatic approach to the SREP, ECB Banking Supervision identified weaknesses in banks’ ICAAP and ILAAP practices that compromise the reliability of their forward-looking projections and may impair their ability to successfully manage their capital and liquidity positions through the COVID‑19 crisis. Banks are encouraged to rigorously capture the impact of and potential for more severe outcomes from COVID-19-related developments in their baseline and adverse scenarios.

In the future, the ICAAP and ILAAP will play even bigger roles in the SREP

In the future, the ICAAP and ILAAP will play a bigger role in the SREP, which should incentivise banks to keep improving these internal processes. Furthermore, ECB Banking Supervision’s approach to determining P2R will more closely account for risk drivers, which is expected to incentivise banks to better identify the different risks they are exposed to.

1.2.6 IT and cyber risk

In 2020 cybercrime and IT deficiencies were again identified as one of the main drivers of risk to the banking sector. To strengthen banks’ resilience in this field, one of ECB Banking Supervision’s priorities in 2020 was to assess IT and cyber risk to banks by way of supervisory actions such as on-site inspections, the annual SREP, the SSM cyber incident reporting process, and other bank-specific and horizontal activities.

The reliability of IT systems became essential when banks started closing branches and moving to remote working arrangements. In this context, ECB Banking Supervision identified IT and cyber risk as one of the most prominent risks associated with COVID-19. Indeed, the number of significant cyber incidents reported to the ECB by supervised institutions increased in 2020, particularly those with an adversarial intent.[20] So far, these incidents have mostly resulted in service unavailability by banks or by banks’ providers. But the increase in cyber incidents highlights the need for banks to step up their IT resilience and address deficiencies such as overly complex IT architecture and reliance on a high number of end-of-life information and communications technology (ICT) systems to carry out critical business functions.

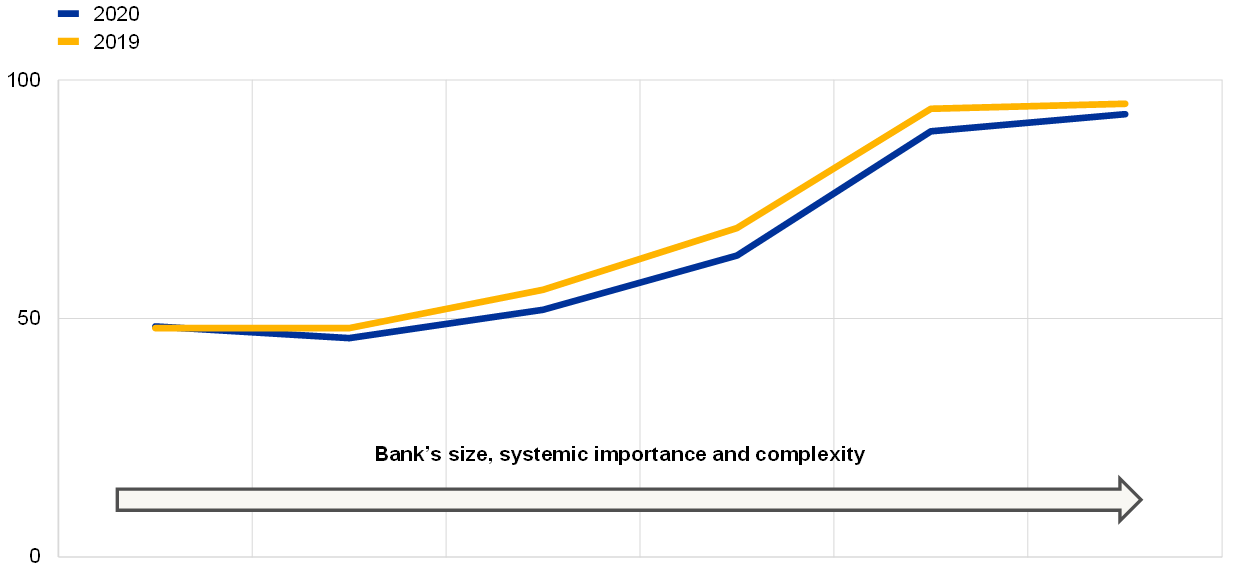

In June 2020 ECB Banking Supervision published its Annual report on the outcome of the SREP IT Risk Questionnaire (ITRQ)[21], developed in cooperation with the NCAs and based on the ITRQ self-assessment by banks. The report presents key observations about banks’ IT risk practices as of the first quarter of 2019. Banks’ outsourcing budgets continued to increase throughout 2018 and until the beginning of 2019, with cloud services becoming more relevant. Worryingly, the number of end-of-life systems supporting business critical activities also continued to increase, and data quality management remains the least mature risk control domain.

ECB Banking Supervision has also contributed to publications by international working groups on these topics, namely the Financial Stability Board’s effective practices for cyber incident response and recovery[22], the Basel Committee on Banking Supervision’s consultative document on principles for operational resilience[23], and the EBA Guidelines on ICT and security risk management[24], which entered into force in June 2020.

1.2.7 Brexit

ECB Banking Supervision will continue to monitor banks’ implementation of their post-Brexit target operating models

The United Kingdom left the European Union on 1 February 2020, entering a transition period in which EU law continued to apply within and to the United Kingdom. This transition period ended on 31 December 2020. In 2020 ECB Banking Supervision worked to ensure that banks and supervisors were prepared for the end of the Brexit transition period and closely monitored banks’ implementation of their post-Brexit plans.

Throughout the year, ECB Banking Supervision followed the political negotiations between the EU and the United Kingdom and assessed their implications from a supervisory perspective. The ECB also provided technical input to the work of the European supervisory authorities, ensuring that key supervisory issues were taken into consideration.

As part of the ongoing supervision of SIs, ECB Banking Supervision continuously updated its assessment of the impact that a potential no-deal, no-equivalence scenario at the end of the transition period would have on SIs in a number of areas, such as investment services and trading venues. ECB Banking Supervision advised banks to continue preparing for all possible Brexit outcomes, and asked them to implement mitigating measures to address possible cliff-edge risks. Overall, banks’ preparations for the end of the transition period were deemed to be sufficient and no market disruptions in the area of financial services were observed at the beginning of January 2021.

ECB Banking Supervision continued to monitor the implementation of the Brexit plans of SIs affected by the United Kingdom’s departure from the EU to ensure they progressed in line with the time frames previously agreed for implementing their post-Brexit target operating models (TOMs). Horizontal monitoring exercises were complemented by bank-specific follow-ups, and supervisory actions were taken when shortcomings were identified. To fully meet the ECB’s supervisory expectations, some banks will still need to take action in the areas of internal governance, business origination, booking models and funding, repapering of EU clients and intragroup arrangements, as well as IT infrastructure and reporting.

Throughout 2020 ECB Banking Supervision continued to communicate its supervisory expectations related to Brexit in several articles in the Supervision Newsletter, posts on the Supervision Blog and via bilateral discussions with the supervised entities.[25]

Post-Brexit, ECB Banking Supervision will continue to monitor banks’ implementation of their TOMs and focus on key supervisory issues that may arise from the transition to the new regime. Under the new cooperation framework concluded in 2019, ECB Banking Supervision and the UK supervisory authorities will continue to cooperate in supervising banks that are active in both the participating countries and the United Kingdom.

1.2.8 Fintech and digitalisation

Throughout 2020 ECB Banking Supervision continued working on its approach to the supervision of the use of fintech by SIs and LSIs. Work has been conducted to develop a common understanding of fintech-related risks and provide methodological support and tools to supervisors.

ECB Banking Supervision continued to engage with NCAs, SIs and LSIs, and other relevant market participants to deepen the understanding of how banks are using innovative technologies and what the implications are for their business models and risk management frameworks. In this context, it continued monitoring market developments and emerging risks, including the impact of the COVID-19 pandemic on digitalisation and innovation across banks. The pandemic has shown that banks under European banking supervision are able to remain operationally resilient, even as reliance on remote working has increased significantly. Going forward, digital transformation and innovation will remain crucial for banks to navigate a highly competitive environment, given the role digitised systems can play in reducing costs and meeting the expectations of increasingly digitally oriented banking customers.

On 27 August 2020 the ECB published the ESCB/European banking supervision response to the European Commission’s consultation on digital finance, which included detailed answers to questions on the various elements to be addressed in the Commission’s strategy. The ECB broadly supports the priority areas identified by the Commission to foster the development of digital finance in the EU, which gained even more importance after the COVID-19 outbreak. While the ECB recognises that digitalisation and innovation can bring significant benefits for financial institutions, the financial system and the broader economy, the digital transformation of the banking sector must also consider all the related risks. While the pandemic has accelerated the digitalisation efforts of banks and highlighted the importance of investing in innovation, it has also shed light on additional challenges that require further monitoring and must be addressed in banks’ risk appetite frameworks.

The ECB is a member of various international and European groups and networks, to which it contributes its experience and its opinions on the development of the regulatory and supervisory frameworks in the area of fintech and digitalisation. As well as continuing this involvement, in 2020 ECB Banking Supervision also contributed to the ECB’s work on crypto-assets and central bank digital currencies, addressing aspects relevant for banking supervision. It also engaged in internal and external workshops, training courses and seminars to foster a common supervisory approach and keep abreast of the various developments in the field of fintech and digitalisation.

Box 2

Supervisory technology

The rapid increase in the amount of available data and computing power and the fast-paced adoption of new technologies are transforming the global financial landscape more than ever, creating opportunities and challenges for supervisors and supervised entities. The COVID-19 pandemic has intensified this trend, further increasing the speed of digital transformation.

In response to this, in 2019 the ECB created a dedicated hub for supervisory technologies (known as “suptech”). This hub brings internal and external stakeholders together to explore the potential of artificial intelligence and other pioneering supervisory technologies.

SSM Digitalisation Blueprint

The SSM Digitalisation Blueprint, which was jointly shaped by the NCAs and the ECB, provides a long-term vision and concrete action plan on the use of technology and digitalisation in the SSM. The projects identified in the Blueprint are clustered around six areas: (i) improving supervisory reporting and exchange with banks via end-to-end digitalisation; (ii) harnessing the power of data, with advanced analytics and a cutting-edge data architecture; (iii) boosting SSM IT systems by fostering user-orientation, connectedness and suptech integration; (iv) processing documents and unstructured data via AI-driven textual analysis; (v) reducing manual tasks and increasing information control through process automation; and (vi) providing smart collaboration tools for SSM-wide digital exchange.

The Blueprint also defines key enabling factors for unleashing the SSM’s full innovative potential, such as a state-of-the-art innovation management framework; the most agile collaboration modalities for SSM-wide projects; a powerful innovation ecosystem; and initiatives to foster a digital culture, including a digitalisation training programme. The Blueprint also covers aspects related to the ethical and transparent use of new technologies and the compliance of their use with the data protection framework.

SSM-wide bodies driving the Digital Agenda

In 2020 the Steering Committee in its Digital Agenda composition (SCDA) was set up from among Supervisory Board members to facilitate the discussion on digital strategic matters. In parallel, the SuperVision Innovators Forum, gathering together supervisors and IT experts from NCAs and the ECB, was established. The Forum played a key role in the identification of supervisory needs and concrete applications of new technologies for banking supervision. The Suptech Hub further established new ways of working by bringing together ECB and NCA staff with multidisciplinary backgrounds (e.g. IT, supervision, data science) to form agile innovation teams. The first four of such teams were set up in September 2020 and up to ten additional teams are planned for 2021.

Large-scale awareness-raising events

As part of the Blueprint objective of fostering a digital culture, a series of large-scale events took place in 2020. The Suptech Virtual Meet-Up and the Supervision Innovators Conference, held in June and November respectively, brought together supervision innovators from around the world to foster collaboration and present cutting-edge developments in artificial intelligence tools.

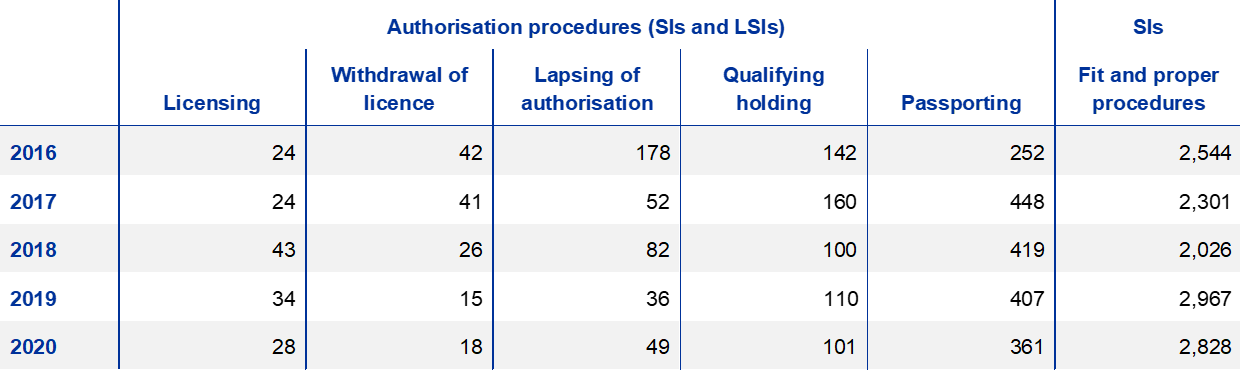

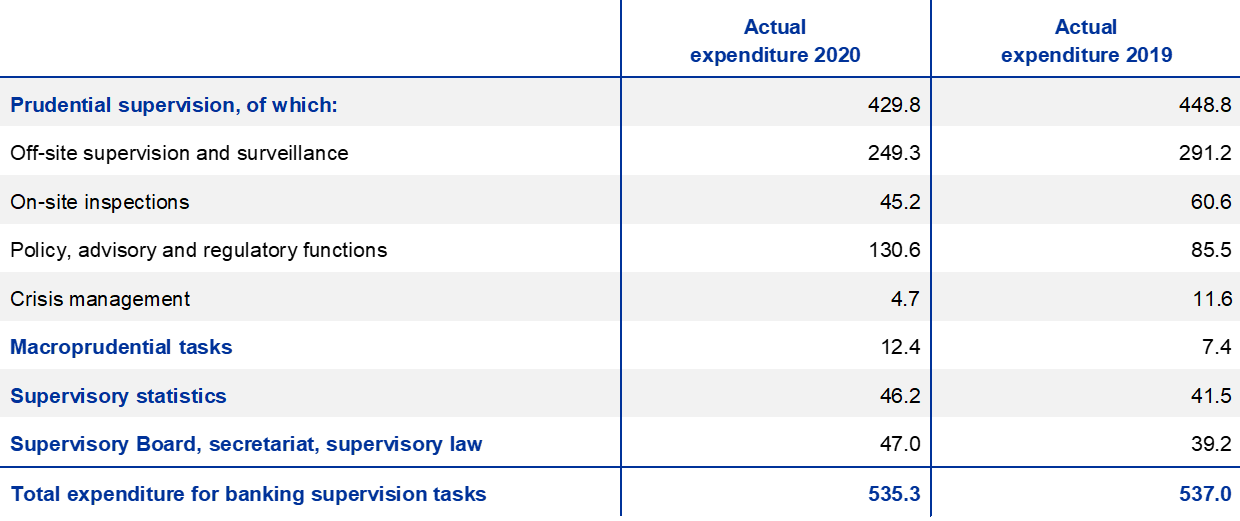

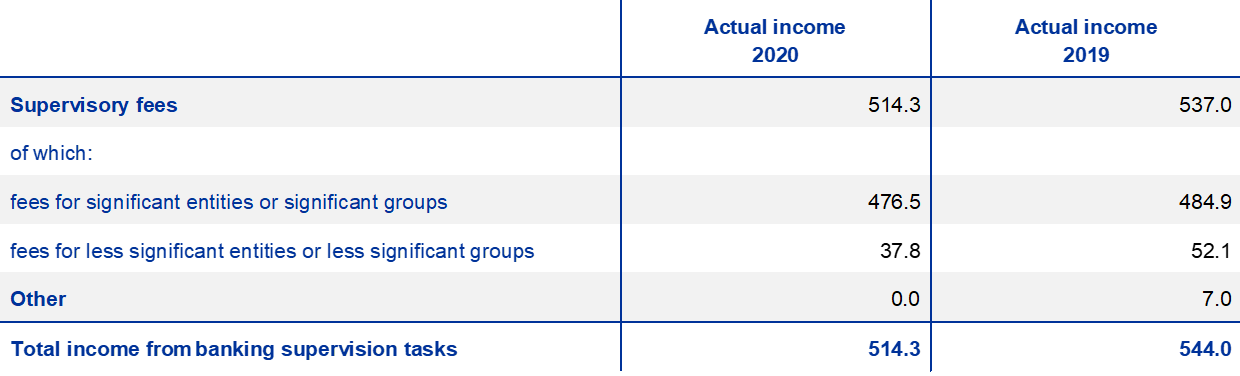

New suptech tools